Inditex Bundle

Can Inditex Maintain Its Dominance in the Fashion Industry?

The fashion industry is a battlefield, constantly reshaped by trends, consumer demands, and technological advancements. Inditex, the parent company of Zara, has long been a dominant force, but the landscape is shifting. Understanding the Inditex SWOT Analysis is crucial to understanding its position.

This analysis delves into the Inditex competitive landscape, examining its key Inditex competitors and the strategies that define its success. We'll explore Inditex market analysis, assessing its position in the retail market and how it navigates challenges in the fast-fashion sector. Understanding Zara competition and the broader fashion industry rivals is key to appreciating Inditex's global expansion strategy and financial performance.

Where Does Inditex’ Stand in the Current Market?

Inditex holds a prominent market position within the global apparel industry, primarily driven by its flagship brand, Zara. Inditex consistently ranks among the top global apparel companies by revenue and market capitalization. This strong position is a key element of the Inditex competitive landscape.

The company's diverse product lines include clothing, accessories, and homeware, catering to a wide range of consumers. Geographically, Inditex operates in over 200 markets with more than 5,700 stores as of early 2024, alongside a significant online presence. This extensive reach allows it to maintain a strong position across Europe, Asia, and the Americas. The company has strategically shifted its positioning by investing heavily in digital transformation and integrating its online and offline channels, moving towards a more unified commerce model.

For instance, Inditex reported a 10.4% increase in sales to €35.9 billion in fiscal year 2024 (ending January 31, 2025), with a strong net income of €5.38 billion, demonstrating robust financial health. This financial scale far surpasses many industry averages, underscoring its leading role. Inditex holds a particularly strong position in the fast-fashion segment, where its agile supply chain and trend responsiveness are key differentiators. Understanding the Inditex market analysis is crucial for grasping its competitive advantages.

Inditex operates in over 200 markets with a significant physical and online presence. While specific market share figures fluctuate, the company consistently ranks among the top global apparel retailers. Its strong financial performance, with sales of €35.9 billion in fiscal year 2024, reflects its leading position.

Inditex demonstrated robust financial health with a net income of €5.38 billion in fiscal year 2024. The company's financial scale, evidenced by its significant revenue and profit figures, far surpasses many industry averages. This financial strength supports its competitive edge.

Inditex has strategically invested in digital transformation, integrating online and offline channels. This move towards a unified commerce model allows the company to cater to evolving consumer preferences. Online sales generated 33% of total sales in 2023, highlighting the importance of this shift.

Inditex's brand portfolio caters to diverse customer segments, from fast-fashion conscious youth to more mature, quality-oriented consumers. This diversified approach allows Inditex to capture a broad market. Learn more about the Target Market of Inditex.

Inditex's market position is characterized by its strong financial performance, global presence, and strategic investments in digital transformation. The company's agility in the fast-fashion segment and its diverse brand portfolio contribute significantly to its competitive advantage.

- Leading global apparel retailer by revenue and market capitalization.

- Extensive global presence with over 5,700 stores and a significant online footprint.

- Strong financial performance, with a 10.4% increase in sales to €35.9 billion in fiscal year 2024.

- Strategic focus on digital transformation and unified commerce.

- Agile supply chain and trend responsiveness in the fast-fashion segment.

