ENEOS Holdings Bundle

Can ENEOS Holdings Navigate the Energy Transition Successfully?

ENEOS Holdings, Japan's energy giant, faces a pivotal moment. This ENEOS Holdings SWOT Analysis will help you understand the complex global energy transition, charting a course between traditional fuel supply and ambitious decarbonization targets. With a history dating back to 1888, ENEOS is striving to redefine its role in a rapidly changing world.

This analysis delves into the core of ENEOS's ENEOS Holdings SWOT Analysis, exploring its Growth Strategy and ambitious goals to become a leading energy and materials company. We will examine the ENEOS Future, its strategic initiatives, ENEOS Business ventures, and how this Japanese Company plans to navigate the challenges and opportunities of the evolving energy landscape, including its renewable energy projects and global expansion plans. Understanding ENEOS Holdings' commitment to sustainability and its investment strategy is crucial for anyone seeking to understand the future outlook of this significant energy company.

How Is ENEOS Holdings Expanding Its Reach?

The ENEOS Holdings is strategically expanding its operations, focusing on low-carbon energy sources while maintaining its core business. The company's growth strategy involves significant investments in renewable energy, LNG, and sustainable aviation fuel (SAF), aiming to adapt to evolving global energy demands. This expansion is supported by a substantial investment plan, highlighting ENEOS's commitment to a sustainable future.

The company's strategic initiatives include geographical expansion, particularly in overseas electricity businesses. ENEOS is also actively pursuing mergers and acquisitions (M&A) in the renewable energy sector to bolster its power generation capabilities. These moves are part of a broader plan to restructure its portfolio and adapt to the changing energy landscape.

As part of its growth strategy, ENEOS is actively pursuing expansion initiatives. The company is investing heavily in low-carbon and decarbonization projects, with a focus on renewable energy and sustainable aviation fuel. This strategic shift is designed to position ENEOS for long-term growth in a changing market. To learn more, see the Marketing Strategy of ENEOS Holdings.

ENEOS plans to invest a total of 1.56 trillion yen (approximately $10.7 billion) through March 2028. A significant portion, 740 billion yen, will be allocated to low-carbon and decarbonization initiatives.

ENEOS is reinforcing and expanding its LNG operations, anticipating rising global demand. The company holds stakes in LNG ventures across Asia and is exploring potential U.S. projects. This expansion is a key element of ENEOS's growth strategy.

The company is investing in SAF, with plans for an in-house manufacturing system at its Wakayama plant from 2028. This investment reflects ENEOS's commitment to sustainable energy solutions and reducing its carbon footprint.

ENEOS is focused on overseas electricity businesses, particularly solar power generation in the U.S., Australia, and Asia. A joint venture with TotalEnergies aims to develop 2 GW of decentralized solar capacity across Asia.

ENEOS is undertaking several key initiatives to drive its future growth. These initiatives include strategic investments in low-carbon energy, geographical expansion, and portfolio restructuring. These efforts are designed to ensure the company’s long-term success.

- Investment in low-carbon energy sources, including LNG and SAF.

- Expansion of overseas electricity businesses, particularly solar power.

- Strategic partnerships and joint ventures to enhance market presence.

- Restructuring of the portfolio, including the sale of the shipping business.

