Euronext Bundle

Who Does Euronext Serve?

Understanding the Euronext SWOT Analysis is crucial for grasping its customer base. Euronext, a leading pan-European market infrastructure operator, caters to a diverse range of financial participants. Knowing the Euronext customer profile is essential for investors and businesses alike. This analysis delves into the specifics of Euronext's customer demographics and Euronext target market.

This exploration will examine the Euronext investors, their geographic distribution, and the specific needs of each segment. We'll uncover how Euronext conducts its Euronext market analysis to refine its services and maintain a strong Euronext user base. Furthermore, the insights provided will be invaluable for anyone seeking to understand the dynamics of the European financial markets and the strategic positioning of key players like Euronext.

Who Are Euronext’s Main Customers?

Understanding the customer demographics of Euronext is crucial for grasping its market position. Euronext, a prominent player in the financial markets, primarily operates on a business-to-business (B2B) model. Its Euronext target market is strategically segmented to serve various key players within the financial ecosystem.

The Euronext customer profile is diverse, encompassing institutional investors, financial intermediaries, and corporations seeking listings. This segmentation allows Euronext to tailor its services effectively. The company's customer base is spread across several European countries, including Belgium, France, Ireland, Italy, the Netherlands, Norway, and Portugal.

The primary customer segments of Euronext include institutional investors, financial intermediaries, and corporations. These groups are essential to Euronext's operations, each playing a critical role in the financial markets. The strategic focus on these segments allows Euronext to maintain its position as a leading exchange operator.

Institutional investors, such as asset managers, pension funds, and hedge funds, are a core segment. They utilize Euronext for trading and investment purposes. These investors are vital for providing liquidity and driving trading volumes on the exchange.

Financial intermediaries, including banks, brokers, and proprietary trading firms, form another significant segment. They rely on Euronext for market access, liquidity, and post-trade services. These intermediaries facilitate trading activities for their clients and contribute to market efficiency.

Corporations that list their securities on Euronext exchanges constitute a crucial segment. They benefit from increased visibility and access to a broad investor base. Listing on Euronext provides these companies with opportunities for capital raising and growth.

Data vendors and technology providers also form part of Euronext's customer base. They leverage Euronext's market data and technology services to create and distribute financial information and trading tools. This segment supports the broader financial ecosystem by providing essential services.

Euronext's customer base is primarily B2B, with institutional investors and financial intermediaries being the most significant. The acquisition of Borsa Italiana Group in 2021 expanded its customer base significantly. Understanding the nuances of each segment is key for Euronext's strategic planning.

- Institutional Investors: Asset managers, pension funds, and hedge funds.

- Financial Intermediaries: Banks, brokers, and proprietary trading firms.

- Corporations: Companies seeking to list securities.

- Data Vendors and Tech Providers: Companies using market data and technology services.

