Fuji Electric Bundle

Unveiling Fuji Electric: How Does This Powerhouse Operate?

Fuji Electric Company, a global titan in energy and thermal technology, has been a driving force in industrial and social infrastructure for over a century. Its innovative solutions have consistently optimized energy efficiency and promoted sustainable development worldwide. From power electronics to semiconductors, Fuji Electric products underpin critical infrastructure across diverse industries.

This deep dive into Fuji Electric will explore its core operations, revealing how it generates value and navigates the complexities of the global market. Understanding the Fuji Electric SWOT Analysis is essential for grasping its strategic positioning and competitive advantages. Whether you're an investor, strategist, or researcher, this analysis provides crucial insights into Fuji Electric's business model, its response to market dynamics, and its future trajectory. We will explore Fuji Electric history, Fuji Electric technologies, and Fuji Electric applications.

What Are the Key Operations Driving Fuji Electric’s Success?

The core operations of the Fuji Electric Company revolve around providing energy and thermal technology solutions. They serve a diverse clientele, including manufacturers, infrastructure developers, and commercial enterprises. Their offerings encompass power electronics, semiconductors, and factory automation equipment. These products are crucial for optimizing energy use, enabling advanced manufacturing controls, and supporting renewable energy initiatives.

The company's value proposition centers on delivering highly efficient and reliable solutions. This is achieved through their expertise in power electronics and thermal control. These solutions lead to tangible customer benefits such as reduced operational costs, increased productivity, and enhanced system reliability. This approach helps Fuji Electric stand out in a competitive market.

Their operational processes are vertically integrated, encompassing research and development, manufacturing, sales, and after-sales service. Fuji Electric invests heavily in R&D to improve product performance and efficiency. They use advanced manufacturing techniques and a globally diversified supply chain. Sales are conducted through direct sales, distributors, and partnerships, allowing them to reach a broad customer base. You can learn more about the company's origins in the Brief History of Fuji Electric.

These systems include inverters, power supplies, and uninterruptible power supplies (UPS). They are essential for various applications, such as industrial automation and renewable energy projects. The demand for these products is driven by the need for energy efficiency and reliable power solutions. The global power electronics market is projected to reach $58.5 billion by 2025.

The company manufactures power semiconductors and sensors. These components are critical for controlling and monitoring electrical power in various devices. The power semiconductor market is expected to grow significantly due to the increasing adoption of electric vehicles and renewable energy systems. The power semiconductor market was valued at $45.8 billion in 2023.

This includes programmable logic controllers (PLCs), human-machine interfaces (HMIs), and robotics. These products are used to automate and control manufacturing processes. The factory automation market is expanding due to the need for increased efficiency and productivity in manufacturing. The global factory automation market is estimated to reach $268.5 billion by 2025.

Fuji Electric has a global presence with operations and sales networks worldwide. This allows them to serve customers in various regions and adapt to local market needs. They have manufacturing facilities and offices in multiple countries to support their global operations. The company's international sales account for a significant portion of its revenue.

Fuji Electric's unique position in the market is due to its deep expertise in power electronics and thermal control. This enables them to offer highly efficient and reliable solutions that meet critical industry needs. Their focus on innovation and customer satisfaction further sets them apart.

- Advanced Technology: Continuous investment in R&D for product improvement.

- Energy Efficiency: Solutions designed to reduce energy consumption.

- Reliability: Products built for long-term performance and minimal downtime.

- Customer Focus: Dedicated to meeting the evolving needs of their customers.

