GoodRx Bundle

How Does GoodRx Revolutionize Drug Pricing?

GoodRx has become a household name in the U.S. healthcare sector, primarily recognized for its mission to reduce prescription medication costs. This innovative platform aggregates drug prices and offers GoodRx SWOT Analysis discount codes, directly addressing the often-complex and high costs of pharmaceuticals. Millions of users rely on GoodRx to lower their out-of-pocket expenses, and the company is expanding into telehealth and other healthcare services.

Understanding GoodRx's operations and revenue model is vital for investors, customers, and industry watchers alike. Investors can gain insights into the company's financial health and competitive advantages by understanding how GoodRx discount codes work. Customers benefit from knowing the mechanisms behind the prescription savings they receive, while industry observers can better grasp the strategies of digital health companies. This analysis will explore GoodRx's core operations, revenue streams, strategic moves, and market position, providing a comprehensive understanding of its business model and future trajectory, including details on GoodRx pricing and how to use GoodRx.

What Are the Key Operations Driving GoodRx’s Success?

GoodRx fundamentally operates by helping consumers find affordable prescription medications. The core of its business is a digital platform that gathers real-time prescription drug prices from various pharmacies across the United States. This allows users to access GoodRx discount coupons and compare prices, leading to significant savings on their medications.

The company serves a wide range of customers, including those with high deductibles, those without insurance, and those seeking to reduce their co-pays. GoodRx’s value proposition is straightforward: to make prescription drugs more affordable and accessible. This is achieved through a combination of price comparison, discount coupons, and educational resources.

Operationally, GoodRx leverages technology to maintain its extensive database of drug prices and discounts. This involves sophisticated data aggregation from pharmacy benefit managers (PBMs) and pharmacies. When a user searches for a drug, GoodRx’s platform quickly identifies the lowest available price and provides a coupon that can be used at the pharmacy. The company’s supply chain is primarily digital, relying on robust data infrastructure and partnerships with PBMs and pharmacies to facilitate transactions.

GoodRx's technology gathers prescription drug prices from over 70,000 pharmacies across the U.S. This extensive network allows the platform to offer a comprehensive price comparison service. The data is updated regularly to ensure users have access to the most current pricing information.

The platform provides users with access to coupons and discounts. These are often negotiated directly with pharmacies or through partnerships with PBMs. Users can present these coupons at the pharmacy to receive reduced prices on their medications.

GoodRx offers an easy-to-use interface, allowing users to quickly search for medications and compare prices. The platform is accessible via web and mobile apps, making it convenient for users to access information on the go. This ease of use enhances the overall user experience.

GoodRx has established strong partnerships with pharmacies and PBMs. These partnerships are crucial for maintaining its data accuracy and providing discounts. The network includes major pharmacy chains and independent pharmacies, ensuring broad coverage.

GoodRx’s core operations translate directly into tangible benefits for its users. The ability to compare drug prices and access discounts results in significant cost savings. This is particularly beneficial for those without insurance or with high-deductible plans.

- Cost Savings: Users can save up to 80% on prescription drugs.

- Price Transparency: The platform provides clear and transparent pricing information.

- Ease of Use: The platform is user-friendly and accessible on multiple devices.

- Wide Coverage: Access to discounts at a vast network of pharmacies.

GoodRx SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does GoodRx Make Money?

The core of how GoodRx operates revolves around its revenue streams and monetization strategies, primarily centered on prescription transactions. The company's platform facilitates access to GoodRx discount and pharmacy coupons, enabling users to find lower drug prices. This model allows GoodRx to generate income through fees from pharmacy benefit managers (PBMs) or pharmacies when users utilize its coupons.

The primary source of revenue for GoodRx comes from prescription transactions. This transaction-based model is the foundation of its financial success. While specific figures for 2024 and 2025 are not yet fully available in public reports, historical data indicates that prescription transactions consistently represent the largest portion of the company's earnings. The company's ability to provide prescription savings directly influences its revenue generation from various stakeholders within the healthcare system.

