GoodRx Bundle

Can GoodRx Maintain its Competitive Edge in the Digital Healthcare Arena?

The pharmaceutical industry is undergoing a digital transformation, and at the forefront is GoodRx, a company that has revolutionized how consumers access and afford prescription drugs. Founded in 2011, GoodRx aimed to bring much-needed transparency to the opaque world of prescription drug pricing. By offering discount coupons and price comparisons, GoodRx quickly gained traction, empowering millions to save on their medications.

GoodRx's journey from a price comparison tool to a comprehensive healthcare platform has been impressive, but it now faces a complex GoodRx SWOT Analysis. This analysis will explore the GoodRx competitive landscape, identifying key GoodRx competitors and evaluating its core strengths. We'll delve into the GoodRx market analysis to understand the challenges and opportunities shaping its future, including the impact on prescription drug prices and the rise of online pharmacy comparison tools, all while considering strategies for healthcare cost savings.

Where Does GoodRx’ Stand in the Current Market?

GoodRx holds a prominent market position within the digital prescription discount and telehealth sectors in the United States. The company's core operations revolve around its prescription discount platform, which aggregates prices and offers coupons from over 70,000 pharmacies across the U.S. This extensive network, combined with its telehealth services, forms the foundation of its market presence.

The value proposition of GoodRx centers on helping consumers reduce out-of-pocket prescription costs, particularly those without comprehensive insurance or facing high deductibles. The platform provides a user-friendly interface for comparing prescription drug prices and accessing discounts. This focus on healthcare cost savings has made GoodRx a significant player in the market.

GoodRx primarily serves individual consumers seeking to reduce prescription costs. In the first quarter of 2024, the company reported revenue of $169.5 million, with prescription transactions revenue at $155.1 million. The adjusted EBITDA for Q1 2024 was $40.5 million. These figures show a strong operational scale within the digital health sector.

GoodRx has a strong market presence in the prescription savings sector. While exact market share figures can vary, it consistently ranks as a leading provider of prescription discounts. The company's extensive network of pharmacy partnerships supports its wide market penetration.

GoodRx has expanded its offerings beyond prescription discounts. This includes telehealth services, showing a move towards becoming a more integrated healthcare platform. This diversification is aimed at capturing a larger share of consumer healthcare spending.

GoodRx's financial performance indicates a robust operational scale. The company's revenue and adjusted EBITDA demonstrate its significant presence in the digital health sector. These figures highlight its financial stability and growth potential.

GoodRx maintains a strong position in the direct-to-consumer prescription savings market. Its brand recognition and large user base contribute to its success. This strong position allows it to effectively compete in the market.

GoodRx focuses on providing prescription drug prices and healthcare cost savings. The company's business model is centered around offering discounts and coupons. An analysis of Target Market of GoodRx reveals its focus on consumers seeking affordable healthcare solutions.

- Aggregating prescription prices for comparison.

- Offering coupon codes for medications.

- Expanding into telehealth services.

- Building strong pharmacy partnerships.

