Ferroglobe Bundle

Who Really Owns Ferroglobe?

Unraveling the Ferroglobe SWOT Analysis is just the beginning; understanding its ownership structure is key to unlocking its potential. Ferroglobe, a global leader in silicon and manganese alloys, plays a crucial role in industries worldwide. Knowing who controls Ferroglobe offers critical insights for investors and stakeholders alike.

This analysis of Ferroglobe ownership will explore the evolution of Ferroglobe shareholders, from its inception to the present day. We'll examine the influence of Ferroglobe investors, institutional holdings, and the role of the board of directors in shaping the company's future. Understanding Who owns Ferroglobe is essential for anyone seeking to make informed decisions about this dynamic company, considering aspects like Ferroglobe stock performance and its strategic direction.

Who Founded Ferroglobe?

The initial ownership of Ferroglobe stemmed from a significant merger. This merger combined Grupo Ferroatlántica SAU, a subsidiary of Grupo Villar Mir, SAU, and Globe Specialty Metals, Inc. on December 23, 2015. This event was pivotal in establishing the company's foundational structure, shaping its future as a major player in the silicon and specialty metals market.

Prior to the merger, VeloNewco Limited was incorporated on February 5, 2015, as a wholly-owned subsidiary of Grupo Villar Mir, SAU. While the exact equity splits of individual founders aren't publicly available, Grupo Villar Mir, S.A.U. held a substantial stake from the beginning. This early influence was crucial in setting the company's direction and strategic goals, as highlighted in the Growth Strategy of Ferroglobe.

As of October 23, 2021, Grupo Villar Mir, S.A.U. held a significant 49% stake in Ferroglobe. This percentage decreased to 36.2% by September 30, 2024. This indicates a shift in the ownership landscape over time, although Grupo Villar Mir, S.A.U. has maintained a considerable influence.

Understanding the early ownership structure provides insight into Ferroglobe's evolution. The merger of Grupo Ferroatlántica and Globe Specialty Metals was a strategic move. The company's articles of association, especially in the early years, gave Grupo Villar Mir significant control. This structure reflected the vision of the founding team, particularly Grupo Villar Mir, to create a global leader in its industry.

- The merger occurred on December 23, 2015.

- VeloNewco Limited was incorporated on February 5, 2015.

- Grupo Villar Mir, S.A.U. held 49% of Ferroglobe as of October 23, 2021.

- Grupo Villar Mir, S.A.U. held 36.2% of Ferroglobe as of September 30, 2024.

Ferroglobe SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Ferroglobe’s Ownership Changed Over Time?

The ownership structure of Ferroglobe PLC, a company listed on the Nasdaq Capital Market under the ticker 'GSM', has seen significant shifts since its IPO following the December 23, 2015 merger. As of March 31, 2025, institutional investors held a substantial portion, approximately 80.74%, of the company's shares. This indicates a strong presence of institutional interest in the company. The evolution of Ferroglobe's ownership reflects the dynamic nature of the industrial metals and mining sector and the strategic positioning of various investors.

Early 2025 data shows a differing perspective on ownership, with institutional shareholders holding 54.58%, insiders at 0.00%, and retail investors owning 45.42%. This highlights the changing landscape of Ferroglobe's shareholder base and the influence of different investor groups. Understanding the ownership dynamics is crucial for assessing the company's stability and future prospects. For further insights into Ferroglobe's business model, consider exploring the article about Revenue Streams & Business Model of Ferroglobe.

| Shareholder | Ownership (March 31, 2025) | Shares (March 31, 2025) |

|---|---|---|

| Cooper Creek Partners Management LLC | 8.05% | 15.0 million |

| Hosking Partners LLP | 5.70% | 10.6 million |

| Barrow Hanley Mewhinney & Strauss LLC | 3.95% | 7.4 million |

As of March 31, 2025, key institutional stakeholders include Cooper Creek Partners Management LLC, Hosking Partners LLP, and Barrow Hanley Mewhinney & Strauss LLC. These major shareholders significantly influence the company's direction. Grupo Villar Mir, S.A.U. held 36.2% of the shares as of September 30, 2024, valued at approximately US$282.2 million. The company's financial performance in 2024 included sales of $1,644 million, adjusted EBITDA of $153.8 million, and free cash flow of $164.1 million for the full year 2024.

Institutional investors hold a significant portion of Ferroglobe shares, indicating strong confidence.

- Major shareholders include Cooper Creek Partners and Grupo Villar Mir.

- The ownership structure reflects the dynamic nature of the industrial metals sector.

- Understanding shareholder composition is key to evaluating the company's future.

- Ferroglobe's financial performance in 2024 showed solid revenue and EBITDA figures.

Ferroglobe PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Ferroglobe’s Board?

The Board of Directors at Ferroglobe oversees the company's strategic direction and governance. According to the 2022 ESG report, the Board included eleven members. This composition included two executive directors and nine non-executive directors. The Articles of Association state that the number of directors must be between a minimum of two and a maximum of eleven.

The board includes representatives from major shareholders and independent directors. This structure ensures a balance between different interests within the company. Independent directors and those representing significant interests are part of this composition, which helps in maintaining a robust oversight of the company's operations and strategic decisions. Understanding the Brief History of Ferroglobe can provide further context on the evolution of its governance structure.

| Director | Position | Date of Appointment |

|---|---|---|

| Marco Levi | Chairman of the Board | 2015 |

| Alan Kestenbaum | Chief Executive Officer | 2015 |

| Guillermo Calvo | Independent Director | 2016 |

The voting structure at Ferroglobe generally follows a one-share-one-vote principle for ordinary shares, which is standard for many publicly traded companies. Shareholders of record have the right to vote on key decisions at general meetings. These include the appointment of directors and other significant corporate matters. Grupo Villar Mir, S.A.U., has historically held a substantial influence over director appointments due to its significant shareholdings. However, the company has been working to align its practices with those in the US and UK markets. This is a move that often strengthens corporate governance and protects the interests of all Ferroglobe shareholders.

