J.Jill Bundle

Can J.Jill Thrive in a Crowded Retail World?

J.Jill, Inc. (NYSE:JILL) has cultivated a unique space in the women's apparel market with its focus on comfortable, stylish clothing. From its catalog roots to a modern omnichannel presence, J.Jill has adapted to evolving consumer demands. This analysis provides a deep dive into the J.Jill SWOT Analysis, its financial performance, and its strategic positioning within the competitive landscape.

Understanding the J.Jill competitive landscape is critical for investors and strategists alike. This report provides a comprehensive J.Jill market analysis, exploring its key competitors and how J.Jill's business strategy stacks up. We will examine J.Jill's current market position, its competitive advantages, and the factors influencing its future outlook, including a detailed J.Jill industry analysis.

Where Does J.Jill’ Stand in the Current Market?

The company maintains a focused market position within the women's apparel industry. Its core operations revolve around designing, sourcing, and selling apparel and related accessories. This strategy primarily targets women aged 35 and older who seek stylish yet comfortable clothing suitable for various occasions. The company's value proposition centers on providing high-quality, versatile clothing that resonates with its target demographic's lifestyle and preferences.

The brand operates a balanced omnichannel business model. This model includes both retail stores and direct-to-consumer channels, such as e-commerce and catalogs. This approach allows the company to reach its target audience through multiple touchpoints, enhancing customer engagement and sales potential. Understanding the Owners & Shareholders of J.Jill is crucial to understanding the company's strategic direction and financial health.

For the fiscal year ended February 1, 2025, the company reported net sales of $610.9 million, a slight increase of 0.5% from the previous year. The company's financial performance reflects its ability to generate significant cash flow, with $47 million in free cash flow for fiscal year 2024. This financial strength supports debt reduction and the initiation of a quarterly dividend.

The company's primary focus is on women's apparel, specifically catering to women aged 35 and older. This targeted approach allows for a deep understanding of customer preferences and needs, enabling the company to curate relevant product offerings. This focused strategy helps the brand maintain its competitive edge within the market.

The company operates an omnichannel business model, integrating both retail stores and direct-to-consumer channels. This approach provides customers with multiple ways to engage with the brand, enhancing convenience and accessibility. The omnichannel strategy is crucial for adapting to evolving consumer shopping behaviors.

The company demonstrated financial stability, with net sales of $610.9 million in fiscal year 2024. A gross margin of 70.4% reflects a focus on full-price selling and disciplined inventory management. This financial health is further supported by a strong free cash flow, enabling strategic investments and shareholder returns.

As of February 1, 2025, the company operated a network of 252 stores across 42 states. This extensive retail presence supports brand visibility and customer accessibility. The store network plays a vital role in the overall customer experience and sales generation.

The company's market position is shaped by its target demographic, omnichannel strategy, and financial performance. The brand's ability to maintain a high gross margin and generate free cash flow indicates disciplined financial management and operational efficiency. These factors collectively contribute to the company's competitive advantages.

- Target Demographic: Women aged 35 and older.

- Omnichannel Sales: Approximately 52% retail, 48% direct-to-consumer in fiscal year 2024.

- Financial Health: Strong free cash flow and a high gross margin.

- Store Count: 252 stores as of February 1, 2025.

