The Home Depot Bundle

Who Really Owns Home Depot?

Unraveling the question of 'Who owns Home Depot?' is key to understanding the retail giant's power and direction. From its transformative IPO to its current market dominance, the ownership structure has profoundly shaped The Home Depot company. Founded in 1978, the company revolutionized home improvement retail, growing into the world's largest in its sector. Understanding the The Home Depot SWOT Analysis is crucial.

The Home Depot corporation's ownership is a complex mix, influencing everything from its strategic decisions to its financial performance. Knowing the Home Depot owner, including the major shareholders and the board of directors, is essential for investors and anyone interested in the company's future. This exploration will examine the Home Depot ownership structure, providing insights into the company's history and its current operational strategies, and helping you understand the roles of the Home Depot executives.

Who Founded The Home Depot?

The Home Depot was brought to life in 1978 by Bernie Marcus, Arthur Blank, and Ron Brill. Marcus, with his retail background, took on the role of the first CEO. Blank, also experienced in retail, became President. Brill was essential as the company's first CFO. The early days of the Home Depot company saw these founders working closely together to build their vision.

Early backing came from a select group of investors, including venture capitalist Ken Langone. Langone provided crucial seed funding, which was key in shaping the company's early strategy. The founders, along with these early investors, held significant control and shared a common goal: to create a comprehensive, one-stop shop for do-it-yourselfers. This collaborative approach was central to the company's early success.

The initial ownership structure was defined by a tight-knit group of founders and early investors. They were deeply involved in the daily operations and strategic direction of the business. Their combined expertise in retail and finance was fundamental to the rapid expansion of the company. The founding team's vision of a warehouse-style store offering a vast selection at competitive prices was reflected in how control was distributed. This allowed them to quickly implement their business model and set themselves apart in the market. To learn more about the company's beginnings, you can read the Brief History of The Home Depot.

The early ownership of the Home Depot was characterized by a strong focus on teamwork and shared goals. The founders and initial investors worked closely together to build the company. Their combined experience in retail and finance was critical to the company's rapid growth. The founders' vision of a warehouse-style store was reflected in the early distribution of control.

- The founders, Bernie Marcus, Arthur Blank, and Ron Brill, held significant control.

- Ken Langone, a venture capitalist, provided crucial seed funding.

- Early agreements likely included standard vesting schedules to ensure long-term commitment.

- The focus was on creating a one-stop shop for do-it-yourselfers.

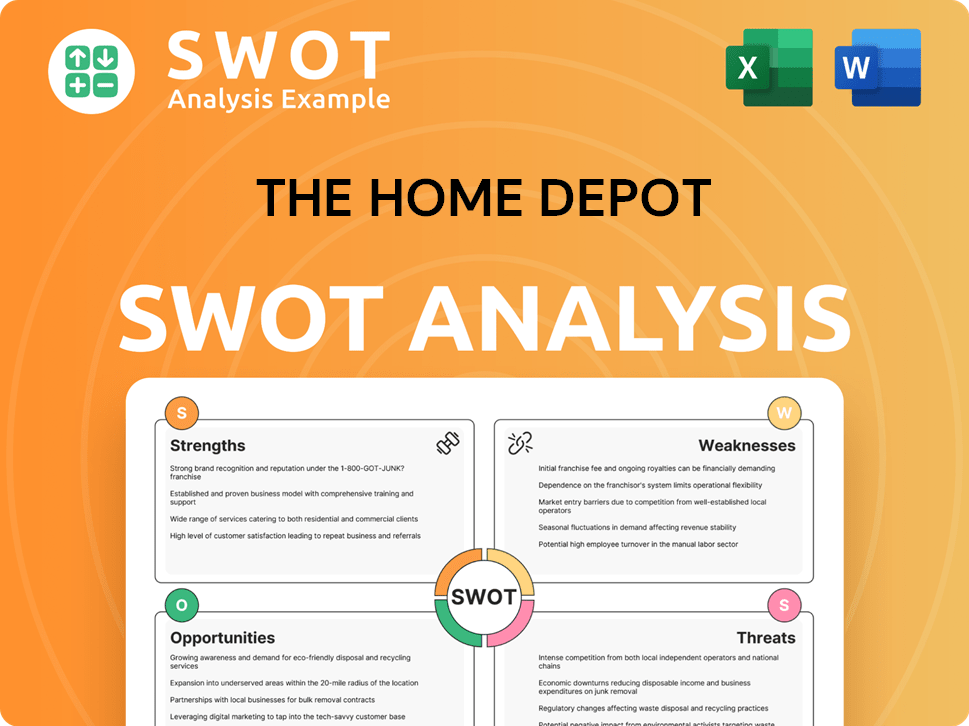

The Home Depot SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has The Home Depot’s Ownership Changed Over Time?

