Enterprise Mobility Bundle

Can Enterprise Holdings Maintain Its Dominance in the Evolving Mobility Landscape?

Enterprise Holdings, a titan in the mobility sector, has consistently adapted and expanded since its inception in 1957. From its humble beginnings to its current status as the world's largest car rental company, the company's journey showcases the critical importance of a well-defined growth strategy. This analysis explores Enterprise Holdings' strategic moves, market position, and future prospects, providing a comprehensive view of its enterprise mobility evolution.

Enterprise Holdings' success story is built on strategic acquisitions and a commitment to customer accessibility. The company's focus on strategic expansion initiatives, leveraging cutting-edge innovation and technology, and maintaining a strong financial outlook are key to its future. Understanding the Enterprise Mobility SWOT Analysis is crucial for grasping the nuances of its business strategy and navigating the challenges and opportunities within the dynamic enterprise mobility market, including mobile solutions and digital transformation.

How Is Enterprise Mobility Expanding Its Reach?

Enterprise Holdings is actively pursuing several expansion initiatives to strengthen its market position and broaden its offerings. These initiatives are crucial for the company's continued growth in the evolving enterprise mobility landscape. A key focus is on geographic expansion, entering new markets and increasing its international presence. This strategy is complemented by efforts to diversify its service portfolio and enhance customer service.

In 2024, the company extended its reach by introducing its Enterprise, National, and Alamo brands to new markets. This expansion included locations in Chile, Thailand, and the U.S. Virgin Islands. This growth is part of a broader strategy to meet the increasing demand for mobile solutions and adapt to the rapid pace of digital transformation within the industry. The company aims to stay competitive by proactively addressing the changing needs of its customers and the market.

These initiatives are driven by the need to access new customers, diversify revenue streams, and stay ahead of evolving industry changes in the mobility sector. The company's strategic approach includes entering new geographical markets and expanding its existing international footprint. Enterprise Holdings is also focused on diversifying its service portfolio and enhancing customer service.

The company has expanded its global presence to over 9,500 locations across more than 90 countries and territories. All European subsidiaries reported revenue growth in fiscal year 2024, including double-digit increases in France, Ireland, and Spain. The UK business has grown to over 480 branches.

Enterprise Holdings offers commercial fleet management, used car sales through Enterprise Car Sales, and commercial truck rental operations. The company aims to enhance customer service through its extensive reserving and renting centers. Expanding vehicle offerings, including SUVs and luxury cars, is a key part of this strategy.

The company's expansion strategy focuses on both geographic growth and service diversification. This approach allows Enterprise Holdings to tap into new customer bases and adapt to changing market demands. Strategic acquisitions have historically been a part of the company's growth strategy.

- Entering new geographical markets.

- Expanding the international footprint.

- Diversifying the service portfolio.

- Enhancing customer service.

Enterprise Mobility SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Enterprise Mobility Invest in Innovation?

The focus on innovation and technology is central to the growth strategy of Enterprise Holdings. The company is actively investing in digital transformation and the integration of cutting-edge technologies to enhance both operational efficiency and customer experience. This strategic direction is crucial in the evolving landscape of the enterprise mobility market.

A key aspect of this strategy is the expansion of its connected car fleet. The company aims to connect its entire fleet, demonstrating a significant investment in digital capabilities. This commitment is designed to improve the customer experience and streamline operations, positioning the company for future growth. The company is also heavily investing in electric vehicles (EVs) and sustainable mobility solutions.

Furthermore, Enterprise Holdings is developing a comprehensive electric vehicle (EV) strategy, addressing customer experience, power and charging viability, and equitable access. This initiative underscores the company's commitment to sustainable mobility solutions and its proactive stance in the rapidly changing automotive industry. This includes partnerships with automakers to integrate more EVs into its fleet and facilitating EV test drives for customers.

As of October 2023, Enterprise Holdings had over 525,000 globally connected vehicles. The company aims to connect its entire fleet of over 2.3 million vehicles by 2026, showing a commitment to digital transformation. This expansion is a core component of its enterprise mobility strategy.

The company is developing a long-term EV strategy focused on customer experience, power and charging viability, and equitable access. In fiscal year 2023, Enterprise partnered with automakers to integrate more EVs into its fleet. This initiative supports the company's focus on sustainable mobility.

Through EFM, Enterprise assists other brands in executing their EV strategies. This demonstrates leadership and commitment to sustainable mobility solutions. This effort highlights the company's broader impact in the enterprise mobility market.

Enterprise Holdings is focused on digital transformation to enhance operational efficiency and customer experience. This includes leveraging technology to improve fleet management and customer service. This is a key aspect of its business strategy.

