Grainger Bundle

How Does Grainger Dominate the Industrial Supply Sector?

In the dynamic world of industrial supplies, understanding the Grainger SWOT Analysis is crucial for any investor or business strategist. Grainger's position in the market is a testament to its strategic prowess, but who are its main rivals, and how does it maintain its edge? This exploration delves into the competitive environment, offering a detailed look at Grainger's strategies and market dynamics.

This analysis of the Grainger competitive landscape will dissect the company's strengths and weaknesses, providing a comprehensive

Where Does Grainger’ Stand in the Current Market?

Grainger holds a leading market position within the Maintenance, Repair, and Operations (MRO) distribution industry. It is a dominant player, especially in North America, where it controls a significant market share. The company's core operations focus on supplying a vast array of essential MRO products, catering to the operational needs of businesses across various sectors.

The company's value proposition centers on providing a comprehensive suite of products and services. This includes a broad product catalog, digital tools, and value-added services like inventory management and technical support. This approach aims to streamline the procurement process and enhance customer experience, making Grainger a one-stop shop for MRO needs. Revenue Streams & Business Model of Grainger provides further insights into its financial structure.

Grainger primarily serves business-to-business (B2B) customers, including large enterprises, government agencies, and small to medium-sized businesses. Its extensive distribution network and broad product catalog meet diverse customer demands. The company's financial health and scale are considerable, with net sales reaching $16.5 billion in 2024, demonstrating its strong market presence and operational capabilities.

Grainger maintains a strong market share in the highly fragmented MRO distribution industry. In North America, it is a dominant player, leveraging its extensive distribution network and broad product catalog. This strong market position allows Grainger to effectively serve a wide range of business customers.

Grainger's primary product lines include a vast array of MRO essentials, such as safety equipment, hand and power tools, and industrial supplies. The company has expanded its offerings to include value-added services like inventory management and technical support. This comprehensive approach enhances customer value and operational efficiency.

Grainger has a robust geographic presence with significant operations across North America and a growing international footprint. It serves customers in over 120 countries, demonstrating its global reach. This wide presence allows Grainger to cater to a diverse customer base worldwide.

Grainger primarily serves B2B customers, including large enterprises, government agencies, and small to medium-sized businesses. Its customer base spans manufacturing, healthcare, retail, and hospitality sectors. This diverse customer base contributes to the company's overall market stability.

Grainger's key strategies include a significant digital transformation and diversification of offerings. The company invests heavily in e-commerce platforms and digital tools to streamline the purchasing process. Its competitive advantages include a strong distribution network and a broad product catalog.

- Extensive Distribution Network: Grainger's wide network ensures product availability and timely delivery.

- Broad Product Catalog: The company offers a comprehensive range of MRO products, catering to diverse customer needs.

- Digital Transformation: Investments in e-commerce and digital tools enhance the customer experience.

- Value-Added Services: Inventory management and technical support provide comprehensive solutions.

