JCET Group Bundle

Who Really Owns JCET Group?

Ever wondered who's truly calling the shots at JCET Group, a giant in the semiconductor world? The ownership structure of a company is a roadmap to its strategy, and understanding JCET Group's ownership is key to unlocking its potential. A shift in ownership can dramatically change a company's future, so let's dive in.

JCET Group's journey, from its beginnings in Jiangyin, China, to its current global footprint, is a fascinating case study in corporate evolution. From its initial founding to its current status, understanding the JCET Group SWOT Analysis is crucial. This article will explore the JCET Group ownership and its impact on the company, providing insights into its JCET shareholders, JCET Group structure, and the influence of its major stakeholders.

Who Founded JCET Group?

The specifics of the founders and early ownership of JCET Group are not extensively documented in public records from its inception in 1972. Information about the initial equity split or shareholding at the time of JCET Group's establishment is limited. Given the company's origins in China during the early 1970s, the initial ownership structure likely reflected the economic and political environment of that era.

Details regarding the original founders, their backgrounds, and their precise individual stakes (percentages or number of shares) are not readily available. The early ownership structure may have involved local government or collective ownership models, common in China at that time, rather than individual private founders in the Western sense.

Similarly, information on early backers, angel investors, or friends and family who acquired stakes during the initial phase of Jiangyin Changjiang Electronics Industry Co., Ltd. is not publicly disclosed. Early agreements such as vesting schedules, buy-sell clauses, or founder exits from this nascent period are also not documented in accessible public records. The evolution of JCET Group from a local entity to a global player suggests a significant transformation in its ownership and operational structure over several decades.

The company's beginnings were shaped by China's economic policies of the early 1970s.

It's probable that collective or government-linked ownership played a role in the initial structure of the company.

Detailed records of early investors and their stakes are not readily accessible to the public.

The company's journey from a local entity to a global player indicates significant changes in ownership and operations.

Precise details about vesting schedules or founder exits from the early period are not available.

The lack of detailed public information emphasizes the company's evolution and growth over time.

Understanding the early ownership of JCET Group is challenging due to limited public information. The company's initial structure was likely influenced by the economic environment of the time, with details of early investors and founders' stakes not readily available. The transformation of JCET Group from a local entity into a global player indicates significant changes in its ownership and operational structure over the decades. For more information about the company's strategic positioning, you can refer to the Target Market of JCET Group.

- The initial ownership structure was shaped by China's economic policies of the 1970s.

- Detailed records of early investors and founders are not publicly accessible.

- The company's evolution reflects significant changes in its ownership structure.

- The early ownership model may have involved collective or government-linked entities.

