Euronext Bundle

How Does the Euronext Company Shape European Finance?

Euronext, a cornerstone of the European financial market, plays a crucial role in connecting businesses with investors. As a leading pan-European market infrastructure operator, Euronext facilitates capital formation and investment across several countries. Understanding Euronext SWOT Analysis is vital for anyone seeking to navigate the complexities of the European financial ecosystem.

This exploration into how Euronext works delves into its operational model, from its stock exchange activities to its revenue streams. Covering everything from Euronext stock market hours to the Euronext IPO process, we'll uncover the inner workings of this major trading platform. Whether you're interested in Euronext Amsterdam trading or the Euronext Paris index, this analysis provides essential insights into the company.

What Are the Key Operations Driving Euronext’s Success?

The Euronext company creates value by operating a comprehensive market infrastructure. It supports the entire trading lifecycle for various asset classes. This includes listing, trading, and post-trade services for corporations, financial institutions, and retail investors.

Its core offerings include listing services, trading services, and post-trade services. Listing services enable companies to raise capital through equity, bond, and ETF listings. Trading services cover cash trading, derivatives trading, and foreign exchange. Post-trade services provide clearing, settlement, and custody solutions.

Euronext's integrated 'federal model' combines local market expertise with a centralized pan-European trading platform. This approach allows for economies of scale while maintaining strong relationships with local market participants. The acquisition of Borsa Italiana Group strengthened its multi-asset offering.

Euronext is a leading listing venue in Europe. It provides companies with access to capital markets. As of the end of 2023, there were over 1,900 issuers listed, representing a total market capitalization of €6.9 trillion.

Trading services encompass cash trading, derivatives trading, and foreign exchange. These services are powered by Euronext's proprietary Optiq® technology. This technology ensures high performance and low latency for efficient execution.

Post-trade services are delivered through Euronext Clearing and its CSD network. These provide clearing, settlement, and custody solutions. Euronext Clearing covers equities, equity derivatives, and commodities.

Euronext's unique 'federal model' combines local expertise with a centralized platform. This approach enhances liquidity and reduces trading costs. It streamlines the post-trade environment, differentiating it from competitors.

Euronext's integrated approach translates into several key benefits for its customers. These benefits include enhanced liquidity, reduced trading costs, and a streamlined post-trade environment.

- Enhanced Liquidity: The centralized platform and wide range of listed securities contribute to higher liquidity.

- Reduced Trading Costs: Efficient technology and economies of scale help lower trading fees.

- Streamlined Post-Trade: Integrated clearing and settlement services simplify the process.

- Multi-Asset Offering: The acquisition of Borsa Italiana Group expanded its offerings, particularly in fixed income.

Euronext SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Euronext Make Money?

The Euronext company generates revenue through a diverse array of channels, primarily centered around trading, post-trade services, and advanced data offerings. As a major player in the financial market, Euronext's revenue streams are designed to capitalize on various aspects of the financial ecosystem.

In 2023, the total revenue and income for Euronext reached €1,474.9 million, reflecting a +6.9% increase compared to the previous year. This growth underscores the effectiveness of its monetization strategies and its strong position in the European stock exchange landscape.

The company's revenue model is built on a combination of transaction fees, subscription-based services, and recurring fees, ensuring a stable and diversified income base. Understanding how Euronext works involves a closer look at these key revenue streams and how they contribute to the company's financial performance.

Euronext's revenue streams are structured to capture value across the entire financial market lifecycle. The company has successfully diversified its income sources, reducing its reliance on any single revenue stream. To better understand Euronext, it's essential to examine its primary revenue sources.

- Trading Revenue: This includes income from cash, derivatives, FX, and power trading. In 2023, trading revenue totaled €502.9 million. Revenue is largely driven by transaction fees, which are based on trading volumes and values.

- Post-Trade Revenue: This segment encompasses clearing, settlement, and custody services. Post-trade revenue is a significant component, reaching €514.8 million in 2023. The full consolidation of Euronext Clearing and the CSDs has enhanced this revenue stream, which benefits from both volume-based fees and asset-under-custody fees.

