JCET Group Bundle

How Does JCET Group Thrive in the Cutthroat Semiconductor Arena?

The semiconductor industry is a battlefield of innovation, and JCET Group is a key player. Facing intense competition, JCET Group must constantly adapt to maintain its position. Understanding the JCET Group SWOT Analysis is crucial for investors and strategists alike.

This analysis will dissect the JCET Group Competitive Landscape, providing a detailed JCET Group Market Analysis to identify the key players. We'll examine JCET Group Competitors, evaluating their strengths and weaknesses to understand how JCET Group maintains its edge in the Semiconductor Industry, focusing on Chip Packaging and Integrated Circuit (IC) manufacturing. Through this, we aim to provide actionable insights for anyone interested in the company's market share analysis and future outlook.

Where Does JCET Group’ Stand in the Current Market?

JCET Group is a significant player in the global outsourced semiconductor assembly and test (OSAT) market. Its core operations encompass a full suite of IC manufacturing services, including package design, product development, wafer probe, package assembly, test, and drop shipment. This comprehensive approach allows JCET to serve a diverse customer base across various end markets, such as mobile, automotive, and consumer electronics.

The company's value proposition lies in its ability to provide end-to-end solutions for semiconductor manufacturing, catering to the needs of both fabless companies and integrated device manufacturers (IDMs). JCET's focus on advanced packaging technologies, like fan-out and SiP (System-in-Package), further enhances its value by addressing the increasing complexity and performance demands of modern semiconductors. This strategic focus, combined with a global footprint, positions JCET as a reliable partner for its clients.

JCET Group holds a prominent position in the global OSAT market. In 2023, JCET was the fourth-largest OSAT company by revenue. This demonstrates a substantial market presence and competitive strength within the Growth Strategy of JCET Group.

JCET has a strong global presence with manufacturing facilities and customer service centers across Asia, North America, and Europe. This widespread presence allows the company to serve its international clientele effectively and capitalize on regional market demands.

JCET Group demonstrated robust financial performance in the first quarter of 2024, with revenue reaching RMB 6.75 billion (approximately USD 930 million). This indicates continued growth despite market fluctuations and positions JCET favorably compared to industry averages.

JCET has strategically shifted its focus to advanced packaging technologies. This move involves significant investments in R&D and the adoption of cutting-edge technologies like fan-out, SiP (System-in-Package), and 3D stacking to meet the evolving demands of the semiconductor industry.

JCET Group's strengths include its comprehensive service offerings, global presence, and focus on advanced packaging. The company's focus on high-growth segments like automotive and high-performance computing represents areas of particular strength. However, the broader macroeconomic slowdown in 2023 presented some challenges to its revenue growth.

- Market Share: JCET Group's market share analysis shows it consistently ranks among the top OSAT providers globally.

- Competitive Advantages: JCET's competitive advantages include its end-to-end service capabilities and strategic focus on advanced packaging solutions.

- Future Outlook: JCET's future outlook appears positive, driven by its investments in advanced technologies and its strong position in key growth markets.

- Industry Position: JCET Group's industry position is solid, supported by its financial performance and strategic initiatives.

