Haier Smart Home Bundle

Can Haier Smart Home Maintain Its Edge in the Smart Home Race?

Haier Smart Home, a pioneer in the Haier Smart Home SWOT Analysis, has revolutionized the home appliance sector by embracing the smart home concept. Its vision of a fully connected ecosystem, from refrigerators to air conditioners, has redefined consumer expectations. This strategic shift has intensified competition, forcing traditional manufacturers to accelerate their digital transformations.

This exploration delves into the Competitive Landscape of Haier Smart Home, examining its key rivals and its strategies for maintaining its leadership in the Smart Home Market. We will conduct a thorough Market Analysis to understand how Haier Smart Home differentiates itself and navigates the challenges within the dynamic Smart Home Industry. Understanding Haier Competitors is crucial to assessing its long-term prospects and Haier Smart Home market share analysis.

Where Does Haier Smart Home’ Stand in the Current Market?

Haier Smart Home maintains a robust market position within the global home appliance and Smart Home Market industries. The company's core operations revolve around the design, manufacturing, and sale of a wide array of smart home solutions. These include refrigerators, washing machines, air conditioners, and kitchen appliances, all integrated through its U+ Smart Life platform. This platform enables seamless connectivity and control across various devices, enhancing user experience and convenience.

The value proposition of Haier Smart Home centers on providing innovative, high-quality, and interconnected smart home products. By focusing on user-centric design and technological advancements, the company aims to offer consumers a fully integrated smart living experience. This approach allows Haier to differentiate itself from traditional appliance manufacturers and create a strong brand presence in the competitive landscape. The company's commitment to innovation is evident in its continuous development of new features and technologies.

Haier Group, the parent company of Haier Smart Home, has held the largest market share in major appliances globally for the 15th consecutive year as of 2024. In 2024, the company held a 16.5% retail volume share. This sustained leadership highlights the company's strong market presence and consumer trust. This success is a result of strategic product development and global market penetration.

The product portfolio of Haier Smart Home encompasses a comprehensive range of smart home solutions. These include refrigerators, washing machines, air conditioners, water heaters, kitchen appliances, and small home appliances. All these products are integrated into the U+ Smart Life platform. This platform allows for easy control and connectivity, creating a seamless smart home experience for consumers.

Haier Smart Home has a significant global presence, with strong market penetration in China, Europe, North America, and Southeast Asia. The company's global footprint is supported by its multi-brand strategy. This strategy includes brands like Haier, Casarte, Leader, GE Appliances, Fisher & Paykel, and Candy. This multi-brand approach allows the company to cater to diverse consumer segments.

In the first three quarters of 2023, Haier Smart Home reported an operating revenue of RMB 199.1 billion, marking a 5.6% year-on-year increase. The net profit attributable to the parent company reached RMB 13.1 billion, reflecting a 12.7% increase. The focus on high-end and smart products has significantly contributed to improved profitability. The company's financial health underscores its strong market position.

Haier Smart Home has strategically positioned itself through acquisitions and brand diversification. The acquisition of GE Appliances in 2016 and Candy in 2019 enabled the company to penetrate premium markets and expand its digital offerings. This strategic expansion has allowed Haier to broaden its consumer base and strengthen its competitive position. The company's ability to adapt and evolve is a key factor in its success.

- Multi-Brand Strategy: Utilizes multiple brands (Haier, Casarte, Leader, GE Appliances, Fisher & Paykel, Candy) to target different consumer segments.

- Global Presence: Strong presence in China, Europe, North America, and Southeast Asia.

- Focus on High-End Products: Emphasis on premium and smart products to enhance profitability.

- Technological Integration: Integration of products into the U+ Smart Life platform for a seamless user experience.