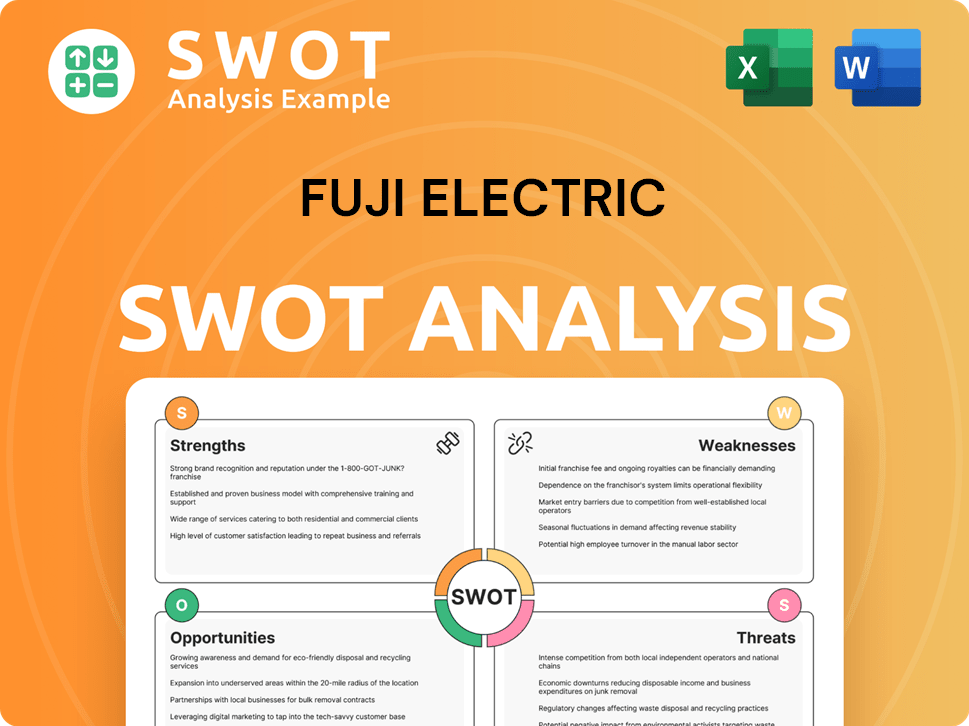

Fuji Electric SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Fuji Electric Make Money?

The revenue streams and monetization strategies of the Fuji Electric Company are multifaceted, reflecting its diverse product portfolio and global market presence. The company generates revenue through a combination of product sales, project-based solutions, and service agreements. Its strategic focus on high-growth sectors like data centers, electric vehicles, and renewable energy is expected to boost sales of related products.

A significant portion of Fuji Electric's revenue comes from selling power electronics systems, semiconductors, and factory automation equipment. These products are essential for various industries, from manufacturing to energy. The company also provides service and maintenance contracts, ensuring its equipment's optimal performance and generating recurring revenue. The company's ability to cross-sell its diverse product portfolio enhances overall revenue.

While specific financial breakdowns for the fiscal year ending March 31, 2025, are not yet fully available, historical data provides insights into the company's revenue structure. Power electronics systems, including inverters and power supplies, have been major contributors. Semiconductors, especially power semiconductors, are increasingly important due to the growth in electric vehicles and renewable energy. Factory automation equipment sales also contribute significantly, driven by the demand for smart factories.

The company employs several strategies to generate revenue and maximize profitability. These include direct product sales, project-based solutions, and recurring revenue from service agreements. The company's focus on emerging markets and its ability to offer bundled solutions are key to its financial performance.

- Power Electronics Systems Sales: Inverters, power supplies, and related equipment for industrial and infrastructure applications.

- Semiconductor Sales: Power semiconductors for electric vehicles, renewable energy, and industrial applications.

- Factory Automation Equipment Sales: Products and solutions for smart factories and enhanced industrial productivity.

- Service and Maintenance Contracts: Ongoing support and maintenance for installed equipment, ensuring optimal performance.

- Project-Based Solutions: Large-scale infrastructure projects requiring customized solutions.

