Fuji Electric Bundle

Can Fuji Electric Company Sustain Its Momentum?

Explore the dynamic world of Fuji Electric, a global leader in energy and thermal technology, and uncover its ambitious Fuji Electric SWOT Analysis. Founded in 1923, the company has evolved from a Japanese industrial pioneer to a global powerhouse, consistently adapting to market demands and driving technological advancements. This analysis delves into Fuji Electric’s journey, its current market position, and its strategic vision for the future.

Fuji Electric's unwavering commitment to innovation and sustainable development is key to its anticipated success. This report provides a comprehensive Fuji Electric Market Analysis, examining its strategic initiatives, including expansion strategies and product innovation, to ensure long term growth potential. We will also analyze the competitive landscape and explore the company's potential for strategic partnerships, offering valuable insights for investors and business strategists alike. Understanding the Fuji Electric Growth Strategy is crucial for anyone looking to understand the future of the power electronics market and the company's role in achieving sustainable development goals.

How Is Fuji Electric Expanding Its Reach?

The expansion initiatives of Fuji Electric are designed to broaden its market reach and diversify revenue streams. These strategies are crucial for maintaining a competitive edge in the evolving energy and industrial sectors. The company is focusing on geographical expansion, particularly in high-growth regions to capitalize on emerging opportunities.

A key aspect of Fuji Electric's strategy involves strengthening its presence in Asia, including India and Southeast Asia. This includes increasing production capacities and enhancing sales networks to meet the rising demand for industrial infrastructure and clean energy solutions. Furthermore, the company is actively involved in expanding its product and service portfolios to align with industry trends.

These initiatives are driven by a desire to access new customer segments, mitigate risks associated with reliance on single markets, and capitalize on global trends toward decarbonization and digitalization. Fuji Electric's strategic approach is aimed at ensuring long-term growth and sustainability in a dynamic market environment.

Fuji Electric is actively expanding its global footprint, with a strong emphasis on high-growth regions. The company is particularly focused on Asia, including India and Southeast Asia, to capitalize on the increasing demand for industrial infrastructure and clean energy solutions. This expansion includes establishing new production facilities and enhancing sales networks.

The company is committed to expanding its product and service offerings to meet evolving market demands. This includes significant investments in renewable energy solutions, such as power conditioners for solar power generation and grid stabilization technologies. Fuji Electric is also enhancing its offerings in data centers, providing uninterruptible power supply (UPS) systems and energy-efficient cooling solutions.

Fuji Electric continuously evaluates opportunities for mergers and acquisitions (M&A) that align with its core competencies and strategic objectives. The company is interested in acquiring businesses that can bolster its semiconductor business or enhance its factory automation capabilities. This strategic approach aims to strengthen its market position and drive innovation.

The primary goals behind Fuji Electric's expansion initiatives include accessing new customer segments and mitigating risks associated with reliance on single markets. The company aims to capitalize on global trends toward decarbonization and digitalization. These efforts are designed to ensure long-term growth and sustainability.

Fuji Electric's expansion strategies are multifaceted, focusing on both geographical and product portfolio growth. The company is investing heavily in renewable energy solutions and data center technologies. This approach is designed to address the evolving needs of its customer base and capitalize on emerging market opportunities.

- Geographical expansion, particularly in Asia (India, Southeast Asia).

- Investment in renewable energy solutions (solar power conditioners, grid stabilization).

- Enhancement of offerings for data centers (UPS systems, energy-efficient cooling).

- Strategic M&A to strengthen semiconductor business and factory automation capabilities.