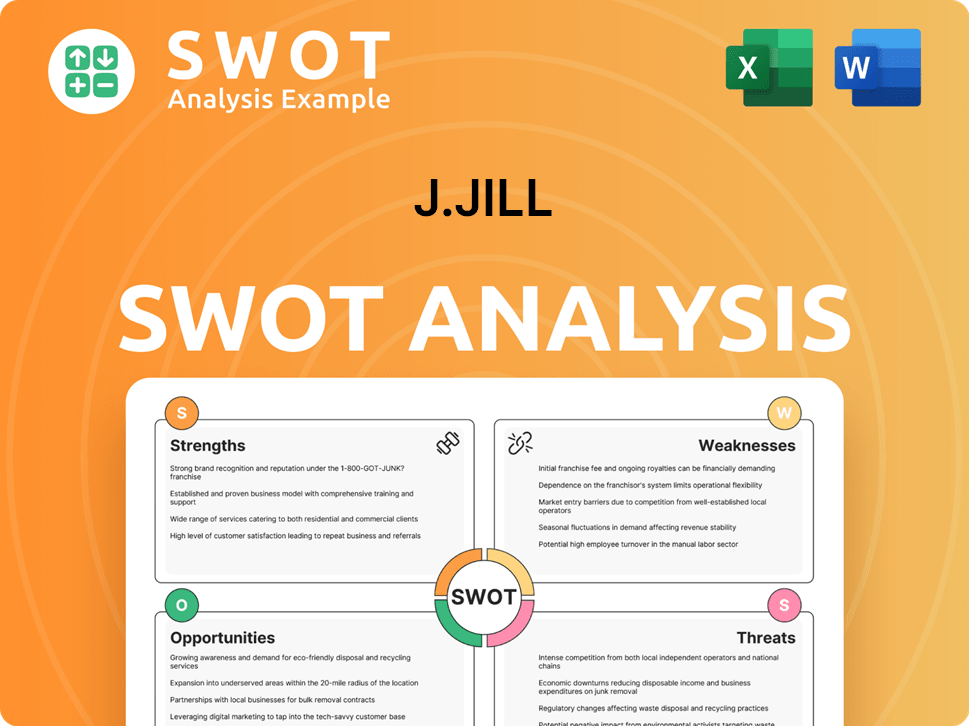

J.Jill SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging J.Jill?

The Marketing Strategy of J.Jill operates within a competitive women's apparel market. This landscape includes both direct and indirect competitors, all vying for market share. Understanding the dynamics of this environment is crucial for assessing J.Jill's position and potential for growth.

J.Jill's competitive landscape involves a mix of established brands and emerging players. The company faces challenges from various angles, including product offerings, pricing strategies, and distribution networks. The apparel industry is subject to constant change, influenced by consumer preferences and economic conditions, which impacts J.Jill's financial performance and strategic decisions.

The company's revenue of $610.9 million in fiscal year 2024 places it within a competitive field. This revenue figure is a key metric when comparing J.Jill's performance against its rivals and evaluating its market share.

Direct competitors, such as Talbots and Chico's FAS Inc., focus on similar demographics and style preferences. They often compete on product offerings, quality, and brand positioning.

Indirect competitors include a broader range of apparel brands. These can range from fast-fashion retailers to established brands that target different segments of the women's apparel market.

Key competitors include brands like Talbots and Chico's FAS Inc., which target a similar age demographic. Other competitors in the broader apparel industry include Canada Goose (GOOS), FIGS (FIGS), and Lanvin Group (LANV).

Competitors employ various strategies, including product innovation, pricing adjustments, and extensive distribution networks. These strategies aim to capture market share and maintain customer loyalty.

The market is influenced by mergers, alliances, and the emergence of new players. These factors continually reshape the competitive landscape, requiring J.Jill to adapt its business strategy.

J.Jill's financial performance, including its revenue of $610.9 million in fiscal year 2024, is a critical factor in assessing its competitive position. Comparing this to competitors' revenues provides insights into market share and overall success.

J.Jill's strengths and weaknesses, brand positioning strategy, and product offerings compared to competitors are critical factors in its market analysis. Understanding these elements helps determine J.Jill's competitive advantages.

- Target Audience: J.Jill focuses on a specific demographic, which helps tailor its product offerings and marketing efforts.

- Brand Positioning: The company's brand positioning strategy emphasizes comfort and timeless styles, differentiating it from fast-fashion brands.

- Product Offerings: J.Jill's product range, including clothing and accessories, caters to its target audience's preferences.

- Customer Satisfaction: Customer satisfaction ratings are essential for retaining customers and building brand loyalty.