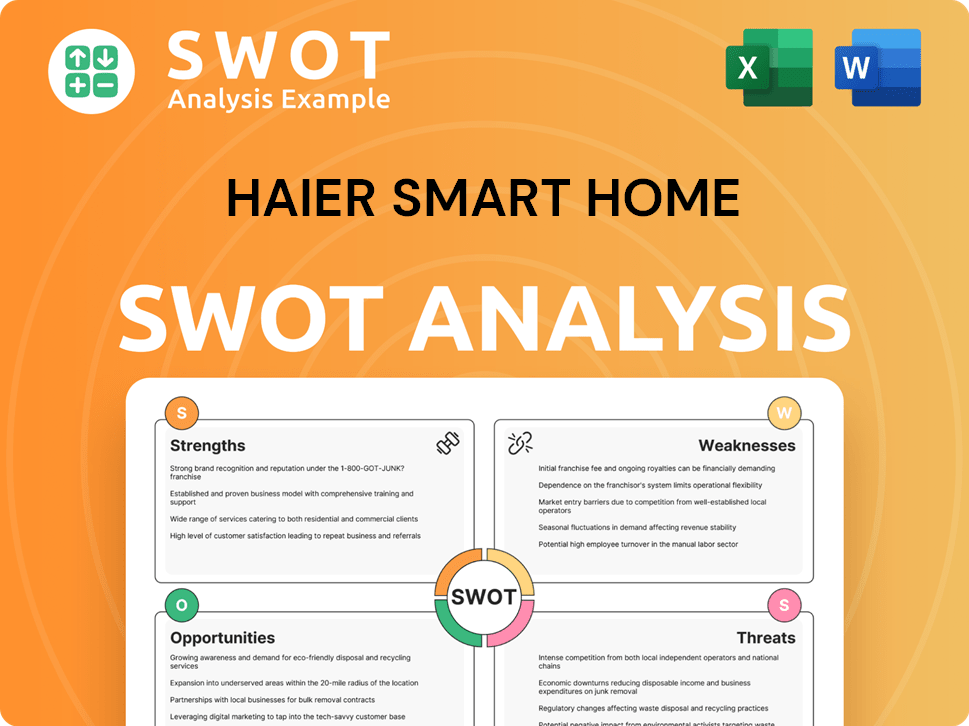

Haier Smart Home SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Haier Smart Home?

The competitive landscape for Haier Smart Home is complex, shaped by a variety of direct and indirect competitors. These rivals span global conglomerates, emerging tech companies, and regional players, all vying for market share in the rapidly evolving smart home market. Understanding these competitors is crucial for assessing Haier Smart Home's position and future prospects.

The Smart Home Industry is characterized by intense competition, with companies constantly innovating and adapting to consumer demands. This environment necessitates continuous market analysis to stay ahead. This chapter will delve into the key competitors, their strategies, and the challenges and opportunities that Haier Smart Home faces.

The competitive dynamics are influenced by factors like technological advancements, consumer preferences, and global economic conditions. The ability to offer integrated smart solutions, personalized user experiences, and competitive pricing is essential for success. The following sections provide a detailed overview of the key players challenging Haier Smart Home.

Direct competitors offer similar products and services, directly competing for the same customer base. These companies often have established brand recognition and extensive distribution networks.

Midea Group is a significant Chinese competitor, offering a broad range of home appliances and HVAC systems. They challenge Haier through aggressive pricing and a strong domestic distribution network. In 2024, Midea's revenue reached approximately $50 billion, highlighting its substantial market presence.

Gree Electric is a dominant player in air conditioning, posing a significant threat in that specific segment. Gree's focus on air conditioning gives it a strong competitive edge. Gree's revenue in 2024 was around $28 billion, demonstrating its specialization and market strength.

LG Electronics competes fiercely with Haier in the premium and smart appliance segments. LG leverages strong brand recognition, advanced technology, and extensive global distribution. LG's appliance and air solution revenue in 2024 was approximately $20 billion.

Samsung Electronics also competes in the premium and smart appliance segments. Samsung's innovation in smart features and connectivity is a key differentiator. Samsung's revenue in the consumer electronics segment in 2024 was around $50 billion.

BSH is known for its high-quality Bosch and Siemens brands, particularly strong in built-in kitchen appliances and premium segments. BSH challenges Haier in European markets. BSH's revenue in 2024 was approximately $17 billion.

Beyond direct competitors, Haier also faces indirect competition from emerging players and niche companies. These competitors may offer complementary products or services that indirectly impact Haier's market position. Understanding these indirect threats is crucial for a comprehensive Market Analysis.

Indirect competitors include technology companies and regional players. The Smart Home Market is also affected by mergers, alliances, and the speed of technology adoption.