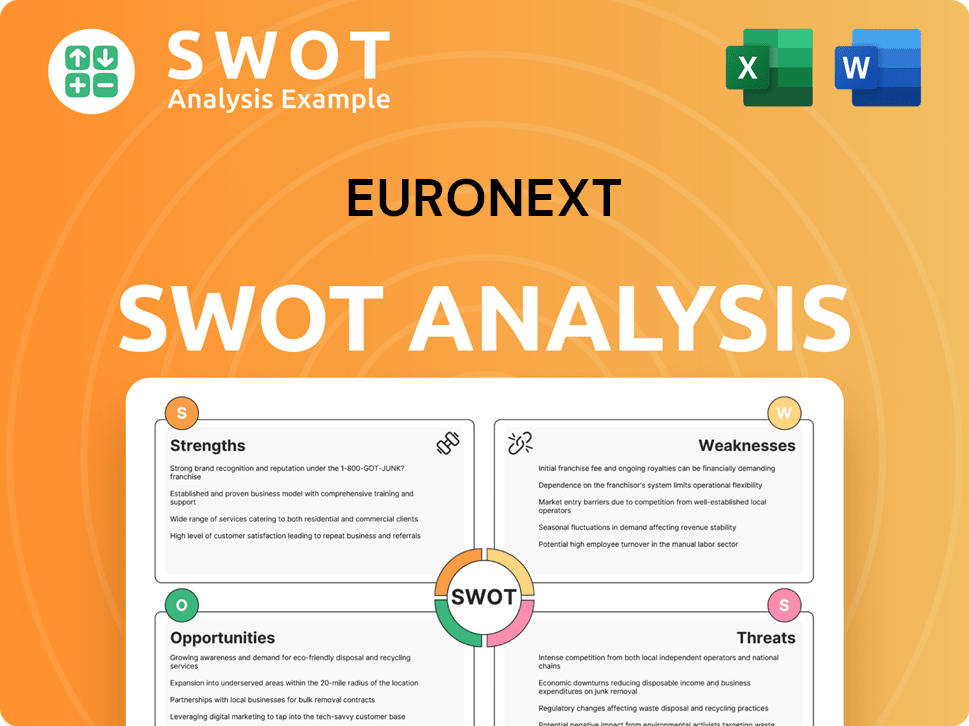

Euronext SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Euronext’s Customers Want?

Understanding the customer needs and preferences is crucial for the success of any financial exchange. For Euronext, this involves catering to a diverse group of users with specific requirements. The primary focus is on providing efficient, reliable, and compliant services that facilitate access to capital markets.

Financial institutions, corporations, and individual investors all have distinct needs that Euronext addresses through its offerings. These needs are shaped by factors such as trading speed, cost-effectiveness, regulatory compliance, and the availability of a wide range of financial instruments. The exchange's ability to meet these demands directly influences its market position and customer satisfaction.

Euronext's customer base is driven by a complex set of needs and preferences, largely centered around efficiency, liquidity, regulatory compliance, and access to capital markets. Financial institutions prioritize high-speed, reliable trading platforms, robust post-trade services, and comprehensive market data to execute their strategies effectively. Corporations seeking to list their securities are primarily motivated by access to capital, enhanced visibility, and the credibility associated with listing on a regulated exchange.

Financial institutions require high-speed trading platforms to execute trades quickly and efficiently. This is a key factor in their decision-making process. Euronext invests in technology to improve its trading platforms and data services, aiming to provide faster and more granular information to its customers.

Customers need access to liquid markets with a wide range of financial instruments. This allows for easier buying and selling of assets. Euronext offers a diverse range of products, including equities, fixed income, and derivatives, to meet these needs.

Adherence to regulatory standards is a top priority for all market participants. Euronext operates within a regulated environment, ensuring transparency and trust. This is particularly important for attracting and retaining institutional investors.

Customers are always looking for cost-effective solutions. Euronext aims to provide competitive pricing and efficient services to attract and retain customers. This includes offering various fee structures and trading models.

Access to comprehensive market data and advanced analytics tools is crucial for informed decision-making. Euronext continuously enhances its data services to provide faster and more granular information to its customers. This includes real-time market data feeds and historical data analysis tools.

The increasing demand for sustainable finance products is influencing Euronext's product development. This has led to the introduction of new indices and trading segments focused on ESG investments. In 2024, Euronext's ESG segment saw significant growth, reflecting the rising importance of sustainable investing.

Euronext segments its customer base to tailor its services effectively. This includes offering specialized services for different segments, such as dedicated investor relations support for listed companies or advanced trading functionalities for high-frequency traders. Understanding the Euronext customer profile helps the exchange meet specific needs.

- Financial Institutions: These include investment banks, brokers, and asset managers who require high-speed trading platforms, robust post-trade services, and comprehensive market data.

- Corporations: Companies seeking to list their securities on Euronext are primarily motivated by access to capital, enhanced visibility, and the credibility associated with listing on a regulated exchange.

- Individual Investors: Retail investors who access the market through brokers. They benefit from the transparency and regulatory oversight provided by Euronext.

- High-Frequency Traders (HFTs): These traders require advanced trading functionalities and low-latency access to the market.

