Inditex Bundle

Can Inditex Maintain Its Fashion Retail Dominance?

Inditex, the Zara parent company, has revolutionized the fashion retail industry since its inception in 1975. Its rapid adaptation to consumer trends and innovative 'fast fashion' model has propelled it to global prominence. This comprehensive analysis explores the Inditex SWOT Analysis, delving into the strategies that have shaped its success and its future trajectory.

This deep dive into Inditex's growth strategy and future prospects examines its competitive advantage, market share, and expansion plans, particularly in regions like Asia. We'll explore how Inditex leverages data analytics, its digital transformation strategy, and sustainable fashion initiatives to navigate the challenges and opportunities within the fashion retail industry. Understanding Inditex's financial performance in 2023 and its responses to economic downturns is crucial for investors and strategists alike.

How Is Inditex Expanding Its Reach?

Inditex, the Zara parent company, is aggressively pursuing a multi-faceted expansion strategy. This strategy focuses on optimizing its existing store network while simultaneously enhancing its online presence. The goal is to reach new customers and diversify revenue streams, solidifying its position within the fashion retail industry.

The company's expansion plans include opening stores in new markets. Inditex aims to launch in 8 new markets in 2024, including Uzbekistan, Cambodia, and Tajikistan. This expansion will bring its total market presence to 220 markets globally. This geographical diversification is a key component of its Inditex growth strategy.

Inditex's strategy also emphasizes improving the quality and size of its physical stores. The company plans to open larger, more technologically advanced Zara stores in key locations worldwide. A prime example is the flagship store opened in Rotterdam in 2024.

Inditex is expanding its global footprint by entering new markets. This includes opening stores in Uzbekistan, Cambodia, and Tajikistan in 2024. The company's presence will extend to 220 markets.

Inditex is focused on enhancing its physical stores. This includes opening larger, more technologically advanced stores, such as the flagship store in Rotterdam. These stores aim to improve the shopping experience.

The company is heavily investing in its online platforms. Inditex recognizes the increasing importance of e-commerce. This investment is a cornerstone of its expansion plans.

Inditex continuously evolves its product offerings across its diverse brands. Zara, for instance, continuously introduces new collections. This includes a focus on lifestyle categories beyond apparel.

Inditex's expansion strategy is built upon several key initiatives. These initiatives are designed to enhance customer experience and boost sales. These include geographical expansion and store optimization.

- Expanding its global presence through new store openings.

- Improving the quality and size of physical stores.

- Investing heavily in online platforms for e-commerce growth.

- Evolving product offerings to meet changing consumer preferences.

Inditex's integrated store and online sales model is a cornerstone of its expansion, providing seamless customer experiences. For more insights, explore the Marketing Strategy of Inditex. This approach is crucial for Inditex's future prospects.

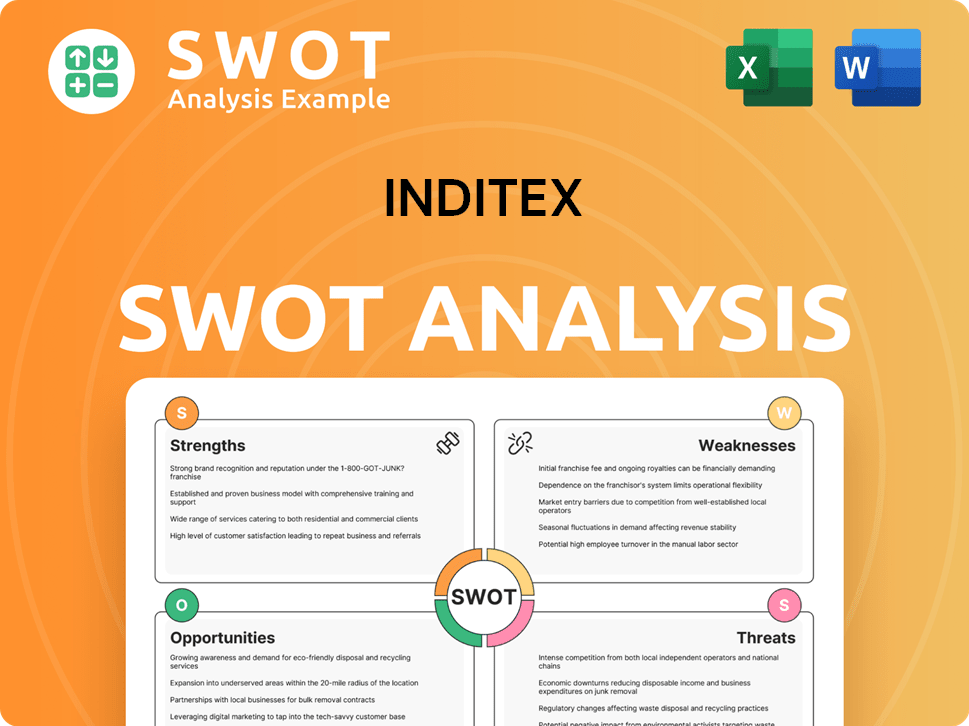

Inditex SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Inditex Invest in Innovation?

