Fuji Electric Bundle

How Does Fuji Electric Stack Up in the Global Energy Tech Arena?

Born from a partnership with Siemens in 1923, Fuji Electric has evolved from a Japanese manufacturer to a global powerhouse. Specializing in energy efficiency and industrial infrastructure, the company's impact resonates worldwide. But in a competitive landscape, how does Fuji Electric truly measure up?

This exploration of the Fuji Electric SWOT Analysis delves into the company's competitive landscape, providing a detailed market analysis of its position within the Fuji Electric industry. We'll dissect Fuji Electric competitors, evaluating their strategies and market shares to understand Fuji Electric's competitive advantages. Furthermore, we will examine Fuji Electric business strategy, assessing its ability to navigate market trends and maintain its global market presence.

Where Does Fuji Electric’ Stand in the Current Market?

The competitive landscape for Fuji Electric is shaped by its strong market position within the energy and thermal technology sectors. The company leverages a diverse product portfolio and global reach to maintain its standing. This includes a significant presence in power electronics, factory automation, and other related areas. A thorough Fuji Electric market analysis reveals its strategic focus on high-growth sectors like renewable energy and electric vehicle components, aligning with global sustainability trends.

Fuji Electric's core operations revolve around several key segments. These include power electronics systems, power and social infrastructure, and industrial infrastructure. Their value proposition lies in providing innovative and reliable solutions that enhance energy efficiency, improve operational performance, and support sustainable development. This approach has helped them secure a prominent position in a competitive market. For a deeper understanding, consider exploring the Growth Strategy of Fuji Electric to see how it navigates the market.

Geographically, Fuji Electric's market presence is substantial, with a strong foothold in Asia, particularly in Japan and China. The company is actively expanding its footprint in North America and Europe, serving a wide range of customers across manufacturing, infrastructure, and energy utilities. This strategic expansion is crucial for maintaining and enhancing its Fuji Electric market share in a competitive environment.

Fuji Electric offers a wide array of products and services. These include power semiconductors, industrial inverters, and UPS systems. Additionally, they provide factory automation equipment like PLCs and HMIs, catering to diverse industrial needs.

Fuji Electric has a significant global presence. They have a strong base in Asia, particularly in Japan and China. Moreover, they are expanding their operations in North America and Europe to serve a diverse customer base.

Fuji Electric's financial performance reflects its market position. For the fiscal year ended March 31, 2024, net sales were 988.4 billion yen. The company projects an increase to 1,030.0 billion yen for the fiscal year ending March 31, 2025, indicating continued growth.

The company's strategic focus includes high-growth areas. These include renewable energy solutions and electric vehicle components. This focus aligns with global sustainability trends and positions them for future growth.

Fuji Electric's market position is bolstered by its diverse product offerings and global reach. It is a significant player in power electronics and factory automation. The company's strategic investments in R&D and its focus on high-growth areas are key to maintaining its competitive edge.

- Strong presence in power semiconductors and related components.

- Significant market share in industrial inverters and UPS systems.

- Focus on renewable energy and electric vehicle components.

- Continued expansion in North America and Europe.

