Euronext Bundle

How Does Euronext Conquer the European Financial Stage?

In the fast-paced world of European stock exchanges, Euronext has emerged as a dominant force. Its strategic acquisitions, like the Borsa Italiana Group, have dramatically reshaped the competitive playing field. But how does Euronext maintain its leading position amidst fierce competition and evolving market dynamics? This analysis dives deep.

Euronext's Euronext SWOT Analysis reveals critical insights into its strengths, weaknesses, opportunities, and threats within the financial markets of Europe. Understanding the Euronext competitive landscape is crucial for investors and strategists alike. This in-depth Euronext market analysis will explore its key competitors and evaluate its strategic positioning within the European financial ecosystem, including its trading platform and recent performance.

Where Does Euronext’ Stand in the Current Market?

Euronext holds a significant market position as a leading pan-European market infrastructure, operating exchanges across key European economies. Its core operations revolve around providing listing services for equities, bonds, and funds, along with cash and derivatives trading and post-trade services like clearing and settlement. Euronext's value proposition lies in offering a unified and diversified platform that enhances trading efficiency and provides access to a broad range of financial instruments for a diverse customer base.

The company's strategic shift from a collection of national exchanges to a unified pan-European operator has been a key driver of its market position. This transformation includes substantial investments in advanced trading technologies and data analytics to enhance its offerings. Euronext has also expanded its revenue streams beyond traditional trading, with a growing focus on data and technology services, demonstrating its commitment to innovation and diversification within the financial markets.

Euronext's regulated markets collectively represent the largest pool of liquidity in Europe for equities and ETFs. As of early 2024, Euronext held approximately 25% of European cash equity trading. The acquisition of Borsa Italiana further solidified its position, making it the largest listing venue in Europe for debt and funds.

Euronext's strong market share in European cash equity trading highlights its importance in the financial markets. The company's ability to attract and maintain a high level of liquidity is crucial for its success. The trading platform's efficiency and reliability are key factors in maintaining its market share.

Euronext's presence spans across Belgium, France, Ireland, Italy, the Netherlands, Norway, and Portugal. This wide geographic reach allows Euronext to serve a diverse customer base. This broad footprint enables Euronext to capture a significant portion of the European market.

For the full year 2023, Euronext reported revenue of 1.47 billion euros, an increase of 3.8% from 2022. The company's reported EBITDA was 834.7 million euros, showcasing strong profitability. These figures demonstrate Euronext's financial health and its ability to generate substantial revenue and profits.

The acquisition of Borsa Italiana significantly strengthened Euronext's position in the European market. This strategic move expanded Euronext's reach and enhanced its ability to offer diverse financial products. This acquisition has been instrumental in the company's growth strategy.

Euronext's competitive advantages include its strong market share, diversified product offerings, and strategic acquisitions. The company's investments in technology and data analytics enhance its competitiveness in the financial markets. The company's strong financial performance and strategic acquisitions support its future growth.

- Leading pan-European market infrastructure.

- Strong presence in equity listings and trading.

- Diversified revenue streams.

- Strategic acquisitions like Borsa Italiana.

Euronext's success is also reflected in its strategic initiatives, including a focus on digital transformation and diversification of revenue streams. For more details on how Euronext is evolving its business, see the Growth Strategy of Euronext. These efforts are designed to maintain and enhance its competitive position in the dynamic European stock exchanges market and the broader financial markets in Europe.

