DZS Bundle

Who Controls the Fate of DZS Company?

Understanding the ownership structure of a company is paramount for investors and stakeholders alike. The recent bankruptcy filing of DZS Inc. marks a significant turning point, raising critical questions about its future. This analysis explores the DZS SWOT Analysis, its ownership evolution, and the implications of its acquisition.

Delving into the details of "Who owns DZS" reveals a complex narrative of strategic shifts and financial challenges. From its founding to its current state, the DZS ownership structure has undergone significant changes. Examining DZS shareholders, DZS executives, and the DZS stock performance provides crucial insights into the company's trajectory. This comprehensive overview aims to inform and empower decision-makers with a clear understanding of DZS's ownership dynamics.

Who Founded DZS?

The story of DZS Company, formerly known as DASAN Zhone Solutions and Zhone Technologies, began in 1999. The original Zhone Technologies was the initial entity. The company has evolved significantly since its inception, undergoing a merger and a subsequent rebranding.

In 2016, Zhone Technologies merged with DASAN Network Solutions, Inc., leading to the formation of DASAN Zhone Solutions, Inc. This merger brought DASAN Networks Inc. (DNI) into a prominent ownership position. The company later adopted the name DZS Inc. in August 2020.

While specific details about the founders' equity splits at the very beginning are not available, the merger with DASAN Network Solutions in 2016 significantly changed the ownership structure. Min Woo Nam, who founded DASAN Engineering, Inc. in 1993, and later DASAN Internet Inc. in 1999, became the Chairman and Director of DASAN Zhone Solutions, Inc. on September 9, 2016.

Zhone Technologies was founded in 1999, marking the start of the company's journey.

In 2016, Zhone Technologies merged with DASAN Network Solutions, Inc. This led to the formation of DASAN Zhone Solutions, Inc.

The company rebranded to DZS Inc. in August 2020, reflecting a new chapter in its corporate identity.

Min Woo Nam, founder of DASAN Engineering, Inc. and DASAN Internet Inc., became Chairman and Director after the merger.

DASAN Networks Inc. (DNI) holds a significant stake in DZS, reflecting its importance in the company's ownership structure.

As of July 21, 2024, DASAN Networks Inc. held 23.44% of shares, totaling 9,093,015 shares, demonstrating its substantial investment in the company.

The evolution of DZS ownership, from its founding as Zhone Technologies to its current structure, highlights the impact of mergers and strategic investments. The significant role of DASAN Networks Inc. is evident in the company's current ownership. For more insights into the company's strategic focus, you can read about the Target Market of DZS.