The ownership structure of the Home Depot company has evolved significantly since its inception. A pivotal moment arrived on September 22, 1981, with its initial public offering (IPO). This transition from private to public ownership opened the doors for a broader investor base and marked a new era for the company. The IPO allowed the company to raise capital and fueled its expansion across the United States and beyond.

As of early 2024, the Home Depot ownership is primarily held by institutional investors. This is a common characteristic of large, publicly traded corporations. The shift to public ownership has also meant increased transparency and adherence to regulations set by the Securities and Exchange Commission (SEC), with detailed ownership information available in annual reports and proxy statements. This structure has enabled the company to access substantial capital for strategic initiatives, including supply chain improvements, e-commerce development, and new store openings.

| Shareholder | Percentage of Shares (as of March 31, 2024) | Type |

|---|---|---|

| The Vanguard Group, Inc. | 8.89% | Institutional Investor |

| BlackRock, Inc. | 7.84% | Institutional Investor |

| State Street Corp | 4.29% | Institutional Investor |

The major shareholders in the Home Depot corporation include prominent institutional investors. These firms manage significant assets and often hold substantial positions in publicly traded companies. The influence of individual insider ownership, including current and former Home Depot executives and board members, while smaller in percentage terms, remains important in corporate governance. Understanding the Home Depot ownership structure is crucial for investors and anyone interested in the company's financial health and strategic direction. Learn more about their Growth Strategy of The Home Depot.

The Home Depot owner structure is primarily institutional, with significant holdings by firms like Vanguard and BlackRock.

- The IPO in 1981 marked a shift from private to public ownership.

- Institutional investors hold the majority of the shares.

- Ownership details are disclosed in annual reports.

- Insider ownership, though smaller, impacts governance.

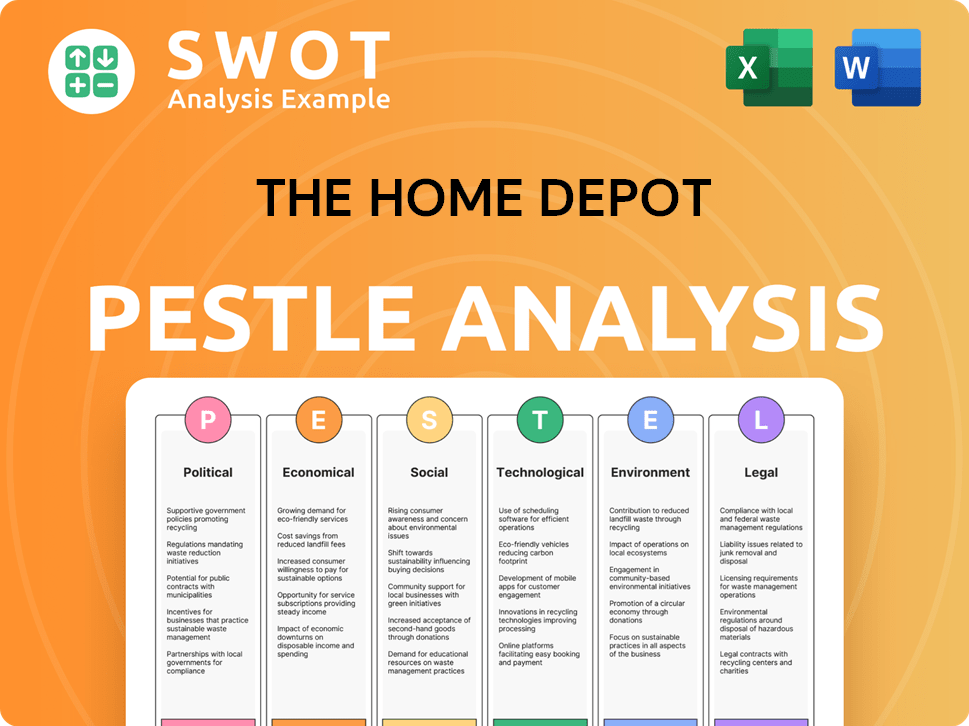

The Home Depot PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on The Home Depot’s Board?