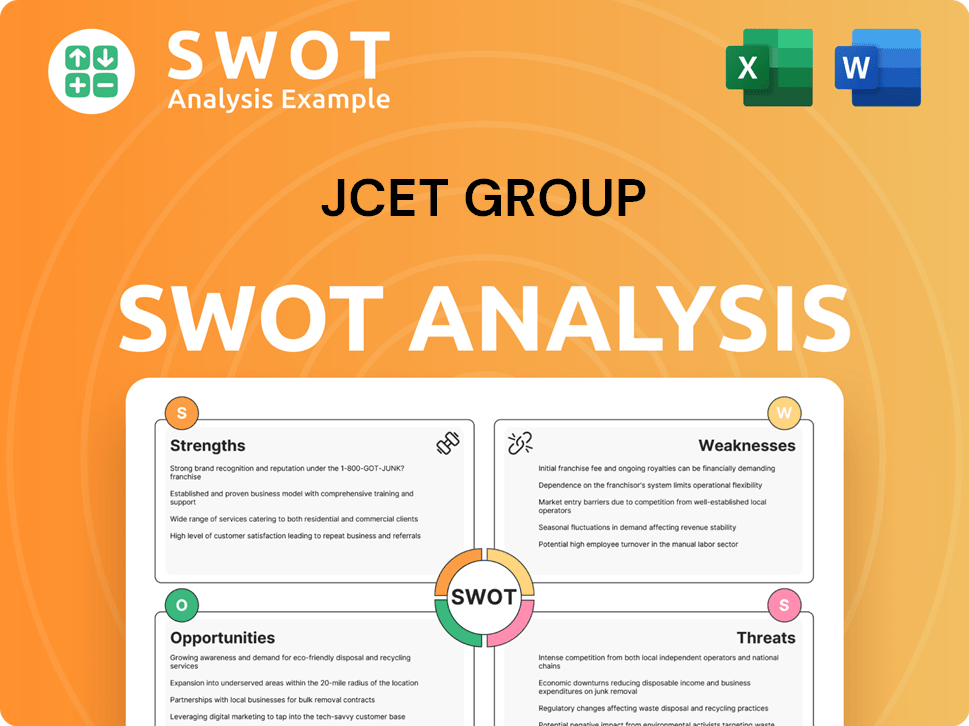

JCET Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging JCET Group?

The Brief History of JCET Group reveals that the company operates in a highly competitive Outsourced Semiconductor Assembly and Test (OSAT) market. This market is characterized by significant global players and rapid technological advancements. Understanding the competitive landscape is crucial for assessing JCET Group's market position and future prospects.

The competitive dynamics involve direct and indirect challenges from various industry participants. These challenges influence JCET Group's strategic decisions, including investments in advanced packaging technologies, geographic expansion, and partnerships. The OSAT industry is also subject to cyclical fluctuations and macroeconomic factors, adding to the complexity of the competitive environment.

The competitive landscape for JCET Group is shaped by several key players. These competitors employ various strategies to gain market share, including technological innovation, cost competitiveness, and strategic partnerships. The following section will explore these key competitors in detail.

JCET Group faces direct competition from major OSAT providers. These competitors offer similar services, including chip packaging and testing. They compete for the same customer base, particularly in high-growth sectors like mobile and high-performance computing.

ASEH is a leading global OSAT provider. It offers a comprehensive range of packaging and testing services. ASEH's scale and broad technological capabilities make it a significant competitor to JCET Group.

Amkor Technology is another major player in the OSAT market. It has a strong presence in the automotive and industrial sectors. Amkor's focus on these sectors poses a direct challenge to JCET Group.

PTI is a significant competitor, particularly in memory chip packaging and testing. PTI's specialized focus allows it to offer optimized solutions for the memory segment. This poses a direct challenge to JCET Group.

JCET Group also faces indirect competition from integrated device manufacturers (IDMs) and emerging players. These competitors may have different strengths and strategies. This indirect competition influences JCET Group's market analysis and strategic planning.

IDMs with in-house packaging and testing capabilities represent indirect competition. Many IDMs are increasingly outsourcing these functions. This trend impacts the competitive landscape.

Emerging players specializing in niche advanced packaging technologies pose a threat. These players may offer highly cost-effective solutions. Their emergence can disrupt the traditional competitive landscape.

The competitive landscape is dynamic, with companies constantly innovating and adapting. Key strategies include technological advancements, strategic partnerships, and cost optimization. The market share of each competitor is influenced by these strategies.

- Technological Innovation: Companies invest heavily in advanced packaging solutions. This includes fan-out packaging and 3D chip stacking. The goal is to meet the evolving needs of high-performance computing and mobile applications.

- Strategic Partnerships: Alliances and mergers reshape the industry. For instance, ASEH's acquisition of SPIL has created a larger, more competitive entity. These partnerships enhance economies of scale and technological capabilities.

- Market Focus: Competitors target specific sectors. Amkor's focus on automotive and industrial markets provides a competitive edge. PTI specializes in memory chip packaging.

- Financial Performance: The financial health of competitors impacts their ability to invest and compete. Analyzing revenue, profitability, and market capitalization provides insights into their competitive positions.

- Geographic Presence: Global presence is a key factor. Companies with manufacturing facilities in multiple regions can better serve their customers. This includes facilities in Asia, North America, and Europe.