- Advanced Data & Other Services: This includes listing, market data, and technology solutions. Listing revenue was €186.2 million in 2023, reflecting Euronext's position as a leading listing venue. Market data revenue stood at €180.2 million, while other revenue, including technology solutions and managed services, amounted to €90.8 million.

- Monetization Strategies: Euronext employs a variety of monetization strategies, including tiered pricing for trading services, subscription-based models for market data, and recurring fees for listing and post-trade services. The acquisition of Borsa Italiana has enhanced its revenue mix, adding a strong fixed income trading and clearing component.

Euronext PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Euronext’s Business Model?

The journey of the Euronext company has been marked by significant milestones and strategic moves that have reshaped its operations and financial standing. A pivotal moment was the acquisition of the Irish Stock Exchange in 2018, followed by Oslo Børs VPS in 2019, significantly expanding its Nordic footprint. The most transformative strategic move was the acquisition of the Borsa Italiana Group from London Stock Exchange Group in April 2021.

This acquisition, valued at €4.4 billion, diversified Euronext's asset classes, particularly in fixed income trading and clearing. It solidified its position as the leading listing venue in Europe and a major player in post-trade services. The integration of Euronext Clearing (formerly CC&G) and Monte Titoli (now Euronext Securities Milan) were key components of this expansion. These moves have positioned Euronext as a major player in the European financial market.

Operational challenges have included integrating diverse entities into a cohesive pan-European platform while navigating different regulatory environments. Euronext has responded by leveraging its 'federal model,' which aims to combine local market expertise with a harmonized technological backbone, exemplified by the migration of acquired markets onto its proprietary Optiq® trading platform. This approach has been crucial in managing the complexities of operating across multiple countries.

Euronext's expansion includes the acquisition of the Irish Stock Exchange in 2018 and Oslo Børs VPS in 2019, broadening its Nordic presence. The acquisition of the Borsa Italiana Group in April 2021 was a transformative move, diversifying its asset classes and solidifying its market position. These strategic acquisitions have been pivotal in Euronext's growth.

The 'federal model' combines local market expertise with a harmonized technological backbone, such as the Optiq® trading platform. Euronext's focus on technology and sustainable finance initiatives, as outlined in its 'Growth for Impact 2024' strategic plan, demonstrates its commitment to innovation. These moves are designed to enhance efficiency and client experience.

Euronext's pan-European presence provides access to diverse pools of liquidity and a broad range of issuers and investors. The Optiq® technology offers a low-latency, high-performance trading environment, attracting market participants. The integrated value chain, from listing to trading and post-trade services, creates an ecosystem effect that enhances stickiness for its clients.

Euronext continues to adapt to new trends by investing in technology, exploring new asset classes like ESG-related products, and focusing on sustainable finance initiatives. The company's strong brand recognition and regulatory expertise across multiple jurisdictions also contribute to its competitive edge. For more insights, consider the Marketing Strategy of Euronext.

Euronext's competitive advantages include its pan-European presence, providing access to diverse liquidity pools. The Optiq® technology enhances trading performance. An integrated value chain, from listing to post-trade services, creates an ecosystem effect.

- Pan-European Presence: Access to diverse pools of liquidity.

- Optiq® Technology: Low-latency, high-performance trading.

- Integrated Value Chain: Enhances client stickiness.

- Strong Brand and Regulatory Expertise: Competitive edge across multiple jurisdictions.

Euronext Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Euronext Positioning Itself for Continued Success?

The Euronext company holds a prominent position within the European market infrastructure. It is the leading listing venue in Europe and a major player in trading and post-trade services, making it a significant entity in the financial market. With a robust market share in European cash trading, the integration of Borsa Italiana has further strengthened its multi-asset capabilities, particularly in fixed income and derivatives. This positions Euronext as a key player in the European stock exchange landscape.