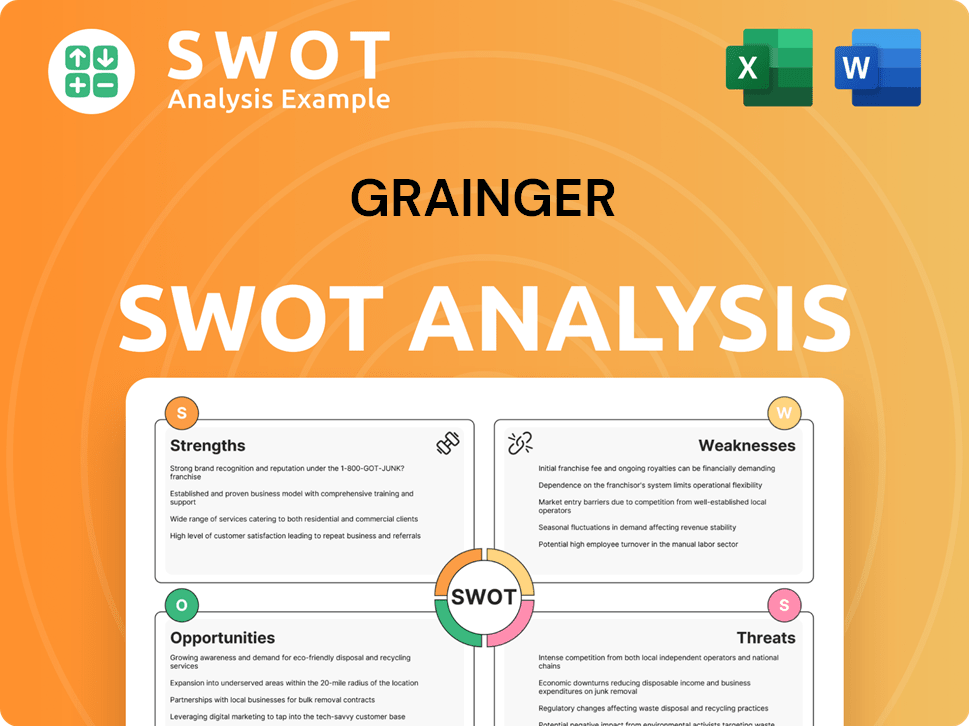

Grainger SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Grainger?

The Grainger competitive landscape is shaped by a diverse array of companies vying for market share in the industrial supply sector. Understanding the key players and their strategies is crucial for a comprehensive Grainger market analysis. This involves examining both direct and indirect competitors to assess the challenges and opportunities facing the company.

Direct competitors, such as Fastenal and MSC Industrial Supply Co., present significant challenges due to their established distribution networks and product offerings. Indirect competitors, including online marketplaces and specialized distributors, further complicate the competitive environment. Analyzing these dynamics provides insights into Grainger's market position and its ability to maintain its competitive edge.

Fastenal is a major direct competitor, operating a vast network of branches and offering a wide range of MRO and industrial supplies. They often emphasize vending solutions and on-site inventory management. Fastenal's extensive distribution network and focus on customer convenience make it a strong contender in the market.

MSC Industrial Supply Co. is another significant direct competitor, known for its focus on metalworking and MRO products. They provide technical expertise and strong customer service. MSC's specialized offerings and customer-centric approach allow it to compete effectively with Grainger.

Local and regional distributors often offer more personalized service and may have strong relationships within specific geographic areas or niche markets. These distributors can provide tailored solutions and build strong customer loyalty.

Online marketplaces, such as Amazon Business, represent a growing competitive threat. Amazon Business leverages its extensive logistics network, competitive pricing, and vast product selection to attract MRO customers, particularly smaller businesses. This offers convenience and a broad array of products beyond traditional MRO items.

Specialized distributors focusing on particular product categories (e.g., safety equipment, electrical components) can pose a challenge by offering deeper expertise and a more tailored product selection within their niche. These distributors can meet specific customer needs more effectively.

Mergers and acquisitions among smaller distributors aim to achieve economies of scale and expand market reach. New entrants, particularly tech-driven startups, are disrupting the traditional MRO distribution model by offering innovative e-procurement solutions and leveraging data analytics to optimize supply chains.

The Grainger industry is constantly evolving, with companies adapting to changing market trends. For example, in 2023, Fastenal reported net sales of approximately $7.1 billion, demonstrating its strong position in the market. MSC Industrial Supply Co. reported net sales of approximately $3.7 billion in fiscal year 2023. These figures highlight the competitive pressure and the importance of strategic initiatives for Grainger's business model. For more insights, you can explore the Growth Strategy of Grainger.

Several factors influence the competitive landscape, including pricing, delivery speed, product selection, and value-added services. Grainger's ability to compete effectively depends on its strengths in these areas.

- Pricing: Competitive pricing is crucial for attracting and retaining customers.