The company forms strategic partnerships with automakers to integrate EVs and advance its mobility solutions. These collaborations are essential for achieving its growth objectives. These partnerships are critical for the future of enterprise mobility solutions.

Enterprise Holdings prioritizes customer experience in its technology and innovation efforts. This includes enhancing digital interactions and providing seamless services. This approach is central to its growth strategy.

Enterprise Holdings' technology strategy includes expanding its connected car fleet and developing a comprehensive EV strategy. These initiatives are designed to improve operational efficiency and enhance the customer experience. The company's focus on digital transformation and sustainable mobility positions it well for the future.

- Connected Car Technology: Investing in connected car technology to improve fleet management and customer service.

- Electric Vehicle Integration: Partnering with automakers to integrate EVs into its fleet and facilitating EV test drives.

- Digital Platforms: Developing digital platforms to enhance customer interactions and streamline operations.

- Sustainable Mobility Solutions: Focusing on sustainable mobility to meet evolving customer and market demands.

- Strategic Partnerships: Forming strategic partnerships with technology providers and automakers.

For a deeper understanding of the company's financial aspects, including revenue streams, consider exploring the Revenue Streams & Business Model of Enterprise Mobility.

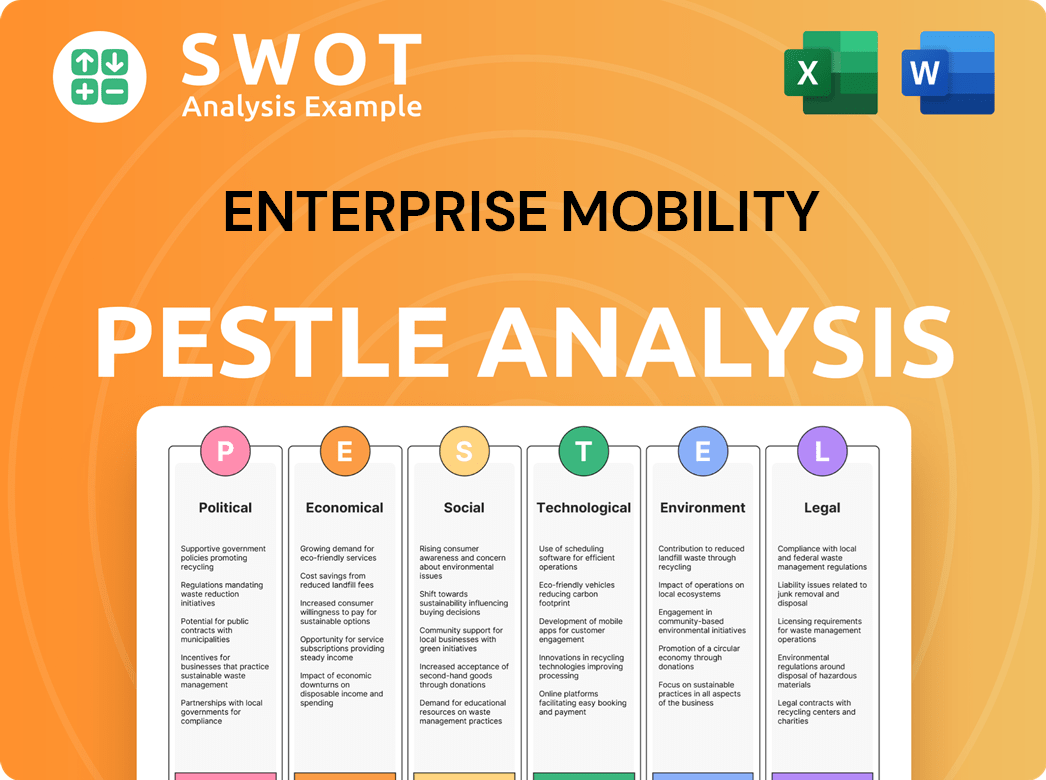

Enterprise Mobility PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Enterprise Mobility’s Growth Forecast?

The financial outlook for Enterprise Mobility, a key player in the enterprise mobility market, shows a robust financial performance. The company, which includes all subsidiaries and Enterprise Fleet Management, reported record annual revenue exceeding $38 billion for its fiscal year ending July 31, 2024. This marks a significant increase from the $35 billion recorded in 2023, highlighting strong growth in the enterprise mobility sector.

Despite a year-on-year decline in earnings during the first half of fiscal year 2025 and fiscal year 2024, the company's expense growth moderated in the first half of fiscal year 2025. This led to a more moderate reduction in earnings. These trends reflect the dynamic nature of the mobile company and its ability to adapt to changing market conditions.

