ENEOS Holdings Bundle

How Well Do You Know ENEOS Holdings?

ENEOS Holdings, a leading Japanese energy company, is a powerhouse in the global energy sector. With over 135 years of experience, the ENEOS Company plays a pivotal role in oil refining, distribution, and marketing, dominating a significant portion of the Japanese market. But how does this energy giant truly operate, and what drives its financial success?

This comprehensive analysis will explore the ENEOS operations, its strategic direction, and the factors shaping its future. We'll examine its diverse revenue streams, from petroleum products to renewable energy initiatives, and provide insights into its competitive landscape. For a deeper dive into its strengths and weaknesses, consider exploring the ENEOS Holdings SWOT Analysis to gain a strategic edge.

What Are the Key Operations Driving ENEOS Holdings’s Success?

ENEOS Holdings creates and delivers value through a diversified portfolio of energy-related businesses. The ENEOS Company focuses on refining, distributing, and marketing petroleum products, alongside manufacturing and selling petrochemicals. Additionally, the company is involved in oil and natural gas exploration, production, and the supply of electricity and hydrogen.

The ENEOS operations are supported by an extensive network, including refineries, pipelines, and service stations, ensuring a smooth supply of energy products. This integrated approach spans resource development to product sales, allowing for greater control and efficiency across the value chain. This comprehensive capability results in a stable and diverse energy supply for customers.

Furthermore, ENEOS Holdings is committed to green chemicals, aiming to reduce environmental impact by manufacturing products from plastic waste and biomass materials. This commitment and its focus on renewable energy position it for future market differentiation and a contribution to a low-carbon society. Understanding the Growth Strategy of ENEOS Holdings provides further insight into its operational and strategic direction.

ENEOS operates primarily in the refining, petrochemicals, oil and gas exploration, and power generation sectors. The refining segment processes crude oil into gasoline, kerosene, and other petroleum products. The petrochemicals segment produces essential materials like ethylene and paraxylene. The company also engages in oil and gas exploration and production activities.

ENEOS offers a stable and diverse energy supply, leveraging an integrated approach from upstream resource development to downstream product sales. The company’s focus on renewable energy and decarbonization initiatives positions it for future market differentiation. Strategic partnerships, such as the long-term agreement with QatarEnergy for naphtha supply, enhance its value proposition.

ENEOS utilizes an extensive network of refineries, pipelines, and service stations to ensure a seamless supply of energy products. The company's integrated approach enables greater control and efficiency across the value chain. This approach allows for effective distribution and marketing of its products.

ENEOS has established strategic partnerships to bolster its supply chain and market presence. A key example is the long-term agreement with QatarEnergy to supply up to 9 million tons of Naphtha over 10 years, starting July 2024. These partnerships ensure a stable supply of raw materials and enhance operational efficiency.

ENEOS Holdings focuses on refining, petrochemicals, and renewable energy. The company's integrated operations and strategic partnerships are key to its success. The company is committed to sustainability and a low-carbon future.

- Refining and marketing of petroleum products.

- Manufacturing and sale of petrochemicals.

- Exploration, development, and production of oil and natural gas.

- Supply of electricity and hydrogen.

