GS Retail Bundle

How Does GS Retail Stack Up in South Korea's Retail Arena?

The South Korean retail sector is a whirlwind of innovation, and GS Retail is right in the thick of it. With online-to-offline (O2O) services reshaping the game, understanding the GS Retail SWOT Analysis is more crucial than ever. This dynamic landscape demands a keen understanding of the players and the strategies that define success. GS Retail, a major player, has evolved significantly since its beginnings.

To truly grasp GS Retail's position, we'll delve into its competitive landscape, dissecting its market share analysis and comparing its financial performance against key GS Retail competitors. This GS Retail market analysis will reveal the company's strategic moves, including its business strategy and how it navigates the ever-changing GS Retail industry. We'll also explore GS Retail's competitive advantages and disadvantages, providing actionable insights for investors and strategists alike, helping to understand the future growth potential.

Where Does GS Retail’ Stand in the Current Market?

GS Retail holds a prominent position within the South Korean retail sector, particularly in the convenience store and supermarket segments. As of early 2024, its flagship convenience store brand, GS25, is a market leader, often competing closely with CU for the top spot. GS Retail's market presence is substantial, with its convenience stores and supermarkets strategically located across the country, ensuring high accessibility for consumers. This widespread presence is a key factor in its competitive edge.

GS Retail's core operations revolve around convenience stores (GS25) and supermarkets (GS THE FRESH), offering a wide array of products, including consumer goods, fresh produce, ready-to-eat meals, and various services. The company has strategically invested in digital transformation, expanding its online platforms and integrating them with its offline stores to offer seamless O2O experiences. This approach enhances customer engagement and loyalty, contributing to its sustained market strength. For a deeper dive into the company's origins, consider reading the Brief History of GS Retail.

GS Retail's value proposition centers on convenience, accessibility, and a diverse product range, catering to the evolving needs of South Korean consumers. The company consistently adapts to market trends, enhancing its offerings with premium products and digital services. This focus on customer satisfaction and operational efficiency supports its strong financial performance and market position.

GS25 consistently maintains a dominant share in the convenience store market. While specific figures fluctuate, GS25 often holds more than 30% of the market share in terms of store count and sales revenue. This strong position makes GS Retail a key player in the GS Retail competitive landscape.

GS Retail has heavily invested in digital transformation, expanding its online platforms and integrating them with its offline stores. This includes strengthening delivery services and developing mobile applications. These initiatives enhance customer engagement and loyalty, supporting the company's business strategy.

In the first quarter of 2024, GS Retail reported strong performance, with its convenience store division showing consistent growth in sales and operating profit. This underscores its resilience in a competitive market and reflects positively on its financial performance comparison.

GS Retail has a strong nationwide presence across South Korea, with thousands of GS25 stores permeating urban and rural areas. This extensive network ensures high accessibility for consumers, supporting its market analysis and overall retail industry trends.

GS Retail's market position is characterized by its strong presence in the convenience store sector and a growing focus on digital integration. The company's strategic moves include expanding its online platforms and enhancing its premium offerings. This approach aims to cater to evolving consumer demands and maintain a competitive edge in the GS Retail industry.

- Dominant market share in convenience stores, often exceeding 30%.

- Significant investments in digital transformation and O2O experiences.

- Focus on enhancing premium offerings and catering to evolving consumer preferences.

- Strong financial performance, with consistent growth in sales and operating profit.

