Haier Smart Home Bundle

Who Buys Smart Homes from Haier?

In the rapidly evolving world of smart home technology, understanding the Haier Smart Home SWOT Analysis is crucial. Haier, a leading smart home company, has transformed from a traditional appliance maker into a global force. But who exactly are the people driving this transformation and choosing Haier's innovative solutions?

This exploration delves into the core of Haier's success: its customers. We'll dissect the customer demographics and Haier target market, examining their preferences, needs, and behaviors. This market analysis will reveal the consumer profile that Haier strategically targets, providing insights into their geographical locations, income levels, and lifestyles. Understanding Haier's target market segmentation strategy is key to grasping the company's future.

Who Are Haier Smart Home’s Main Customers?

Understanding the customer demographics and target market is crucial for any smart home company. The [Company Name] strategically segments its customer base to cater to diverse needs and preferences. This approach allows it to effectively market its products and services, ensuring a strong market presence.

The primary customer segments for [Company Name] include both consumers (B2C) and businesses (B2B). The B2C segment is further divided into sub-segments based on lifestyle, income, and technological adoption. The company's focus on smart home solutions positions it well to capture a significant share of the growing market.

The company's approach to its target market is data-driven, utilizing market analysis to understand consumer behavior and preferences. This allows for the development of products and marketing strategies that resonate with specific customer segments. For instance, the company's premium brand, Casarte, saw over 20% year-over-year domestic revenue growth in Q1 2025.

The B2C segment is primarily composed of consumers who prioritize high-end, smart, and energy-efficient appliances. The company's Casarte brand targets affluent consumers, while the 'Leader' brand focuses on younger, tech-oriented demographics. The company’s market analysis reveals a growing demand for interconnected living, prompting a shift towards integrated smart home solutions.

The B2B segment includes commercial refrigeration businesses. Strategic acquisitions, such as Carrier's refrigeration business in 2024, have expanded its B2B customer base. These efforts support its development in the European market and contribute to its overall growth strategy. The company is expanding its reach by targeting businesses with its smart home solutions.

The company employs a segmentation strategy based on age, lifestyle, and income levels. The 'Leader' brand, for example, achieved a 26% increase in retail sales in 2024, indicating its success in targeting younger consumers. The company’s focus on AI technologies and advanced large models further enhances its ability to meet the needs of its target market.

The company’s customer base is primarily located in China, but it is expanding its reach globally. The strategic acquisitions and partnerships support its expansion into the European market. The company is focusing its marketing efforts on regions with high growth potential for smart home solutions.

The consumer profile includes early adopters of technology, affluent households, and those seeking energy-efficient appliances. The buying behavior is influenced by factors such as product reviews, brand reputation, and the desire for integrated smart home solutions. The company's focus on AI and advanced models is a key factor in attracting customers.

- High-income individuals and families.

- Tech-savvy consumers interested in smart home integration.

- Consumers seeking energy-efficient appliances.

- Businesses looking for commercial refrigeration solutions.

