GS Retail Bundle

Who Really Controls GS Retail?

Unraveling the intricacies of corporate ownership is key to understanding a company's trajectory, and in the dynamic world of retail, this is more crucial than ever. The ownership structure of a company directly impacts its strategic decisions, operational efficiency, and overall accountability to its stakeholders. Discovering who owns GS Retail provides valuable insights into its governance, long-term vision, and potential for growth.

GS Retail, a cornerstone of the South Korean retail market, provides a compelling case study in corporate ownership. Its journey, from its origins as LG25 to its current status as a major player with convenience stores, supermarkets, and hotels, is deeply intertwined with its ownership evolution. To gain a deeper understanding of GS Retail's strategic direction, consider exploring the GS Retail SWOT Analysis.

Who Founded GS Retail?

The story of GS Retail's ownership begins with its roots in the larger GS Group, which emerged from a long-standing partnership between the Koo and Huh families. The initial convenience store, LG25, opened its doors in Seoul in 1990, marking a key step in the company's evolution. This early phase set the stage for the future structure of GS Retail.

The foundation of the broader LG Group, from which GS Group later separated, involved a 60-40 share ownership between the Koo and Huh families as early as 1941. While specific equity splits for GS Retail at its inception are not readily available, the company's foundation was part of the larger conglomerate's diversified business ventures. The transition from LG25 to GS25 in 2005, following the separation, clearly indicates the shift in control under the GS Group.

The "beautiful separation" of the Huh family's businesses from LG Group led to the establishment of GS Holdings (now GS Corporation) on July 1, 2004, with the legal separation finalized on January 27, 2005. This significant event directly impacted GS Retail, as LG25 was subsequently rebranded to GS25 in 2005, signifying its new alignment under the GS Group.

Understanding the ownership structure of GS Retail involves tracing its history back to the broader GS Group. The shift from LG25 to GS25 in 2005, following the separation of the Huh family's businesses from LG Group, marked a significant change. This transition saw GS Holdings (now GS Corporation) become the parent entity, solidifying its control over GS Retail. For a deeper dive into the business model, consider reading this article: Revenue Streams & Business Model of GS Retail.

- The Koo and Huh families' partnership was fundamental to the early ownership structure.

- The separation in 2004-2005 reshaped the corporate landscape, leading to GS Holdings' control.

- The rebranding to GS25 in 2005 symbolized the new direction under the GS Group.

- While specific founder exits are not publicly detailed, the separation agreement dictated asset distribution.

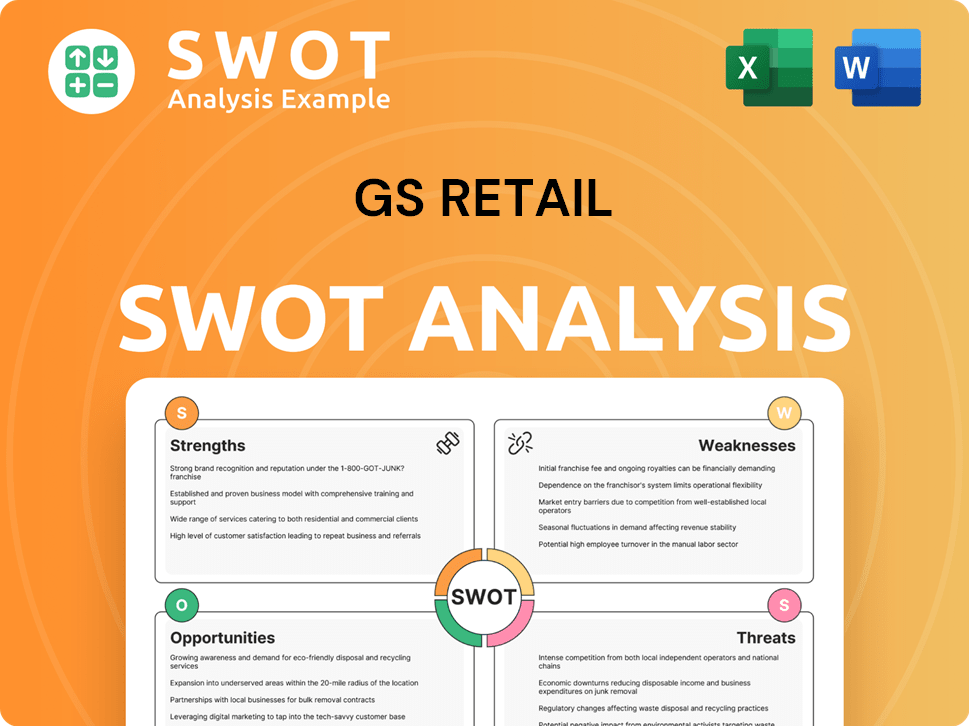

GS Retail SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has GS Retail’s Ownership Changed Over Time?

