The Home Depot Bundle

Who Buys from Home Depot?

In the ever-changing world of The Home Depot SWOT Analysis, understanding its customer base is paramount. The Home Depot's success hinges on its ability to adapt to shifts in customer demographics and the evolving needs of its target market. From DIY enthusiasts to professional contractors, the company must continually refine its approach to stay ahead.

This exploration delves into the Home Depot customer profile, examining factors like Home Depot customer age range, Home Depot customer income levels, and Home Depot customer location analysis. We'll dissect Home Depot customer segmentation to uncover Home Depot buying behavior and how these insights shape the company's strategies in the competitive home improvement retail landscape. Analyzing Home Depot customer gender breakdown, Home Depot customer education levels, and Home Depot customer interests home projects will reveal how the company caters to diverse needs and preferences.

Who Are The Home Depot’s Main Customers?

Understanding the customer base is crucial for any business, and for a large home improvement retail giant, it's particularly important. The company, like other major players in the home improvement retail sector, caters to two primary customer segments: individual consumers and professional customers. These segments, with their distinct characteristics, drive the company's sales and shape its strategic initiatives. Analyzing the customer demographics and understanding the Home Depot target market provides insights into its operational strategies.

The Home Depot customer profile is diverse, reflecting the broad appeal of home improvement and construction products. The company's success hinges on its ability to meet the varied needs of these segments, from DIY enthusiasts to professional contractors. The company's strategies are tailored to maximize customer satisfaction and drive sales growth within each segment. This dual approach allows the company to maintain a strong market position.

The company's approach to customer segmentation is key to its business model. It allows for targeted marketing, product offerings, and service improvements. The company's ability to understand and serve both segments effectively is a significant factor in its sustained success in the competitive home improvement retail market.

The B2C segment includes homeowners, renters, and DIY enthusiasts. This group is often aged between 25-54, with a significant portion being homeowners. They are interested in maintaining, renovating, and decorating their homes. They typically engage in smaller projects, seek convenience, and are influenced by product aesthetics and ease of use.

This segment values convenience, product aesthetics, and ease of use. They are driven by the desire to personalize their living spaces. The company focuses on providing a wide range of products and services to meet the needs of this segment.

The B2B segment, known as 'Pro' customers, includes professional contractors, remodelers, repairmen, and facility managers. This segment is characterized by higher average transaction values and frequent purchases. They demand bulk quantities, specialized tools, and efficient service. The company focuses on catering to the unique needs of these business customers.

This segment values bulk quantities, specialized tools, and efficient service. The company has invested in dedicated Pro services, such as the Pro Xtra loyalty program, to cater to their needs. The Pro segment has demonstrated strong sales growth.

The company's strategy involves tailored approaches for each segment. For the B2C segment, it focuses on providing a wide range of products and services, emphasizing convenience and aesthetics. For the B2B segment, the company offers specialized services and bulk purchasing options. The company's ability to cater to both segments effectively is a key factor in its market success. For more detailed information on the company's financial performance and strategic decisions, you can refer to Owners & Shareholders of The Home Depot.

The company serves both individual consumers (B2C) and professional customers (B2B), each with distinct needs and preferences. The B2C segment is driven by homeownership and DIY projects, while the B2B segment values bulk purchasing and specialized services.

- The B2C segment is often aged 25-54, with a focus on home maintenance and renovation.

- The B2B segment, or 'Pro' customers, are professional contractors and remodelers.

- The company invests in services tailored to each segment, such as the Pro Xtra loyalty program.

- In fiscal year 2023, the Pro segment continued to outperform the DIY segment.