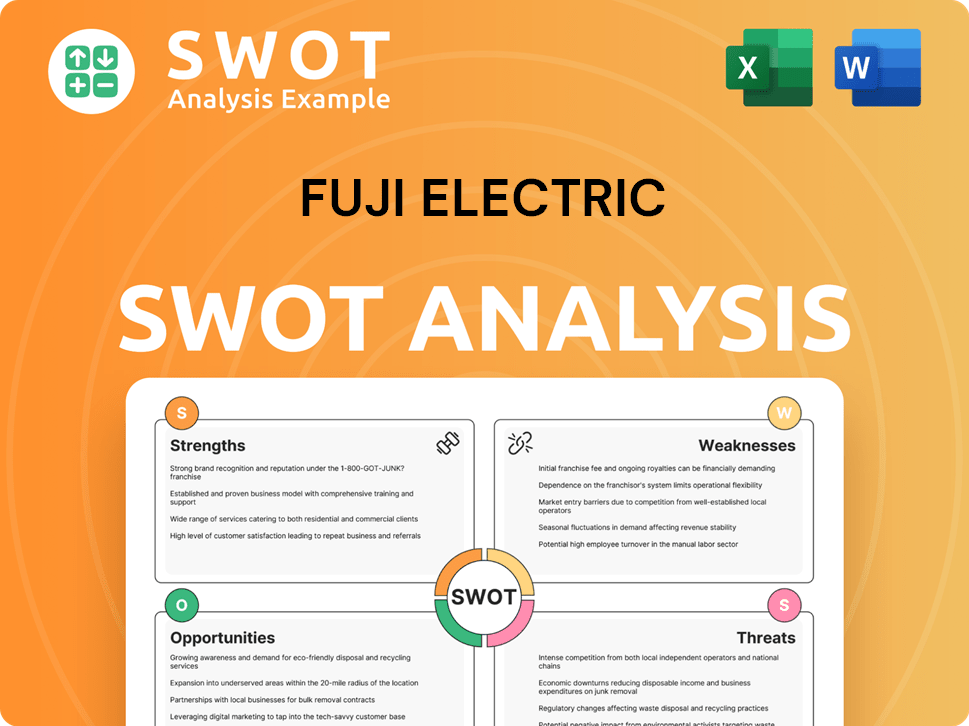

Fuji Electric SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Fuji Electric Invest in Innovation?

The innovation and technology strategy of the company is critical to its sustained growth. The company focuses on leveraging cutting-edge advancements to deliver superior products and solutions. This approach is designed to drive both market share and long-term profitability, ensuring the company remains competitive in a rapidly evolving technological landscape.

A significant portion of the company's strategy involves substantial investments in research and development (R&D). This commitment to technological advancement is a core pillar of its business model. The company's focus on in-house development, particularly in power semiconductors, is essential for maintaining its competitive edge in the market. This strategy is designed to meet the evolving demands of the industry and to capitalize on emerging opportunities.

The company's innovation strategy is deeply intertwined with its commitment to sustainability. The company is focused on developing energy-saving products and solutions that contribute to a low-carbon society. This includes advanced power electronics for renewable energy systems, high-efficiency motors, and energy management systems. These initiatives not only support environmental goals but also open up new market opportunities.

The company's R&D expenses for fiscal year 2023 reached approximately 4.0% of net sales. This significant investment underscores the company's commitment to technological advancement and its proactive approach to product innovation.

The company is actively developing next-generation SiC (silicon carbide) power semiconductors. These semiconductors offer superior performance compared to conventional silicon-based devices. The company is targeting mass production for automotive applications by 2025.

The company is embracing digital transformation and automation across its operations and product offerings. This includes integrating AI and IoT technologies into its factory automation equipment. The 'Fuji Electric DX' initiative aims to optimize manufacturing processes and improve customer service through data analytics and digital platforms.

Sustainability initiatives are deeply embedded in the company's innovation strategy. The company focuses on developing energy-saving products and solutions that contribute to a low-carbon society. This includes advanced power electronics for renewable energy systems and energy management systems.

The company holds numerous patents in its core areas, reflecting its leadership in pushing technological boundaries. This strong intellectual property portfolio supports its market position and enables the development of new products and platforms.

Continuous innovation allows the company to develop new products and platforms that meet evolving market demands. This directly contributes to its growth objectives and helps set new industry standards. The company's focus on innovation is a key driver of its Brief History of Fuji Electric.

The company's strategic focus on innovation is evident in its key technological advancements and its approach to market analysis. These advancements are designed to enhance its competitive position and drive future growth.

- Power Semiconductors: Development of next-generation SiC power semiconductors for automotive applications, targeting mass production by 2025.

- Digital Transformation: Integration of AI and IoT technologies in factory automation equipment to enhance productivity and energy management.

- Sustainability: Development of energy-saving products, including advanced power electronics for renewable energy systems.

