DZS Bundle

Can DZS Reshape the Future of Connectivity?

DZS, a key player in network access solutions, recently made a strategic move by acquiring NetComm in June 2024, signaling its ambition to dominate the market. From its origins as Zhone Technologies to its current iteration, DZS has consistently evolved, now serving over 200 active customers globally. This evolution and its DZS SWOT Analysis are critical to understanding its future trajectory.

This analysis delves into the DZS growth strategy, examining its expansion plans and how it intends to capitalize on the burgeoning telecommunications industry. We'll explore the DZS company's recent financial performance, its competitive advantages, and the impact of 5G on its future prospects. Understanding DZS's market share and the key drivers of its future growth is crucial for investors and strategists alike, making this a vital read for anyone interested in DZS business and investment opportunities.

How Is DZS Expanding Its Reach?

The company, DZS, has been actively pursuing several expansion initiatives to fuel its DZS growth strategy. These efforts primarily focus on strategic acquisitions and market adjustments to strengthen its position in the telecommunications sector. The goal is to enhance its product portfolio and market reach, especially in key regions.

A significant move in June 2024 was the acquisition of NetComm. This acquisition is expected to be accretive, showing positive cross-selling sales synergy. This move is part of a broader plan to fortify its market presence in broadband networking, connectivity, and cloud edge portfolios. These efforts are particularly focused on the Americas, Europe, the Middle East, and Australia/New Zealand.

In April 2024, DZS divested its Asia business. This strategic decision allows the company to concentrate resources on other regions, which is anticipated to improve gross margins. The company's focus is on high-quality, differentiated broadband access solutions to meet the growing global demand for reliable connectivity. For more context, you can read a Brief History of DZS.

DZS is working to convert approximately $150 million of scheduled backlog and $75 million of paid inventory to cash. The company expects positive sales and inventory conversion results in the second half of 2024 and throughout 2025. These financial maneuvers are designed to improve cash flow and support future growth initiatives.

The company anticipates a return to double-digit revenue growth in the second half of 2024. This growth is fueled by strong strategic customer projects and technology trials. The company is investing in its platforms, which are being leveraged by communications service providers (CSPs) to transform their networks and deliver gigabit connectivity.

DZS is actively implementing several strategies to drive its DZS business forward. These strategies include acquisitions, market adjustments, and a focus on high-demand solutions. The company's expansion plans are designed to capitalize on market opportunities and enhance its competitive position.

- Strategic Acquisitions: The acquisition of NetComm in June 2024 is a prime example of this strategy, aimed at expanding product offerings and market reach.

- Regional Focus: Divesting the Asia business to concentrate on the Americas, Europe, the Middle East, and Australia/New Zealand.

- Technology Investments: Focusing on high-quality, differentiated broadband access solutions to meet growing global demand.

- Financial Management: Converting backlog and inventory to cash to support operations and future investments.

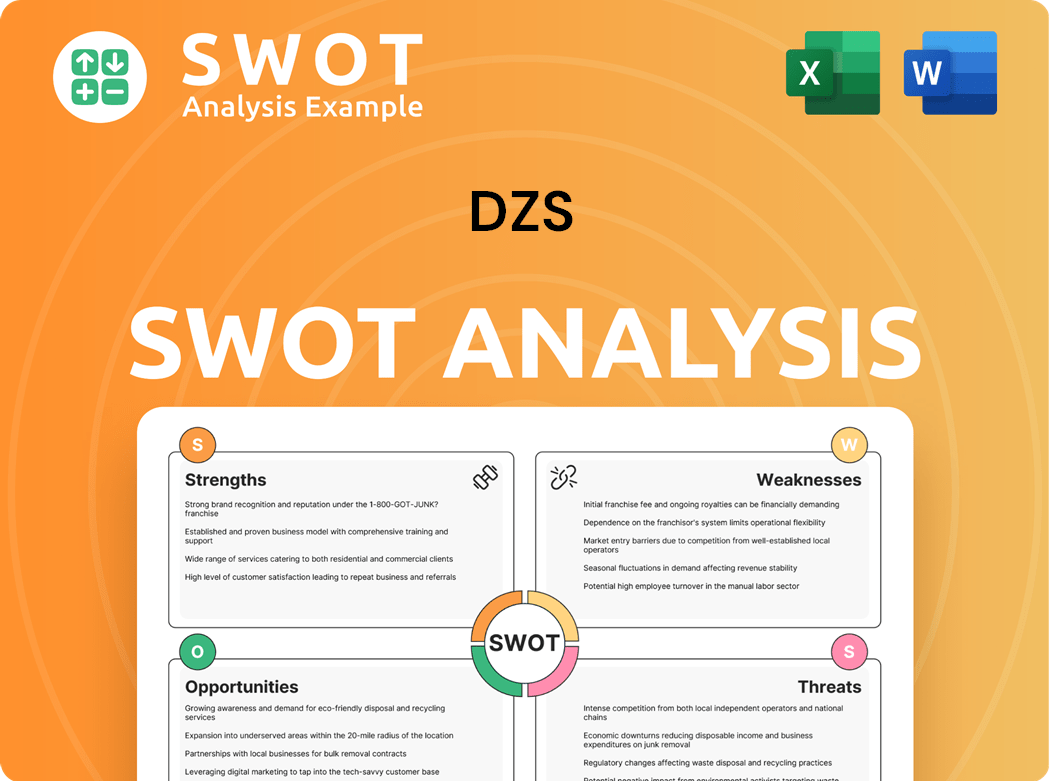

DZS SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does DZS Invest in Innovation?