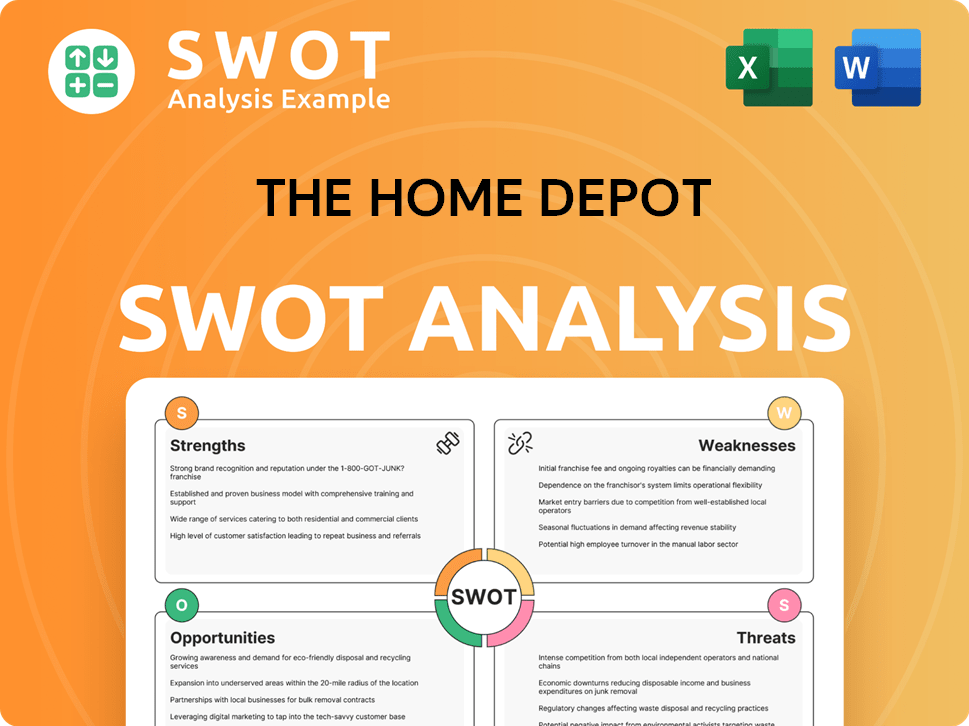

The Home Depot SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do The Home Depot’s Customers Want?

Understanding the needs and preferences of its diverse customer base is crucial for the success of The Home Depot. The company caters to both do-it-yourself (DIY) consumers and professional contractors (Pros), each with distinct motivations and purchasing behaviors. This customer-centric approach enables the company to tailor its offerings, services, and overall shopping experience to meet the specific demands of each segment.

For DIY customers, the appeal often lies in the desire to save money, the satisfaction of personal accomplishment, and the ability to personalize their living spaces. Pros, on the other hand, are driven by efficiency, reliability, and cost-effectiveness, focusing on business operations. The Home Depot's strategies, from product selection to service offerings, are designed to resonate with these varied customer needs. This approach has helped the company maintain its position as a leader in the Growth Strategy of The Home Depot, and the home improvement retail industry.

The company continuously gathers customer feedback through various channels, which influences product assortment, store layout, and the development of new services, such as enhanced digital tools for project planning and order management, reflecting a response to evolving customer expectations for convenience and digital integration. This commitment to understanding and adapting to customer needs has been a cornerstone of its success.

DIY customers often seek readily available products and clear instructions. They are motivated by the ability to customize their living spaces and the satisfaction of completing projects themselves. Perceived value, product quality, and a wide assortment are key factors influencing their purchasing decisions.

Pros prioritize efficiency, reliability, and cost-effectiveness. They require timely access to materials, competitive pricing, durable tools, and specialized services. Repeat purchases and consistent product availability are crucial for their business operations.

Online research, in-store browsing, and recommendations significantly influence DIY customers' decisions. Pros rely on consistent product availability and efficient order fulfillment. Both segments value knowledgeable staff, though the type of knowledge sought may differ.

The Pro Xtra program, dedicated Pro desks, and expanded delivery options cater to professional customers. The company invests in improving its supply chain to ensure pros have access to materials when needed. Digital tools for project planning and order management are also available.

The Home Depot continuously gathers customer feedback through various channels. This feedback influences product assortment, store layout, and the development of new services. The company adapts to evolving customer expectations for convenience and digital integration.

Enhanced digital tools for project planning and order management are offered. The company is responding to evolving customer expectations for convenience and digital integration. This includes online shopping behavior and in-store preferences.

The Home Depot's customer base is segmented into DIY consumers and professional contractors, each with distinct needs and preferences. Understanding these differences allows the company to tailor its offerings effectively. Here's a breakdown of key aspects influencing the Home Depot customer profile and buying behavior:

- DIY Consumers: Value cost savings, project satisfaction, and customization. They seek readily available products, clear instructions, and project inspiration.

- Professional Contractors: Prioritize efficiency, reliability, and cost-effectiveness. They need timely access to materials, bulk purchase options, and specialized services.

