Haier Smart Home Bundle

Decoding Haier Smart Home: How Does It Thrive?

Haier Smart Home, a titan in the home appliance industry, is rapidly transforming living spaces with its innovative Haier Smart Home SWOT Analysis. In a market ripe with opportunities, the company's impressive financial results, including a substantial revenue increase in 2024, highlight its robust performance and strategic vision. But how does this smart home company actually function, and what drives its continued success in the competitive landscape of home automation?

This analysis provides a comprehensive look at the Haier ecosystem, exploring its core strategies and how it leverages smart appliances and IoT devices to create a seamless user experience. We'll examine the company's diverse product range and how its smart home technology functions, offering insights valuable for anyone interested in understanding the future of home living. Whether you're curious about setting up Haier smart home devices or want to know about Haier smart home features and benefits, this is your guide.

What Are the Key Operations Driving Haier Smart Home’s Success?

The core of the Haier smart home business revolves around creating and delivering value through a comprehensive range of home appliances and integrated smart home solutions. This includes designing, developing, manufacturing, and selling products like refrigerators, washing machines, air conditioners, kitchen appliances, and water heaters. The company targets a broad spectrum of customers, focusing on providing personalized, convenient, and intelligent living experiences through its interconnected smart home platform.

Operationally, the company leverages a globally integrated enterprise model. This model includes 143 manufacturing sites worldwide and an extensive chain of 230,000 retail locations, ensuring efficient production and broad distribution. A significant emphasis is placed on technology development and innovation, with substantial investment in research and development. For example, the X11 Washing Machine exceeds Europe's energy efficiency A-Class rating by 50%.

The company's operational processes also include rigorous supply chain management, strategic partnerships, and a focus on digital transformation to enhance efficiency and user engagement. In 2024, its domestic order response cycle improved by 13% due to digital inventory management and marketing initiatives. This commitment to innovation and efficiency is key to its success in the smart home company market.

With 143 manufacturing sites worldwide, the company ensures efficient production. An extensive network of 230,000 retail locations facilitates broad product distribution. This global footprint supports its ability to meet diverse market demands and maintain a strong presence in the smart appliances sector.

The company invests heavily in research and development, leading to innovative products. The X11 Washing Machine, for example, exceeds Europe's energy efficiency A-Class rating by 50%. This focus on innovation drives the development of advanced IoT devices and enhances its competitive edge.

Digital transformation plays a key role in improving operational efficiency. In 2024, its domestic order response cycle improved by 13%. This improvement is a direct result of digital inventory management and marketing initiatives, enhancing user engagement.

The 'RenDanHeYi' philosophy fosters a user-centric approach and empowers micro-enterprises. This translates into innovative products and personalized smart home scenarios. The Haier ecosystem is designed to enhance user experience through AI-driven solutions.

The company's operations are unique due to its 'RenDanHeYi' philosophy, fostering a user-centric approach and empowering micro-enterprises. This translates into innovative products and personalized smart home scenarios through the Haier Smart Home App and Experiential Cloud Platform. AI-driven solutions enhance user experience, such as sound wave human sensing technology in air conditioners.

- Innovative Products: Continuously introduces new and advanced appliances.

- Personalized Smart Home Scenarios: Offers customized experiences through the Haier Smart Home App.

- Enhanced User Experience: Utilizes AI-driven solutions to improve user interaction.

- Global Footprint: Operates with extensive manufacturing and retail networks.

