DZS Bundle

How Does DZS Company Stay Ahead in the Telecom Game?

DZS Inc., a global force in network access solutions, is making waves with its impressive turnaround, highlighted by a $23 million net income in Q2 2024. This company is a key player, providing essential infrastructure for high-speed data, video, and voice services to service providers and enterprises worldwide. With strategic moves like the divestiture of its Asia business and the acquisition of NetComm, DZS is clearly focused on growth and efficiency.

For anyone looking to understand the intricacies of the telecommunications sector, grasping the operations of DZS is crucial. This includes understanding their DZS SWOT Analysis, DZS's technology, and how DZS Company is innovating to meet the demands of a rapidly evolving market. Whether you're an investor, a customer, or simply curious about how DZS products and DZS services work, this deep dive will provide valuable insights into DZS Corporation's core business and its role in fiber optic networks.

What Are the Key Operations Driving DZS’s Success?

The core of DZS Corporation lies in providing comprehensive network access solutions and communications platforms. These include fiber access, mobile transport, and software-defined networking, enabling service providers and enterprises to deliver high-speed data, video, and voice services. With over 1,000 deployments worldwide, DZS serves a global customer base, focusing on delivering reliable and efficient connectivity.

DZS's value proposition centers on delivering high-quality, differentiated broadband access solutions. Their offerings, such as the DZS Velocity fiber access systems and Helix connected edge Wi-Fi solutions, are designed to meet the evolving needs of the telecommunications industry. The company emphasizes on-time product delivery, which is crucial for maintaining customer satisfaction and market competitiveness.

Operationally, DZS focuses on technology development and manufacturing communications network equipment. They are committed to environmentally hardened access and optical designs, which are essential for the emerging network edge. DZS's supply chain and distribution networks support a global reach, with a strategic focus on key regions following the divestiture of its Asia business in April 2024. This strategic focus enhances their market differentiation.

DZS offers a range of products and services, including fiber access systems, connected edge Wi-Fi solutions, and optical transport solutions. These products support high-speed data, video, and voice services. DZS also provides services such as network design, deployment, and ongoing support to its customers.

DZS leverages advanced technologies like 10 Gigabit Passive Optical Networking (10Gig PON) and 400G per wavelength DWDM ROADM transport. The company focuses on environmentally hardened designs for the network edge. DZS is committed to continuous innovation to meet the evolving needs of its customers and the telecommunications industry.

DZS serves a global market, with a strategic focus on North America, Europe, the Middle East, Africa, Australia, and New Zealand. The company collaborates with partners like Infinera for integrated coherent pluggable solutions. These partnerships enhance DZS's offerings and market reach.

For a deeper dive into the company's financial performance, market share, and the industries it serves, you can explore Owners & Shareholders of DZS. This provides valuable insights into DZS Company's financial health and strategic direction.

DZS's operations are characterized by a focus on technology development, product delivery, and cost optimization. They emphasize environmentally hardened access and optical designs, which are critical for the emerging network edge. Their strategic partnerships and global supply chain support their market reach and differentiation.

- Focus on high-quality, differentiated broadband access solutions.

- Commitment to on-time product delivery.

- Strategic partnerships to enhance offerings.

- Global supply chain and distribution networks.