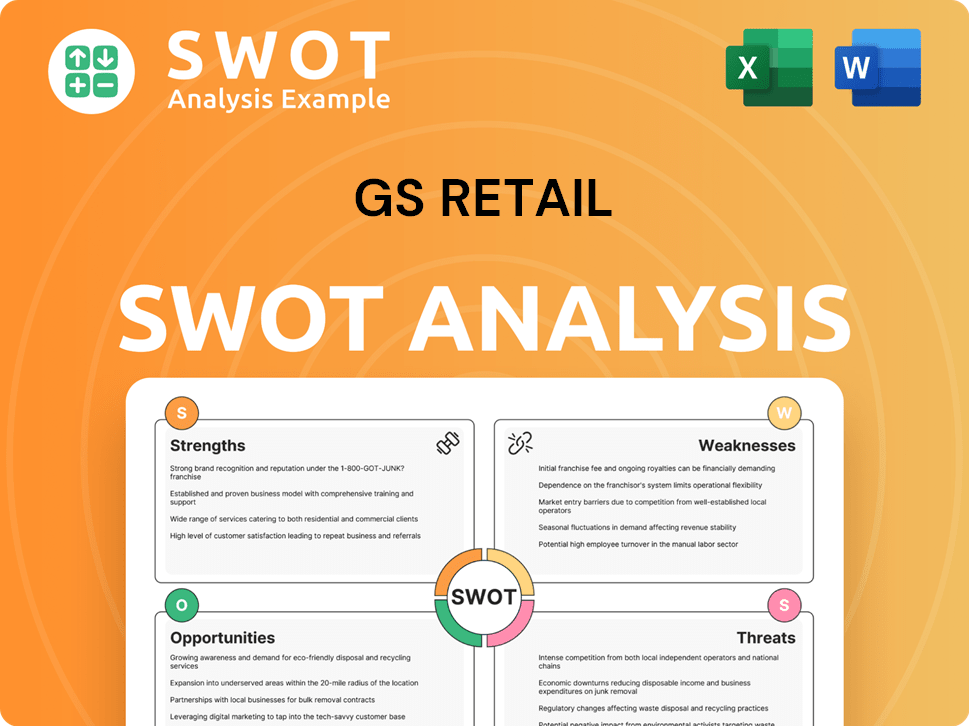

GS Retail SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging GS Retail?

The Marketing Strategy of GS Retail is significantly influenced by the competitive environment in South Korea's retail sector. GS Retail's success hinges on its ability to navigate a complex landscape filled with both direct and indirect competitors. Understanding the strategies and market positions of these rivals is crucial for GS Retail to maintain and enhance its market share across its various business segments, including convenience stores and supermarkets.

GS Retail's competitive landscape analysis reveals a dynamic market where innovation, pricing, and digital integration are key differentiators. The company faces intense competition from established players and emerging online platforms. This requires GS Retail to continuously adapt its business strategies to stay ahead of the curve and meet evolving consumer demands. The company's performance is heavily influenced by its ability to respond to these competitive pressures effectively.

GS Retail operates in the highly competitive convenience store sector, where it directly competes with BGF Retail's CU. Both companies are constantly vying for market share through product innovations, promotional activities, and digital service enhancements. CU, like GS25, has a vast network of stores across the country and emphasizes fresh food and private-label products. In 2024, the convenience store market in South Korea was estimated to be worth approximately ₩30 trillion, highlighting the stakes involved in this competition.

CU, operated by BGF Retail, is GS25's primary competitor. Both companies are focused on expanding their store networks and enhancing customer offerings. In 2024, CU held a market share of around 33% in the convenience store sector, closely followed by GS25.

7-Eleven, managed by Korea Seven, leverages its global brand recognition and supply chain to compete. 7-Eleven's market share in 2024 was approximately 20%, making it a significant player in the market. The company focuses on adapting global strategies to the local market.

E-Mart24, backed by Shinsegae Group, is a rapidly growing competitor. It challenges established players with aggressive pricing and innovative store concepts. E-Mart24's market share has been steadily increasing, reaching around 10% by late 2024.

In the supermarket segment, GS THE FRESH competes with major hypermarket chains. These chains offer a broader product range and larger store formats. The hypermarket segment's total revenue in 2024 was approximately ₩45 trillion.

Online grocery platforms like Coupang Fresh and Market Kurly pose indirect competition. They offer home delivery services, catering to consumers seeking convenience. The online grocery market grew by 25% in 2024, indicating the increasing importance of e-commerce.

Mergers and acquisitions, such as Shinsegae's acquisition of eBay Korea, reshape the competitive landscape. These moves enhance digital capabilities and consolidate market power. The acquisition of eBay Korea has allowed Shinsegae to strengthen its online presence and compete more effectively.

GS Retail's competitive advantages include its extensive store network and strong brand recognition. The company's disadvantages include the intense competition from rivals with similar offerings. GS Retail’s ability to innovate and adapt to changing consumer preferences is critical for maintaining its market position. The company's focus on private label products and digital services is a key strategy to differentiate itself. Here are some key points:

- Extensive Store Network: GS25 has a wide presence across South Korea, providing convenience to consumers.

- Brand Recognition: GS25 enjoys strong brand recognition, which helps attract and retain customers.

- Private Label Products: The company's focus on private label products provides higher profit margins and customer loyalty.