The innovation and technology strategy of DZS is designed to fuel its DZS growth strategy. It centers on leveraging advanced solutions, with a strong emphasis on open, AI-automated broadband networks. This approach is crucial for the company's DZS future prospects in the rapidly evolving telecommunications sector.

The company aims to deliver broadband everywhere through fixed and wireless gigabit connectivity. This vision is built on the belief that the future competitiveness of communication service providers (CSPs) and enterprises will be defined at the network edge. This focus positions the company to capitalize on the increasing demand for high-speed internet access.

Over the past four years, the company has invested significantly in creating next-generation Network Edge, Connectivity, and Cloud Software solutions. These investments are geared towards orchestration, automation, and WiFi/FWA self-installation. This strategic focus aims to provide comprehensive solutions for its customers.

The company offers solutions like DZS Velocity Optical Line Terminal Systems and DZS Helix Optical Network Terminals (ONT). These are designed to enable service providers to deliver multi-gigabit services at scale. The Velocity platform is unique in its ability to transition from centralized to disaggregated architectures.

The company provides home/business WiFi, fiber extension, and fixed wireless access (FWA) solutions. The Aurus family of products is used by carriers to provide wireless broadband services. This helps in expanding the reach of broadband services.

The company's Cloud software solutions provide a commercial, carrier-grade network-slicing enabled orchestration platform. This supports Open RAN and 4G/5G networks. These solutions are key for the company's DZS business in the cloud software market.

The company offers solutions like DZS Chronos and DZS Saber. These solutions facilitate mobile operators' migration to fifth-generation wireless technologies. This is a crucial area for future growth.

The Velocity platform is powered by the company's award-winning sdNOS operating system. This enables rapid introduction and activation of new services. It is a key technological advantage.

The company's focus on innovation is evident in its investment in cutting-edge solutions. This helps the company stay ahead in a competitive market. This is a crucial aspect of the company's DZS market analysis.

The company's technological advancements are central to its growth strategy. These innovations are designed to meet the evolving needs of service providers and enterprises. The company's commitment to innovation is further detailed in Mission, Vision & Core Values of DZS.

- 50G PON Technology: The Velocity platform is designed to support 50G PON technologies in the future, demonstrating a commitment to long-term scalability.

- Open RAN Support: The company's cloud software solutions support Open RAN, aligning with industry trends towards open and disaggregated networks.

- Network Slicing: The carrier-grade orchestration platform enables network slicing, allowing for efficient resource allocation and service customization.

- Wireless Broadband Services: The Aurus family of products provides carriers with tools to offer wireless broadband services, expanding the company's market reach.

