ENEOS Holdings Bundle

Who Really Controls ENEOS Holdings?

Understanding the ownership of ENEOS Holdings is crucial for anyone invested in the energy sector. From its origins in Japan's industrial heartland to its current status as a global energy player, ENEOS's story is one of strategic evolution. Unraveling ENEOS Holdings SWOT Analysis, and its ownership structure unveils the forces driving its future.

The journey of ENEOS Holdings from its predecessors, including Nippon Oil, to its present form as ENEOS Corporation reflects a complex interplay of mergers, acquisitions, and strategic shifts. Knowing who owns ENEOS provides insights into the company's priorities and its response to market dynamics. This exploration into the ENEOS ownership reveals the key players and their influence on this energy giant, revealing the ENEOS parent company and its impact on ENEOS Japan and beyond.

Who Founded ENEOS Holdings?

Understanding the founders and early ownership of ENEOS Holdings requires looking back at its origins. The company's current form emerged from the 2017 merger of JX Holdings and TonenGeneral Sekiyu. Therefore, the initial ownership structure is a blend of the ownership of these two entities, which themselves evolved through numerous mergers in the Japanese oil industry.

ENEOS Holdings's history is deeply rooted in the Japanese oil industry. JX Holdings' lineage traces back to Nippon Oil, established in 1888. TonenGeneral Sekiyu had its roots in the Esso and Mobil operations in Japan. This complex history means there isn't a single set of 'founders' in the traditional sense.

The initial shareholding in ENEOS Holdings was determined by the exchange ratio agreed upon during the merger, where JX Holdings became the wholly owning parent company through a share exchange. The early ownership of the predecessor companies involved a mix of industrialist investors and financial institutions. For a deeper dive into the company's past, consider reading the Brief History of ENEOS Holdings.

The direct founding of ENEOS Holdings as it exists today stems from the 2017 merger of JX Holdings and TonenGeneral Sekiyu.

The early ownership structure is a composite of the ownership structures of JX Holdings and TonenGeneral Sekiyu.

JX Holdings' lineage traces back to Nippon Oil, established in 1888, while TonenGeneral Sekiyu had its roots in the Esso and Mobil operations in Japan.

The initial shareholding was determined by the exchange ratio agreed upon during the merger, where JX Holdings became the wholly owning parent company through a share exchange.

Early backers for these historical entities would have included influential Japanese business families and nascent financial institutions.

The vision of these founding teams was clearly reflected in the establishment of robust energy supply chains crucial for Japan's industrialization and economic growth.

The early ownership of ENEOS Corporation is a complex subject due to the company's history of mergers and acquisitions. ENEOS Japan, as it exists today, is the result of the 2017 merger. The company's structure reflects the evolution of the Japanese oil industry over more than a century. Understanding the ENEOS parent company involves recognizing the historical roots of its predecessors.

- The 2017 merger was a pivotal event in the formation of ENEOS Holdings.

- Early ownership was determined by the exchange ratio during the merger.

- The company's history includes Nippon Oil and the Esso/Mobil operations in Japan.

- Early investors included Japanese business families and financial institutions.