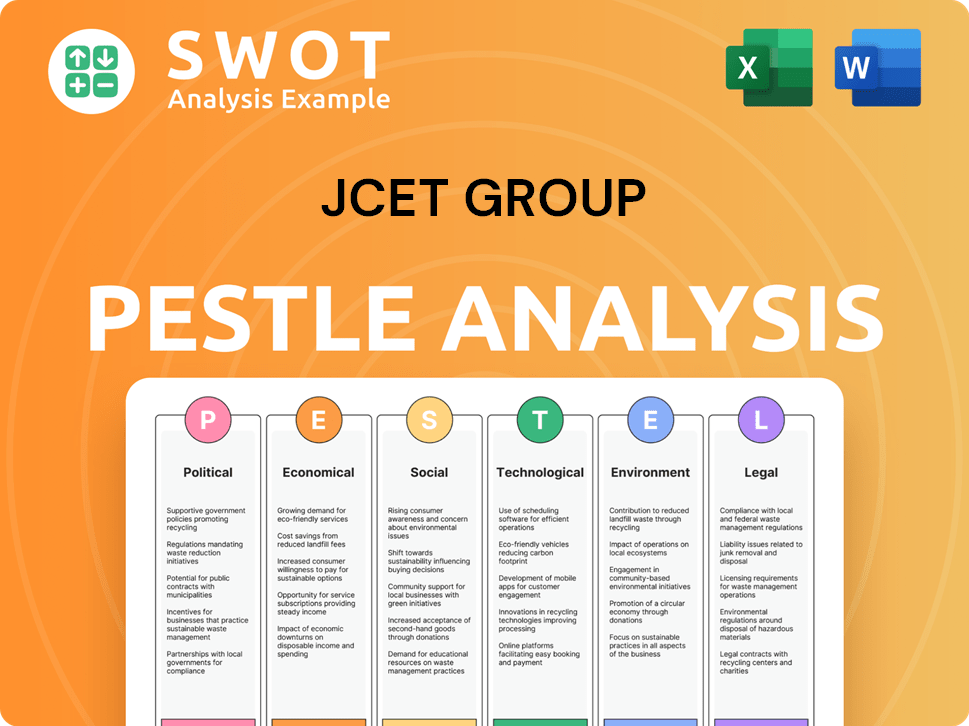

JCET Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives JCET Group a Competitive Edge Over Its Rivals?

The competitive landscape for JCET Group is shaped by its strategic focus on advanced packaging technologies, extensive global reach, and strong customer relationships. These factors contribute significantly to its market position within the Semiconductor Industry. A deep dive into JCET Group Market Analysis reveals a company that has consistently invested in innovation and expansion to maintain its competitive edge. Understanding these advantages is crucial for assessing JCET Group's industry position and its ability to navigate market challenges.

JCET Group's competitive advantages are multifaceted, stemming from its strategic focus on advanced packaging technologies, extensive global footprint, and strong customer relationships. A primary advantage lies in its comprehensive turnkey solutions, offering a full spectrum of services from design to drop shipment. This integrated approach simplifies the supply chain for customers, reducing lead times and improving efficiency, a critical factor in the fast-paced semiconductor industry. The company's continuous investment in research and development, particularly in cutting-edge packaging technologies like fan-out wafer-level packaging (FOWLP), system-in-package (SiP), and 3D integration, positions it at the forefront of innovation. For instance, JCET's advancements in high-density fan-out packaging are crucial for supporting the miniaturization and performance demands of next-generation mobile devices and high-performance computing applications.

Another key advantage is its significant economies of scale and global manufacturing capacity. With multiple production facilities across Asia, North America, and Europe, JCET can efficiently serve a diverse global customer base and respond flexibly to fluctuating market demands. This extensive network also contributes to supply chain resilience, a highly valued attribute in the current geopolitical and economic climate. Furthermore, JCET's strong customer relationships, built on years of reliable service and collaborative innovation, foster customer loyalty and repeat business.

JCET Group has achieved significant milestones, including expanding its global manufacturing footprint and investing heavily in advanced packaging technologies. These moves have strengthened its position in the market. The company's focus on innovation has led to breakthroughs in Chip Packaging, enhancing its competitive edge. These advancements are critical for supporting the miniaturization and performance demands of next-generation mobile devices and high-performance computing applications.

Strategic partnerships and acquisitions have been central to JCET Group's growth strategy. These moves have allowed JCET Group to expand its capabilities and market reach. The company's focus on high-value-added services further differentiates it. These strategic initiatives are designed to enhance its competitive advantages and ensure long-term sustainability.