- Xiaomi: Enters the market with interconnected devices, posing an indirect threat through integrated smart platforms and competitive pricing. Xiaomi's IoT platform has a vast user base, enhancing its competitive position.

- Regional Players: Provide localized competition in various markets. These companies often have a strong understanding of local consumer preferences and distribution networks.

- Mergers and Alliances: Such as Panasonic's acquisition of Blue Yonder in 2021, indicate a trend towards integrated supply chain and smart solutions. This alters the competitive landscape by creating more comprehensive offerings.

- Smart Technology Adoption: The speed of smart technology adoption, ecosystem integration, and personalized user experiences are key factors in the competitive landscape. Companies that can quickly adapt and offer innovative solutions gain a competitive advantage.

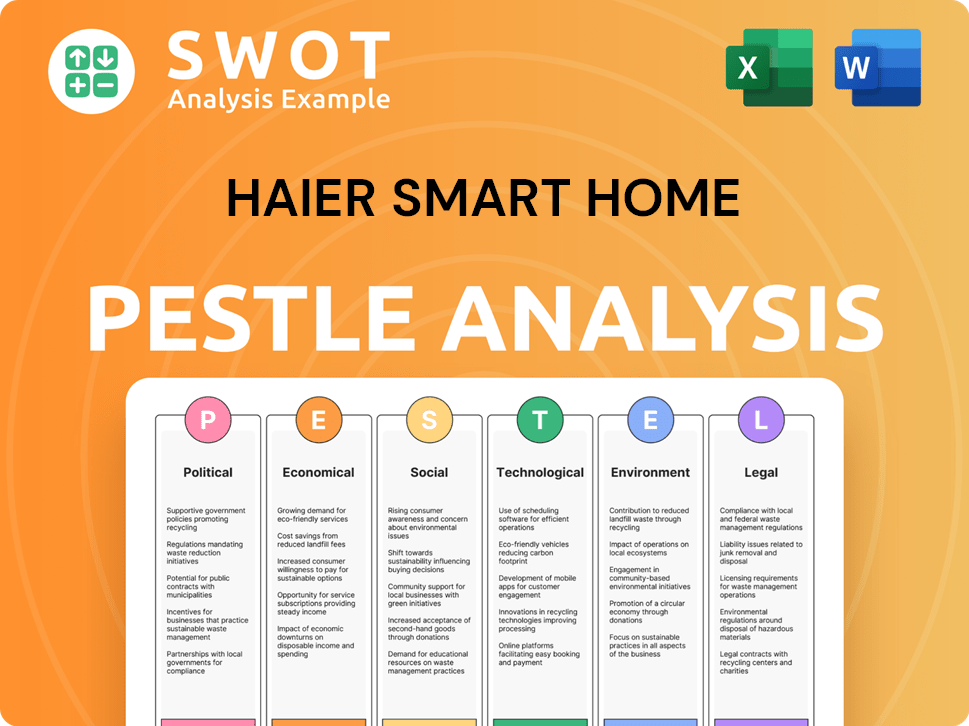

Haier Smart Home PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Haier Smart Home a Competitive Edge Over Its Rivals?

The competitive landscape for Haier Smart Home is shaped by its pioneering smart home ecosystem, a diverse brand portfolio, and a significant global footprint. The company's strategy focuses on integrating a wide range of smart home appliances through its U+ Smart Life platform. This approach aims to provide seamless user experiences, fostering customer loyalty and driving market share gains in the competitive Smart Home Market.

A key element of the company's success is its multi-brand strategy, which includes brands like Haier, Casarte, Leader, GE Appliances, Fisher & Paykel, and Candy. This allows it to cater to various consumer segments and price points across different regions. The company's manufacturing capabilities and global supply chain provide significant economies of scale, supporting competitive pricing and broad product availability. For a deeper dive into the company's target audience, consider exploring the Target Market of Haier Smart Home.

The RenDanHeYi (RDHY) organizational model further distinguishes the company, fostering innovation and agility. This model allows for rapid responses to market changes and personalized product development. These advantages have evolved over time, with continuous investment in R&D to enhance smart home capabilities. However, the sustainability of its technological advantages depends on ongoing innovation in AI, IoT, and data analytics to stay ahead of industry trends and potential competition.