The Board of Directors of The Home Depot, as of early 2025, oversees the company's governance and strategic direction. The board includes a mix of independent directors and executive leadership, with expertise in areas like retail, finance, technology, and operations. This structure is designed to ensure a balance of expertise and independent judgment, representing the interests of a diverse shareholder base. The board's primary focus is on long-term value creation for shareholders, overseeing executive performance, and aligning the company's strategic direction with market opportunities and shareholder expectations.

Specific board members representing major institutional shareholders are not typically identified by name in public disclosures. However, the board's composition reflects the needs of a large retail enterprise. The board's decisions are primarily focused on long-term value creation for shareholders, overseeing executive performance, and ensuring the company's strategic direction aligns with market opportunities and shareholder expectations.

| Board Member | Title | Relevant Experience |

|---|---|---|

| Ted Decker | President and CEO | Extensive experience in retail operations and financial management. |

| Richard McPhail | Executive Vice President and CFO | Deep expertise in financial strategy and corporate finance. |

| Craig Menear | Chairman of the Board | Former CEO with significant experience in retail leadership. |

The Home Depot operates under a one-share-one-vote voting structure, ensuring that all shareholders have proportional influence based on their ownership stake. There are no indications of dual-class shares or special voting rights. While founders Bernie Marcus and Arthur Blank are no longer involved in day-to-day operations, their legacy and influence are still acknowledged. Recent years have not seen significant public proxy battles or activist investor campaigns that have fundamentally reshaped the board or its decision-making processes. For more detailed information on the company's history, you can explore the article on the company's background.

The Board of Directors oversees governance and strategic direction. The company uses a one-share-one-vote system. The board includes independent directors and executive leadership.

- Diverse expertise in areas like retail and finance.

- Focus on long-term value creation.

- No dual-class shares or special voting rights.

- Stable governance environment.

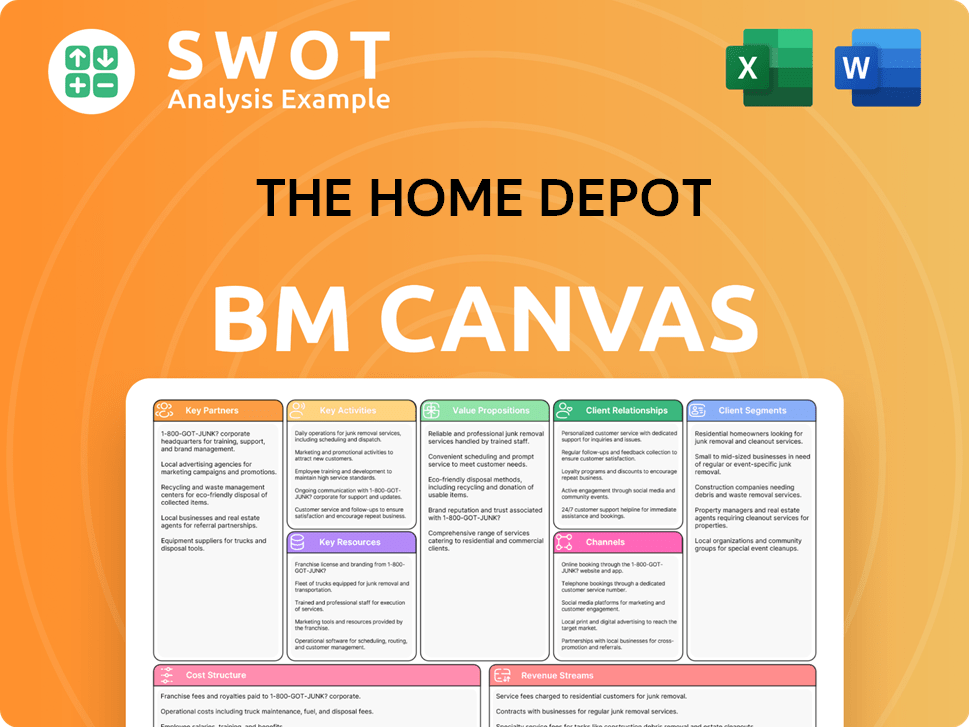

The Home Depot Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped The Home Depot’s Ownership Landscape?

In the past few years, the ownership structure of the Home Depot company has remained relatively stable, with institutional investors continuing to hold a significant portion of the stock. The company's focus on returning value to shareholders through share buyback programs has been a consistent feature. For instance, in fiscal year 2023, Home Depot repurchased approximately $15.0 billion of its outstanding shares. This strategy gradually increases the ownership percentage of the remaining shareholders, a subtle form of ownership consolidation.

