Inditex Bundle

Who Really Pulls the Strings at Inditex?

Understanding the Inditex SWOT Analysis is crucial, but have you ever wondered who truly controls the global fashion powerhouse behind Zara? From its origins as a small dressmaking shop in Spain, Inditex has transformed into a retail giant, captivating consumers worldwide. Knowing the Inditex ownership structure is key to understanding its strategic direction and future prospects.

Delving into the Inditex company structure reveals a fascinating story of entrepreneurial vision and evolving ownership. Founded by Amancio Ortega, the company’s journey from a local business to a multinational corporation is directly tied to its ownership dynamics. Exploring who owns Zara clothing brand and the broader Inditex empire provides valuable insights for investors and anyone interested in the fashion industry. This exploration will uncover the details of the Inditex ownership, including the influence of major shareholders and the impact of its public listing.

Who Founded Inditex?

The foundational ownership of the Inditex company was primarily held by its founder, Amancio Ortega Gaona, and his then-wife, Rosalía Mera. Ortega's entrepreneurial vision led to the establishment of a dressmaking workshop in 1963, which evolved into the first Zara store in 1975. While precise equity splits at the company's inception aren't publicly detailed, Amancio Ortega held the dominant stake, reflecting his central role in the company's creation and early direction.

Rosalía Mera was a crucial co-founder, holding a significant, though smaller, shareholding, contributing to the initial capital and operational development of Inditex. The early years of the company were characterized by concentrated ownership, allowing for swift decision-making and agile execution in response to rapidly changing fashion trends. This structure was instrumental in the company's early growth and expansion.

The early ownership structure of Inditex did not involve external investors beyond the founders. The company's growth was largely self-funded through reinvested profits. There are no prominent records of early agreements such as vesting schedules, buy-sell clauses, or founder exits that significantly shaped early ownership, as the company remained privately held and closely controlled by Ortega and Mera for many years. Similarly, no major ownership disputes or buyouts in the very early stages are publicly documented.

The initial ownership of Inditex, and thus Zara's owner, was concentrated with Amancio Ortega and Rosalía Mera. This structure facilitated rapid decision-making and a focus on vertical integration.

- Amancio Ortega's dominant stake reflected his entrepreneurial leadership.

- Rosalía Mera's contribution was also essential to the company's formation.

- The company's early growth was largely self-financed.

- No external investors or significant ownership disputes are documented in the early stages.

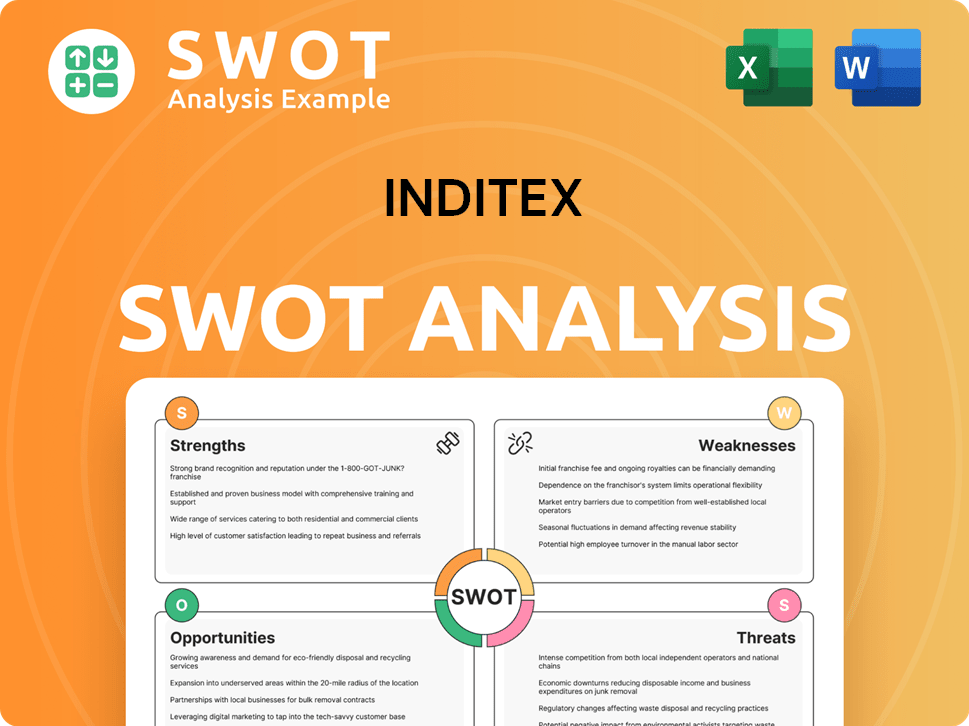

Inditex SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Inditex’s Ownership Changed Over Time?