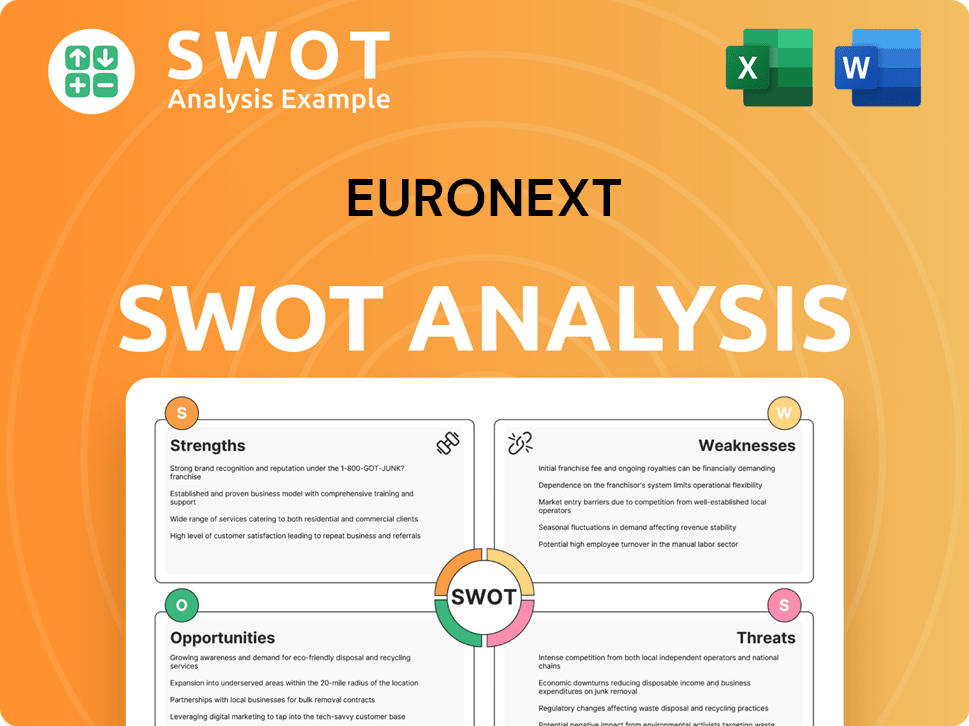

Euronext SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Euronext?

The Marketing Strategy of Euronext involves navigating a dynamic competitive landscape. Euronext's success hinges on understanding and effectively positioning itself against a range of rivals in the European and global financial markets. This analysis is crucial for investors, financial professionals, and business strategists seeking to understand Euronext's market position and future prospects.

Euronext's competitive environment is shaped by both direct and indirect competitors. These entities challenge Euronext across various business lines, including trading, clearing, data services, and listings. The ongoing evolution of the financial technology sector and the consolidation within the exchange industry further intensify the competitive dynamics, requiring Euronext to adapt and innovate to maintain its market share and profitability.

Understanding the Euronext competitive landscape is vital for assessing its strategic position and future growth potential. This analysis provides a comprehensive overview of the key players and their strategies, helping stakeholders make informed decisions.

Euronext's direct competitors are primarily other major global and regional exchange groups. These exchanges compete for listings, trading volume, and market share in various financial instruments.

LSEG is a significant rival, especially in global capital markets, data, and post-trade services. The acquisition of Refinitiv has significantly boosted LSEG's data and analytics capabilities, posing a direct challenge to Euronext's growing data services segment. LSEG's global reach and comprehensive service offerings make it a formidable competitor.

Deutsche Börse AG, which operates the Frankfurt Stock Exchange and Eurex (derivatives exchange), is another major competitor. It is particularly strong in derivatives trading, clearing, and settlement. Deutsche Börse's strong position in the European market and its diversified business model make it a key competitor.

Nasdaq Inc. and the New York Stock Exchange (NYSE), while primarily US-focused, also compete for global listings and trading in certain international securities. They offer technology solutions to other exchanges, further expanding their competitive footprint. These exchanges have a strong global presence and compete for international listings.

Euronext also faces competition from indirect competitors. These entities offer alternative trading venues and services that challenge Euronext's market share in various areas.

MTFs such as Cboe Europe and Aquis Exchange provide alternative trading venues for equities. They challenge Euronext's market share in cash equity trading through competitive pricing and innovative trading models. These platforms attract traders with lower fees and advanced trading functionalities.

Independent clearing houses and central securities depositories (CSDs) also represent competition. Euronext has strengthened its vertical integration through its ownership of Euronext Clearing and various CSDs. These services are crucial for the settlement and clearing of trades.

Emerging players in financial technology (FinTech) are disrupting the traditional competitive landscape. They offer blockchain-based trading platforms, digital asset exchanges, and new data analytics services, which could impact Euronext's long-term business model. FinTech innovation presents both opportunities and challenges.

Several factors influence the competitive dynamics within the Euronext market. These include technological advancements, regulatory changes, and the evolving needs of market participants.

- Market Share: Euronext's market share in cash equities and derivatives trading compared to competitors like LSEG and Deutsche Börse.