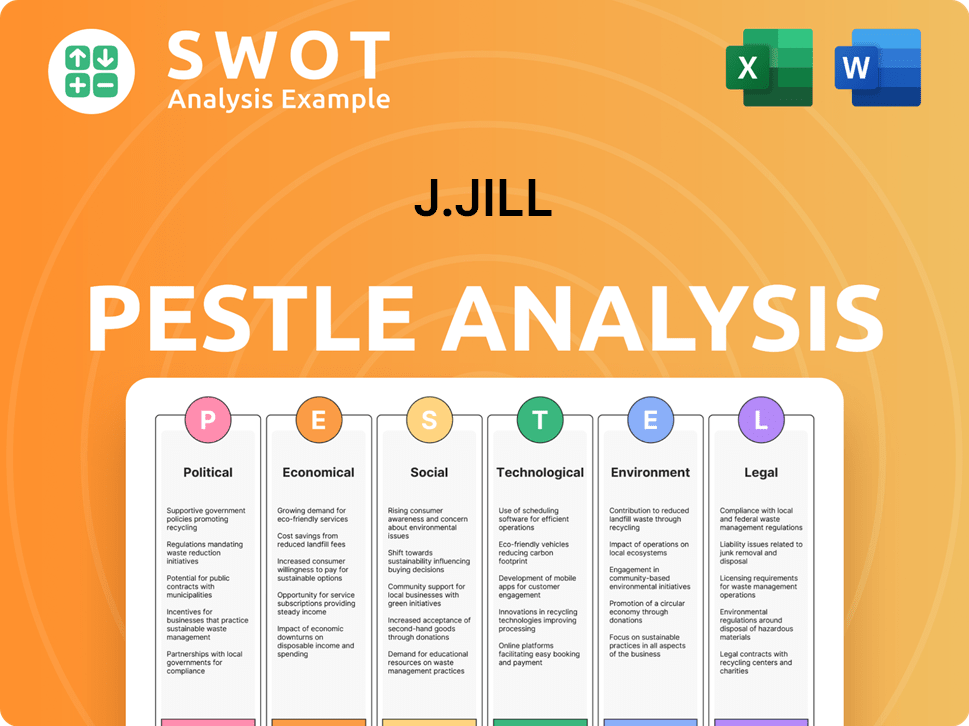

J.Jill PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives J.Jill a Competitive Edge Over Its Rivals?

The competitive landscape for J.Jill is shaped by its distinct brand identity and strategic operational model. The company's focus on a 'relaxed, easy, and inspired style' caters to women aged 35 and older, allowing it to establish a unique market position. This approach is crucial in understanding the J.Jill competitive landscape and its ability to differentiate itself within the fashion industry.

A key element of J.Jill's competitive advantage is its strong customer loyalty. The company benefits from a loyal customer base, with an average tenure exceeding 10 years. This loyalty, combined with an omnichannel business strategy, supports robust financial performance. Understanding J.Jill's market analysis shows how these factors contribute to its overall success.

Operationally, J.Jill emphasizes disciplined inventory management and a focus on full-price selling. These strategies have led to impressive gross margins, reaching 70.4% in fiscal year 2024. The omnichannel model, with a near 50:50 split between online and retail sales, further strengthens its market position by offering customers multiple shopping options. Recent investments in a new Order Management System (OMS) are expected to boost omnichannel capabilities and improve margins, demonstrating J.Jill's commitment to operational efficiency.

J.Jill's brand is built around a relaxed, comfortable, and inspired style, which appeals to a specific demographic. This clear brand positioning helps to differentiate it from competitors and build a loyal customer base. The brand's focus on quality fabrics and timeless designs also contributes to its brand equity and customer retention.

With an average customer tenure of over 10 years, J.Jill demonstrates strong customer loyalty. The company fosters this loyalty through a customer-centric approach and a high-touch shopping experience. This includes both its retail stores and its robust e-commerce platform, ensuring a consistent and positive brand experience.

J.Jill's operational model focuses on disciplined inventory management and full-price selling, leading to strong financial results. The company's gross margins reached 70.4% in fiscal year 2024, reflecting effective cost control and pricing strategies. Investments in technology, like the new OMS, aim to further enhance operational efficiency and drive margin benefits.

J.Jill's omnichannel approach, with a nearly 50:50 split between online and retail sales, provides customers with flexible shopping options. This strategy enhances customer convenience and supports sales across multiple channels. The omnichannel model allows J.Jill to meet customers where they are, improving overall customer satisfaction.