- Digital Services: GS25's digital initiatives, such as mobile apps and online ordering, enhance customer convenience.

- Competition: Intense competition from CU and 7-Eleven impacts market share.

- E-commerce: The growth of online grocery platforms poses a challenge to traditional brick-and-mortar stores.

- Pricing Strategies: Aggressive pricing by competitors affects profitability.

- Supply Chain: Efficient supply chain management is critical for managing costs and ensuring product availability.

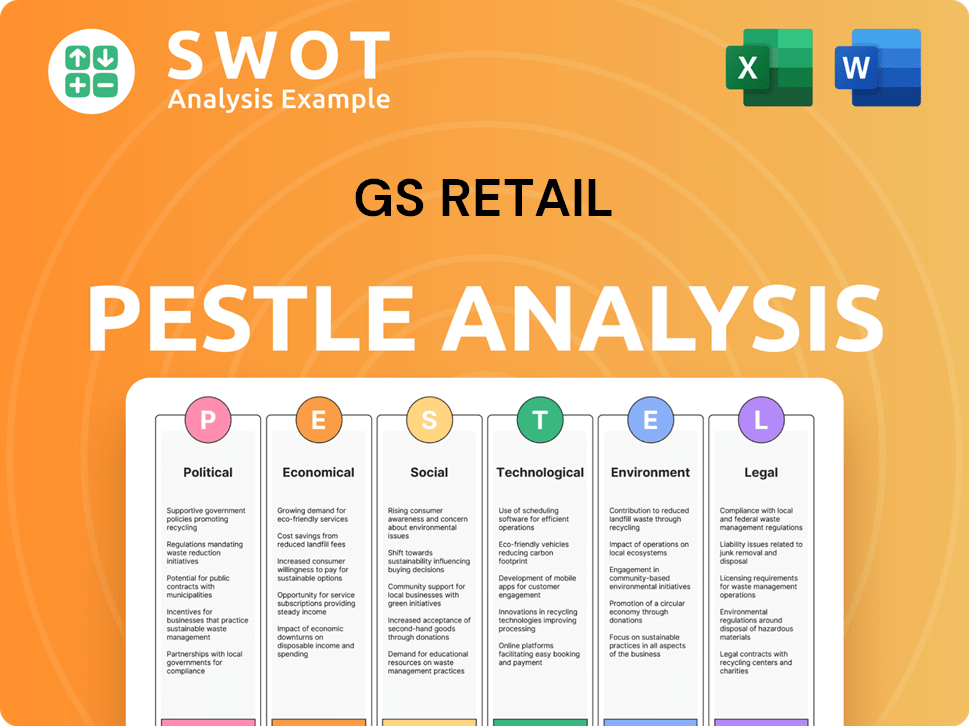

GS Retail PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives GS Retail a Competitive Edge Over Its Rivals?

The competitive landscape for GS Retail is shaped by its strategic moves and key milestones, which have significantly influenced its competitive edge. The company has consistently focused on expanding its physical presence and integrating digital technologies to enhance customer experience and operational efficiency. These efforts have positioned GS Retail as a leading player in the convenience store sector, with a strong emphasis on brand loyalty and supply chain optimization.

GS Retail's business strategy involves continuous innovation in product offerings and services, adapting to evolving consumer preferences. The company's performance is closely tied to its ability to navigate market trends and maintain a competitive advantage. By leveraging its extensive network and digital capabilities, GS Retail aims to strengthen its market position and drive sustainable growth in the dynamic retail industry.

A detailed Growth Strategy of GS Retail reveals how the company has built a strong foundation for future success. This includes strategic investments in technology, expansion of its product portfolio, and the development of customer-centric services. GS Retail's commitment to these areas underscores its dedication to remaining competitive and meeting the changing needs of its customers.

GS Retail's primary competitive advantage is its vast network of convenience stores, especially under the GS25 brand. This extensive presence provides unparalleled accessibility to consumers across South Korea. The strategic location of these stores allows for efficient distribution and significant economies of scale.

GS Retail has cultivated strong brand equity over many years, fostering high customer loyalty. This loyalty is driven by consistent product quality, diverse offerings, and reliable service. The brand's reputation enhances customer trust and encourages repeat business.