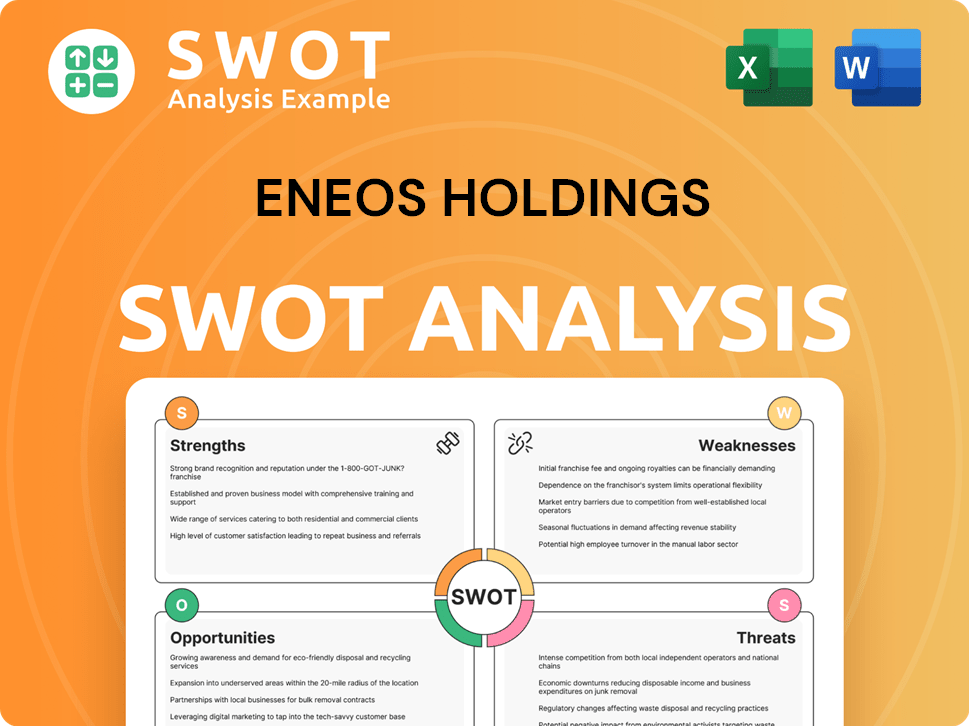

ENEOS Holdings SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does ENEOS Holdings Make Money?

The revenue streams of ENEOS Holdings, a prominent Japanese energy company, are primarily driven by its extensive energy and materials businesses. The company's operations encompass a diverse range of activities, with a significant portion of revenue derived from the sale of petroleum products such as gasoline, kerosene, and lubricants. Additionally, ENEOS generates income from petrochemical products and oil and natural gas exploration and production.

ENEOS's monetization strategies are evolving to include renewable energy initiatives, reflecting a strategic shift towards cleaner energy alternatives. This expansion involves developing and operating solar, wind, and biomass power generation projects, alongside investments in low-carbon energy sources such as liquefied natural gas (LNG) and sustainable aviation fuel (SAF). These efforts are part of a broader strategy to diversify revenue and reduce reliance on traditional fossil fuels.

The consolidated revenue for fiscal year 2024 (April 1, 2024, to March 31, 2025) was 12,322 billion yen, a slight decrease of 0.2% from the previous year. While the petroleum products business remains a significant component, it experienced lower-than-expected revenue in FY2024. The company is also expanding power purchase agreements (PPA) and utilizing storage batteries to generate revenue.

ENEOS generates revenue through a variety of sources, with a strong emphasis on both traditional and emerging energy sectors. The ENEOS business model is designed to adapt to changing market dynamics, ensuring long-term sustainability and growth. The company is actively involved in the development of renewable energy projects, focusing on solar, wind, and biomass power generation.

- Petroleum Products: Sales of gasoline, kerosene, lubricants, and other related products constitute a major revenue stream.

- Petrochemicals: Production and sale of various petrochemical products.

- Oil and Natural Gas: Exploration, production, and sale of oil and natural gas.

- Renewable Energy: Development and operation of solar, wind, and biomass power generation projects. ENEOS aims to develop a cumulative total of 2 million kW primarily from solar and onshore wind power plants.

- Low-Carbon Energy: Investments in liquefied natural gas (LNG) and sustainable aviation fuel (SAF). A new three-year business plan through March 2028 allocates 740 billion yen to low-carbon and decarbonization initiatives.