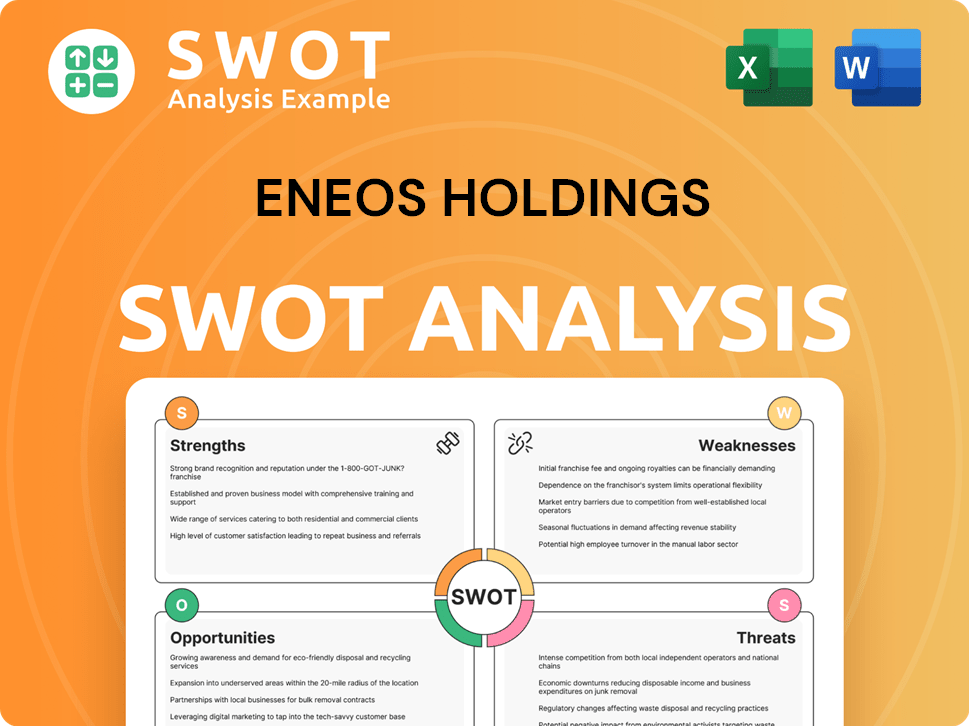

ENEOS Holdings SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has ENEOS Holdings’s Ownership Changed Over Time?

The evolution of ENEOS Holdings' ownership has been shaped by major consolidations within the Japanese energy sector. The most significant event was the business integration on April 1, 2017, when JX Holdings, Inc. and TonenGeneral Sekiyu K.K. merged to form JXTG Holdings, Inc. JXTG Holdings, Inc. was later rebranded as ENEOS Holdings, Inc. on June 25, 2020. This integration was a strategic move to create a stronger and more competitive energy group. At the time of the 2017 integration, JX Holdings became the wholly owning parent company through a share exchange, with TonenGeneral Sekiyu becoming a wholly-owned subsidiary. This restructuring aimed to enhance operational efficiency and market competitiveness.

As a publicly traded company on the Tokyo Stock Exchange (TSE), the ENEOS ownership structure is primarily distributed among institutional investors, investment funds, and individual shareholders. This ownership model reflects a broader trend in global markets, influencing company strategy towards long-term value creation and shareholder returns. The company's focus includes strategic investments in growth areas like renewable energy and adherence to global governance standards. You can learn more about the company's strategic direction in the article Growth Strategy of ENEOS Holdings.

| Ownership Category | Ownership Details (as of March 31, 2024) | Notes |

|---|---|---|

| Institutional Investors | Trust banks (e.g., The Master Trust Bank of Japan, Ltd., Custody Bank of Japan, Ltd.) and major financial institutions | Hold a significant portion of outstanding shares, often exceeding 10-15% combined. |

| Individual Shareholders | Current and former executives, individual investors | Hold a comparatively small percentage of the total shares. |

| Other | No single families, venture capital, or private equity firms hold controlling stakes. | Reflects a diversified ownership structure. |

The shift towards greater institutional ownership has reinforced a focus on operational efficiency and shareholder returns. For the fiscal year ended March 31, 2024, ENEOS Holdings reported a total shareholder return of over 50%, indicating a strong commitment to maximizing shareholder value. This focus is a key aspect of the ENEOS Holdings company structure.

ENEOS ownership is primarily held by institutional investors, reflecting a trend towards long-term value creation.

- The company's structure is influenced by its publicly traded status.

- Major institutional investors include trust banks and financial institutions.

- The ownership structure supports strategic investments and global governance.

- The focus is on operational efficiency and shareholder returns.