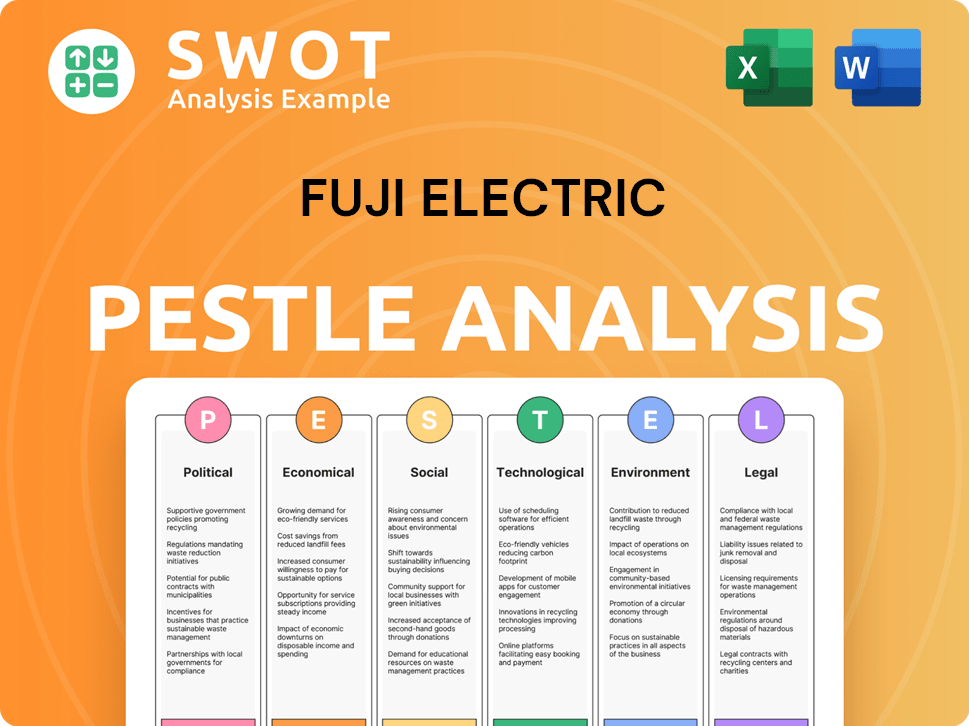

Fuji Electric PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Fuji Electric’s Business Model?

Fuji Electric Company has a rich history marked by significant milestones and strategic shifts. The company has consistently adapted to technological advancements and market demands. Its journey reflects a commitment to innovation and a proactive approach to global trends.

Strategic moves have been central to Fuji Electric's evolution. These include substantial investments in power electronics and semiconductor technology, which are key to its success. The company has also focused on expanding its global presence and forming strategic partnerships to enhance its market reach and technological capabilities.

Fuji Electric's competitive edge is rooted in its strong brand reputation and technological expertise. This is supported by a robust patent portfolio. The company's ability to innovate and adapt to changing market dynamics, such as the growing demand for electric vehicle components and renewable energy solutions, further strengthens its position.

Fuji Electric's history includes several key milestones. These include the development of advanced power semiconductors and the expansion of its global operations. The company has consistently invested in research and development to stay at the forefront of technological advancements.

Fuji Electric has made strategic moves to strengthen its market position. These include investments in power electronics and semiconductor technology. The company has also expanded its global footprint to better serve international markets and mitigate risks.

Fuji Electric's competitive advantages are significant. These stem from its strong brand reputation and technological expertise. The company's extensive patent portfolio and focus on innovation further differentiate its products in the market.

Recent developments include the company's focus on electric vehicle (EV) components and renewable energy solutions. Fuji Electric is also investing in digitalization and IoT solutions for its factory automation offerings. These moves are crucial for sustaining its business model.

Fuji Electric continues to adapt to market demands by investing in new technologies and expanding its global presence. The company's commitment to innovation and sustainability is evident in its product offerings and strategic partnerships. This approach helps Fuji Electric maintain a strong position in the competitive market.

- Power Electronics and Semiconductors: Fuji Electric's core business revolves around power electronics and semiconductors. These components are essential for various applications, including industrial automation, energy management, and electric vehicles. The company's expertise in these areas allows it to offer high-efficiency and reliable products.

- Global Expansion: Fuji Electric has strategically expanded its operations globally, establishing manufacturing and sales bases in key regions. This expansion allows the company to better serve international markets and mitigate risks associated with geopolitical factors and supply chain disruptions.

