Ferroglobe Bundle

How Does Ferroglobe Navigate the Silicon Metal Industry's Competitive Waters?

In the dynamic world of industrial materials, Ferroglobe stands as a key player, producing essential silicon metal and ferroalloys. Its journey from inception to global prominence highlights its critical role in sectors from automotive to solar energy. This analysis dives deep into the Ferroglobe SWOT Analysis, exploring its market position and key rivals.

This exploration of the Ferroglobe competitive landscape will dissect its strategies and competitive advantages. We'll examine the company's financial performance and global market presence, including a detailed Ferroglobe market analysis to understand its standing within the silicon metal industry and ferroalloys market. Understanding who Ferroglobe's competitors are and their impact on the company's future growth prospects is crucial.

Where Does Ferroglobe’ Stand in the Current Market?

Ferroglobe holds a significant market position as a leading global producer of silicon metal and silicon-based and manganese-based alloys. The company serves a broad customer base across various industries, including chemical products, aluminum, steel, solar energy, automotive, and foundries. This positions it as a key supplier in critical material markets.

The company's products are fundamental to manufacturing processes, from silicon used in semiconductors and solar panels to ferroalloys vital for steel production and aluminum casting. Ferroglobe's operational footprint spans North America, Europe, South America, and Asia, reflecting its global reach and influence within the silicon metal industry and ferroalloys market.

Historically, strategic expansions and acquisitions, such as the 2015 combination of Globe Specialty Metals and Grupo FerroAtlántica, have enabled Ferroglobe to adapt to shifts in global demand. This has helped maintain its competitive standing in the face of market fluctuations. The company's financial performance reflects its scale relative to industry averages, with a focus on production optimization and cost management to maintain a strong market position.

Ferroglobe is a leading global producer of silicon metal, silicon-based alloys, and manganese-based alloys. It serves a diverse customer base across multiple industries. The company's global presence and product offerings position it as a key player in the silicon metal and ferroalloys markets.

Ferroglobe has a significant presence across North America, Europe, South America, and Asia. This widespread operational footprint allows it to serve customers globally. Its strategic locations support efficient distribution and market penetration.

The company's product lines are essential for manufacturing processes in various sectors. These include silicon used in semiconductors and solar panels, and ferroalloys used in steel production. This diverse portfolio supports its market position.

Ferroglobe reported revenue of $470.9 million for the first quarter of 2024, demonstrating its substantial operational scale. The company focuses on optimizing production and managing costs. This focus supports its commitment to maintaining a strong market position.

Ferroglobe's strategic advantages include its global presence and diversified product portfolio. Its ability to adapt to market changes through acquisitions and operational efficiencies is also key. These factors contribute to its resilience and strategic importance in the global metallurgical industry.

- Strong presence in key regions like North America and Europe.

- Diverse product portfolio catering to multiple industries.

- Focus on production optimization and cost management.

- Strategic acquisitions to expand its market reach.