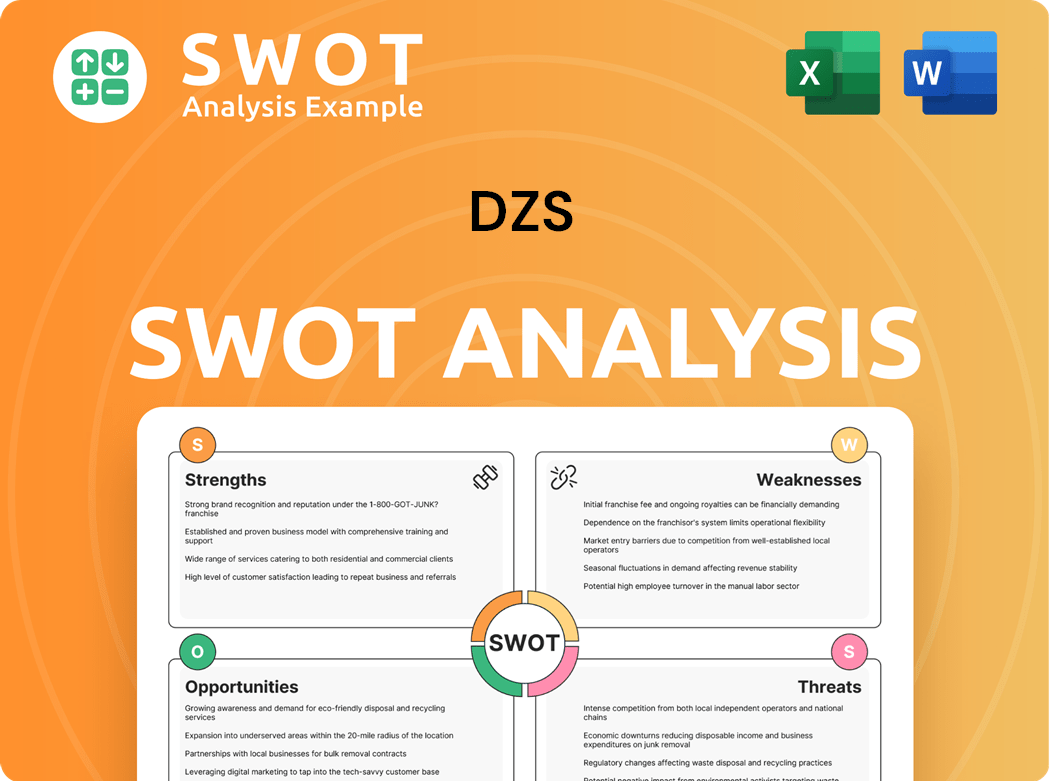

DZS SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does DZS Make Money?

The revenue streams and monetization strategies of the DZS Company revolve around its network access solutions and communication platforms. The company's financial performance in recent quarters reveals strategic shifts and focuses on key areas for sustained growth. Understanding these strategies is crucial for assessing the company's financial health and future prospects.

In Q2 2024, DZS reported a revenue of $31 million, consistent with the previous year. However, the first half of 2024 saw a decrease of 21% compared to the first half of 2023, totaling $59 million. The company's total revenue for the trailing twelve months (TTM) in 2024 was approximately $0.16 billion USD.

The company's revenue model is primarily based on product sales. These include fiber access, mobile transport, and software-defined networking solutions. Strategic divestitures have also played a role in shaping the revenue mix, as seen with the sale of its enterprise Industrial Internet of Things (IoT) portfolio to Lantronix for $6.5 million in November 2024. For more information on the competitive environment, you can check out the Competitors Landscape of DZS.

The core of DZS's revenue comes from selling its network access solutions and communication platforms. This includes products like fiber access, mobile transport, and software-defined networking solutions.

The company has made strategic moves, such as selling its enterprise IoT portfolio. This helps DZS to focus on core competencies and streamline operations.

Acquisitions are a part of DZS's strategy, with the NetComm acquisition in June 2024 expected to boost sales. This is part of the company's plan to leverage acquisitions for cross-selling opportunities.

Converting inventory into cash is a key focus. This helps strengthen the company's financial position and supports its growth initiatives.

DZS anticipates improved revenue and profitability in Q4 2024 and throughout 2025. This is driven by a growing sales pipeline and the benefits from acquisitions like NetComm.

In Q3 2024, net revenue reached $38.1 million, marking a 22.8% increase from Q2 2024, showing positive momentum.

The company uses several strategies to generate revenue and improve its financial performance:

- Acquisitions: Leveraging acquisitions like NetComm to create cross-selling opportunities and boost sales.

