J.Jill Bundle

Can J.Jill's Growth Strategy Secure Its Future?

Explore the evolving landscape of J.Jill, Inc. (NYSE:JILL), a prominent player in the women's apparel market. From its catalog roots to a modern omnichannel presence, J.Jill's journey reflects its adaptability. This analysis delves into the J.Jill SWOT Analysis, examining the company's strategic direction and future prospects within the dynamic retail industry.

J.Jill's financial performance in fiscal year 2024, with a gross margin of 70.4% and adjusted EBITDA of $107.1 million, sets the stage for a deeper dive into its growth strategy. We'll dissect J.Jill's expansion plans, including new store openings and online sales growth, while considering the impact of retail industry trends and the company's brand positioning strategy. Understanding J.Jill's ability to navigate the women's apparel market and adapt to e-commerce is crucial for assessing its long-term potential and J.Jill's future prospects.

How Is J.Jill Expanding Its Reach?

The expansion initiatives of the company are central to its growth strategy. The company is focusing on both physical store expansion and enhancing its direct-to-consumer (DTC) capabilities. This dual approach aims to capture new customers and increase brand awareness, particularly targeting women aged 45 and older.

The company's strategy involves a blend of brick-and-mortar expansion and digital channel enhancements. This approach is designed to cater to the evolving preferences of its target demographic. The company's focus on omnichannel capabilities reflects the broader retail industry trends.

The company's financial performance is closely tied to its ability to execute these expansion plans successfully. The company's strategic decisions are aimed at navigating the competitive landscape and achieving sustainable growth.

The company plans to open between 5 to 10 net new stores in fiscal year 2025. This is part of a longer-term goal to have 20 to 25 net new stores by the end of 2026, and up to 50 net new stores by the end of 2029. These new stores are strategically located to attract new customers and boost brand visibility.

New store openings are expected to deliver healthy financial results. The company anticipates payback periods of just under three years and cash-on-cash returns exceeding 30%. This financial outlook underscores the company's confidence in its expansion strategy and its ability to choose profitable locations.

The company is actively investing in its direct-to-consumer channel. In fiscal year 2024, this channel accounted for 47.5% of net sales, showing a 1.9% increase compared to the previous year. This focus on digital sales and customer engagement is a key component of the company's omnichannel strategy.

The company is dedicated to attracting new customers and increasing the value of its current customer base across all channels. It specifically targets women aged 45 and older, a demographic the company believes is underserved in the women's apparel market. This demographic focus helps shape the company's marketing and advertising strategies.

In fiscal year 2024, the company returned to net store growth, adding three new stores. This brought the total store count to 252 by February 1, 2025. This turnaround reflects the company's renewed focus on expansion after a period of optimizing its store fleet.

- The company is carefully considering the impact of economic conditions, including the effects of inflation and consumer spending trends.

- The company's expansion plans and financial performance are key factors for investors.

- The company's ability to adapt to e-commerce trends is crucial for its future prospects.

- The company's brand positioning strategy is focused on providing quality apparel.