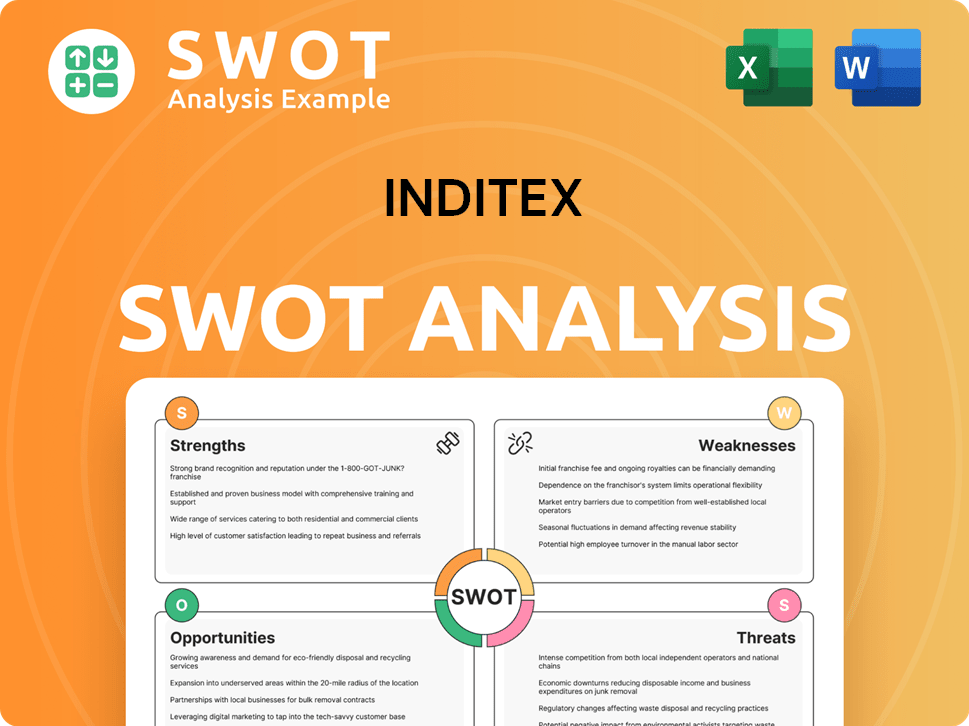

Inditex SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Inditex?

The Inditex competitive landscape is shaped by a complex interplay of fast-fashion giants, traditional retailers, and emerging online players. Understanding Inditex competitors involves analyzing their market strategies, financial performance, and ability to adapt to changing consumer preferences and technological advancements. This analysis is crucial for evaluating Inditex's market position and its future growth prospects.

Inditex market analysis reveals a highly competitive environment where factors like speed to market, pricing, and sustainability initiatives play a significant role. The company's ability to maintain its competitive edge depends on its capacity to innovate, optimize its supply chain, and effectively engage with consumers across various channels. The fashion industry is constantly evolving, and Inditex must continuously adapt to stay ahead.

Zara competition and the broader fashion industry are characterized by rapid changes and intense rivalry. Several key players significantly influence the competitive dynamics. The following sections will delve into the major rivals and how they challenge Inditex.

H&M Group is one of Inditex's primary competitors, operating brands like H&M, COS, and & Other Stories. H&M competes directly with Zara on price and trend-driven collections. H&M's global presence and extensive retail network make it a formidable rival.

Uniqlo, part of Fast Retailing, differentiates itself with a focus on high-quality basics and innovative fabric technologies. Uniqlo's approach targets the everyday wear segment. Uniqlo's strategy presents a different challenge to Inditex, focusing on durability and functionality.

Shein, an ultra-fast fashion e-commerce giant, is a significant threat due to its aggressive pricing and data-driven online model. Shein captures a substantial share of the Gen Z market. Shein's rapid growth has put pressure on Inditex to optimize its supply chain and digital engagement.

Gap Inc. is a traditional apparel retailer that competes with Inditex, although its focus and brand positioning differ. Gap Inc. operates multiple brands and maintains a significant retail presence. The competition involves factors like brand image and target customer demographics.

Mango is another traditional apparel retailer that competes with Inditex, especially in the mid-market segment. Mango's brand positioning and product offerings overlap with some of Inditex's brands. The competition is primarily based on design, pricing, and retail presence.

A growing number of online-only fashion retailers and direct-to-consumer (DTC) brands also compete with Inditex. These brands often leverage digital marketing and innovative business models. These new entrants challenge traditional retailers through their agility and customer-centric approach.

Several factors determine the competitive landscape for Inditex, including speed to market, sustainability, and pricing. These factors are crucial for understanding Zara's biggest rivals in fast fashion and the overall fashion industry rivals. The ability to adapt to these factors will determine the future of Inditex.

- Speed to Market: The ability to quickly identify trends and bring new products to market is crucial. Zara's supply chain analysis reveals its strengths in this area, but competitors like Shein are pushing the boundaries of speed.

- Sustainability Initiatives: Consumers are increasingly demanding sustainable practices. Inditex and its competitors are investing in sustainable materials and ethical production. Inditex's sustainability initiatives and competition are becoming increasingly important.

- Pricing Strategies: Competitive pricing is essential. Zara's pricing strategy compared to rivals must balance value and profitability.

- Digital Engagement: Online retail and digital marketing are critical. The impact of online retail on Inditex is significant, and the company must compete effectively in the digital space.

- Brand Portfolio and Market Position: Inditex's diverse brand portfolio allows it to target different market segments. Understanding Inditex's brand portfolio and competition is important.

