JCET Group Bundle

How is JCET Group Dominating the Semiconductor Market?

In the cutthroat world of semiconductors, understanding the sales and marketing strategies of industry leaders is paramount. JCET Group, a powerhouse in integrated circuit manufacturing, has seen its advanced packaging solutions, like the innovative XDFOI®, drive remarkable revenue growth. This deep dive will uncover the secrets behind JCET Group's success, exploring their innovative JCET Group SWOT Analysis, sales channels, and marketing campaigns.

This analysis will dissect JCET Group's approach to JCET Group Sales Strategy and JCET Group Marketing Strategy, revealing how they've cultivated customer loyalty and expanded their global footprint. We'll examine their JCET Group Business Development initiatives, including their tactics for Semiconductor Sales and Integrated Circuit Marketing, providing valuable insights for investors and industry professionals alike. Learn how JCET Group effectively promotes its Chip Manufacturing Promotion to achieve record-breaking financial results and maintain a competitive edge.

How Does JCET Group Reach Its Customers?

The sales and marketing strategy of JCET Group, a prominent player in the semiconductor industry, is primarily centered around a direct sales model. This strategy enables the company to offer comprehensive, turnkey solutions for semiconductor packaging and testing directly to manufacturers and OEMs worldwide. This direct engagement allows for tailored services, encompassing package design, product development, wafer probing, package assembly, testing, and drop shipment, ensuring close collaboration with major semiconductor manufacturers.

The evolution of JCET Group's sales channels has been significantly influenced by the growing demand for advanced packaging technologies and the need for close collaboration with major semiconductor manufacturers. The company's focus on high-value-added segments has been crucial, with a strategic shift towards advanced packaging being a key driver of growth. This approach has allowed JCET Group to strengthen customer loyalty by leveraging its core applications and advancing the commercialization of innovative technologies.

Key partnerships and exclusive distribution deals are integral to JCET's growth and market share. For instance, the acquisition of 80% equity in SanDisk Semiconductor Shanghai Co., Ltd. (SDSS) in Q4 2024 expanded JCET's memory chip packaging capabilities, bolstering its position in the memory and computing electronics markets, which saw revenue grow by 38.1%. This strategic acquisition, valued at approximately USD 624 million, aims to increase JCET's market share in the storage sector. Furthermore, JCET's close collaboration with customers through pilot lines, such as the one for automotive chip advanced packaging initiated in August 2023, allows customers to secure production capacity in advance, streamlining verification and introduction processes for future products and helping them capture market share in the rapidly growing automotive semiconductor market.

JCET Group primarily utilizes a direct sales model, providing turnkey solutions to manufacturers and OEMs globally. This approach allows for tailored services and close collaboration, which is crucial in the semiconductor industry.

The company has strategically shifted towards advanced packaging, which is a high-value-added segment. This focus has been a key driver of growth, with advanced packaging accounting for over 72% of total annual revenue as of Q4 2024.

JCET Group leverages key partnerships and exclusive distribution deals to expand its market share. The acquisition of SDSS is a prime example of this strategy, expanding memory chip packaging capabilities.

Close collaboration with customers through pilot lines, such as the one for automotive chips, allows for streamlined processes. This approach helps customers secure production capacity and capture market share.

JCET Group's sales strategy is multifaceted, focusing on direct engagement, strategic partnerships, and customer collaboration. This approach enables the company to meet the evolving demands of the semiconductor market effectively. The company's focus on advanced packaging and high-value-added segments has been crucial to its success.

- Direct Sales: Direct engagement with manufacturers and OEMs for tailored solutions.

- Strategic Partnerships: Acquisitions and exclusive deals to expand market reach.

- Customer Collaboration: Pilot lines and early capacity allocation.

- Advanced Packaging: Focus on high-value segments, with over 72% of revenue from advanced packaging in Q4 2024.