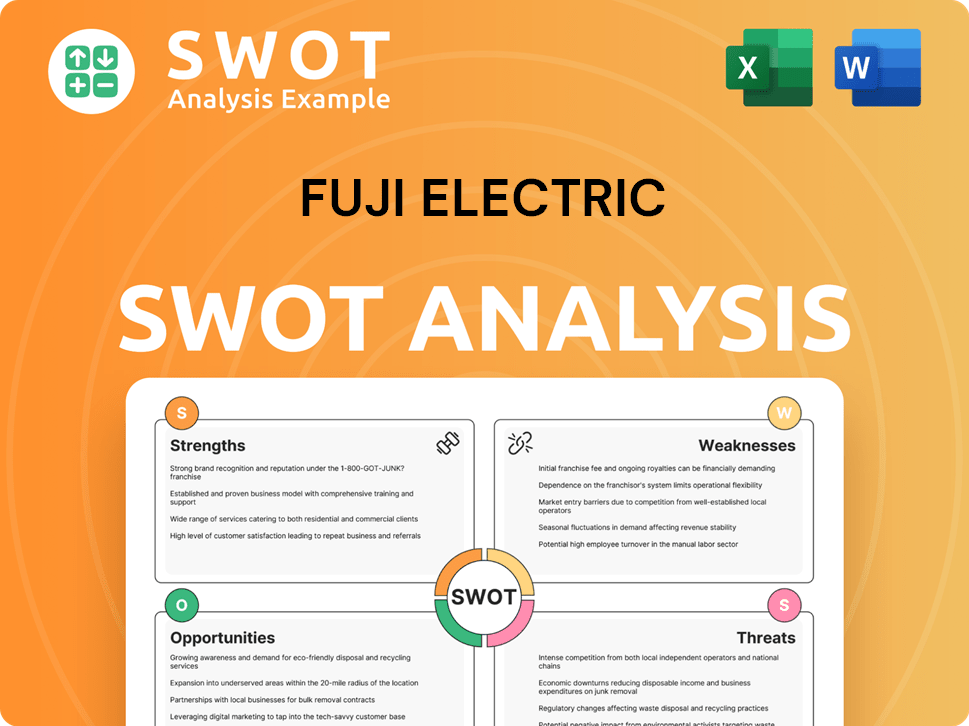

Fuji Electric SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Fuji Electric?

The Fuji Electric competitive landscape is shaped by a diverse array of rivals across its various business segments. This includes companies in power electronics, industrial infrastructure, and semiconductors. Understanding these competitors is crucial for assessing Fuji Electric's market position and strategic direction.

Fuji Electric's market analysis reveals a competitive environment where it faces both direct and indirect challenges. The company's business strategy must consider the strengths and weaknesses of its rivals to maintain and grow its market share. This includes monitoring market trends and adapting to technological advancements.

The competitive intelligence report on Fuji Electric highlights the importance of staying informed about competitor activities, including product launches, strategic alliances, and financial performance. This information is vital for making informed decisions and capitalizing on opportunities.

In the power electronics and industrial infrastructure sectors, Fuji Electric faces competition from global giants. These competitors offer a wide range of products and services that overlap with Fuji Electric's offerings, creating direct competition in various markets.

Siemens is a major competitor, providing industrial automation, power generation, and smart infrastructure solutions. Siemens' broad portfolio allows it to compete directly with Fuji Electric in factory automation and power distribution. In 2024, Siemens reported revenues of approximately €77.4 billion, showcasing its significant market presence.

ABB specializes in robotics, power, and automation, often competing for similar industrial projects and smart grid initiatives. ABB's global presence and diverse product offerings make it a strong contender in the market. ABB's revenue for 2024 was around $32.2 billion, demonstrating its substantial market share.

Schneider Electric focuses on energy management and automation, competing directly with Fuji Electric in power electronics and industrial control systems. Schneider Electric's comprehensive solutions for homes, buildings, and industries position it as a key rival. Schneider Electric's revenue in 2024 was approximately €36.5 billion.

Mitsubishi Electric competes across many of Fuji Electric's offerings, including factory automation and power devices. Mitsubishi Electric's strong brand recognition and extensive product portfolio make it a significant competitor in the Japanese and global markets. Mitsubishi Electric's revenue for fiscal year 2024 was approximately ¥5,036.3 billion.

In the semiconductor sector, Fuji Electric faces competition from leading providers of power semiconductors. These companies focus on providing components for automotive, industrial, and consumer applications. The competitive landscape is dynamic, with new players emerging and established companies innovating.

Besides the major players, Fuji Electric also competes with other companies in niche areas. These companies often focus on specialized renewable energy technologies or advanced IoT solutions for factories. The competitive landscape is constantly evolving due to strategic alliances and mergers.

- Infineon Technologies: A leading provider of power semiconductors.

- STMicroelectronics: Another major player in the power semiconductor market.

- ON Semiconductor: Competes in power semiconductors for various applications.

- Emerging Players: Companies focused on renewable energy technologies and advanced IoT solutions.

