The Home Depot Bundle

Can The Home Depot Maintain Its Dominance in the Home Improvement Market?

The Home Depot's journey from a modest startup in 1978 to the world's largest home improvement retailer is a testament to its innovative business model and strategic foresight. The acquisition of HD Supply in 2020 amplified its presence, particularly within the professional customer segment, fundamentally reshaping its growth trajectory. This article delves into the The Home Depot SWOT Analysis to uncover the secrets behind its enduring success.

Understanding The Home Depot's growth strategy and future prospects requires a deep dive into its strategic initiatives, including its expansion plans and online sales strategy, to navigate the evolving retail industry trends. Analyzing its market share and financial performance review, alongside the competitive landscape, will provide insights into its long-term growth strategy. This comprehensive Home Depot company analysis will also explore the opportunities and challenges it faces in the home improvement market, offering valuable perspectives on its investment potential.

How Is The Home Depot Expanding Its Reach?

The company's expansion initiatives are primarily focused on enhancing its market position and diversifying revenue streams. A key element of this strategy involves investing in its 'One Home Depot' interconnected retail approach. This integration connects physical stores, online platforms, and the supply chain to improve customer experience. This strategy is essential for understanding the Mission, Vision & Core Values of The Home Depot.

The strategy includes optimizing fulfillment capabilities like buy online, pick up in-store (BOPIS) and curbside pickup options. These options have seen significant adoption by customers. Furthermore, the company is expanding its flatbed distribution centers (FDCs) to better serve Pro customers with bulk materials and job-site delivery. The goal is to increase efficiency and service levels across North America.

The company is also focused on deepening its reach within existing markets. This is being achieved by enhancing its Pro ecosystem. This includes expanding its Pro Xtra loyalty program, offering tailored services, and providing a more robust product assortment specifically for professional contractors. The company aims to capture a larger share of the professional market, which represents a significant growth opportunity.

The company is actively expanding its Pro Xtra loyalty program. This includes offering tailored services and a more robust product assortment for professional contractors. The goal is to increase market share in the professional segment. This is a key part of the Home Depot growth strategy.

The expansion of flatbed distribution centers (FDCs) is a crucial initiative. The goal is to improve service levels and efficiency, especially for Pro customers. The company plans to have approximately 17 FDCs by the end of fiscal year 2024.

The 'One Home Depot' strategy integrates physical stores, online platforms, and the supply chain. This integration provides a seamless customer experience. It includes optimizing fulfillment options like BOPIS and curbside pickup.

The company is focusing on deepening its reach within existing markets. This is being achieved by enhancing its Pro ecosystem and improving its supply chain. The emphasis is on optimizing its existing footprint.

The company is concentrating on enhancing its Pro ecosystem and optimizing its supply chain. This includes expanding the Pro Xtra loyalty program and increasing the number of flatbed distribution centers. These initiatives are designed to improve customer experience and increase market share.

- Expansion of Pro Xtra loyalty program.

- Investment in flatbed distribution centers (FDCs).

- Focus on 'One Home Depot' interconnected retail strategy.

- Optimization of fulfillment capabilities.

