Enterprise Mobility Bundle

How Does Enterprise Holdings Navigate the Enterprise Mobility Maze?

The transportation industry is undergoing a massive transformation, and at the forefront is Enterprise Holdings, a company that has evolved from a car leasing business to a global mobility giant. This evolution highlights the company's strategic prowess and its ability to thrive in a complex Enterprise Mobility SWOT Analysis competitive landscape. Founded in 1957, Enterprise Holdings has redefined how individuals and businesses access and manage their mobility needs. This exploration delves into the competitive dynamics shaping this influential player.

Enterprise Holdings' journey from a regional leasing operation to a global leader demonstrates exceptional adaptability. Today, Enterprise Holdings operates through brands like Enterprise Rent-A-Car, National Car Rental, and Alamo Rent A Car. This introduction sets the stage for a deeper exploration into the competitive landscape, identifying its main rivals, and analyzing the unique differentiators that underpin its success in the enterprise mobility market. We will explore the latest industry trends, conduct a market analysis, and examine the competitive advantages of Enterprise Holdings and other top mobile company providers.

Where Does Enterprise Mobility’ Stand in the Current Market?

Enterprise Holdings, a major player in the enterprise mobility sector, holds a dominant position in the global transportation solutions market, particularly in car rentals. Its core operations revolve around providing comprehensive mobility solutions, including car rentals under the Enterprise Rent-A-Car, National Car Rental, and Alamo Rent A Car brands. These services cater to a wide range of clients, from individual travelers to businesses needing fleet management.

The company's value proposition lies in its extensive network, diverse service offerings, and customer-centric approach. Enterprise Holdings offers a broad portfolio that includes traditional car rentals, commercial fleet management, and used car sales. This diversification allows it to meet various customer needs and adapt to changing market dynamics. Enterprise's global presence and brand recognition are key factors in its market leadership.

Enterprise Holdings' global reach, with operations spanning North America, Europe, Latin America, and Asia, allows it to serve a broad customer base. It has strategically expanded its offerings beyond car rentals to include commercial fleet management and used car sales. This shift from a pure car rental company to a comprehensive transportation solutions provider reflects its adaptability and strategic vision. For more insights, check out the Marketing Strategy of Enterprise Mobility.

While specific market share figures for privately held companies are often undisclosed, industry analyses consistently rank Enterprise Holdings as a leader in the car rental market. In 2023, the company reported total revenues exceeding $35 billion, highlighting its substantial scale and economic impact. Enterprise maintains a strong position in the North American car rental market.

Enterprise Holdings has a significant global presence, with operations across North America, Europe, Latin America, and Asia. This extensive reach allows the company to serve a broad spectrum of international and domestic travelers and businesses. Their wide geographic footprint is a key factor in their competitive advantage.

Enterprise Holdings benefits from strong brand recognition, an extensive branch network, and strategic acquisitions. These factors allow it to maintain a strong foothold in both airport and local rental markets. The company's diversification into commercial fleet management and used car sales also strengthens its competitive position.

Enterprise Holdings demonstrates robust financial health, supported by consistent growth and a substantial asset base. While specific 2024 and 2025 revenue figures are not publicly available, the company's past performance and market position suggest continued financial strength. The company's financial stability is a key factor in its long-term success.

The enterprise mobility market is influenced by several key trends, including the increasing demand for integrated transportation solutions and the growing importance of fleet management services. The shift towards electric vehicles (EVs) and sustainable transportation options is also gaining traction. These trends are shaping the competitive landscape for enterprise mobility providers.

- Growing demand for comprehensive mobility solutions.

- Increased focus on fleet management and operational efficiency.

- Adoption of electric vehicles and sustainable transportation options.

- Strategic acquisitions and partnerships to expand service offerings.

Enterprise Mobility SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Enterprise Mobility?

The competitive landscape for Enterprise mobility is multifaceted, encompassing both direct and indirect competitors. Understanding these dynamics is crucial for Owners & Shareholders of Enterprise Mobility to make informed strategic decisions. The industry is constantly evolving due to technological advancements and changing consumer preferences, necessitating continuous market analysis.

Direct competitors in the car rental segment include major players like Avis Budget Group and Hertz Global Holdings. Indirect competition comes from ride-sharing services such as Uber and Lyft, car-sharing services like Zipcar, and commercial fleet management providers like Ryder System, Inc.

The rise of new technologies and business models continues to reshape the competitive landscape. This includes the adoption of electric vehicles and autonomous vehicle technology, which presents both challenges and opportunities for existing players. The enterprise mobility market is dynamic, and staying ahead requires a deep understanding of the current industry trends and future projections.

Avis Budget Group and Hertz Global Holdings are the primary direct competitors. They compete on a global scale, offering extensive fleets and services. These companies often engage in price wars and promotional activities to attract customers.

Ride-sharing services like Uber and Lyft have significantly impacted the market. They offer on-demand transportation, challenging traditional car rentals. These services appeal to urban consumers and those seeking convenience.

Car-sharing services like Zipcar and peer-to-peer platforms such as Turo offer alternatives for shorter-term vehicle access. Commercial fleet management providers, including Ryder System, Inc., also compete by providing comprehensive fleet solutions.