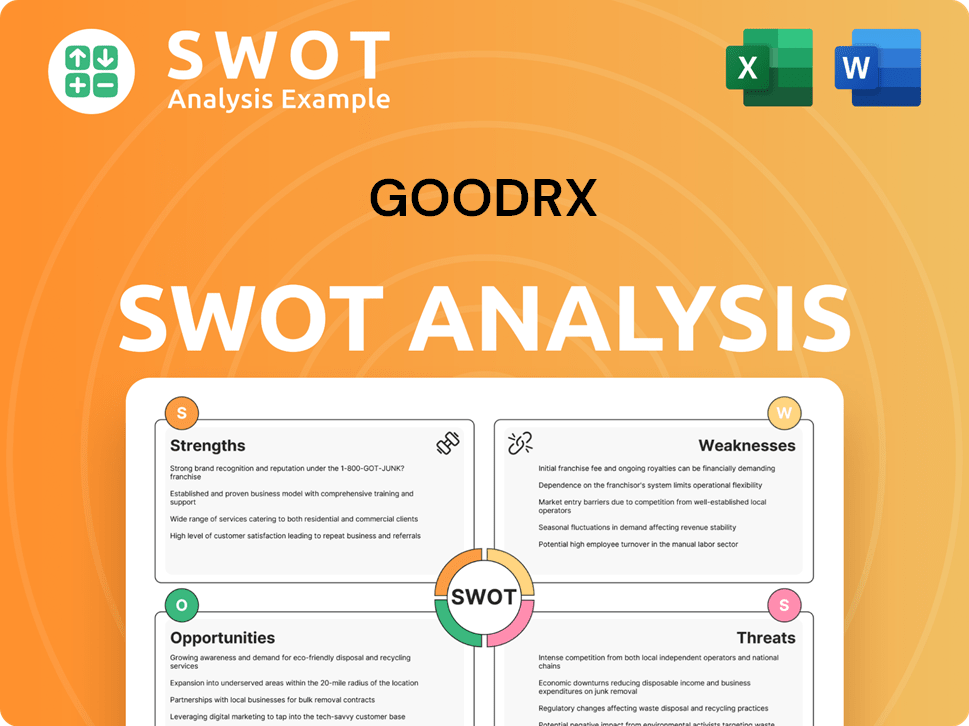

GoodRx SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging GoodRx?

The GoodRx competitive landscape is multifaceted, encompassing both direct and indirect rivals across its various service offerings. Analyzing the GoodRx market analysis reveals a dynamic environment where competition is fierce, particularly in the prescription discount and telehealth sectors. Understanding the key players and their strategies is crucial for assessing GoodRx's position and future prospects.

GoodRx's competitors range from established pharmacy chains to emerging telehealth providers and tech giants. These competitors often have significant resources, broader service portfolios, and established relationships within the healthcare ecosystem. The competitive pressures are constantly evolving, requiring GoodRx to adapt and innovate to maintain its market position.

In the core prescription discount market, GoodRx faces several direct competitors. These rivals provide similar services, offering discount cards and coupons to help consumers save on prescription drug prices. The competition often centers on price, pharmacy network coverage, and ease of use, making it a highly competitive space.

SingleCare is a direct competitor to GoodRx, operating a similar model by providing discount cards and coupons for prescription medications. They compete on price and pharmacy network, often offering comparable savings. SingleCare's user-friendly platform and extensive pharmacy network make it a strong contender in the market.

Optum Perks, backed by UnitedHealth Group, leverages the vast resources and established relationships of its parent company. They offer prescription discounts and other healthcare services. Their integration with the healthcare ecosystem provides a competitive advantage.

Major pharmacy chains like CVS and Walgreens offer their own loyalty programs and discount initiatives. These programs aim to retain customers and reduce the need for third-party discount platforms. They leverage their existing customer base and pharmacy network to compete.

In the telehealth sector, GoodRx Care competes with established players and emerging virtual care providers. These competitors often have broader service portfolios and deeper integrations with traditional healthcare providers. The telehealth market is seeing rapid growth and increased competition.

Teladoc Health is a market leader in telehealth, offering a comprehensive suite of virtual care services. They provide primary care, mental health, and chronic condition management. Teladoc often partners with employers and health plans.

Amwell boasts a wide range of telehealth solutions, frequently collaborating with health systems. They offer various virtual care services. Amwell's partnerships and comprehensive offerings make it a significant competitor.

The GoodRx competitive landscape is also influenced by new entrants and tech giants. These entities introduce innovative solutions and possess substantial resources. Mergers and acquisitions in the healthcare IT space further intensify the competition.

- Amazon's Healthcare Initiatives: Amazon's acquisition of PillPack and its broader push into healthcare represent a significant competitive threat. Amazon's vast resources and distribution capabilities allow it to disrupt the market.

- Innovation in Medication Adherence: New solutions for medication adherence and price transparency challenge GoodRx. These innovations aim to improve patient outcomes and reduce healthcare costs.

- Virtual Care Solutions: Emerging virtual care providers constantly evolve, offering new ways to access healthcare. These providers often focus on specific areas like mental health or chronic disease management.

