Grainger Bundle

How Does Grainger Keep the World Running?

W.W. Grainger, Inc. is a powerhouse in the industrial supply sector, but how does the Grainger SWOT Analysis reveal its inner workings? As a leading distributor of maintenance, repair, and operating (MRO) products, Grainger keeps businesses and institutions operational across North America, Japan, and the United Kingdom. With over 4.5 million customers and a vast product catalog, understanding the

Grainger's impressive $17.2 billion revenue in 2024 highlights its significance in the market, offering insights into

What Are the Key Operations Driving Grainger’s Success?

The Grainger company creates value through two main business models: High-Touch Solutions and Endless Assortment. These models cater to different customer needs, from large businesses with complex requirements to smaller customers seeking streamlined online purchasing. This dual approach allows Grainger to serve a broad market, offering a wide range of products and services tailored to specific customer segments.

The High-Touch Solutions model focuses on providing comprehensive services to larger customers. This includes technical support, inventory management, and curated digital experiences. The Endless Assortment model, exemplified by Zoro.com and MonotaRO.com, offers a vast selection of products online, appealing to customers who prefer a self-service, digital purchasing experience. Both models are supported by a robust supply chain and extensive distribution network.

The core of Grainger's business operations involves an extensive supply chain and a vast distribution network. This network includes over 30 distribution centers and 600 branches across the U.S. and Canada. The company maintains strong relationships with over 5,000 primary suppliers, ensuring a steady flow of over 2 million MRO products and services. This integrated approach enables Grainger to offer a 'one-stop-shop' experience, ensuring reliable delivery and exceptional customer service.

Serves large to mid-sized customers with complex operational needs. Provides approximately 2 million MRO products and services. Focuses on value-added solutions, technical support, and inventory management, improving productivity and reducing costs for customers.

Caters to smaller customers with streamlined online purchasing. Includes Zoro.com and MonotaRO.com. Offers an expansive product assortment—over 14 million products on Zoro.com and over 24 million on MonotaRO.com. Provides a transparent online relationship.

Includes over 30 distribution centers and 600 branches across the U.S. and Canada. Enables efficient and quick product delivery. Supports both High-Touch Solutions and Endless Assortment models. Ensures products reach customers promptly.

Maintains strong relationships with over 5,000 primary suppliers. Ensures a steady supply of over 2 million MRO products. Supports the wide range of products offered by Grainger. Is crucial for the company's ability to meet customer demands.

Grainger's unique approach combines extensive product offerings, efficient distribution, and advanced e-commerce capabilities with strong customer relationships and technical expertise. This integrated strategy allows the company to provide a comprehensive solution for MRO supplies. This approach translates into reduced complexity, improved inventory management, and access to specialized technical support for customers. Learn more about the Marketing Strategy of Grainger.

- Extensive Product Selection: Over 14 million products on Zoro.com.

- Efficient Distribution: Over 600 branches across the U.S. and Canada.

- Advanced E-commerce: Streamlined online ordering process.

- Customer Relationships: Strong focus on customer service and technical support.

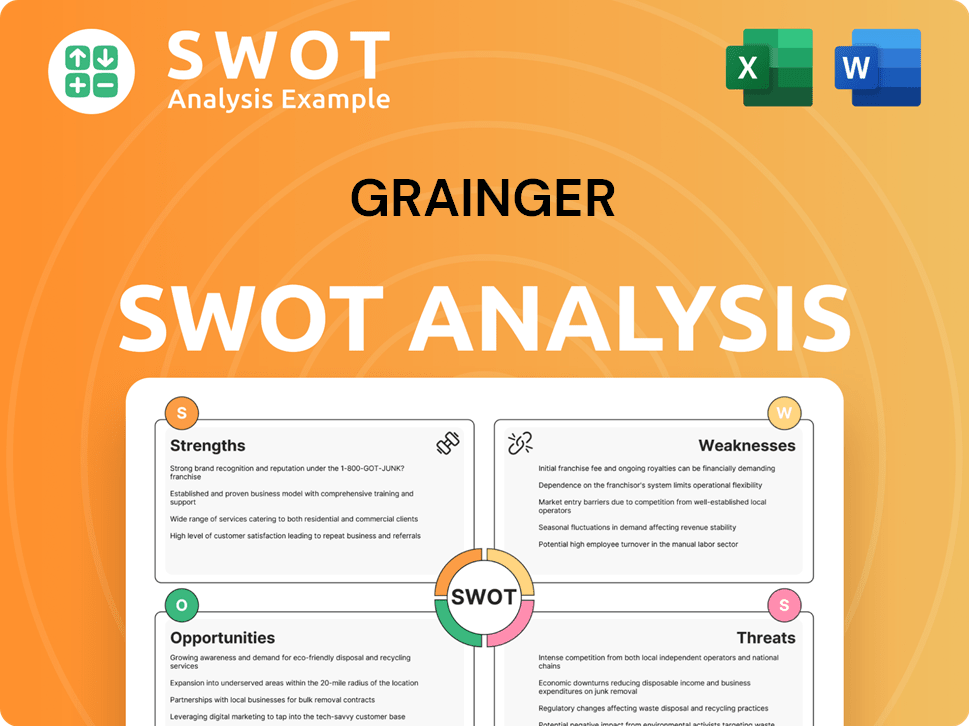

Grainger SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Grainger Make Money?