- R&D Investment: Allocation of approximately 4.0% of net sales to R&D in fiscal year 2023, demonstrating a strong commitment to innovation.

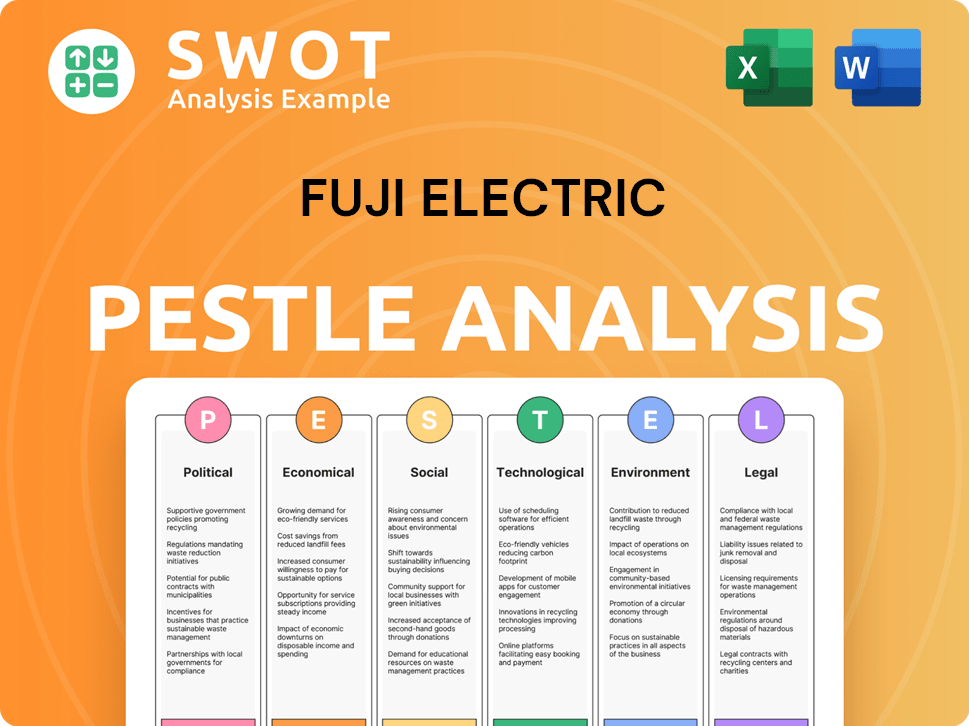

Fuji Electric PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Fuji Electric’s Growth Forecast?

The financial outlook for the company indicates sustained growth, underpinned by strategic investments and a strong market position. The company's 'FY2023-2025 Mid-Term Management Plan' sets ambitious targets for revenue growth and enhanced profitability, with a goal of achieving a return on equity (ROE) exceeding 10%. This growth is anticipated in key segments like power electronics systems and power semiconductors, particularly in areas related to energy infrastructure and industrial automation. This growth is driven by the company's strategic focus and investment in key areas.

For the fiscal year ending March 31, 2025, the company anticipates net sales of approximately JPY 1,120.0 billion and an operating income of JPY 92.0 billion. This projection reflects a steady increase from previous periods, demonstrating the company's consistent financial performance. The company is also aiming for an operating profit margin of around 8.2% for the same period, which highlights efforts to improve profitability through operational efficiencies and a favorable product mix. The company's financial strategy includes prudent capital management and a focus on generating free cash flow.

The company's investment strategy is closely aligned with its growth objectives, with significant capital expenditure allocated towards expanding production capacities for power semiconductors and enhancing R&D capabilities. The company's strong financial health and strategic investments are expected to support its growth trajectory, with no immediate plans for significant external financing. Understanding the Revenue Streams & Business Model of Fuji Electric provides further insight into the company's financial dynamics and strategic direction.

The company's market analysis reveals significant opportunities in the power electronics and power semiconductors sectors. These sectors are vital for energy infrastructure and industrial automation. The focus on these areas supports the company's Fuji Electric Growth Strategy.

The company's business development strategy involves expanding production capacities and enhancing R&D. This approach supports the company's Fuji Electric Future Prospects. These initiatives are designed to drive sustainable growth.