- Renewable Energy Solutions: Fuji Electric is actively involved in the renewable energy sector, providing products and solutions for solar power generation and energy storage systems. This focus aligns with the global trend towards sustainable energy sources and helps the company contribute to environmental conservation.

- Financial Performance: While specific figures can fluctuate, Fuji Electric's financial performance reflects its strategic focus and market position. The company's revenue and profitability are influenced by factors such as global economic conditions, demand for its products, and the effectiveness of its cost management strategies. For instance, in fiscal year 2024, the company reported a net sales increase, driven by strong demand in industrial infrastructure and power electronics.

To learn more about the company's growth strategy, you can read this article: Growth Strategy of Fuji Electric.

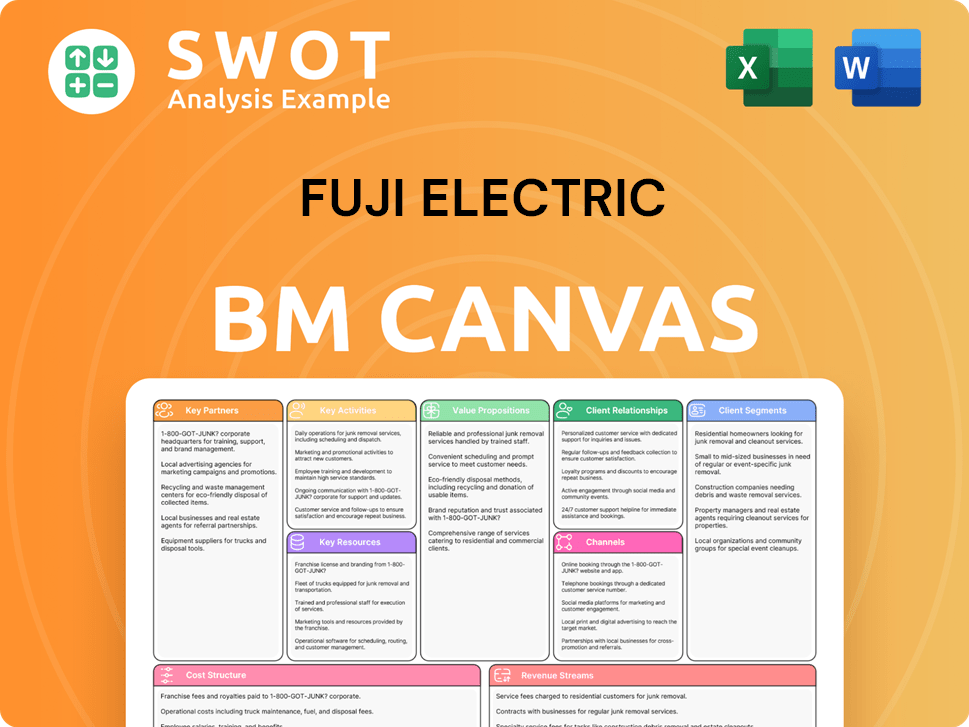

Fuji Electric Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Fuji Electric Positioning Itself for Continued Success?

The industry position of Fuji Electric Company is strong, as it is a major global player in energy and thermal technology. It is particularly prominent in power electronics and industrial automation. The company's established customer relationships and global network support customer loyalty and a wide global reach. The company is recognized for its robust presence in industrial inverters, power semiconductors, and various factory automation components.

Several risks and headwinds could affect Fuji Electric's operations. These include geopolitical tensions, competition from established and emerging innovators, and potential technological disruptions. Regulatory changes, economic downturns, and shifts in industrial investment cycles could also impact demand for their Fuji Electric products. For example, in 2024, supply chain disruptions and rising material costs have affected the entire semiconductor industry, including Fuji Electric.

Fuji Electric holds a significant market position in the power electronics and industrial automation sectors. Its global presence and established customer base contribute to its strong market share. The company's focus on innovation and technological advancements allows it to maintain a competitive edge in the industry.

Fuji Electric faces risks such as geopolitical instability, intense competition, and technological disruptions. Changes in environmental regulations and economic fluctuations also pose challenges. The global semiconductor market's volatility and supply chain issues can impact the company's operations and profitability.