- Inventory Management: Focusing on converting approximately $79 million of inventory into cash to improve financial strength.

- Strategic Focus: Concentrating on core products and divesting non-core assets to streamline operations.

- Sales Pipeline: Anticipating improved revenue and profitability in Q4 2024 and throughout 2025 due to a growing sales pipeline.

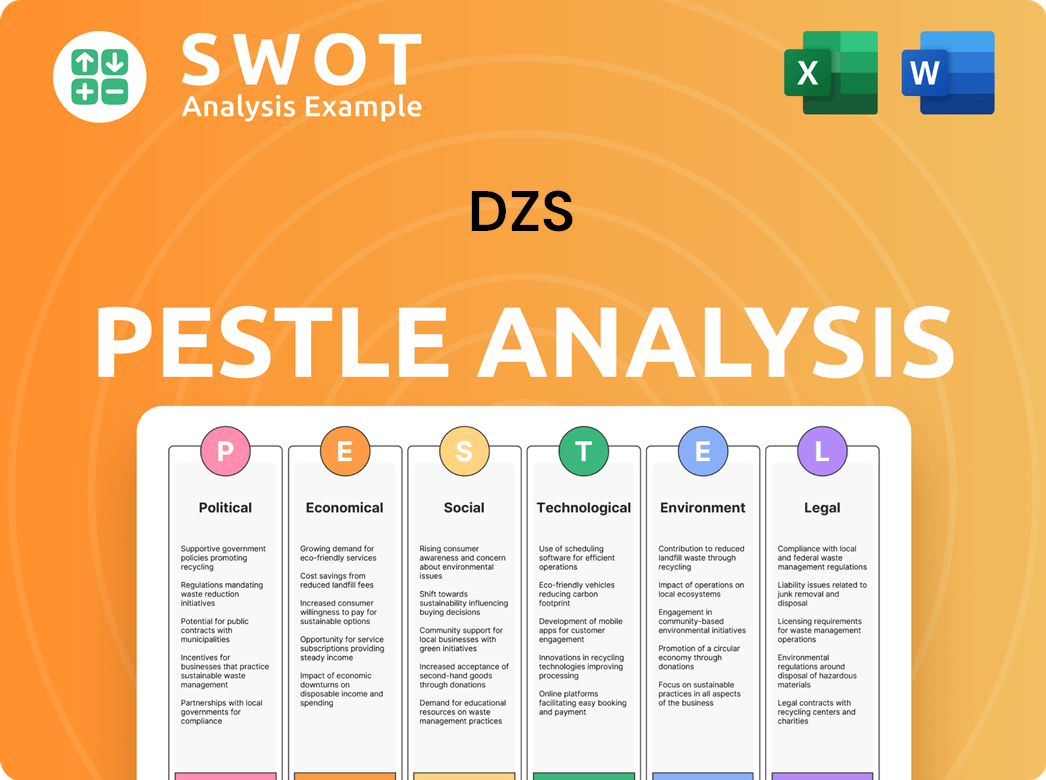

DZS PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped DZS’s Business Model?

In 2024 and 2025, DZS Corporation, or DZS, has undertaken significant strategic shifts to reshape its operations and financial performance. These moves include strategic acquisitions and divestitures, aimed at strengthening its market position and streamlining its focus on core broadband access and connectivity solutions. The company's ability to adapt to market demands and capitalize on emerging opportunities highlights its commitment to innovation and growth in the telecommunications sector.

DZS has focused on improving its financial health and operational efficiency. The company has improved its gross margin and reduced operating expenses. DZS is positioning itself for growth by concentrating on high-margin regions and leveraging synergies from acquisitions. The company's strategic initiatives are designed to enhance its competitive edge and capitalize on the growing demand for advanced broadband solutions.

DZS's strategic moves and milestones reflect its commitment to innovation and growth. The company's focus on high-quality broadband access solutions and technology leadership positions it well for future opportunities. For a deeper dive into DZS's growth strategy, consider reading Growth Strategy of DZS.