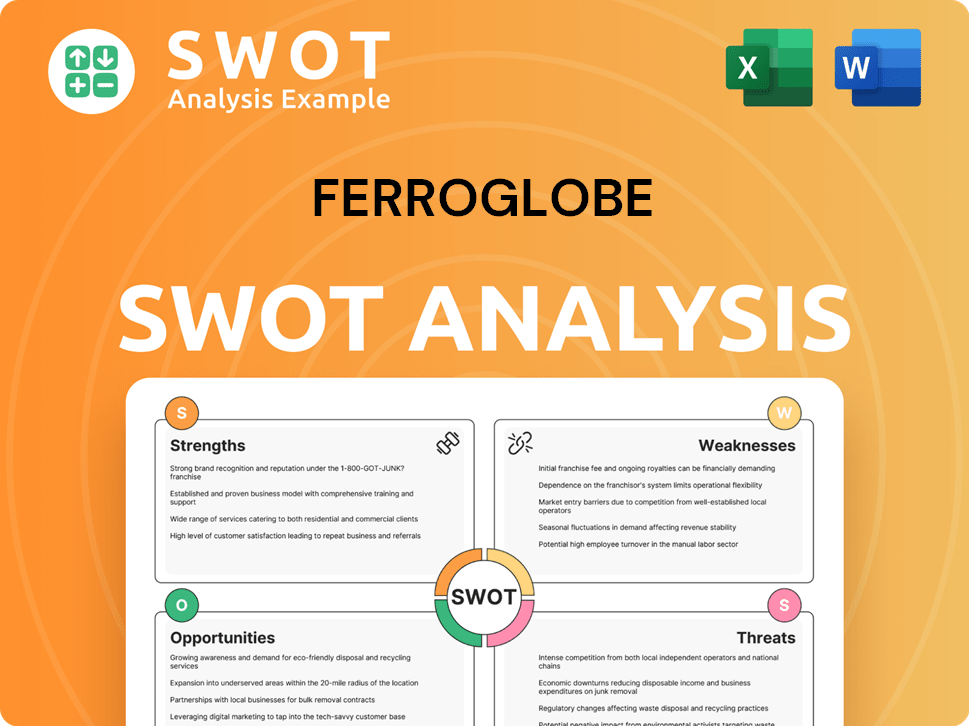

Ferroglobe SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Ferroglobe?

The Ferroglobe competitive landscape is shaped by a global market with both direct and indirect competitors in the production of silicon metal and ferroalloys. Understanding the Ferroglobe competitors is crucial for assessing its market position and strategic challenges. This analysis provides a detailed look at the key players and market dynamics influencing Ferroglobe's market analysis.

The ferroalloys market is subject to fluctuations in raw material costs, energy prices, and global demand. Companies with favorable energy contracts or access to lower-cost raw materials can gain a competitive edge. The industry also sees instances of high-profile competition, particularly during periods of oversupply or economic downturns, where aggressive pricing strategies become more prevalent.

The competitive environment is dynamic, with market share shifts influenced by factors such as raw material costs, energy prices, and global demand fluctuations. New or emerging players, particularly from regions with developing industrial bases, can also disrupt traditional competitive dynamics by offering lower-cost alternatives. Mergers and alliances, while less frequent at the very top tier, can also reshape the competitive environment by consolidating production capacity and market influence.

Elkem ASA is a leading producer of silicones, ferrosilicon, and carbon materials. Elkem competes directly with Ferroglobe in the silicon metal and ferrosilicon markets. Elkem serves similar end-user industries such as chemicals, aluminum, and solar.

Rima Industrial S/A is a strong competitor in manganese alloys and silicon metal production, with a notable presence in the South American market. Rima Industrial S/A is a direct competitor to Ferroglobe.

Eramet competes with Ferroglobe in manganese alloys. Eramet's integrated mining and metallurgical operations give it an advantage in raw material sourcing. Eramet is a French multinational mining and metallurgy company.

Various regional producers and smaller, specialized manufacturers also contribute to the competitive landscape. These companies often challenge on price or cater to niche market segments. These players add complexity to the Ferroglobe competitive landscape.

Market share shifts are influenced by raw material costs, energy prices, and global demand. Aggressive pricing strategies are more prevalent during periods of oversupply or economic downturns. New players from regions with developing industrial bases can disrupt traditional dynamics.

Mergers and alliances can reshape the competitive environment. Understanding the Ferroglobe competitors is important for strategic planning. For more insights, read about the Growth Strategy of Ferroglobe.

Ferroglobe's ability to compete depends on various factors, including its cost structure, technological advancements, and market access. Key advantages may include efficient production processes and strategic partnerships. However, the company faces challenges from fluctuating raw material prices and energy costs.

- Cost Structure: Companies with lower production costs have a competitive edge.

- Technological Advancements: Innovation in production methods can improve efficiency.

- Market Access: Strong distribution networks and customer relationships are essential.

- Raw Material Prices: Fluctuations in the cost of raw materials impact profitability.

