Grainger Bundle

Can Grainger Maintain Its Momentum in the Industrial Supply Market?

Founded in 1928, W.W. Grainger, Inc. has evolved from a small Chicago-based operation into a global leader in the MRO (maintenance, repair, and operating) products industry. With a market capitalization of $47.89 billion as of April 1, 2025, Grainger's journey reflects a remarkable success story. This analysis dives into Grainger's Grainger SWOT Analysis, growth strategies, and future prospects, offering actionable insights for investors and business strategists alike.

Grainger's commitment to being a key partner for businesses underscores its strategic direction for 2025, focusing on expanding its market leadership. Understanding Grainger's growth strategy involves examining its expansion plans, technological advancements, and financial performance within the industrial supply market. This comprehensive Grainger company analysis will explore Grainger's competitive advantages, including its digital transformation strategy and supply chain optimization, to assess its long-term growth potential and future investment opportunities.

How Is Grainger Expanding Its Reach?

The expansion initiatives of the company are primarily driven by organic growth, with a focus on enhancing its existing business models. The company's strategic plan involves significant investments in both its High-Touch Solutions segment and its Endless Assortment segment to capture growth opportunities within the industrial supply market. This approach is designed to strengthen its market position and capitalize on the evolving needs of its diverse customer base.

The company's growth strategy is centered around two primary business models: High-Touch Solutions and Endless Assortment. High-Touch Solutions caters to larger customers with complex requirements, while Endless Assortment focuses on smaller customers through digital channels. This dual approach allows the company to address a broad spectrum of customer needs and market segments, contributing to its overall growth and market share analysis.

The company's future prospects are closely tied to its ability to execute these expansion initiatives effectively. By focusing on organic growth, improving its digital capabilities, and optimizing its supply chain, the company aims to achieve sustainable growth and enhance its long-term growth potential. For further insights, you can explore the perspectives of Owners & Shareholders of Grainger.

The High-Touch Solutions segment targets larger customers with complex needs. The company aims for a 6-8% Compound Annual Growth Rate (CAGR) by 2025. This segment is focused on expanding its sales force and improving sales coverage to support this growth.

The Endless Assortment segment targets smaller customers through digital channels. The company aims for high-teens sales growth in local currency for both Zoro and MonotaRO through 2025. This segment focuses on gaining new customers and expanding product assortments.

The company is heavily investing in improving its e-commerce capabilities. Approximately 70% of revenue in the High-Touch Solutions segment already comes through digital channels. This digital transformation strategy is crucial for supporting both business models.

The company is adding 3.5 million square feet to its supply chain network. This includes a 535,000-square-foot distribution center in Gresham, Oregon, and a 1.2 million-square-foot distribution center near Houston. These investments are designed to improve order fulfillment.

The company's expansion plans include significant investments in its sales force, digital platforms, and supply chain infrastructure. These initiatives are designed to support both the High-Touch Solutions and Endless Assortment segments, driving overall growth and enhancing its competitive advantages. These strategic moves are critical for Grainger's long-term growth potential.

- Expanding the sales force to improve sales coverage.

- Enhancing e-commerce capabilities to support digital channels.

- Adding new distribution centers to optimize the supply chain.

- Focusing on customer acquisition and repeat purchase rates.