Recent actions, such as the share buyback program approved at the June 2024 annual general meeting, show the board's responsiveness to shareholder interests. This indicates a commitment to enhancing shareholder value through strategic capital allocation.

- Shareholders authorized the repurchase of up to 37.8 million shares.

- This represents approximately 20% of the issued share capital.

- The buyback program will span a five-year period.

- This demonstrates a proactive approach to managing the company's capital structure.

Ferroglobe Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Ferroglobe’s Ownership Landscape?

Over the past few years, the company has been actively managing its capital. This includes a capital return program featuring quarterly dividends and share repurchases. In the first quarter of 2025, the company repurchased 720,000 shares at an average price of $3.75, totaling $2.7 million. From the third quarter of 2024 through the first quarter of 2025, the company repurchased 1.3 million shares for approximately $5 million. The quarterly dividend was increased to $1.4 per share, an 8% increase from the prior quarter. These actions directly influence the profile of the company's ownership.

In Q1 2025, the company made strategic investments, including an investment in Coreshell to advance silicon-rich EV battery technology. Additionally, the company is expanding its silicon metal capacity in North America and developing strategic partnerships, which have been beneficial due to trade measures and onshoring trends. These moves, along with the ongoing capital return program, shape the dynamics of who owns the company and the interests of its shareholders.

| Metric | Data | Period |

|---|---|---|

| Institutional Ownership | Approximately 53.62% | May 2025 |

| Mutual Fund Ownership | Increased from 21.15% to 21.81% | May 2025 |

| Insider Ownership | Around 0.04% | March 31, 2025 |

Institutional investors continue to hold a significant portion of the company's shares, with approximately 53.62% ownership as of May 2025. Mutual funds have increased their holdings, rising from 21.15% to 21.81% during the same period. Insider ownership remains minimal, at roughly 0.04% as of March 31, 2025. The company's strategic positioning in the electric vehicle (EV) and solar sectors, along with its strong balance sheet and capital return policy, are likely to influence future trends in Ferroglobe ownership. To understand the competitive landscape, you can explore the Competitors Landscape of Ferroglobe.

The ownership structure is primarily influenced by institutional investors, who hold a majority stake. Mutual funds also play a significant role, with insider ownership being very limited.

The company has been actively returning capital to shareholders through dividends and share repurchases. Strategic investments have also been made to support growth.

Institutional investors are the primary owners, followed by mutual funds. Insider ownership is minimal.

The company's strategic positioning in the EV and solar sectors and its financial policies are expected to influence future ownership trends.

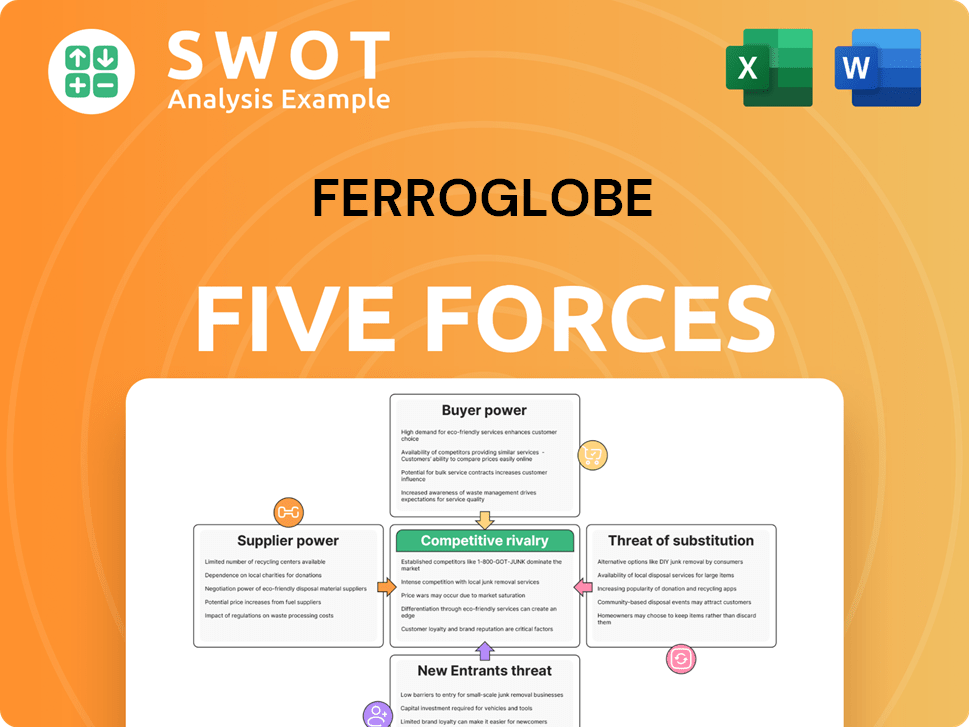

Ferroglobe Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Ferroglobe Company?

- What is Competitive Landscape of Ferroglobe Company?

- What is Growth Strategy and Future Prospects of Ferroglobe Company?

- How Does Ferroglobe Company Work?

- What is Sales and Marketing Strategy of Ferroglobe Company?

- What is Brief History of Ferroglobe Company?

- What is Customer Demographics and Target Market of Ferroglobe Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.