Ferroglobe Bundle

Decoding Ferroglobe: How Does This Global Leader Operate?

Ferroglobe, a pivotal player in the global industrial landscape, is a leading producer of silicon metal and ferroalloys, essential materials for a wide array of industries. With revenues reaching $1.7 billion in 2023, the Ferroglobe SWOT Analysis reveals a company deeply intertwined with global manufacturing and technological innovation. Its influence spans from solar energy to steel production, making it a critical component of modern economies.

Understanding Ferroglobe's operations is key for investors, industry analysts, and anyone interested in the dynamics of the materials sector. The company's strategic focus on Silicon metal and Ferroalloys, coupled with its global manufacturing footprint, positions it uniquely within the supply chains of numerous essential industries. This exploration will examine the Ferroglobe company, its production processes, and how it navigates the challenges and opportunities within its competitive market.

What Are the Key Operations Driving Ferroglobe’s Success?

The core operations of the Ferroglobe company center around the production of silicon metal, silicon-based alloys, and manganese-based alloys. These metallurgical products are essential for various industries, including chemical products, aluminum, steel, solar energy, automotive, and foundries. Ferroglobe creates value by supplying critical raw materials that are vital components in a wide array of end products.

Ferroglobe's value proposition is rooted in its capacity to consistently produce high-quality, specialized materials on a global scale. This offers reliability and technical expertise to its industrial customers. Its integrated production model, from raw material handling to finished product, allows for stringent quality control and optimized production costs, providing a competitive edge in a capital-intensive industry.

The operational process starts with sourcing raw materials like quartz, coal, and wood chips for silicon metal production, and manganese ore for manganese alloys. These materials are then processed in specialized submerged arc furnaces at Ferroglobe's production facilities worldwide. The company transforms these materials into high-purity metals and alloys through energy-intensive pyrometallurgical processes. Ferroglobe's logistical capabilities ensure efficient transportation of raw materials to its plants and finished products to its international customer base.

Ferroglobe's main products include silicon metal and ferroalloys like ferrosilicon and ferromanganese. These materials are crucial for many industries. Silicon metal is fundamental for the production of silicones and polysilicon, while ferroalloys are indispensable for steel and cast iron production.

The production process involves sourcing raw materials, processing them in submerged arc furnaces, and transforming them into high-purity metals and alloys. This energy-intensive process ensures the quality and purity of the final products. Efficient logistics are also critical for transporting materials.

Ferroglobe operates globally, serving a diverse customer base. It is a significant player in the silicon metal and ferroalloys market. The company's international presence allows it to meet the demands of various industries worldwide, including the steel and solar energy sectors.

Ferroglobe creates value by providing essential raw materials. These materials are critical for a wide array of end products. The company's focus on quality and reliability ensures it remains a key supplier in the metallurgical industry. Its integrated model helps in cost optimization.

Ferroglobe's operations are characterized by its ability to consistently produce high-quality, specialized materials. The company’s integrated production model, from raw material handling to finished product, allows for stringent quality control and optimized production costs. This approach gives Ferroglobe a competitive edge in the industry.

- Sourcing of raw materials, including quartz, coal, and manganese ore.

- Processing in submerged arc furnaces to produce silicon metal and ferroalloys.

- Stringent quality control throughout the production process.

- Efficient logistical capabilities for raw materials and finished products.

Ferroglobe SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Ferroglobe Make Money?

Understanding the revenue streams and monetization strategies of the Ferroglobe company is key to grasping its financial performance. The company primarily earns its revenue through the sale of metallurgical products, with a focus on silicon metal and ferroalloys. These products are essential in various industries, making Ferroglobe operations a significant player in the global market.

Ferroglobe employs several strategies to maximize its revenue. These strategies include leveraging global commodity prices, securing long-term supply agreements, and focusing on specialized product offerings. The company's diversified customer base and global footprint further support its revenue generation.

The main revenue streams for Ferroglobe are derived from the sale of its core products. In 2023, silicon metal accounted for approximately 42% of the company's total revenue. Ferrosilicon contributed around 35%, and manganese alloys made up about 18%. The remaining revenue is generated from other related products and services.

Ferroglobe's monetization strategies are closely tied to global commodity prices, which are influenced by supply and demand in the chemical, aluminum, steel, and solar industries. The company uses a mix of long-term supply agreements and spot market sales to optimize revenue. The company's ability to produce specialized grades of alloys and silicon metal also enables it to command premium prices.