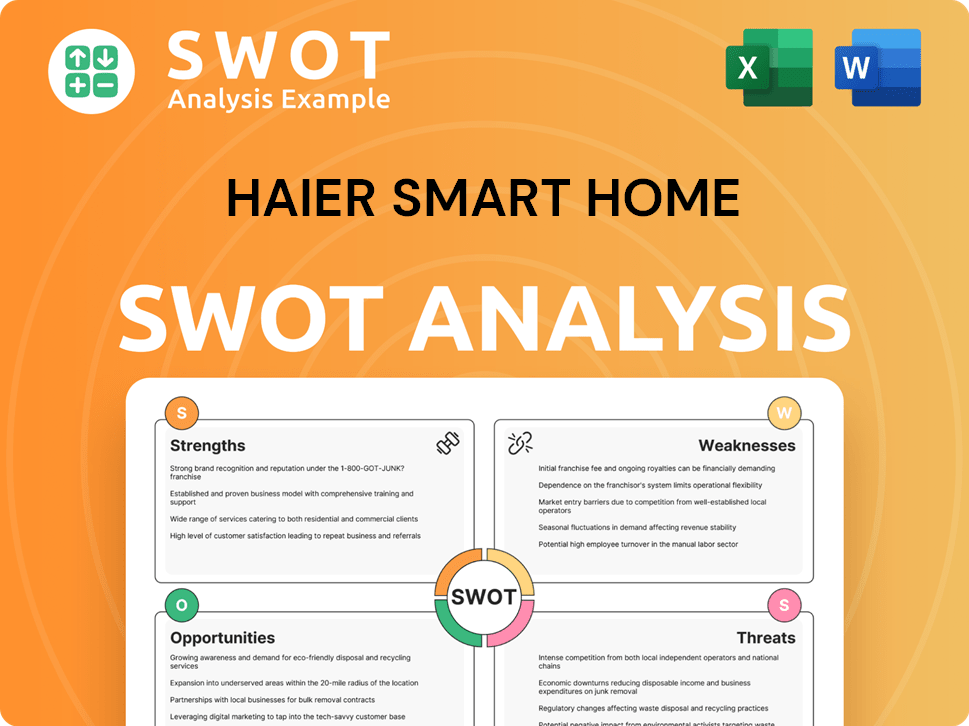

Haier Smart Home SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Haier Smart Home’s Customers Want?

Understanding the customer needs and preferences is crucial for a smart home company like Haier. The primary drivers for Haier's customers include convenience, personalization, and energy efficiency. This focus is evident in the demand for products that offer intelligent and versatile interactions.

Consumers are increasingly looking for a seamless smart living experience. This is reflected in the success of high-value-added products. These products include energy-efficient appliances and those designed for efficient space utilization. The company's responsiveness to market trends and consumer incentives is also a key factor.

Purchasing behaviors are influenced by product upgrades and the increasing adoption of new categories. Haier addresses common pain points by tailoring marketing, product features, and customer experiences. This approach allows the company to meet the evolving needs of its target market effectively.

Haier's customer demographics are driven by the desire for a convenient, personalized, and efficient smart home. The company's focus on these needs is reflected in its product offerings and marketing strategies. This approach allows them to effectively target their ideal customers.

- Convenience: Customers want easy-to-use and integrated smart home solutions.

- Personalization: Consumers seek products that can be customized to their specific needs and preferences.

- Energy Efficiency: There's a growing demand for appliances that conserve energy and reduce utility costs.

- Seamless Smart Living: Customers desire a connected ecosystem where all devices work together effortlessly.

Haier's 'San Yi Niao' integrated cabinet-appliance solution is a great example of how they address these needs. This solution provides a seamless, intelligent home experience, from initial needs analysis to after-sales service. In 2024, Haier capitalized on trade-in policies in China, achieving a 10% overall revenue increase and over 30% growth for Casarte. This demonstrates their ability to adapt to market changes and meet consumer demands. For further insights, explore the Growth Strategy of Haier Smart Home.