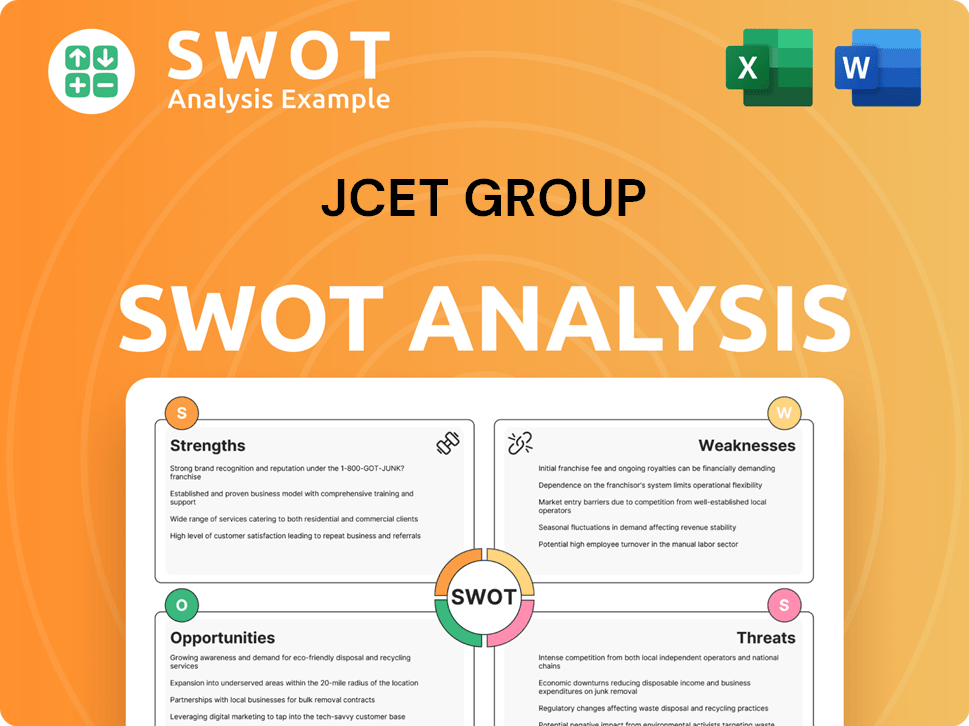

JCET Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does JCET Group Use?

The marketing tactics of JCET Group, a key player in the semiconductor industry, are primarily geared towards building brand awareness and generating leads within the B2B integrated circuit manufacturing services sector. Their strategy focuses on demonstrating technological expertise and fostering industry leadership. This approach is crucial for a company that provides advanced packaging and testing services for integrated circuits.

JCET Group's marketing strategy is heavily influenced by direct engagement and industry thought leadership. They actively participate in industry conferences and events, such as the 'Global Advanced Packaging Developers Conference,' to promote their services and explore innovative collaborations. This positions them as a leader in the semiconductor market.

While specific details on digital marketing are not extensively disclosed, JCET Group strategically utilizes digital channels to disseminate information about financial results, technological advancements, and ESG initiatives. This approach is crucial for showcasing their commitment to sustainable growth and responsible operations, which is a key aspect of their marketing efforts.

JCET Group actively participates in industry conferences and events. They hosted the 'Global Advanced Packaging Developers Conference' in 2024, highlighting their deep integration across the IC back-end manufacturing industry.

JCET Group utilizes digital channels to share financial results, technological advancements, and ESG initiatives. The release of the 2024 ESG Report in April 2025 is a key content marketing piece.

The company focuses on strengthening customer loyalty through core applications and advancing the commercialization of innovative technologies. This includes continuous investment in research and development.

JCET Group invested RMB 1.72 billion in research and development in 2024, a 19.3% year-on-year increase. They filed 587 new patent applications, reinforcing their focus on innovation.

JCET Group emphasizes its advanced packaging solutions, such as the XDFOI® platform. This platform has achieved stable mass production and is a significant revenue driver.

JCET Group focuses on data-driven marketing and customer segmentation to strengthen customer loyalty and advance the commercialization of innovative technologies. This approach supports their Growth Strategy of JCET Group.

JCET Group's marketing strategy leverages several key tactics to promote its services and maintain a competitive edge in the semiconductor market. These tactics include:

- Direct engagement through industry events and conferences, such as the 'Global Advanced Packaging Developers Conference.'

- Strategic use of digital channels for content marketing, including the release of financial results, technological advancements, and ESG reports.

- Focus on customer loyalty through core applications and the commercialization of innovative technologies.

- Continuous investment in research and development, with RMB 1.72 billion invested in 2024, an increase of 19.3% year-on-year.

- Emphasis on advanced packaging solutions, such as the XDFOI® platform, which is a significant revenue driver.

- Data-driven marketing and customer segmentation to enhance customer relationships and drive innovation.