- Market Dynamics: The prescription drug market is valued at several billion dollars annually. The market is expected to continue growing, attracting more competitors.

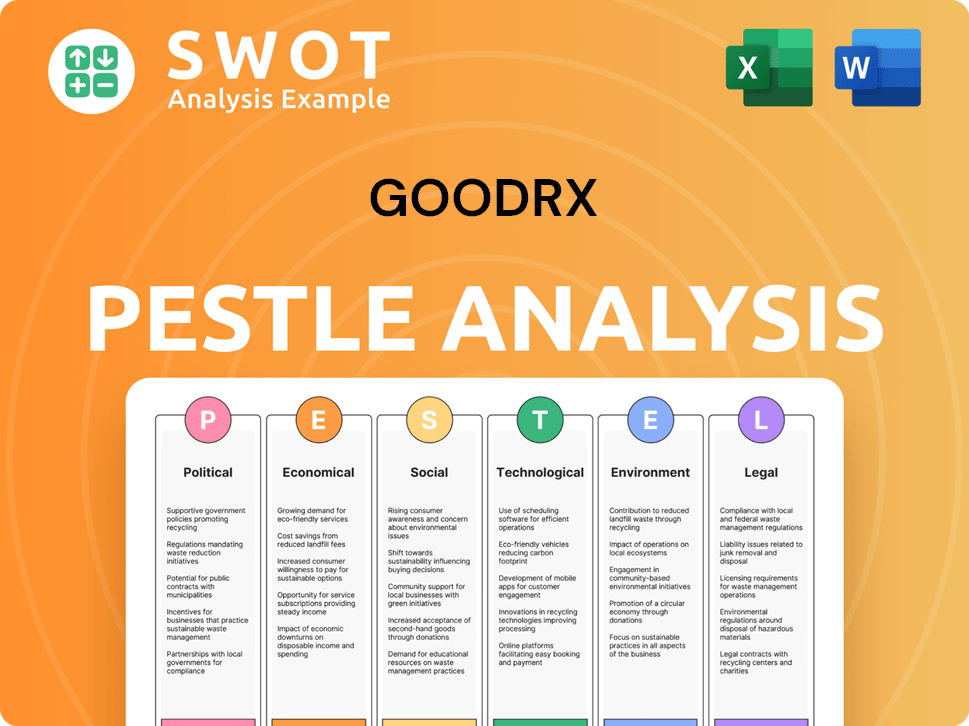

GoodRx PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives GoodRx a Competitive Edge Over Its Rivals?

The core competitive advantages of the company stem from its extensive network, strong brand recognition, and data-driven approach to prescription pricing. The company's vast network of pharmacies, numbering over 70,000 across the United States, allows it to aggregate a comprehensive database of prescription drug prices and negotiate favorable discounts. This wide reach gives users a broad range of options and significant potential savings, a key differentiator in the fragmented pharmaceutical market.

The company's brand equity is also a significant asset. It has become a well-known and trusted name for prescription savings, fostering customer loyalty and driving organic user acquisition. The company's proprietary technology and data analytics capabilities enable it to process millions of pricing data points, identify optimal discounts, and present them to users in an easily digestible format.

This technological backbone allows for real-time price comparisons and personalized savings opportunities. The company has leveraged these advantages in its marketing efforts, emphasizing the tangible savings it provides to consumers. While these advantages have been central to its success, their sustainability is a continuous challenge. The entry of new competitors and the potential for pharmacies to develop more sophisticated in-house discount programs could threaten its pricing power. For a deeper understanding of the company's origins, check out this Brief History of GoodRx.

The company's extensive network of pharmacies, including major chains and independent pharmacies, allows it to offer a wide selection of prescription drug prices. This expansive network enables users to compare prices from various pharmacies, increasing their chances of finding the lowest possible cost. The network's breadth is a significant competitive advantage in the GoodRx competitive landscape.

The company has established itself as a trusted brand in the healthcare savings market. This strong brand recognition drives customer loyalty and organic user acquisition. The brand's reputation for providing reliable information and significant savings on prescription drug prices is a key factor in its success.