The Inditex growth strategy is heavily reliant on technological innovation and digital transformation. This approach is crucial for maintaining its competitive edge in the fast-paced fashion retail industry. The company consistently invests in its technological infrastructure to optimize operations and enhance customer experience.

Inditex focuses on integrating technology across all aspects of its business, from supply chain management to customer-facing applications. This strategy supports its fast-fashion model, enabling quick responses to market trends and efficient inventory management. The company's commitment to innovation is evident in its ongoing efforts to improve its digital platforms and sustainability initiatives.

Inditex future prospects are closely tied to its ability to adapt and innovate. The company's investments in technology are designed to improve efficiency, reduce waste, and enhance customer engagement. By leveraging data analytics and advanced technologies, Inditex aims to strengthen its position in the global market and drive sustainable growth.

Inditex has significantly invested in digital transformation to enhance its online presence and customer experience. This includes improvements to its e-commerce platforms, mobile applications, and in-store digital tools. The 'Store Mode' feature in the Zara app, for example, exemplifies this strategy.

The company utilizes advanced technologies to optimize its supply chain, ensuring efficient inventory management and rapid product distribution. This includes real-time tracking of inventory and optimized product allocation across its global network. This is a key component of the Inditex competitive advantage.

Inditex employs data analytics to understand customer preferences, predict trends, and optimize its product offerings. This data-driven approach helps the company make informed decisions about design, production, and distribution. How Inditex uses data analytics is crucial for its success.

The company is increasingly integrating sustainability into its technological advancements, aiming for more circular and responsible production processes. This includes exploring innovative materials and technologies to reduce its environmental impact. Inditex sustainable fashion initiatives are gaining importance.

While specific figures on R&D investments are not always publicly disclosed, Inditex consistently invests in in-house development to enhance its technological capabilities. This includes improvements in supply chain logistics, data analytics, and customer-facing digital tools.

Technology plays a critical role in improving operational efficiency across all aspects of the business. This includes streamlining processes, reducing costs, and improving the speed and responsiveness of the supply chain. This helps in Inditex company analysis.

Inditex continues to invest in technology to maintain its leadership in the fashion retail industry. These advancements are critical for its Inditex growth strategy. Here are some key areas of focus:

- Integrated Stock Management System: Real-time inventory tracking and optimized product allocation across stores and online channels.

- E-commerce Enhancements: Improved online platforms, mobile apps, and features like 'Store Mode' in the Zara app.

- Data Analytics: Utilizing data to understand customer preferences, predict trends, and optimize product offerings.

- Supply Chain Optimization: Advanced logistics to ensure efficient and rapid distribution of products.

- Sustainability Technologies: Implementing technologies to support circular and responsible production processes.

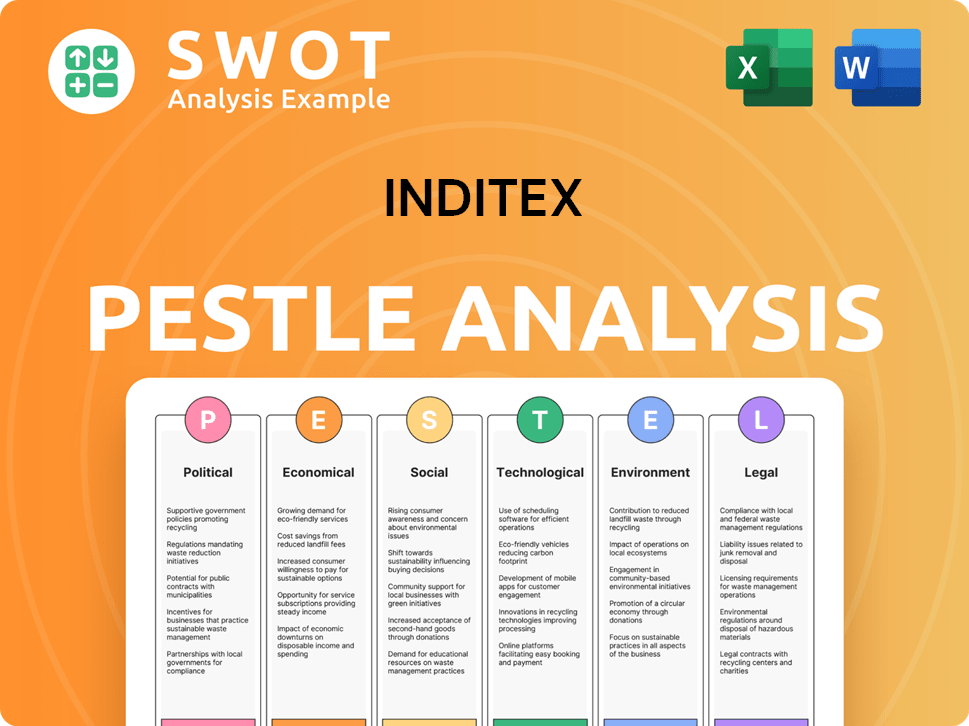

Inditex PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Inditex’s Growth Forecast?