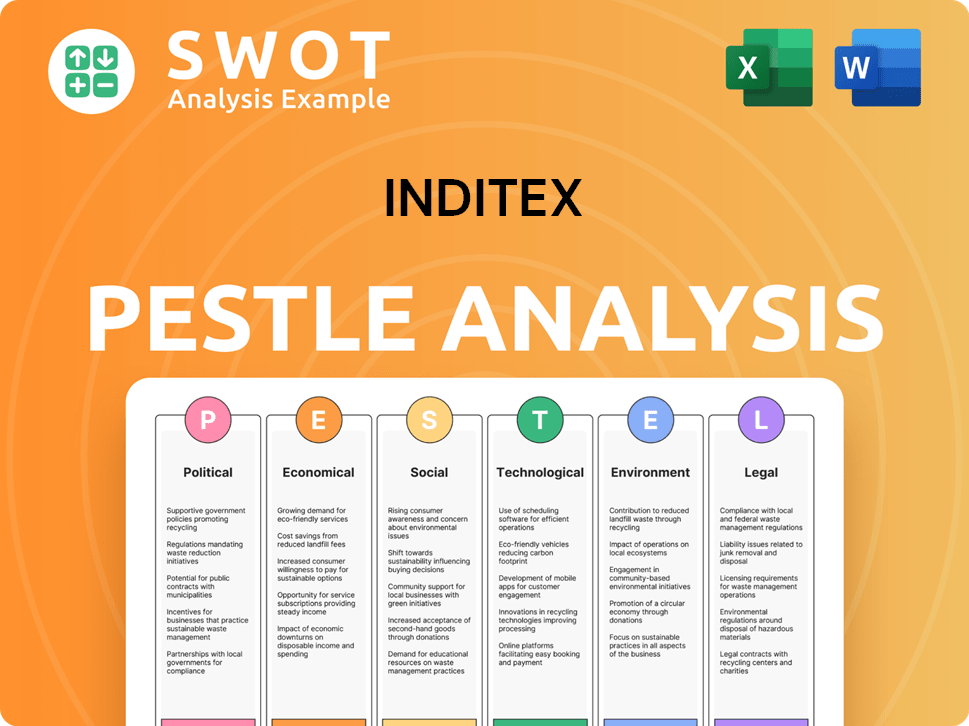

Inditex PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Inditex a Competitive Edge Over Its Rivals?

Inditex's competitive advantages are deeply rooted in its unique business model, often known as 'fast fashion 2.0.' This model sets it apart from many rivals in the fashion industry. Its agility and vertically integrated supply chain are key strengths, allowing for rapid responses to changing trends. This approach enables quick design-to-store cycles, which is a significant advantage in a market where trends evolve quickly.

A primary strength is its highly agile and vertically integrated supply chain. Unlike many competitors that outsource extensively, Inditex maintains significant control over design, manufacturing, and distribution, allowing it to rapidly respond to changing fashion trends. This enables Zara, for example, to move a design from concept to store floor in a matter of weeks, significantly faster than the industry average. This speed to market minimizes fashion risk and allows for smaller, more frequent drops of new merchandise, creating a sense of scarcity and encouraging repeat visits.

Inditex's strong brand equity, particularly with Zara, is another key advantage. Zara is globally recognized and associated with fashionable, affordable clothing. This brand loyalty is cultivated through consistent product offerings and effective marketing. Furthermore, Inditex leverages advanced data analytics and technology, including RFID technology for inventory management, to optimize its operations and enhance the customer experience across its global network of stores and online platforms. Its extensive global distribution network, comprising thousands of physical stores and a robust e-commerce presence, provides unparalleled reach to diverse markets. To understand the company's origins, one can explore the Brief History of Inditex.

Zara faces competition from various players in the fashion industry. Key rivals include H&M, Uniqlo, and fast-fashion brands. These competitors also focus on rapid trend replication and global expansion. The competitive landscape is dynamic, with new entrants and evolving consumer preferences constantly reshaping the market.

Inditex's market position is strong, particularly in Europe, where it holds a significant retail market share. Its global expansion strategy has been successful, with a presence in numerous countries. The company's financial performance is closely watched, with revenue and profit margins being key indicators of its success against competitors. In 2024, Inditex reported sales of €36.1 billion.