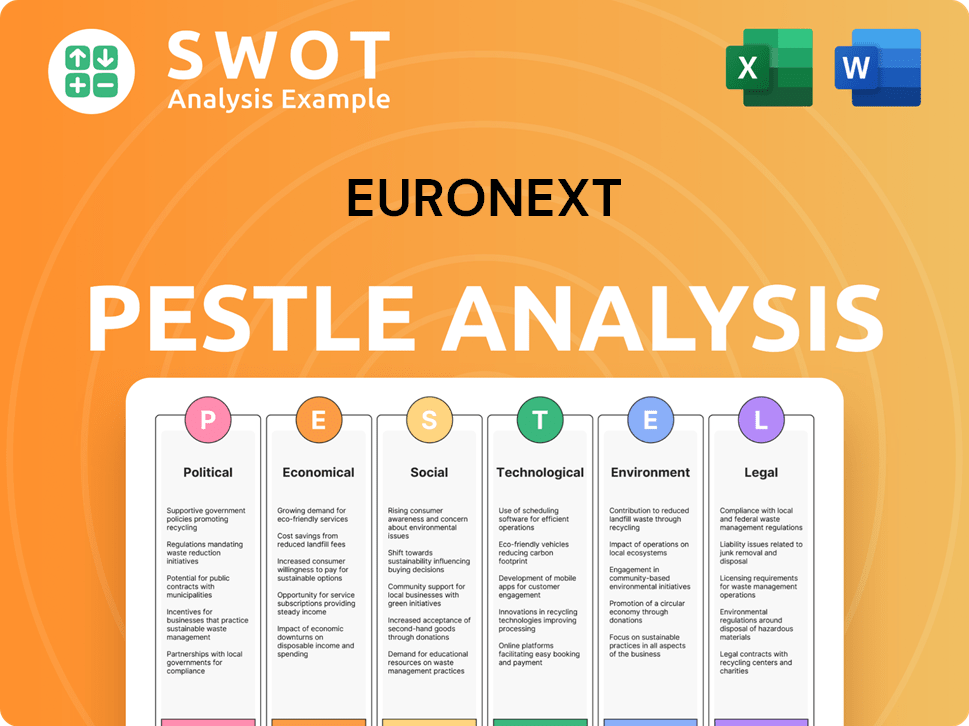

Euronext PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Euronext operate?

Euronext has a strong geographical presence across Europe, operating regulated exchanges in major financial centers. Its primary markets include Belgium (Brussels), France (Paris), Ireland (Dublin), Italy (Milan), the Netherlands (Amsterdam), Norway (Oslo), and Portugal (Lisbon). This extensive reach allows Euronext to serve a diverse customer base.

The company's market share and brand recognition are particularly robust in its historical core markets, such as France, the Netherlands, and Belgium. The acquisition of the Borsa Italiana Group in 2021 significantly strengthened its presence in Italy, making it one of its largest markets. This expansion reflects Euronext's strategic focus on consolidating its pan-European footprint.

Euronext's geographical distribution of sales and growth often mirrors the economic activity and capital market development within each country. Recent expansions and strategic integrations have contributed to strong growth in various markets. As of 2023, Euronext reported diversified revenue streams across its various geographies, underscoring its broad European reach and its ability to cater to a wide range of Euronext investors.

Euronext operates in key financial centers across Europe, including Belgium, France, Ireland, Italy, the Netherlands, Norway, and Portugal. This extensive network allows the company to serve a broad Euronext user base, with a strong presence in its core markets.

The company's customer demographics vary across regions, with differences in preferences and buying power. For example, the Italian market, with its strong SME sector, has a different profile of listed companies and local investor base compared to the more international markets of Amsterdam or Paris. Euronext tailors its services to meet the specific needs of each market.

Euronext offers localized services, including local language support and adapting listing requirements to national legal systems. Initiatives like those in Portugal support SMEs in accessing capital markets. This approach helps Euronext maintain strong relationships with its Euronext customer profile.

The acquisition of Borsa Italiana Group in 2021 was a key strategic move. This expansion consolidated its pan-European footprint. These strategic moves have helped Euronext to further define its Euronext target market.

Euronext's main markets include Belgium, France, Ireland, Italy, the Netherlands, Norway, and Portugal. These markets represent a diverse range of economies and investor profiles. Each market contributes to the company's overall revenue and growth.

Euronext adapts its offerings to meet the specific regulatory frameworks and market practices of each country. This includes providing local language support and adapting listing requirements. Understanding Euronext customer needs analysis is critical.

