Enterprise Mobility Bundle

Who Are Enterprise Mobility's Key Customers?

In an era of rapid technological advancement and shifting consumer behavior, understanding Enterprise Mobility SWOT Analysis is critical for success. With the enterprise mobility market poised for substantial growth, knowing the company's customer demographics and target market is more important than ever. This deep dive explores the evolving landscape of Enterprise Mobility's customer base, revealing the driving forces behind their choices and how the company adapts to meet their needs.

Enterprise Mobility, a leader in transportation solutions, must continuously refine its strategies. This includes a detailed examination of its customer demographics and target market to stay ahead of the curve. By analyzing the needs of the mobile workforce, business users, and IT decision makers, Enterprise Mobility can tailor its offerings and maintain its competitive edge in a dynamic market, ensuring it remains a preferred choice for mobility solutions.

Who Are Enterprise Mobility’s Main Customers?

Understanding the primary customer segments is crucial for any enterprise operating in the mobility sector. For the [Company Name], this involves a dual focus: catering to both individual consumers (B2C) and businesses (B2B). Analyzing the customer demographics and target market allows for tailored strategies that enhance market penetration and customer satisfaction. This comprehensive approach is essential for sustained growth and competitive advantage.

The B2C segment historically centered on individuals needing replacement vehicles or local rentals, differentiating [Company Name] from airport-centric competitors. However, acquisitions expanded its reach to include leisure and business travelers. The B2B segment targets businesses needing fleet management, commercial truck rentals, and car sales. This diversification allows [Company Name] to serve a broad spectrum of customers, adapting to evolving market demands. Identifying the target market for mobile device management is essential for success.

The company's adaptability is evident in its evolving target segments. Originally focused on 'home city' rentals, the strategy expanded to encompass both local and airport markets. This shift was driven by market opportunities and a desire to provide comprehensive transportation solutions. The addition of SUVs and luxury cars to its vehicle offerings further reflects its commitment to meeting diverse consumer preferences. For a deeper dive into strategic planning, consider exploring the Marketing Strategy of Enterprise Mobility.

The B2C segment includes individuals needing replacement vehicles and those seeking local rentals. While specific detailed demographics are not publicly available for recent years, the general car rental market shows a slight majority of female owners. As of December 2023, females accounted for 53.40% of car owners.

The B2B segment includes businesses of various sizes requiring vehicles for operational needs, employee transportation, or specialized fleet requirements. The company's business model includes a variable expense base, which contributes to earnings resiliency. In fiscal year 2024, the company expanded its client engagements, with over 256 clients, an increase of 140 clients compared to 2023.

The initial focus on 'home city' rentals gradually expanded to include airport markets. The company has also broadened its vehicle offerings to include SUVs and luxury cars. This evolution reflects a commitment to offering a full spectrum of transportation solutions and catering to a wider range of consumer preferences. Understanding the needs of mobile workers is key.

Revenues increased moderately year-on-year, primarily due to higher average revenues per vehicle. Higher revenues in the first half of 2025 benefited from solid increases in leisure and commercial rental days across both the Home City and Airport businesses. This indicates strong performance in both B2C and B2B segments. Factors influencing enterprise mobility adoption are important.

The primary customer segments include individual consumers and businesses of varying sizes. Consumers require replacement vehicles or local rentals, while businesses need fleet management and commercial vehicle solutions. Enterprise mobility solutions for specific industries are crucial.

- Individual Consumers: Seeking convenience and reliability for short-term transportation needs.

- Small to Medium-Sized Businesses (SMBs): Requiring cost-effective fleet solutions and employee transportation.

- Large Enterprises: Needing comprehensive fleet management, vehicle sales, and specialized transportation services.

- Leisure Travelers: Utilizing airport locations for rental vehicles.

Enterprise Mobility SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Enterprise Mobility’s Customers Want?

Understanding the needs and preferences of customers is crucial for the success of any enterprise mobility company. The primary drivers for customers in 2025 are convenience, flexibility, and reliability. These factors influence their purchasing behaviors, leading them to prioritize ease of booking, accessibility of locations, and a diverse fleet to meet specific requirements.

Customers are increasingly demanding faster and more convenient solutions. Contactless services, such as digital keys and QR codes for check-in/check-out, are becoming highly preferred. Time efficiency and safety are top priorities, with many customers seeking to minimize face-to-face interactions and avoid queues. This shift is driven by technological advancements and changing consumer expectations.

Decision-making criteria often include competitive pricing, vehicle availability, and the overall rental experience. Loyalty is influenced by consistent service quality, efficient problem resolution, and personalized offerings. For example, loyalty programs like Enterprise Plus offer upgrades and discounts to encourage repeat business.

Customers in 2025 want fast and easy solutions. Contactless services like digital keys and QR codes are highly valued. Time efficiency and safety are key, minimizing face-to-face interactions.

Competitive pricing and vehicle availability are critical. Customers compare options to find the best deals. The overall rental experience also plays a significant role in their decisions.

