ENEOS Holdings Bundle

How Does ENEOS Holdings Navigate the Shifting Energy Sector?

The global energy sector is in constant flux, demanding adaptability and foresight from industry leaders. ENEOS Holdings, a key player in Japan's energy market, faces the dual pressures of maintaining energy security and driving the transition to a sustainable future. Understanding the ENEOS Holdings SWOT Analysis is crucial for grasping its position.

This exploration of the ENEOS Holdings competitive landscape will reveal its key rivals and strategic positioning within the ENEOS Holdings industry. We'll conduct a thorough ENEOS Holdings market analysis, examining ENEOS Holdings competitors and how the company leverages its strengths. This ENEOS Holdings overview will provide valuable insights into its ENEOS Holdings business strategy and future growth strategies.

Where Does ENEOS Holdings’ Stand in the Current Market?

The core operations of ENEOS Holdings center around Japan's energy sector, where it holds a dominant position. The company specializes in petroleum refining and distribution, with a significant market share in gasoline and other petroleum products. ENEOS Holdings has a substantial refining capacity, and a vast network of service stations across Japan, which strengthens its retail presence.

The value proposition of ENEOS Holdings lies in its comprehensive energy solutions, catering to both industrial clients and individual consumers. It provides essential products like gasoline, and also supplies petrochemicals to various industries. ENEOS is strategically diversifying its portfolio, investing in renewable energy and next-generation technologies to adapt to global decarbonization efforts and maintain a competitive edge.

ENEOS Holdings maintains the largest market share in the Japanese gasoline market. While specific figures for 2024-2025 are subject to change, the company consistently leads in domestic petroleum product sales. This strong position is supported by its extensive refining capacity and service station network.

ENEOS Holdings' refining capacity is approximately 1.9 million barrels per day across its domestic refineries. This substantial capacity enables the company to meet a significant portion of Japan's petroleum product demand. The scale of its refining operations is a key factor in its competitive advantage within the ENEOS Holdings competitive landscape.

ENEOS Holdings operates a vast network of over 12,000 service stations throughout Japan. This extensive retail presence ensures broad market coverage and direct access to consumers. The service station network is crucial for distributing gasoline and other petroleum products effectively.

While primarily focused on Japan and Asia, ENEOS Holdings has expanded its global presence through upstream oil and gas ventures. These ventures are located in regions such as North America, the Middle East, and Southeast Asia. This expansion helps diversify its revenue streams and mitigate risks.

ENEOS Holdings is strategically shifting towards renewable energy sources to reduce its reliance on traditional fossil fuels. This includes investments in solar, wind, and other sustainable energy projects. This move is part of a broader strategy to adapt to the changing energy landscape and meet global decarbonization goals. The Marketing Strategy of ENEOS Holdings reflects these efforts to stay ahead of the curve.

- Focus on renewable energy projects.

- Investments in next-generation energy technologies.

- Diversification of revenue streams.

- Adaptation to global decarbonization efforts.