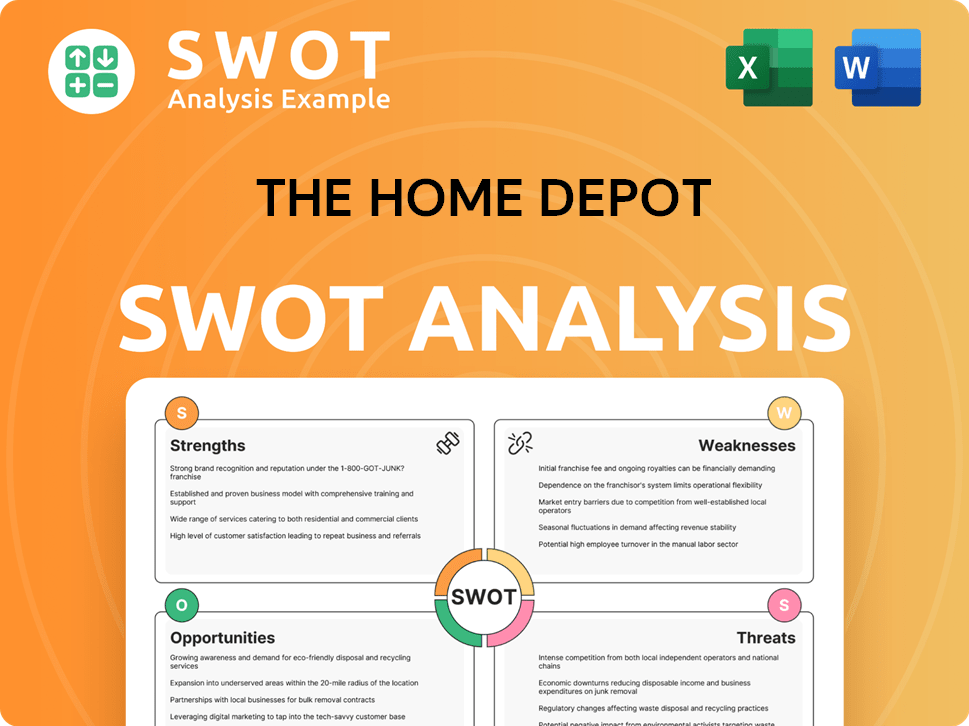

The Home Depot SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does The Home Depot Invest in Innovation?

The company strategically uses technology and innovation to fuel its sustained growth. This approach focuses on enhancing customer experience and improving operational efficiency. The goal is to create a seamless retail experience for both do-it-yourself (DIY) and professional (Pro) customers.

Significant investments are being made in digital transformation. This includes continuous improvements to e-commerce platforms, mobile applications, and in-store digital tools. The company leverages AI and machine learning to personalize product recommendations, streamline search functions, and optimize inventory management. These efforts are crucial to the company's Home Depot growth strategy.

Advanced analytics are integrated to better understand customer behavior and optimize merchandising. Automation is being explored and implemented in the supply chain and distribution centers. This is done to improve efficiency and speed up deliveries, especially for Pro customers. These initiatives are key to understanding the Home Depot future prospects.

The company is heavily investing in digital platforms. This includes e-commerce, mobile apps, and in-store digital tools. The goal is to create a seamless experience for all customers.

AI and machine learning are used to personalize product recommendations. They also help streamline search functions and improve inventory management. This enhances the overall customer experience.

Advanced analytics are used to understand customer behavior. This data helps optimize merchandising and tailor offerings. This improves sales and customer satisfaction.

Automation is being implemented in the supply chain and distribution centers. This improves efficiency and speeds up deliveries. This is particularly beneficial for Pro customers.

The company is enhancing the Pro customer experience. This includes improved online ordering and fulfillment options. The goal is to create a more efficient shopping journey.

Consistent capital expenditure on technology infrastructure and digital capabilities is a priority. This demonstrates a strong commitment to innovation. This investment supports the company's long-term goals.

While specific R&D investment figures are not always disclosed in detail, the company's consistent capital expenditure on technology infrastructure and digital capabilities demonstrates a strong commitment to innovation. In recent earnings calls, executives have highlighted the ongoing investment in technology to enhance the Pro customer experience, including improved online ordering and fulfillment options. The focus is on creating a more efficient and personalized shopping journey, whether customers are engaging online, in-store, or through its various service offerings. To learn more about the company's history, you can read the Brief History of The Home Depot.

The company's technology strategy focuses on enhancing customer experience and operational efficiency. This includes investments in digital platforms, AI, and supply chain automation. These initiatives are designed to drive Home Depot company analysis and growth.

- E-commerce Enhancements: Continuous improvements to online platforms and mobile apps to provide a seamless shopping experience.

- AI-Driven Personalization: Using AI to personalize product recommendations and streamline search functions.

- Supply Chain Optimization: Implementing automation in distribution centers to improve delivery speed.

- Pro Customer Focus: Enhancing online ordering and fulfillment options for professional customers.