Autonomous vehicle technology and electric vehicle adoption are transforming the industry. Companies must adapt their fleets and services to remain competitive. Mergers and acquisitions also influence market share and competitive dynamics.

The enterprise mobility market is influenced by consumer behavior, technological advancements, and economic conditions. Understanding these factors is essential for strategic planning. The competitive landscape is constantly evolving, requiring continuous adaptation.

Companies must focus on innovation, customer experience, and operational efficiency. Adapting to new technologies and market trends is crucial for long-term success. Strategic partnerships and acquisitions can also play a key role.

The enterprise mobility market is highly competitive, with various players vying for market share. A thorough market analysis reveals the strengths and weaknesses of each competitor. Understanding the competitive advantages of enterprise mobility providers is crucial for strategic decision-making.

- Avis Budget Group: Strong global presence and reservation systems.

- Hertz Global Holdings: Brand recognition and significant airport presence.

- Uber and Lyft: On-demand transportation services.

- Ryder System, Inc.: Comprehensive fleet management solutions.

- Zipcar and Turo: Car-sharing and peer-to-peer platforms.

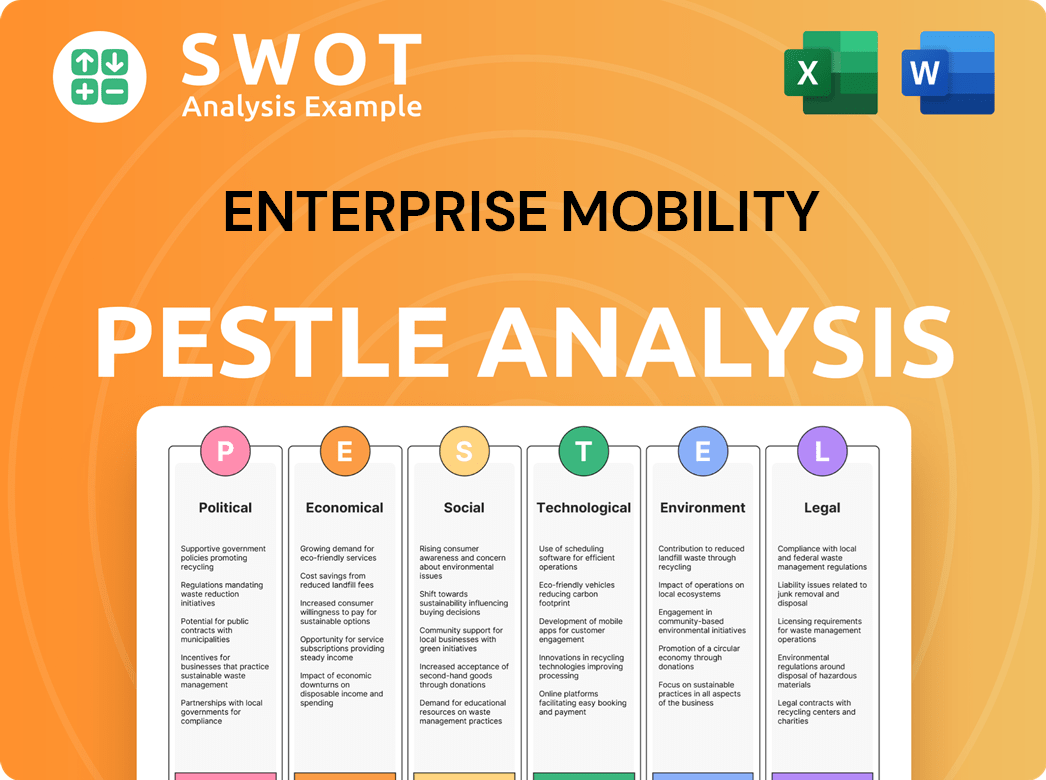

Enterprise Mobility PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Enterprise Mobility a Competitive Edge Over Its Rivals?

The competitive landscape for enterprise mobility is shaped by key players vying for market share. Understanding the competitive advantages of companies in this space is crucial for strategic decision-making. These advantages often stem from a combination of factors, including technological innovation, market reach, and customer service excellence. A thorough market analysis reveals the strengths and weaknesses of each competitor, providing insights into industry trends and the future of mobile solutions.

Analyzing the competitive landscape helps businesses identify opportunities and mitigate risks. By examining the strategies of top enterprise mobility companies, organizations can benchmark their performance and adapt to evolving market dynamics. This involves assessing various aspects, from mobile device management competitive landscapes to the impact of 5G on enterprise mobility. The goal is to gain a competitive edge by leveraging these insights.

The enterprise mobility market is dynamic, with companies constantly innovating to meet the demands of a mobile workforce. Staying informed about the latest trends in enterprise mobility and the best enterprise mobility vendors for security is essential. This knowledge allows businesses to make informed decisions about their mobile strategies and choose the right solutions for their needs. The competitive analysis of mobile app development companies and enterprise mobility solutions for small businesses provides a comprehensive view of the market.