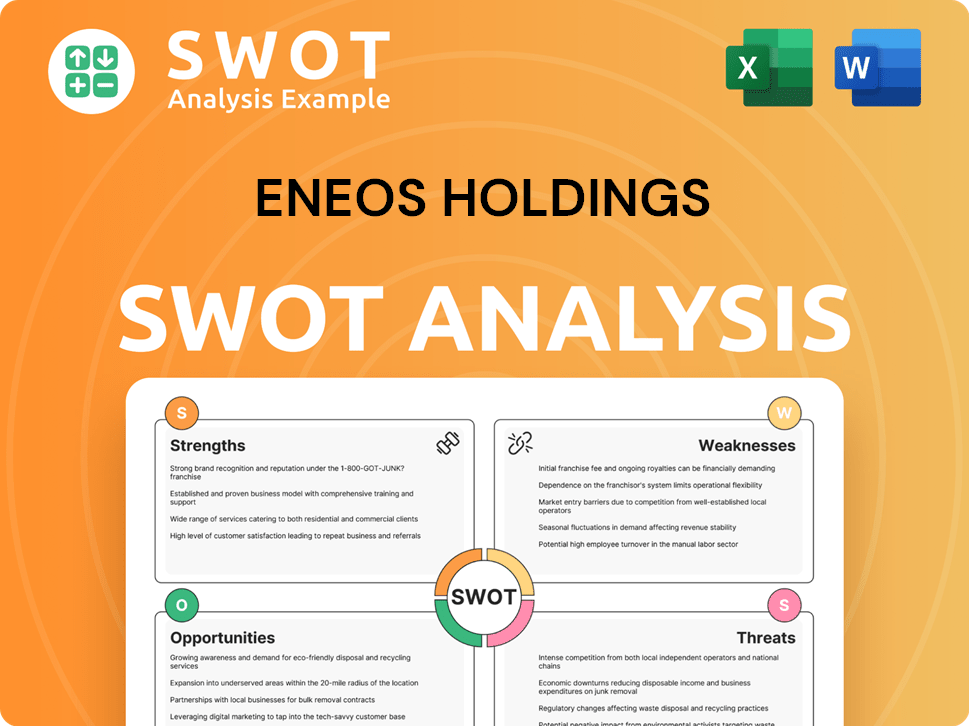

ENEOS Holdings SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging ENEOS Holdings?

The ENEOS Holdings competitive landscape is shaped by a diverse set of players, both domestically and internationally, across its various business segments. Understanding these ENEOS Holdings competitors is crucial for assessing its market position and strategic direction. This analysis provides insights into the key rivals and the competitive dynamics influencing the company's performance.

ENEOS Holdings market analysis reveals a complex environment where traditional oil and gas operations intersect with the evolving demands of the energy transition. The company's ability to navigate this competitive terrain will determine its future success. This overview highlights the major challenges and opportunities ENEOS Holdings faces.

In Japan, ENEOS Holdings competes with Idemitsu Kosan Co., Ltd. and Cosmo Energy Holdings Co., Ltd. These companies have significant market share in refining, distribution, and petrochemicals. They challenge ENEOS Holdings through their extensive service station networks and diversified energy offerings.

Idemitsu Kosan is a major integrated energy company. It competes with ENEOS Holdings through its refining, distribution, and petrochemical operations. They focus on renewable energy initiatives to capture market share.

Cosmo Energy Holdings is another significant Japanese refiner and distributor. They compete by leveraging strong brand recognition and expanding their renewable energy footprint. Their strategies include pricing and service station network optimization.

Globally, ENEOS Holdings faces competition from energy giants like Shell, BP, ExxonMobil, and Chevron. These companies have vast financial resources and global supply chains. They are also significant players in the international trading of petroleum and petrochemical products.

In the renewable energy sector, ENEOS Holdings competes with specialized renewable energy developers, utility companies, and technology firms. This includes companies focused on solar, wind, and hydrogen. The competitive landscape is rapidly evolving with new entrants and alliances.

The development of hydrogen infrastructure and sustainable aviation fuels is driving collaborations. These alliances aim to accelerate technological deployment. ENEOS Holdings is actively involved in these partnerships to enhance its market position.

The ENEOS Holdings industry is influenced by several factors. These include pricing strategies, service station network optimization, and the growth of renewable energy. ENEOS Holdings business strategy must adapt to these changes to maintain its competitive edge. For a deeper understanding of ENEOS Holdings overview, consider reading Revenue Streams & Business Model of ENEOS Holdings.

- ENEOS Holdings market share analysis indicates a strong position in Japan.

- ENEOS Holdings key competitors 2024 include both domestic and international players.

- Who are ENEOS Holdings main rivals: Idemitsu Kosan, Cosmo Energy, Shell, BP, ExxonMobil, and Chevron.

- ENEOS Holdings competitive advantages include its integrated operations and established distribution network.

- ENEOS Holdings SWOT analysis highlights its strengths, weaknesses, opportunities, and threats.

- ENEOS Holdings financial performance compared to competitors shows its profitability and revenue generation.

- ENEOS Holdings recent acquisitions and their impact on the competitive landscape.

- ENEOS Holdings future growth strategies focus on renewable energy and international expansion.

- ENEOS Holdings competitive positioning in renewable energy is crucial for its future success.

- How does ENEOS Holdings compare to its rivals in Japan in terms of market share and profitability.

- ENEOS Holdings global market presence is expanding through strategic partnerships and investments.

- ENEOS Holdings challenges and opportunities include the energy transition and geopolitical risks.