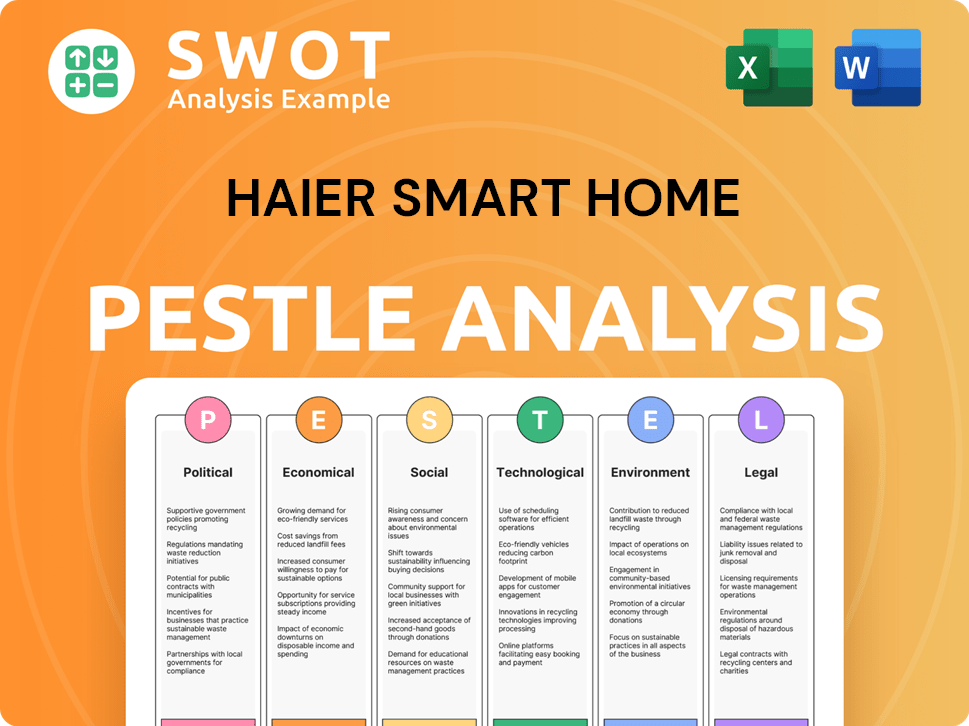

Haier Smart Home PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Haier Smart Home operate?

The geographical market presence of the [Company Name] is extensive, spanning over 160 countries and regions worldwide. This includes key markets such as China, North America, and Europe, as well as emerging markets across South Asia, Southeast Asia, and Africa. This global reach is a critical component of its strategy to capture a broad customer base and drive revenue growth, making it a significant player in the smart home industry.

In 2024, the company's overseas revenue reached RMB 143.914 billion, reflecting a 5.43% increase compared to the previous year. This growth highlights the effectiveness of its international expansion efforts and its ability to adapt to diverse market demands. The company's strategic focus on both established and emerging markets underscores its commitment to sustained global leadership in the smart home sector.

The company's success in different regions can be attributed to its localized strategies, which include tailored product offerings and targeted marketing campaigns. This approach has allowed the company to resonate with diverse consumer profiles and preferences, solidifying its market position. A detailed Market analysis reveals the company's strategic approach to geographical expansion and its impact on revenue streams.

China remains a core market for the company, where it holds a strong leadership position. In 2023, the company held a 28% overall market share in home appliances within China. The company's dominant position in key segments like refrigeration and laundry, with a 40-50% share, underscores its market strength.

In North America, the company's GE Appliances division focuses on product leadership and supply chain improvements. Despite facing sluggish demand and increased competition, the company has solidified its position as an industry leader. This strategic approach ensures sustained market presence.

Europe has demonstrated impressive growth, with the company's sales increasing significantly. The company is becoming a major competitor in this market. In Q1 2025, Europe saw a 31.4% year-over-year revenue growth, highlighting the company's successful expansion in the region.

Emerging markets are becoming key revenue drivers for the company. South Asian sales exceeded RMB 11.5 billion in 2024, marking a 21.05% revenue increase in South Asia alone. The Indian market performed exceptionally well, with sales exceeding USD 1 billion in 2024.

The company is actively expanding its presence in emerging markets through localized strategies. This includes local R&D, manufacturing, and sales efforts. The company aims to double sales in India to USD 2 billion by 2027. The opening of the first phase of its eco-park in Egypt in May 2024, with a production capacity exceeding 200,000 units, is a key step in this expansion.

- India: The company aims to double sales to USD 2 billion by 2027.

- Egypt: The first phase of an eco-park opened in May 2024, with a production capacity exceeding 200,000 units.

