JCET Group Bundle

How Does JCET Group Thrive in the Semiconductor World?

JCET Group, a powerhouse in the integrated circuit (IC) back-end manufacturing sector, recently celebrated a record-breaking year, achieving RMB 35.96 billion in revenue for 2024. This impressive performance solidifies its position as a key player in the global semiconductor landscape. As one of the top companies in the industry, JCET Group's operations are critical to understanding the current market dynamics.

Delving into JCET Group SWOT Analysis reveals the company's strengths and strategic positioning. JCET Company's comprehensive services, from chip manufacturing to semiconductor packaging and testing, cater to diverse markets, reflecting its adaptability and technological prowess. Understanding the JCET Group business model and its global presence is essential for anyone looking to navigate the complexities of the integrated circuit industry and its future plans.

What Are the Key Operations Driving JCET Group’s Success?

The core of JCET Group's operations lies in providing comprehensive Outsourced Semiconductor Assembly and Test (OSAT) solutions. This involves managing the complex back-end processes of semiconductor manufacturing. This allows clients to concentrate on design and marketing. Their services include semiconductor package integration design and characterization, R&D, wafer probing, bumping, package assembly, final testing, and global drop shipment.

JCET Group offers a wide array of services, including advanced wafer-level packaging, 2.5D/3D packaging, System-in-Package (SiP) solutions, flip-chip packaging, and wire bonding technologies. They serve diverse customer segments across mobile, communication, computing, consumer electronics, automotive, and industrial applications. This broad reach highlights their adaptability and market presence. Their focus on advanced packaging technologies, such as XDFOI® multi-dimensional fan-out packaging, which achieved mass production in 2024, is crucial for high-performance computing (HPC) and automotive applications.

The company's operational processes are supported by advanced manufacturing techniques and a global footprint. This includes eight major production bases across China, South Korea, and Singapore. These are complemented by R&D centers in China and Korea. This extensive network supports efficient supply chain solutions and close collaboration with global customers. This global presence is a key factor in their ability to serve a wide range of clients efficiently. To learn more about the company's operations, you can read this article about JCET Group by clicking here: JCET Group's business model.

JCET Group provides a wide range of semiconductor packaging and testing services. These include advanced wafer-level packaging, 2.5D/3D packaging, and System-in-Package (SiP) solutions. They also offer flip-chip packaging and wire bonding technologies.

JCET Group serves diverse customer segments. These include mobile, communication, computing, consumer electronics, automotive, and industrial sectors. Their services are essential for various electronic devices.

JCET Group has a significant global presence. They have eight major production bases across China, South Korea, and Singapore. R&D centers are located in China and Korea.

They continuously invest in advanced packaging technologies. An example is their proprietary XDFOI® multi-dimensional fan-out packaging. This technology enhances functionality and performance.

JCET Group's value proposition centers on enabling enhanced functionality, miniaturization, and improved performance for electronic devices. They provide comprehensive OSAT solutions, allowing clients to focus on their core competencies. Their advanced packaging technologies, such as XDFOI®, are crucial for high-performance computing and automotive applications.

- Focus on advanced packaging technologies.

- Global manufacturing and R&D network.

- Comprehensive OSAT solutions.

- Customer-focused approach.

JCET Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does JCET Group Make Money?

The core of JCET Group's revenue generation lies in its comprehensive integrated circuit (IC) manufacturing and technology services. The company specializes in providing turnkey solutions for semiconductor packaging and testing. This includes package design, product development, wafer probe, package assembly, testing, and drop shipment, all contributing to its diverse revenue streams.

In 2024, JCET Group achieved a record-high annual revenue. This growth was primarily driven by its focus on advanced packaging technologies, demonstrating the effectiveness of its strategic direction and operational execution.

The company's monetization strategy is centered around offering a full range of services to meet the evolving needs of high-growth sectors. This approach allows JCET operations to capture value across various market segments.

The company's financial performance in 2024 reflects its strong market position and effective monetization strategies. JCET Company has demonstrated consistent financial health and strategic acumen.

- In 2024, JCET Group reported a record-high annual revenue of RMB 35.96 billion, marking a 21.2% increase year-on-year.