- ENEOS Holdings vs other oil and gas companies in terms of sustainability and innovation.

- ENEOS Holdings competitive intelligence report provides insights into its rivals' strategies and performance.

- ENEOS Holdings strategic partnerships are essential for growth and market penetration.

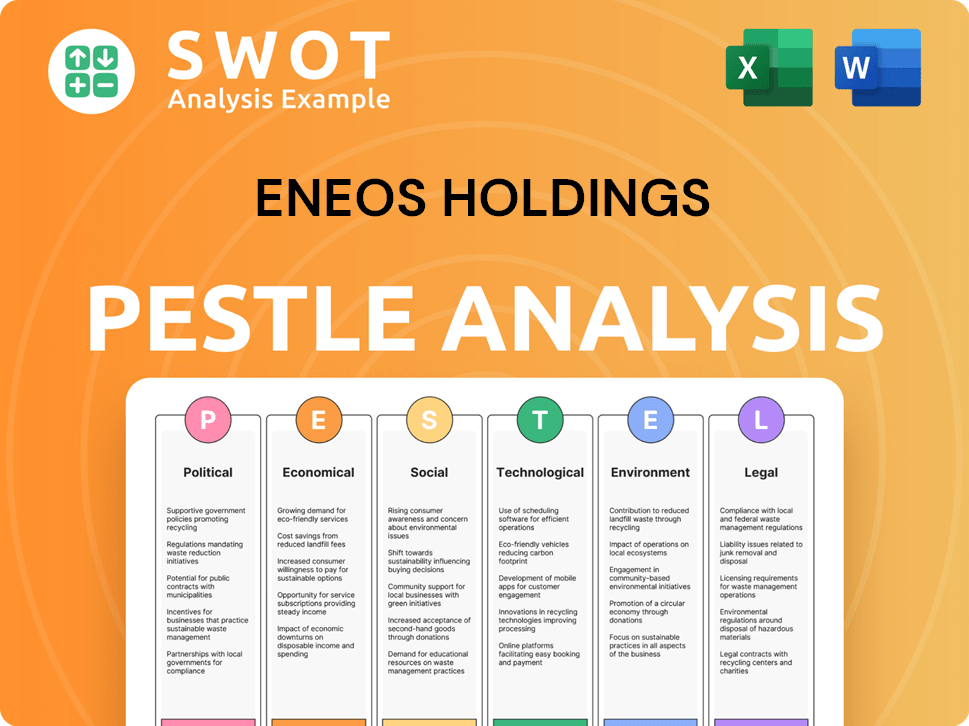

ENEOS Holdings PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives ENEOS Holdings a Competitive Edge Over Its Rivals?

Understanding the Brief History of ENEOS Holdings is crucial for analyzing its competitive advantages. The company, a major player in the Japanese energy sector, has built a strong foundation over decades. This has allowed it to develop significant competitive strengths. These strengths are essential for navigating the evolving energy landscape.

The competitive landscape for ENEOS Holdings is shaped by its strategic moves and key milestones. ENEOS has consistently adapted to market changes, including the shift towards renewable energy. Its investments in new technologies and infrastructure have been pivotal. This has allowed the company to maintain its edge in a dynamic industry.

ENEOS Holdings' competitive edge stems from its integrated business model. This model spans from upstream exploration to downstream retail. This integration enables operational efficiencies and cost management. This is a key factor in its market analysis and overall success. The company's focus on innovation and sustainability further strengthens its position.

ENEOS boasts an extensive infrastructure within Japan. This includes a vast network of refineries, storage facilities, and service stations. This network ensures efficient distribution and provides a significant logistical advantage. The company has the largest number of service stations in Japan.

The company benefits from strong brand equity and customer loyalty. This has been built over more than a century of operation in the Japanese market. This fosters repeat business and provides a stable customer base. This is a key factor in its market share analysis.

ENEOS's integrated business model, spanning exploration, refining, petrochemicals, and retail, allows for economies of scale. This integration helps manage supply chain risks and optimize costs. This is a key element of its ENEOS Holdings business strategy.

The company is actively investing in technologies related to hydrogen production, advanced battery materials, and renewable energy solutions. These investments position ENEOS for future growth in the decarbonized economy. This is crucial for its competitive positioning in renewable energy.