The financial outlook for Inditex, the Zara parent company, appears robust, with significant growth in recent years. The company's performance in 2023 demonstrates its strong market position and effective business strategies. This positive trend is expected to continue, supported by strategic investments and expansion plans.

Inditex's financial health is underscored by its ability to generate substantial profits and maintain healthy margins. This financial strength allows the company to invest in future growth initiatives, enhancing its competitive advantage in the fashion retail industry. The company's focus on optimizing its commercial space and integrating technology further supports its ambitious growth plans.

Inditex's financial performance in 2023 was notably strong, with a net profit of €5.38 billion, marking a 30.3% increase compared to the previous year. Sales also increased, reaching €35.9 billion, a 10.4% rise from 2022. The gross margin stood at 57.8%, indicating healthy profitability. These figures highlight Inditex's solid financial position and its ability to navigate market challenges effectively. To understand how Inditex stacks up against its rivals, consider reviewing the Competitors Landscape of Inditex.

Inditex plans to invest approximately €1.8 billion in 2024. This investment will primarily focus on optimizing commercial spaces, integrating technology, and improving logistics. These investments are designed to drive long-term growth and maintain a competitive edge in the fashion retail industry.

Analyst forecasts generally remain positive for Inditex, anticipating continued sales growth. This growth is expected to be driven by online expansion and strategic store upgrades. The company's strong financial position provides a stable foundation for these ambitious growth plans.

Inditex's strong cash flow generation and consistent dividend payouts further underscore its solid financial position. This financial stability supports the company's ability to invest in growth initiatives and navigate market fluctuations effectively.

Inditex's strong financial performance supports its Inditex growth strategy. The company continues to focus on expanding its global market presence. This includes strategic investments in key markets and enhancing its online sales strategy to capture a larger share of the fashion retail industry.

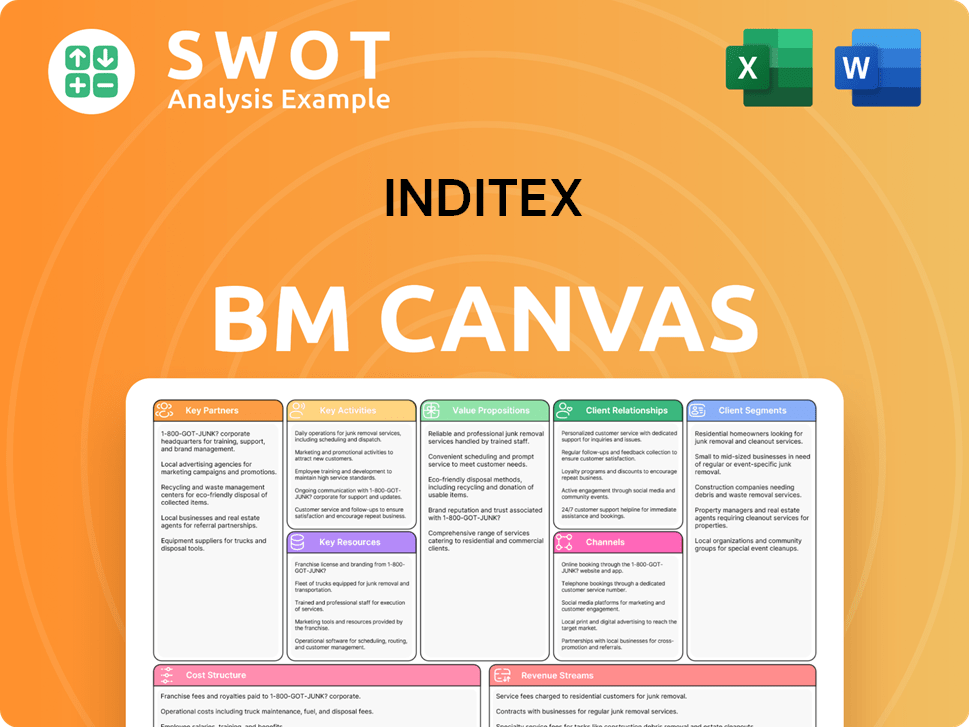

Inditex Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Inditex’s Growth?

The Mission, Vision & Core Values of Inditex faces several potential risks and obstacles that could affect its future. These challenges range from market competition to supply chain vulnerabilities. Successfully navigating these hurdles is crucial for the company's continued growth and maintaining its position in the fashion retail industry.

