Grainger Bundle

Who Really Controls Grainger?

Understanding Grainger's ownership is key to unlocking its future. From its humble beginnings in 1927, Grainger company has grown into a $40+ billion powerhouse. This analysis delves into the intricate web of shareholders and stakeholders that shape the company's trajectory. This deep dive will explore the evolution of Grainger ownership, from its founder's vision to its current status as a publicly traded giant.

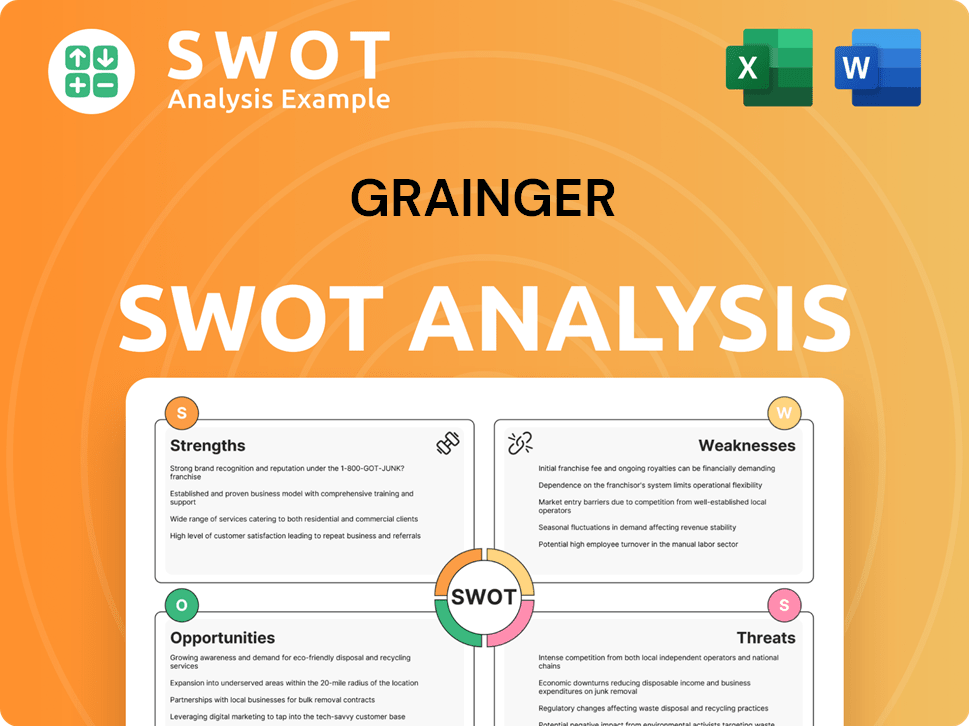

The evolution of Grainger company from a small business to a Fortune 500 leader is a testament to its strategic adaptability and market dominance. Exploring the ownership structure provides critical insights into Grainger's strategic direction, performance, and future prospects. Learn more about the company's strengths and weaknesses with a comprehensive Grainger SWOT Analysis. This examination of W.W. Grainger Inc, its Grainger stock, and the influence of its major shareholders will provide a complete understanding of its governance.

Who Founded Grainger?

The origins of the Grainger company trace back to 1927, when William W. Grainger established the business. Initially, the company began as a wholesale distributor of electric motors, operating from a modest office in Chicago, Illinois.

During the initial years, William W. Grainger held the primary ownership and control of the company. This reflected his role as the founder and sole proprietor, establishing the foundation for what would become a significant player in the MRO (Maintenance, Repair, and Operations) industry.

Specific details about the initial equity distribution are not readily available in public records, which is typical for privately held businesses of that era. However, it is understood that William W. Grainger's vision and leadership were central to the company's early direction and growth.

William W. Grainger held the predominant shareholding in the company's early years.

The company started as a wholesale distributor of electric motors.

The company's initial operations were based in Chicago, Illinois.

There is no widely publicized information regarding significant early backers or angel investors.

Early agreements would have likely centered on the operational aspects of a burgeoning distribution business.

No notable early ownership disputes or buyouts have been widely reported.

The early history of Grainger ownership

and Grainger company

is characterized by the strong leadership of William W. Grainger. The company's initial focus on electric motors and its establishment in Chicago laid the groundwork for its future expansion. While specific details on early investors are limited, the founder's vision was paramount. Today, understanding the company's history helps in analyzing its current structure and future prospects, including aspects like Grainger stock

and the influence of Grainger executives

.

- William W. Grainger founded the company in 1927.

- The company started as a wholesale distributor of electric motors.