J.Jill's competitive advantages are rooted in its brand identity, customer loyalty, and operational efficiency. These factors collectively contribute to its strong market position and financial performance. Understanding these advantages is critical for evaluating J.Jill's strengths and weaknesses in the competitive landscape.

- Brand Identity: A distinct brand that resonates with its target demographic.

- Customer Loyalty: A highly loyal customer base with long average tenure.

- Operational Efficiency: Disciplined inventory management and strong gross margins.

- Omnichannel Strategy: A balanced approach to online and retail sales.

For a deeper dive into the company's strategic initiatives, consider exploring the Growth Strategy of J.Jill. This provides additional insights into how J.Jill is positioning itself for future growth and navigating the competitive pressures within the fashion retail sector. Analyzing these factors is essential for understanding J.Jill's business strategy and its ability to maintain its competitive edge.

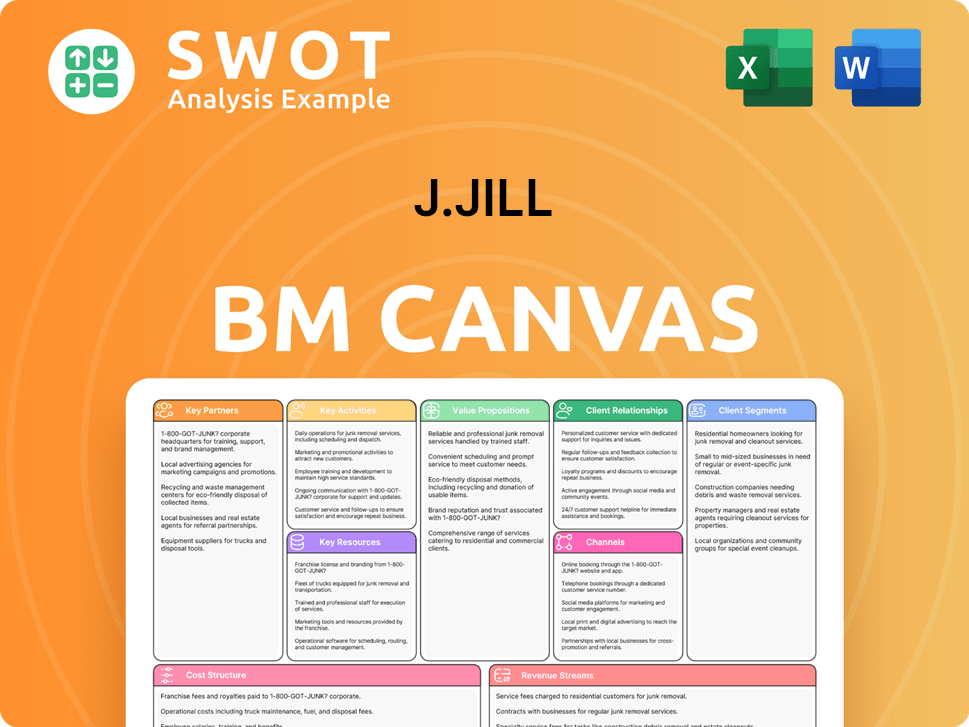

J.Jill Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping J.Jill’s Competitive Landscape?

The women's apparel market is experiencing significant changes, driven by technological advancements and shifting consumer preferences. The global market was valued at USD 1,035.2 billion in 2024 and is projected to reach USD 1,372.7 billion by 2033, growing at a CAGR of 3.2% from 2025 to 2033. This growth is influenced by factors such as e-commerce expansion and the demand for sustainable practices. Understanding the Target Market of J.Jill is crucial for navigating this evolving landscape.

For the company, the competitive landscape includes economic fluctuations and intense competition, presenting both challenges and opportunities. The company's strategic initiatives, such as expanding its e-commerce presence and focusing on sustainability, aim to capitalize on market trends. With plans to open new stores and enhance operational efficiency, the company is positioning itself for long-term success.

Key trends include the increasing adoption of e-commerce, with the U.S. retail e-commerce market seeing a 2.7% increase in sales for Q4 2024. There's also a growing demand for inclusive sizing, diverse fashion representation, and sustainable practices. The trend towards 'premiumization,' where consumers are willing to pay more for high-quality and unique items, also presents a notable growth factor.