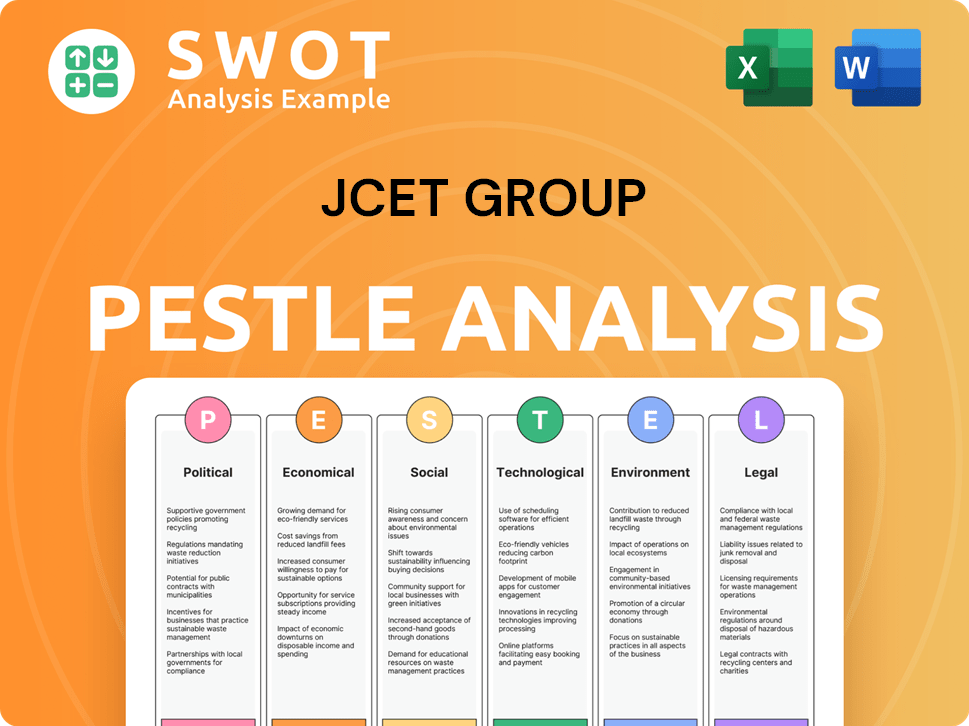

JCET Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is JCET Group Positioned in the Market?

JCET Group positions itself as a leading global provider of integrated circuit (IC) manufacturing and technology services, focusing on comprehensive turnkey solutions. Its brand emphasizes continuous innovation, strategic global partnerships, and a commitment to advanced packaging technologies. This approach is central to its JCET Group Sales Strategy, aiming to capture a significant share of the expanding semiconductor market.

The company differentiates itself through an extensive portfolio covering mainstream integrated circuit system applications, including network communication, mobile terminals, high-performance computing, and automotive electronics. This broad coverage is vital for its JCET Group Marketing Strategy, ensuring it can meet diverse customer needs and maintain a competitive edge. Its core message revolves around providing 'advanced and reliable integrated circuit back-end manufacturing technology and services for a smarter world.' This message resonates with manufacturers and OEMs requiring cutting-edge semiconductor solutions.

JCET's brand perception is reinforced by its strong financial performance and market standing. In 2024, the company achieved record-high revenue of RMB 35.96 billion, a 21.2% year-on-year increase. This financial success underpins its marketing efforts and strengthens its position in the global market. JCET's ability to innovate and adapt, such as through its XDFOI® multi-dimensional fan-out packaging platform, which contributed significantly to its revenue, accounting for over 72% of the total in 2024, is crucial for its JCET Group Business Development.

JCET leverages technological advancements to enhance its brand image. The mass production of the XDFOI® packaging platform is a prime example. This innovation is crucial for high-performance computing and automotive applications, driving revenue growth and market share.

Strategic global partnerships are central to JCET's strategy. These collaborations help expand its market reach and access new technologies. Such partnerships are essential for navigating the competitive landscape of Semiconductor Sales.

JCET's strong financial performance, with record revenue in 2024, reinforces its brand strength. This financial success supports ongoing investments in R&D and strategic acquisitions, such as the SanDisk (Shanghai) deal in Q4 2024, which expanded its memory chip packaging capabilities.

JCET's brand recognition is enhanced by its inclusion in the 'Semiconductor 30 2025' list, ranking 29th globally with a brand value up 14% to USD 667 million. This recognition validates its market position and strengthens customer trust. For more insights, explore the Competitors Landscape of JCET Group.

JCET's approach to Integrated Circuit Marketing involves several key strategies:

- Continuous investment in R&D to stay at the forefront of technological advancements.

- Strategic acquisitions to expand capabilities and market reach, such as the SanDisk (Shanghai) deal.

- Focus on providing comprehensive turnkey solutions to meet diverse customer needs.

- Maintaining brand consistency across global manufacturing sites and service offerings.