The Grainger company generates revenue primarily through the sale of maintenance, repair, and operating (MRO) products and services. In 2024, the company's total revenue reached a substantial $17.2 billion. This revenue stream is diversified across two main business models, reflecting the company's strategic approach to meet diverse customer needs.

The company's revenue model is strategically divided to cater to different customer segments. The High-Touch Solutions segment focuses on larger customers, offering value-added services. The Endless Assortment segment, which includes online platforms like Zoro.com and MonotaRO.com, caters to a broader market through high-volume online sales.

The company's financial performance reflects its revenue model's effectiveness. The gross profit margin for the full year 2024 was 39.4%, maintaining a consistent level compared to the previous year. The company's ability to maintain profitability while navigating market dynamics is notable.

This segment primarily serves larger customers and focuses on providing value-added MRO solutions. It includes product sales, technical support, and inventory management services. In 2024, this segment contributed $13.7 billion to the total revenue.

The Endless Assortment segment, including Zoro.com and MonotaRO.com, focuses on high-volume online sales. It offers a vast array of products with an easy online search experience. This segment generated $3.1 billion in revenue in 2024.

This category includes businesses like Cromwell in the U.K. contributing an additional $0.4 billion to the total revenue in 2024. These businesses add to the overall diversification of the company's revenue streams.

The company employs competitive pricing strategies to maintain its market share and profitability. This approach ensures that the company remains competitive in the market while meeting customer needs.

Volume-based initiatives are another key strategy used by the Grainger business to drive sales and maintain profitability. These initiatives help in optimizing sales volume and enhancing customer relationships.

Despite near-term margin headwinds, the long-term margin outlook remains positive due to operating leverage and productivity gains. This suggests that the company is well-positioned for sustained profitability.

For 2025, the company anticipates net sales between $17.6 billion and $18.1 billion. The projected gross profit margin is expected to be between 39.1% and 39.4%, with an operating margin ranging from 15.1% to 15.5%. The Grainger company's ability to maintain and grow its revenue streams is a key indicator of its success. To understand more about the company's journey, you can read a Brief History of Grainger.

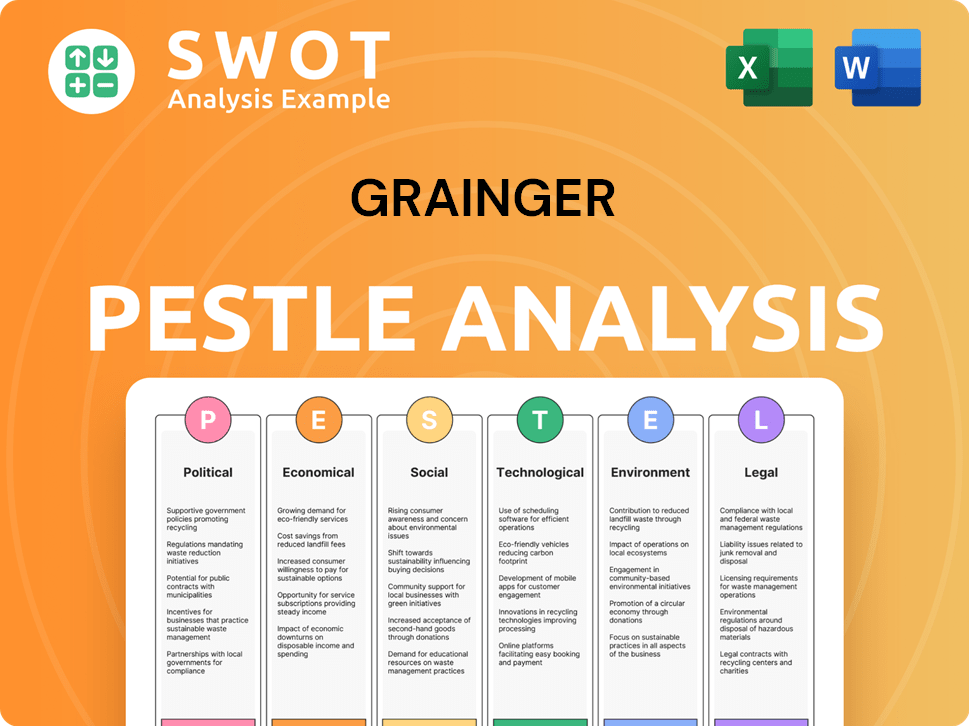

Grainger PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Grainger’s Business Model?