The Inditex company's ownership structure saw a major shift with its Initial Public Offering (IPO) on May 23, 2001. This transition moved the company from private, founder-led control to a publicly traded entity. At the IPO, Inditex had an initial market capitalization of roughly €9 billion. This event allowed Amancio Ortega, the founder, to sell some of his shares while still keeping a significant controlling stake.

The current ownership of Inditex remains largely concentrated with its founder. As of March 2025, Amancio Ortega Gaona is the largest shareholder, holding about 59.29% of the company through Pontegadea Inversiones, S.L. This substantial ownership gives him considerable influence over the company's strategic direction and major decisions. The remaining shares are publicly traded on the Madrid Stock Exchange, with a variety of institutional investors, mutual funds, index funds, and individual shareholders. Major institutional investors often include large asset management firms, although their individual holdings typically don't match Ortega's.

| Event | Date | Impact on Ownership |

|---|---|---|

| Initial Public Offering (IPO) | May 23, 2001 | Transitioned from private to public ownership; allowed Amancio Ortega to divest a portion of shares. |

| Ongoing Shareholding | Ongoing (as of March 2025) | Amancio Ortega Gaona, through Pontegadea Inversiones, S.L., holds approximately 59.29%, maintaining significant control. |

| Public Trading | Since 2001 | Remaining shares are publicly traded, held by institutional and individual investors. |

The concentration of ownership with Amancio Ortega has enabled Inditex to maintain a long-term strategic vision, often prioritizing sustainable growth and vertical integration. This contrasts with companies where more dispersed ownership might lead to greater pressure for short-term financial performance. While the IPO brought in new capital and diversified the shareholder base, Ortega's continued majority ownership ensures his founding vision continues to heavily influence company strategy and governance.

Amancio Ortega, the Zara owner, maintains significant control over Inditex. The IPO in 2001 was a pivotal moment, transforming the company's structure. Public shareholders own the remaining shares, ensuring a diverse investor base.

- Amancio Ortega's stake is approximately 59.29% as of March 2025.

- The IPO raised capital and broadened the shareholder base.

- Inditex's structure supports long-term strategic planning.

- The company's headquarters is located in Arteixo, Spain.

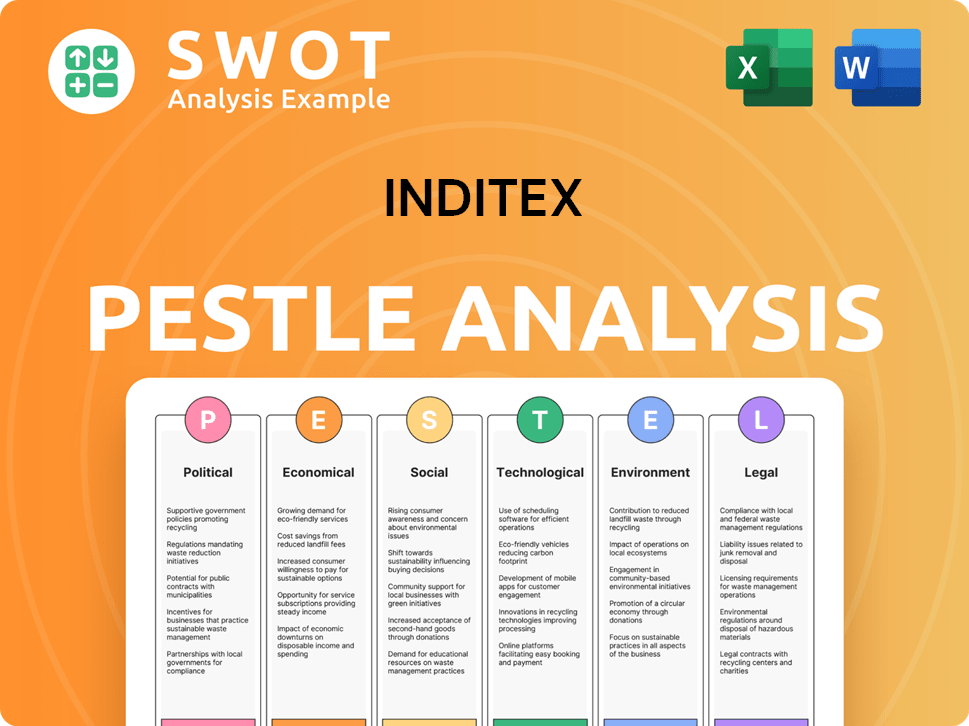

Inditex PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Inditex’s Board?