The ownership of GS Retail has evolved significantly, particularly with its integration into GS Group and strategic moves to optimize its structure. As of December 31, 2024, GS Holdings Corp. held the largest share at 47.38%, which represents 39,613,454 shares. The public companies held 47% of shares as of February 22, 2025, and 40% as of May 28, 2025, indicating considerable influence from public investors. Institutional ownership was at 15% as of February 22, 2025, and 13% as of May 28, 2025. The National Pension Service of Korea also holds a substantial stake, with 8.566% of shares as of April 9, 2025. This data provides a clear picture of who owns GS Retail and the distribution of its ownership.

A key event in GS Retail's ownership history was the merger with GS Home Shopping. This merger, agreed upon in November 2020 and completed by July 2021, aimed to bolster both online and offline businesses, resulting in an entity with approximately 9 trillion won (around $8.1 billion) in assets. The merger used a swap ratio of 4.22 shares of GS Retail for one share of GS Home Shopping. Furthermore, the company announced a spin-off of its Parnas Hotel and Freshmeat subsidiaries to simplify its structure and enhance shareholder value. This spin-off, with a new entity named GS P&L Co., Ltd., was effective December 26, 2024, with the listing date set for January 16, 2025. The equity spin-off ratio was 0.8105782 (GS Retail) to 0.1894218 (Parnas Holdings), later revised to 0.1917167 as of November 26, 2024. These strategic actions demonstrate an ongoing effort to refine the company's structure and potentially draw in more foreign investors, with 7.4% foreign ownership as of June 4, 2024.

| Stakeholder | Shareholding Percentage (as of December 31, 2024) | Shares Held |

|---|---|---|

| GS Holdings Corp. | 47.38% | 39,613,454 |

| Public Companies (as of May 28, 2025) | 40% | - |

| National Pension Service of Korea (as of April 9, 2025) | 8.566% | - |

Understanding the Marketing Strategy of GS Retail is crucial for grasping how its ownership structure impacts its market position and strategic decisions. Key stakeholders like GS Group and the public investors significantly influence the company's direction. The strategic moves, such as the merger with GS Home Shopping and the spin-off of subsidiaries, demonstrate the company's commitment to adapting to market dynamics and enhancing shareholder value. These adjustments are key to understanding who owns GS Retail and how its ownership structure shapes its future.

GS Retail's ownership is primarily held by GS Holdings Corp., with significant influence from public investors and institutional stakeholders.

- The merger with GS Home Shopping expanded GS Retail's business scope.

- The spin-off of subsidiaries aims to streamline operations and boost shareholder value.

- Strategic decisions reflect efforts to adapt to market changes and attract investment.

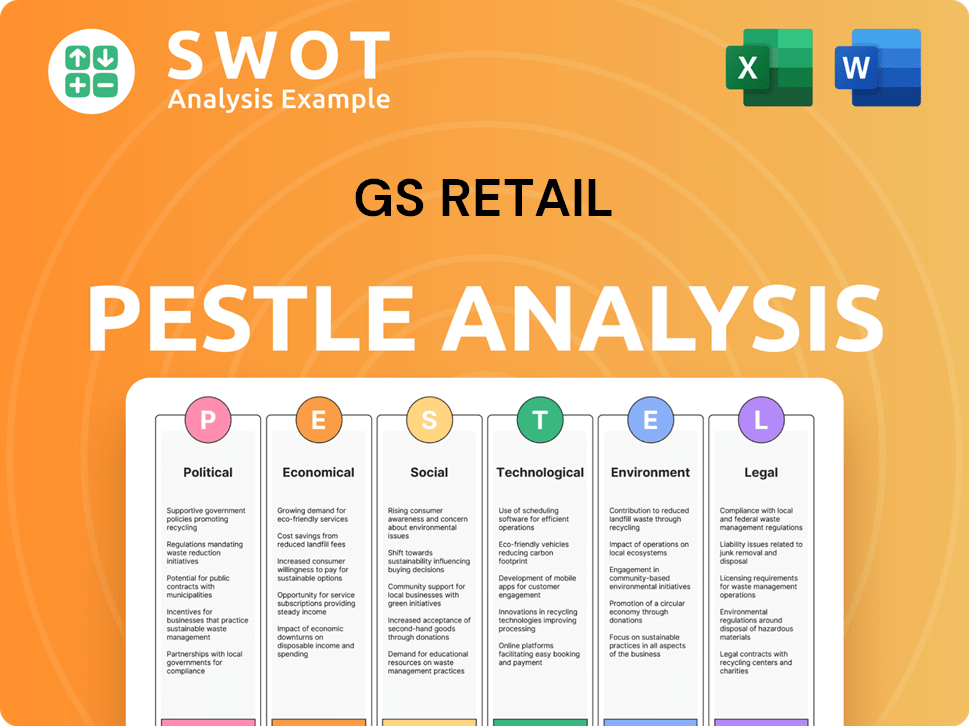

GS Retail PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on GS Retail’s Board?