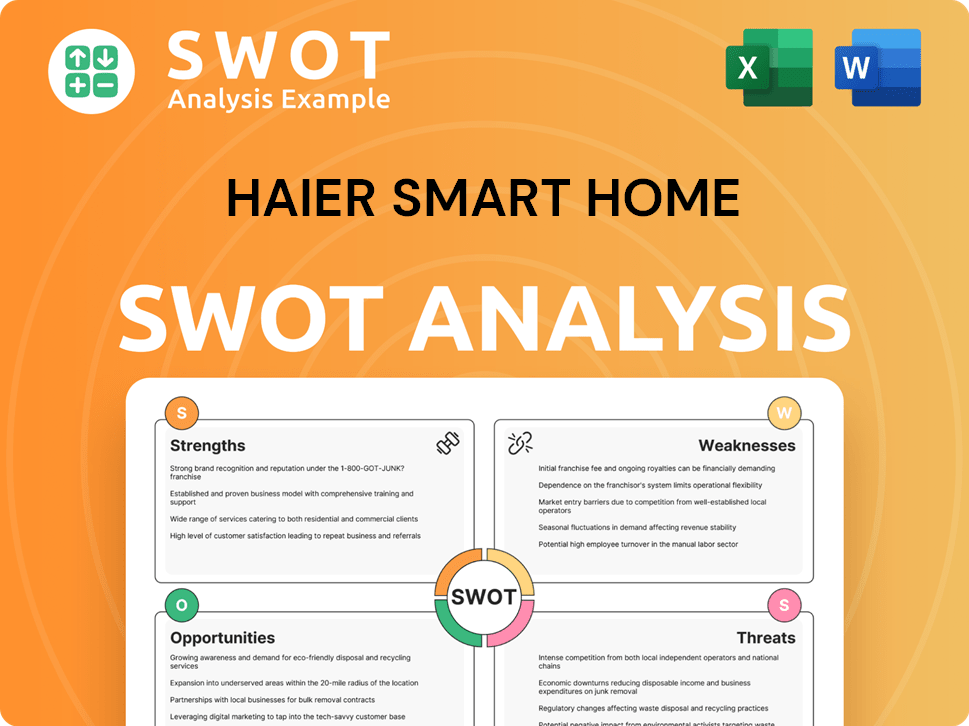

Haier Smart Home SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Haier Smart Home Make Money?

The primary revenue streams for the Haier Smart Home company come from selling a wide array of home appliances and smart home solutions. These include refrigeration, kitchen appliances, laundry appliances, air solutions, and water solutions. The company's approach to monetization involves a focus on high-end and smart appliances, leveraging premium brands, and offering bundled services.

In 2024, the company's global revenue reached a substantial RMB 285.981 billion. Beyond direct sales, the company also generates revenue through other business operations such as small home appliances, cleaning robots, and channel distribution services for the Haier Group and third-party brands. The Haier ecosystem is a key driver for revenue growth.

The company strategically uses government initiatives, such as China's trade-in policy, to boost sales. Additionally, it is exploring subscription-based models and integrating energy management devices and complementary services within its hOn SMART HOME ecosystem. The international market also contributes significantly to its revenue, with overseas revenue reaching RMB 143.914 billion in 2024.

The following is a breakdown of the revenue contribution by different segments, showcasing the company's diversified revenue streams. The company's success is also reflected in the volume growth of its premium products.

- Refrigeration business: RMB 83.556 billion (up 2.01% year-on-year).

- Kitchen appliances: RMB 41.184 billion.

- Laundry appliances: RMB 63.321 billion (up 2.98% year-on-year).

- Air solutions: RMB 49.616 billion (up 7.62% year-on-year).

- Water solutions: RMB 16.175 billion (up 5.47% year-on-year).