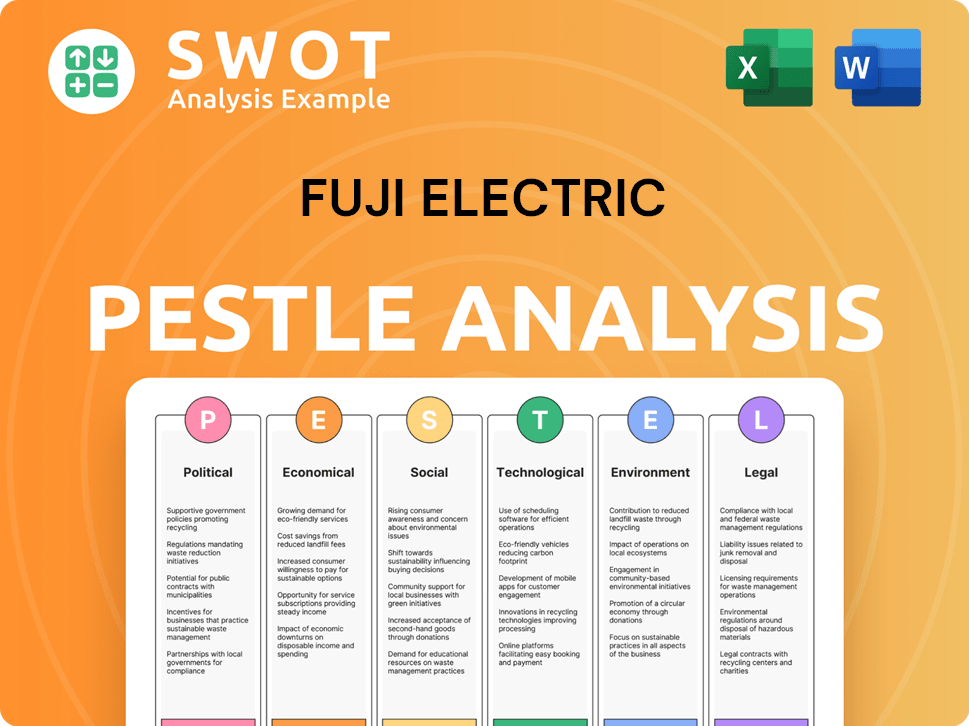

Fuji Electric PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Fuji Electric a Competitive Edge Over Its Rivals?

Understanding the Brief History of Fuji Electric is crucial to grasping its competitive advantages. The company has built a strong foundation over a century, evolving from electrical machinery to sustainable energy and automation solutions. This evolution highlights its adaptability and strategic foresight in leveraging core competencies. A deep dive into its technological prowess, extensive product offerings, and commitment to innovation reveals the essence of its competitive edge in the market.

The company's competitive advantages stem from its technological expertise, broad product range, and dedication to innovation. Its proprietary power electronics technology is a cornerstone, supporting high-performance inverters, UPS systems, and power semiconductors. These technologies are essential for energy efficiency and reliability across various industrial applications, providing a significant advantage. The company's long-standing experience and intellectual property in thermal management and energy conversion contribute to developing highly efficient and compact products.

Furthermore, the company benefits from a strong brand reputation built over a century, associated with quality, reliability, and advanced engineering. This brand equity fosters significant customer loyalty, particularly in its established markets. Its comprehensive global distribution and service network also serve as a competitive advantage, enabling the company to effectively reach diverse customer segments and provide timely support.

The company's proprietary power electronics technology sets it apart. This expertise supports high-performance inverters, UPS systems, and power semiconductors. These technologies are critical for energy efficiency and reliability in various industrial applications, giving it a distinct edge in the competitive landscape.

The company offers a wide array of products, from power semiconductors to factory automation systems. This diverse portfolio allows it to cater to various customer needs across different sectors. A broad product range enhances its market position analysis and competitive intelligence report.

The company's brand is synonymous with quality, reliability, and advanced engineering. This reputation fosters strong customer loyalty, especially in established markets. This brand equity is a key factor in maintaining and expanding its market share.

The company has a comprehensive global distribution and service network. This enables it to effectively reach diverse customer segments and provide timely support. Its global presence is a significant factor in its strategies for market dominance.