Industry trends, such as the growing influence of passive investment vehicles like index funds, also play a role in shaping Home Depot's ownership profile. As of March 2024, index funds held a substantial stake in the company's stock. This shift often leads to a more stable, long-term investor base. The company's strategic focus on growth, digital acceleration, and supply chain optimization, supported by its broadly distributed public ownership, remains unchanged. Consistent dividend payouts and share repurchase programs are key components of its shareholder return strategy, which influences investor interest and ownership stability.

| Metric | Details | Data |

|---|---|---|

| Share Repurchases (Fiscal Year 2023) | Amount of shares repurchased | Approximately $15.0 billion |

| Index Fund Ownership (As of March 2024) | Percentage of stock held by index funds | Substantial |

| Dividend Payouts | Consistent | Ongoing |

The Home Depot's ownership structure reflects broader market dynamics, with institutional investors and index funds playing key roles. The company's commitment to shareholder value through dividends and share repurchases is a notable aspect of its financial strategy. For a deeper understanding of the company's customer base, explore the Target Market of The Home Depot.

Institutional investors are major holders of Home Depot stock. Index funds also have a significant presence in the company's ownership. Share buybacks are a strategy to return value to shareholders.

Consistent dividend payouts are part of Home Depot's shareholder return strategy. Share repurchase programs consolidate ownership among existing holders. These actions aim to maintain investor interest and stability.

The ownership profile reflects market trends, including the rise of passive investment. There have been no indications of privatization or significant changes in public listing. The company focuses on strategic growth and digital initiatives.

Home Depot repurchased approximately $15.0 billion of shares in fiscal year 2023. Index funds hold a substantial portion of the company's stock as of March 2024. Consistent dividend payouts are a feature of the company's financial strategy.

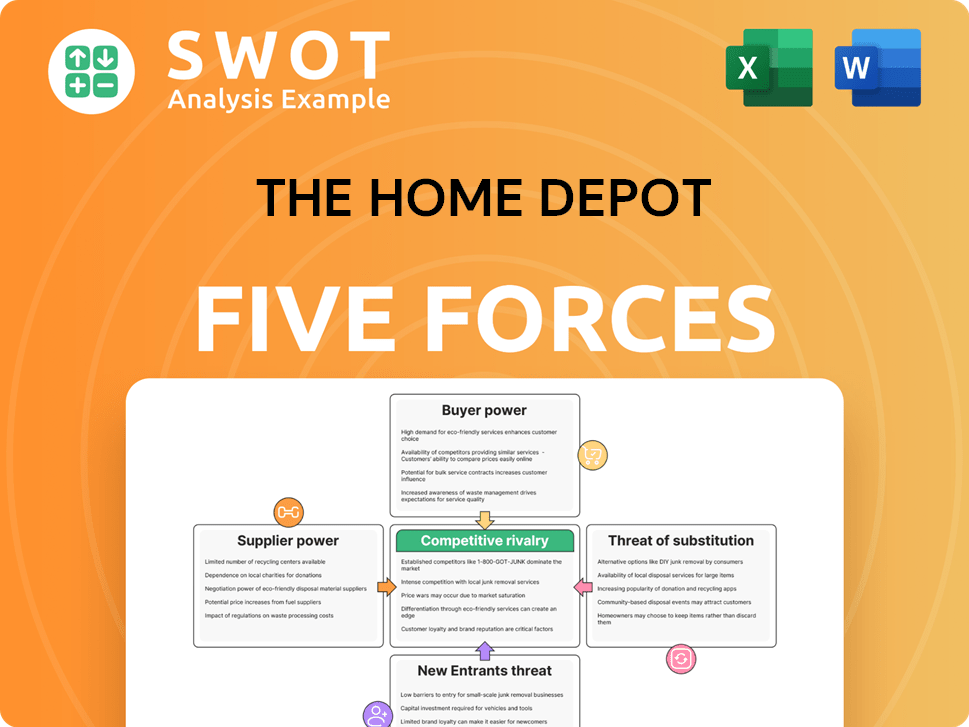

The Home Depot Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of The Home Depot Company?

- What is Competitive Landscape of The Home Depot Company?

- What is Growth Strategy and Future Prospects of The Home Depot Company?

- How Does The Home Depot Company Work?

- What is Sales and Marketing Strategy of The Home Depot Company?

- What is Brief History of The Home Depot Company?

- What is Customer Demographics and Target Market of The Home Depot Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.