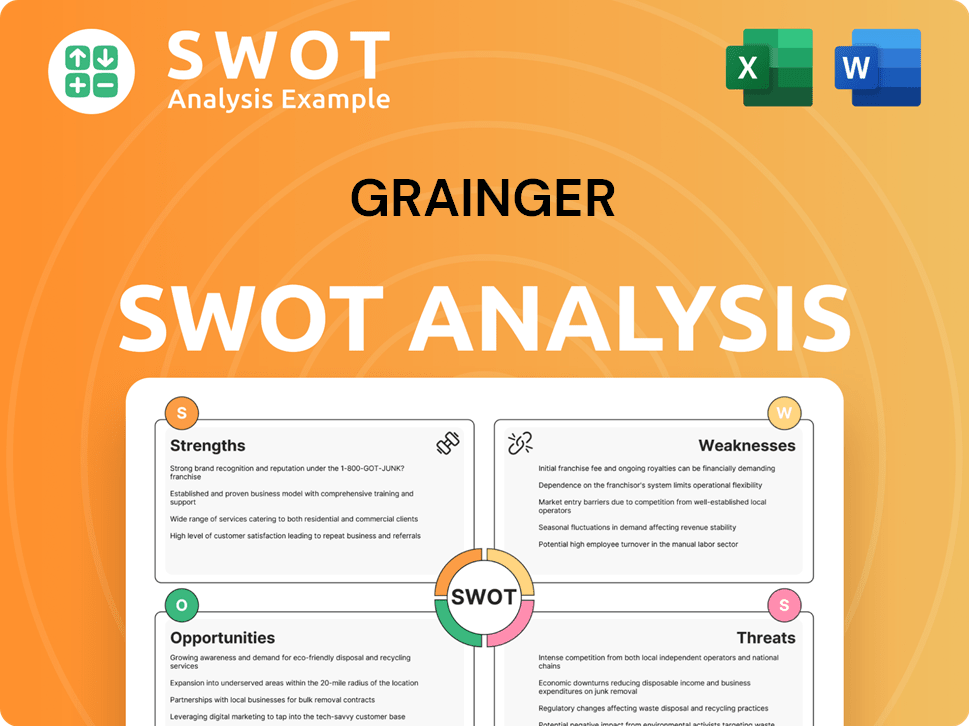

Grainger SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Grainger Invest in Innovation?

The company is actively leveraging technology and innovation to drive sustained growth, with a strong focus on digital transformation. This approach is central to its overall Grainger growth strategy, aiming to enhance efficiency and customer service within the industrial supply market.

A key aspect of this strategy involves significant investments in data and technology capabilities. These investments support the company's strategic growth engines, enabling it to better serve its customers and maintain a competitive edge. The company's Grainger future prospects are closely tied to its ability to adapt and innovate in a rapidly evolving market.

The company's initiatives are designed to reinforce its leadership position in the MRO (Maintenance, Repair, and Operations) industry. Its strategic plan includes a focus on digital transformation and customer experience improvements. For a deeper understanding of the company's foundational principles, you can explore the Mission, Vision & Core Values of Grainger.

The company has invested heavily in building market-leading data and technology capabilities. This includes proprietary product and customer information systems. These systems are crucial for storing, codifying, and scaling data assets.

A significant focus is on expanding artificial intelligence (AI) applications. The company uses its proprietary data to explore new ways to boost revenue, improve efficiency, and enhance customer service. This involves developing in-house machine learning models and data tools.

Enhancing the online customer experience is a key part of the digital transformation. This includes personalized product recommendations and streamlined ordering processes. The development of mobile apps and digital tools is also a priority.

The company is leveraging computer vision in its KeepStock program to streamline the installation process. This application of technology improves efficiency and customer service. This is a specific example of innovation in industrial supplies.

Investment in advanced analytics and AI is aimed at optimizing pricing and inventory management. These tools help the company manage its resources more effectively. This contributes to Grainger's market share analysis and overall financial performance.

The development of mobile apps and other digital tools is a key element. These tools are designed to improve customer engagement and accessibility. This aligns with Grainger's e-commerce strategy and expansion plans.

The company's technological advancements are critical for achieving its growth objectives. These advancements reinforce its leadership in the MRO industry. They also enable the company to better serve its customers and adapt to changing market dynamics.

- Proprietary Systems: Development of Product Information Management (PIM) and Customer Information Management (CIM) systems.

- AI Applications: Implementation of in-house machine learning models and data tools.

- Customer Experience: Enhancements through personalized recommendations and streamlined ordering.

- Mobile and Digital Tools: Development of mobile apps to improve customer engagement.