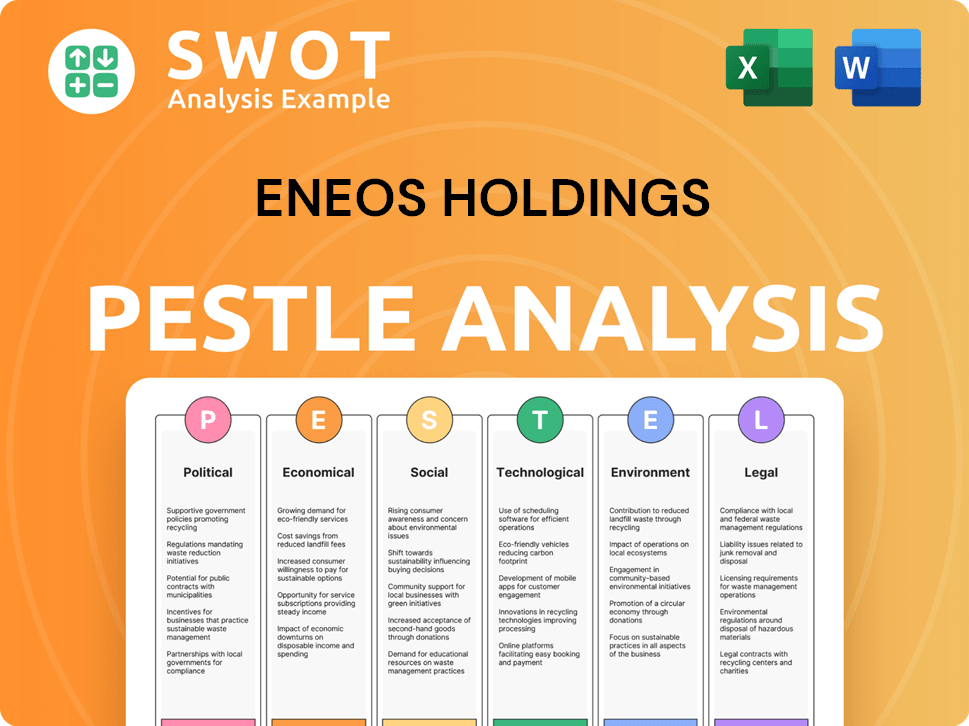

ENEOS Holdings PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on ENEOS Holdings’s Board?

The Board of Directors of ENEOS Holdings, as of 2024, includes a mix of internal executives and independent outside directors. This structure reflects a commitment to corporate governance. The board typically consists of a Chairman, President, and several internal directors who are executive officers of the company, alongside independent outside directors. These independent directors provide external perspectives and ensure accountability to shareholders. The composition of the board can change, but the presence of independent directors is a consistent feature.

The independent directors are appointed for their expertise and ability to provide impartial judgment. They do not typically represent specific major shareholders. The board's composition ensures a balance between internal expertise and external oversight, which is vital for strategic decision-making and maintaining investor confidence. This structure helps in navigating the complexities of the energy sector and the evolving landscape of corporate governance.

| Board Role | Description | Notes |

|---|---|---|

| Chairman | Leads the board and oversees its activities. | Often an internal executive or a former executive. |

| President | Chief Executive Officer, responsible for daily operations. | Key executive officer and board member. |

| Internal Directors | Executive officers of the company. | Provide operational expertise and strategic input. |

| Independent Outside Directors | Non-executive directors with no ties to the company's management. | Provide external perspectives and ensure accountability. |

The voting structure of ENEOS Holdings follows the principle of one-share-one-vote, which is standard for companies listed on the Tokyo Stock Exchange. There are no special voting rights or dual-class shares that would grant outsized control to any single entity. This structure ensures that voting power is directly proportional to the number of shares held. Major shareholders, such as institutional investors, exert their influence through their collective voting power at annual general meetings. These meetings are where proposals related to director appointments, dividend policies, and other significant corporate actions are decided. The company's focus on transitioning towards a more sustainable energy portfolio is likely influenced by discussions with major shareholders and broader market expectations for environmental, social, and governance (ESG) performance. For more insights, consider exploring the Marketing Strategy of ENEOS Holdings.