- Trading Volume: The total value of shares traded on Euronext's platforms versus its rivals.

- Listing Fees: The cost of listing on Euronext compared to other exchanges, influencing companies' decisions.

- Data Services Revenue: Revenue generated from data and analytics services, a growing area of competition.

- Technological Infrastructure: The efficiency and reliability of Euronext's trading platforms, including latency and uptime.

- Regulatory Compliance: Adherence to European and international regulations, impacting market access and operations.

- Strategic Alliances: Partnerships and acquisitions that enhance Euronext's competitive position.

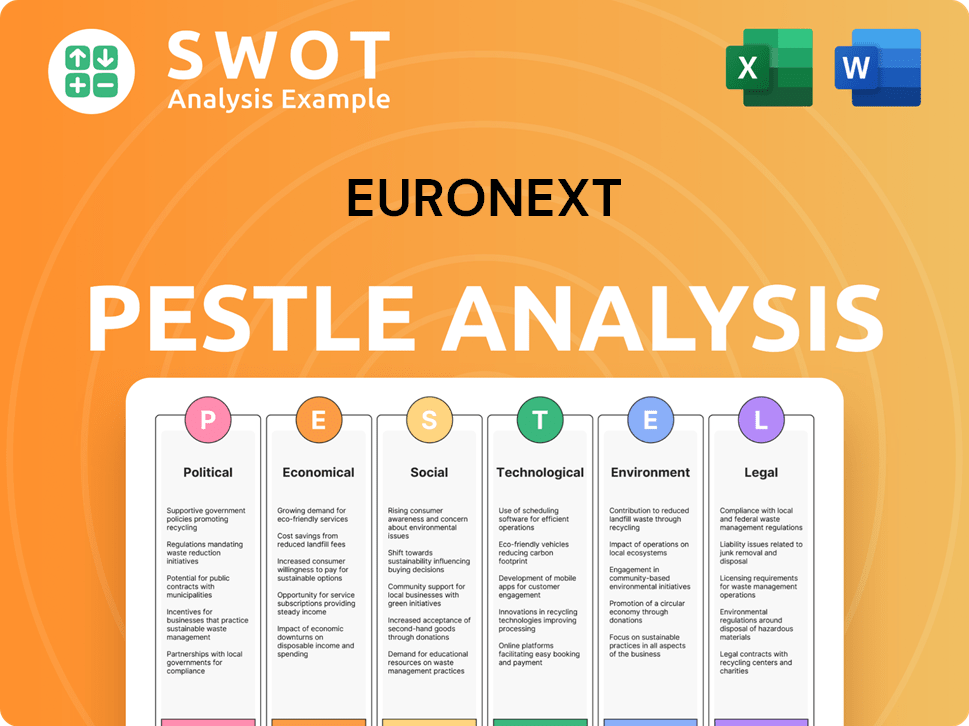

Euronext PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Euronext a Competitive Edge Over Its Rivals?

The Owners & Shareholders of Euronext have built a competitive advantage through strategic moves and a pan-European reach. Euronext's journey has been marked by key milestones, including mergers and acquisitions that have expanded its footprint across Europe. These strategic moves have enabled Euronext to establish a strong position in the European stock exchange landscape.

Euronext's competitive edge stems from its integrated business model and extensive network of regulated exchanges. This allows it to offer a comprehensive suite of services, from listing and trading to clearing and settlement. By centralizing technology and operations, Euronext achieves cost efficiencies, setting it apart from smaller exchanges. This has positioned Euronext to compete effectively in the financial markets of Europe.

Euronext's competitive advantages are multifaceted, stemming from its pan-European reach, integrated business model, and strategic acquisitions. A primary advantage is its extensive network of regulated exchanges across seven key European economies, providing a broad and diversified pool of liquidity for issuers and investors. This wide geographic presence allows Euronext to offer a single entry point to multiple European capital markets, a significant draw for international companies seeking to list and trade.

Euronext operates regulated exchanges in seven key European countries. This extensive network provides a broad and diversified pool of liquidity. It allows international companies to access multiple European capital markets through a single entry point.