As of the end of 2023, Euronext had over 1,900 issuers listed on its markets, representing a total market capitalization of €6.9 trillion. The company faces competition from major exchange groups like Deutsche Börse and London Stock Exchange Group, as well as various alternative trading systems. Euronext distinguishes itself through its pan-European model, offering localized services within a harmonized technological framework. This structure supports its operations across multiple European countries.

Euronext is the leading listing venue in Europe. It has a strong market share in European cash trading. The integration of Borsa Italiana has strengthened its multi-asset capabilities.

Regulatory changes across multiple jurisdictions can impact operations. Intense competition from other exchanges poses a challenge. Economic downturns or geopolitical instability can reduce trading volumes.

The 'Growth for Impact 2024' strategic plan guides Euronext's future. It focuses on accelerating growth and enhancing efficiency. The company aims to play a leading role in sustainable finance.

Expanding derivatives and fixed income offerings is a key initiative. Leveraging data and technology services is also important. Continued integration of acquired entities supports growth.

Euronext's 'Growth for Impact 2024' plan focuses on accelerating growth, enhancing efficiency, and making a positive impact on society. Key initiatives include expanding derivatives and fixed income offerings, leveraging data and technology, and integrating acquired entities. The company is also focused on sustainable finance.

- Expanding Derivatives and Fixed Income

- Leveraging Data and Technology Services

- Integrating Acquired Entities

- Focus on Sustainable Finance

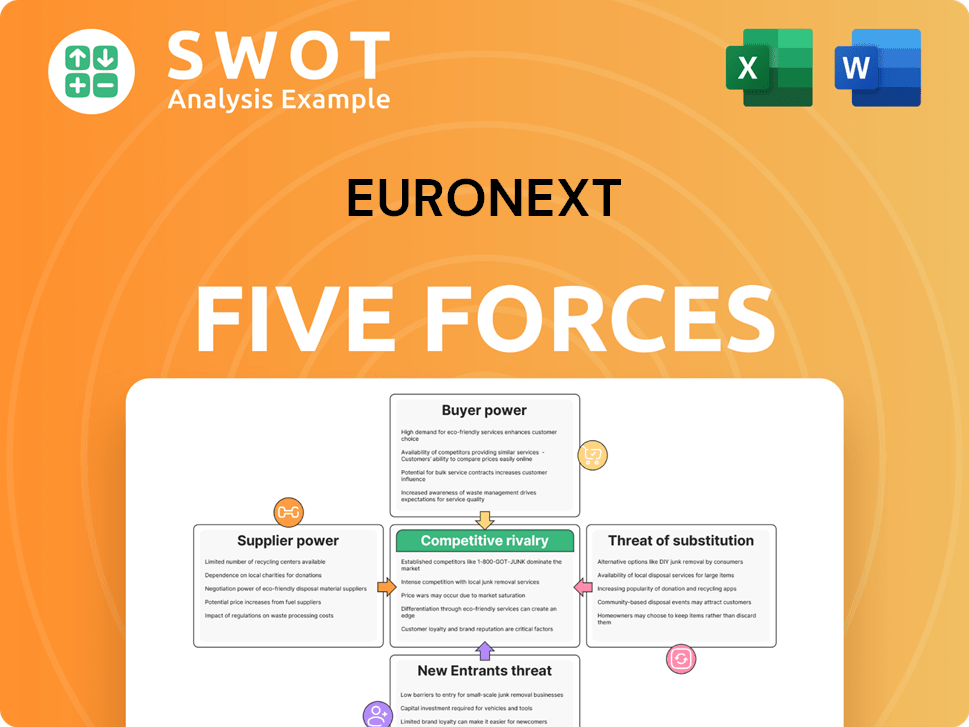

Euronext Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Euronext Company?

- What is Competitive Landscape of Euronext Company?

- What is Growth Strategy and Future Prospects of Euronext Company?

- What is Sales and Marketing Strategy of Euronext Company?

- What is Brief History of Euronext Company?

- Who Owns Euronext Company?

- What is Customer Demographics and Target Market of Euronext Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.