Inditex's competitive strengths include its agile supply chain, strong brand equity, and technological integration. These advantages enable the company to respond quickly to market trends and maintain a loyal customer base. Continuous investment in technology and sustainability initiatives further strengthens its position in the market. The company's gross profit for the fiscal year 2024 was €20.8 billion.

Inditex's global expansion involves strategic store openings and a robust e-commerce presence. The company focuses on entering new markets and expanding its footprint in existing ones. This strategy helps Inditex reach a wider customer base and increase its market share. As of 2024, Inditex operates in over 200 markets.

Inditex's competitive edge comes from its ability to quickly adapt to fashion trends and maintain a strong brand image. The company's vertically integrated model allows for efficient operations and reduced time-to-market. Inditex's focus on sustainability and digital innovation further enhances its competitive position.

- Agile Supply Chain: Enables rapid response to market changes.

- Strong Brand Equity: Builds customer loyalty and recognition.

- Technological Integration: Optimizes operations and enhances customer experience.

- Global Distribution Network: Provides extensive market reach.

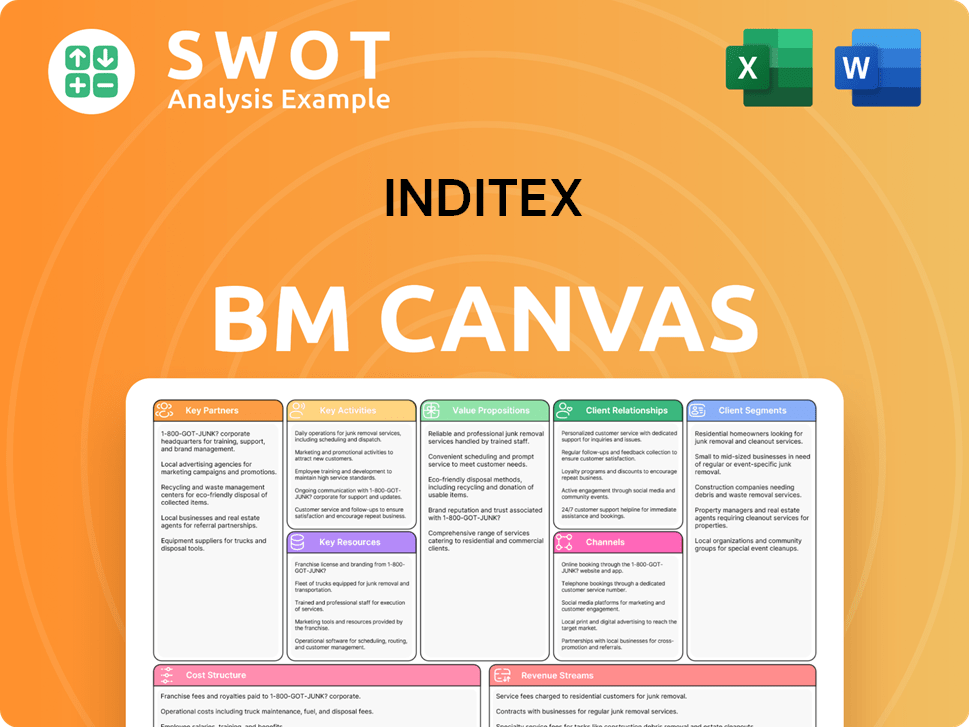

Inditex Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Inditex’s Competitive Landscape?

The Inditex competitive landscape is shaped by dynamic trends, including the growth of e-commerce, increasing consumer demand for sustainability, and the influence of digital marketing. The company faces both challenges and opportunities in this environment. Understanding Inditex market analysis and its position relative to Inditex competitors is crucial for evaluating its future prospects.

Zara competition and other fashion industry rivals are intensifying, especially with the rise of ultra-fast fashion. Inditex must adapt to these changes to maintain its retail market share and capitalize on emerging opportunities. The company's ability to leverage its strengths will determine its success in the years to come.

The fashion industry is experiencing a surge in e-commerce, with online sales growing significantly. Consumers are increasingly focused on sustainability and ethical practices, pushing brands to adopt eco-friendly initiatives. Social media and digital marketing play a crucial role in influencing consumer behavior and brand perception. Technological advancements, such as AI and supply chain optimization, are reshaping the competitive landscape.