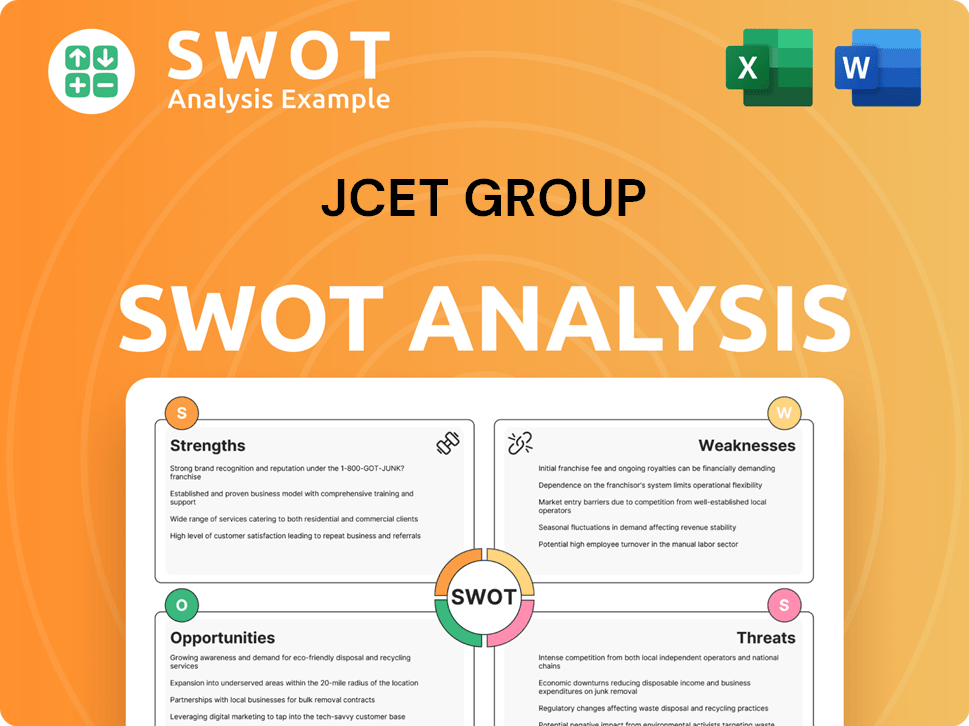

JCET Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has JCET Group’s Ownership Changed Over Time?

The evolution of JCET Group's ownership reflects its transformation from a domestic entity to a global semiconductor service provider. Its initial public offering (IPO) on the Shanghai Stock Exchange was a crucial step, enabling wider public ownership. This transition marked the beginning of significant changes in its shareholder base and strategic direction.

A key event in JCET ownership occurred in 2015 with the acquisition of STATS ChipPAC. This move, backed by a consortium led by the China Integrated Circuit Industry Investment Fund (the 'Big Fund'), altered JCET Group structure and its position in the global market. The 'Big Fund' became a major shareholder, aligning with China's strategic goals for its semiconductor industry. This acquisition significantly impacted JCET shareholders and its overall strategic direction.

| Event | Impact on Ownership | Year |

|---|---|---|

| Initial Public Offering (IPO) | Expanded public ownership | Early Stage |

| Acquisition of STATS ChipPAC | 'Big Fund' became a major shareholder, increased global presence | 2015 |

| Ongoing Market Activity | Fluctuations in shareholder percentages due to trading and transactions | Ongoing |

As of early 2024, JCET Group investors include state-backed entities, institutional investors, and public shareholders. The 'Big Fund' remains a significant stakeholder, highlighting the strategic importance of JCET Group. Other major shareholders include domestic and international institutional investors. For example, as of December 31, 2023, the China Integrated Circuit Industry Investment Fund Co., Ltd. was a primary shareholder. These ownership dynamics, detailed in JCET Group's annual reports, enable the company to expand globally, invest in advanced technologies, and pursue further mergers and acquisitions. Understanding the JCET Group parent company and its major stakeholders is crucial for investors and stakeholders.

The ownership structure of JCET Group has evolved significantly, influenced by strategic acquisitions and public listings.

- The 'Big Fund' plays a key role.

- Institutional investors hold substantial stakes.

- Ownership details are available in annual reports.

- These dynamics shape the company's global strategy.