The Board of Directors at ENEOS Holdings includes both internal executives and independent outside directors, ensuring a balance of expertise and oversight.

- The voting structure follows the one-share-one-vote principle.

- Major shareholders influence decisions through collective voting.

- The company is focused on enhancing transparency and shareholder engagement.

- The strategic direction is influenced by major shareholders and market expectations.

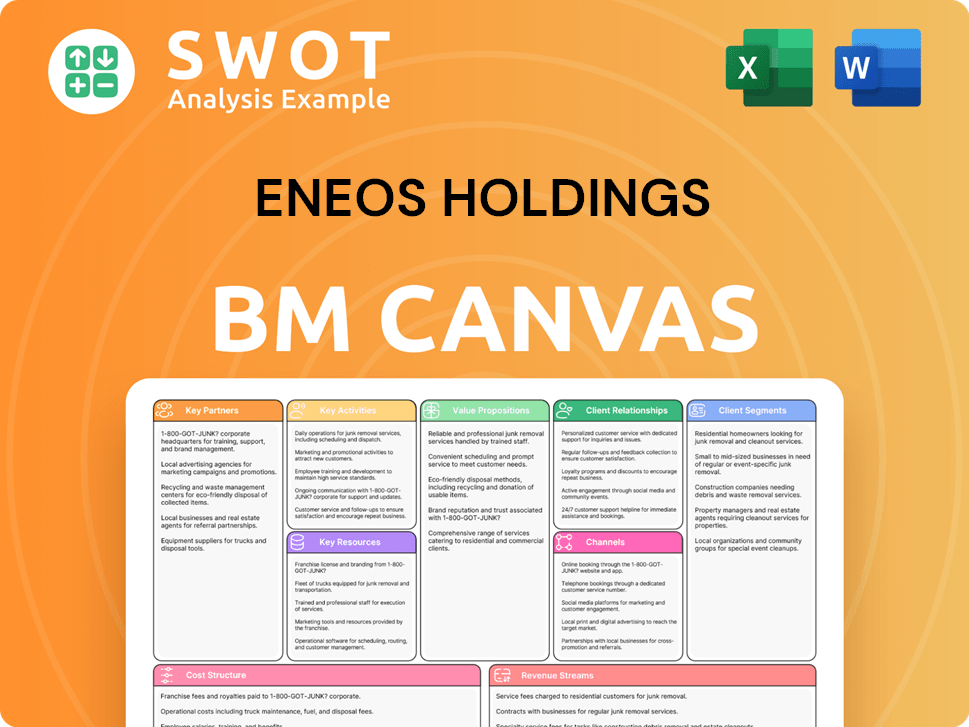

ENEOS Holdings Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped ENEOS Holdings’s Ownership Landscape?

Over the past few years, ENEOS Holdings has focused on transforming its business, especially in response to global energy transitions. This shift impacts ENEOS ownership by potentially attracting new investors focused on ESG criteria and sustainable finance. For example, the company has invested in hydrogen energy and sustainable aviation fuel (SAF) initiatives, with projects announced or underway in 2024 and 2025. The company's strategic pivot involves increasing investment in renewable energy sources, signaling a long-term move away from its traditional reliance on fossil fuels.

In terms of capital allocation, ENEOS Holdings has prioritized shareholder returns, including share buybacks. In its fiscal year ending March 31, 2024, the company highlighted its commitment to stable shareholder returns. While specific large-scale secondary offerings or major founder departures are not prominent in recent news, the company has actively managed its asset portfolio. This includes divestitures of non-core businesses and strategic acquisitions that align with its long-term vision. Industry trends also show increasing institutional ownership in large Japanese corporations, often driven by passive investment vehicles.

| Aspect | Details | Impact on Ownership |

|---|---|---|

| Renewable Energy Investments | Investments in hydrogen, SAF, and other sustainable projects. | Attracts ESG-focused investors; potential shift in shareholder base. |

| Shareholder Returns | Share buybacks and commitment to stable returns. | Benefits existing shareholders; may influence investor perception. |

| Asset Portfolio Management | Divestitures and strategic acquisitions. | Reflects long-term vision; could subtly alter ownership profile. |