- Purchasing Behavior: DIY customers are influenced by perceived value, product quality, and assortment. Pros rely on consistent product availability and efficient order fulfillment.

- Information Sources: Online research and recommendations are important for DIY customers. Pros often use repeat purchases and rely on consistent product availability.

- Service Preferences: Both segments value knowledgeable staff, although the type of knowledge sought differs. DIYers may need project guidance, while pros seek technical specifications.

- Digital Integration: Enhanced digital tools for project planning and order management are offered. The company is responding to evolving customer expectations for convenience and digital integration.

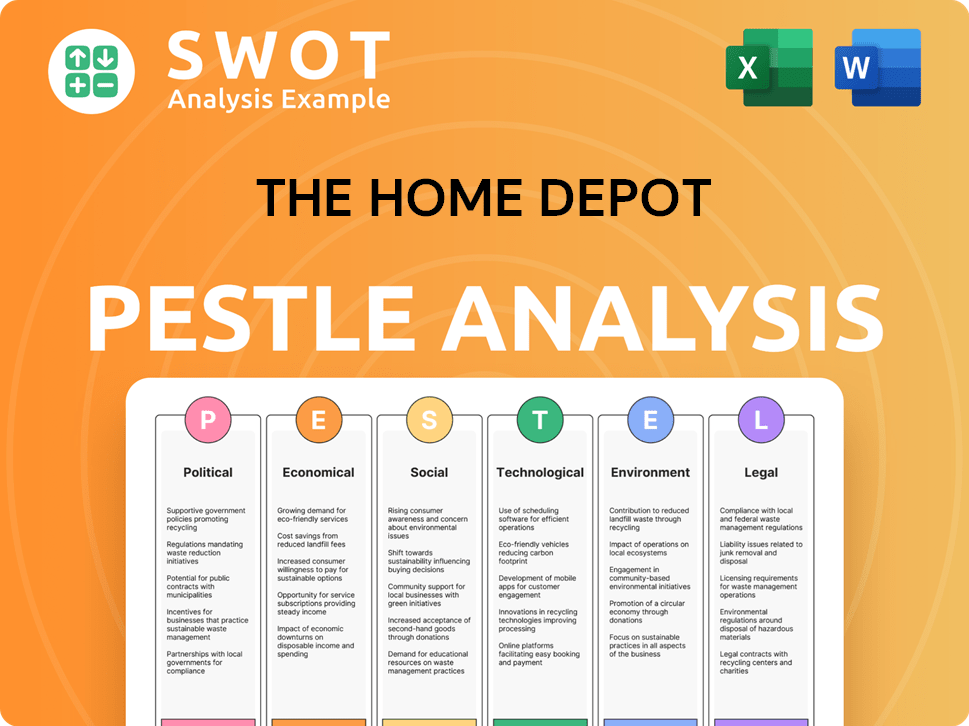

The Home Depot PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does The Home Depot operate?

The geographical market presence of The Home Depot is primarily concentrated in North America. The company has a strong foothold across the United States, Canada, and Mexico, with the vast majority of its stores located within the U.S. This strategic focus allows for efficient operations and targeted marketing efforts.

Key markets for The Home Depot are often found in densely populated suburban areas and growing metropolitan regions. These areas typically have high homeownership rates, creating a continuous demand for home improvement and maintenance products. The company's brand recognition is exceptionally strong in these areas, benefiting from years of established presence and extensive advertising.

The Home Depot's approach involves localizing product assortments and marketing strategies. This is done to cater to regional preferences and climatic conditions. For example, product availability for hurricane preparedness might be more prominent in coastal regions, while snow removal equipment would be emphasized in northern climates.

The Home Depot holds a significant market share in the home improvement retail sector within the United States. In 2023, the company's revenue reached approximately $152 billion, demonstrating its strong market position. This dominance is a result of its extensive store network and effective customer service.

As of early 2024, The Home Depot operates over 2,300 stores across North America. The majority of these stores are located in the United States, with a growing presence in Canada and Mexico. The strategic placement of these stores allows the company to serve a wide customer base efficiently.

The Home Depot tailors its product offerings to regional preferences. For instance, in areas prone to hurricanes, the stores stock a wide range of preparedness products. In contrast, stores in colder regions emphasize snow removal equipment and winter-related items. This localized approach enhances customer satisfaction.

