Ferroglobe Bundle

Can Ferroglobe Forge Ahead?

Ferroglobe, a global titan in silicon and manganese-based alloys, is strategically navigating the dynamic ferroalloys industry. With a diverse customer base spanning critical sectors, the company's global footprint positions it for significant market impact. This analysis delves into Ferroglobe's Ferroglobe SWOT Analysis, exploring its growth strategy and future prospects.

This exploration of Ferroglobe's Ferroglobe growth strategy will examine its strategic initiatives and financial performance. We'll analyze the Ferroglobe company analysis, including its position in the silicon metal market and its Ferroglobe future prospects. Understanding Ferroglobe stock performance and its Ferroalloys industry context is crucial for assessing its investment potential and long term outlook.

How Is Ferroglobe Expanding Its Reach?

The company is actively pursuing several expansion initiatives to bolster its market presence and diversify revenue streams. This strategy is crucial for long-term growth and resilience in the dynamic Silicon metal market and Ferroalloys industry. These initiatives are designed to capitalize on emerging opportunities and strengthen the company's position in key regions.

A core element of Ferroglobe's strategy involves entering new markets, with a specific focus on high-growth areas. This includes regions like China, India, and Southeast Asia. These areas are experiencing significant demand growth, particularly in sectors such as electronics, solar energy, and automotive industries. This expansion is a key part of the Ferroglobe growth strategy.

Furthermore, the company is diversifying its product portfolio to cater to various industries. This diversification allows it to tap into multiple growth opportunities and reduce its reliance on any single sector. This includes expanding into the aluminum, solar, electronics, and chemicals sectors.

Ferroglobe is strategically entering new markets, particularly in high-growth regions such as China, India, and Southeast Asia. These regions are experiencing increased demand for silicon metal. This expansion is driven by the growing electronics, solar, and automotive industries in these areas.

The company is diversifying its product portfolio to cater to various industries. This includes expanding into the aluminum, solar, electronics, and chemicals sectors. This diversification helps reduce reliance on any single sector and opens up multiple growth opportunities.

Ferroglobe is focusing on securing raw materials and enhancing production capacity. This includes the recent acquisition of a high-purity quartz mine. This ensures a reliable supply chain and supports production goals.

The company is expanding its silicon metal production capacity in the U.S. This includes brownfield expansions that require less investment. These expansions are designed to meet the growing demand from the solar and EV battery markets.

A significant component of Ferroglobe's expansion strategy involves securing raw materials and boosting production capacity. To this end, the company recently acquired a high-purity quartz mine in South Carolina. This acquisition is expected to increase annual production capacity to over 300 kilotons of quartz. It will also increase its mining capacity by 50% when combined with existing operations in Alabama. This move is aimed at strengthening the supply chain and ensuring a reliable supply of high-purity quartz. Further insight into the company's business model can be found in the article Revenue Streams & Business Model of Ferroglobe.

Ferroglobe's expansion plans include strategic market entries and capacity enhancements. The focus is on high-growth regions and securing essential raw materials. These initiatives are crucial for sustainable growth and strengthening the company's market position.

- Entering new markets, especially in China, India, and Southeast Asia.

- Diversifying the product portfolio to include aluminum, solar, electronics, and chemicals.

- Acquiring a high-purity quartz mine to secure raw materials.

- Expanding silicon metal production capacity in the U.S.

Ferroglobe SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Ferroglobe Invest in Innovation?

The company is actively leveraging technology and innovation to drive sustained growth, especially in response to the evolving needs of the energy transition. This strategic focus is evident in its investments in new silicon-dominant anode technology. This innovation aims to provide higher energy density, faster charging capabilities, and a reduced environmental footprint for batteries, offering a sustainable alternative to traditional materials.

The company's commitment to pioneering advancements in the battery industry is further demonstrated through its work in silicon metal powder projects tailored for batteries and advanced technologies. This proactive approach positions the company to capitalize on the growing demand for advanced battery materials and technologies. This proactive approach positions the company to capitalize on the growing demand for advanced battery materials and technologies.

R&D investments and collaborations are central to the company's strategy, as seen in its strategic investment in Coreshell, a battery solution company, to advance the use of silicon in batteries. This investment exemplifies the company's commitment to innovation and its proactive approach to staying at the forefront of technological advancements in the silicon metal market.

The company is developing new silicon-dominant anode technology using advanced micrometer silicon. Commercialization is expected by the end of this decade. This technology aims to enhance battery performance.

The company is heavily involved in silicon metal powder projects designed for batteries and advanced technologies. This focus highlights the company's commitment to innovation within the battery sector. This strategic direction positions the company to meet the growing demand for advanced battery materials.