- South Asia: Sales increased by 21.05% in 2024, exceeding RMB 11.5 billion.

- Localization: Local R&D, manufacturing, and sales are key to driving expansion.

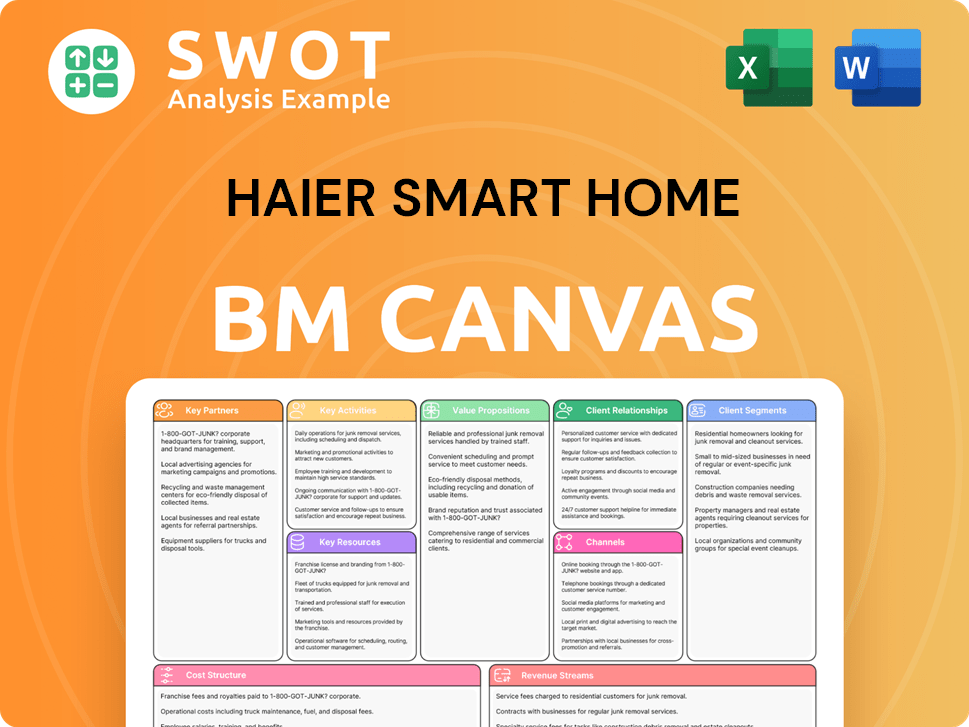

Haier Smart Home Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Haier Smart Home Win & Keep Customers?

The company's customer acquisition and retention strategies are centered around digital transformation, product innovation, and a strong focus on user experience. These strategies are designed to attract new customers while fostering loyalty among existing ones. The company leverages digital marketing and inventory management to enhance user engagement, leading to improvements in operational efficiency and customer satisfaction. These efforts are crucial for maintaining a competitive edge in the smart home market.

To acquire new customers, the company emphasizes its premium product leadership and actively capitalizes on government initiatives. The company's premium brand has a significant market share in the high-end built-in appliance segment. Moreover, the company's active participation in government programs, such as trade-in policies, boosts sales. These strategies are essential for expanding its customer base and driving revenue growth. The company's focus on premium offerings and strategic partnerships positions it well for continued success.

For customer retention, the company focuses on building smart customer service capabilities and utilizing its 'Rendanheyi' organizational model. These initiatives aim to enhance customer satisfaction and foster long-term relationships. The company's smart interaction solutions and AI-driven app contribute to improved customer service and engagement. The 'Rendanheyi' model promotes rapid innovation and tailored solutions, further enhancing customer loyalty. These strategies are key to ensuring customer satisfaction and driving repeat business.

The company utilizes digital marketing strategies and efficient inventory management to improve user engagement. This approach resulted in a 13% improvement in the domestic order response cycle in 2024. Social media platforms are actively used for content marketing and user engagement to elevate product series.