The current Board of Directors of Inditex reflects a blend of representatives from major shareholders and independent voices. As of early 2025, the Board includes executive directors, proprietary directors representing significant shareholders, and independent directors. Marta Ortega Pérez, daughter of Amancio Ortega, serves as the non-executive Chairwoman, indicating the continued influence of the founding family in the company's governance. Óscar García Maceiras is the Chief Executive Officer and a member of the Board.

The composition of the board balances different perspectives, ensuring both operational oversight and the representation of shareholder interests. This structure helps Inditex manage its strategic direction while maintaining a degree of independence in its decision-making processes. The presence of independent directors is crucial for ensuring that the company adheres to best practices in corporate governance, which is important for maintaining investor confidence and long-term sustainability.

| Board Member | Position | Notes |

|---|---|---|

| Marta Ortega Pérez | Non-Executive Chairwoman | Daughter of Amancio Ortega |

| Óscar García Maceiras | Chief Executive Officer | Also a Board Member |

| Independent Directors | Various | Ensuring independent oversight |

Given Amancio Ortega's approximately 59.29% stake through Pontegadea Inversiones, S.L., his control over voting power is substantial. Inditex operates primarily under a one-share-one-vote structure. Ortega's majority ownership gives him significant influence over strategic decisions, board appointments, and major corporate actions. While there are no publicly reported special voting rights or golden shares beyond the standard share structure, Ortega's substantial shareholding ensures his dominant influence. This ownership structure is a key factor in understanding the Inditex company structure.

Amancio Ortega, the founder, maintains significant control through his majority stake in Inditex, the Zara owner. This control is primarily exercised through his voting power, which influences strategic decisions and board appointments. The governance structure of Inditex ensures a balance between family influence and independent oversight.

- Amancio Ortega holds approximately 59.29% of Inditex through Pontegadea Inversiones, S.L.

- Marta Ortega Pérez, Amancio Ortega's daughter, is the non-executive Chairwoman.

- The Board includes executive, proprietary, and independent directors.

- Inditex operates under a one-share-one-vote system.

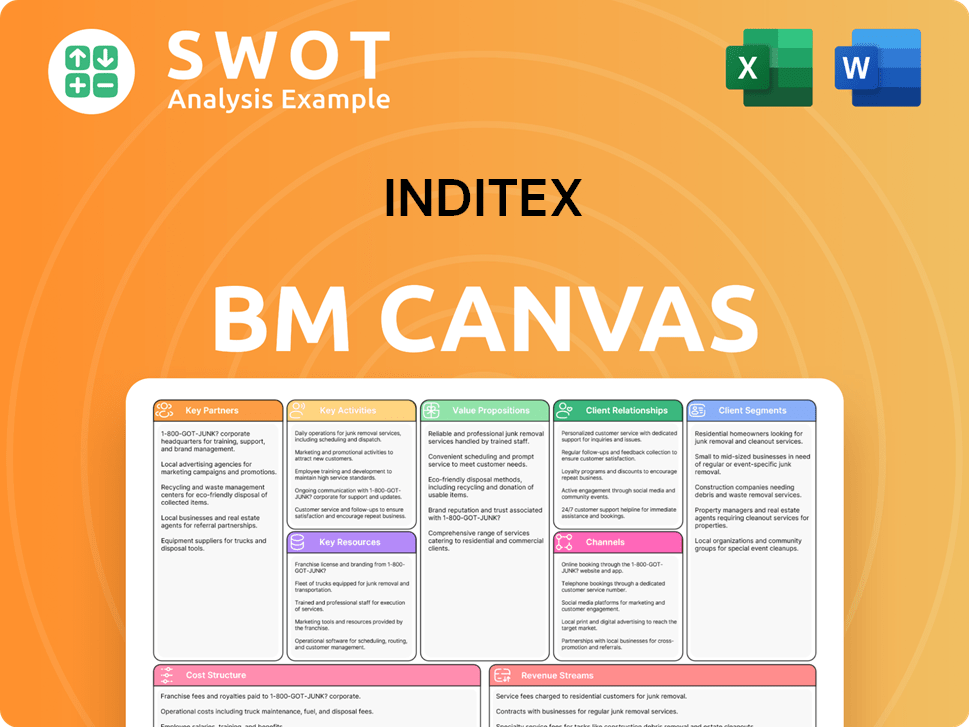

Inditex Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Inditex’s Ownership Landscape?