In April 2024, DZS divested its Asia business. This move allowed DZS to concentrate on higher-margin regions. The acquisition of NetComm in June 2024 expanded DZS's broadband connectivity portfolio.

DZS sold its enterprise Industrial IoT portfolio to Lantronix for $6.5 million in November 2024. The company divested its in-home WiFi software and service assurance portfolio. These moves strengthened the balance sheet and refocused the company.

DZS focuses on high-quality, differentiated broadband access solutions. The company leads in technology like 10Gig PON and 400G optical transport. DZS achieved the U.S. BEAD Program 'Build America Buy America' manufacturing readiness certification in October 2024.

DZS improved its GAAP gross margin to 29.4% in Q3 2024. Operating expenses were reduced by 29% year-over-year in the first half of 2024. The company aims for break-even Adjusted EBITDA in 2025.

DZS divested its Asia business in April 2024 and acquired NetComm in June 2024. These moves were aimed at streamlining operations and expanding market reach. The company is focused on cost savings and leveraging synergies from acquisitions to achieve break-even Adjusted EBITDA in 2025.

- Divestiture of Asia business in April 2024.

- Acquisition of NetComm in June 2024.

- U.S. BEAD Program 'Build America Buy America' manufacturing readiness certification in October 2024.

- Targeting break-even Adjusted EBITDA in 2025.

DZS Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is DZS Positioning Itself for Continued Success?

Understanding the industry position, risks, and future outlook of DZS Corporation is crucial for investors and stakeholders. The company operates within the competitive communications equipment market, offering DZS products and DZS services for voice, data, and video delivery. This analysis provides insights into the challenges and opportunities facing DZS.

DZS faces a dynamic market landscape. Its products are deployed globally by over 1,000 customers, including regional, national, and international carriers and service providers. However, the company is navigating significant headwinds that impact its financial stability and market position. For a deeper understanding of the company's target audience, consider reading about the Target Market of DZS.

DZS competes with major players like Nokia, Calix, and Adtran. Its core business faces competition from Huawei and ZTE. In the FiberLAN business, Tellabs and Cisco are key competitors. The company's global footprint includes deployments across various service providers.

A significant risk for DZS is its dwindling cash reserves, which may necessitate strategic alternatives like raising capital or selling assets. The company was delisted from Nasdaq in October 2024 due to non-compliance with filing requirements. Challenges also include converting inventory to cash and securing new orders.

DZS is optimistic about the second half of 2024 and 2025, anticipating improved demand and positive results from sales and inventory conversion. Strategic initiatives include focusing on growth, cost savings, sales synergies, and monetizing inventory. The company aims for break-even Adjusted EBITDA in 2025.

In Q3 2024, DZS experienced a revenue decrease of 23.92% year-on-year. The company aims to convert approximately $79 million of inventory to cash. Focusing on key performance indicators such as growth and profitability, DZS is working towards relisting on Nasdaq.

DZS is implementing several strategies to improve its financial position and market presence. These include focusing on key performance indicators (KPIs) and capitalizing on market opportunities.

- Focus on four key performance indicators: growth and profitability, cost savings, sales synergies from the NetComm acquisition, and monetizing inventory.

- Aiming to achieve break-even Adjusted EBITDA in 2025 and positive cash flow.

- Working towards being relisted on Nasdaq, anticipating market stabilization in the latter half of 2024.

- Investing in broadband access, optical connectivity, and cloud software.

- Capitalizing on government stimulus programs like the U.S. BEAD program.

DZS Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of DZS Company?

- What is Competitive Landscape of DZS Company?

- What is Growth Strategy and Future Prospects of DZS Company?

- What is Sales and Marketing Strategy of DZS Company?

- What is Brief History of DZS Company?

- Who Owns DZS Company?

- What is Customer Demographics and Target Market of DZS Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.