JCET Group's competitive edge comes from its comprehensive turnkey solutions and strong customer relationships. Its global manufacturing capacity enhances its ability to serve a diverse customer base efficiently. The company's focus on R&D and innovation in Integrated Circuit (IC) packaging technologies is a key differentiator. JCET Group's ability to attract and retain a highly skilled talent pool also contributes significantly to its sustained competitive position.

JCET Group holds a significant position in the semiconductor market, driven by its advanced packaging capabilities and global presence. The company's focus on high-density fan-out packaging is crucial for supporting the miniaturization and performance demands of next-generation mobile devices and high-performance computing applications. JCET Group's market share analysis reveals its strong foothold in the industry. The company's revenue breakdown indicates a diversified portfolio of services and products.

To maintain its edge, JCET Group continuously leverages its advantages through strategic partnerships, aggressive R&D investments, and a focus on high-value-added services. The company's ability to attract and retain a highly skilled talent pool, particularly in advanced packaging engineering, also contributes significantly to its sustained competitive position. Understanding Revenue Streams & Business Model of JCET Group provides further insights into the company's operations and financial performance.

- Strategic partnerships are crucial for expanding capabilities and market reach.

- Aggressive R&D investments drive innovation in packaging technology.

- Focus on high-value-added services enhances customer relationships.

- Attracting and retaining skilled talent is key to maintaining a competitive edge.

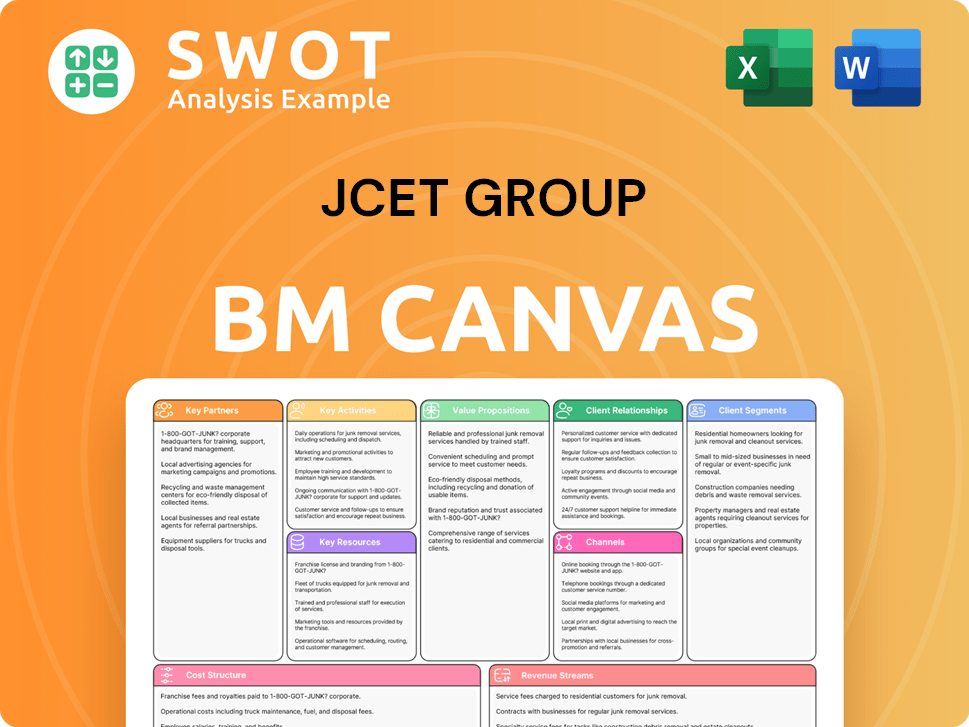

JCET Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping JCET Group’s Competitive Landscape?

The semiconductor industry is currently undergoing significant shifts, creating both challenges and opportunities for companies like JCET Group. These changes are driven by technological advancements, geopolitical factors, and evolving consumer demands. Understanding these trends is crucial for a comprehensive JCET Group Competitive Landscape analysis and assessing its future prospects.

The JCET Group Market Analysis reveals a landscape shaped by intense competition and rapid technological innovation. The ability to adapt to new packaging technologies and navigate global market dynamics will be critical for sustained growth. This includes managing risks associated with supply chain disruptions and economic downturns.