ENEOS Holdings' competitive advantages are multi-faceted, ensuring its resilience in a changing market. These advantages include a robust infrastructure, strong brand recognition, and an integrated business model. The company's focus on innovation and strategic partnerships further enhances its position.

- Extensive Distribution Network: ENEOS operates the largest service station network in Japan, ensuring efficient product delivery.

- Strong Brand Reputation: Over a century of operation has built strong brand equity and customer loyalty.

- Integrated Operations: The integrated model provides economies of scale and supply chain management.

- Technological Investments: Investments in hydrogen, battery materials, and renewable energy solutions.

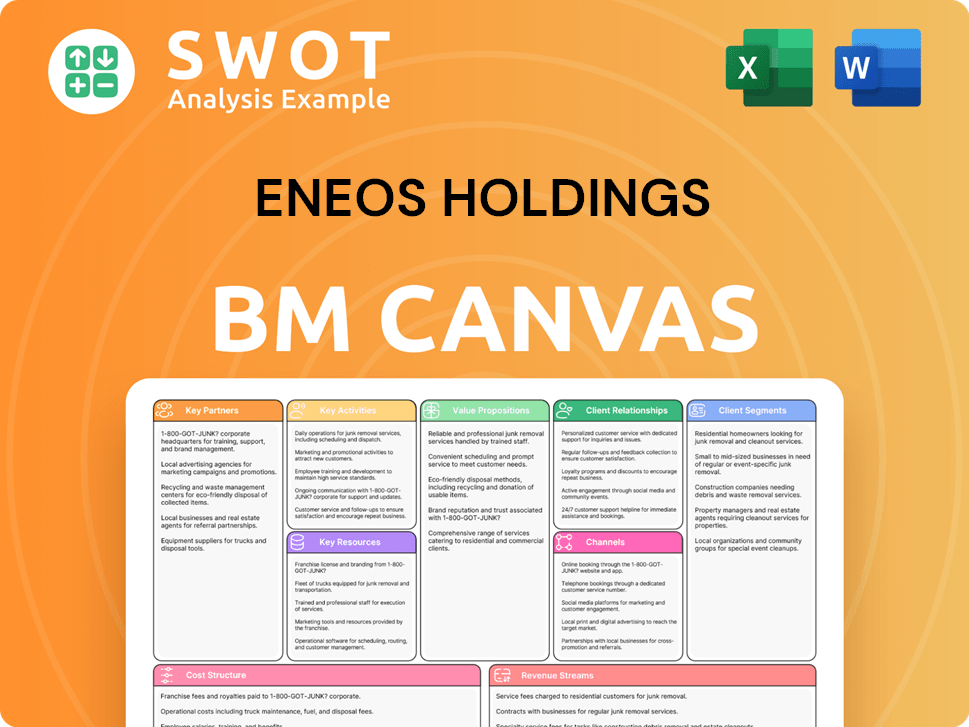

ENEOS Holdings Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping ENEOS Holdings’s Competitive Landscape?

The ENEOS Holdings competitive landscape is shaped by global energy transitions, geopolitical risks, and technological advancements. The company faces the challenge of adapting to a lower-carbon future while competing with both established oil and gas firms and emerging renewable energy players. Understanding its position requires a deep dive into its strategic initiatives, market analysis, and financial performance relative to its key rivals.

ENEOS Holdings industry faces significant risks, including fluctuating oil prices, regulatory changes, and the shift towards renewable energy. However, it also has significant opportunities in areas such as renewable energy development, hydrogen production, and sustainable aviation fuels. Its future outlook hinges on its ability to successfully navigate these challenges and capitalize on emerging opportunities, as detailed in its business strategy.

The energy sector is undergoing a significant transformation, driven by the global push for decarbonization and the increasing adoption of renewable energy sources. Digitalization and automation are also reshaping the value chain, enhancing operational efficiency and customer experience. Geopolitical instability and supply chain disruptions continue to pose challenges to resource availability and pricing.

Key challenges include managing the decline in demand for fossil fuels, adapting to stringent environmental regulations like carbon pricing, and mitigating the impact of geopolitical uncertainties. Competition from renewable energy companies and the need for substantial investments in new technologies also present significant hurdles. Securing reliable access to raw materials and managing supply chain disruptions are also critical.