- Energy Costs: Energy prices significantly influence production costs.

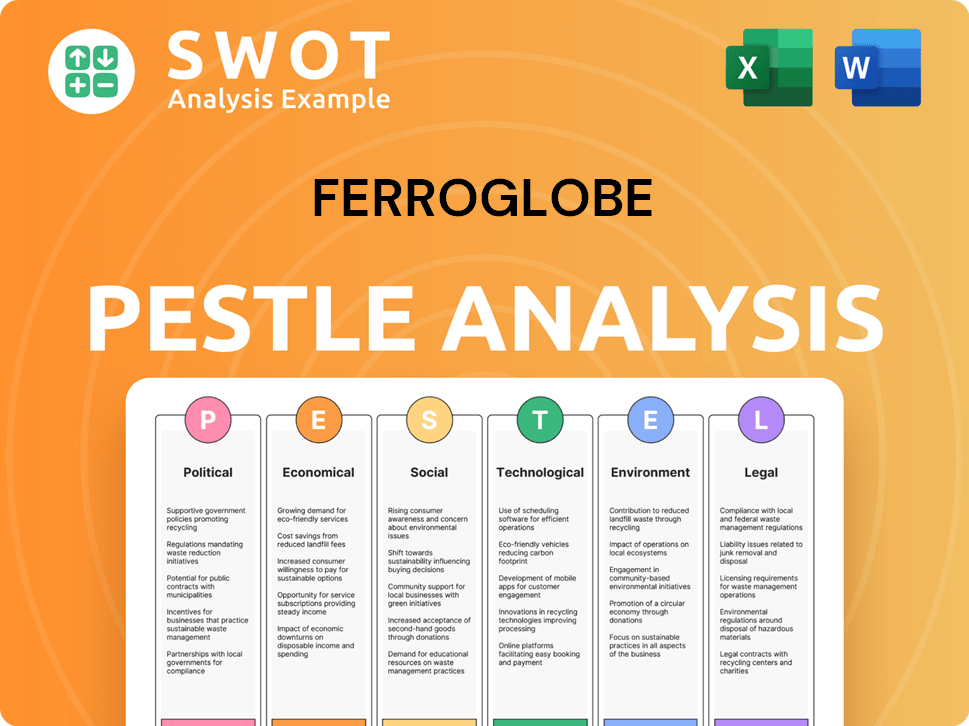

Ferroglobe PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Ferroglobe a Competitive Edge Over Its Rivals?

Analyzing the Ferroglobe competitive landscape reveals several key strengths that position the company in the global silicon metal and ferroalloys market. These advantages are crucial in understanding Ferroglobe's competitive advantages and its ability to compete effectively. The company's strategic moves and operational efficiencies contribute to its sustained market position.

Ferroglobe's global presence, spanning North America, Europe, South America, and Asia, is a significant competitive differentiator. This widespread footprint enables efficient service to a diverse customer base, optimizes logistics, and allows for better adaptation to regional market demands and supply chain disruptions. This extensive reach is a key factor in Ferroglobe market analysis and its ability to navigate the complexities of the silicon metal industry.

A diversified product portfolio, including silicon metal, silicon-based alloys, and manganese-based alloys, further strengthens Ferroglobe's position. This diversification reduces reliance on any single market segment and provides revenue stability, which is essential in a commodity-driven market. The company's expertise in specialized metallurgical processes contributes to product quality and operational efficiency, supporting its Ferroalloys market presence.

Ferroglobe operates production facilities across North America, Europe, South America, and Asia. This global presence enhances its ability to serve a diverse customer base and adapt to regional market dynamics. The strategic locations optimize logistics and reduce supply chain risks.

The company offers a wide range of products, including silicon metal, silicon-based alloys, and manganese-based alloys. This diversification caters to various industries, reducing reliance on any single market segment. This approach provides revenue stability and resilience.

