The Home Depot Bundle

How Does Home Depot Dominate the Home Improvement Arena?

The home improvement industry is a battlefield, and Home Depot stands as a giant. Founded in 1978, Home Depot quickly became a go-to destination for DIY enthusiasts and professionals alike. With its impressive $159.5 billion in sales in fiscal year 2024, the company's journey from a single store to a global powerhouse is a testament to its strategic prowess.

This exploration of the Home Depot competitive landscape will dissect its market positioning, examining its The Home Depot SWOT Analysis, key rivals, and competitive advantages. We'll delve into the Home improvement industry, analyzing Home Depot competitors, and providing a thorough Home Depot market analysis. Understanding Home Depot's strategies is crucial for anyone looking to understand the dynamics of retail competition and the DIY market.

Where Does The Home Depot’ Stand in the Current Market?

The Home Depot holds a dominant position in the home improvement industry. Its core operations revolve around providing a wide array of products and services to both professional contractors and do-it-yourself (DIY) customers. This includes everything from building materials and tools to home decor and installation services, making it a one-stop shop for home improvement needs.

The company's value proposition centers on offering a comprehensive product selection, competitive pricing, and exceptional customer service. Home Depot differentiates itself through its vast store network, knowledgeable staff, and commitment to helping customers complete their projects successfully. This approach has solidified its status as a leader in the home improvement industry, as detailed in an article about the Target Market of The Home Depot.

Home Depot's market share in the home improvement industry is substantial. As of Q1 2025, the company's market share reached 52.15%, showcasing its strong competitive advantage. This significant lead over competitors highlights its success in the DIY market and broader retail competition.

Beyond the home improvement industry, Home Depot also holds a notable position in the overall retail sector. Its market share in this wider context was 8.19% as of Q1 2025. This underscores the company's broad reach and influence within the retail landscape, making it a key player in the industry.

Home Depot offers a diverse range of products and services. Its offerings include building materials, home improvement products, lawn and garden items, decor, and facilities maintenance, repair, and operations (MRO) supplies. The company also provides services such as home improvement installation and tool rentals.

The company's presence spans across North America, with 2,347 stores at the end of fiscal 2024. This includes locations in the U.S., Canada, and Mexico. The company is actively expanding, with 12 new store openings in 2024 and plans for 13 more in 2025, focusing on the Pro customer segment.

Home Depot's financial performance reflects its strong market position. Total sales for fiscal 2024 were $159.5 billion, a 4.5% increase from the previous year. Net earnings for fiscal 2024 reached $14.8 billion. The company's Q4 2024 comparable sales saw a positive increase of 0.8%, the first positive quarter since 2022.

- For fiscal 2025, Home Depot anticipates total sales growth of approximately 2.8%.

- Comparable sales growth is projected to be around 1.0%.

- These figures highlight the company's resilience and strategic focus on growth.

- Home Depot's strategies to compete include digital upgrades and Pro customer segment investments.