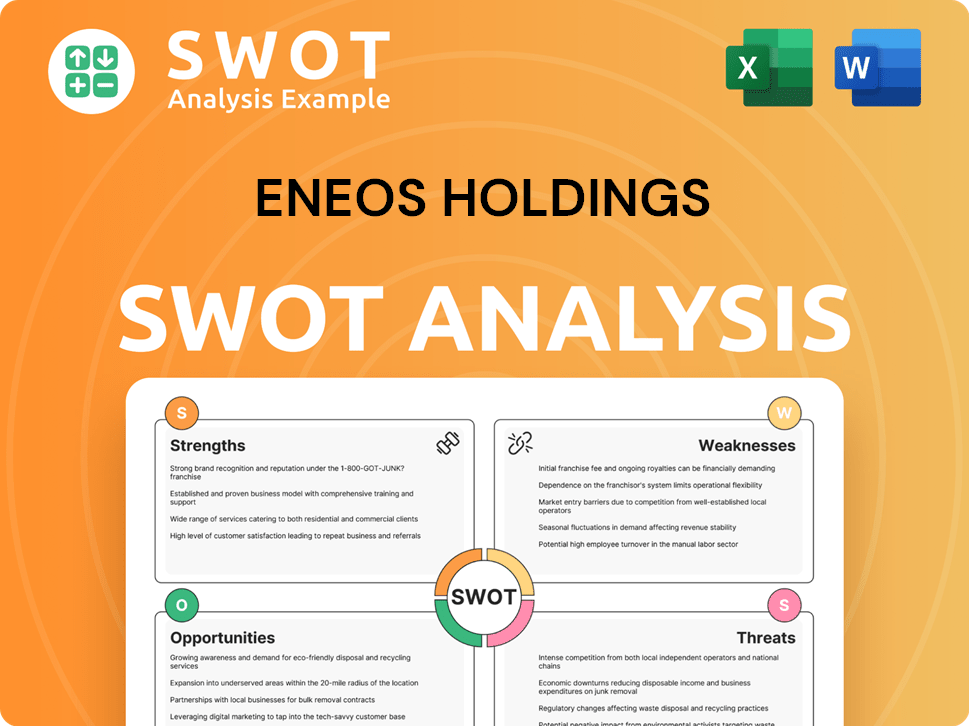

ENEOS Holdings SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does ENEOS Holdings Invest in Innovation?

The ENEOS Holdings growth strategy is heavily reliant on innovation and technology, particularly in the areas of decarbonization and digital transformation. This approach is central to its future outlook and aims to ensure long-term sustainability in a rapidly changing energy market. The company's commitment to reducing its carbon footprint is a key driver of its strategic investments.

ENEOS is actively pursuing energy transitions through energy saving measures at its refineries, plants, and smelters. It is also expanding its use of renewable energy sources to support its decarbonization goals. This dual approach reflects a comprehensive strategy to address both operational efficiency and environmental responsibility, aligning with global trends in sustainable energy practices.

ENEOS has set ambitious targets for carbon neutrality, aiming for its own emissions (Scope 1 and 2) by fiscal 2040 and for Scope 3 emissions by fiscal 2050. These goals are supported by significant investments in various technologies and initiatives designed to reduce its environmental impact and promote sustainable growth. The company's commitment to these targets underscores its dedication to environmental stewardship.

While initially targeting significant hydrogen supply by 2040, ENEOS has recalibrated its hydrogen strategy in its new three-year business plan (FY2025-2027). The company is prioritizing low-carbon alternatives like LNG and SAF. However, ENEOS is not abandoning hydrogen entirely.

ENEOS highlights its proprietary direct synthesis technology for methylcyclohexane (MCH) hydrogen carrier as a core strength. The company also owns 30% of Japan's hydrogen stations. This technology is key to its strategy.

ENEOS aims to establish a CO2-free hydrogen supply chain through imports. This initiative is crucial for securing a sustainable hydrogen supply. The company is also developing synthetic fuels using captured CO2 and hydrogen from renewable energy.

ENEOS has a proven track record in carbon capture, utilization, and storage (CCUS). This includes the Petra Nova CCUS Project in the United States, which reduces CO2 emissions by 1.4 million tons per year. The company is also accelerating studies for Japan's first large-scale CCS project off the coast of Western Kyushu.

The Western Kyushu project is targeting an injection of 1.7 million tons of CO2 per year by 2030. This project is a significant step towards achieving its carbon reduction goals. This project is important for its ENEOS future.

ENEOS is focusing on digital transformation and smart technologies. The company is developing business models utilizing distributed power sources. Demonstrations of 'Ouchi de ENE Mane' and 'Dokoka de ENE Mane' are underway.

Through its corporate venture capital arm, ENEOS Innovation Partners, the company invests in and collaborates with startups. These collaborations focus on energy storage technology, electric vehicles, and aquaculture technology. These investments are crucial for the ENEOS business and its growth strategy.

- Investments include transparent solar panels with Ubiquitous Energy, Inc.

- Automated plant operation AI systems with Preferred Networks.

- These partnerships and investments are key to driving innovation and achieving its long-term goals.

- For further insights into the company's background, consider reading Brief History of ENEOS Holdings.