- William W. Grainger held the primary ownership in the early years.

- The company's initial operations were based in Chicago, Illinois.

Grainger SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Grainger’s Ownership Changed Over Time?

The transformation of the ownership structure of the [Company Name], now known as [Company Name], began with its initial public offering (IPO) in 1967. This pivotal event marked a shift from private to public ownership, enabling broader investment opportunities and introducing a diverse group of shareholders. Before the IPO, ownership was concentrated, but the public offering opened the doors for institutional and individual investors to participate in the company's growth. This transition was a critical step in the company's evolution, setting the stage for its future expansion and market presence.

Following the IPO, the ownership of [Company Name] has largely been dominated by institutional investors. These entities, including asset management firms, mutual funds, and index funds, collectively hold a significant portion of the company's outstanding shares. This shift has influenced the company's strategic direction and governance, emphasizing shareholder value and requiring transparent financial reporting. The influence of major institutional investors has led to increased scrutiny and engagement, shaping the company's approach to financial performance and long-term strategy. The details of these ownership changes are regularly disclosed in the company's filings with the Securities and Exchange Commission (SEC), specifically in its 10-K annual reports and DEF 14A proxy statements.

| Ownership Milestone | Year | Impact |

|---|---|---|

| IPO on NYSE | 1967 | Transition to public ownership, increased shareholder base. |

| Institutional Investor Growth | Ongoing | Dominance of institutional investors, influence on strategy. |

| SEC Filings | Annually | Transparency and regulatory compliance regarding ownership. |

As of early 2025, the major shareholders of [Company Name] include prominent institutional investors. The Vanguard Group holds a substantial stake, often exceeding 8-10% of the outstanding shares. BlackRock, Inc. typically holds a comparable percentage. State Street Corporation and various mutual funds and index funds also hold significant positions. These institutional holdings collectively represent a significant majority of [Company Name]'s ownership, often ranging from 75% to 85% of the total shares. Individual insider ownership, including current and former executives and board members, is typically less than 1-2%. Understanding who owns [Company Name] is essential for investors and stakeholders. For more insights into the company's financial operations, consider exploring Revenue Streams & Business Model of Grainger.

The evolution of [Company Name]'s ownership reflects its journey from a private entity to a publicly traded corporation, with institutional investors playing a major role.

- The IPO in 1967 marked a significant shift, opening the door for public investment.

- Institutional investors, such as The Vanguard Group and BlackRock, hold substantial stakes.

- The focus on shareholder value and transparent reporting has increased due to institutional influence.

- Ownership details are regularly disclosed in SEC filings.

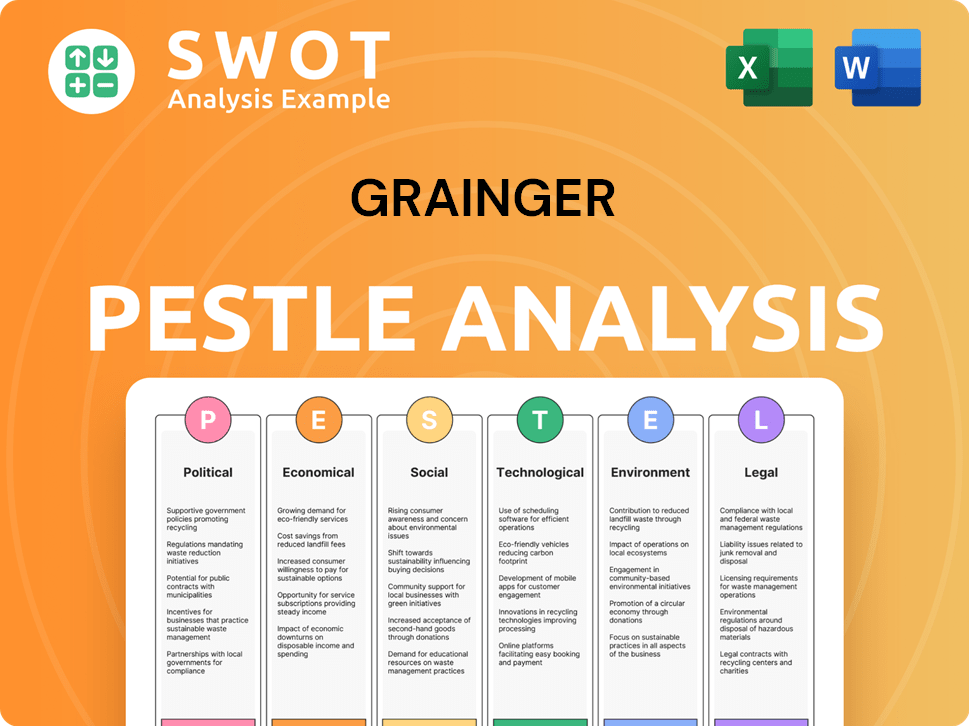

Grainger PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Grainger’s Board?