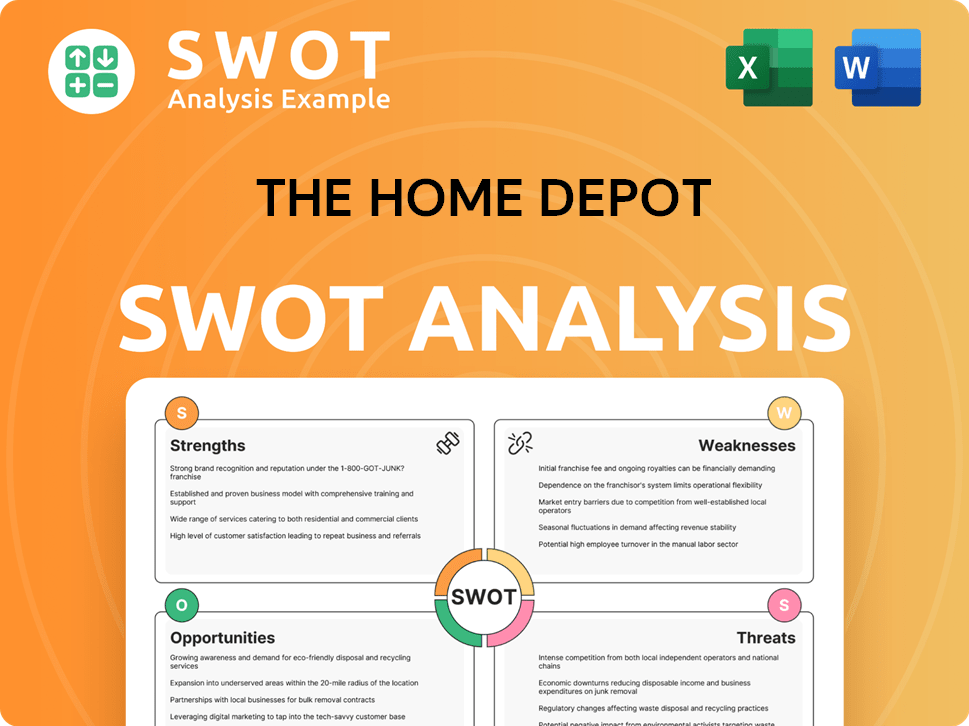

The Home Depot SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging The Home Depot?

The Home Depot competitive landscape is primarily shaped by its rivalry with other large home improvement retailers, the rise of online marketplaces, and specialized suppliers. Understanding these competitors is crucial for a thorough Home Depot market analysis. The company's market position and strategies are constantly evolving in response to these competitive pressures.

Home Depot faces challenges across various fronts, including direct competition from Lowe's, the growth of online retailers like Amazon, and the emergence of specialized suppliers. The company employs various strategies to maintain its market leadership. These strategies include a focus on professional contractors, expansion through acquisitions, and enhancing its online presence.

Home Depot's financial performance compared to competitors is a key indicator of its success. Home Depot's ability to adapt to changing market dynamics and consumer preferences is critical for its continued growth and profitability.

Lowe's is Home Depot's most significant direct competitor in the Home improvement industry. Home Depot's market share is approximately 47% compared to Lowe's 28% as of fiscal year 2023. The two companies compete on product selection, pricing, and customer service.

Home Depot leads in outdoor power equipment with a 46.2% market share. Walmart and Amazon are also making inroads in this category, with 7.9% and 7.7% dollar share respectively as of Q4 2024. This highlights the increasing competition from online retailers.

Home Depot dominates the power tools market with a 52.3% market share. This strong position reflects Home Depot's focus on professional contractors and DIY customers. Lowe's also competes in this category.

Lowe's holds a lead in major appliances with a 40.2% market share, while Home Depot has 36.2%. This indicates a strong competitive dynamic in this segment. Both companies invest in their appliance offerings to attract customers.

Amazon and Walmart are significant players in the home improvement market. Home Depot and Lowe's together controlled 65% of global web sales in the Hardware & Home Improvement online category for retailers based in North America in 2024. Amazon and Walmart offer convenience and competitive pricing.

Other significant players in the home improvement industry include The Sherwin-Williams Company, Builders FirstSource Inc., Tractor Supply Co, and Fastenal Co. These companies compete in various niches within the broader market. These competitors challenge Home Depot's market share.

The competitive landscape includes challenges across various fronts. Competitors like Lowe's challenge Home Depot through a focus on DIY customers and personalized service. Emerging players and digital-first retailers, including Amazon, are disrupting the traditional landscape by offering convenience and competitive pricing. Home Depot's acquisition of SRS, a distributor of design-oriented surfaces, appliances, and architectural specialty products, which is expected to add about $10 billion in annualized revenue, strengthens Home Depot's position in serving professional contractors. These competitive dynamics require Home Depot to continually innovate and adapt to maintain its market position.

The Home Depot competitive landscape is complex, with Lowe's as its primary rival. Online retailers and specialized suppliers also pose significant challenges. Home Depot's strategies include focusing on professional contractors and expanding its online presence. The company's ability to adapt to changing market dynamics is crucial for its success.

- Lowe's is the main direct competitor.

- Online retailers like Amazon and Walmart are growing their market share.

- Home Depot leads in outdoor power equipment and power tools.

- Home Depot is projected to reach $23.6 billion in web sales by the end of 2024.