- Long-Term Supply Agreements: Securing stable demand and predictable revenue.

- Spot Market Sales: Capitalizing on favorable pricing conditions.

- Diversified Customer Base: Mitigating revenue volatility across different sectors. To learn more about the target market, see Target Market of Ferroglobe.

- Global Operations: Optimizing logistics and responding to local demand fluctuations.

- Specialized Products: Producing high-value alloys and silicon metal for premium pricing.

Ferroglobe PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Ferroglobe’s Business Model?

The journey of the Ferroglobe company has been marked by strategic moves and significant milestones. A pivotal event was the 2015 merger of Globe Specialty Metals and FerroAtlántica, which established Ferroglobe, expanding its global presence and product range. This consolidation allowed the company to benefit from economies of scale and strengthen its market position.

Ferroglobe has focused on operational efficiency and debt reduction. In 2023, the company successfully refinanced its debt, improving its financial flexibility. This proactive approach helps the company navigate the volatile market conditions and maintain a strong financial foundation. Understanding the Competitors Landscape of Ferroglobe is also crucial for grasping its strategic positioning.

The company's competitive advantage lies in its extensive global production network, which enables it to serve diverse markets and mitigate regional risks. Its long-standing customer relationships, technical expertise in specialized alloy production, and commitment to sustainability initiatives further contribute to its sustained business model. The company continues to adapt to new trends, such as the growing demand for silicon metal driven by the solar energy and electric vehicle battery sectors, by strategically allocating resources and optimizing production to meet these evolving market needs.

The 2015 merger was a critical milestone, creating a global leader in the production of silicon metal and ferroalloys. This strategic move expanded Ferroglobe's market reach and production capabilities significantly. More recently, the company has focused on debt reduction and operational efficiency to bolster its financial health.

Ferroglobe strategically adapts to market changes, such as the rising demand for silicon metal. The company optimizes its production processes and allocates resources to meet the needs of the solar energy and electric vehicle battery sectors. Refinancing debt in 2023 was also a key strategic move.

Ferroglobe's global production network gives it a competitive advantage by allowing it to serve various markets and reduce regional risks. Its established customer relationships, technical expertise, and sustainability efforts also contribute to its strong market position. The company's focus on higher-margin products and operational efficiency further enhances its competitiveness.

Ferroglobe's operations are influenced by fluctuating raw material costs and energy price volatility. The company responds by adjusting production schedules and focusing on higher-margin products. The growing demand for silicon metal, particularly from the solar and EV industries, presents significant opportunities for Ferroglobe.

In response to high energy costs, Ferroglobe temporarily curtailed production at some facilities in late 2022 and early 2023 to manage profitability. The company's strategic focus on higher-margin products and operational efficiency has helped it navigate challenging market conditions. Ferroglobe's commitment to sustainability and its role in the steel industry also contribute to its overall business strategy.

- Refinancing of debt in 2023 improved financial flexibility.

- Adaptation to fluctuating raw material and energy costs.

- Strategic allocation of resources towards silicon metal production.

- Focus on serving diverse markets through a global production network.

Ferroglobe Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Ferroglobe Positioning Itself for Continued Success?

The Ferroglobe company holds a significant position in the global silicon metal and ferroalloys market. It's recognized as a leading producer with a substantial global presence, especially in silicon metal. This is crucial for high-growth sectors like solar energy and specialty chemicals. The company's widespread production facilities across different continents help it serve a diverse customer base and respond to regional market needs, promoting customer loyalty due to consistent supply and product quality.

However, Ferroglobe faces several key risks, including the cyclical nature of the industries it serves (steel, aluminum, chemicals), exposure to volatile raw material and energy prices, and strong competition from other global producers. Regulatory changes related to environmental standards and trade policies can also impact its operations and profitability. For example, anti-dumping duties or changes in energy regulations in key operating regions can significantly affect its cost structure and market competitiveness. Looking ahead, Ferroglobe is focused on strategic initiatives aimed at operational excellence, debt reduction, and capitalizing on the increasing demand for silicon metal, particularly from the solar and electric vehicle battery industries.

Ferroglobe is a major player in the silicon metal and ferroalloys market. The company's global presence allows it to serve customers worldwide. It has a strong market share, especially in the silicon metal sector.

The company faces cyclical demand in its key markets, such as steel and aluminum. It is exposed to volatile raw material and energy costs. Competition from other global producers is also a significant risk.