The U+ Smart Life platform is a key differentiator, integrating various smart home appliances for seamless user experiences. This proprietary technology enhances customer loyalty through convenience and energy efficiency. It enables the company to offer a cohesive and interconnected ecosystem, setting it apart in the Smart Home Industry.

The company's multi-brand approach, including Haier, Casarte, and others, allows it to cater to diverse consumer segments. This strategy enables the company to compete effectively across various price points and regional preferences. The brand portfolio provides a comprehensive market reach, leveraging distinct brand identities and distribution networks.

The company benefits from significant economies of scale due to its massive manufacturing capabilities and global supply chain. This enables cost efficiencies and competitive pricing. Its extensive distribution network, both online and offline, ensures broad product availability. This global presence is crucial in the Competitive Landscape.

The RenDanHeYi (RDHY) organizational model fosters agility, innovation, and direct customer engagement. This unique culture promotes entrepreneurship and accountability within the organization. This model allows for rapid response to market changes and personalized product development, giving the company a competitive edge.

Haier Smart Home's competitive advantages are multifaceted, including a proprietary smart home ecosystem, a multi-brand strategy, global reach, and a unique organizational model. These factors contribute to its strong market position and ability to compete effectively in the Smart Home Market.

- U+ Smart Life platform for seamless integration.

- Multi-brand strategy for diverse consumer segments.

- Significant economies of scale and global supply chain.

- RDHY model fostering innovation and agility.

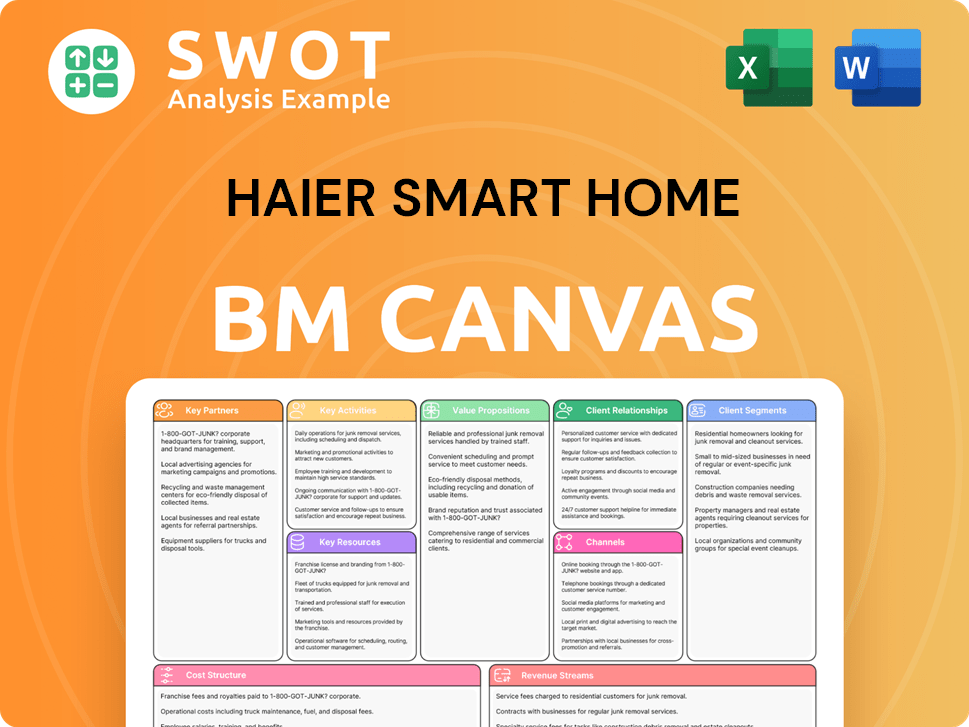

Haier Smart Home Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Haier Smart Home’s Competitive Landscape?

The home appliance industry is experiencing significant shifts, driven by technological advancements and evolving consumer preferences. This dynamic environment presents both opportunities and challenges for companies like Haier Smart Home. The Smart Home Market is expanding, with increasing demand for integrated and intelligent appliances.

Regulatory changes and global economic factors also play a crucial role. Energy efficiency standards and sustainability initiatives are becoming increasingly important, while economic pressures and supply chain disruptions can impact operations. Understanding these trends is vital for assessing the competitive landscape and future prospects of Haier Smart Home.