- Acquisitions like SRS help Home Depot serve professional contractors.

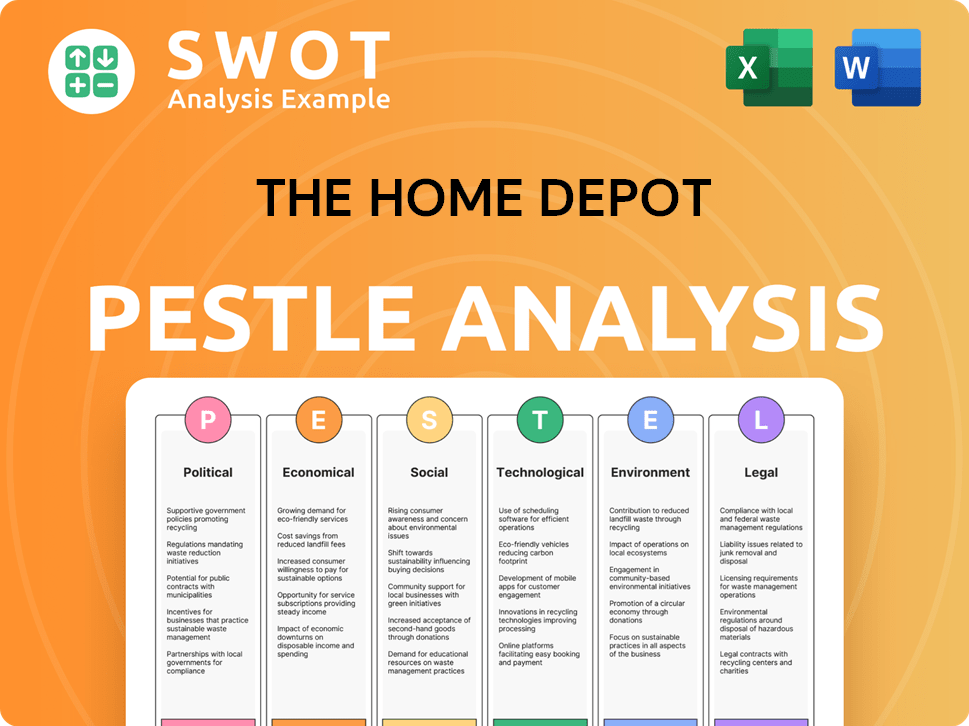

The Home Depot PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives The Home Depot a Competitive Edge Over Its Rivals?

Analyzing the Home Depot competitive landscape reveals a company distinguished by its substantial advantages. These advantages stem from its expansive scale, strategic focus on the professional customer segment, robust omnichannel capabilities, and continuous technological investments. These factors collectively fortify its position within the home improvement industry.

The company's dominance in the home improvement sector is supported by its financial performance and strategic initiatives. The company's market share, brand value, and operational efficiency are key differentiators. The company's ability to adapt and innovate in response to market changes is crucial for maintaining its competitive edge in the face of retail competition.

The company's commitment to customer satisfaction and value, along with its digital transformation efforts, further enhances its competitive position. The company's strategies are designed to maintain and expand its market share. The company's ongoing investments in technology and supply chain improvements provide a competitive advantage in the dynamic DIY market.

As the world's largest home improvement retailer, the company leverages its vast scale to exert significant market influence. This scale enables the company to achieve economies of scale, which helps drive down costs. The company's size provides substantial resources to defend its market dominance.

A key differentiator for the company is its focus on the professional (Pro) market. Approximately 70% of its sales come from contractors and Pros. The company is expanding its Pro offerings by localizing product assortment, creating a dedicated sales force, and improving digital tools.

The company's brand value, estimated at approximately $52.8 billion in 2024, significantly surpasses its main competitor, Lowe's. The company emphasizes value for money through its 'Match and Beat' program, which enhances customer satisfaction and loyalty. This focus on value helps to retain customers.

The company's digital transformation and omnichannel strategy are critical to its success. The company leverages AI-powered cloud innovation to enhance inventory management and supply chain efficiency. The company's supply chain resilience, including direct fulfillment centers, helps slash delivery times.