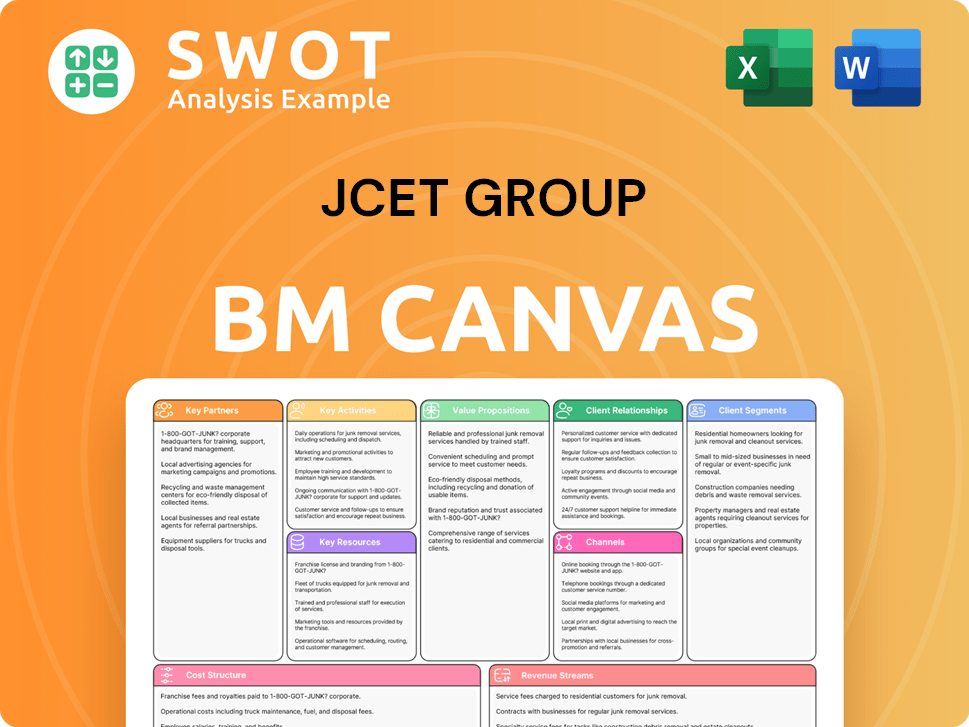

JCET Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are JCET Group’s Most Notable Campaigns?

The JCET Group Sales Strategy and JCET Group Marketing Strategy are primarily centered on business-to-business (B2B) activities, focusing on technological advancements and strategic initiatives that drive customer acquisition and retention within the integrated circuit manufacturing sector. Given its position as a technology services provider, JCET Group's 'campaigns' are often defined by its pursuit of cutting-edge technologies and market expansion strategies. These initiatives, such as the development of advanced packaging solutions and expansion into new market segments, serve as the core of its JCET Group Business Development efforts.

JCET Group's approach to sales and marketing is intrinsically linked to its technological prowess and strategic partnerships. The company's primary focus is on providing advanced packaging and testing services for integrated circuits, targeting high-performance computing, automotive, and memory electronics markets. These efforts are supported by significant investments in research and development, strategic acquisitions, and collaborations with key players in the semiconductor industry.

The company's success is evident in its financial performance, with advanced packaging accounting for over 72% of its total annual revenue in 2024. This reflects the effectiveness of its sales and marketing strategies in driving revenue growth and market share. JCET Group's proactive approach to market expansion and technological innovation has been crucial in maintaining its competitive edge and achieving its business objectives.

JCET Group's continuous pursuit of advanced packaging technologies is a key 'campaign'. The mass production of the XDFOI® multi-dimensional fan-out packaging platform in 2024 enabled heterogeneous integration for high-performance computing (HPC) and automotive applications. This initiative is supported by substantial R&D investments, reaching RMB 1.72 billion in 2024, and has resulted in advanced packaging accounting for over 72% of total annual revenue.

Another crucial strategic 'campaign' involves expansion into the automotive chip packaging market. The JCET Automotive Chip Back-end Manufacturing Base in Lingang, Shanghai, is expected to have equipment entry in the first half of 2025. This aims to provide comprehensive solutions for the automotive sector, with automotive electronics business revenue increasing by 66.0% year-on-year in Q1 2025. Collaborations with industry partners are vital for this campaign's success.