The acquisition of Borsa Italiana strengthened Euronext's vertical integration. This integration allows Euronext to offer end-to-end services, from listing to clearing and settlement. This integrated model improves efficiency and reduces costs for market participants.

Euronext benefits from the trust of market participants and regulators. Its established brand across Europe attracts new listings and trading volumes. This trust is crucial in the highly regulated financial industry.

Euronext centralizes technology infrastructure and operational processes. This centralization helps achieve cost efficiencies that smaller exchanges cannot match. Investments in technology and data analytics also enhance trading platforms.

Euronext's main competitive advantages include its pan-European reach, integrated business model, and brand equity. These advantages help it attract listings and trading volumes. However, Euronext faces challenges from FinTech innovation and consolidation among competitors.

- Geographic Footprint: Euronext operates in seven European countries, providing a broad market reach.

- Integrated Services: The acquisition of Borsa Italiana enhanced end-to-end service offerings.

- Brand and Trust: Euronext's established brand and regulatory trust are significant assets.

- Technology and Scale: Euronext leverages economies of scale in technology and operations.

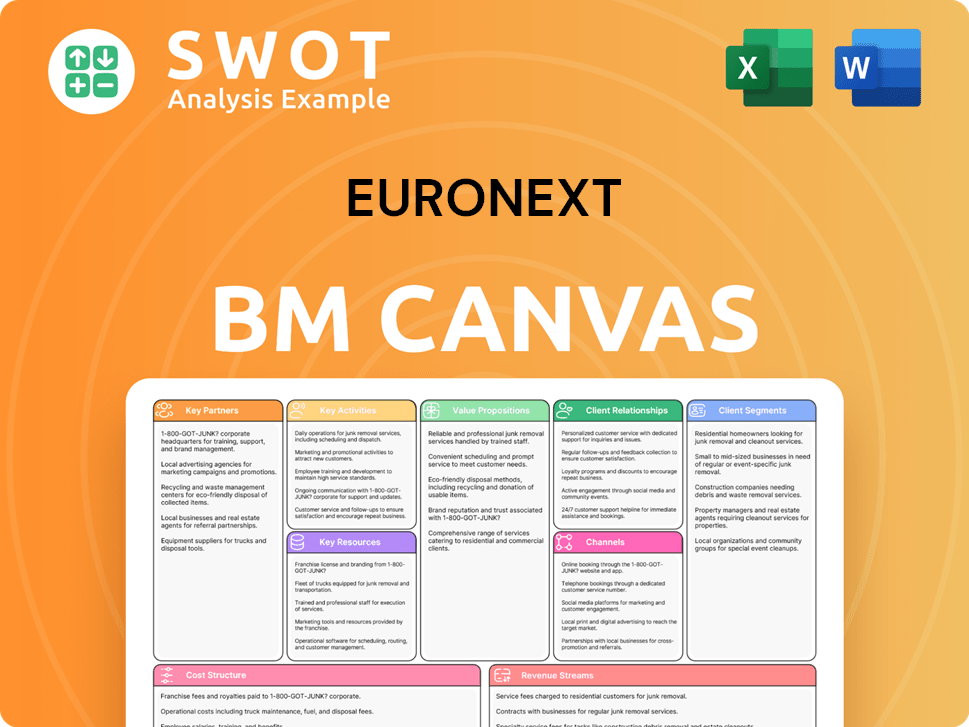

Euronext Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Euronext’s Competitive Landscape?

The competitive landscape for Euronext is shaped by industry trends, regulatory changes, and global economic conditions. Technological advancements, such as blockchain and AI, offer both opportunities and challenges. Regulatory changes and economic shifts influence market dynamics, impacting Euronext's financial performance and strategic direction. Analyzing the Euronext competitive landscape is crucial for understanding its position within the European stock exchanges.

Euronext faces potential disruptions from DeFi and new market entrants, while also having significant growth opportunities in sustainable finance and strategic partnerships. The company's ability to diversify, innovate in data and analytics, and expand post-trade offerings will be critical. Understanding Euronext market analysis helps assess its adaptability and resilience in a dynamic financial environment. For a deeper dive into the company's strategic direction, consider reading about the Growth Strategy of Euronext.

Technological advancements, including AI and blockchain, are transforming the financial markets. Regulatory changes, like the ongoing review of MiFID II/MiFIR, impact market structure. Global economic shifts, such as inflation and interest rate changes, influence trading volumes and investor sentiment.