The company’s integrated business model, from component manufacturing to system solutions, allows for greater control over quality and cost. Consistent investment in R&D, particularly in silicon carbide (SiC) power devices and advanced factory automation solutions, keeps it at the forefront of technological advancements. These advantages are crucial for its financial performance compared to competitors.

- Proprietary Technology: Leading-edge power electronics and thermal management.

- Brand Strength: A century-long reputation for quality and reliability.

- Global Network: Extensive distribution and service capabilities worldwide.

- Vertical Integration: Control over the entire value chain, enhancing efficiency.

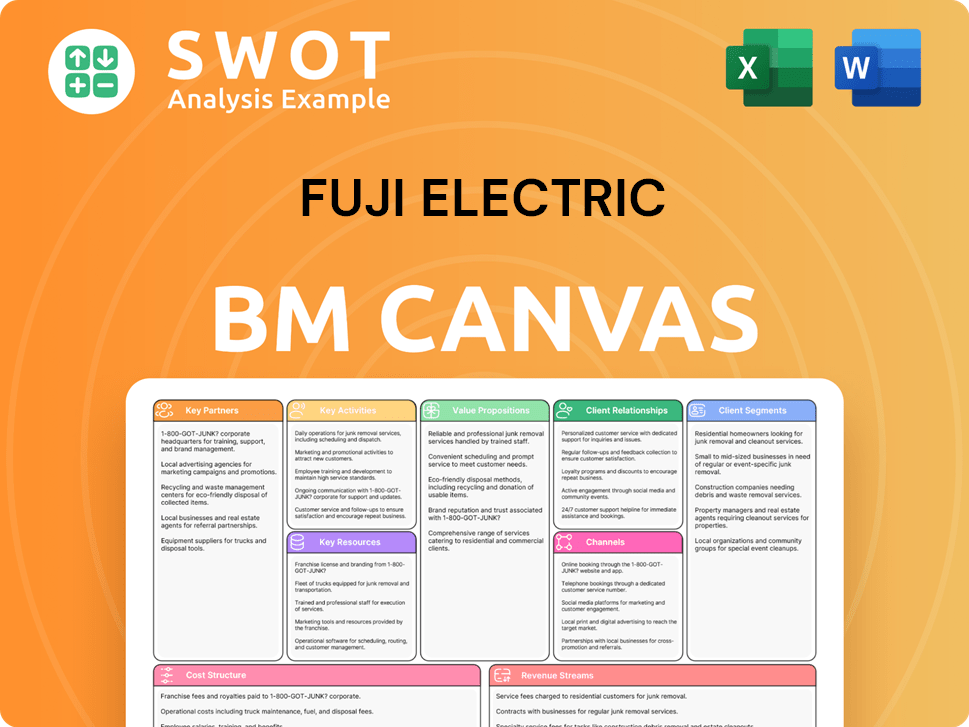

Fuji Electric Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Fuji Electric’s Competitive Landscape?

The competitive landscape for Fuji Electric is significantly influenced by industry trends and market dynamics. The company faces both opportunities and challenges due to the global shift towards sustainable energy and the growth of the electric vehicle (EV) market. Understanding the Fuji Electric competitive landscape is crucial for investors and stakeholders.

Fuji Electric's market position is impacted by its ability to adapt to evolving technologies and manage global supply chains. Key risks include competition from established players and the potential for disruptive technologies. The future outlook for Fuji Electric depends on its strategic responses to these factors and its ability to maintain its market share.

The primary trend affecting Fuji Electric is the global push towards decarbonization, driving demand for renewable energy solutions. The EV market's rapid growth also significantly impacts the company, increasing the need for power semiconductors. Digital transformation and Industry 4.0 are fueling demand for advanced automation solutions.

Fuji Electric faces challenges such as the need for continuous innovation and managing complex global supply chains. Geopolitical tensions and economic uncertainties can also impact demand and supply chain stability. Aggressive pricing strategies from competitors and the emergence of disruptive technologies pose additional threats.