The journey of the Grainger company has been marked by strategic investments and adaptations, solidifying its strong position in the Maintenance, Repair, and Operations (MRO) industry. A significant strategic move has been the heavy investment in technology and e-commerce solutions, which has proven to be a key competitive advantage. This digital transformation has enabled Grainger to enhance its customer experience through improved product knowledge and deeper customer understanding.

Grainger's operational strategies have evolved to meet challenges, such as global supply chain disruptions. These strategies focused on improving product availability and next-day order completion capabilities. These efforts have significantly differentiated Grainger from its competitors. The company has built robust e-commerce platforms like Grainger.com, Zoro.com, and MonotaRO.com, which are central to its High-Touch and Endless Assortment business models.

Grainger's competitive advantages are multifaceted. Its extensive product offering, with over 30 million products globally, caters to diverse customer needs. The company's vast distribution network, comprising numerous distribution centers and branches across North America, Japan, and the UK, ensures efficient product delivery. Furthermore, Grainger's strong brand reputation, established since its founding in 1927, and its focus on exceptional customer service and technical expertise contribute significantly to its competitive edge. The company also benefits from economies of scale and strong supplier relationships, allowing for competitive pricing and high product quality. For a deeper dive into Grainger's strategic growth, consider reading about the Growth Strategy of Grainger.

Grainger has a long history, starting in 1927. Over the years, it has expanded its product offerings and distribution network. The company has consistently adapted to technological advancements and customer needs.

Significant investments in e-commerce platforms and digital solutions. Focus on improving supply chain resilience and product availability. Expansion of its global presence through acquisitions and organic growth.

Extensive product catalog with over 30 million items. Robust distribution network with numerous locations. Strong brand reputation and focus on customer service and technical expertise.

In 2024, Grainger reported strong financial results, with sales growth driven by effective e-commerce strategies. The company continues to invest in its supply chain to enhance efficiency. Grainger focuses on sustainability initiatives, reflecting its commitment to environmental responsibility.

Grainger offers a comprehensive range of Grainger products, ensuring customers find what they need. Its extensive distribution network enables fast and reliable delivery, enhancing customer satisfaction. The company's strong supplier relationships and economies of scale allow for competitive pricing and high product quality.

- Extensive product catalog.

- Robust distribution network.

- Strong brand reputation.

- Focus on customer service.

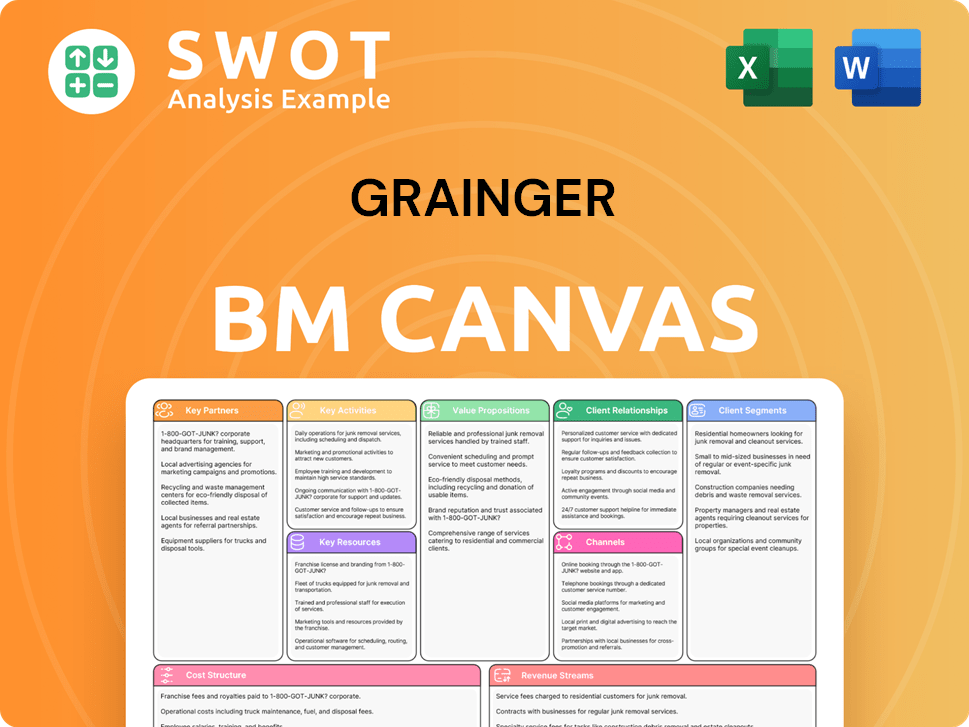

Grainger Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Grainger Positioning Itself for Continued Success?