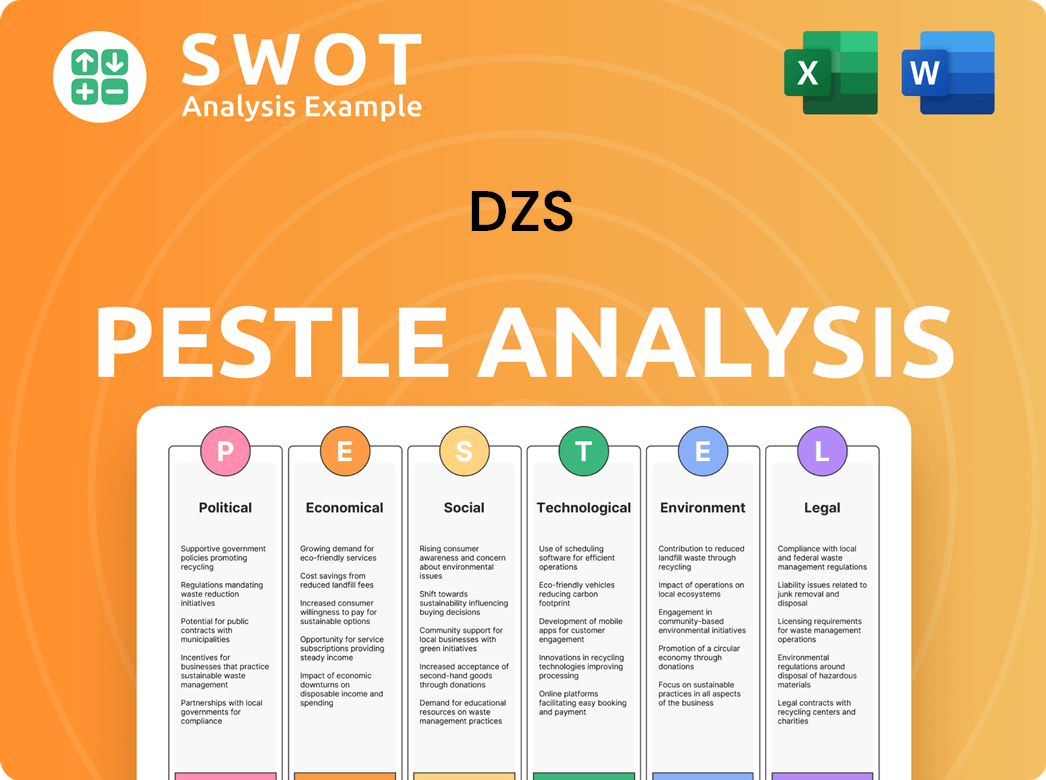

DZS PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is DZS’s Growth Forecast?

The financial outlook for DZS presents a complex picture, balancing recent improvements with ongoing challenges. DZS's DZS growth strategy includes initiatives to improve its financial standing, with a focus on achieving profitability and expanding its market presence. The company is working towards generating positive cash flow and increasing revenue through strategic actions.

In the third quarter of 2024, DZS experienced a rise in net revenue, reaching $38.1 million, which is a 22.8% increase from the previous quarter. This growth marks the fourth consecutive quarter of topline expansion. The company's gross margin also improved, with the GAAP gross margin reaching 29.4% and the non-GAAP adjusted gross margin at 36.7%, showing enhanced operational efficiency.

Despite these positive developments, DZS reported a net loss of $25.7 million on a GAAP basis in Q3 2024. However, this was an improvement compared to the previous year. The company is aiming to achieve break-even Adjusted EBITDA by 2025, driven by cost-saving measures and synergies from the NetComm acquisition. This focus on operational efficiency is a key part of its DZS business strategy.

DZS anticipates a return to double-digit revenue growth in the second half of 2024. Analysts project the company's annual revenue to be around $165 million by December 31, 2025. The company is focused on converting inventory to cash and converting scheduled backlog to boost its financial performance.

For the year ended December 31, 2024, total net revenue was reported as $120.1 million, a decrease of 3.0% compared to 2023. Despite this, the company is actively managing its debt, issuing new debt and repaying existing debt to optimize its capital structure. This shows DZS's commitment to improving its DZS financial performance.

DZS is focused on converting approximately $79 million of inventory to cash, with expectations for positive results in the second half of 2024 and throughout 2025. The company's strategic initiatives include a focus on the fiber optic market and the impact of 5G on its DZS future prospects. Further insights can be found in the Competitors Landscape of DZS.

Analysts project that DZS could potentially reach $541 million in revenue by the end of 2026. This indicates significant long-term growth potential for the company. The company's ability to manage its debt and capitalize on market opportunities will be crucial for achieving its goals.

DZS Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow DZS’s Growth?

The DZS company faces significant risks that could hinder its future. These challenges stem from its current financial state and market dynamics, potentially impacting its DZS growth strategy and overall DZS future prospects.

A critical turning point occurred in March 2025 when the company announced it was exploring strategic options due to cash flow issues, including potential bankruptcy. This situation highlights the precariousness of the company's position.

The financial instability and operational difficulties present major obstacles for the DZS business. The company's delisting from Nasdaq in October 2024 and subsequent trading on the OTC Market underscore the severity of its challenges. The operational income for the last twelve months as of Q2 2024 was -$104.27 million, indicating substantial operational losses.

The company's financial health is described as precarious, with a high debt burden and rapid cash burn. These factors directly threaten the company's ability to execute its plans.

Softness in capital spending by service providers in the second half of 2023 and the first half of 2024 is a major concern. This could lead to reduced revenue growth in the future.

While foreign subsidiaries might continue, they will likely experience near-term business disruption. This could affect the company's overall performance and strategic goals.

The impact of the ongoing COVID-19 pandemic and the global economic climate can amplify the risks. These external factors can exacerbate the company's existing challenges.

The cessation of U.S. operations and the commencement of Chapter 7 liquidation proceedings on March 14, 2025, is a critical risk. This directly impacts the company's ability to operate in the U.S. market.

The exploration of strategic alternatives, including the possibility of bankruptcy, highlights the uncertain future. This uncertainty creates instability for stakeholders and investors.

The delisting from Nasdaq in October 2024 due to non-compliance with filing requirements is a significant concern. This can negatively impact investor confidence and access to capital. This situation is further discussed in Owners & Shareholders of DZS.

The softness in capital spending by service providers in the second half of 2023 and the first half of 2024 raises concerns about future revenue growth. This can lead to reduced profitability and hinder the DZS company's ability to invest in new opportunities.

DZS Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.