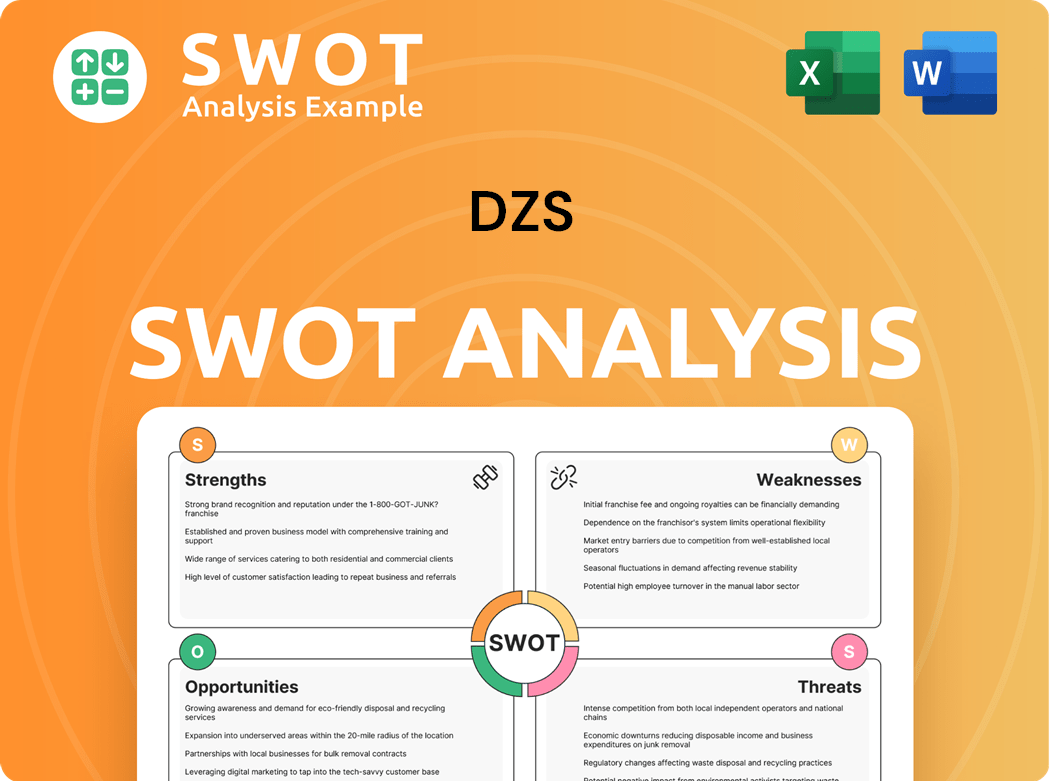

DZS SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has DZS’s Ownership Changed Over Time?

The ownership structure of the DZS Company has seen significant shifts since its initial public offering. Following its IPO on November 13, 2003, the company's market capitalization was a modest $811K. The market cap grew to $61.385 million by December 31, 2023. However, by June 6, 2025, the market cap had plummeted to just $3.88 thousand, reflecting the company's financial struggles.

Several key events heavily impacted the ownership of DZS. DASAN Networks Inc. (DNI) was a major institutional holder, owning 23.44% as of July 21, 2024. Institutional investors collectively held 41.08% of outstanding shares. The divestiture of its Asia business to DASAN Networks Inc. in January 2024 and the acquisition of NetComm in June 2024 were also significant. The inability to file restated financial reports led to its delisting from Nasdaq in August 2024. Eventually, DZS Inc. filed for Chapter 7 bankruptcy on March 14, 2025, and Zhone Technologies, Inc. acquired substantially all of its assets on May 1, 2025.

| Date | Event | Impact on Ownership |

|---|---|---|

| November 13, 2003 | IPO | Market capitalization of $811K |

| January 2024 | Divestiture of Asia business to DASAN Networks Inc. | Altered major shareholder structure |

| June 2024 | Acquisition of NetComm | Expanded asset base |

| August 2024 | Delisting from Nasdaq | Shares traded over-the-counter |

| March 14, 2025 | Chapter 7 Bankruptcy Filing | U.S. operations ceased |

| May 1, 2025 | Zhone Technologies, Inc. Acquisition | Acquired assets, including technology, intellectual property, and customer contracts |

The decline in institutional ownership from 17.68% in July 2024 to 0.87% by April 2025, coupled with the Chapter 7 bankruptcy, underscores the dramatic shift in DZS's financial health and ownership. The acquisition by Zhone Technologies, Inc., owned by the Zekelman brothers, signals a new phase for the company, with a change in leadership and strategic direction. For more detailed insights, you can explore articles about DZS, which provide additional context on [DZS company stock price history](0).

DZS Company's ownership has changed significantly due to financial challenges and strategic decisions.

- Initial Public Offering in 2003.

- Major institutional ownership by DASAN Networks Inc.

- Bankruptcy filing and asset acquisition by Zhone Technologies, Inc.

- Dramatic decrease in market capitalization.