In recent years, The Home Depot has focused on optimizing its existing store footprint rather than expanding internationally. This strategy includes investments in store remodels and technological upgrades. These improvements aim to enhance the customer experience and supply chain efficiency within its established markets.

The Home Depot's customer base is diverse, encompassing homeowners, renters, and professional contractors. Understanding this diversity is crucial for effective marketing and product offerings. This customer segmentation helps tailor the shopping experience.

- Homeowners: Represent a significant portion of the customer base, focusing on home improvement projects, maintenance, and decor.

- Professional Contractors: Account for a substantial amount of sales, relying on the company for supplies, tools, and bulk purchases.

- DIY Enthusiasts: Individuals interested in do-it-yourself projects, seeking guidance, and a wide range of products.

- Renters: Customers who may be looking for smaller projects and maintenance items.

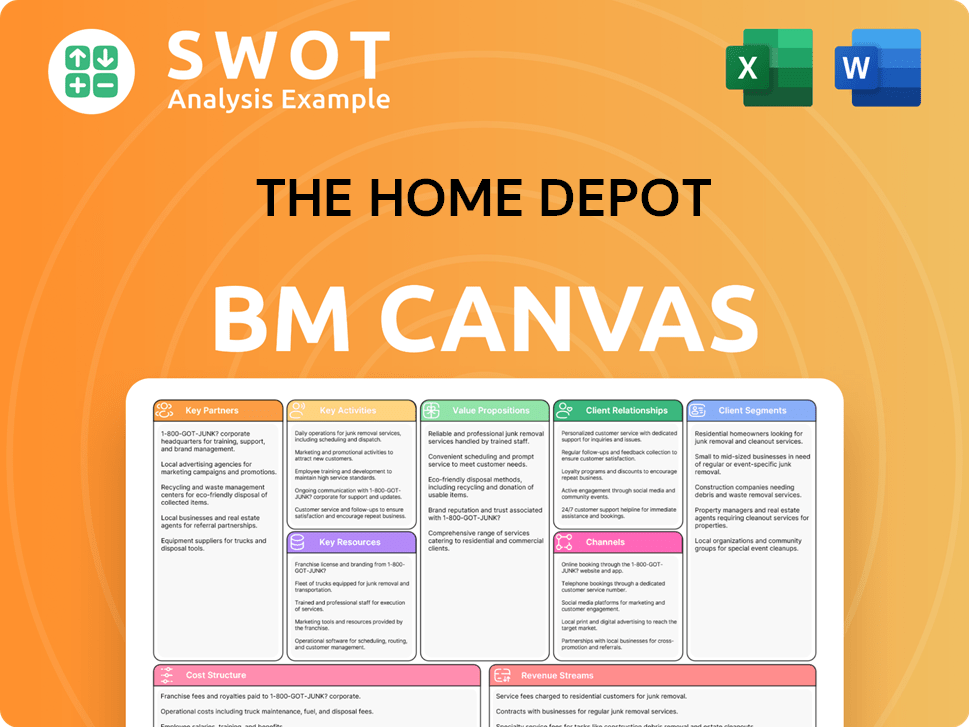

The Home Depot Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does The Home Depot Win & Keep Customers?

The Home Depot's customer acquisition and retention strategies are designed to capture a broad market while fostering customer loyalty. These strategies encompass digital marketing, traditional advertising, in-store experiences, and loyalty programs. The approach targets both professional contractors and do-it-yourself (DIY) customers, aiming to create a seamless and satisfying shopping experience across all channels.

Digital marketing is a cornerstone of their acquisition strategy, leveraging SEO, PPC advertising, and social media. The company's website and mobile app are crucial for online sales, in-store pickup, and project inspiration. Traditional advertising, including TV commercials, continues to reach a wide audience, particularly during seasonal promotions and major sales events. These efforts are supported by robust data analytics to understand customer behavior and optimize marketing spend.

Retention efforts focus on building strong customer relationships. The Pro Xtra loyalty program offers exclusive benefits to professional customers, fostering repeat business. For DIY customers, the focus is on exceptional in-store service, knowledgeable staff, and a wide product assortment to encourage return visits. Personalized marketing, driven by customer data, tailors promotions and recommendations based on past purchases and browsing behavior. Recent initiatives integrate online and in-store shopping to meet evolving customer expectations.