Opportunities for Fuji Electric include expanding into new geographic markets, particularly in developing economies. Strategic partnerships to develop integrated solutions also present growth potential. The company can capitalize on the increasing demand for energy-efficient products and automation solutions.

Fuji Electric is enhancing its product lineup for EVs and renewable energy to address market demands. The company is strengthening its global production and sales networks. Investing in next-generation technologies is also a key part of their strategy to maintain a competitive edge.

The Fuji Electric competitive landscape is shaped by its key rivals and its ability to adapt to technological advancements. The company's strategies for market dominance include product innovation and strategic partnerships. A thorough Fuji Electric market analysis reveals critical insights into its performance and market position.

- Fuji Electric market share is influenced by its product portfolio and its ability to meet customer demands.

- Fuji Electric competitors include companies that offer similar products and services in the power electronics and automation sectors.

- Fuji Electric's business strategy focuses on sustainable growth and innovation in key markets.

- Understanding Fuji Electric's competitive advantages is essential for evaluating its long-term prospects.

For a deeper dive into the company's marketing strategies, consider reading the Marketing Strategy of Fuji Electric. The company is focusing on enhancing its product lineup for EVs and renewable energy. In 2024, the global power semiconductor market was valued at approximately $50 billion, with projections showing continued growth. Fuji Electric's investments in next-generation technologies are aimed at staying competitive in this dynamic environment. The company's financial performance, when compared to its competitors, reflects its strategic positioning and market responsiveness.

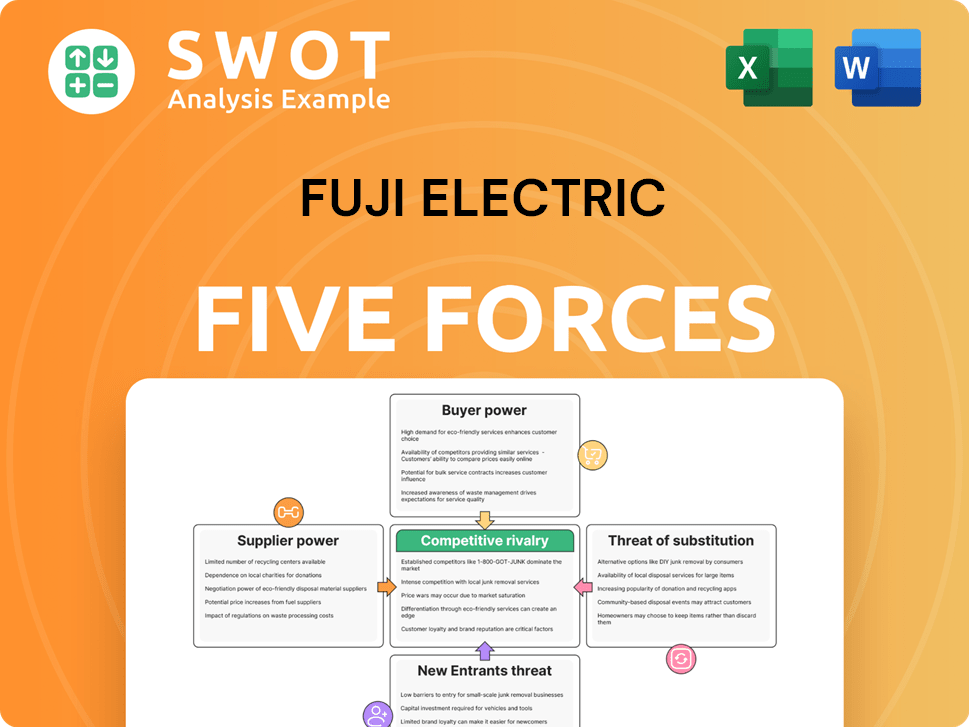

Fuji Electric Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Fuji Electric Company?

- What is Growth Strategy and Future Prospects of Fuji Electric Company?

- How Does Fuji Electric Company Work?

- What is Sales and Marketing Strategy of Fuji Electric Company?

- What is Brief History of Fuji Electric Company?

- Who Owns Fuji Electric Company?

- What is Customer Demographics and Target Market of Fuji Electric Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.