The semiconductor industry is experiencing a surge in demand for advanced packaging solutions. This is driven by the need for higher performance, greater power efficiency, and smaller form factors in electronic devices. Heterogeneous integration, chiplets, and 3D stacking are becoming increasingly important.

Developing and implementing advanced packaging technologies requires substantial capital expenditure and a skilled workforce. Geopolitical tensions and trade disputes can disrupt supply chains and increase operational costs. The cyclical nature of the semiconductor industry presents challenges.

The rising demand for AI, 5G, and automotive semiconductors offers significant growth avenues. Emerging markets, particularly in Southeast Asia and India, present new customer bases and manufacturing locations. Strategic partnerships can unlock new revenue streams.

The semiconductor market is expected to grow. The OSAT segment needs to adapt to evolving customer demands and technological shifts. The evolving competitive landscape requires continuous investment in advanced packaging and expanding global presence.

To maintain a strong JCET Group industry position, the company must focus on several key strategies. This includes investing in advanced packaging technologies, expanding capacity in high-growth segments, and forming strategic partnerships. These moves will help navigate the JCET Group market challenges.

- Advanced Packaging Investment: Continuous investment in R&D for chip packaging, including 3D stacking and chiplet technologies.

- Geographic Expansion: Expanding manufacturing footprints, especially in Southeast Asia and India, to diversify supply chains.

- Strategic Partnerships: Forming alliances with fabless companies and IDMs to co-develop next-generation packaging solutions.

- Focus on High-Growth Segments: Prioritizing growth in AI, 5G, and automotive semiconductors.

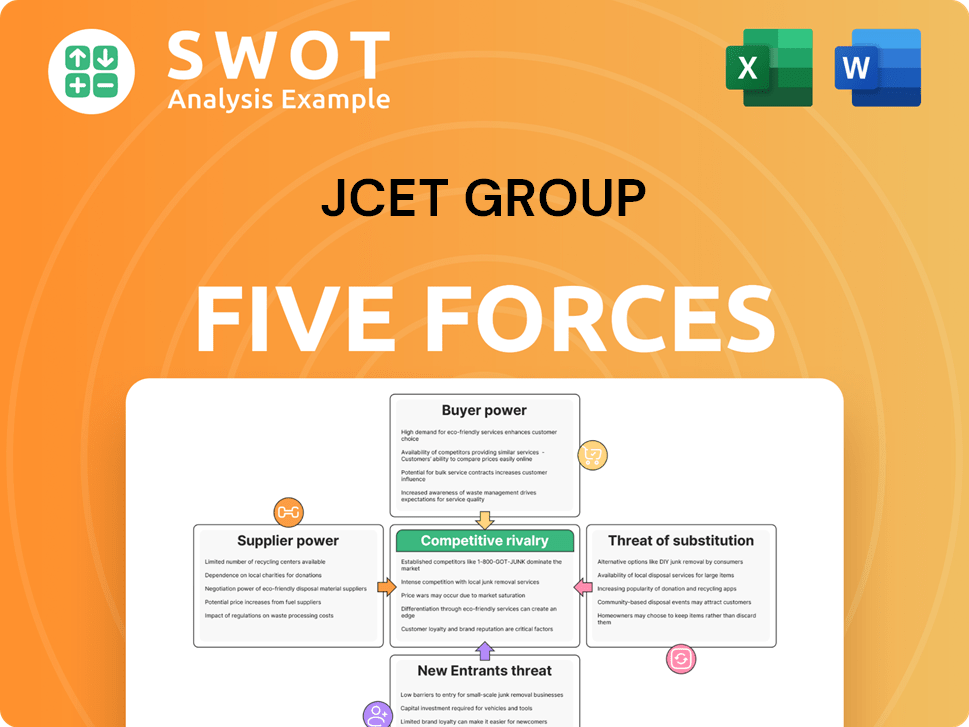

JCET Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of JCET Group Company?

- What is Growth Strategy and Future Prospects of JCET Group Company?

- How Does JCET Group Company Work?

- What is Sales and Marketing Strategy of JCET Group Company?

- What is Brief History of JCET Group Company?

- Who Owns JCET Group Company?

- What is Customer Demographics and Target Market of JCET Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.