The acquisition of 80% equity in SanDisk Semiconductor Shanghai Co., Ltd. (SDSS) in Q4 2024 for approximately USD 624 million represents a significant 'campaign'. This strategic move expanded JCET's market share in the storage segment, directly bolstering memory chip packaging capabilities. This led to a 38.1% revenue growth in the computing and memory electronics markets, demonstrating proactive market expansion.

JCET Group's commitment to research and development (R&D) is a cornerstone of its sales and marketing approach. The company invested RMB 1.72 billion in R&D in 2024, a 19.3% year-on-year increase. This investment led to the filing of 587 new patent applications, reinforcing its technological leadership and supporting its Semiconductor Sales efforts. This focus on innovation enables JCET to offer cutting-edge solutions and maintain a competitive edge.

JCET Group's sales and marketing strategies are multifaceted, encompassing technological advancements, strategic acquisitions, and targeted market expansion. These strategies are designed to drive revenue growth, enhance customer loyalty, and strengthen its market position. The company’s approach is heavily influenced by its focus on innovation and its ability to meet the evolving needs of its clients.

- Advanced Packaging: Continual investment in advanced packaging technologies, such as XDFOI®, to meet the demands of high-performance computing and automotive applications.

- Market Expansion: Strategic moves into high-growth sectors like automotive electronics through new manufacturing bases.

- Strategic Acquisitions: Acquisitions, like the one involving SDSS, to broaden capabilities and market reach in areas like memory chip packaging.

- R&D Investment: Significant investment in research and development to foster innovation and maintain a competitive advantage, with a focus on Integrated Circuit Marketing.

- Partnerships: Collaborations with OEMs, Tier 1 suppliers, and IC suppliers to secure production capacity and streamline product verification.

For a deeper understanding of the markets and customers JCET Group targets, further insights can be found in an article about the Target Market of JCET Group. The company’s strategies are designed to enhance its presence in key markets and to drive long-term growth. This proactive approach to Chip Manufacturing Promotion helps JCET Group maintain its market leadership and adapt to the rapidly changing semiconductor landscape.

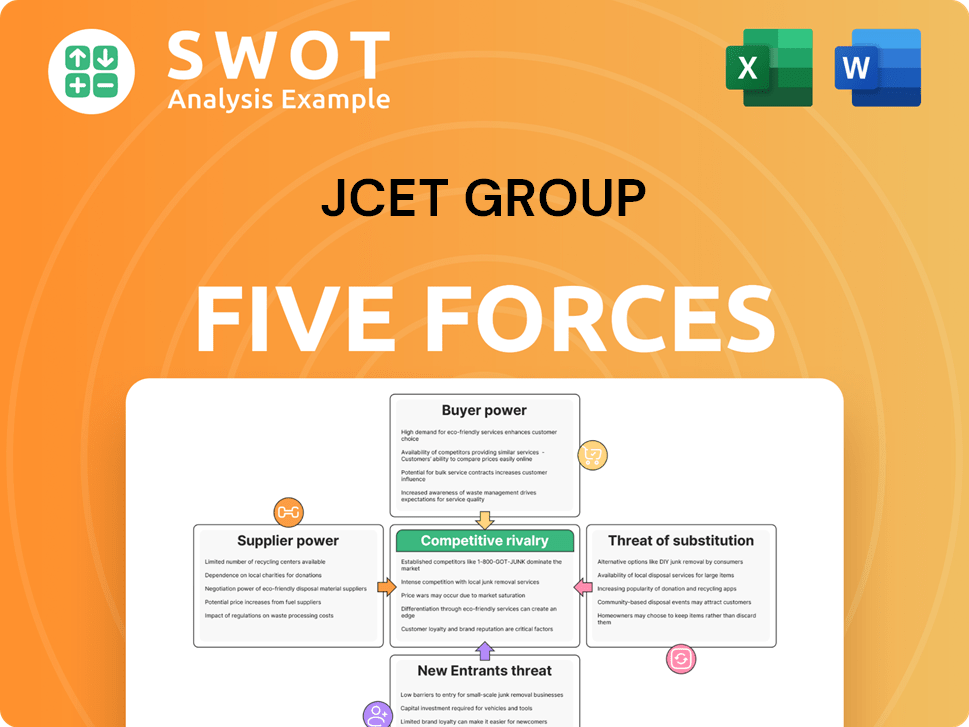

JCET Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of JCET Group Company?

- What is Competitive Landscape of JCET Group Company?

- What is Growth Strategy and Future Prospects of JCET Group Company?

- How Does JCET Group Company Work?

- What is Brief History of JCET Group Company?

- Who Owns JCET Group Company?

- What is Customer Demographics and Target Market of JCET Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.