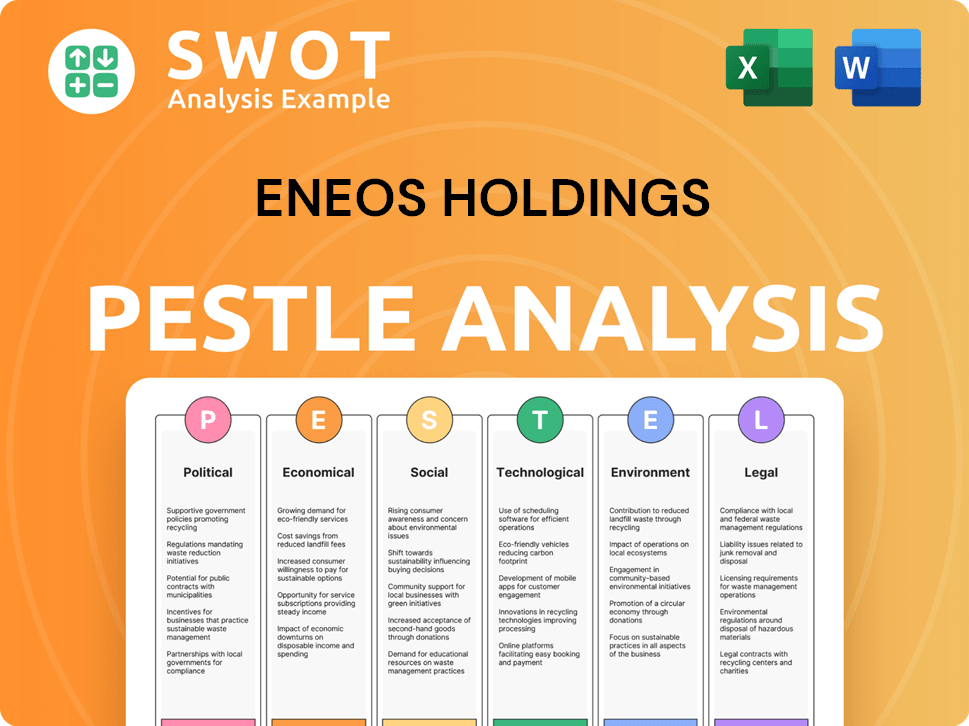

ENEOS Holdings PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is ENEOS Holdings’s Growth Forecast?

The Mission, Vision & Core Values of ENEOS Holdings is navigating a complex financial environment. The company, a prominent energy company, experienced a decrease in net profit and operating profit in the fiscal year ending March 31, 2024 (FY2024). Revenue also saw a slight dip, reflecting the dynamic shifts within the Japanese Company and the broader energy sector.

For FY2024, ENEOS Holdings reported a net profit of 226.1 billion yen, which is a 21.5% decrease from the previous fiscal year. The operating profit significantly dropped by 72.2% to 106.1 billion yen. Revenue slightly decreased to 12,322 billion yen, a 0.2% decline compared to the previous year. This financial performance underscores the challenges the company faces, including the reclassification of its Metals Business as discontinued operations.

Despite these challenges, ENEOS Holdings is strategically positioning itself for future growth. The company's focus on operational efficiencies and strategic initiatives, including the sale of its maritime transportation business, is expected to drive a recovery in profitability in the coming years. The Japanese company's strategic moves aim to strengthen its position in the energy market.

In FY2024, ENEOS Holdings reported a net profit of 226.1 billion yen, marking a 21.5% decrease. Operating profit plummeted by 72.2% to 106.1 billion yen. Revenue saw a slight decrease of 0.2% to 12,322 billion yen.

For fiscal year 2025, ENEOS forecasts a substantial increase in operating profit, projecting 360.0 billion yen. This represents a significant increase of 253.9 billion yen compared to the previous year. The company anticipates a further decline in revenue.

ENEOS plans to invest a total of 1.56 trillion yen (approximately $10.7 billion) under its new three-year business plan through March 2028. A significant portion, 740 billion yen, is allocated to low-carbon and decarbonization initiatives.

The company aims to raise its refinery utilization rate to 90% by fiscal 2027. Despite financial headwinds, ENEOS plans to increase its annual dividends per share to 26 yen, up from 22 yen.

ENEOS Holdings is focusing on strategic investments and operational efficiencies to drive future growth. The company's commitment to decarbonization and renewable energy projects is a key part of its long-term goals. The company's financial outlook includes specific targets for refinery utilization and dividend increases, reflecting a commitment to shareholder returns.