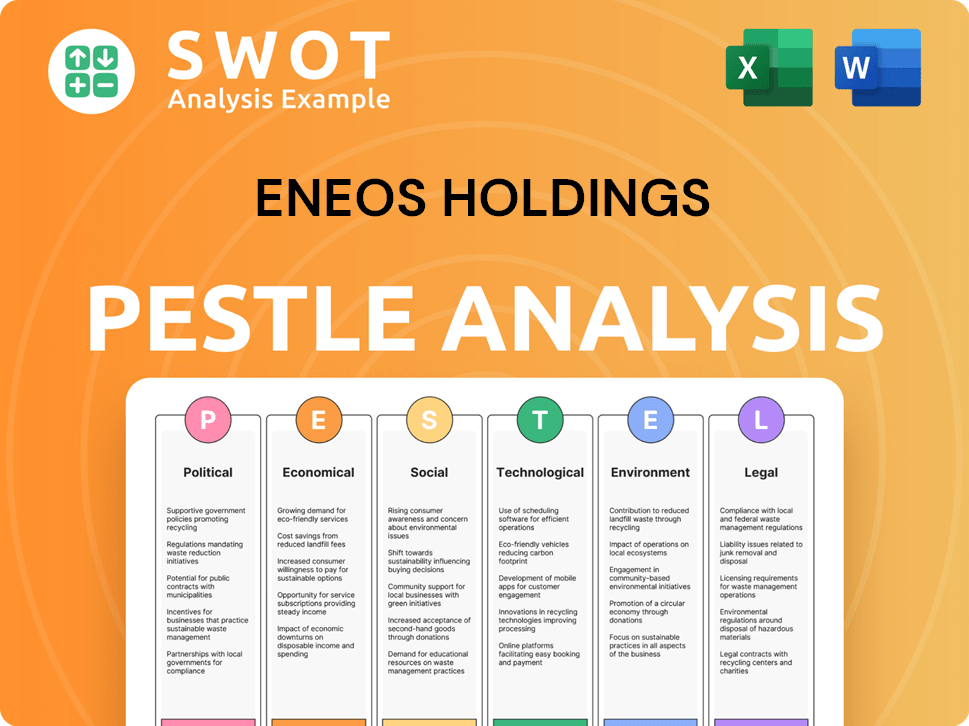

ENEOS Holdings PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped ENEOS Holdings’s Business Model?

The evolution of ENEOS Holdings showcases a series of key milestones and strategic shifts that have shaped its trajectory in the energy sector. The company has actively adapted to the changing global energy landscape, particularly focusing on its response to the energy transition. This involves significant investments in renewable energy and decarbonization initiatives, demonstrating a commitment to sustainability and long-term viability.

Strategic moves by ENEOS include a recalibrated business plan through March 2028, involving a substantial investment of 1.56 trillion yen ($10.7 billion). A significant portion, 740 billion yen, is allocated to low-carbon and decarbonization projects, including renewables and carbon capture technologies. The company has also adjusted its focus within the renewable energy sector, increasing investments in liquefied natural gas (LNG) and sustainable aviation fuel (SAF).

ENEOS's competitive edge is built on its strong brand presence and extensive infrastructure as Japan's largest oil refiner. The company's integrated business model spans both the energy and materials sectors. ENEOS is also actively involved in technological development and open innovation, particularly in next-generation energies, further strengthening its market position.

In fiscal year 2024, ENEOS faced operational challenges, with revenue decreasing by 0.2% to 12,322 billion yen and operating profit dropping by 72.2% to 106 billion yen. Despite these headwinds, the company projects a recovery in operating profit for fiscal year 2025. ENEOS plans to increase its dividend payout, reflecting confidence in its future performance.

Strategic actions, such as classifying the Metals Business as discontinued operations, have impacted its financial figures. ENEOS is also actively involved in carbon capture and storage (CCS) initiatives, aiming to start a CCS business by fiscal 2030 and commercialize 20 million tonnes of CCS per year by fiscal 2040. The company is adapting to new trends by joining initiatives like the eFuel Alliance in May 2024.