Ferroglobe is focusing on operational improvements and debt reduction. It aims to capitalize on the growing demand for silicon metal, especially in the solar and EV battery sectors. The company plans to expand its revenue by serving core markets and strategically positioning itself for the green energy transition.

Ferroglobe's strategic initiatives include optimizing its asset base and improving profitability. The company is investing in high-growth areas and focusing on efficiency gains. These efforts are designed to enhance long-term value and sustainability.

When evaluating Ferroglobe (Ferroglobe company), investors should consider the company's market position, its ability to manage risks, and its strategic initiatives. The company's performance is closely tied to the demand for silicon metal and ferroalloys. Understanding the dynamics of the steel, aluminum, and chemical industries is also crucial.

- Market Volatility: Investors should monitor fluctuations in raw material and energy prices, which can significantly impact profitability.

- Strategic Focus: The company's success depends on its ability to execute its strategic plans, including operational improvements and debt reduction.

- Growth Opportunities: The increasing demand from the solar and electric vehicle industries offers significant growth opportunities for Ferroglobe operations.

- Competitive Landscape: Investors should assess Ferroglobe's competitive position, considering the presence of other global producers.

For a deeper dive into Ferroglobe's growth strategy, consider reading the article on Growth Strategy of Ferroglobe, which offers additional insights into the company's strategic direction and market positioning. Recent data indicates that the solar industry is experiencing rapid growth, with silicon metal demand expected to increase substantially in the coming years. The electric vehicle market is also driving demand for silicon metal, further enhancing the company's growth prospects. In 2024, the company has been focusing on streamlining its operations and improving its cost structure to maintain competitiveness in a volatile market. Investors should pay close attention to the company's financial performance and its ability to adapt to changing market conditions.

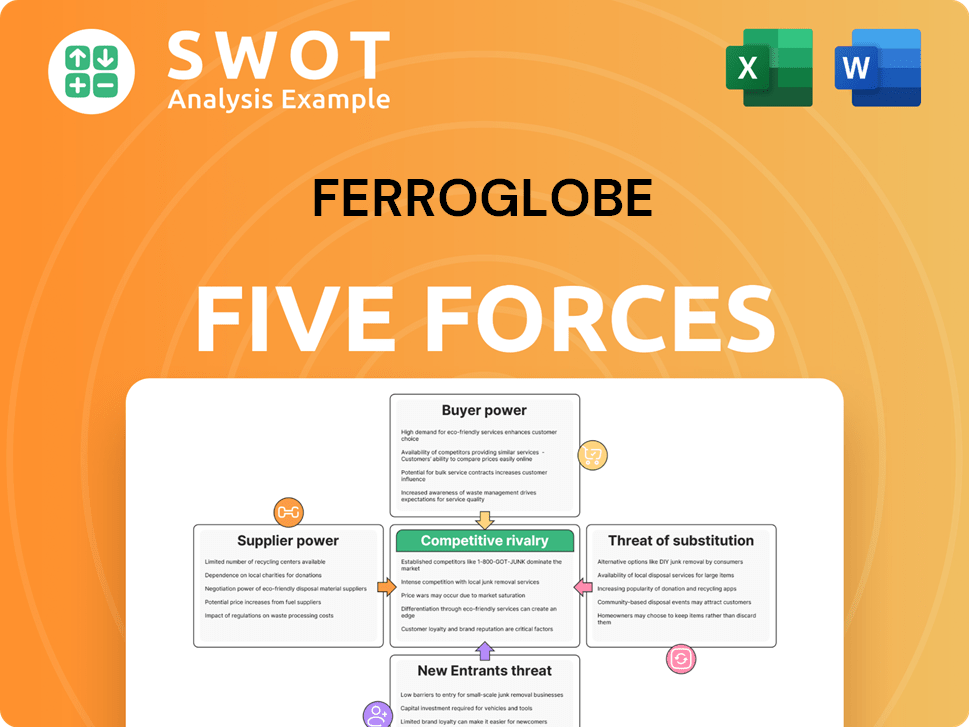

Ferroglobe Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Ferroglobe Company?

- What is Competitive Landscape of Ferroglobe Company?

- What is Growth Strategy and Future Prospects of Ferroglobe Company?

- What is Sales and Marketing Strategy of Ferroglobe Company?

- What is Brief History of Ferroglobe Company?

- Who Owns Ferroglobe Company?

- What is Customer Demographics and Target Market of Ferroglobe Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.