A highly efficient and integrated supply chain is crucial for managing fresh food and daily necessities. GS Retail's supply chain allows for rapid replenishment of shelves, minimizing stockouts and ensuring product freshness. This is particularly important for its ready-to-eat meal offerings.

GS Retail's ongoing investment in digital transformation enhances customer engagement and operational efficiency. Mobile applications and online platforms offer personalized promotions, loyalty programs, and seamless online-to-offline services. Data analytics further strengthens customer relationships.

GS Retail's competitive advantages are multifaceted, including its extensive store network, strong brand recognition, and efficient supply chain. The company's ability to adapt to evolving consumer preferences through digital integration is a key differentiator. These advantages have allowed GS Retail to maintain a strong position in the market.

- Extensive Store Network: Thousands of strategically located outlets offer unparalleled accessibility.

- Brand Loyalty: Built over decades through consistent quality and reliable service.

- Efficient Supply Chain: Enables rapid replenishment and ensures product freshness.

- Digital Innovation: Enhances customer engagement and streamlines operations.

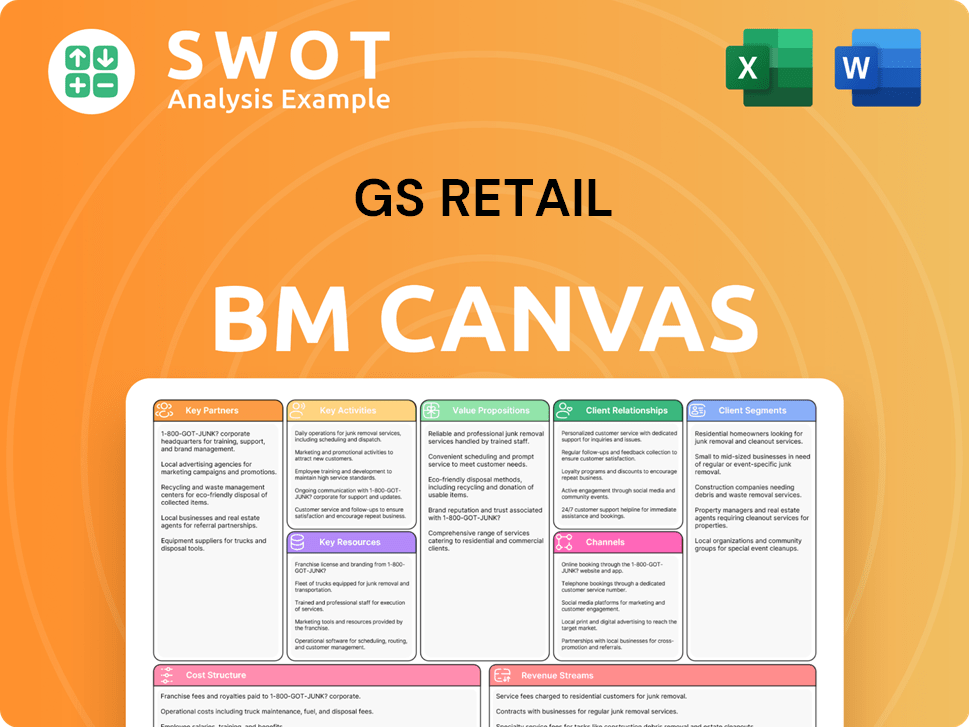

GS Retail Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping GS Retail’s Competitive Landscape?

The South Korean retail sector, where GS Retail operates, is undergoing significant shifts driven by technological advancements, changing consumer behaviors, and economic pressures. These factors are reshaping the GS Retail competitive landscape, presenting both challenges and opportunities for the company. Understanding these dynamics is crucial for assessing GS Retail market analysis and its future prospects.

GS Retail's position is influenced by its ability to adapt to these trends. The company faces risks such as increased competition from online retailers and changing consumer preferences. However, it also has opportunities to leverage its existing infrastructure and brand recognition to expand its market share and enhance its GS Retail business strategy. The future outlook depends on how effectively GS Retail navigates these complexities and capitalizes on emerging growth areas.

Key trends include the integration of AI and big data, which are transforming operations, from inventory management to personalized marketing. Regulatory changes and sustainability concerns are also impacting retail practices. Consumer demand for convenience, personalization, and sustainable products continues to rise, driving the need for retailers to adapt quickly. The impact of global economic shifts, including inflation and supply chain disruptions, is another major factor.