The Board of Directors of GS Retail oversees the company's operations, with its composition reflecting the ownership structure. As of December 31, 2024, GS Holdings Corp. held a significant stake, owning 47.38% of the shares, which gives them considerable influence over board appointments and strategic decisions. Details on the specific affiliations of all current board members are not fully available in the provided search results, but the substantial ownership by GS Holdings Corp. indicates their strong presence.

As of March 19, 2025, Seo-Hong Heo holds the position of Chief Executive Officer at GS Retail. Other key executives include Soon-Ki Hong as President, Jin-Seok Oh and Young-Hwan Kwon as Corporate Officers, and Yeong-Tae Jeong as Human Resources Officer. The voting structure generally follows a one-share-one-vote principle. However, the significant ownership by GS Holdings Corp. provides them with substantial voting power in key decisions. The top two shareholders combined held 56% of the business as of February 22, 2025, highlighting a concentrated control over the company.

| Executive | Title | Date |

|---|---|---|

| Seo-Hong Heo | Chief Executive Officer | March 19, 2025 |

| Soon-Ki Hong | President | March 19, 2025 |

| Jin-Seok Oh | Corporate Officer | March 19, 2025 |

| Young-Hwan Kwon | Corporate Officer | March 19, 2025 |

| Yeong-Tae Jeong | Human Resources Officer | March 19, 2025 |

Recent corporate actions, such as the spin-off of the Parnas Hotel and Freshmeat subsidiaries, announced on June 3, 2024, and with a shareholder meeting expected on September 10, 2024, demonstrate the board's involvement in strategic restructuring. This is aimed at enhancing shareholder value. The low foreign ownership, at 7.4% as of June 4, 2024, has been cited as a factor influencing decisions, suggesting a focus on investor sentiment. To understand more about the company's strategic direction, you can read about the Growth Strategy of GS Retail.

GS Holdings Corp. is the primary owner, holding a significant percentage of shares, which influences board appointments and key decisions.

- The CEO as of March 19, 2025, is Seo-Hong Heo.

- The voting structure is generally one-share-one-vote, but GS Holdings Corp.'s stake gives them significant control.

- Recent corporate actions, like the spin-off, show the board's role in strategic decisions.

- Low foreign ownership suggests a focus on domestic investor sentiment.

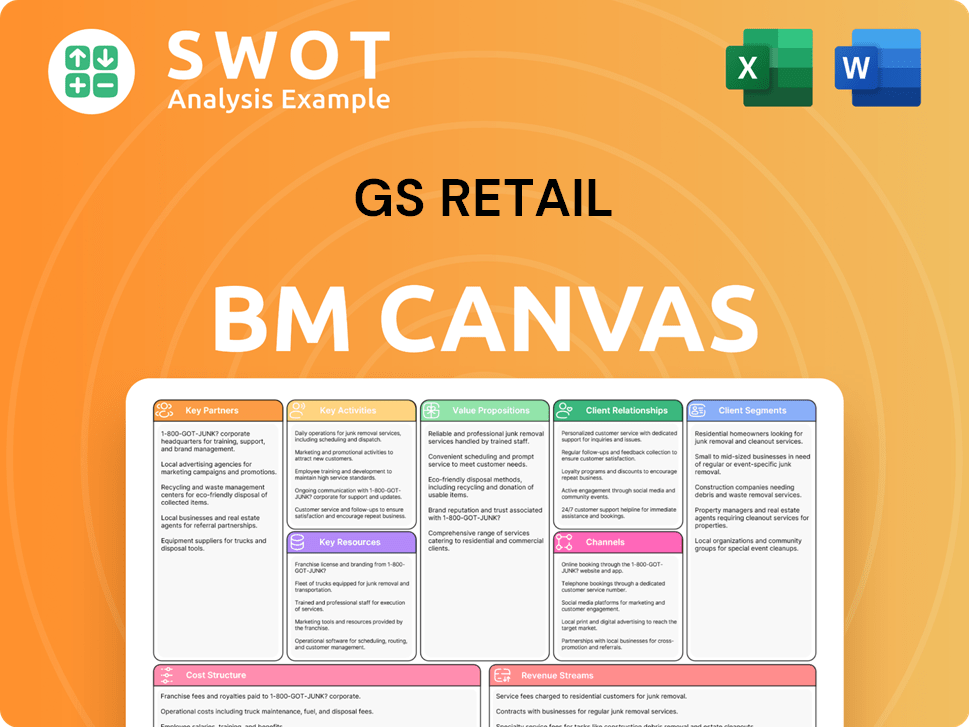

GS Retail Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped GS Retail’s Ownership Landscape?