Significant opportunities exist in renewable energy projects, including solar, wind, and geothermal power. Developing a hydrogen supply chain, investing in battery materials for electric vehicles, and producing sustainable aviation fuels are also key areas for growth. Digitalization and strategic partnerships offer avenues to enhance operational efficiency and capture new market opportunities.

ENEOS Holdings's strategy involves diversifying its energy portfolio, strengthening research and development in next-generation energy technologies, and forming strategic partnerships. This includes investing in renewable energy projects, expanding into hydrogen production, and developing advanced battery materials. These initiatives aim to position the company for long-term sustainability and growth.

ENEOS Holdings is actively pursuing a transition towards a low-carbon future, with a focus on renewable energy, hydrogen, and advanced materials. The company is strategically investing in these areas to mitigate risks associated with declining fossil fuel demand and capitalize on emerging market opportunities. These efforts are designed to enhance the company's competitive advantages.

- Renewable Energy Investments: Expanding its portfolio of solar, wind, and geothermal projects.

- Hydrogen Development: Investing in the development of a hydrogen supply chain.

- Advanced Materials: Focusing on battery materials for electric vehicles and sustainable aviation fuels.

- Strategic Partnerships: Forming alliances to accelerate its transition and capture new market opportunities.

ENEOS Holdings has a global market presence, with operations and investments spanning across various regions. The company's ability to adapt to changing market dynamics and maintain a strong financial position is crucial for its success. The article, Growth Strategy of ENEOS Holdings, provides insights into the company's mission and strategic direction.

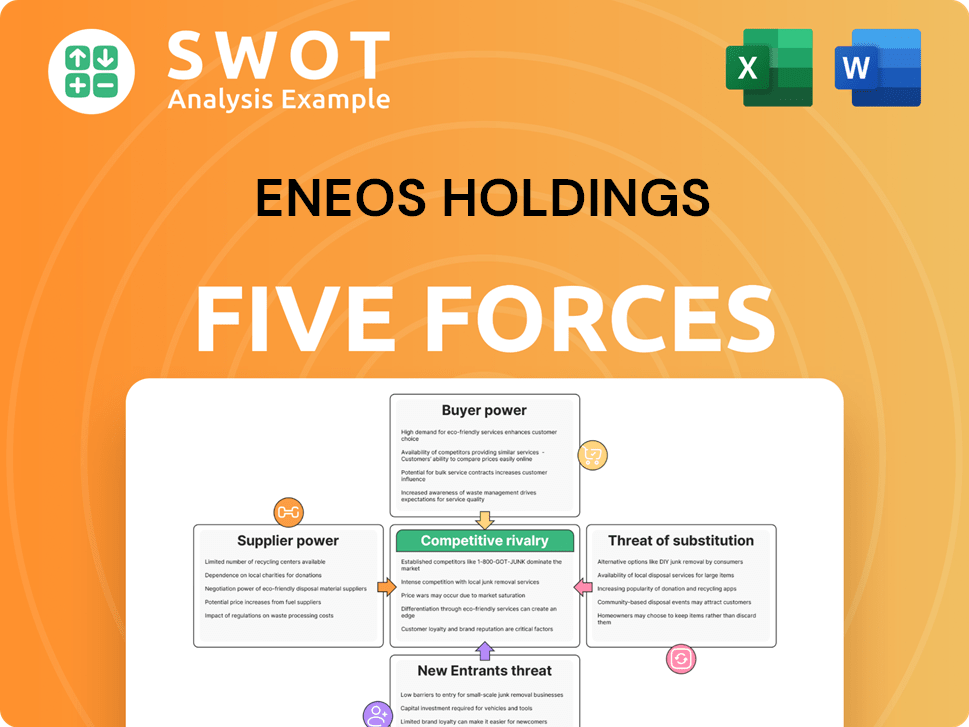

ENEOS Holdings Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of ENEOS Holdings Company?

- What is Growth Strategy and Future Prospects of ENEOS Holdings Company?

- How Does ENEOS Holdings Company Work?

- What is Sales and Marketing Strategy of ENEOS Holdings Company?

- What is Brief History of ENEOS Holdings Company?

- Who Owns ENEOS Holdings Company?

- What is Customer Demographics and Target Market of ENEOS Holdings Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.