Consistent service quality and efficient problem resolution build customer loyalty. Personalized offerings and loyalty programs, such as Enterprise Plus, encourage repeat business.

Customers appreciate flexibility, including last-minute bookings and short-term rentals. Customizable packages for long-term needs are also in demand. These options cater to diverse customer requirements.

Consumers expect transparency in pricing and data usage. Sustainability practices are becoming increasingly important. Brands that align with environmental values are favored.

Leveraging customer data to personalize interactions is crucial. Tailoring communications, offering behavior-based triggers, and segmenting customers for personalized content are key strategies.

Feedback and market trends significantly influence product development and service enhancements for enterprise mobility. The integration of electric vehicles (EVs) is a notable trend, with most gas-powered rental cars expected to be out of the market by 2030. Consumer behavior trends highlight transparency, sustainability, and empathy as core expectations, and companies are adapting to these changing demands.

- Electric Vehicle Integration: Car rental companies are actively integrating EVs into their fleets to meet sustainability goals.

- Customer Data Personalization: Enterprise Mobility tailors its marketing and customer experiences by leveraging customer data to personalize interactions and boost engagement.

- Focus on Sustainability: Consumers increasingly value transparency in pricing, data usage, and sustainability practices.

- Adapting to Consumer Expectations: Companies are focusing on providing remote customer support and flexible rental options.

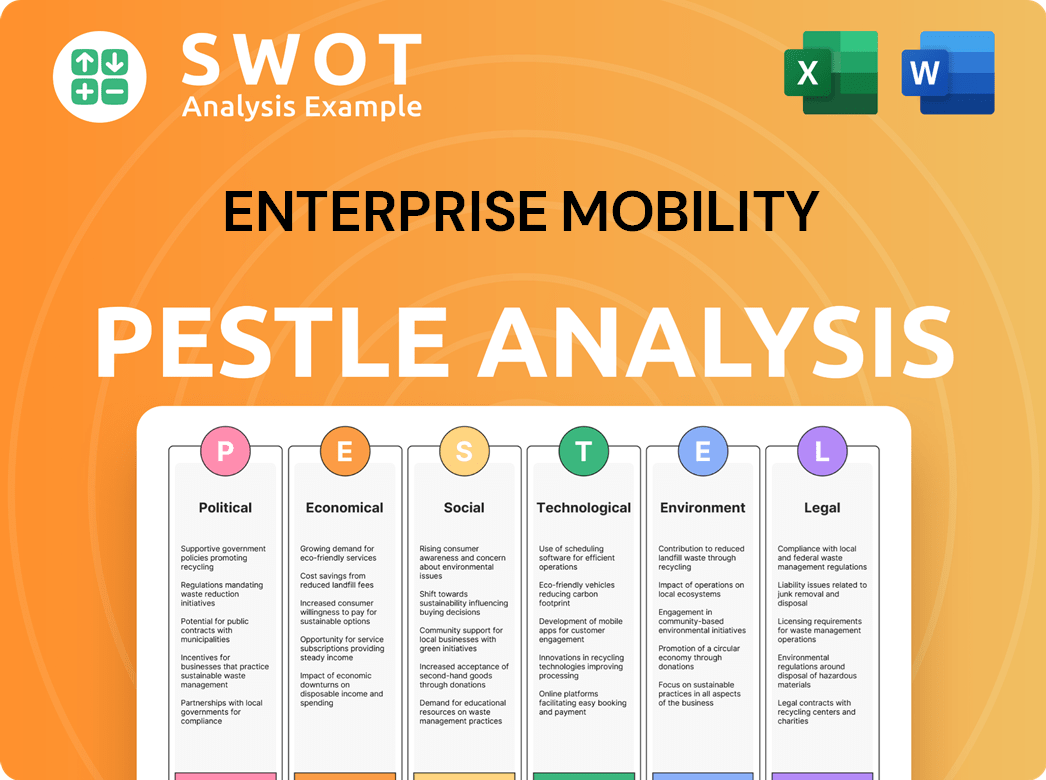

Enterprise Mobility PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Enterprise Mobility operate?

Enterprise Mobility maintains a substantial global footprint, with operations spanning six continents. Its extensive network includes over 10,000 branches worldwide, serving customers in more than 90 countries. This widespread presence allows the company to cater to a diverse range of customer demographics and business needs, solidifying its position as a key player in the enterprise mobility sector.

In North America, Enterprise Mobility, along with Avis Budget Group, holds a significant market share, exceeding 40% of the U.S. car rental industry as of 2024. The North American car rental market itself was valued at over USD 76.00 billion in 2024, with projections indicating an 8.80% Compound Annual Growth Rate (CAGR) from 2025 to 2034. The U.S. market alone was estimated at USD 53.41 billion in 2024, expected to reach approximately USD 125.39 billion by 2034.