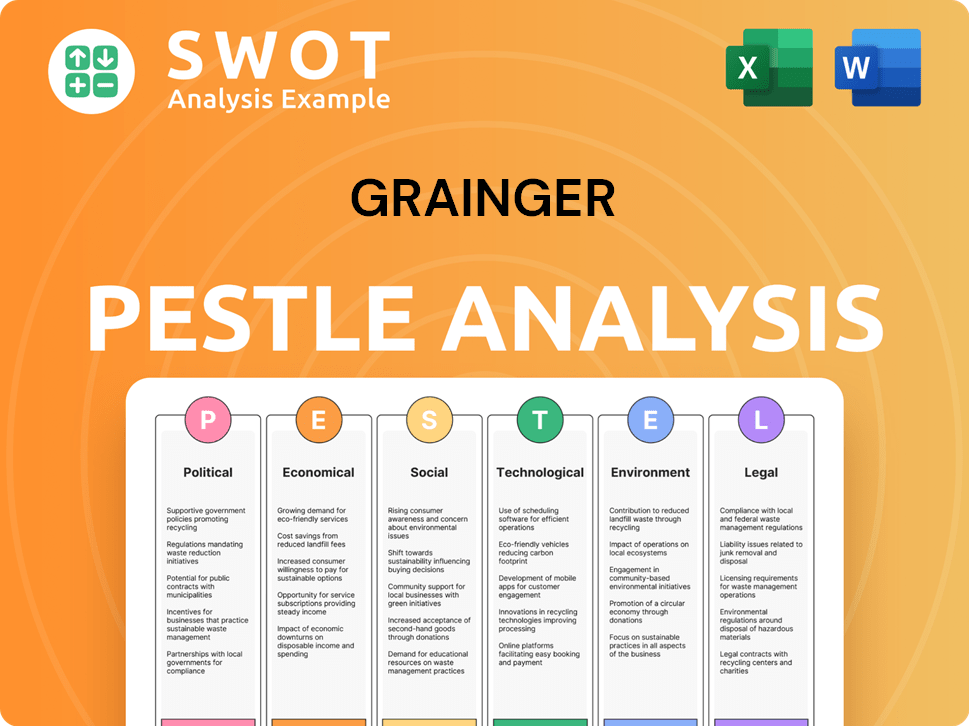

Grainger PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Grainger’s Growth Forecast?

In 2024, the company demonstrated robust financial health, with revenues reaching $17.2 billion, marking a 4.2% increase year-over-year. This performance reflects the strength of its business model and its ability to navigate the industrial supply market. A comprehensive Marketing Strategy of Grainger reveals insights into the company's approach to customer acquisition and market positioning.

The company's financial results for the first quarter of 2025 further illustrate its solid standing. Sales for Q1 2025 were reported at $4.3 billion, a 1.7% increase compared to Q1 2024. The company's ability to maintain and grow its revenue streams underscores its resilience and strategic planning.

The company's commitment to enhancing its supply chain and technological capabilities is evident in its planned capital expenditures for 2025, which are expected to range from $450 million to $550 million. These investments are crucial for supporting the company's expansion plans and maintaining its competitive advantages within the industrial supply market.

For the first quarter of 2025, Grainger reported sales of $4.3 billion, up 1.7% from Q1 2024. Diluted earnings per share (EPS) were $9.86, reflecting a 2.5% increase compared to the first quarter of 2024. The company's consistent performance demonstrates its strong market position and effective business development strategies.

In Q1 2025, the gross profit margin was 39.7%, an increase of 30 basis points from Q1 2024. The operating margin for the same period was 15.6%. These figures highlight the company's efficiency in managing costs and maintaining profitability, key aspects of Grainger's strategic plan.

The company anticipates net sales to be between $17.6 billion and $18.1 billion, representing a growth of 2.7% to 5.2%. Daily, constant currency sales growth is expected to be between 4.0% and 6.5%. These projections reflect the company's positive outlook and its ability to capitalize on industrial supply market opportunities.

For 2025, the gross profit margin is projected to be between 39.1% and 39.4%, while the operating margin is expected to be between 15.1% and 15.5%. These forecasts indicate the company's continued focus on maintaining profitability and efficiency in its operations.

Diluted earnings per share for 2025 are forecasted to be between $39.00 and $41.50. This projection demonstrates the company's confidence in its ability to generate strong earnings and deliver value to shareholders, reflecting its long-term growth potential.

Grainger anticipates operating cash flow to be between $2.05 billion and $2.25 billion in 2025. This strong cash flow position supports the company's investments in supply chain optimization and technology enhancements, key elements of the company's digital transformation strategy.