S&P Global Ratings anticipates that Enterprise's credit metrics will moderate somewhat through fiscal year ending July 31, 2025, from the record highs of 2022-2023. However, they are expected to remain appropriate for its 'A-' issuer credit rating. This stable outlook is supported by consistent credit metrics, including EBIT interest coverage of at least 7x and funds from operations (FFO) to debt in the mid-50% area through 2025. Understanding these financial aspects is crucial for anyone interested in the Marketing Strategy of Enterprise Mobility.

Enterprise Mobility achieved record annual revenue of over $38 billion in fiscal year 2024. This represents a substantial increase from the $35 billion reported in 2023, demonstrating strong revenue growth.

While earnings saw a year-on-year decline in the first half of fiscal year 2025 and fiscal year 2024, the pace of expense growth moderated. This indicates the company's efforts to manage costs effectively.

S&P Global Ratings expects Enterprise's credit metrics to moderate somewhat through fiscal year ending July 31, 2025, but remain appropriate for its 'A-' issuer credit rating. The outlook is stable, supported by consistent financial performance.

The company's strategy includes reinvesting a significant portion of its cumulative earnings back into the business. This allows for investments in new technologies, markets, and services, supporting long-term growth.

Firming used vehicle values are expected to positively impact operating results. However, rising new unit prices and auto parts costs are anticipated to lead to increased vehicle expenses.

The company maintains a sound risk profile with a conservative risk culture and a strong fleet management platform. It has ample and well-managed liquidity, including cash, committed credit facilities, and strong cash flows from operations.

Enterprise Mobility Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Enterprise Mobility’s Growth?

The company, despite its prominent position in the enterprise mobility market, faces several risks and obstacles that could affect its growth. These challenges range from intense market competition to the rapid evolution of technology and potential supply chain disruptions. Successfully navigating these hurdles is crucial for sustaining its leadership and achieving its strategic goals in the dynamic enterprise mobility landscape.

One of the primary challenges is the competitive environment, with strong players constantly vying for market share. Regulatory changes and geopolitical factors also pose significant risks, potentially impacting travel patterns and vehicle expenses. The company's large-scale operations, including a vast global presence and complex technology infrastructure, present inherent operational risks that must be carefully managed.

Another key consideration is residual value risk, which the company has managed effectively through various economic cycles due to its conservative depreciation policy and strong fleet management capabilities. Supply chain vulnerabilities, particularly concerning new vehicle availability, have historically impacted the car rental industry, leading to pricing fluctuations and increased vehicle expenses. Furthermore, technological disruption, including the rapid evolution of AI and IoT, presents both opportunities and threats.

The company operates in a highly competitive market. Key rivals, like Hertz and Avis, constantly seek to gain market share, requiring the company to continuously adapt its business strategy. Maintaining its leading position demands ongoing innovation and responsiveness to competitors' actions, as highlighted in the Brief History of Enterprise Mobility.

Changes in regulations and geopolitical events can significantly impact business operations. Tariffs, trade disputes, and economic downturns can affect travel, vehicle prices, and overall operational costs. These factors require careful monitoring and strategic planning to mitigate potential negative impacts.

The company's large scale, with approximately 9,500 global locations, introduces inherent operational risks. Managing a vast fleet and complex technology platforms requires robust risk management strategies. The company's ability to mitigate these risks is vital for sustained success. However, the company is noted for its well-managed operational risk, having not reported a material operational issue in recent years.

Residual value risk is a significant factor in the car rental industry. The company has effectively managed this risk through conservative depreciation policies and strong fleet management. Economic cycles and market fluctuations can impact vehicle values, necessitating careful financial planning and asset management.

Supply chain disruptions, such as semiconductor chip shortages, can affect vehicle availability. These shortages can lead to pricing fluctuations and increased vehicle expenses. While the immediate impact of the chip shortage has normalized, ongoing supply chain issues remain a potential concern for the industry.

Rapid technological advancements, including AI and IoT, present both opportunities and threats. AI-powered social engineering and cybersecurity risks are increasing. Securing the expanding IoT ecosystem is a significant challenge, requiring proactive measures to protect against vulnerabilities. The company mitigates these risks through a conservative risk culture, diversification of revenue streams, and robust fleet management platforms.

Enterprise Mobility Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Enterprise Mobility Company?

- What is Competitive Landscape of Enterprise Mobility Company?

- How Does Enterprise Mobility Company Work?

- What is Sales and Marketing Strategy of Enterprise Mobility Company?

- What is Brief History of Enterprise Mobility Company?

- Who Owns Enterprise Mobility Company?

- What is Customer Demographics and Target Market of Enterprise Mobility Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.