Enterprise Rent-A-Car, a key part of Enterprise Mobility, dominates the U.S. car rental market, securing a 39% share of bookings as of December 2023. This dominance underscores the company's strong appeal to its target market and its effective strategies for customer acquisition and retention. For more insights into the business model, consider reading about the Revenue Streams & Business Model of Enterprise Mobility.

Enterprise Mobility and Avis Budget Group collectively control over 40% of the U.S. car rental market. The U.S. market size was estimated at USD 53.41 billion in 2024, demonstrating strong market presence.

The company's international presence began with the opening of its first international office in Windsor, Ontario, in 1993. The European market entry happened in Reading, England, in 1994.

The Middle East car rental market is expected to grow at a CAGR of 10.42% between 2025 and 2030. Saudi Arabia is projected to generate the most revenue in this region.

Enterprise Mobility adapts its offerings, marketing, and partnerships to succeed in diverse markets. Strategic alliances have led to a 7% increase in customer acquisition in 2024.

Understanding the geographical market presence is crucial for identifying the target market and customer demographics for enterprise mobility solutions. This includes analyzing the needs of mobile workers and business users.

- Enterprise Mobility’s presence spans over 90 countries.

- The U.S. car rental market is projected to reach USD 125.39 billion by 2034.

- Localized strategies are key to success in diverse markets.

- Strategic partnerships have increased customer acquisition by 7% in 2024.

Enterprise Mobility Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Enterprise Mobility Win & Keep Customers?

Attracting and keeping customers is crucial for the success of any enterprise mobility company. This involves a strategic blend of marketing, customer service, and loyalty programs. The aim is to not only bring in new clients but also to foster long-term relationships that boost customer lifetime value.

For acquiring new customers, targeted marketing is key. This includes focusing on specific segments like business travelers. A strong online presence and digital marketing, including social media, are used to reach a wider audience and encourage engagement. Partnerships and sponsorships also play a significant role in increasing brand recognition and engaging with the target audience, especially in sectors like car rentals.

Customer retention efforts involve loyalty programs, personalized experiences, and excellent after-sales service. Loyalty programs offer rewards to encourage repeat business. Personalizing the customer experience, using data insights, and providing fast and contactless services are also vital.

Targeted marketing campaigns are essential for reaching specific customer segments, such as business travelers. By tailoring advertisements, the company highlights the convenience and benefits of their services. This approach ensures that marketing efforts resonate with the intended audience, increasing the likelihood of customer acquisition.

A robust online presence and digital marketing are critical components of the acquisition strategy. Utilizing digital channels, including social media, broadens reach and boosts customer engagement. Digital ad spending in the U.S. is projected to reach $258 billion by 2025, with mobile ad spending accounting for 74% of the total, emphasizing the importance of these channels.

Partnerships and sponsorships help boost brand recognition and engage with the target audience. Collaborations within the car rental sector have shown positive results, with a 7% increase in customer acquisition in 2024. These strategic alliances enhance visibility and provide opportunities to connect with potential customers in relevant environments.

Loyalty programs, such as Enterprise Plus, offer rewards, discounts, and exclusive offers to encourage repeat business. These programs serve as a direct communication channel, providing updates, news, and exclusive offers. This approach not only rewards customer loyalty but also fosters a sense of community and engagement.

Personalizing the customer experience is a key strategy. Companies leverage data insights to segment customers and provide tailored content, product recommendations, and special offers across channels. This level of personalization enhances customer satisfaction and increases the likelihood of repeat business.

Providing fast and contactless services is another important strategy. Options like digital keys or QR codes for check-in/check-out and remote customer support enhance convenience and efficiency. These services are increasingly important in today's market, meeting customer expectations for seamless interactions.

Customer data and CRM systems are crucial for targeting campaigns and refining strategies. Analyzing customer behavior and preferences provides actionable insights to guide strategic decisions, identify friction points, and reduce churn. The ability to leverage retention analytics and predictive models is increasingly important for effective customer retention.

Successful acquisition campaigns often involve a strong inbound marketing approach and content marketing optimized for SEO to attract new customers. Creating valuable content that addresses customer needs helps draw in potential clients and establish the company as a trusted resource.

Innovative retention initiatives include proactively addressing customer issues and continually educating customers on product value. This approach demonstrates a commitment to customer satisfaction and helps build long-term relationships. Addressing issues promptly can significantly reduce churn.

Changes in strategy over time have likely included an increased emphasis on digital channels and personalized experiences, reflecting evolving consumer expectations for seamless and convenient interactions. These adjustments ensure the company remains competitive and meets the changing needs of its customers. For more insights, see this article for Owners & Shareholders of Enterprise Mobility.

Enterprise Mobility Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Enterprise Mobility Company?

- What is Competitive Landscape of Enterprise Mobility Company?

- What is Growth Strategy and Future Prospects of Enterprise Mobility Company?

- How Does Enterprise Mobility Company Work?

- What is Sales and Marketing Strategy of Enterprise Mobility Company?

- What is Brief History of Enterprise Mobility Company?

- Who Owns Enterprise Mobility Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.