Intense competition, rapid shifts in consumer preferences, and regulatory changes are significant external factors. Internally, managing a vast network of physical stores while expanding online presents a constant strategic balancing act. The company must remain agile to adapt and thrive in a dynamic market.

Supply chain disruptions, including geopolitical events and fluctuations in raw material prices, pose a substantial risk, particularly given the company's global manufacturing and distribution network. These vulnerabilities can impact production costs and delivery times, affecting profitability and customer satisfaction.

The fashion retail industry is highly competitive, with established global players and emerging online retailers vying for market share. This intense competition puts pressure on pricing, innovation, and customer loyalty. Inditex's ability to differentiate itself through its fast-fashion model and brand portfolio is crucial.

Consumer tastes evolve rapidly, and staying ahead of trends is essential. The company must constantly adapt its designs, production, and marketing strategies to meet changing demands. Failure to do so can lead to inventory issues and reduced sales.

Changes in labor practices, environmental standards, and international trade regulations can impact the company's operations. Compliance with these regulations can increase costs and require adjustments to its supply chain. The company must proactively manage these risks.

Geopolitical events, raw material price fluctuations, and logistical disruptions can disrupt the supply chain. Diversifying its manufacturing base and investing in localized production helps mitigate these risks. The company needs to maintain a resilient supply chain.

Managing its vast network of physical stores while scaling its online presence requires strategic resource allocation. The company must find the right balance between physical and digital channels. This includes investing in e-commerce infrastructure and optimizing store networks.

Economic downturns can impact consumer spending and demand for discretionary items like fashion. The company needs to adapt its pricing and marketing strategies to maintain sales during economic challenges. Monitoring economic indicators is critical.

The company employs a highly integrated and agile supply chain to adjust quickly to market changes. It uses a robust risk management framework, including scenario planning, to prepare for potential disruptions. Diversifying its manufacturing base and investing in localized production reduces reliance on single regions.

In recent years, the company has shown resilience, but faces the need to maintain its market share in a competitive landscape. Data from 2024 and early 2025 will be crucial to assess the impact of these risks and the effectiveness of mitigation strategies. The company's ability to maintain its revenue and profitability is key.

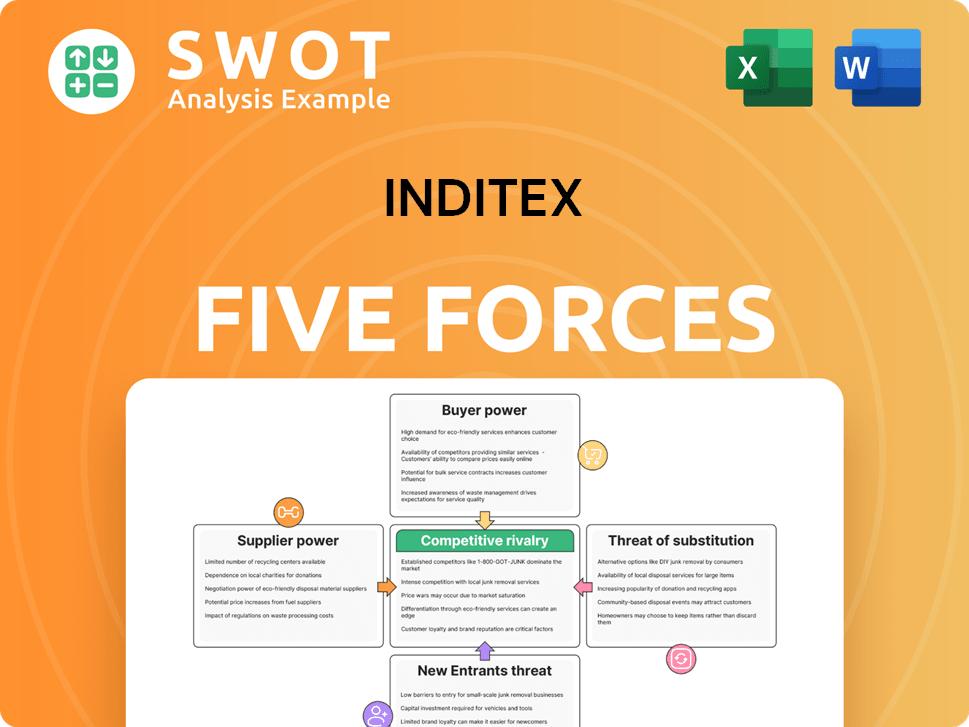

Inditex Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Inditex Company?

- What is Competitive Landscape of Inditex Company?

- How Does Inditex Company Work?

- What is Sales and Marketing Strategy of Inditex Company?

- What is Brief History of Inditex Company?

- Who Owns Inditex Company?

- What is Customer Demographics and Target Market of Inditex Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.