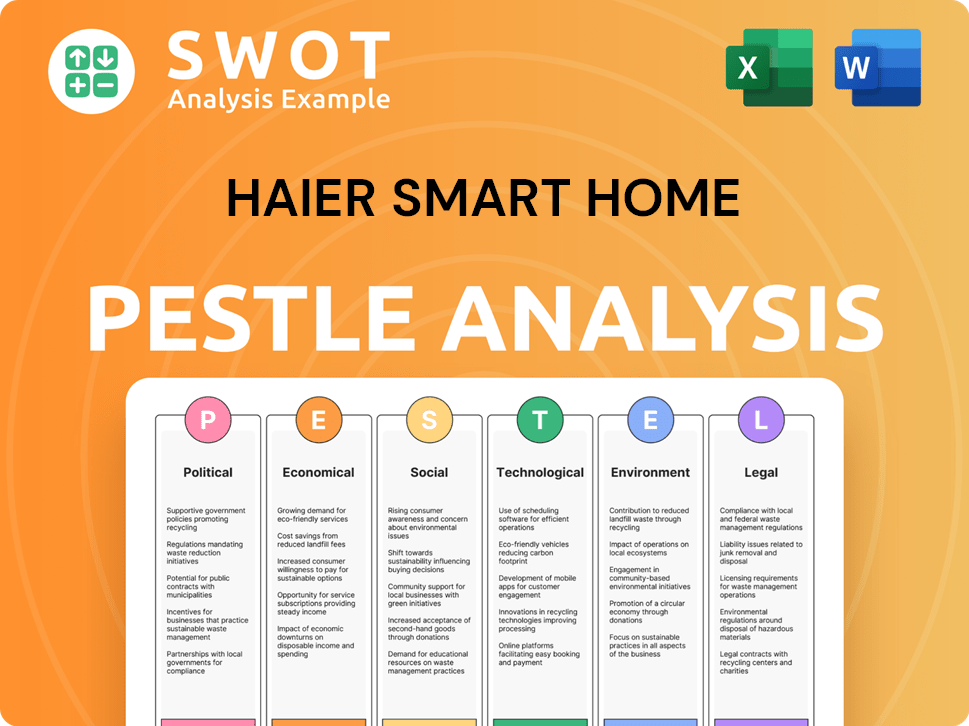

Haier Smart Home PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Haier Smart Home’s Business Model?

The evolution of Haier Smart Home has been marked by significant milestones, strategic expansions, and a commitment to innovation. These elements have collectively shaped the company's operations and financial performance, establishing its position within the competitive landscape of the smart home industry. A key focus has been on strengthening its global presence and diversifying its product offerings to cater to evolving consumer demands.

A pivotal strategic move was the acquisition of GE Appliances in 2016, which significantly boosted its presence in North America and contributed to a sustained growth rate. Further expansion included the commencement of operations at its eco-park in Egypt in 2024, with a production capacity exceeding 200,000 units. This expansion, along with acquisitions like CCR and Kwikot, has broadened its product portfolio and strengthened its global footprint.

Facing market challenges, including macroeconomic fluctuations, Haier has prioritized technological innovation and digital transformation. The company's focus on full-chain digitalization in 2024 led to improved profitability, with the net profit margin increasing from 6.1% in 2023 to 6.6%, demonstrating its resilience and adaptability in a dynamic market environment.

Haier's journey includes several key milestones. The acquisition of GE Appliances in 2016 was a pivotal move, significantly expanding its presence in North America. The commencement of operations at its eco-park in Egypt in 2024 further expanded its global manufacturing footprint, with a production capacity exceeding 200,000 units.

Strategic moves have been central to Haier's growth. Acquisitions like CCR and Kwikot have bolstered its global presence and product offerings. The company has also prioritized technological innovation, digital transformation, and optimizing its global strategic footprint to navigate market challenges.

Haier's competitive advantages are multifaceted. It holds the top position in the global major home appliance industry for 16 consecutive years. Its cost leadership, driven by economies of scale and automation, resulted in an industry-leading gross margin of 30.9% in 2024. Technology leadership, particularly in smart home solutions, provides a significant edge.

Haier's smart home technology offers a range of features and benefits. These include intelligent and versatile user interactions, powered by AI integration. The company's focus on customer-centric approaches, guided by its 'RenDanHeYi' philosophy, further solidifies its competitive position. Haier continues to embrace AI technologies to facilitate comprehensive applications across its operations.