The Grainger company holds a leading position in the Maintenance, Repair, and Operations (MRO) industry. It has a significant presence in North America, Japan, and the United Kingdom. The company serves over 4.5 million customers worldwide, highlighting its extensive global reach and customer loyalty. In 2024, Grainger reported revenues of $17.2 billion, demonstrating its strong market standing.

Its business model includes High-Touch Solutions and Endless Assortment, allowing it to cater to a broad customer base. However, the Grainger business faces several risks, including competition from online retailers, macroeconomic factors such as inflation, and supply chain disruptions. The company is actively addressing these challenges through strategic initiatives and investments to maintain and expand its market position.

Grainger is a leader in the fragmented MRO market, with a strong presence in key regions. It serves a vast customer base, reflecting its significant market share and customer loyalty. The company’s consistent revenue growth, reaching $17.2 billion in 2024, underscores its robust industry position.

The company faces risks from online competition, macroeconomic factors, and supply chain disruptions. Competition, particularly from online retailers, poses a challenge to margins and market share. Macroeconomic conditions like inflation and economic downturns can impact operating expenses and demand. Supply chain issues also present an ongoing risk.

Grainger is focused on expanding its leadership through strategic growth drivers and investments. These include developing advanced MRO solutions, differentiated sales and services, and expanding product assortment. The company projects net sales between $17.6 billion and $18.1 billion for 2025.

Grainger is investing in its business to support its growth objectives. Capital expenditures for 2025 are projected between $450 million and $550 million. The company aims to outperform the U.S. MRO market growth by 400-500 basis points annually in its High-Touch Solutions segment.

To maintain its industry leadership, Grainger is focusing on several key areas. These strategies are designed to strengthen the company's market position and drive future growth. For more insights, consider reading about Owners & Shareholders of Grainger.

- Developing advantaged MRO solutions.

- Offering differentiated sales and services.

- Expanding product assortment in the Endless Assortment segment.

- Investing in supply chain capacity expansion.

- Enhancing technology to improve operational efficiency.

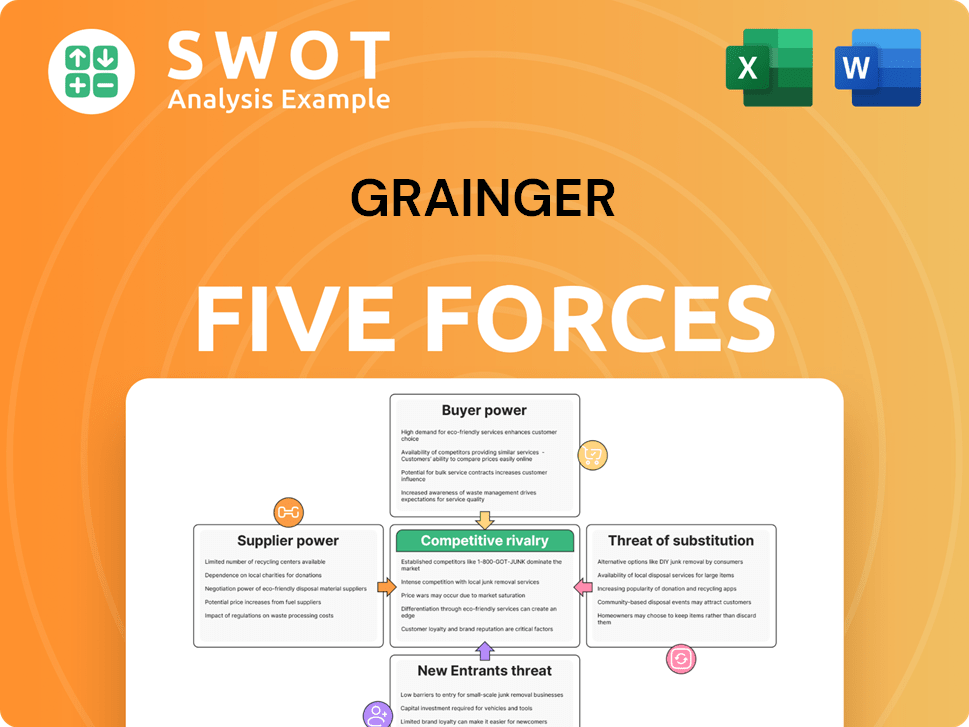

Grainger Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Grainger Company?

- What is Competitive Landscape of Grainger Company?

- What is Growth Strategy and Future Prospects of Grainger Company?

- What is Sales and Marketing Strategy of Grainger Company?

- What is Brief History of Grainger Company?

- Who Owns Grainger Company?

- What is Customer Demographics and Target Market of Grainger Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.