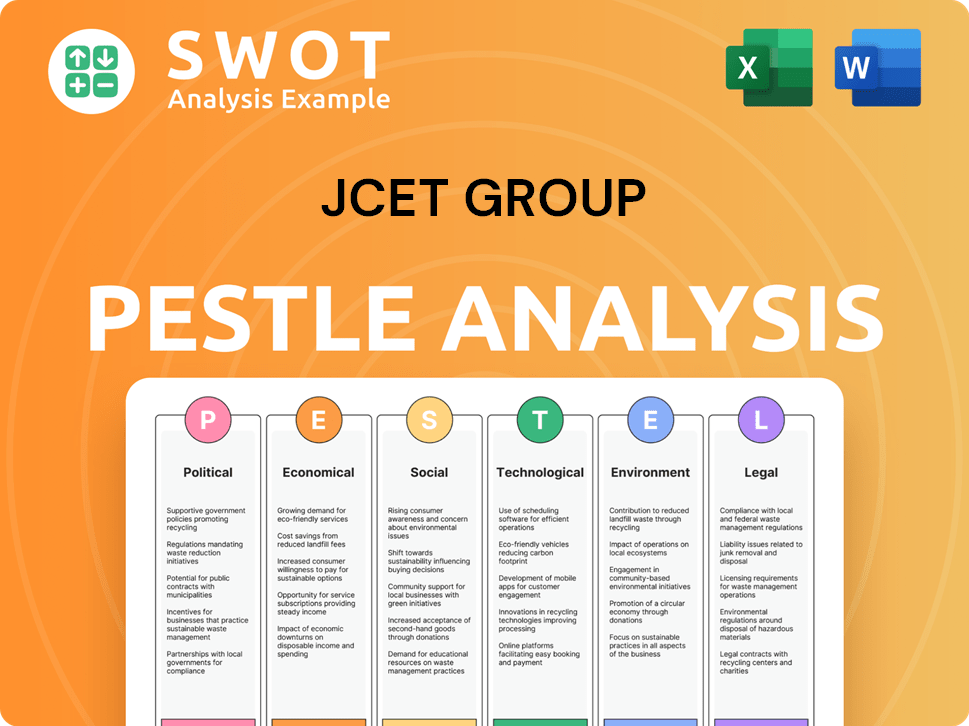

JCET Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on JCET Group’s Board?

As of early 2025, the Board of Directors of JCET Group reflects a blend of representatives from major shareholders, management, and independent members, crucial for understanding the company's governance and decision-making. The board typically includes representatives from its largest shareholders, such as the China Integrated Circuit Industry Investment Fund Co., Ltd. (the 'Big Fund'), which holds a substantial ownership stake. These representatives often serve as non-executive directors, ensuring that the strategic interests of major state-backed investors are considered in board decisions. Understanding the Brief History of JCET Group provides context for these governance structures.

The board's composition is designed to balance the interests of various stakeholders. The presence of both executive and non-executive directors, along with independent members, aims to ensure effective oversight and strategic guidance. The board's decisions are focused on maintaining JCET Group's competitive edge in the global OSAT market, expanding its technological capabilities, and optimizing its operational efficiencies. The specific names and affiliations of board members can change, but the structure generally remains consistent.

| Board Member Category | Role | Typical Affiliations |

|---|---|---|

| Major Shareholder Representatives | Non-Executive Director | China Integrated Circuit Industry Investment Fund Co., Ltd. ('Big Fund') |

| Management | Executive Director | JCET Group Executives |

| Independent Members | Independent Director | Various backgrounds (financial, technical, etc.) |

The voting structure of JCET Group, a publicly listed company on the Shanghai Stock Exchange, generally follows a one-share-one-vote principle for its ordinary shares. However, the significant ownership concentration among major shareholders, particularly the 'Big Fund,' grants them considerable influence over strategic decisions, including board member elections and major corporate actions. As of early 2025, no publicly available information indicates the presence of dual-class shares or special voting rights that would grant disproportionate control to specific individuals or entities outside of their equity holdings. The company's governance structure, influenced by its major state-backed shareholder, tends to prioritize long-term strategic development aligned with national semiconductor industry goals.

JCET Group's board includes representatives from major shareholders, management, and independent members, reflecting its ownership structure. The 'Big Fund' significantly influences strategic decisions due to its substantial stake in JCET ownership. The company's governance prioritizes long-term strategic development in line with national semiconductor industry goals.

- The board is composed of a mix of executive and non-executive directors.

- The voting structure generally follows a one-share-one-vote principle.

- The 'Big Fund' plays a crucial role in strategic decisions.

- JCET shareholders influence the direction of the company.