GS Retail faces challenges from new market entrants, particularly in online grocery and quick commerce. Changing business models, such as subscription services, require significant investment in technology. Declining demand for traditional brick-and-mortar retail and increased regulations pose risks. Aggressive pricing strategies from online competitors can also impact profitability. The ability to compete effectively in last-mile delivery and fresh food categories is critical.

GS Retail can leverage the growing demand for O2O services by integrating its online platforms with its physical store network, offering enhanced click-and-collect and rapid delivery options. Expansion into emerging product categories, such as health-focused foods and eco-friendly products, can drive growth. Strategic partnerships with technology firms and logistics providers can enhance digital capabilities and delivery efficiency. Diversifying service offerings beyond traditional retail, such as parcel and financial services, also presents opportunities.

GS Retail is focusing on strengthening its digital ecosystem and diversifying its service offerings. The company is optimizing its supply chain with AI-powered logistics to enhance efficiency. These efforts are designed to maintain resilience and capture future growth in the dynamic retail landscape. The company's ability to adapt and innovate will be key to its success. The company's competitive position is likely to evolve towards a more digitally-driven, hyper-convenient model.

GS Retail's strategy focuses on digital transformation, service diversification, and supply chain optimization. The goal is to enhance customer experience and operational efficiency. This includes leveraging data analytics for personalized marketing and inventory management. The company aims to strengthen its position in the GS Retail competitive landscape.

- Digital Ecosystem: Investing in online platforms and integrating them with physical stores to offer seamless O2O services.

- Service Diversification: Expanding beyond traditional retail to include parcel services and financial services within stores.

- Supply Chain Optimization: Utilizing AI-powered logistics to improve efficiency and reduce costs.

- Product Innovation: Expanding into new product categories like health-focused and eco-friendly products.

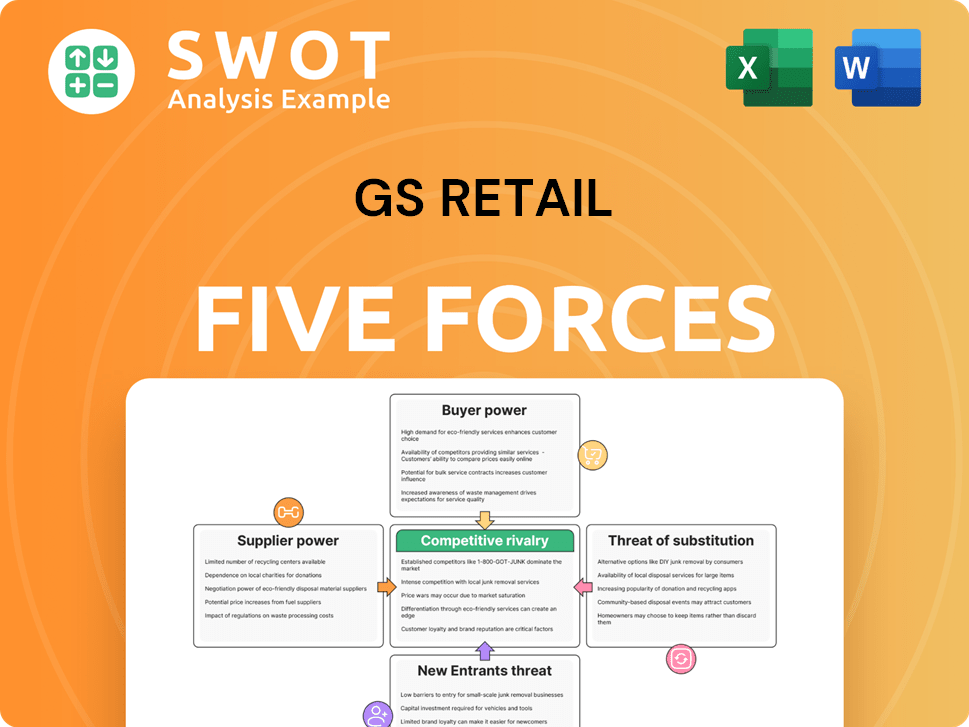

GS Retail Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of GS Retail Company?

- What is Growth Strategy and Future Prospects of GS Retail Company?

- How Does GS Retail Company Work?

- What is Sales and Marketing Strategy of GS Retail Company?

- What is Brief History of GS Retail Company?

- Who Owns GS Retail Company?

- What is Customer Demographics and Target Market of GS Retail Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.