Capital expenditures for 2025 are expected to range from $450 million to $550 million. These investments are primarily focused on expanding supply chain capacity and improving technology, which are critical for supporting Grainger's growth strategy.

The company plans to return excess capital to shareholders through share repurchases, projected to be between $1.15 billion and $1.25 billion in 2025. Consistent annual dividend increases also contribute to shareholder value, reflecting Grainger's commitment to its investors.

While not explicitly detailed in the financial outlook, the company's investments in supply chain and technology likely support sustainability initiatives. These initiatives are increasingly important for long-term growth and competitive advantage.

The company's financial performance and future prospects are influenced by economic trends, including inflation, interest rates, and overall industrial activity. Grainger's ability to adapt to these trends will be crucial for maintaining its financial health.

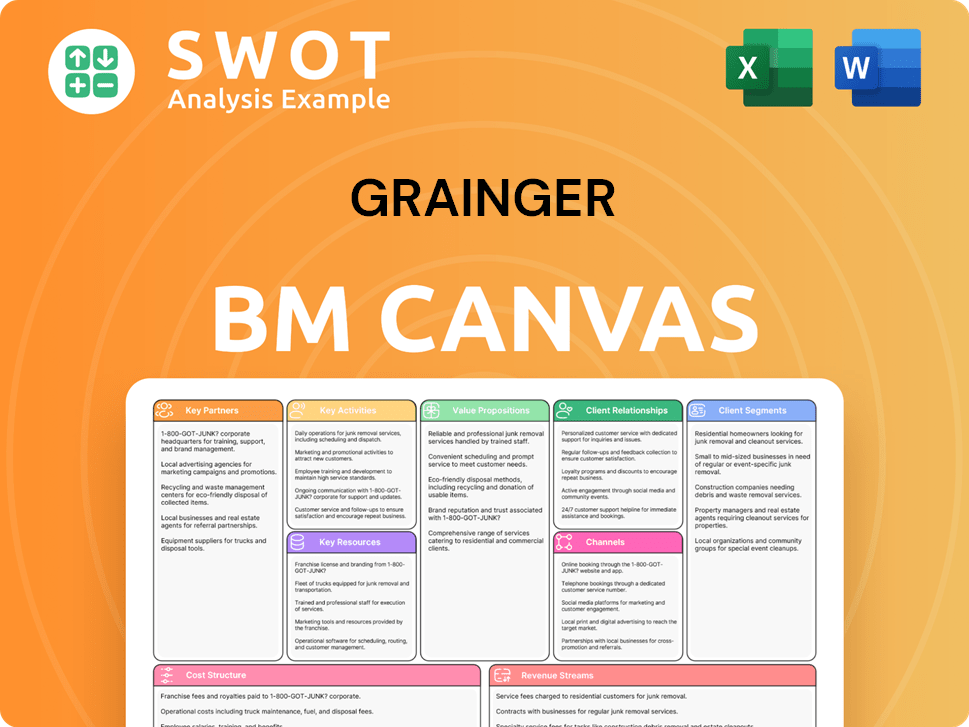

Grainger Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Grainger’s Growth?

The future prospects of the company, and its overall growth strategy, are subject to several potential risks and obstacles. The industrial supply market is highly competitive, with various players vying for market share. Moreover, macroeconomic factors, technological disruptions, and regulatory changes pose significant challenges that could impact the company's performance.

The company must navigate these challenges to maintain its position and achieve its growth objectives. Effective risk management and strategic adaptation are crucial for ensuring sustainable growth. Understanding these potential pitfalls is essential for a comprehensive company analysis.

Competition in the industrial supply market is fierce, with rivals ranging from manufacturers selling directly to internet-based businesses. To maintain its competitive edge, the company must continuously adapt to technological advancements and e-commerce trends. This dynamic environment requires a robust business development plan.

The company faces competition from various sources, including direct manufacturers, wholesale distributors, retailers, and online platforms. Continuous adaptation to technological advancements and e-commerce trends is critical. The ability to differentiate through service and business models is key.

Economic downturns, recessions, and inflation can reduce demand for MRO products, impacting financial results. High inflation can affect margins and consumer spending. Effective cost and pricing management is crucial to mitigate these risks.