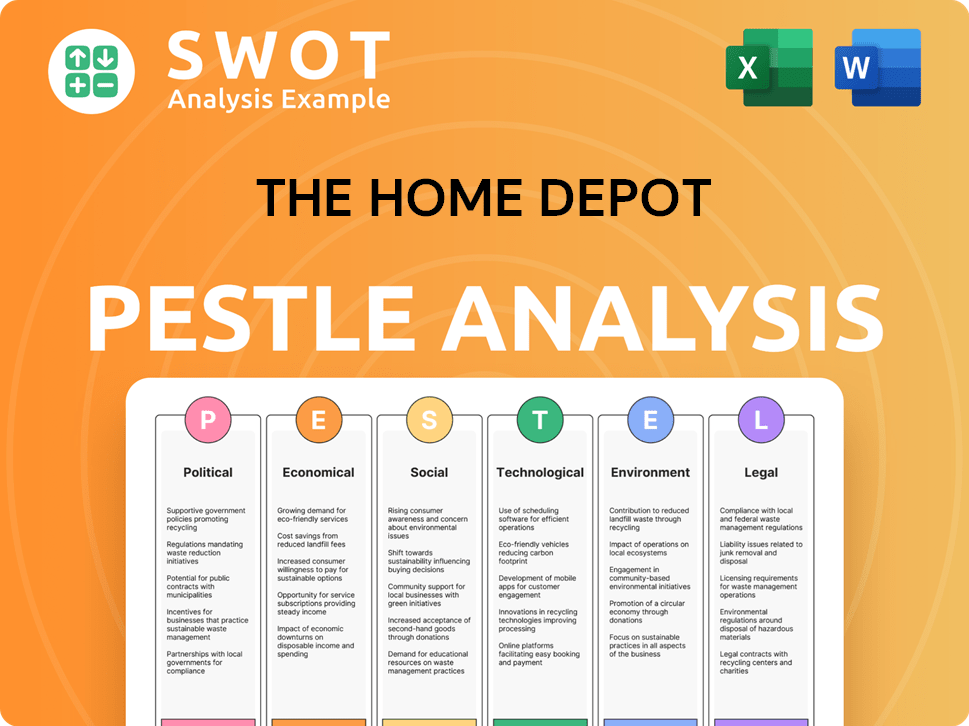

The Home Depot PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is The Home Depot’s Growth Forecast?

The financial outlook for The Home Depot is positive, with the company anticipating continued growth driven by strategic initiatives. For fiscal year 2024, the company projects sales growth of approximately 1.0%, alongside a similar increase in comparable sales. This steady forecast reflects the company's confidence in navigating the dynamic home improvement market.

The company expects its diluted earnings per share to grow by approximately 9.9% in fiscal year 2024, reaching around $16.94. These financial goals are supported by ongoing investments in its interconnected retail strategy, supply chain enhancements, and initiatives aimed at expanding its presence in the Pro market. The company's focus on these areas is a key part of its Home Depot growth strategy.

Historically, The Home Depot has demonstrated strong financial performance. In fiscal year 2023, sales reached $152.7 billion, with diluted earnings per share of $15.13. The company's gross margin for fiscal year 2023 was 33.5%, indicating effective cost management. This strong financial foundation supports its future prospects.

The Home Depot anticipates sales growth of approximately 1.0% and comparable sales growth of about 1.0% for fiscal year 2024. The company's diluted earnings per share are projected to grow by approximately 9.9%, reaching around $16.94.

The company is investing in its interconnected retail strategy, supply chain improvements, and initiatives to capture a larger share of the Pro market. These investments are crucial for long-term growth and adapting to retail industry trends.

In fiscal year 2023, The Home Depot reported sales of $152.7 billion and diluted earnings per share of $15.13. The gross margin for fiscal year 2023 was 33.5%, demonstrating efficient cost management and a strong Home Depot business model.

The company's capital allocation strategy prioritizes investments that drive long-term growth, including technology upgrades, supply chain optimization, and store improvements. The company is committed to returning value to shareholders through dividends and share repurchases.

Key drivers for revenue growth include the interconnected retail strategy, which combines online and in-store experiences, and supply chain optimization to improve efficiency. Expanding the Pro market segment also contributes to revenue growth.

The Home Depot operates within the home improvement market, which is influenced by factors such as housing starts, consumer spending, and economic conditions. The company's strategic initiatives are designed to navigate these market dynamics.