Haier's competitive advantages are multifaceted and include brand strength, market leadership, cost leadership, and technology leadership. These advantages are supported by a strong distribution network and a customer-centric approach.

- Brand Strength and Market Leadership: Haier has held the top position in the global major home appliance industry for 16 consecutive years.

- Cost Leadership: Haier's economies of scale and in-house component production contribute to cost advantages, with an industry-leading gross margin of 30.9% in 2024.

- Technology Leadership: Investments in R&D and AI integration provide a significant edge, delivering intelligent, versatile, and personalized user interactions.

- Distribution and Customer Focus: Extensive distribution networks and a customer-centric approach, guided by the 'RenDanHeYi' philosophy, further solidify its competitive position.

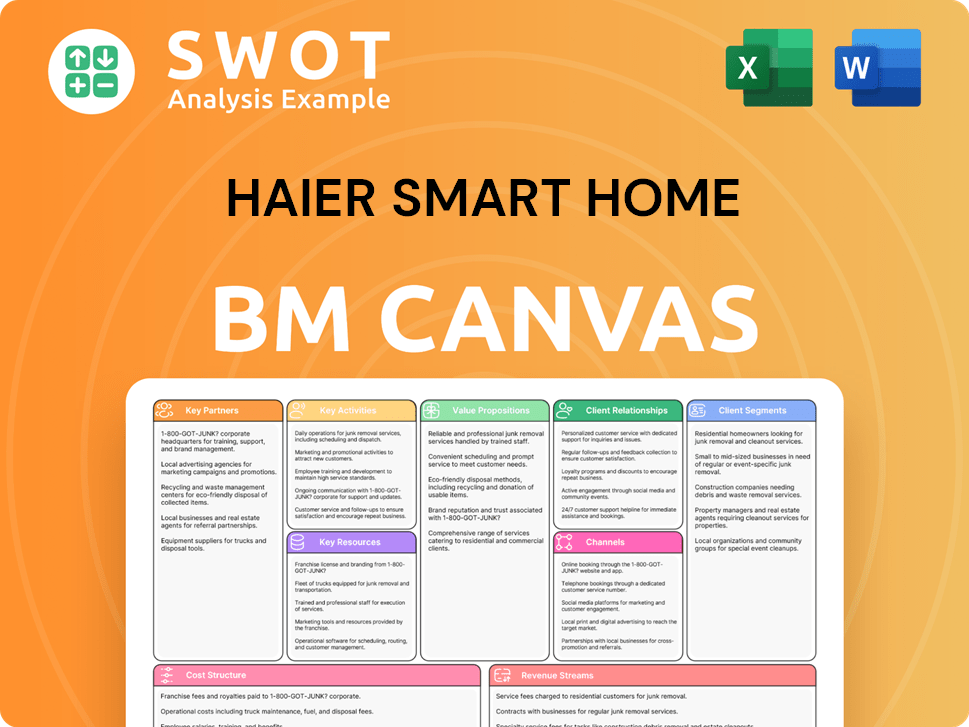

Haier Smart Home Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Haier Smart Home Positioning Itself for Continued Success?

The industry position, risks, and future outlook for the Haier Smart Home company are crucial for understanding its potential. As a leading smart home company, it faces both opportunities and challenges in a rapidly evolving market. This analysis will explore its current market standing, the risks it confronts, and its strategic vision for the future.

The Haier ecosystem has a strong foundation, but the company must navigate various risks to maintain its leadership. These risks include economic factors, competition, and technological advancements. The company's future depends on its ability to innovate, adapt, and expand its global footprint.

The company holds a dominant position in the global home appliance industry. Its global market share by volume reached 9.4% in 2024, according to Euromonitor International. It has maintained the top position in the major home appliance industry worldwide for 16 consecutive years by retail volume.

Macroeconomic fluctuations and shifts in trade policies could significantly impact the global home appliance market. The company is vulnerable to raw material price increases, especially for metals and plastics. Intense competition from global giants and technological disruption from new players also pose ongoing challenges.