The company is well-positioned to capitalize on industry trends, particularly in renewable energy projects and automation solutions. These trends are key drivers for Fuji Electric Company. The company's focus on these areas is strategic.

The financial performance forecast for the fiscal year ending March 31, 2025, includes net sales of approximately JPY 1,120.0 billion and an operating income of JPY 92.0 billion. The company aims for an operating profit margin of around 8.2%. These figures highlight the company's growth trajectory.

The company's expansion strategies focus on several key areas to drive growth and enhance market presence. These strategies include:

- Expanding production capacities for power semiconductors to meet increasing demand.

- Enhancing R&D capabilities to foster product innovation and maintain a competitive edge.

- Targeting growth in the power electronics systems and power semiconductors segments.

- Focusing on energy infrastructure and industrial automation to capitalize on market trends.

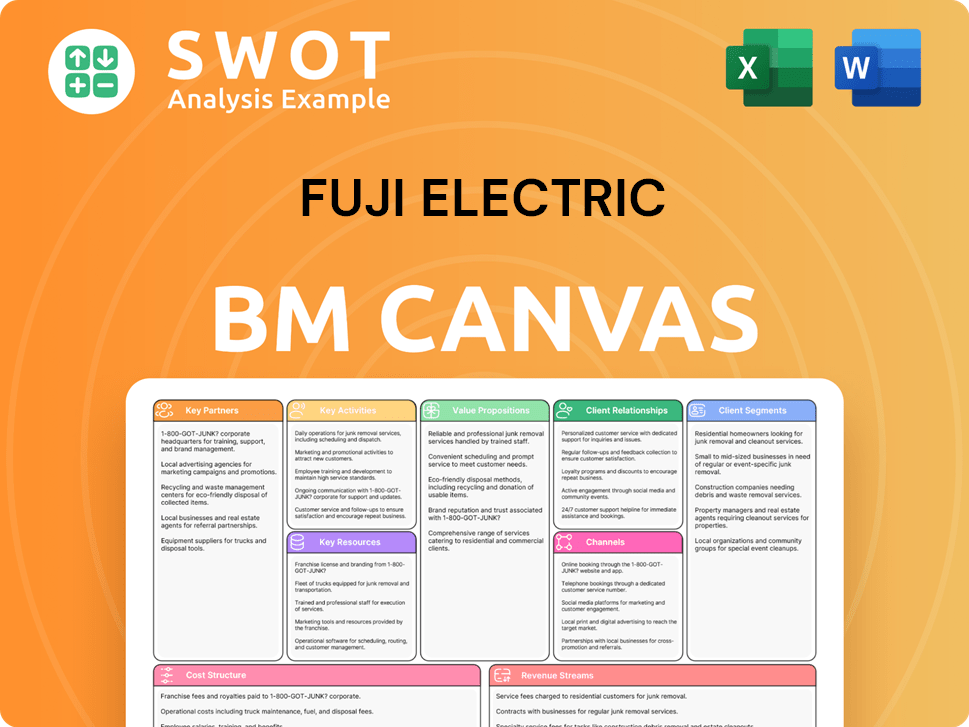

Fuji Electric Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Fuji Electric’s Growth?

The path for Fuji Electric Company towards its growth objectives is fraught with potential risks and obstacles. These challenges span market competition, technological disruptions, and internal resource constraints. Understanding and proactively managing these risks is crucial for the company's long-term success and the realization of its Fuji Electric future prospects.

Market dynamics present a significant hurdle. Intense competition, driven by both established and emerging players, demands continuous innovation and cost efficiency. External factors such as regulatory changes and supply chain vulnerabilities further complicate the landscape, requiring strategic adaptation and robust risk management. The ability to navigate these complexities will define Fuji Electric's growth strategy.

Fuji Electric faces the challenge of maintaining a competitive edge in sectors like power electronics and semiconductors. Rapid technological advancements, such as the evolution of AI and quantum computing, could render existing technologies obsolete, demanding substantial investments in new areas. Moreover, dependencies on specific raw materials and components, particularly for semiconductors, pose risks related to production delays and cost increases.

The power electronics market is highly competitive, with numerous global and regional players. Fuji Electric must continuously innovate to maintain its market share. The competitive landscape includes companies from Japan, Europe, and the United States, such as Mitsubishi Electric and Siemens.