Euronext generally holds a strong market share in its operating countries. This strong market position is a result of strategic expansions and localized services. The company's success is linked to its ability to understand and serve its diverse Euronext customer segmentation by industry.

The geographic distribution of sales and growth often reflects economic activity and capital market development. Strong growth has been observed in markets where Euronext has expanded its product offerings. As of 2023, Euronext reported diversified revenue streams. To learn more about the financial performance, you can read this article about Euronext's financial strategy.

The customer base includes a mix of institutional and retail investors, as well as companies seeking to list their shares. The company's ability to cater to a wide range of customers is a key factor in its success. This includes both Euronext customer profile for SMEs and large corporations.

Euronext continues to focus on strategic market entry and consolidation to strengthen its pan-European footprint. The company's approach includes adapting its offerings to meet the specific needs of each local market. This helps Euronext to maintain and grow its Euronext customer geographic distribution.

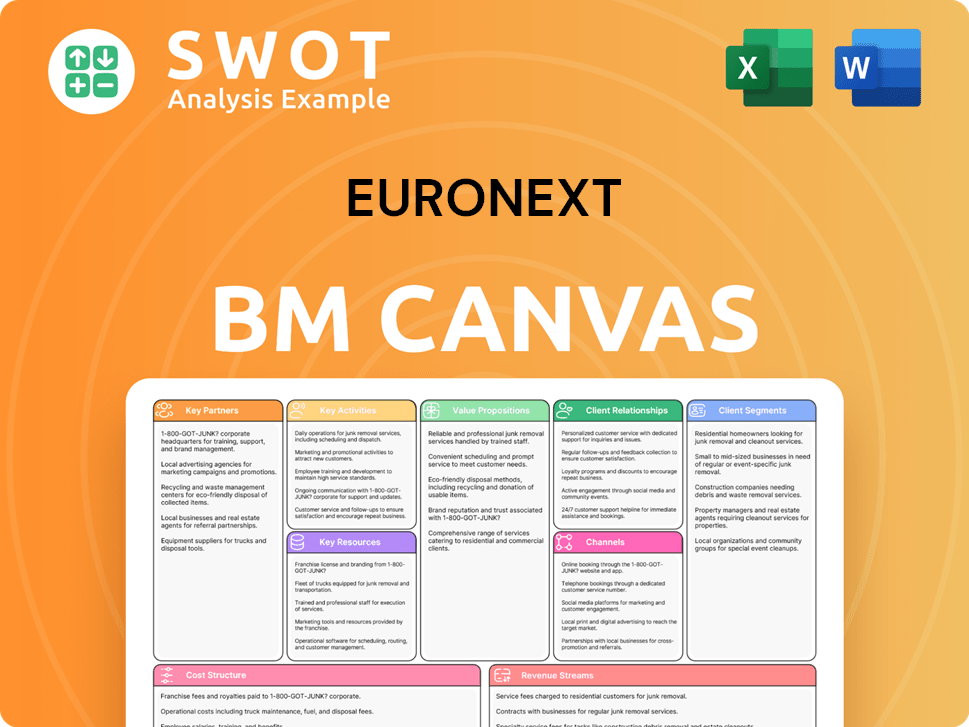

Euronext Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Euronext Win & Keep Customers?

Euronext's customer acquisition and retention strategies are primarily geared towards financial institutions, corporations, and technology providers, reflecting its B2B operational model. This approach includes direct sales, participation in industry events, and targeted digital marketing. The focus is on building strong relationships and providing superior service to maintain a loyal customer base. Understanding the Growth Strategy of Euronext is vital to grasping their customer acquisition and retention dynamics.

The company utilizes customer data and CRM systems to segment clients, tailor communications, and personalize service offerings. This enables Euronext to understand client needs and track engagement effectively. While traditional loyalty programs are less applicable, Euronext prioritizes retention through platform enhancements and a strong ecosystem. This includes providing reliable trading infrastructure, efficient post-trade services, and comprehensive market data, all of which contribute to customer satisfaction and long-term engagement.

Successful campaigns often involve expanding service offerings, such as introducing new derivatives or ESG-related indices, to attract new investor segments. Retention initiatives include tailored advisory services and educational programs for market participants, which further enhance customer value. These efforts aim to enhance the value proposition and improve the customer experience, contributing to sustained client engagement.