GoodRx has diversified its revenue streams beyond prescription transactions. The company has expanded into telehealth services, such as GoodRx Care, where users can consult with healthcare providers. Additionally, GoodRx has explored opportunities through pharmaceutical manufacturer solutions, offering advertising and other services to drug manufacturers to promote their products and patient savings programs. This diversification supports its overall monetization strategy, aiming to provide value to consumers while generating income from multiple sources.

GoodRx's financial model is built on several key elements that drive its revenue and profitability. Understanding these components is crucial for assessing its business performance and market position.

- Prescription Transactions: This is the primary source of revenue. GoodRx earns fees from PBMs and pharmacies when users utilize GoodRx pricing to purchase prescriptions.

- Telehealth Services: GoodRx Care offers telehealth consultations, generating revenue from these healthcare services.

- Pharmaceutical Manufacturer Solutions: The company provides advertising and savings programs for drug manufacturers, creating an additional revenue stream.

- Subscription Services: GoodRx offers a subscription service, GoodRx Gold, providing additional discounts and benefits for a monthly fee.

- Advertising Revenue: Revenue is generated through advertisements on the platform, including those from pharmaceutical companies and other healthcare-related businesses.

GoodRx PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped GoodRx’s Business Model?

The evolution of GoodRx has been marked by significant milestones that have shaped its market position and operational strategies. Its initial success was built on providing access to GoodRx discount, and it has since expanded its services to include telehealth, demonstrating a commitment to comprehensive healthcare solutions. These strategic moves have allowed the company to broaden its value proposition and adapt to the changing dynamics of the healthcare market.

A key strategic decision was the expansion into telehealth services with GoodRx Care. This move enabled the company to offer a more integrated healthcare experience, addressing not only medication costs but also access to medical consultations. The company's ability to form strategic partnerships has been crucial in enhancing its reach and service offerings, further solidifying its position in the market.

As of 2024, GoodRx reported over 60 million monthly active users, highlighting its substantial reach within the healthcare sector. The company's revenue for 2023 was approximately $760 million, showcasing its financial strength and market penetration. These figures underscore the company's ability to maintain and grow its user base and revenue streams.

GoodRx began by offering GoodRx pricing for prescription savings. It expanded into telehealth with GoodRx Care, and formed strategic partnerships to enhance its services. These steps have diversified its offerings and strengthened its market presence.

The transition into telehealth was a pivotal strategic move. The company has also focused on forming partnerships to expand its service offerings. These moves reflect a proactive approach to meeting evolving consumer needs and market demands.

GoodRx's strong brand recognition and extensive pharmacy network provide a competitive edge. Its technology leadership in presenting complex pricing data is also a key differentiator. The company continues to innovate in digital health and expand its services.

In 2024, GoodRx announced a partnership with Sanofi to integrate its prescription savings into Sanofi's patient support programs. This collaboration highlights its ongoing efforts to partner within the pharmaceutical industry. This strategic alliance aims to improve patient access to medications.

GoodRx's competitive advantages include strong brand recognition and an extensive network of pharmacy partnerships, allowing it to offer a wide array of pharmacy coupons. Its technology leadership in aggregating and presenting complex pricing data provides a significant edge. The company is adapting to new trends by focusing on innovation in digital health and expanding its service offerings, such as exploring GoodRx and telehealth.

- Strong brand recognition and user trust.

- Extensive pharmacy network for broad discount access.

- Technological innovation in drug price comparison.

- Strategic partnerships to enhance service offerings.

GoodRx Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is GoodRx Positioning Itself for Continued Success?

In the competitive landscape of digital health, especially within the prescription savings sector, the company holds a significant position. Its market share is influenced by its ability to consistently offer competitive GoodRx pricing and maintain user engagement. The company competes with other discount card providers, pharmacy loyalty programs, and evolving models from pharmaceutical companies.

The future outlook for the company involves a continued focus on expanding its telehealth services, deepening its partnerships within the pharmaceutical industry, and leveraging its data and technology to enhance its platform. The company aims to sustain and expand its ability to generate revenue by continuing to address the critical need for affordable healthcare solutions and by innovating its offerings to meet evolving consumer and industry demands.