- Delivery Speed: Fast and reliable delivery is a key differentiator.

- Product Selection: A wide range of products meets diverse customer needs.

- Value-Added Services: Services like technical support and inventory management enhance customer value.

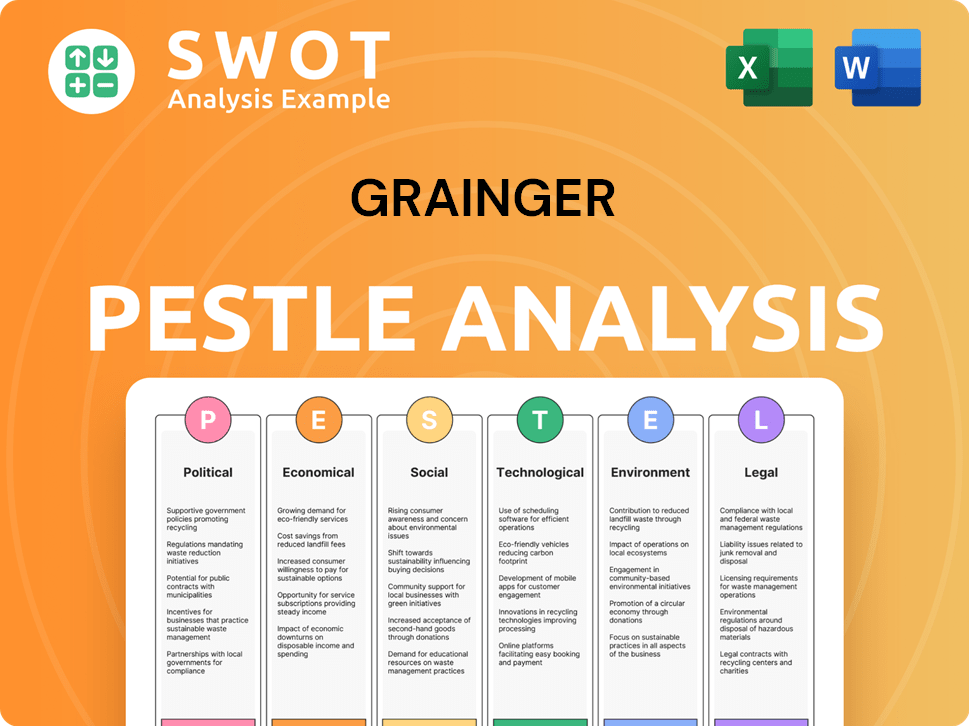

Grainger PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Grainger a Competitive Edge Over Its Rivals?

Understanding the Grainger competitive landscape requires a deep dive into its core strengths. The company's ability to maintain a significant market presence is rooted in its strategic advantages. These advantages have allowed it to navigate the complexities of the Grainger industry and maintain a strong position.

Grainger's business model has been pivotal in its success. The company's focus on providing a vast selection of products and efficient delivery services has solidified its position. This approach has been critical in shaping its competitive edge. For a deeper understanding, you can explore the Brief History of Grainger.

The company's strategic moves and market adaptations are essential for maintaining its competitive edge. These moves have allowed Grainger to stay ahead of its Grainger competitors and maintain a strong market share.

Grainger offers a vast selection of products, with over 1.7 million unique items available. This extensive catalog allows the company to serve as a one-stop shop for a wide array of maintenance, repair, and operations (MRO) needs. This comprehensive product range reduces the need for customers to source from multiple suppliers, streamlining their procurement processes.

Grainger’s efficient distribution network is a key competitive advantage. The company operates numerous distribution centers and branches strategically located to ensure rapid product delivery. This logistical strength enables Grainger to offer next-day or same-day delivery for a substantial portion of its orders, which is crucial for businesses requiring immediate access to essential supplies.