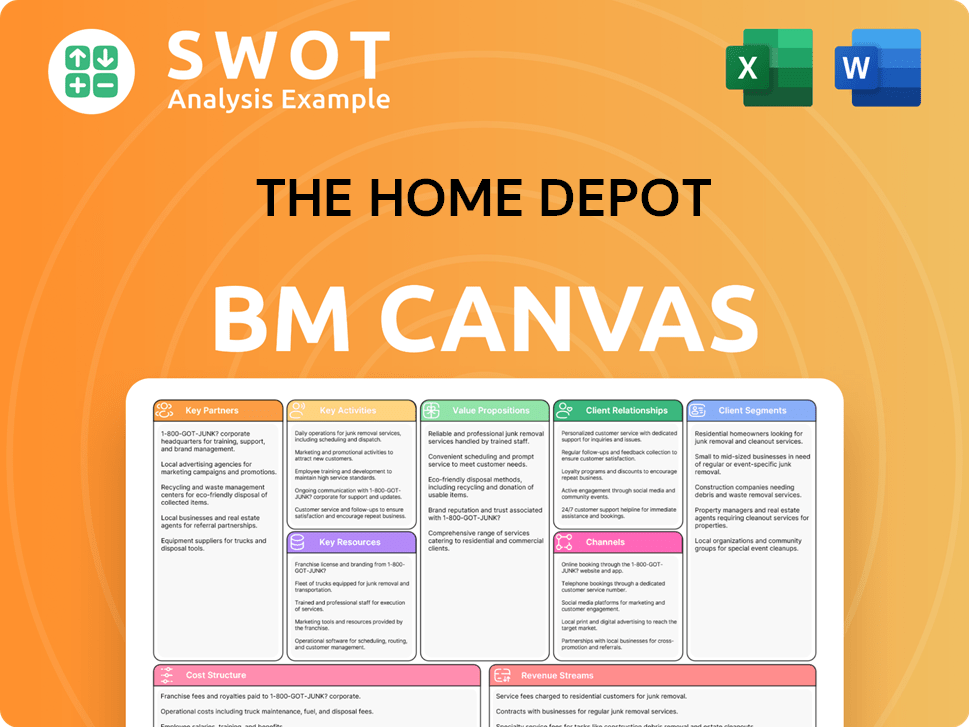

The Home Depot Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow The Home Depot’s Growth?

The company, like any major player in the home improvement market, faces several potential risks and obstacles that could affect its growth trajectory. These challenges span various areas, including market competition, economic fluctuations, and supply chain vulnerabilities. A thorough understanding of these risks is crucial for assessing the company's long-term sustainability and investment potential.

The competitive landscape of the home improvement market, with rivals like Lowe's and online retailers, requires continuous innovation and strategic adaptation. Economic downturns and shifts in housing market dynamics can significantly influence consumer spending on home improvement projects, directly impacting sales and revenue. Supply chain issues, technological disruptions, and cybersecurity threats also pose significant challenges to the company's operational efficiency and financial performance.

Addressing these risks involves a multifaceted approach, including strategic initiatives, robust operational strategies, and proactive risk management. The company’s ability to navigate these challenges will be critical in maintaining its market position and achieving its growth objectives. An effective response to these risks is essential for investors and stakeholders assessing the company's long-term outlook.

The home improvement market is intensely competitive, with major players like Lowe's vying for market share. Competition necessitates continuous innovation in products, services, and pricing strategies. The company must continually adapt to stay ahead in the retail industry trends.

Economic downturns and changes in interest rates can significantly affect consumer spending on home improvement projects. Higher interest rates can cool the housing market, impacting the demand for renovations. The company’s financial performance review is closely tied to these economic cycles.

Global events, geopolitical tensions, and natural disasters can disrupt the supply chain, impacting the availability and cost of materials. These disruptions can lead to inventory shortages and increased operational expenses. Supply chain optimization is crucial for mitigating these risks.

The rapid pace of technological change, particularly in e-commerce and AI, requires continuous investment to stay competitive. The company must consistently upgrade its digital platforms and invest in new technologies. The company’s online sales strategy is a key area of focus.