The company is a key player in the digital health market, specializing in prescription savings. It offers users access to GoodRx discount and pharmacy coupons, helping them find lower drug prices. The company's success depends on its ability to offer competitive pricing and maintain user engagement.

The company faces risks from changes in pharmacy benefit manager (PBM) practices and regulatory shifts in the pharmaceutical industry. Competition from established players and new entrants in the digital health space poses another challenge. Maintaining its value proposition in a dynamic healthcare landscape is also crucial.

The company plans to expand its telehealth services and strengthen partnerships within the pharmaceutical industry. Leveraging data and technology to improve its platform is a key strategy. The goal is to continue addressing the need for affordable healthcare and innovate to meet consumer and industry demands.

The company generates revenue primarily through transaction fees from pharmacies and subscription services. The company's ability to maintain and increase revenue depends on its ability to attract and retain users, offer competitive pricing, and innovate its service offerings.

The company is focusing on several strategic initiatives to ensure future growth. These include expanding its telehealth offerings, enhancing its partnerships with pharmaceutical companies, and leveraging data analytics to improve user experience and service offerings. These initiatives are designed to enhance the company's competitive position and drive sustainable growth.

- Expansion of Telehealth Services: To offer more comprehensive healthcare solutions.

- Enhanced Partnerships: Collaborating with pharmaceutical companies to offer better deals.

- Data Analytics: Using data to improve user experience and service offerings.

- Subscription Services: Expanding the features and value of its subscription tiers.

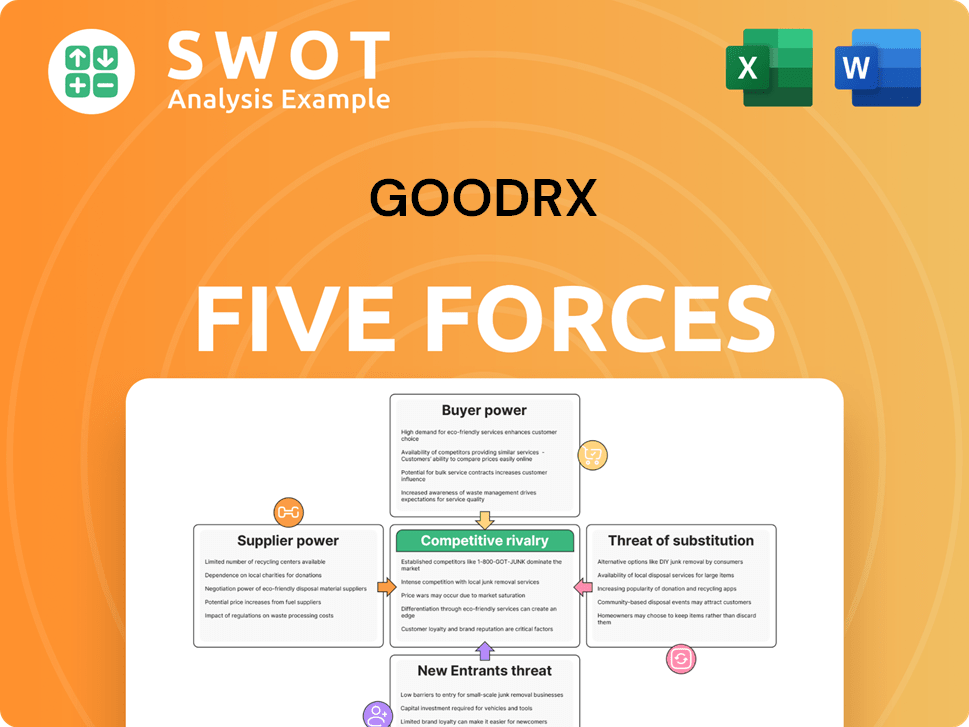

GoodRx Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of GoodRx Company?

- What is Competitive Landscape of GoodRx Company?

- What is Growth Strategy and Future Prospects of GoodRx Company?

- What is Sales and Marketing Strategy of GoodRx Company?

- What is Brief History of GoodRx Company?

- Who Owns GoodRx Company?

- What is Customer Demographics and Target Market of GoodRx Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.