The company utilizes advanced data analytics to gather and analyze prescription drug prices. This data-driven approach allows it to identify the best discounts and provide users with real-time price comparisons. By continuously refining its algorithms, it ensures users receive the most up-to-date and accurate pricing information.

The company offers an easy-to-use platform that allows users to quickly search for medications and compare prices. Its intuitive interface and mobile app enhance the user experience, making it simple for consumers to find and access discounts. This ease of use is a key factor in attracting and retaining users.

The company's competitive advantages include its vast pharmacy network, strong brand recognition, and data-driven pricing strategies. These elements enable it to offer substantial savings on prescriptions, attracting a large user base. The company’s ability to negotiate favorable discounts and provide a user-friendly platform further strengthens its position in the market.

- Extensive Pharmacy Network: Over 70,000 pharmacies nationwide.

- Strong Brand Recognition: Trusted name in prescription savings.

- Data-Driven Pricing: Real-time price comparisons and personalized savings.

- User-Friendly Platform: Easy-to-use interface and mobile app.

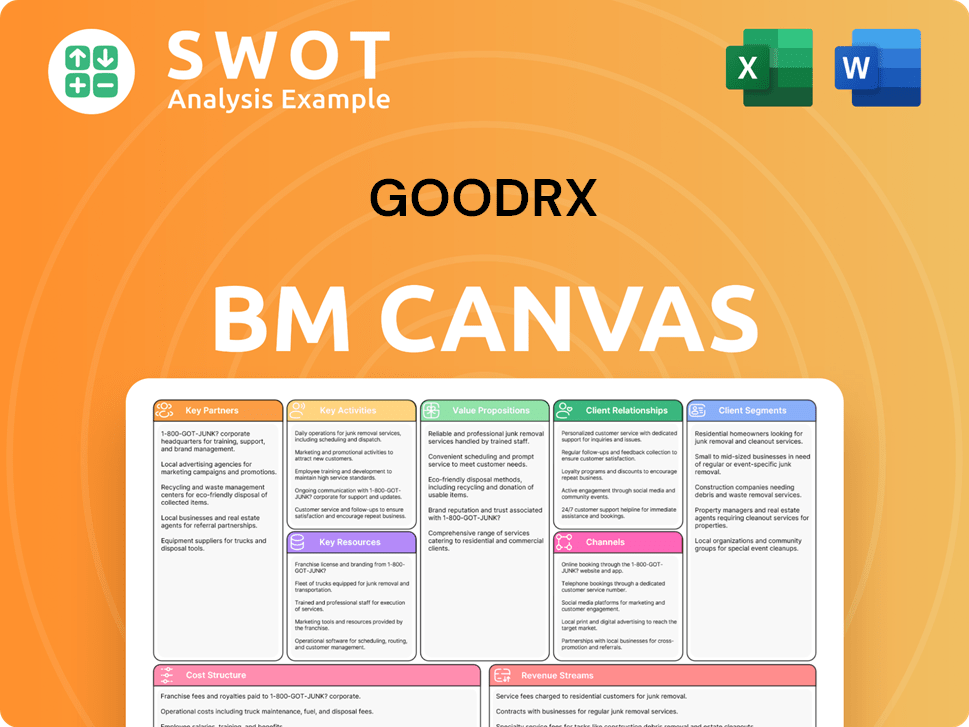

GoodRx Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping GoodRx’s Competitive Landscape?

The competitive landscape for GoodRx is influenced by industry trends, including the rising costs of prescription drugs, the growth of telehealth, and increased healthcare sector regulations. The need for consumers to manage healthcare expenses continues to drive demand for cost-saving solutions, like those offered by GoodRx. The telehealth boom, amplified by the COVID-19 pandemic, presents both opportunities and challenges due to the proliferation of competitors.

Future challenges include potential saturation in the prescription discount market and the need to innovate to stay ahead of technological advancements. The company also faces the threat of reduced demand if healthcare reforms lower out-of-pocket drug costs. Aggressive moves by large pharmacy benefit managers (PBMs) or integrated healthcare systems could erode GoodRx's market share. For a detailed look at how GoodRx approaches its market, consider exploring the Marketing Strategy of GoodRx.