As of early 2025, the Board of Directors of the Grainger company includes a blend of independent directors and executives. This structure supports corporate governance. The board's composition and its oversight role are detailed in Grainger's annual proxy statements. These statements provide insights into the relationship between the board, ownership, and decision-making processes within the company. Information about the current Grainger's board of directors is available in the company's investor relations materials.

Grainger's board is accountable to a diverse shareholder base, including large institutional investors. While there aren't recent reports of proxy battles, the presence of significant institutional investors ensures the board's accountability. The company operates under a one-share-one-vote structure, ensuring voting power aligns with share ownership. This structure is a standard practice for public companies, ensuring that each share of common stock generally entitles its holder to one vote on matters brought before shareholders. This approach promotes transparency and fairness in shareholder voting.

| Board Member | Title | Year Joined Board |

|---|---|---|

| D.G. Macpherson | Chairman and CEO | 2016 |

| William J. Bares | Lead Independent Director | 2013 |

| M. Susan Chambers | Director | 2015 |

Grainger's commitment to a one-share-one-vote structure is a key aspect of its corporate governance. This structure means that voting power is directly proportional to the number of shares owned. This is a standard practice among publicly traded companies. This approach ensures that voting power is directly proportional to the number of shares owned. There are no reports of dual-class shares or special voting rights that would grant outsized control to specific entities. The company's approach to shareholder voting reflects a commitment to fair and transparent governance practices.

Grainger's Board of Directors includes independent directors and executives, supporting good governance.

- The company operates under a one-share-one-vote structure.

- Large institutional investors influence board decisions.

- Details are available in annual proxy statements.

- The board is accountable to a diverse shareholder base.

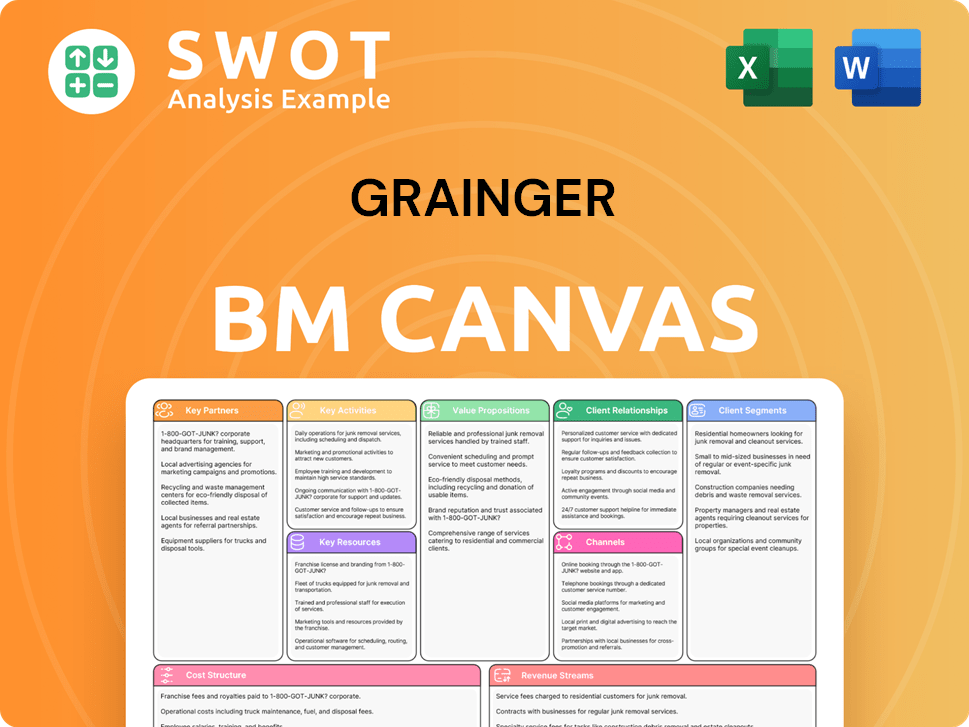

Grainger Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Grainger’s Ownership Landscape?

Over the past few years (2022-2025), the ownership structure of the Grainger company has remained relatively stable, primarily characterized by substantial institutional holdings. While there might be minor shifts due to share buybacks or secondary offerings, there haven't been major events that have significantly altered the overall ownership distribution. Leadership transitions, such as changes in CEO roles, have occurred, but these haven't fundamentally changed the ownership structure.