The company made a strategic investment in Coreshell, a battery solution company. This investment supports the advancement of silicon in batteries. This move underscores the company's dedication to innovation and strategic partnerships.

The company has set ambitious decarbonization goals. The aim is to reduce Scope 1 and 2 carbon emissions by at least 26% by 2030, using a 2020 baseline. This commitment demonstrates the company's focus on sustainability.

The 'Vagalume' project in Sabón, Spain, focuses on substituting fossil-based raw materials. The project has a total investment of €28 million. It also benefits from an €11.7 million grant from the European Union.

A project in France aims to implement bioreductants for silicon production. This initiative received a €5.88 million grant. It is expected to reduce CO2 emissions by 73,120 tonnes per year.

The company's innovation and technology strategy is deeply intertwined with its sustainability efforts. This approach not only drives technological advancements but also aligns with global environmental goals. These initiatives are crucial for the company's Brief History of Ferroglobe and future prospects.

- Focus on Silicon Anode Technology: Developing advanced silicon-dominant anode technology to improve battery performance.

- Battery Industry Investments: Strategic investments in companies like Coreshell to advance silicon's use in batteries.

- Decarbonization Targets: Aiming to reduce Scope 1 and 2 carbon emissions by at least 26% by 2030.

- 'Vagalume' Project: Substituting fossil-based raw materials with low-carbon alternatives in Spain.

- Bioreductants in France: Implementing bioreductants to reduce CO2 emissions by 73,120 tonnes annually.

Ferroglobe PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Ferroglobe’s Growth Forecast?

The financial outlook for Ferroglobe in 2025 anticipates an adjusted EBITDA between $100 million and $170 million. This projection considers various uncertainties, including trade measures, market conditions, and geopolitical factors. Despite these challenges, management expects significant improvement from the second quarter of 2025 onwards. This forecast is crucial for understanding the Ferroglobe future prospects.

In the first quarter of 2025, Ferroglobe reported sales of $307.2 million. This represents a decrease of 16.4% compared to the previous quarter and a 21.6% decrease from the same period last year. The adjusted EBITDA for Q1 2025 was negative at $(26.8) million, a substantial decline from $9.8 million in Q4 2024. However, the company still managed to generate $5.1 million in free cash flow during Q1 2025, showing resilience in a challenging market.

For the full year 2024, Ferroglobe reported an adjusted EBITDA of $153.8 million and generated $164.1 million in free cash flow. The net profit attributable to the parent company for 2024 was $5.2 million, or $0.03 per diluted share. This financial performance provides a baseline for assessing the Ferroglobe company analysis and its potential for growth.

Ferroglobe's Q1 2025 sales were $307.2 million, with an adjusted EBITDA of $(26.8) million. The company generated $5.1 million in free cash flow during the quarter, demonstrating its ability to manage cash flow even during a challenging period. The EBITDA margin as of March 31, 2025, was 3.46%.

For the full year 2024, Ferroglobe reported an adjusted EBITDA of $153.8 million and free cash flow of $164.1 million. The net profit was $5.2 million, or $0.03 per diluted share. These figures provide a broader perspective on the company's financial health and its ability to generate profits.

Ferroglobe maintained a strong balance sheet with a net cash position of $19.2 million as of March 31, 2025. The company increased its quarterly cash dividend to $0.014 per share in March 2025, an 8% increase. This indicates financial stability and a commitment to returning value to shareholders.

Analysts forecast Ferroglobe's revenue for 2025 to be around $290.46 billion. Some projections suggest the stock price could reach $6.87 by 2025, representing an 89.12% gain from current values. This highlights the potential for future growth and investor confidence.

Understanding Ferroglobe's financial performance involves looking at several key metrics. These metrics help in evaluating the Ferroglobe growth strategy and its potential for future success.

- Adjusted EBITDA Guidance: $100 million to $170 million for 2025.

- Q1 2025 Sales: $307.2 million.

- Q1 2025 Adjusted EBITDA: $(26.8) million.

- 2024 Adjusted EBITDA: $153.8 million.

- 2024 Free Cash Flow: $164.1 million.

- Net Cash Position (March 31, 2025): $19.2 million.

- Dividend Increase: 8% increase in quarterly cash dividend in March 2025.

- Stock Price Forecast: Potential 89.12% gain by 2025.

For further insights into the company's ownership structure and potential impact on financial decisions, consider exploring the information available at Owners & Shareholders of Ferroglobe.

Ferroglobe Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Ferroglobe’s Growth?

The growth strategy and future prospects of Ferroglobe are subject to various risks and obstacles. The company's performance can be significantly impacted by market dynamics, including fluctuations in product prices and demand influenced by economic cycles and raw material costs. Understanding these challenges is crucial for a comprehensive Ferroglobe company analysis.