Euronext faces challenges from DeFi and digital asset exchanges, which could disrupt traditional models. New competitors and increased regulatory scrutiny pose threats. Declining demand for traditional equity trading and higher compliance costs are also potential issues.

There's increasing demand for sustainable finance products, offering growth potential. Strategic partnerships and acquisitions in emerging markets or technology areas could drive expansion. Product innovations in data and analytics, and post-trade services, represent avenues for revenue enhancement.

Euronext is evolving into a diversified market infrastructure provider. It leverages its pan-European reach and integrated services to remain resilient. The company aims to capitalize on digital transformation and sustainable finance opportunities. The company's performance is closely tied to Euronext trading platform efficiency and market dynamics.

In 2024, Euronext's revenue reached approximately €1.4 billion, reflecting its strong position in the market. The company's focus on ESG initiatives has led to a significant increase in sustainable finance listings. Euronext’s strategic alliances and acquisitions, such as the acquisition of the Irish Stock Exchange in 2018, have expanded its footprint and service offerings. The company's commitment to technological infrastructure continues to be a key factor in maintaining its competitive edge.

- Euronext's market share analysis indicates a strong presence in European markets, with a significant portion of trading volume.

- Euronext vs Deutsche Börse comparison shows Euronext's strategic focus on pan-European integration and diversified services.

- The company's IPO market analysis reveals its role in facilitating capital raising for European companies.

- Euronext's ESG initiatives are increasingly important, aligning with the growing demand for sustainable investments.

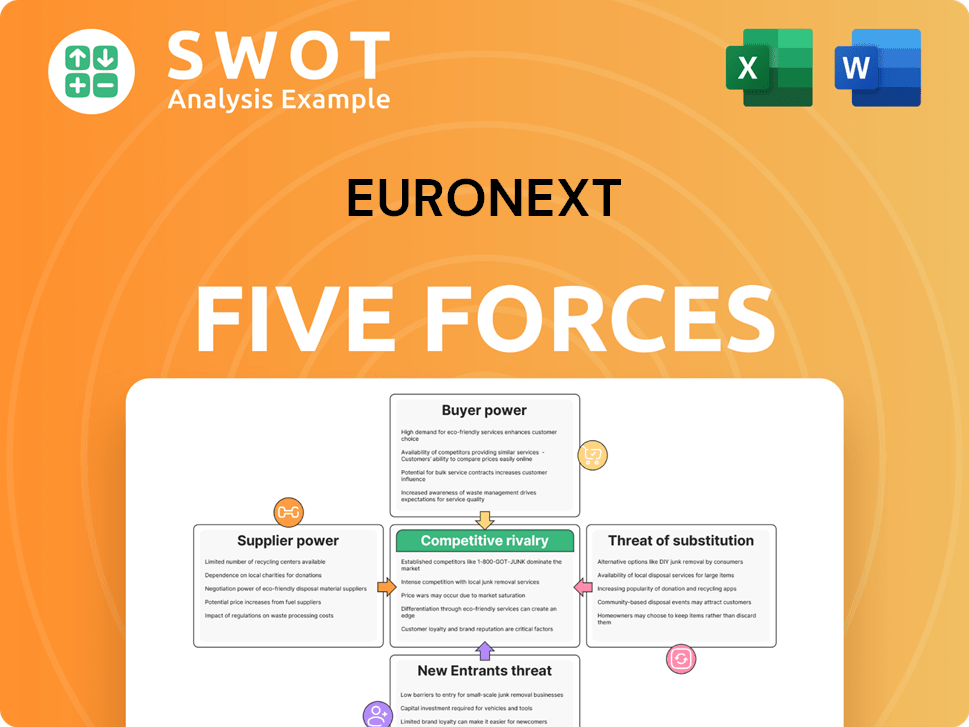

Euronext Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Euronext Company?

- What is Growth Strategy and Future Prospects of Euronext Company?

- How Does Euronext Company Work?

- What is Sales and Marketing Strategy of Euronext Company?

- What is Brief History of Euronext Company?

- Who Owns Euronext Company?

- What is Customer Demographics and Target Market of Euronext Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.