A common trend among well-established public companies like Grainger is the increasing concentration of ownership among large institutional investors and passive index funds. This can lead to greater stability in the shareholder base. It can also lead to increased scrutiny from these entities regarding ESG (Environmental, Social, and Governance) factors and long-term strategic performance. Grainger's public communications and analyst reports continue to emphasize operational efficiency, market expansion, and shareholder returns. These priorities reflect the interests of its largely institutional ownership base. There have been no public announcements or strong indications from the company or analysts about potential privatization or significant founder dilution.

| Metric | Value (Approximate) | Source |

|---|---|---|

| Market Capitalization (as of early 2024) | Around $40 Billion | Financial News Sources |

| Institutional Ownership (as of late 2024) | Approximately 85% | Financial News Sources |

| Revenue (2023) | Around $16.6 Billion | Company Filings |

The company's focus remains on delivering value to its shareholders, which is typical for a company with its ownership profile. For those interested in learning more about the competitive landscape, consider exploring the Competitors Landscape of Grainger.

Grainger's ownership has shown stability in the past few years, with institutional investors holding a significant portion of the shares. This stability often reflects a mature company with a well-defined strategy. Changes in leadership have not fundamentally shifted the ownership dynamics.

Large institutional investors significantly influence Grainger's strategic direction. These investors often prioritize long-term performance, ESG factors, and shareholder value. The company's focus on operational efficiency and market expansion aligns with these priorities.

Grainger's market capitalization is substantial, reflecting its size and market position. The company's revenue continues to be significant, demonstrating its ongoing success. Institutional ownership remains high, indicating confidence from major investors.

The company is expected to maintain its focus on shareholder value and strategic growth. No major ownership changes or privatization plans have been announced. Grainger's financial performance and market position are key indicators of its future.

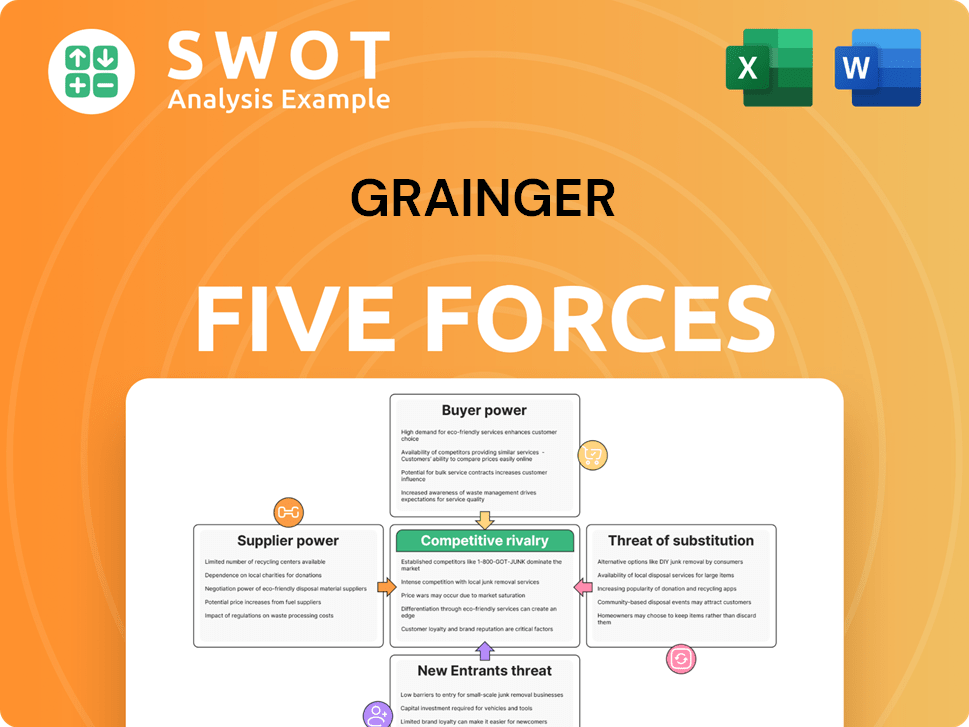

Grainger Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Grainger Company?

- What is Competitive Landscape of Grainger Company?

- What is Growth Strategy and Future Prospects of Grainger Company?

- How Does Grainger Company Work?

- What is Sales and Marketing Strategy of Grainger Company?

- What is Brief History of Grainger Company?

- What is Customer Demographics and Target Market of Grainger Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.