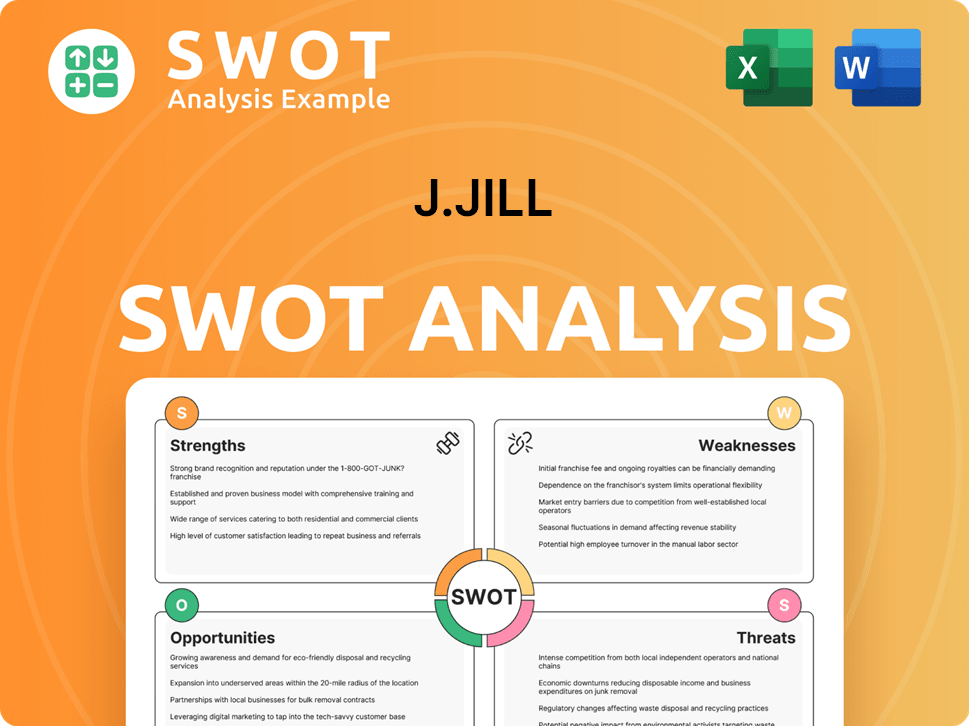

J.Jill SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does J.Jill Invest in Innovation?

The company is actively leveraging technology and innovation to boost operational efficiency and improve customer experience. This approach is a key component of its overall J.Jill growth strategy, aiming to sustain and enhance its market position within the retail industry trends.

A significant initiative involves the implementation of a new Order Management System (OMS). This system is designed to streamline operations and enable ship-from-store capabilities, which is expected to be fully operational by the second half of 2025. The company's investment in this technology reflects a commitment to adapting to the evolving women's apparel market and improving its service offerings.

Digital transformation also includes refining marketing strategies and product innovations. The company is using geotargeted marketing and continuous testing across various channels to drive traffic, acquire new customers, and increase brand awareness. These efforts are crucial for maintaining a competitive edge in the current market environment.

The new Order Management System (OMS) is a major undertaking. It is expected to enhance operational efficiency, and enable ship-from-store capabilities.

Operating expenses related to the OMS project were approximately $2.0 million in fiscal year 2024.

The company is focused on refining marketing strategies. It also introduces product innovations to boost brand awareness.

The company is committed to environmental, social, and governance (ESG) goals. It is tracking Scope 1 and Scope 2 greenhouse gas (GHG) emissions during 2024.

The company aims to set a GHG reduction goal by 2025. This shows a commitment to sustainability.

The company's technological advancements and strategic initiatives are designed to support long-term growth and enhance its market position. These efforts are crucial for adapting to the dynamic retail environment and meeting the evolving needs of its customer base, influencing the J.Jill future prospects.

- Order Management System (OMS): The OMS is expected to be fully implemented by the second half of 2025, with approximately $2.0 million in operating expenses in 2024 and an estimated $2 million in 2025, primarily in the first quarter.

- Digital Marketing and Innovation: The company is employing geotargeted marketing and continuous testing of marketing channels to drive traffic and brand awareness.

- ESG Goals: The company is tracking Scope 1 and Scope 2 greenhouse gas emissions in 2024, with a goal to set a GHG reduction target by 2025, reflecting a commitment to sustainable fashion initiatives.