Intense competition from ultra-fast fashion retailers like Shein, with aggressive pricing and extensive product catalogs, poses a threat. Evolving regulatory landscapes concerning labor practices and environmental impact create compliance challenges. Shifts in consumer preferences towards niche or personalized fashion could impact market share. Managing textile waste and sourcing sustainable materials are also significant hurdles. The need to adapt to changing consumer behaviors and technological advancements is critical.

Leveraging a strong global presence and established brands to penetrate emerging markets offers significant growth potential. Continued investment in technological innovation, such as AI for personalized recommendations, can enhance the online shopping experience. Strategic partnerships with technology firms or sustainable material innovators could unlock new growth avenues. Expanding the digital footprint and optimizing online-offline synergy presents opportunities for increased sales. Enhancing brand reputation through sustainable practices and circularity initiatives can attract environmentally conscious consumers.

Inditex aims to have 100% of its products made from more sustainable materials by 2030, demonstrating a commitment to sustainability. The company focuses on optimizing its agile supply chain to quickly respond to changing fashion trends. Enhancing its online-offline synergy, such as through integrated store and online experiences, is a key strategy. Investing in technological innovation, like AI for personalized recommendations, is critical. The company is actively investing in circularity initiatives to reduce waste and promote sustainability.

Inditex's future depends on its ability to navigate industry trends, address challenges, and seize opportunities. The company's strategic responses, including investments in sustainability, technology, and supply chain optimization, are crucial. The company's competitive position is evolving towards a more digitally integrated, sustainably focused, and hyper-responsive model. For more insights into the company's ownership structure, consider reading about Owners & Shareholders of Inditex.

- The shift towards e-commerce and digital marketing is reshaping the retail landscape.

- Sustainability and ethical practices are becoming increasingly important to consumers.

- Technological innovation and supply chain optimization are key competitive advantages.

- Inditex's strategic focus includes sustainability, digital integration, and supply chain agility.

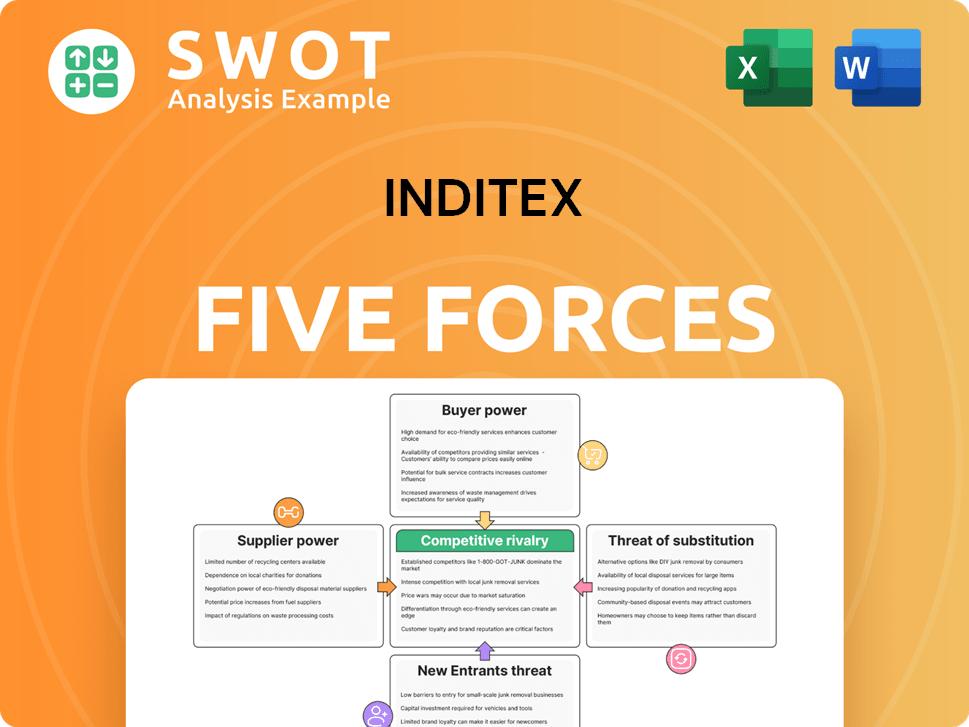

Inditex Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Inditex Company?

- What is Growth Strategy and Future Prospects of Inditex Company?

- How Does Inditex Company Work?

- What is Sales and Marketing Strategy of Inditex Company?

- What is Brief History of Inditex Company?

- Who Owns Inditex Company?

- What is Customer Demographics and Target Market of Inditex Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.