Key trends include the rise of IoT, AI, and 5G, driving demand for smart appliances. Consumers seek personalized and energy-efficient solutions. Regulatory focus on energy efficiency and sustainability influences product design. These trends offer growth potential for Haier Smart Home.

Challenges include increased competition from tech companies and price pressures. Rapid technological changes demand continuous R&D investment. Data security and privacy concerns in interconnected homes are critical. Economic factors like inflation and supply chain issues also pose risks.

Opportunities exist in emerging markets and the premium smart home segment. Strategic partnerships and ecosystem expansion can drive growth. Continuous innovation in smart technology and a diversified brand portfolio are advantageous. Optimizing global operations is also a key factor.

Haier focuses on expanding its U+ Smart Life platform and developing AI-powered functionalities. The company leverages its green manufacturing practices and sustainable products. It strengthens its multi-brand portfolio and optimizes global operations. These strategies aim to solidify its position in the Smart Home Market.

The Competitive Landscape for Haier Smart Home involves both established appliance manufacturers and tech companies. The company's ability to innovate and adapt to changing consumer demands is critical. Strategic partnerships and a strong global presence are key to success. For more on the company's structure, see Owners & Shareholders of Haier Smart Home.

- The global smart home market is projected to reach $195 billion by 2027, according to Statista.

- Haier Smart Home has been actively expanding its product portfolio, including new AI-powered features.

- The company's focus on energy-efficient appliances aligns with increasing consumer demand for sustainable products.

- Partnerships with technology providers are crucial for expanding the smart home ecosystem.

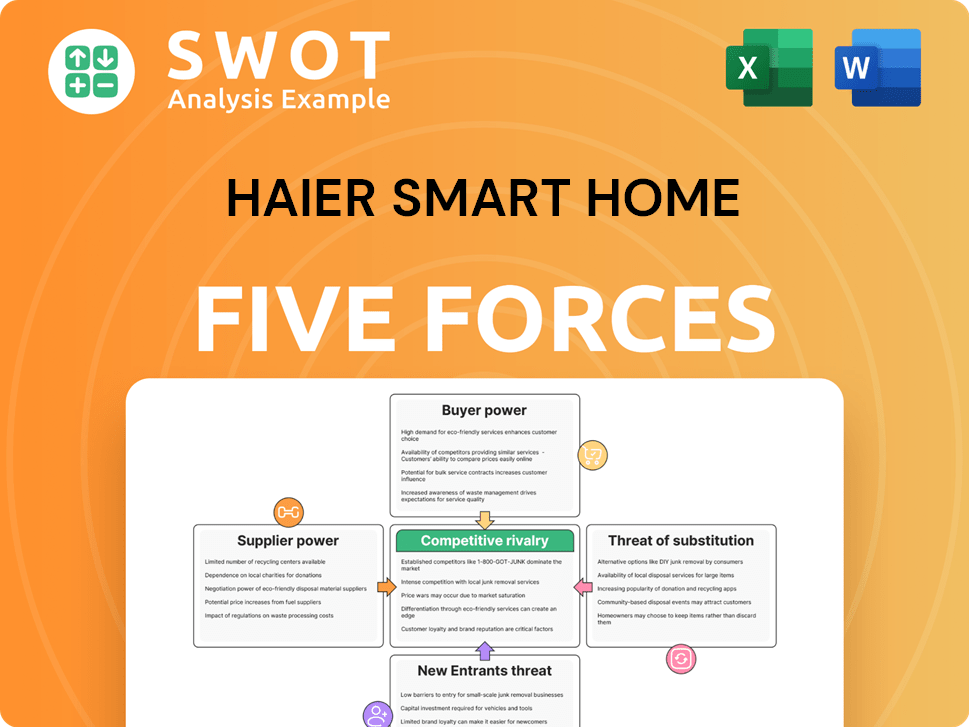

Haier Smart Home Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Haier Smart Home Company?

- What is Growth Strategy and Future Prospects of Haier Smart Home Company?

- How Does Haier Smart Home Company Work?

- What is Sales and Marketing Strategy of Haier Smart Home Company?

- What is Brief History of Haier Smart Home Company?

- Who Owns Haier Smart Home Company?

- What is Customer Demographics and Target Market of Haier Smart Home Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.