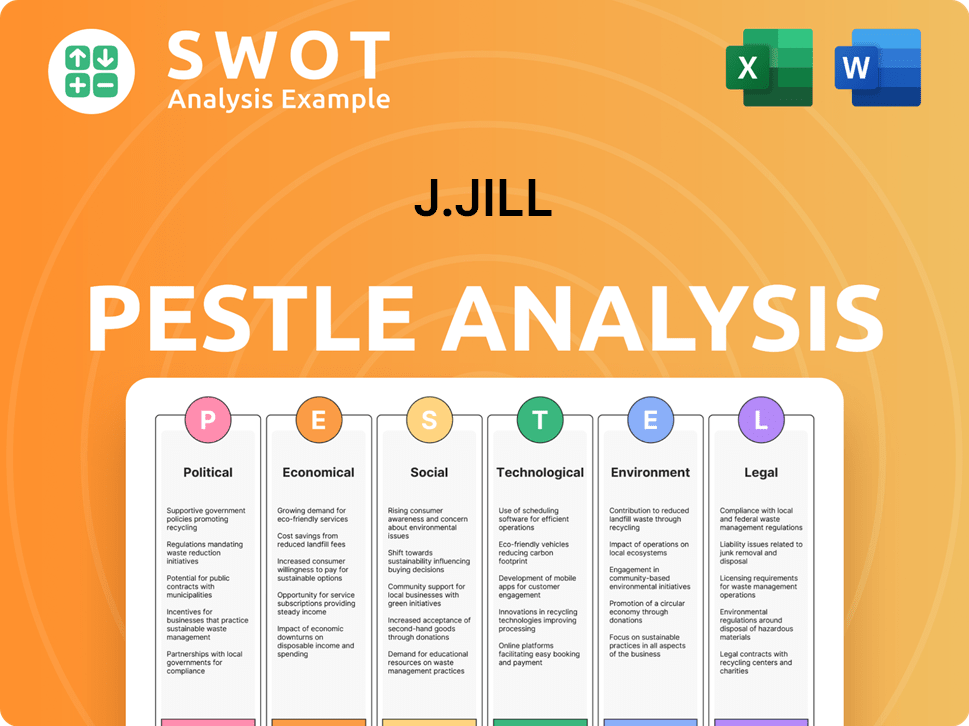

J.Jill PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is J.Jill’s Growth Forecast?

The financial outlook for J.Jill in fiscal year 2025 reflects a strategic approach to navigate the evolving retail landscape. The company anticipates a modest increase in net sales, with a focus on maintaining profitability and managing operational costs effectively. This outlook is influenced by current retail industry trends and the broader economic conditions, which the company is carefully monitoring.

For fiscal year 2025, J.Jill projects net sales growth between 1% and 3%. This forecast indicates a cautious but optimistic view, considering the current women's apparel market dynamics. The company's focus remains on enhancing its brand presence and customer engagement to drive sustainable growth. The projected adjusted EBITDA is between $101.0 million and $106.0 million, which highlights the company's commitment to operational efficiency.

Capital expenditures are estimated at approximately $25.0 million for fiscal 2025, reflecting ongoing investments in infrastructure and strategic initiatives. The company expects to generate free cash flow of around $40.0 million. This financial outlook supports the company's J.Jill growth strategy and its ability to adapt to market changes. For a deeper understanding, consider reading Brief History of J.Jill.

In fiscal year 2024, which ended February 1, 2025, J.Jill reported net sales of $610.9 million, a 0.5% increase year-over-year. The company's performance reflects its resilience and strategic initiatives. The gross margin for the full year was 70.4%, demonstrating effective management of costs and pricing strategies.

Operating income for fiscal year 2024 was $75.7 million, with a net income of $39.5 million. The net income per diluted share was $2.61. The adjusted net income per diluted share was $3.47. These figures highlight the company's ability to generate profits despite market challenges.

J.Jill increased its quarterly dividend by 14.3% to $0.08 per share, payable on April 16, 2025. This reflects an annualized dividend rate of $0.32 per common share. This increase demonstrates the company's commitment to returning value to shareholders.

Despite a slow start to Q1 2025, with net sales expected to decline 1% to 4% and comparable sales to decline 2% to 5%, management remains confident. The company is focused on its long-term success. The company is implementing strategies to mitigate the impact of the economic downturn.