Over the past few years, GS Retail, has undergone significant shifts in its ownership and strategic direction. The merger with GS Home Shopping, finalized by July 2021, was a pivotal move. This strategic alliance aimed to integrate both offline and online retail strengths, resulting in an entity with an annual transaction value of approximately $13.5 billion. This merger substantially altered the equity structure, with an exchange ratio of 4.22 shares of GS Retail for one share of GS Home Shopping.

More recently, GS Retail announced the spin-off of its hotel and fresh meat subsidiaries, Parnas Hotel and Freshmeat, to create a new entity, initially named Parnas Holdings (later GS P&L Co., Ltd.). This spin-off, effective December 26, 2024, and listed on January 16, 2025, aimed to streamline the business structure and potentially increase foreign investment, which was at 7.4% as of June 4, 2024. The allocation ratio for the spin-off was revised to 0.1917167 as of November 26, 2024. These moves reflect the company's efforts to adapt to market dynamics and enhance shareholder value.

In 2025, industry trends show a continued emphasis on consolidation, portfolio diversification, and strategic restructuring. GS Retail's spin-off aligns with the trend of optimizing business structures. Globally, the retail sector is seeing increased institutional ownership and a focus on innovation, sustainability, and digital commerce. The expansion into Vietnam, targeting 700 stores by 2027, and partnerships with companies like Musinsa, highlight its commitment to geographic and market expansion. Global retail sales are projected to reach $31.3 trillion by 2025, indicating robust growth opportunities.

GS Retail's ownership structure involves its parent company, GS Group, and other major shareholders. The company's stock information is available to the public. GS Retail's corporate structure includes various subsidiaries.

Key initiatives include geographic expansion, particularly in Vietnam. The company is also focused on diversifying its offerings. These strategies align with broader industry trends. Partnerships play a crucial role in this expansion.

GS Retail's market share is significant within the retail sector in Korea. The company faces competition from other major players. Financial performance is a key indicator of its success. The company's business model is geared towards retail.

The company is expected to continue adapting to changing market dynamics. Innovation and sustainability are driving factors. Digital commerce plays a crucial role in its future strategies. Investor relations provide insights into the company's performance.

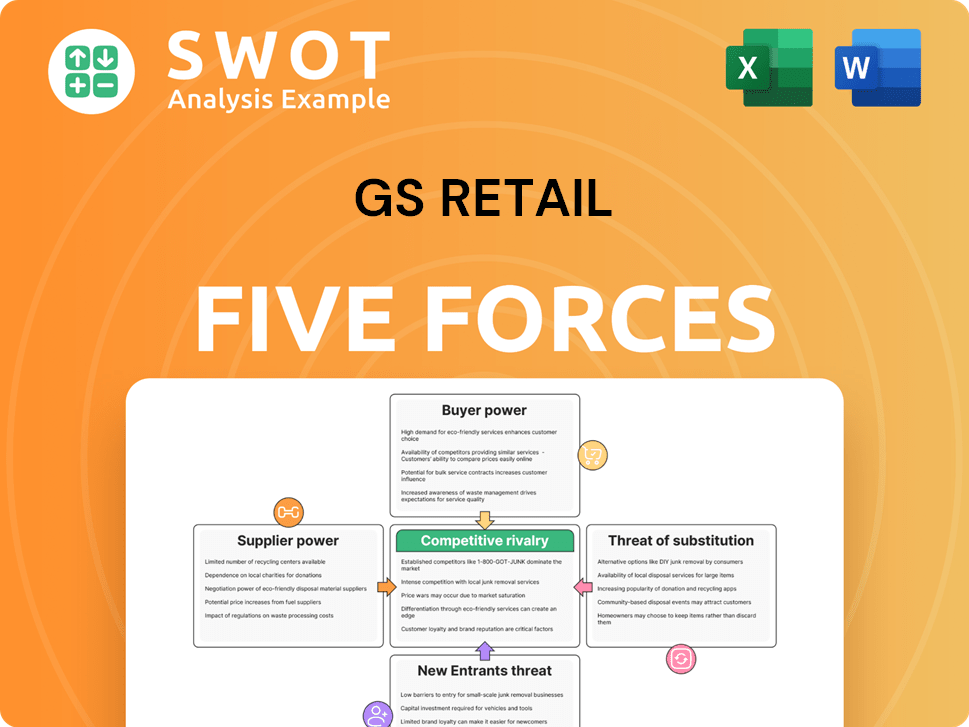

GS Retail Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of GS Retail Company?

- What is Competitive Landscape of GS Retail Company?

- What is Growth Strategy and Future Prospects of GS Retail Company?

- How Does GS Retail Company Work?

- What is Sales and Marketing Strategy of GS Retail Company?

- What is Brief History of GS Retail Company?

- What is Customer Demographics and Target Market of GS Retail Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.