- Revenue from advanced packaging accounted for over 72% of total annual revenue in 2024, highlighting the importance of this segment.

- The XDFOI® multi-dimensional fan-out packaging technology alone contributed over 72% of total revenue in 2024, up from two-thirds in 2023.

- The computing electronics segment saw a substantial revenue increase of 38.1% year-on-year in 2024.

- Automotive electronics revenue grew by 20.5% year-on-year.

- The acquisition of an 80% stake in SanDisk (Shanghai) in Q4 2024 expanded memory chip packaging capabilities.

- The company has maintained positive free cash flow for six consecutive years (2019-2024).

JCET Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped JCET Group’s Business Model?

The evolution of JCET Group, a key player in the semiconductor industry, is marked by significant milestones and strategic initiatives. Initially established in 1972 as Jiangyin Transistor Factory, the company has transformed into a global leader in chip manufacturing and integrated circuit packaging. Its journey includes a strategic shift to JCET in 2000 and a listing on the Shanghai Stock Exchange in 2003, setting the stage for substantial growth and expansion.

A pivotal move was the acquisition of STATS ChipPAC in August 2015 for $1.8 billion, which significantly broadened JCET's global footprint and capabilities. This acquisition propelled JCET to become the third-largest semiconductor packaging and testing company worldwide. Further optimizing its capital structure, the controlling shareholder changed to Panshi Hong Kong in 2024, reflecting ongoing strategic adjustments.

JCET operations are defined by continuous innovation and strategic investments. The company's commitment to technological advancement is evident in its R&D expenditures, which reached RMB 1.72 billion in 2024, a 19.3% increase year-on-year. This investment led to the filing of 587 new patent applications, bringing the total patent portfolio to 3,030 by the end of 2024. These efforts underscore JCET's focus on maintaining a competitive edge in the dynamic semiconductor packaging market.

JCET Group's history includes its establishment in 1972, restructuring to JCET in 2000, and listing on the Shanghai Stock Exchange in 2003. The acquisition of STATS ChipPAC in 2015 was a major strategic move. In 2024, the controlling shareholder changed to Panshi Hong Kong.

The acquisition of STATS ChipPAC expanded its global presence. Continuous investment in R&D, with RMB 1.72 billion spent in 2024, is a key strategy. Focus on advanced packaging solutions and optimizing production efficiency are ongoing strategic priorities.

Strong technological leadership in advanced packaging, such as HFBP dual-sided heat dissipation, enhances customer loyalty. Economies of scale from its global manufacturing sites contribute to its success. Diversified customer base across high-growth applications supports sustained business model.

R&D expenditure reached RMB 1.72 billion in 2024. The company filed 587 new patent applications in 2024. The total patent portfolio reached 3,030 by the end of 2024. These figures highlight the company's commitment to innovation and growth.

JCET Group continues to innovate, with key breakthroughs like the mass production of its XDFOI® multi-dimensional fan-out packaging platform in 2024. The completion and operation of the JCET Microelectronics Microsystem Integration High-End Manufacturing Base in Jiangyin in 2024 further enhanced its manufacturing capabilities. The company is adapting to new trends by focusing on intelligent manufacturing and green production.

- The XDFOI® platform enables heterogeneous integration for HPC and automotive applications.

- Collaboration with Allegro MicroSystems in 2024 to develop localized packaging for magnetic sensors and power management chips.

- Focus on intelligent manufacturing and green production to enhance sustainability and efficiency.

- Owners & Shareholders of JCET Group have played a crucial role in the company's strategic direction.

JCET Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is JCET Group Positioning Itself for Continued Success?

Understanding the operational dynamics of JCET Group requires a look at its standing within the semiconductor industry. As a leading player in semiconductor packaging and testing, JCET Group holds a significant position globally. Its strategic initiatives and innovative approach have positioned it as a major force in the chip manufacturing sector.

JCET operations are subject to various risks, including the cyclical nature of the semiconductor market and global trade dynamics. The company's ability to maintain its competitive edge through continuous innovation and efficient capital management is crucial. The company's success in the market depends on its capacity to navigate these challenges effectively.

JCET Group is the largest semiconductor packaging and test services provider in mainland China and ranks third globally. It has a strong market presence in the Asia-Pacific region and is expanding in North America and Europe. The company's brand value increased by 14%, reaching USD 667 million in 2025, according to the Brand Finance Semiconductor 30 report, where it ranked 29th.