The financial performance of J.Jill in fiscal 2024 and the outlook for 2025 provide insights into the company's strategic direction and financial health. These figures are crucial for understanding the J.Jill financial performance and its ability to navigate the competitive landscape.

- Net Sales Growth (Fiscal 2025): 1% to 3%

- Adjusted EBITDA (Fiscal 2025): $101.0 million to $106.0 million

- Free Cash Flow (Fiscal 2025): Approximately $40.0 million

- Net Sales (Fiscal 2024): $610.9 million

- Gross Margin (Fiscal 2024): 70.4%

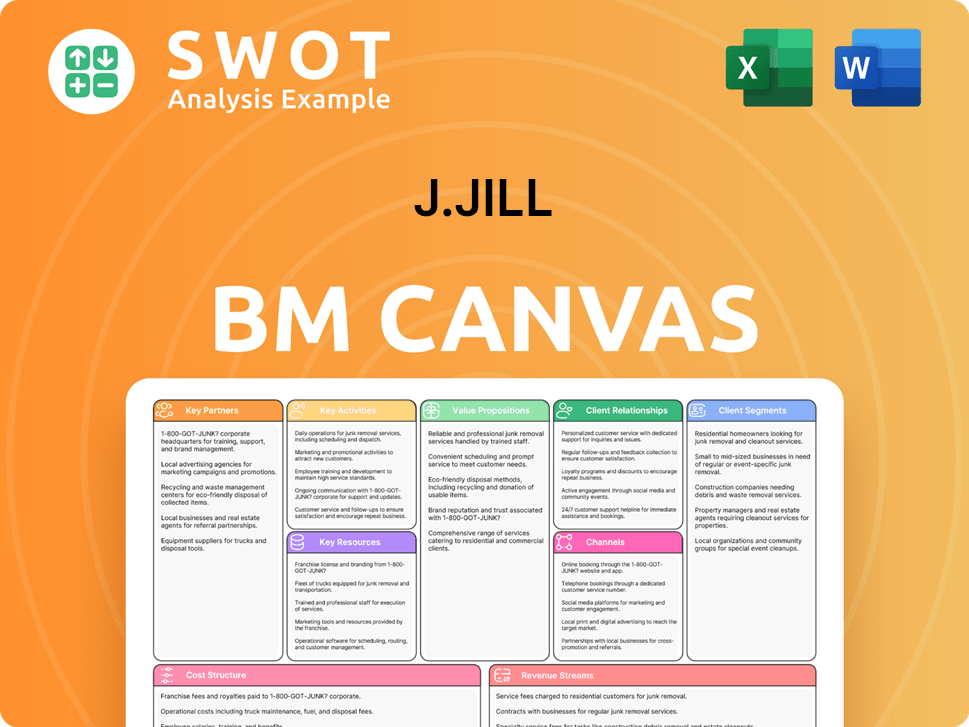

J.Jill Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow J.Jill’s Growth?

The path for the J.Jill growth strategy and its future prospects is not without potential pitfalls. The company faces several risks that could affect its ability to achieve its goals. Understanding these obstacles is crucial for a comprehensive J.Jill company analysis.

A key challenge is the unpredictable nature of consumer behavior. Economic conditions and global events can significantly influence how customers spend. This is a critical factor impacting the women's apparel market and J.Jill's financial performance.

Operational risks also present challenges. The implementation of new systems, like the Order Management System (OMS), can cause short-term disruptions. These disruptions can impact the efficiency of operations. In addition, external factors such as adverse weather conditions and supply chain issues can also affect the company's performance.

The uncertain consumer sentiment and price sensitivity are significant risks. These factors are influenced by broader macroeconomic and geopolitical conditions. This cautious consumer behavior has already led to a slower start in the first quarter of fiscal year 2025.

The new Order Management System (OMS) is a strategic investment, but its initial rollout could cause near-term disruptions. While the OMS is intended for long-term efficiency, its implementation could affect day-to-day operations. These disruptions could affect the company's ability to meet customer demand.