Supply chain disruptions, stemming from natural disasters, geopolitical events, or labor shortages, can affect product availability and increase costs. The company mitigates these risks through a diversified supplier base and inventory management. In 2024, supply chain issues continue to pose challenges.

The company's increasing reliance on e-commerce platforms exposes it to online payment fraud and changes in digital marketing effectiveness. Cybersecurity threats are also an emerging risk. Continuous investment in digital infrastructure and security is necessary.

Changes in environmental and social regulations could increase compliance costs and affect the company's reputation. Tariff uncertainties, as mentioned in the 2025 guidance, could impact cost management. Pricing actions and supplier negotiations are strategies to mitigate these risks.

Economic trends significantly influence the demand for industrial supplies. The company’s financial performance is closely tied to the overall economic health. Understanding and adapting to these trends is crucial for long-term success.

The company operates in a highly competitive market. Understanding the Competitors Landscape of Grainger is essential to assess its strategic positioning and potential challenges. The company's ability to adapt to market dynamics is key.

Analyzing financial performance is crucial for understanding the impact of these risks. Factors like revenue growth, profit margins, and operational efficiency are key indicators. The company's financial health is directly influenced by its ability to manage risks effectively.

The strategic plan must address these potential risks. It should include measures to mitigate supply chain disruptions, adapt to technological changes, and manage macroeconomic impacts. Proactive planning is essential for ensuring long-term growth. In 2024, the company is focusing on these strategies.

A thorough market analysis helps identify potential risks and opportunities. Understanding market trends, customer behavior, and competitive dynamics is essential. This analysis informs the company’s strategic decisions and expansion plans.

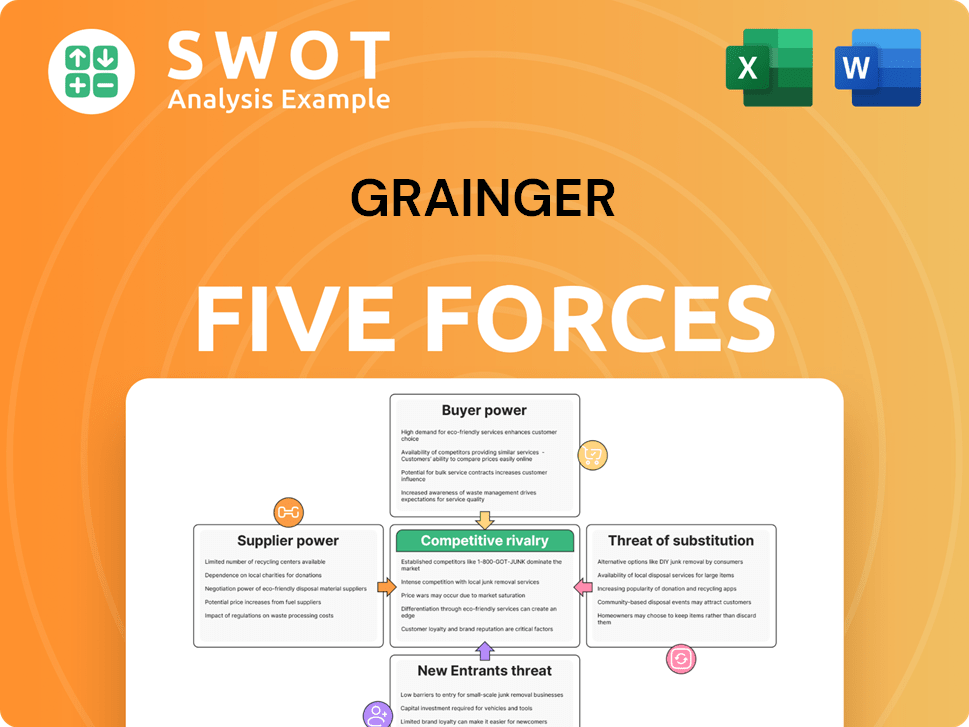

Grainger Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Grainger Company?

- What is Competitive Landscape of Grainger Company?

- How Does Grainger Company Work?

- What is Sales and Marketing Strategy of Grainger Company?

- What is Brief History of Grainger Company?

- Who Owns Grainger Company?

- What is Customer Demographics and Target Market of Grainger Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.