Grainger has built a strong brand reputation and long-standing customer relationships over decades. This has cultivated trust and loyalty among its diverse customer base. The company's reliability and consistent service make it a preferred supplier for many industrial and institutional clients. This strong brand equity provides a significant competitive advantage.

Grainger has invested heavily in digital capabilities, including its e-commerce platform and advanced inventory management systems. These technological advancements enhance the customer experience and streamline ordering processes. Digital sales accounted for approximately 85% of total sales in 2024, demonstrating the success of its digital transformation efforts.

Grainger's competitive advantages are multifaceted, encompassing extensive product offerings, efficient distribution, and strong customer relationships. These elements work together to provide a robust foundation for its market position. Its focus on digital capabilities further enhances its competitive edge.

- Extensive Product Selection: Offering over 1.7 million products.

- Efficient Distribution: Providing next-day or same-day delivery.

- Strong Brand Reputation: Building trust and loyalty over decades.

- Digital Transformation: With approximately 85% of sales through digital channels in 2024.

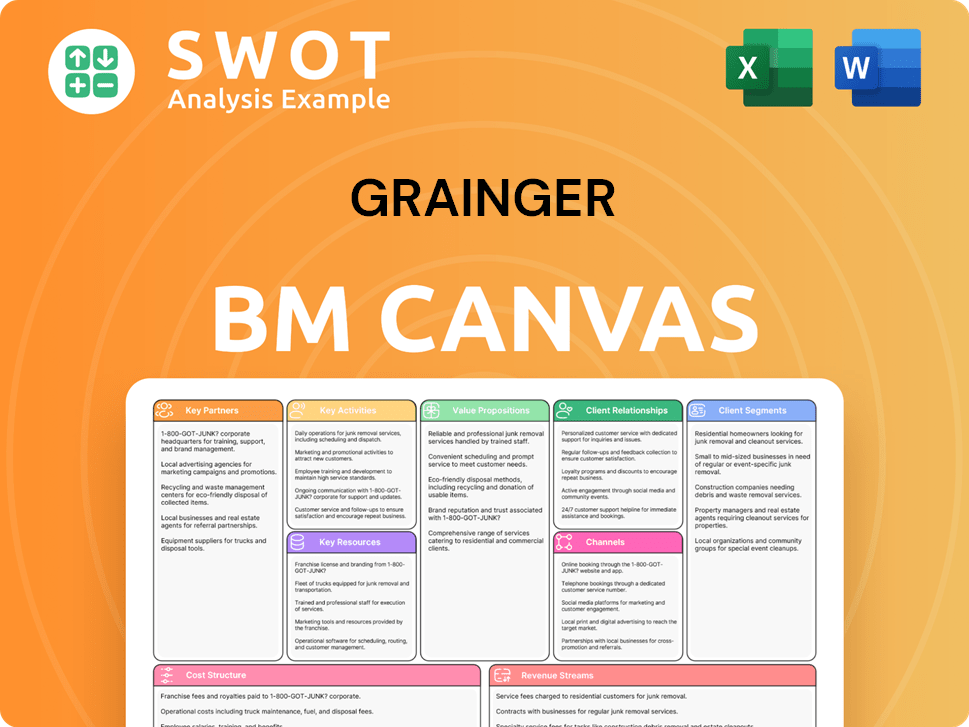

Grainger Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Grainger’s Competitive Landscape?

The industrial Maintenance, Repair, and Operations (MRO) sector is experiencing significant transformations. Grainger's market position is shaped by industry trends, challenges, and opportunities, including digital advancements, supply chain resilience, and sustainability. Understanding the Grainger competitive landscape is crucial for businesses and investors.

Grainger's market analysis reveals a dynamic environment. The company faces the task of adapting to evolving customer expectations and maintaining its competitive edge. This involves leveraging its strengths while addressing potential threats from competitors and emerging market dynamics.

E-commerce platforms, data analytics, and automation are reshaping procurement processes. Customers demand seamless online experiences and real-time inventory visibility. Distributors must invest in digital capabilities to meet these demands and stay competitive within the Grainger industry.