The company heavily invests in digital channels to attract customers. This includes search engine optimization (SEO) to improve search rankings, pay-per-click (PPC) advertising for targeted campaigns, and social media marketing to engage with potential customers. These strategies drive traffic to the website and mobile app, crucial for online sales and in-store pickup.

Traditional advertising, such as television commercials and print ads, remains a key component. These ads are particularly effective for seasonal promotions and major sales events, reaching a broad audience. This approach complements digital marketing, ensuring comprehensive market coverage.

The Pro Xtra loyalty program is designed to retain professional customers. It offers exclusive benefits, discounts, and personalized services, encouraging repeat business. This program helps to build strong relationships with contractors and other professionals.

For DIY customers, the company focuses on exceptional in-store service. This includes knowledgeable staff and a wide product assortment to create a positive shopping experience. This approach aims to encourage return visits and build customer loyalty.

Personalized marketing is a key component of the retention strategy. Customer data and CRM systems are used to tailor promotions and product recommendations based on past purchases and browsing behavior. This enhances customer engagement and increases the likelihood of repeat purchases.

- Targeted email campaigns based on purchase history.

- Product recommendations on the website and app.

- Customized offers and promotions.

- Exclusive deals for loyalty program members.

The company's customer acquisition and retention strategies are supported by a deep understanding of its Revenue Streams & Business Model of The Home Depot. These strategies are crucial for maintaining a competitive edge in the home improvement retail market. Recent initiatives, such as the integration of online and in-store shopping, and expanded delivery options, demonstrate the company's commitment to adapting to evolving customer expectations.

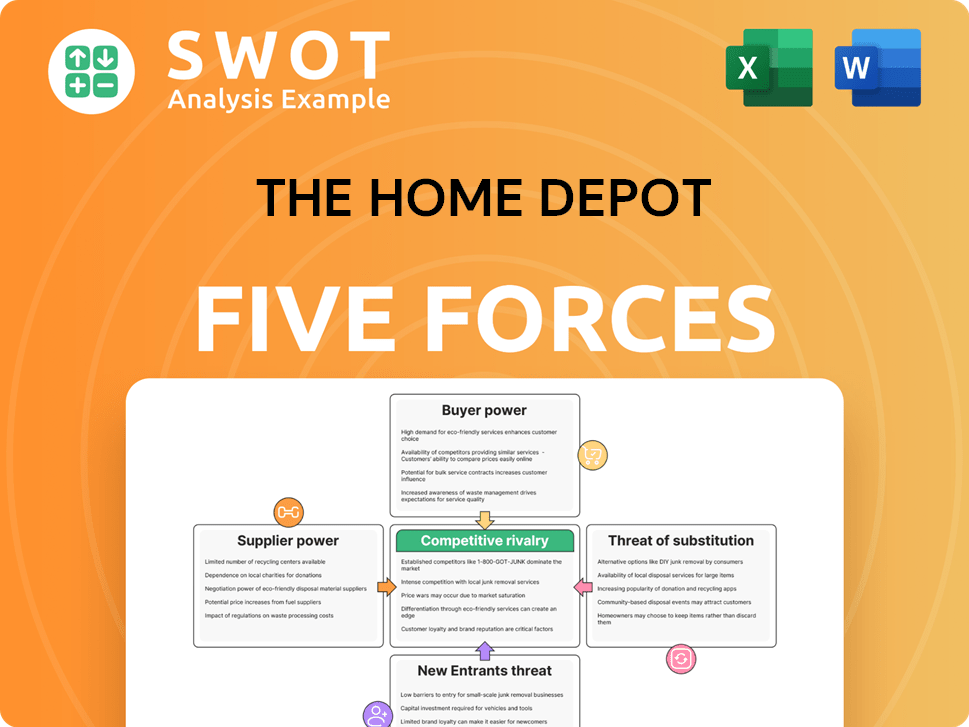

The Home Depot Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of The Home Depot Company?

- What is Competitive Landscape of The Home Depot Company?

- What is Growth Strategy and Future Prospects of The Home Depot Company?

- How Does The Home Depot Company Work?

- What is Sales and Marketing Strategy of The Home Depot Company?

- What is Brief History of The Home Depot Company?

- Who Owns The Home Depot Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.