- FY2024 Net Profit: 226.1 billion yen (21.5% decrease)

- FY2024 Operating Profit: 106.1 billion yen (72.2% decrease)

- FY2024 Revenue: 12,322 billion yen (0.2% decrease)

- FY2025 Projected Operating Profit: 360.0 billion yen

- Total Investment (through March 2028): 1.56 trillion yen

- Dividend per Share Increase: From 22 yen to 26 yen

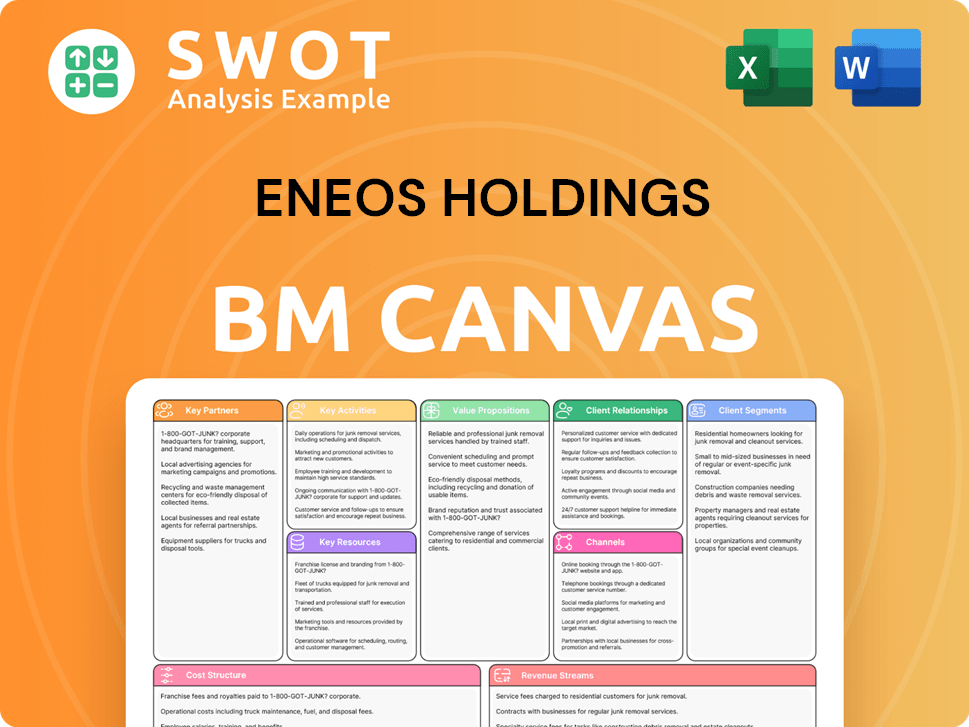

ENEOS Holdings Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow ENEOS Holdings’s Growth?

The growth strategy of ENEOS Holdings is subject to several potential risks and obstacles, particularly stemming from the volatile energy sector. These challenges include the pace of the global shift towards carbon neutrality and the impact of market competition and regulatory changes. Understanding these risks is crucial for assessing the future outlook of the company and its ability to achieve its long-term goals.

One significant hurdle is the anticipated delay in the widespread adoption of carbon neutrality. This delay forces ENEOS to recalibrate its investments in hydrogen and ammonia projects, impacting its strategic plans. The company's focus on LNG and sustainable aviation fuel (SAF) investments reflects this shift. Furthermore, supply chain vulnerabilities and evolving environmental regulations add to the complexity.

Internally, ENEOS must manage the transformation of its business portfolio while maintaining a solid earnings base in traditional energy sectors. The company aims to reduce its Scope 1 and 2 greenhouse gas emissions by 46% by fiscal 2030 compared to fiscal 2013. ENEOS is also committed to achieving carbon neutrality for Scope 3 emissions by 2050. Managing these multifaceted challenges is critical for ENEOS to maintain its competitive edge and achieve sustainable growth. To understand the company's target market, consider reading about the Target Market of ENEOS Holdings.

The delay in the global shift towards carbon neutrality is a major obstacle. This necessitates a reevaluation of investment strategies in hydrogen and ammonia, impacting ENEOS's growth initiatives. The company's three-year plan reflects this adjustment, prioritizing LNG and SAF.