The company's long-term vision, the 'ENEOS Group Long-Term Vision 2040,' outlines a path towards becoming a 'comprehensive energy and materials company,' implying continued evolution in its business and potentially its investor base. This strategy may involve further strategic investments or divestitures that could subtly alter its ENEOS ownership profile. The company's headquarters is located in Tokyo, Japan, and it is a publicly traded company. The company's focus on energy transition is a key factor influencing its future ownership trends.

ENEOS is increasingly investing in renewable energy sources. This includes hydrogen and sustainable aviation fuel projects. These moves are part of a broader effort to transition away from fossil fuels, aligning with global energy trends.

The company prioritizes shareholder returns through share buybacks. This approach aims to increase earnings per share. This benefits existing shareholders and reflects a commitment to financial stability.

Institutional ownership is increasing in large Japanese corporations. Passive investment vehicles like index funds drive this trend. This can lead to a more diversified shareholder base.

The company's long-term vision aims to become a comprehensive energy and materials company. This implies continued evolution in its business. This could attract a different investor base.

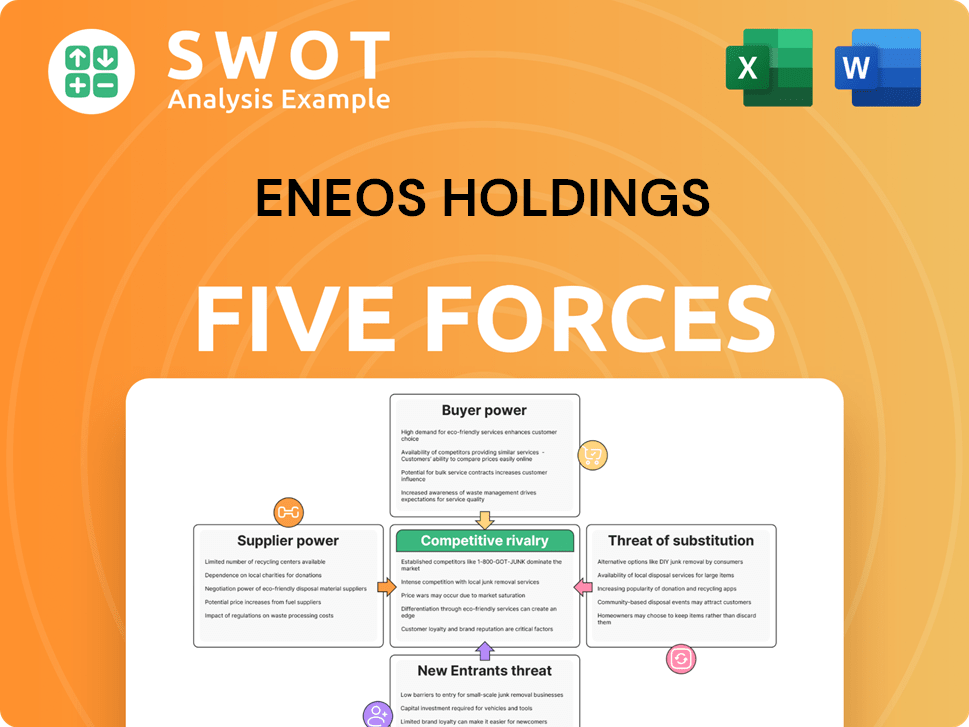

ENEOS Holdings Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of ENEOS Holdings Company?

- What is Competitive Landscape of ENEOS Holdings Company?

- What is Growth Strategy and Future Prospects of ENEOS Holdings Company?

- How Does ENEOS Holdings Company Work?

- What is Sales and Marketing Strategy of ENEOS Holdings Company?

- What is Brief History of ENEOS Holdings Company?

- What is Customer Demographics and Target Market of ENEOS Holdings Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.