The semiconductor industry's cyclical nature and demand fluctuations for end consumer products pose risks. International trade dynamics and regulatory changes also affect the global supply chain. Intense competition within the OSAT market requires continuous innovation and capital investment to maintain a technological edge.

JCET Group plans to strengthen technological innovation and promote open collaboration across the industry chain. It aims to focus on intelligent manufacturing and green production. The company's Q1 2025 results show a positive trajectory, with revenue up 36.4% year-on-year to RMB 9.34 billion and net profit up 50.4% year-on-year to RMB 200 million.

JCET Group is accelerating the transformation of its business structure towards high-value-added segments, particularly in advanced packaging for high-performance computing and automotive applications. The company is also expanding high-reliability packaging technology in aerospace and military industries. It aims to optimize its product structure and capacity layout.

JCET Group is focused on sustaining growth through technological innovation and strategic initiatives. The company's focus on advanced packaging for high-performance computing and automotive applications positions it well for future trends. For more insights, check out the Marketing Strategy of JCET Group.

- Expanding in High-Reliability Packaging: JCET Group is increasing its presence in the aerospace and military sectors.

- Optimizing Product Structure: The company is working on enhancing its product mix and capacity layout.

- Focus on Advanced Packaging: JCET Group is targeting high-value segments like high-performance computing and automotive applications.

- Intelligent Manufacturing: The company is investing in intelligent manufacturing and green production processes.

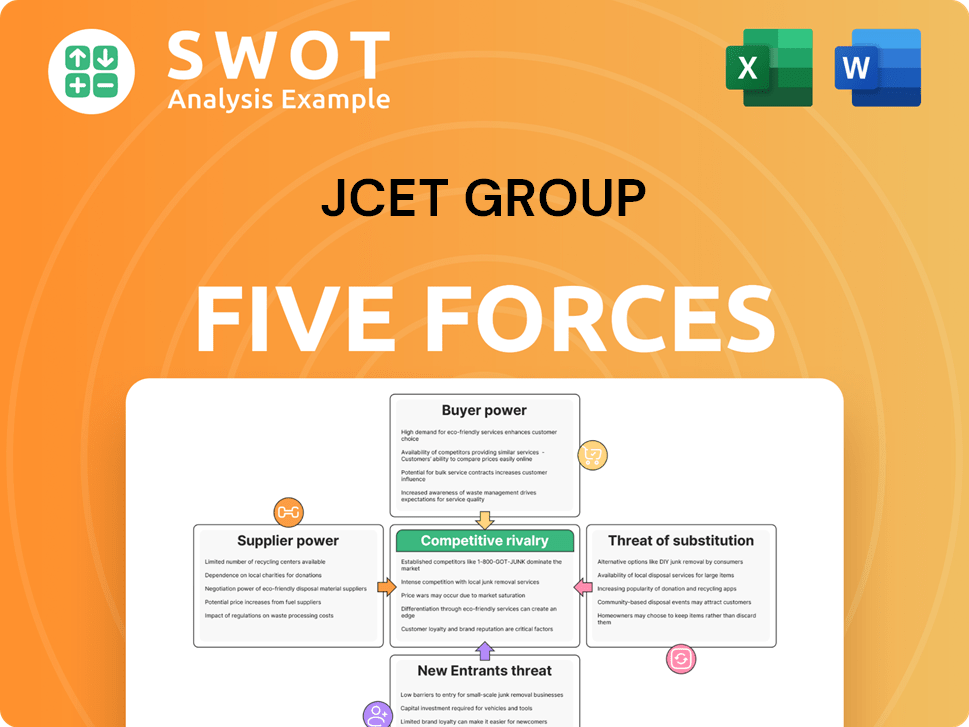

JCET Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of JCET Group Company?

- What is Competitive Landscape of JCET Group Company?

- What is Growth Strategy and Future Prospects of JCET Group Company?

- What is Sales and Marketing Strategy of JCET Group Company?

- What is Brief History of JCET Group Company?

- Who Owns JCET Group Company?

- What is Customer Demographics and Target Market of JCET Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.