The energy market is subject to evolving environmental regulations and policies. Evolving environmental regulations and policies can impact investment strategies and operational costs. Supply chain vulnerabilities also pose a risk to operations and the stable supply of energy.

Managing the transformation of its business portfolio while maintaining a solid earnings base in traditional energy sectors is crucial. The company acknowledges that the stable supply of petroleum products will remain essential for the foreseeable future. Strategic portfolio restructuring is key.

Supply chain disruptions can significantly impact operations. These vulnerabilities can affect the stable supply of energy and materials. ENEOS must mitigate these risks to ensure operational continuity and meet customer demands effectively.

Achieving carbon neutrality for Scope 3 emissions by 2050 is a complex challenge. This requires collaboration across the value chain. ENEOS is actively working on strategies to address these broader emissions challenges.

Geopolitical uncertainties can affect investment decisions and project timelines. Rising costs and international conflicts can impact the pace of energy transition projects. ENEOS must navigate these risks strategically.

Climate-related risks are a significant concern for ENEOS. The company actively participates in initiatives like the Green Transformation (GX) League in Japan. ENEOS supports the Task Force on Climate-related Financial Disclosures (TCFD) recommendations, demonstrating a proactive approach to managing climate-related risks and opportunities.

Strategic portfolio restructuring is a key measure for mitigating risks. ENEOS assesses and prepares multiple options for quick and flexible responses to changes in decarbonization trends. This approach allows the company to adapt to evolving market conditions and policy changes effectively.

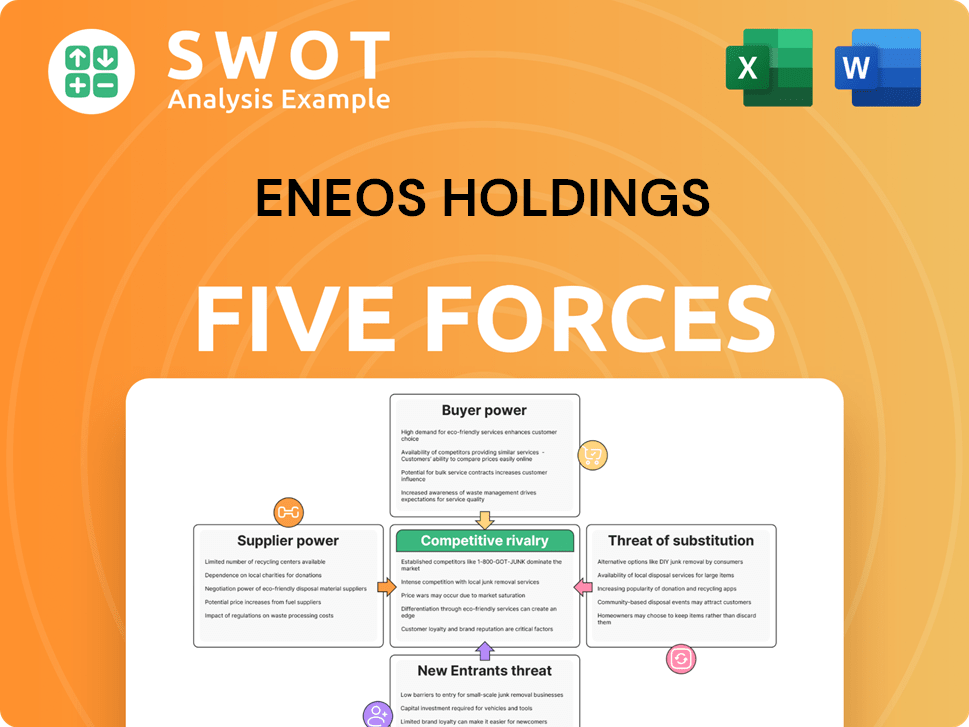

ENEOS Holdings Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of ENEOS Holdings Company?

- What is Competitive Landscape of ENEOS Holdings Company?

- How Does ENEOS Holdings Company Work?

- What is Sales and Marketing Strategy of ENEOS Holdings Company?

- What is Brief History of ENEOS Holdings Company?

- Who Owns ENEOS Holdings Company?

- What is Customer Demographics and Target Market of ENEOS Holdings Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.