Rising prescription drug prices, increasing telehealth adoption, and regulatory scrutiny shape the market. The demand for cost-saving solutions remains high due to the pressure on consumers to manage healthcare costs. Telehealth expands opportunities for virtual care services but also increases competition.

Potential market saturation and the need for innovation are key challenges. Reduced demand for prescription discounts if healthcare reforms lower costs poses a risk. Competition from PBMs and integrated healthcare systems could erode market share.

Expansion into new healthcare verticals, leveraging user data, and strategic partnerships offer growth. New revenue streams could come from programs like chronic disease management and medication adherence tools. Partnerships with health plans and employers could broaden reach.

GoodRx is evolving into a more holistic digital health platform. The company aims to offer a wider array of consumer-centric healthcare solutions. This move is designed to capitalize on the digital transformation of healthcare.

The GoodRx competitive landscape includes various players in the prescription drug prices market, such as SingleCare and pharmacy chains. GoodRx competitors are constantly vying for market share. The market is dynamic, with shifting strategies and new entrants.

- GoodRx market analysis reveals a focus on providing healthcare cost savings.

- The company faces competition from both established pharmacies and emerging digital platforms.

- Online pharmacy comparison tools offer consumers alternatives for discounts.

- GoodRx market share analysis 2024 shows its position in the market.

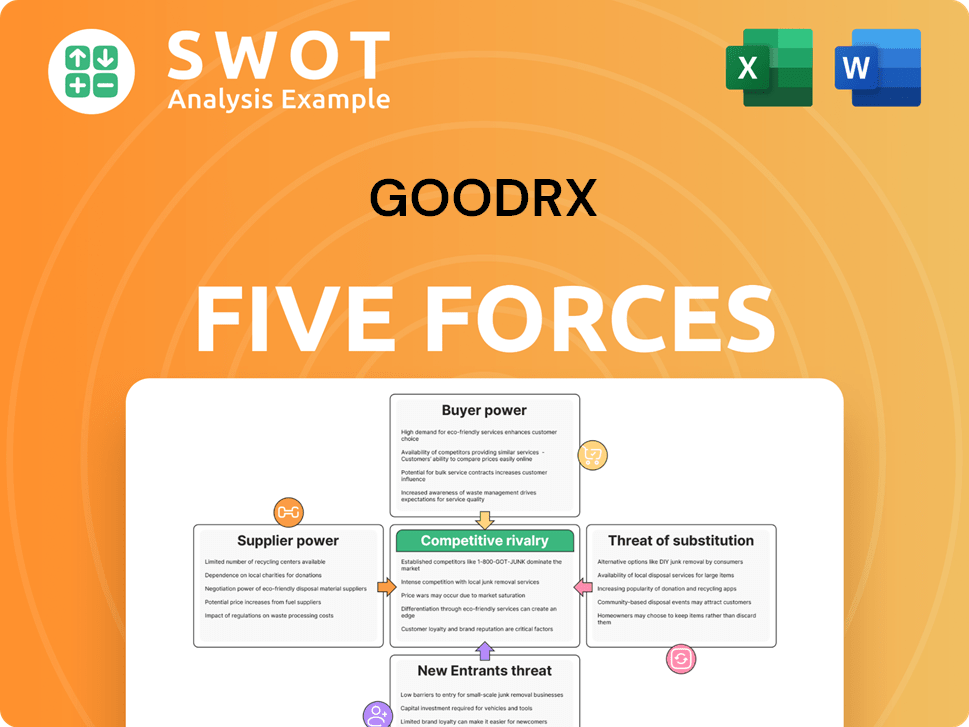

GoodRx Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of GoodRx Company?

- What is Growth Strategy and Future Prospects of GoodRx Company?

- How Does GoodRx Company Work?

- What is Sales and Marketing Strategy of GoodRx Company?

- What is Brief History of GoodRx Company?

- Who Owns GoodRx Company?

- What is Customer Demographics and Target Market of GoodRx Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.