The company is focused on driving deep transformations in its business models and organizational structures in both domestic and overseas markets in 2025. Strategic initiatives include enhancing competitiveness in product innovation, digital inventory management, and cost optimization. The company aims to fully embrace AI technologies in 2025.

In China, the company maintains a leading position across all product categories, with particularly dominant shares of 40-50% in refrigeration and laundry segments in 2023. Its Casarte brand has strengthened its premium market leadership, with retail sales increasing by 12% in 2024. The company has significant market shares in Asia (25.9%), North America (24.5%), and Australia and New Zealand (15.9%) in 2024.

The smart home company is focusing on sustainable, high-quality growth through technological innovation, digital transformation, and global strategic footprint optimization. This includes expanding its omni-channel presence in the domestic market and accelerating country-specific product innovation in overseas markets. For more details on how this is achieved, read the Growth Strategy of Haier Smart Home.

- Enhancing competitiveness in product innovation.

- Implementing digital inventory management.

- Focusing on direct consumer engagement and content marketing.

- Optimizing costs to improve profitability.

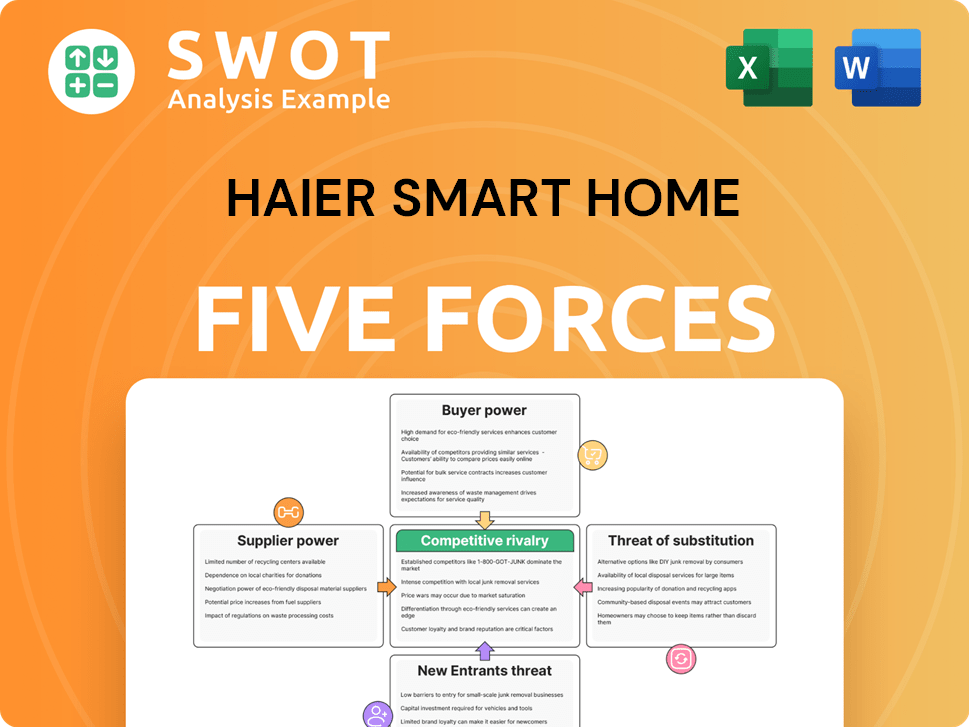

Haier Smart Home Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Haier Smart Home Company?

- What is Competitive Landscape of Haier Smart Home Company?

- What is Growth Strategy and Future Prospects of Haier Smart Home Company?

- What is Sales and Marketing Strategy of Haier Smart Home Company?

- What is Brief History of Haier Smart Home Company?

- Who Owns Haier Smart Home Company?

- What is Customer Demographics and Target Market of Haier Smart Home Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.