Ferroglobe leverages its scale to achieve economies of scale in production. This cost efficiency is crucial in a commodity-driven market. Operational optimization and cost management are key to maintaining this advantage.

The company's long-standing expertise and operational know-how contribute to product quality and production efficiency. Accumulated knowledge within its production processes enhances operational efficiency and product consistency. This is a key factor in understanding Ferroglobe's market position.

Ferroglobe's competitive advantages are built on a strong global presence, a diversified product portfolio, and operational efficiencies. The company’s strategic focus on cost management and operational optimization supports its market position. These factors are essential for Ferroglobe's financial performance.

- Extensive global footprint across key regions.

- Diversified product offerings, reducing market segment risk.

- Economies of scale in production, leading to cost efficiencies.

- Operational expertise and continuous improvement initiatives.

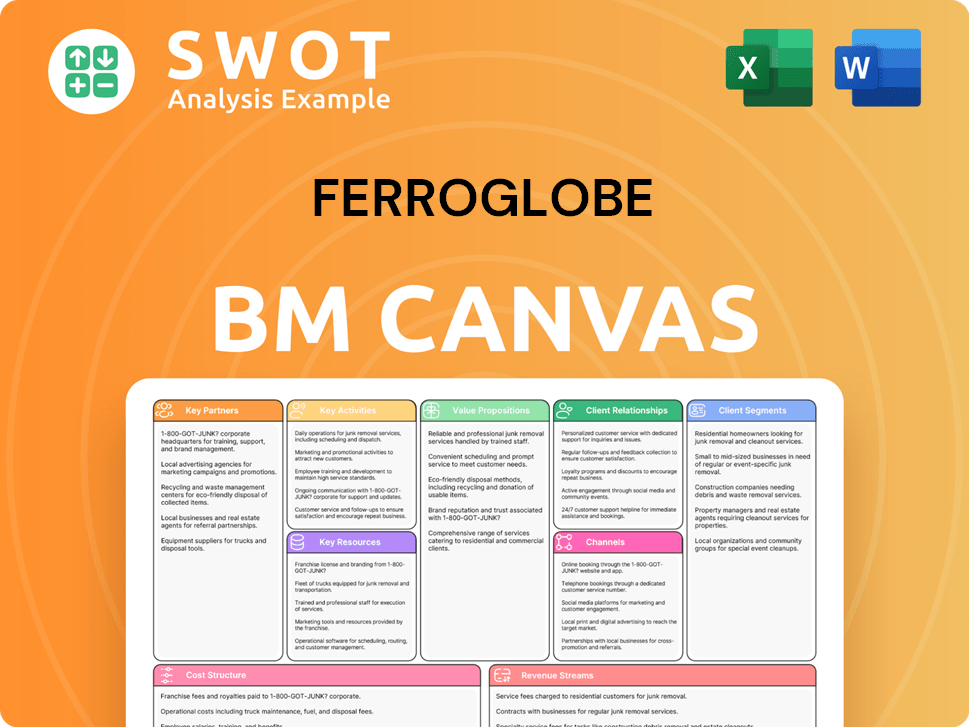

Ferroglobe Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Ferroglobe’s Competitive Landscape?

The competitive landscape for Ferroglobe is shaped by industry trends, regulatory changes, and global economic shifts. The company faces both opportunities and challenges in the silicon metal and ferroalloys market. Understanding these dynamics is crucial for assessing Ferroglobe's future prospects and its ability to maintain a strong market position.

The company’s financial performance and strategic decisions are significantly influenced by these external factors. For instance, the impact of fluctuating raw material prices and energy costs on profitability was highlighted in the Q1 2024 earnings call. This underscores the need for effective cost management and strategic planning to navigate market volatility. For more insights, consider reading a Brief History of Ferroglobe.

The silicon metal industry is experiencing increasing demand, particularly from the solar energy and semiconductor sectors. Regulatory changes, especially those concerning environmental protection and carbon emissions, are also significant. Global economic shifts, including inflation and potential slowdowns, impact demand from key customer segments, such as automotive and construction.