Global disruptions have increased the focus on supply chain resilience and diversification. Businesses seek MRO partners that ensure consistent product availability. This creates opportunities for distributors with robust and geographically diverse supply chains.

Customers increasingly prefer suppliers offering eco-friendly products and responsible operational practices. This trend influences purchasing decisions and pushes distributors to integrate sustainability into their offerings. This is one of the challenges and opportunities for Grainger competitors.

The MRO market is competitive, with various players vying for market share. Grainger's market share in North America and globally is significant, but it faces challenges from both traditional and online competitors. Adapting to these market dynamics is crucial for sustained growth.

Grainger's business model is challenged by the need to maintain its competitive edge against agile online competitors. Intensified price competition and specialized niche distributors pose threats. However, significant opportunities exist for Grainger to expand digital services and penetrate emerging markets.

- Digital Expansion: Leveraging its strong brand to expand digital services and e-procurement solutions.

- Market Penetration: Further penetrating emerging markets and expanding product offerings.

- Product Portfolio: Expanding into high-growth areas like sustainable MRO products and advanced safety solutions.

- Operational Efficiency: Improving operational efficiency to meet customer expectations for faster service.

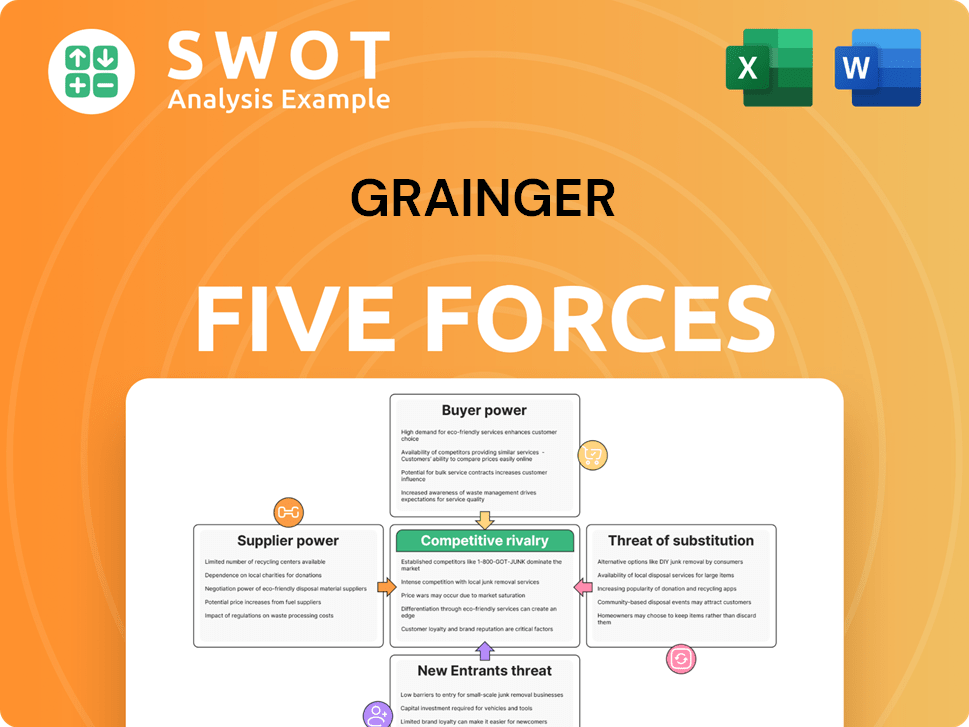

Grainger Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Grainger Company?

- What is Growth Strategy and Future Prospects of Grainger Company?

- How Does Grainger Company Work?

- What is Sales and Marketing Strategy of Grainger Company?

- What is Brief History of Grainger Company?

- Who Owns Grainger Company?

- What is Customer Demographics and Target Market of Grainger Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.