The retail sector faces ongoing challenges, including adverse weather conditions and broader promotional pressures. Weather events, such as those experienced in February 2025, can impact store traffic and sales. Promotional pressures can also squeeze margins.

Supply chain vulnerabilities and increased shipping costs pose potential obstacles. J.Jill has already increased its flat-rate shipping fee due to significant cost increases from shipping partners. These rising costs can impact profitability and the customer experience.

Maintaining a strong brand image and optimizing omnichannel operations are ongoing risks. Adapting to changes in consumer preferences is also crucial. The brand's ability to evolve with customer expectations is essential for long-term success.

The company anticipates sales declines of 1% to 4% in the first quarter of fiscal year 2025 due to cautious consumer behavior. This highlights the importance of effective risk management strategies. Further details on the company's financial performance can be found in the Revenue Streams & Business Model of J.Jill.

Management addresses these risks through disciplined expense management. Strategic investments in systems and store expansions are also important. The company focuses on leveraging its loyal customer base. These strategies are designed to improve J.Jill's financial performance.

The retail industry trends and the women's apparel market are constantly evolving. J.Jill must adapt to changing consumer preferences. This includes optimizing omnichannel operations and maintaining a strong brand image. The company's ability to respond to these changes is crucial.

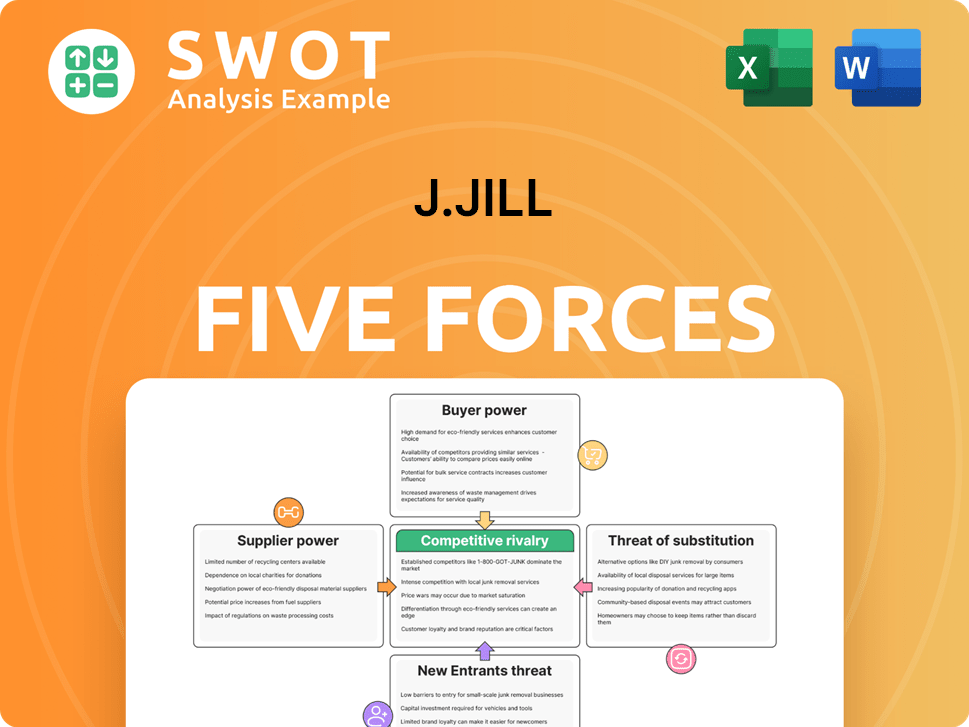

J.Jill Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of J.Jill Company?

- What is Competitive Landscape of J.Jill Company?

- How Does J.Jill Company Work?

- What is Sales and Marketing Strategy of J.Jill Company?

- What is Brief History of J.Jill Company?

- Who Owns J.Jill Company?

- What is Customer Demographics and Target Market of J.Jill Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.