ENEOS is strategically focusing on several key areas to ensure its long-term success. These include investments in low-carbon and decarbonization initiatives, enhancing its refinery utilization rate, and expanding its involvement in sustainable energy sources. This strategic approach is designed to navigate the evolving energy landscape and capitalize on emerging opportunities.

- Increased investment in LNG and SAF.

- Aiming to raise refinery utilization to 90% by fiscal year 2027.

- Developing CCS business with a target of 20 million tonnes of CCS per year by fiscal 2040.

- Joining initiatives like the eFuel Alliance.

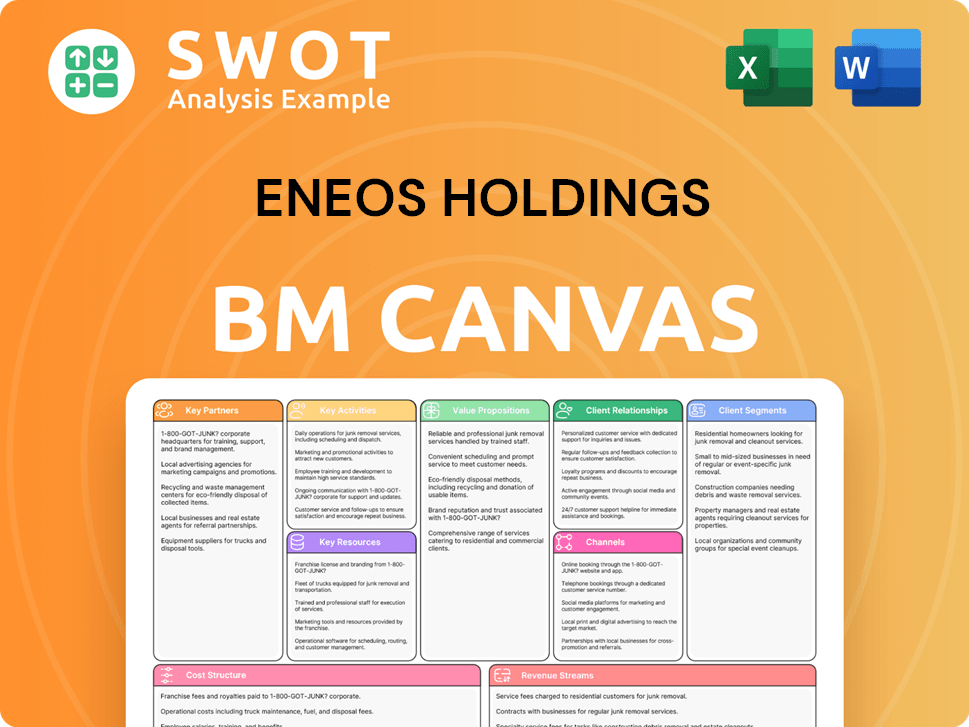

ENEOS Holdings Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is ENEOS Holdings Positioning Itself for Continued Success?

As a leading Japanese energy company, ENEOS Holdings holds a prominent position in Japan's energy sector. It is the largest oil refiner, controlling approximately 50% of petroleum product sales. While its ENEOS operations extend globally, particularly in Asia, the company faces competition from other industry players.

The ENEOS Company faces several risks, including fluctuations in commodity prices, particularly for crude oil and petroleum products, which can impact its financial performance. The declining demand for petroleum products in Japan, alongside the transition to alternative energy sources, presents a significant challenge. Securing oil and natural gas reserves and potential surges in electricity procurement prices add to the complexities. Macroeconomic factors, such as oil price swings and interest rate pressures, also pose near-term risks for ENEOS Holdings.

ENEOS is the largest oil refiner in Japan, holding a substantial market share in petroleum product sales. Its global presence is significant, especially in Asia, due to its oil and natural gas exploration and production, and petrochemical operations. ENEOS competes with other major energy companies.