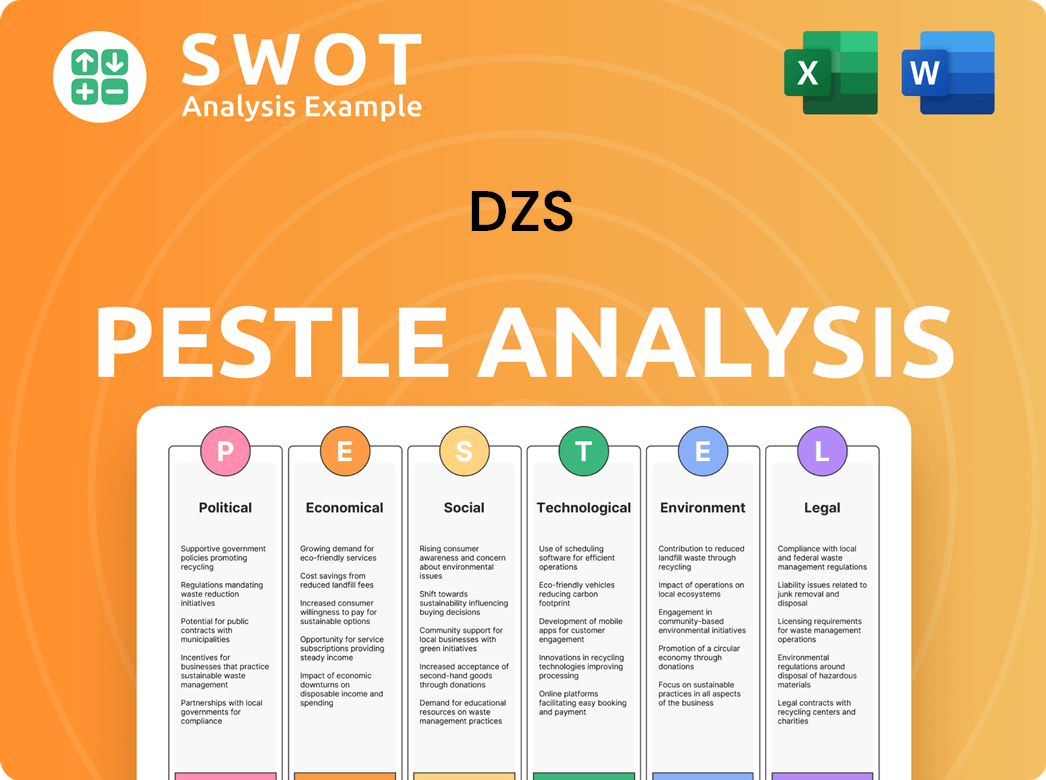

DZS PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on DZS’s Board?

Before the Chapter 7 bankruptcy filing in March 2025 and subsequent acquisition, the board of directors of DZS Inc. included key figures. Charlie Vogt served as President, CEO, and Director, having joined in August 2020. Other board members included Matt Bross, who was a Director since January 2021 and also the Strategy Committee Chair. Joon Kim held the position of Audit Committee Chair. Additional directors included Paul Choi and Todd Jackson, both appointed in February 2024. Choon Yul Yoo, who was the COO of Dasan Networks Inc., also served as a Director. Min Woo Nam, Chairman and CEO of DASAN Networks Inc., was Chairman and Director of DZS Inc. since September 2016, highlighting the influence of DASAN Networks as a major shareholder.

The board's composition and the influence of major shareholders like DASAN Networks Inc. were critical factors in the company's governance. Insider ownership, encompassing officers and directors, was reported at 31.14% as of April 30, 2025, indicating significant control by internal stakeholders. The delisting from Nasdaq in August 2024 due to delayed financial filings and the eventual Chapter 7 bankruptcy filing in March 2025, followed by the acquisition of its assets by Zhone Technologies in May 2025, dramatically reshaped the company's governance structure. This period saw insider transactions, with directors and the CEO acquiring shares through option conversions and direct purchases, reflecting ongoing involvement even amid financial difficulties. For more insights, consider reading about the Marketing Strategy of DZS.