The company boasts a vast global presence, with tens of thousands of locations worldwide. This extensive network, including a significant presence in local neighborhoods and airports, provides unparalleled convenience and accessibility. This wide reach enables the company to serve a broad customer base and offers a logistical advantage for fleet management and one-way rentals. The company's strategic placement ensures it is readily available to customers, supporting its market leadership.

The company leverages proprietary technology, particularly in reservation systems and fleet management software, to drive operational efficiencies and enhance the customer experience. These technological advancements contribute to streamlined processes, reduced costs, and improved service delivery. The focus on technology allows the company to adapt quickly to market changes and maintain a competitive edge.

The company's brands are widely recognized and trusted by consumers, built on decades of reliable service and effective marketing. This strong brand recognition translates into repeat business and a competitive edge in attracting new customers. The brand's reputation for quality and reliability fosters customer loyalty, which is crucial in a competitive market. This loyalty supports the company's long-term success and market share.

The company benefits from economies of scale, allowing it to negotiate favorable terms with vehicle manufacturers and service providers. This leads to cost efficiencies that can be passed on to customers or reinvested in the business. These economies of scale provide a significant advantage in terms of pricing and profitability. The ability to manage costs effectively is essential for maintaining a competitive position in the enterprise mobility market.

The company's diverse service offerings, encompassing car rentals, fleet management, and used car sales, create a comprehensive transportation ecosystem. This diversification reduces reliance on any single revenue stream and allows for cross-selling opportunities, increasing customer lifetime value. The company's commitment to customer service, often cited as a cornerstone of its business philosophy, fosters strong relationships and repeat patronage.

- Extensive Network: The company's wide geographical reach provides unparalleled convenience.

- Brand Recognition: Strong brand equity fosters customer loyalty and attracts new customers.

- Technological Innovation: Proprietary systems drive operational efficiency and enhance customer experience.

- Economies of Scale: Favorable terms with suppliers lead to cost advantages.

Enterprise Mobility Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Enterprise Mobility’s Competitive Landscape?

The enterprise mobility sector is experiencing significant shifts, driven by technological advancements and evolving consumer preferences. The competitive landscape is dynamic, with companies needing to adapt to new challenges and opportunities. Understanding the current market analysis and industry trends is crucial for businesses aiming to succeed in this space.

The future of mobile solutions hinges on several factors, including the adoption of new technologies, regulatory changes, and economic conditions. Companies must strategize to maintain a competitive edge. This includes focusing on fleet electrification, digital transformation, and diversifying service offerings to remain resilient and capitalize on future growth.

Industry trends are significantly influencing the enterprise mobility sector. Electric vehicles (EVs) and autonomous driving technologies are reshaping the market. Regulatory changes, such as environmental standards and data privacy laws, are also impacting operations. Shifting consumer preferences towards on-demand mobility models are another critical factor.

Several challenges lie ahead for enterprise mobility companies. Investment in EV charging infrastructure and fleet modernization is essential. Data privacy and cybersecurity measures are increasingly important due to stricter regulations. Economic factors, including inflation and interest rate fluctuations, can affect consumer spending and travel patterns. The need for continual adaptation to new mobility models is also a major challenge.

Significant opportunities exist for growth and innovation. Vehicle subscription services offer an alternative to traditional ownership. Expansion into emerging markets, where car ownership is lower but demand for flexible transport is rising, presents substantial potential. Strategic partnerships and leveraging data analytics to optimize operations can also create a competitive advantage. The growth of the subscription economy presents an avenue for companies to explore vehicle subscription services.

Companies in this sector must adapt their strategies to remain competitive. This includes focusing on fleet electrification to meet environmental standards. Digital transformation is crucial for optimizing operations and enhancing customer experiences. Diversifying service offerings to meet changing consumer demands is also essential. Companies should focus on fleet electrification, digital transformation, and diversified service offerings to remain resilient and capitalize on future growth.

To thrive in the evolving enterprise mobility market, companies must adopt forward-thinking strategies. These include embracing technological advancements like EVs and autonomous vehicles. Adapting to regulatory changes and consumer preferences is also key. Strategic partnerships and data analytics are vital for optimizing operations and enhancing customer experiences. A deeper dive into the growth strategy of enterprise mobility can be found in this article: Growth Strategy of Enterprise Mobility.

- Focus on Fleet Electrification: Invest in EVs and charging infrastructure to meet environmental standards.

- Embrace Digital Transformation: Implement digital tools and platforms to optimize operations and enhance customer experiences.

- Diversify Service Offerings: Explore vehicle subscription services and other flexible mobility solutions.

- Strategic Partnerships: Collaborate with technology companies and ride-sharing platforms to expand reach.

Enterprise Mobility Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Enterprise Mobility Company?

- What is Growth Strategy and Future Prospects of Enterprise Mobility Company?

- How Does Enterprise Mobility Company Work?

- What is Sales and Marketing Strategy of Enterprise Mobility Company?

- What is Brief History of Enterprise Mobility Company?

- Who Owns Enterprise Mobility Company?

- What is Customer Demographics and Target Market of Enterprise Mobility Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.