The company's competitive advantages are multifaceted, encompassing its market position, customer focus, brand value, and digital capabilities. These advantages are supported by strategic investments and operational efficiencies, allowing the company to maintain a strong position in the Home Depot competitive landscape.

- Market Leadership: The company's status as the largest home improvement retailer provides significant scale and market influence.

- Pro Customer Focus: A dedicated focus on professional customers, accounting for a significant portion of sales, drives loyalty and revenue.

- Brand Value: A strong brand, valued at approximately $52.8 billion in 2024, enhances customer trust and loyalty.

- Omnichannel Strategy: A robust digital and omnichannel strategy, utilizing AI and efficient supply chains, improves customer experience and operational efficiency.

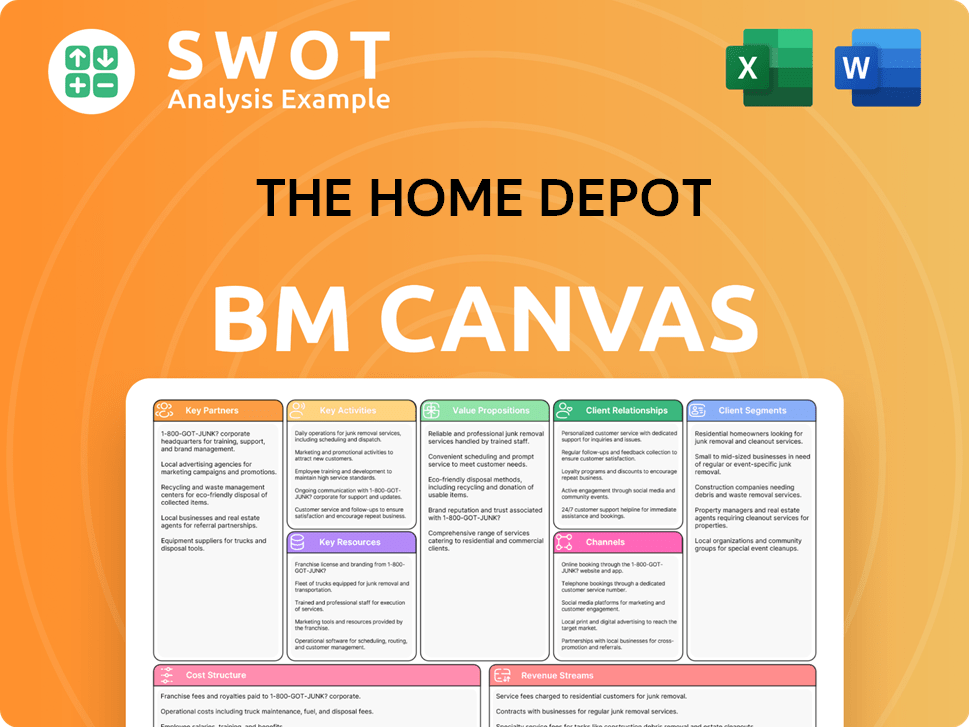

The Home Depot Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping The Home Depot’s Competitive Landscape?

The home improvement industry, where the Home Depot competitive landscape is firmly established, is shaped by technological advancements, changing consumer preferences, and economic conditions. A significant trend is the rise of 'click-and-mortar' shoppers, who blend online and physical shopping experiences. Home Depot is adapting to this omnichannel approach, with digital sales increasing by 9% in fiscal Q4 2024. This strategy is crucial in a market where understanding the Home Depot market analysis is essential for success.

The industry faces challenges due to macroeconomic uncertainty, high interest rates, and inflation, which impact consumer spending on significant home improvement projects. Building material costs are also increasing, with framing lumber projected to be up 14%, and other materials like concrete block, conduit, and copper wire also seeing cost increases. These factors influence the Home Depot's position in the home improvement market, requiring strategic adjustments to maintain a competitive edge.

Technological integration, particularly in AI and machine learning, is a key focus for Home Depot to improve inventory management, supply chain efficiency, and e-commerce. The growth of 'click-and-mortar' shoppers, with approximately 40% of consumers using both digital and physical channels, is another significant trend. Home Depot's ability to leverage these trends will be crucial in the DIY market.