The company emphasizes premium product leadership, particularly through its Casarte brand. Casarte has consolidated its leadership in built-in specifications and bottom-mounted refrigeration systems. Refrigeration models priced above RMB 10,000 captured a 64% offline market share in Q1 2025.

The company actively capitalizes on government initiatives, such as trade-in policies in China. These policies contributed to a 10% overall revenue growth in Q4 2024. This strategic alignment with government programs supports sales and market expansion.

The company focuses on building smart customer service capabilities, including a knowledge base system and smart interaction solutions. The proportion of smart interactions increased by 25.52% year-on-year in 2024. Smart resolution rates improved by 10.35%.

The company's hOn app, utilizing Artificial Intelligence, allows remote management of products and services, offering advice and usage statistics. The 'Rendanheyi' organizational model, which decentralizes decision-making and prioritizes user needs, also contributes to customer satisfaction and retention.

- The hOn app maximizes connected appliance performance and contributes to energy savings.

- The 'Rendanheyi' model enables rapid innovation and tailored solutions.

- These strategies enhance customer loyalty and drive long-term engagement.

- The company's approach combines technological innovation with customer-centric practices.

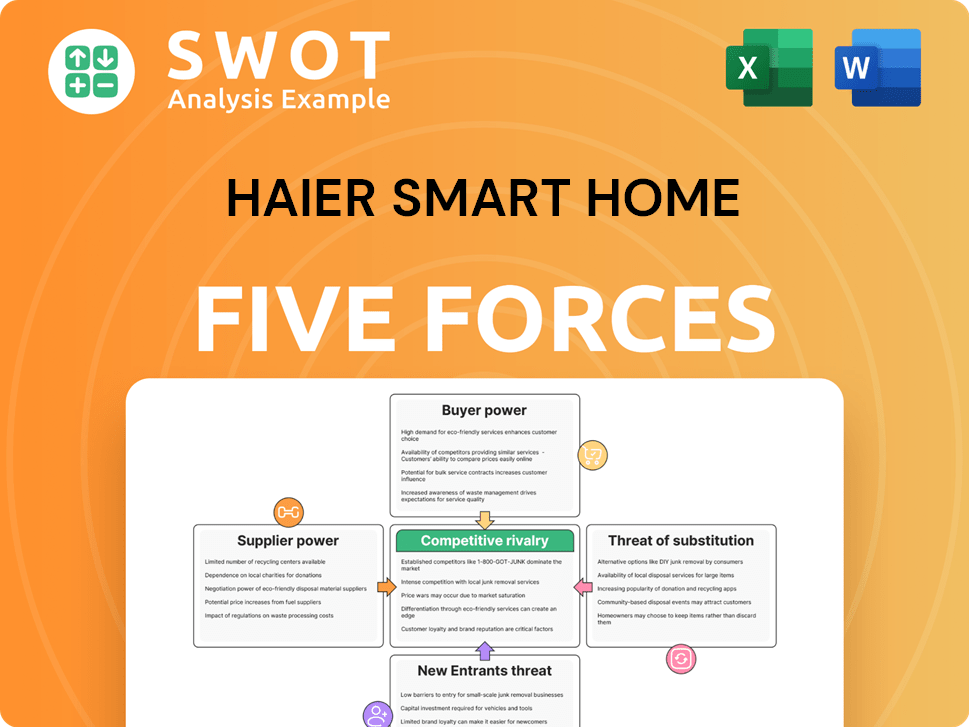

Haier Smart Home Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Haier Smart Home Company?

- What is Competitive Landscape of Haier Smart Home Company?

- What is Growth Strategy and Future Prospects of Haier Smart Home Company?

- How Does Haier Smart Home Company Work?

- What is Sales and Marketing Strategy of Haier Smart Home Company?

- What is Brief History of Haier Smart Home Company?

- Who Owns Haier Smart Home Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.