The company faces risks related to cybersecurity threats and data privacy breaches, which require robust security protocols and compliance measures. Protecting customer data and maintaining trust are critical. The company invests significantly in these areas to mitigate risks.

Evolving consumer preferences and demands for sustainable products and services require the company to adapt its offerings. The company must focus on sustainability initiatives and customer experience improvements. Understanding these shifts is essential for long-term growth.

The company employs several strategic initiatives to mitigate risks, including diversifying its supplier base and implementing strategic inventory management. Investments in its resilient supply chain network are ongoing. Furthermore, the company focuses on enhancing its digital platforms and investing in new technologies to improve customer experience and operational efficiency.

Operational strategies include robust security protocols and compliance measures to address cybersecurity and data privacy risks. The company regularly assesses these risks through comprehensive frameworks, including scenario planning, to prepare for potential impacts. These measures help ensure preparedness and minimize negative impacts on its growth trajectory.

In fiscal year 2023, the company reported net sales of approximately $152.7 billion. The company's commitment to managing its financial performance is evident in its actions. These metrics provide insight into the company's ability to manage risks and capitalize on opportunities within the home improvement market. The company’s strategic initiatives have helped it maintain a strong financial position amidst these challenges.

The company continues to hold a significant market share in the home improvement market, competing directly with Lowe's and other retailers. The competitive landscape is dynamic, with strategies focused on customer experience improvements and online sales. For a detailed look at the company's business model and strategic initiatives, you can refer to this article: Home Depot growth strategy.

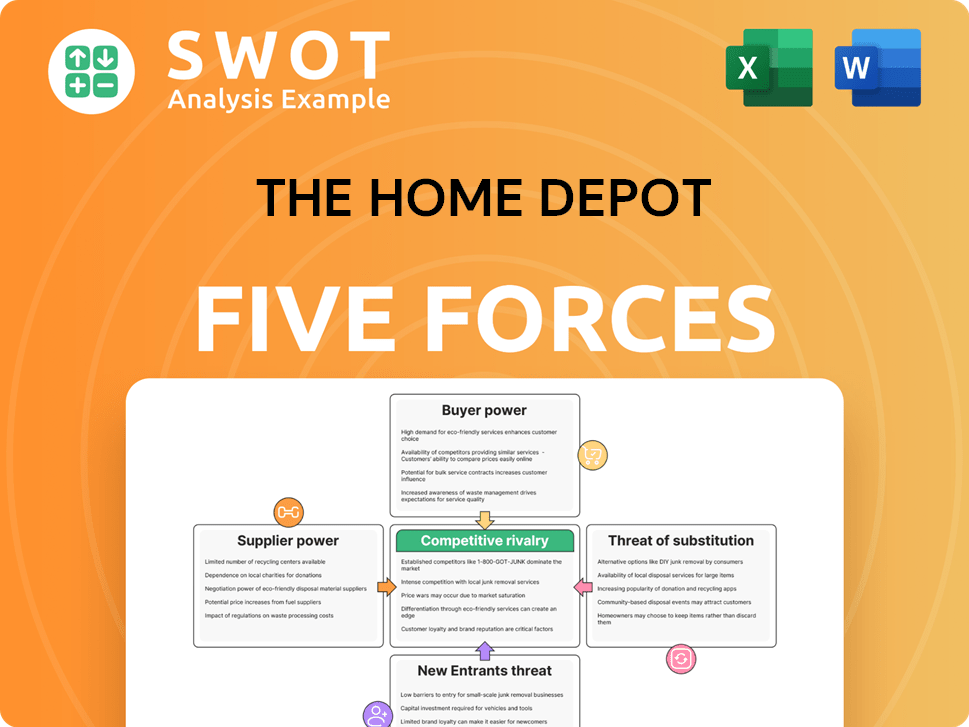

The Home Depot Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of The Home Depot Company?

- What is Competitive Landscape of The Home Depot Company?

- How Does The Home Depot Company Work?

- What is Sales and Marketing Strategy of The Home Depot Company?

- What is Brief History of The Home Depot Company?

- Who Owns The Home Depot Company?

- What is Customer Demographics and Target Market of The Home Depot Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.