Stricter environmental regulations necessitate continuous investment in cleaner production technologies. Fluctuations in raw material prices and energy costs directly affect profitability. Aggressive new competitors with lower cost structures pose a threat. Disruptions in raw material supply chains and a potential global economic downturn could also impact the company.

Emerging markets with industrialization and infrastructure development will drive demand for silicon and ferroalloys. Product innovations, such as advanced materials for electric vehicles, present avenues for diversification. Strategic partnerships, particularly with technology companies, could enable co-development of new products and secure long-term supply agreements.

Ferroglobe is focusing on operational efficiency and cost management. The company may explore higher-value product segments and sustainable production methods. Adapting to market volatility and capitalizing on long-term growth trends are key priorities. This includes a proactive approach to managing risks and seizing opportunities.

Ferroglobe is implementing strategies focused on operational efficiency and cost management to navigate market challenges. The company is also exploring opportunities in higher-value product segments and sustainable production methods. These actions aim to adapt to market volatility and capitalize on long-term growth trends, ensuring resilience in the face of competition.

- Operational efficiency improvements to reduce costs.

- Exploration of higher-value product segments.

- Investment in sustainable production methods.

- Strategic partnerships for product development.

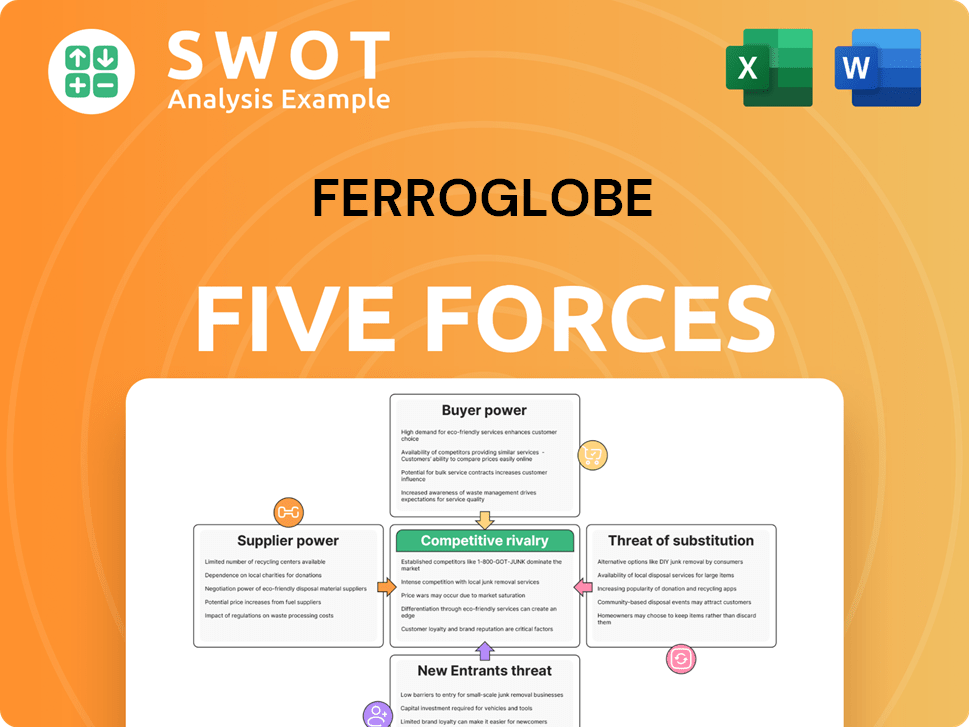

Ferroglobe Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Ferroglobe Company?

- What is Growth Strategy and Future Prospects of Ferroglobe Company?

- How Does Ferroglobe Company Work?

- What is Sales and Marketing Strategy of Ferroglobe Company?

- What is Brief History of Ferroglobe Company?

- Who Owns Ferroglobe Company?

- What is Customer Demographics and Target Market of Ferroglobe Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.