Euronext employs a multi-channel approach for acquiring customers, focusing on direct sales and industry engagement. This includes participation in conferences, targeted digital marketing through professional networks, and leveraging thought leadership content. The aim is to attract a diverse client base within the financial sector.

Retention strategies center on superior service quality, continuous platform enhancements, and a strong ecosystem. This involves providing reliable trading infrastructure, efficient post-trade services, and comprehensive market data. The focus is on building long-term relationships with clients.

Customer data and CRM systems are crucial for segmenting clients and personalizing interactions. Euronext uses these tools to understand client needs, track engagement, and tailor communication. This approach helps in offering customized service offerings.

Euronext continuously enhances its technology platform, such as the 2024 migration to Aruba Global Cloud Data Center. Additionally, the introduction of new products and services, like ESG-related indices, supports both acquisition and retention by attracting new clients and meeting evolving market demands.

Euronext's customer acquisition strategy involves expanding service offerings and introducing new products. Retention efforts include tailored advisory services and educational programs. These initiatives enhance the overall customer experience and contribute to sustained client engagement.

- Direct Sales and Relationship Building: Focus on establishing strong relationships with financial institutions and corporations.

- Technological Advancements: Continuous platform enhancements, such as data center upgrades, to improve service quality.

- Product Innovation: Introduction of new products like derivatives and ESG-related indices to attract new segments.

- Customer Support: Providing tailored advisory services and educational programs to enhance customer value.

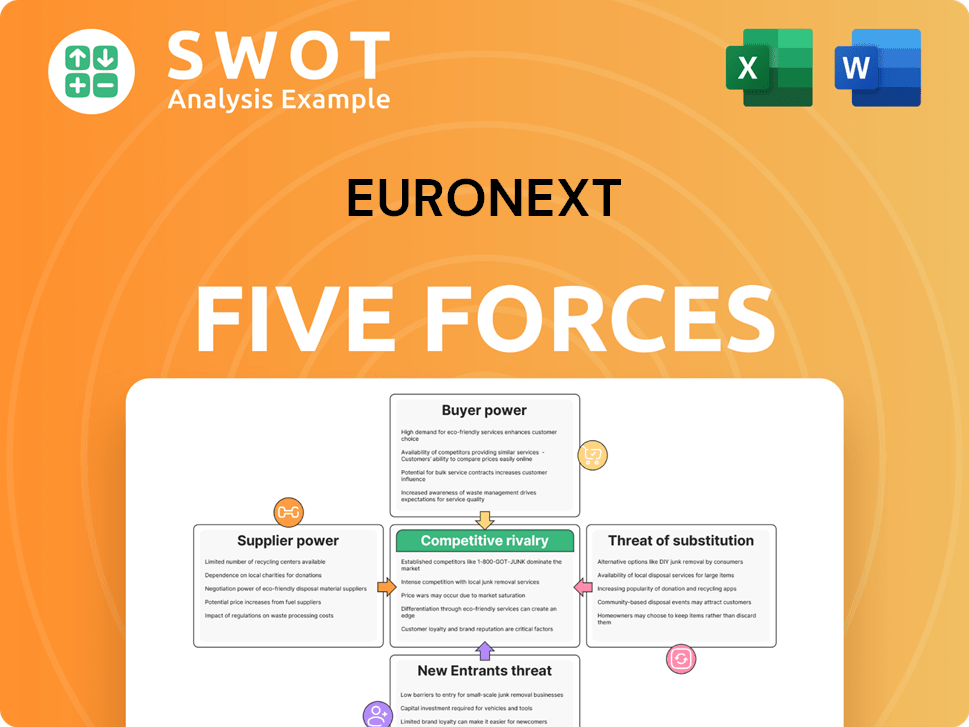

Euronext Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Euronext Company?

- What is Competitive Landscape of Euronext Company?

- What is Growth Strategy and Future Prospects of Euronext Company?

- How Does Euronext Company Work?

- What is Sales and Marketing Strategy of Euronext Company?

- What is Brief History of Euronext Company?

- Who Owns Euronext Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.