Over the past few years, the ownership structure of the Inditex company has remained relatively consistent. The primary influence continues to be held by Amancio Ortega, the founder. The company's strategic financial activities, such as the 2024 dividend payment of €1.54 per share, reflect its financial health and commitment to shareholders. There have been no significant share buybacks or secondary offerings that would drastically alter the ownership percentages of major stakeholders. This stability is a key characteristic of Inditex ownership.

A notable development has been the shift in leadership, with Marta Ortega Pérez, Amancio Ortega's daughter, becoming the non-executive Chairwoman in April 2022. Simultaneously, Óscar García Maceiras was appointed CEO. These changes, while significant for operational leadership, did not alter the fundamental ownership structure. The consistent ownership, particularly from the founder, is a defining feature when considering who owns Zara and the broader Inditex company.

While institutional ownership is increasing across many public companies, Inditex stands out due to the high concentration of ownership with its founder. This contrasts with the trend of founder dilution often seen as companies mature. For more details on the company's origins, you can read a brief history of Inditex. The current ownership structure appears stable, providing a solid foundation for Inditex's continued global operations.

Amancio Ortega maintains a significant stake, ensuring stability. There have been no major changes in the controlling ownership. The company focuses on organic growth, avoiding ownership restructuring.

Marta Ortega Pérez became the non-executive Chairwoman in April 2022. Óscar García Maceiras was appointed CEO. These changes did not affect the fundamental ownership structure but rather the operational leadership.

Institutional ownership is increasing across large public companies. Inditex has a high concentration of ownership with its founder, resisting founder dilution. No public statements about future ownership changes have been made.

Inditex announced a dividend payment of €1.54 per share for the 2024 fiscal year. The company's focus is on organic growth. There have been no significant share buybacks or secondary offerings.

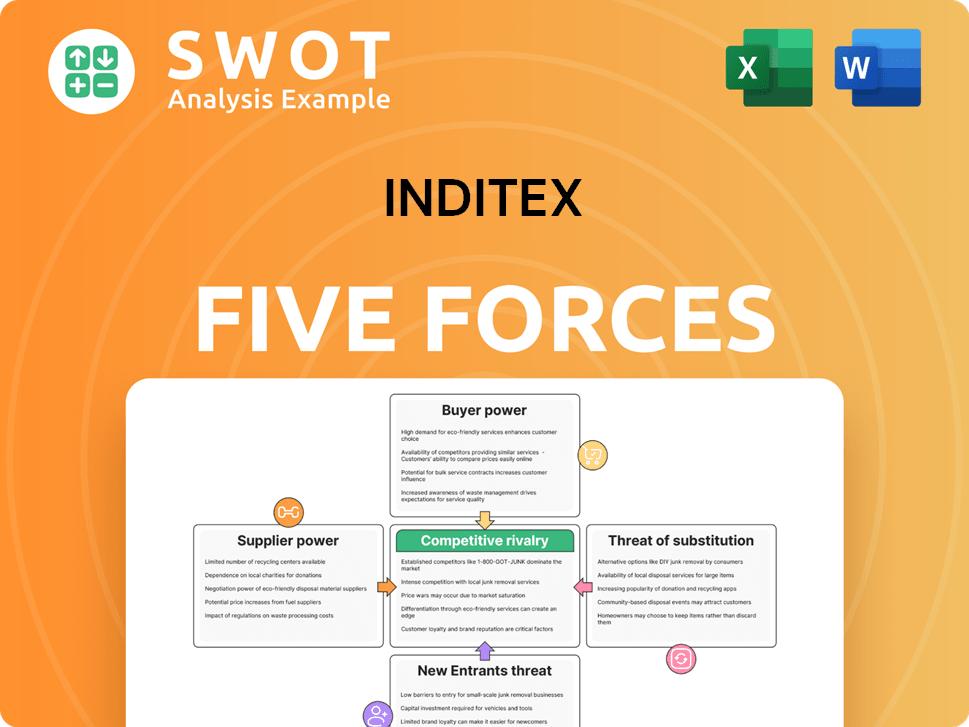

Inditex Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Inditex Company?

- What is Competitive Landscape of Inditex Company?

- What is Growth Strategy and Future Prospects of Inditex Company?

- How Does Inditex Company Work?

- What is Sales and Marketing Strategy of Inditex Company?

- What is Brief History of Inditex Company?

- What is Customer Demographics and Target Market of Inditex Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.