Global events have highlighted supply chain risks. Dependencies on specific components, especially semiconductors, can lead to production delays and increased costs. Diversifying sourcing channels and strengthening supplier relationships are critical strategies for mitigating these risks.

Rapid technological advancements, such as AI and quantum computing, could render existing technologies obsolete. Fuji Electric needs to invest in R&D to stay competitive. The company's ability to adapt to these changes will determine its long-term growth potential.

Changes in environmental standards and trade policies can impact operations and market access. Stricter emissions regulations may require significant R&D investments. Trade tensions can disrupt global supply chains. These factors necessitate proactive adaptation and risk management.

Internal resource constraints, including skilled labor and capital, can impede growth. Securing adequate resources for large-scale expansion is critical. Effective resource allocation and strategic partnerships are key to overcoming these limitations.

Geopolitical instability can disrupt supply chains and impact market access. Continuous monitoring of market trends and geopolitical developments is essential. Fuji Electric employs scenario planning to mitigate the impact of these risks.

Fuji Electric addresses these risks through several strategies. Diversification of its product portfolio and geographical markets reduces reliance on single revenue streams. Robust risk management frameworks, including scenario planning and continuous market monitoring, are employed. Strengthening supplier relationships and diversifying sourcing channels are also key.

To understand the financial health and future, one can analyze the Fuji Electric market analysis and Fuji Electric financial performance forecast. Recent data indicates the company's commitment to sustainable development goals and investment in renewable energy projects. For further insights, consider reading about Owners & Shareholders of Fuji Electric.

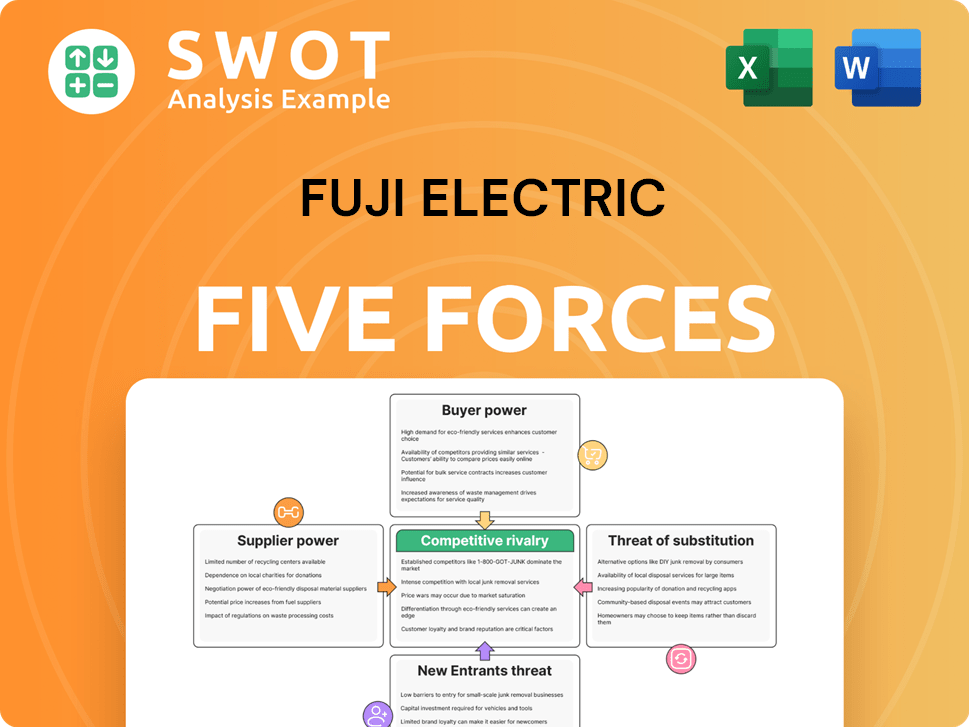

Fuji Electric Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Fuji Electric Company?

- What is Competitive Landscape of Fuji Electric Company?

- How Does Fuji Electric Company Work?

- What is Sales and Marketing Strategy of Fuji Electric Company?

- What is Brief History of Fuji Electric Company?

- Who Owns Fuji Electric Company?

- What is Customer Demographics and Target Market of Fuji Electric Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.