Market competition, regulatory changes, and supply chain vulnerabilities pose significant challenges. The ferroalloys industry is inherently cyclical, and external factors can quickly affect profitability. Furthermore, the company must navigate the complexities of global trade measures and adapt to evolving environmental regulations.

These factors can impact the Competitors Landscape of Ferroglobe and its ability to achieve its strategic goals. The company's ability to mitigate these risks will be critical to its long-term success and its financial performance review.

The ferroalloys industry is highly competitive, with prices and demand fluctuating based on economic cycles. In 2023, Ferroglobe experienced a sharp decrease in pricing and reduced volumes, impacting its financial results. These market dynamics directly affect the Ferroglobe stock and its investment potential.

Global trade measures can introduce uncertainties, affecting the timing and impact of Ferroglobe's operations. While favorable decisions have been made in U.S. ferrosilicon cases, new trade cases filed by U.S. silicon metal producers present additional risks. This impacts the Ferroglobe strategic initiatives 2024.

Ferroglobe's operations are subject to regulatory changes, including cap-and-trade programs in the EU. Climate change, sustainability regulations, and the company's decarbonization initiatives can add operational burdens. These factors are important to consider when analyzing the Ferroglobe ESG performance.

Supply chain vulnerabilities, including shortages and price swings in critical raw materials, can affect production costs. The company is particularly vulnerable to energy market fluctuations, with electricity being essential and a significant cost factor. This highlights the importance of the Ferroglobe renewable energy strategy.

Electricity is indispensable to Ferroglobe's operations and accounts for a high percentage of production costs. The company is working to diversify its power supply from 2024 by engaging with green energy producers. This affects the Ferroglobe long term outlook.

Ferroglobe is addressing these risks through strategies such as diversifying suppliers and implementing real-time monitoring tools for potential disruptions. These measures are part of the company's broader approach to risk management, which is vital for sustainable practices.

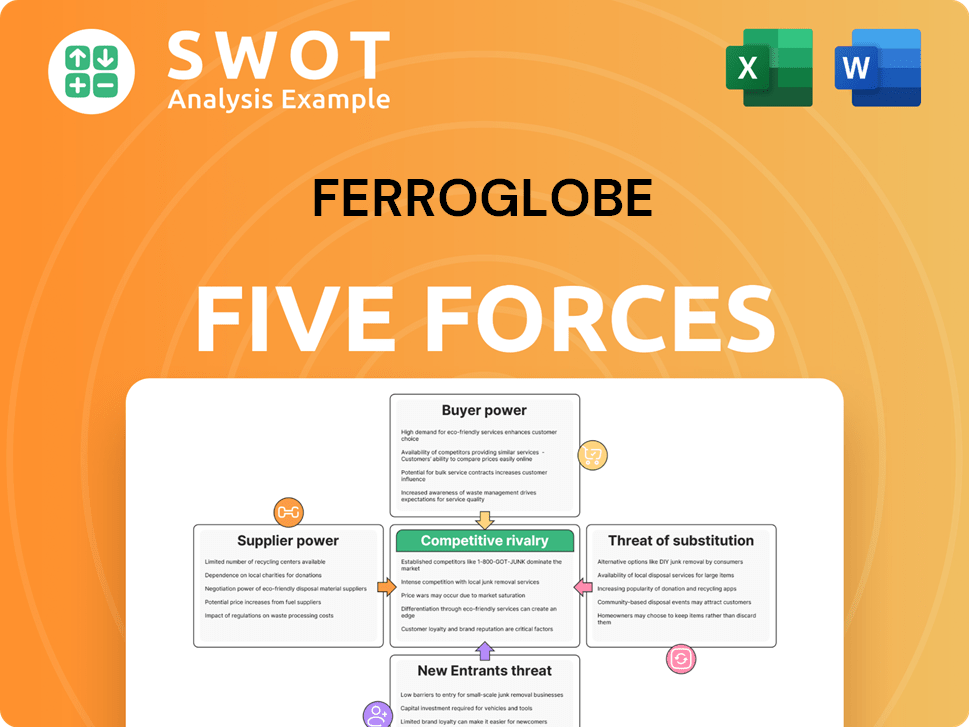

Ferroglobe Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Ferroglobe Company?

- What is Competitive Landscape of Ferroglobe Company?

- How Does Ferroglobe Company Work?

- What is Sales and Marketing Strategy of Ferroglobe Company?

- What is Brief History of Ferroglobe Company?

- Who Owns Ferroglobe Company?

- What is Customer Demographics and Target Market of Ferroglobe Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.