Key risks include fluctuations in commodity prices, especially crude oil and petroleum products, which can affect margins. Declining demand for petroleum products in Japan and the transition to alternative energy sources pose challenges. Securing oil and natural gas reserves and potential electricity price increases are additional risks.

ENEOS is committed to energy transition and sustainability, aiming for carbon neutrality by fiscal 2040. This involves developing renewable energy projects and expanding its LNG operations. While revenue is expected to decrease in fiscal year 2025, operating profit is projected to increase.

ENEOS is focusing on renewable energy, including solar and wind power, with a target of 2 million kW of development. It's also reinforcing and expanding its LNG operations, anticipating steady demand growth. The company aims to balance traditional energy supply with investments in low-carbon and decarbonized energy solutions.

Looking ahead, ENEOS is actively pursuing energy transition and sustainability. The Carbon Neutrality Plan, updated in May 2025, outlines the company's commitment to achieving carbon neutrality in its own emissions by fiscal 2040, and contributing to societal emission reductions. This includes large-scale renewable energy projects.

- Development of 2 million kW of solar and onshore wind power.

- Establishing a renewable hydrogen business.

- Offshore wind power generation project commencing construction in fiscal year 2025.

- Reinforcing and expanding LNG operations.

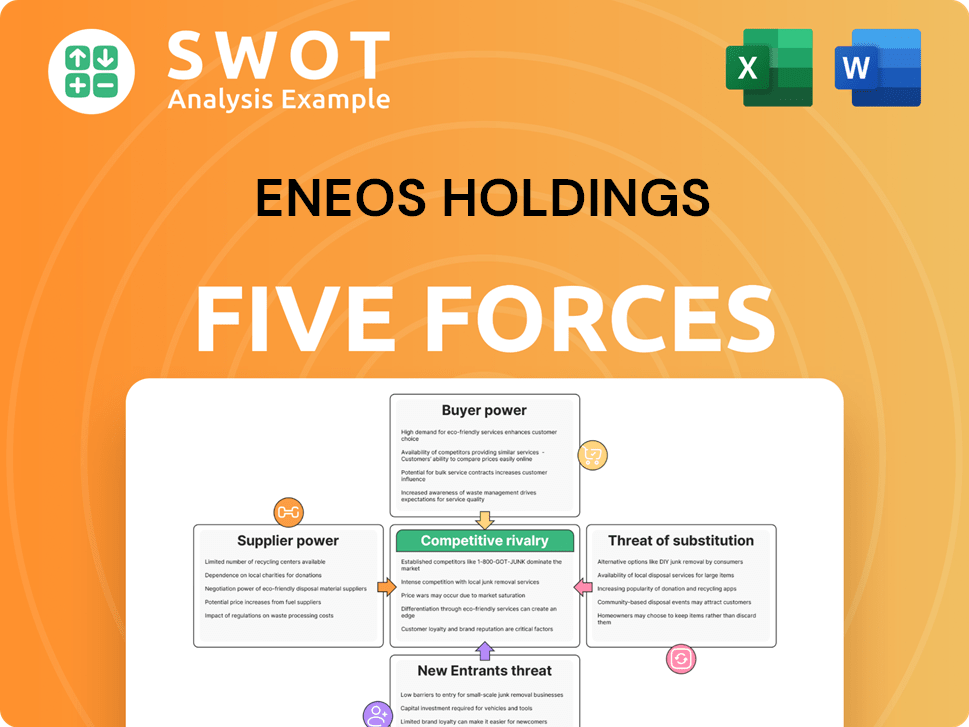

ENEOS Holdings Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of ENEOS Holdings Company?

- What is Competitive Landscape of ENEOS Holdings Company?

- What is Growth Strategy and Future Prospects of ENEOS Holdings Company?

- What is Sales and Marketing Strategy of ENEOS Holdings Company?

- What is Brief History of ENEOS Holdings Company?

- Who Owns ENEOS Holdings Company?

- What is Customer Demographics and Target Market of ENEOS Holdings Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.