Fuji Electric's future is shaped by its strategic focus on sustainable growth, decarbonization, and digital transformation. The company aims to expand its presence in electric vehicles, renewable energy, and data centers. The company's leadership is committed to innovation, global expansion, and enhancing ESG initiatives.

Fuji Electric is focused on expanding its contributions to decarbonization and digital transformation. This includes accelerating the development and market penetration of power semiconductors for electric vehicles and renewable energy. The company is also expanding its factory automation offerings with advanced IoT and AI capabilities.

Fuji Electric is committed to sustainable growth by capitalizing on the increasing global demand for energy-efficient solutions and smart industrial infrastructure. The company plans to reinforce its technological leadership and strategically diversify its business portfolio. For instance, the company is increasing its investment in research and development to stay ahead of market trends.

- Focus on power semiconductors for electric vehicles and renewable energy.

- Enhancement of solutions for data centers.

- Expansion of factory automation offerings with IoT and AI capabilities.

- Strengthening of environmental, social, and governance (ESG) initiatives.

The company's financial performance is closely tied to global economic trends and technological advancements. The company's ability to navigate these challenges and capitalize on opportunities will determine its future success. For a deeper understanding of the competitive landscape, consider the Competitors Landscape of Fuji Electric.

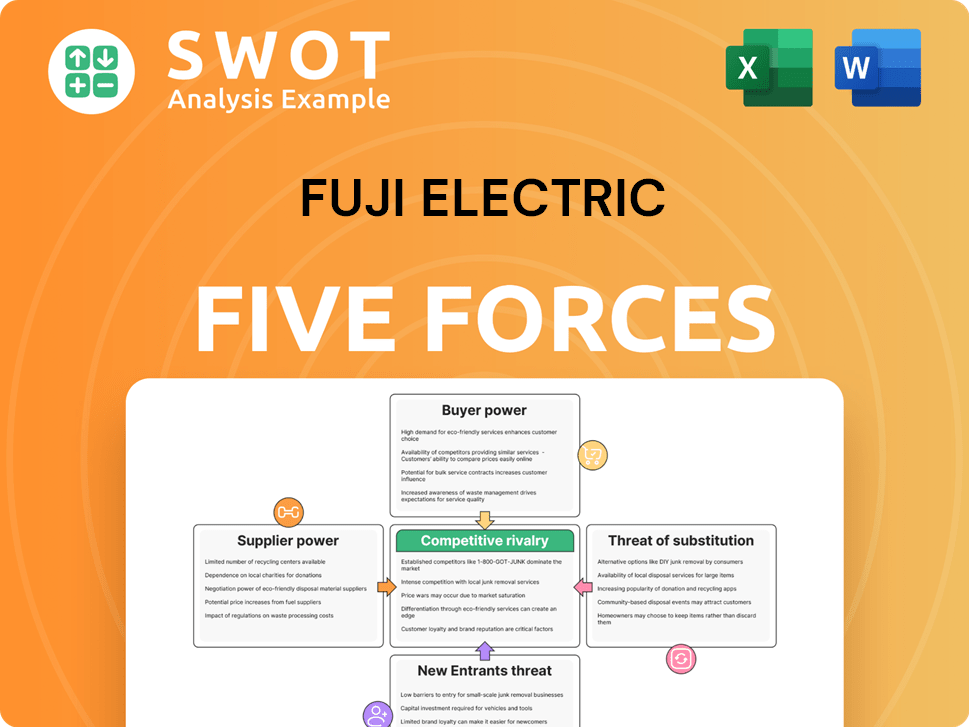

Fuji Electric Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Fuji Electric Company?

- What is Competitive Landscape of Fuji Electric Company?

- What is Growth Strategy and Future Prospects of Fuji Electric Company?

- What is Sales and Marketing Strategy of Fuji Electric Company?

- What is Brief History of Fuji Electric Company?

- Who Owns Fuji Electric Company?

- What is Customer Demographics and Target Market of Fuji Electric Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.