Macroeconomic uncertainty, high interest rates, and inflation are pressuring consumer demand for larger home improvement projects. Building material costs are seeing elevated costs in the first half of 2025, with framing lumber projected to be up 14% from last year. Supply chain strains, including shipping surges and raw material shortages, also pose potential threats, impacting the retail competition.

Strategic investments in the Pro segment, which has shown growth, offer a significant opportunity. The company plans to open approximately 13 new stores in 2025, expanding its physical footprint. Exploring new revenue streams, such as home improvement and repair services, and the aging housing stock in the U.S. present long-term demand for renovation, influencing Home Depot competitors.

Ongoing investments in differentiated capabilities, such as its interconnected shopping experience and growth in Pro wallet share, are aimed at allowing it to grow faster than the market over time. This approach is part of Home Depot's strategy to compete effectively and maintain its market position. To understand the strategies, read Marketing Strategy of The Home Depot.

Home Depot is focusing on omnichannel strategies, with continued investment in its digital platform and physical stores. The company is expanding its Pro segment to cater to professional customers, which has shown growth and helped offset slower consumer demand. These strategic moves are aimed at enhancing Home Depot's competitive advantages.

- Digital Transformation: Enhancing e-commerce capabilities and integrating online and in-store experiences.

- Pro Segment Growth: Expanding services and offerings to attract and retain professional customers.

- Store Expansion: Opening new stores in strategic locations to increase market presence.

- Supply Chain Optimization: Improving inventory management and supply chain efficiency.

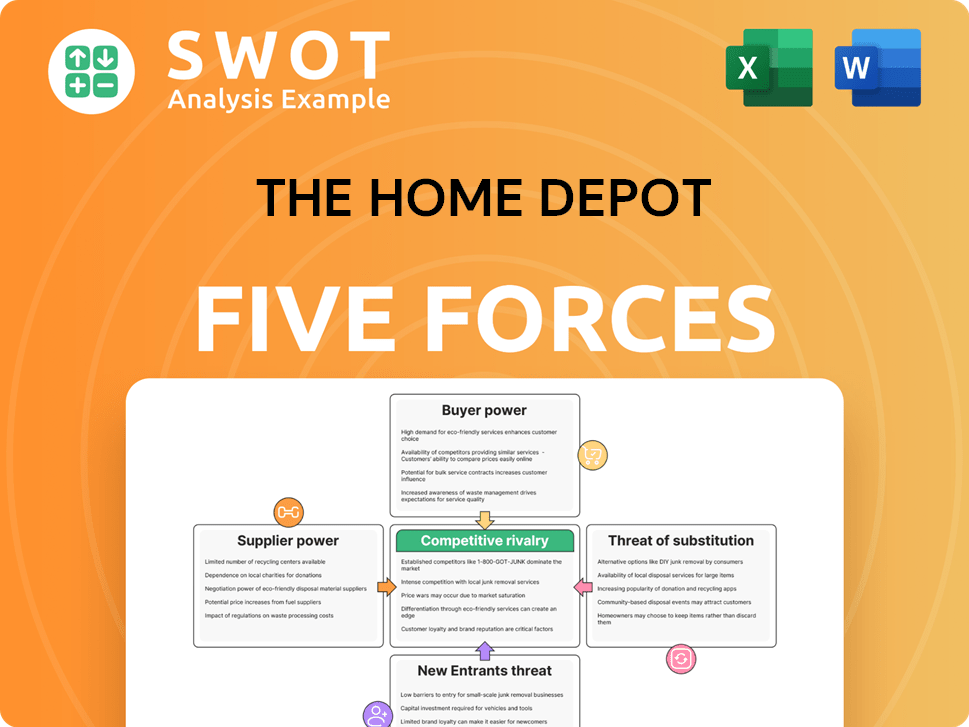

The Home Depot Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of The Home Depot Company?

- What is Growth Strategy and Future Prospects of The Home Depot Company?

- How Does The Home Depot Company Work?

- What is Sales and Marketing Strategy of The Home Depot Company?

- What is Brief History of The Home Depot Company?

- Who Owns The Home Depot Company?

- What is Customer Demographics and Target Market of The Home Depot Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.