| Board Member | Position | Notes |

|---|---|---|

| Charlie Vogt | President, CEO, and Director | Joined August 2020 |

| Matt Bross | Director, Strategy Committee Chair | Director since January 2021 |

| Joon Kim | Audit Committee Chair | |

| Paul Choi | Director | Joined February 2024 |

| Todd Jackson | Director | Joined February 2024 |

| Choon Yul Yoo | Director | COO of Dasan Networks Inc. |

| Min Woo Nam | Chairman and Director | Chairman and CEO of DASAN Networks Inc. |

The significant voting power held by DASAN Networks Inc., with a reported 23.44% ownership as of July 2024, played a crucial role in the company's decision-making processes. The actions of the DZS executives and the DZS shareholders, particularly during the period leading up to the bankruptcy, underscore the importance of understanding DZS ownership structure and the influence of key stakeholders in the company's trajectory. The high level of insider ownership, combined with the strategic moves of major shareholders, shaped the company's governance and strategic direction.

Understanding DZS ownership involves examining the board of directors and major shareholders.

- DASAN Networks Inc. held a significant stake, influencing decision-making.

- Insider ownership was substantial, reflecting internal control.

- The board composition changed due to financial challenges and the eventual acquisition.

- These factors are critical for understanding DZS stock and its history.

DZS Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped DZS’s Ownership Landscape?

The past few years have been marked by significant shifts in the ownership structure of the DZS Company. In January 2024, DZS divested its Asia business to DASAN Networks Inc., a major shareholder, accounting for approximately 50% of its revenue at the time. This strategic move was followed by the acquisition of NetComm in June 2024, which aimed to strengthen DZS's position in broadband connectivity and IIoT devices. These actions reflect the company's efforts to adapt to the evolving telecommunications market.

A major challenge for DZS was the lengthy process of restating its financial results for 2022 and Q1 2023, which was completed in August 2024. This delay led to the delisting of DZS stock from the NASDAQ stock market in August 2024, with shares subsequently trading over-the-counter. The company's financial struggles culminated in the filing for Chapter 7 bankruptcy on March 14, 2025, leading to the cessation of its U.S. operations. These events significantly impacted DZS shareholders and the company's overall financial health.

The most recent and impactful change in DZS ownership occurred on May 1, 2025, when Zhone Technologies, Inc. acquired substantially all of DZS's assets. This included technology, intellectual property, lab facilities, IT systems, and certain customer and supplier contracts, as well as international subsidiaries. Zhone Technologies, owned by the Zekelman brothers, now controls the core assets of DZS. These developments highlight the dynamic nature of the telecommunications equipment market and the influence of factors such as increasing demand for advanced network solutions. For more context on the competitive environment, you can explore the Competitors Landscape of DZS.

Divestiture of Asia business to DASAN Networks Inc. in January 2024. Acquisition of NetComm in June 2024. Delisting from NASDAQ in August 2024. Chapter 7 bankruptcy filing on March 14, 2025. Acquisition by Zhone Technologies, Inc. on May 1, 2025.

The Chapter 7 bankruptcy filing resulted in the cessation of DZS's U.S. operations. This had a significant impact on DZS shareholders and employees. The bankruptcy process led to the sale of DZS's assets to Zhone Technologies, Inc.

Zhone Technologies acquired substantially all of DZS's assets on May 1, 2025. This included all of DZS's technology, intellectual property, and customer contracts. The acquisition signifies a complete change in ownership for the core DZS assets.

Increasing demand for advanced network solutions and consolidation within the telecommunications equipment market influenced DZS's strategic decisions. These trends likely played a role in the company's bankruptcy and subsequent acquisition by Zhone Technologies.

DZS Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of DZS Company?

- What is Competitive Landscape of DZS Company?

- What is Growth Strategy and Future Prospects of DZS Company?

- How Does DZS Company Work?

- What is Sales and Marketing Strategy of DZS Company?

- What is Brief History of DZS Company?

- What is Customer Demographics and Target Market of DZS Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.