Economic fluctuations affecting consumer spending and intense competition remain significant threats. The company needs to navigate price sensitivity and adapt to changing consumer demands. Maintaining a strong brand presence and differentiating its offerings in a crowded market are crucial for future success.

The company can capitalize on e-commerce growth and enhance its online presence. Its commitment to sustainability initiatives, as highlighted in its 2024 Impact Report, aligns with growing eco-consciousness among consumers, offering a potential differentiator. Strategic investments and disciplined approach aim to ensure long-term success.

The company plans to open 5 to 10 new stores in fiscal 2025 and aims for 20 to 25 net new stores by the end of 2026, indicating a strategy of physical expansion alongside digital growth. The ongoing implementation of a new Order Management System (OMS) is expected to enhance operational efficiency and enable ship-from-store capabilities by the second half of 2025, further optimizing its omnichannel strategy.

Looking ahead to fiscal year 2025, the company anticipates net sales to increase by 1% to 3% and comparable sales to be flat to up 2%. Despite a cautious outlook for Q1 FY25 due to a slow start and continued price sensitivity, J.Jill's strategic investments and disciplined approach aim to ensure long-term success.

- Focus on e-commerce growth and online presence.

- Commitment to sustainability initiatives.

- Physical store expansion and operational efficiency improvements.

- Navigating economic challenges and intense competition.

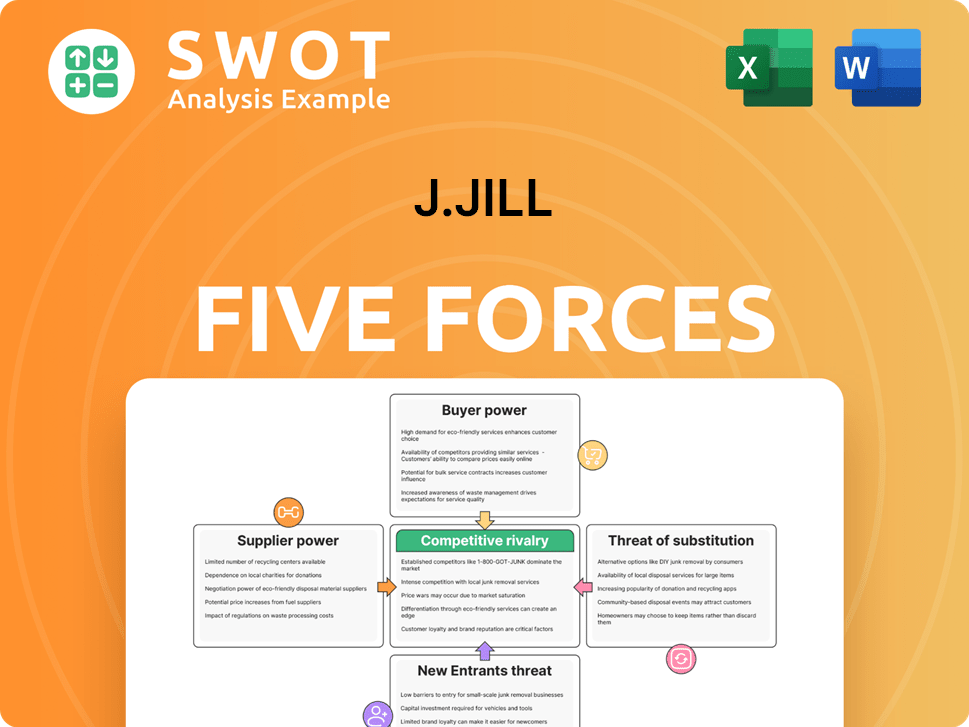

J.Jill Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of J.Jill Company?

- What is Growth Strategy and Future Prospects of J.Jill Company?

- How Does J.Jill Company Work?

- What is Sales and Marketing Strategy of J.Jill Company?

- What is Brief History of J.Jill Company?

- Who Owns J.Jill Company?

- What is Customer Demographics and Target Market of J.Jill Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.