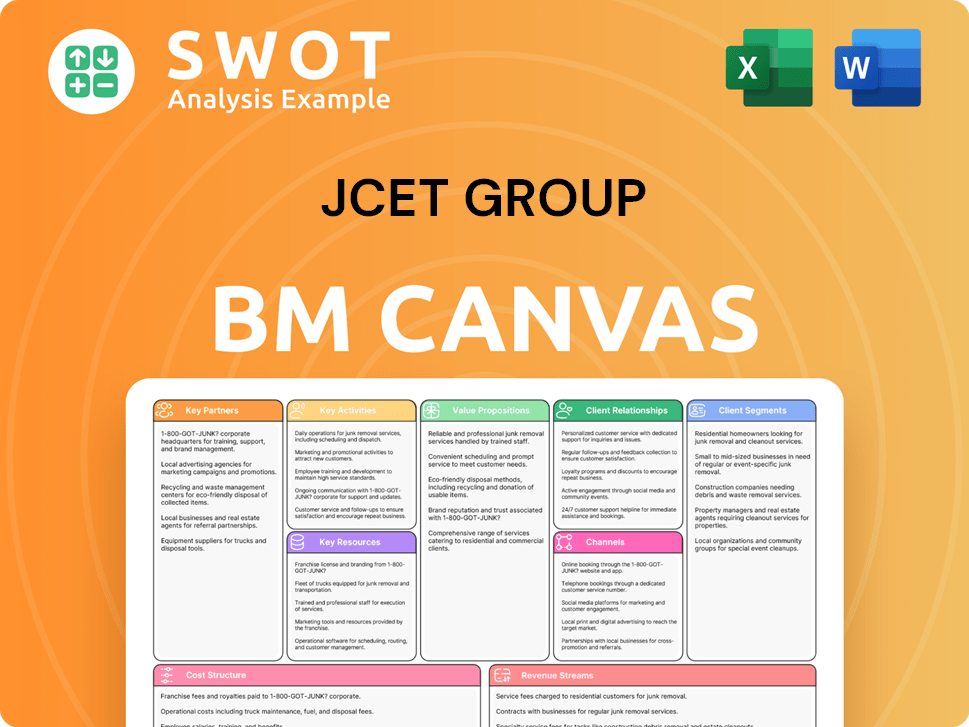

JCET Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped JCET Group’s Ownership Landscape?

Over the past few years, the ownership structure of JCET Group has remained relatively stable, with key stakeholders maintaining their positions. There have been no major announcements regarding significant share buybacks or secondary offerings that would fundamentally alter the JCET ownership landscape. The company has focused on expanding organically and advancing its technology in the semiconductor packaging and testing sector.

A key trend influencing JCET, and the broader semiconductor industry, is the increasing strategic importance of the sector. This has led to continued interest and investment from government-backed funds, particularly in China. This reinforces the role of the 'Big Fund' as a major long-term investor in JCET Group. While founder departures are in the past, leadership changes at the executive level and within the board of directors occur as part of normal corporate succession planning, without necessarily indicating a shift in fundamental ownership.

| Ownership Aspect | Details | Data (as of 2024/2025) |

|---|---|---|

| Major Shareholders | Significant institutional investors and state-backed funds. | Specific percentages and names are subject to change; check recent filings. |

| Institutional Ownership | Increased interest from institutional investors in technology companies. | Varies; check quarterly and annual reports for up-to-date figures. |

| Market Position | Focus on strengthening market position and technological capabilities. | JCET Group continues to be a significant player in the OSAT market. |

Industry-wide trends, such as increased institutional ownership in technology companies and consolidation within the OSAT market, also indirectly influence JCET Group structure. As of 2024, the global semiconductor industry continues to experience high demand, which benefits major players like JCET. For more insights, you can explore the Growth Strategy of JCET Group.

JCET Group investors include a mix of institutional investors and state-backed funds. The company's investor relations typically provide updates on major shareholder changes. The company's financial reports offer details about its JCET Group shareholders.

JCET Group's market capitalization fluctuates based on market conditions and company performance. Check recent financial news and stock information for the latest figures. The company's financial reports provide detailed information on its market capitalization.

Stay updated on the latest news about JCET Group through financial news outlets and company announcements. JCET Group typically announces important changes through its investor relations channels. Financial reports provide key insights.

The JCET Group ownership structure is primarily composed of institutional investors and state-backed funds. The company's annual reports provide a comprehensive overview of its ownership. The JCET Group parent company structure also influences its ownership dynamics.

JCET Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of JCET Group Company?

- What is Competitive Landscape of JCET Group Company?

- What is Growth Strategy and Future Prospects of JCET Group Company?

- How Does JCET Group Company Work?

- What is Sales and Marketing Strategy of JCET Group Company?

- What is Brief History of JCET Group Company?

- What is Customer Demographics and Target Market of JCET Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.