J.Jill Bundle

Decoding J.Jill: How Does This Retailer Thrive?

J.Jill, Inc. (NYSE:JILL) is a key player in the women's apparel market, offering comfortable and stylish clothing. With a multi-channel approach that includes J.Jill SWOT Analysis, retail stores, catalogs, and a strong online presence, J.Jill caters to a specific customer base. As of early 2025, the company maintained a significant store footprint, demonstrating its commitment to physical and digital retail.

Navigating a competitive landscape, understanding the J.Jill business model is vital for investors and consumers alike. The company's financial results, including its revenue streams and strategic moves, offer valuable insights into its resilience and future growth potential. This exploration will uncover how J.Jill, a publicly traded company, has adapted to the evolving retail environment, focusing on its J.Jill stores, J.Jill online platform, and the quality of its J.Jill clothing.

What Are the Key Operations Driving J.Jill’s Success?

The core of the J.Jill business revolves around creating and delivering value through versatile apparel, footwear, and accessories. The company focuses on providing an easy, thoughtful, and inspired style to meet the various needs of its customers. J.Jill caters primarily to affluent women aged 45 and over, a demographic known for its strong brand loyalty.

J.Jill's operational strategy is built on a multi-channel distribution model. This includes physical retail stores, an e-commerce platform, and catalog sales. The company had 252 stores across the U.S. as of fiscal year 2024. The e-commerce platform offers home delivery and in-store pickup options, contributing significantly to sales. Direct-to-consumer net sales represented 47.5% of total net sales in fiscal year 2024, showing a 1.9% increase compared to the previous year.

The company is implementing a new Order Management System (OMS) to improve operational efficiency. This system will enable ship-from-store capabilities, with completion expected in the second half of fiscal year 2025. J.Jill emphasizes disciplined inventory management, which has supported strong gross margins. The company's approach includes its core J.Jill brand and sub-brands like Pure Jill, Wearever, and Fit, offering a balanced assortment of fashion staples and new trend-right pieces.

J.Jill operates through a multi-channel distribution strategy, including retail stores, e-commerce, and catalogs. The company focuses on providing a balanced assortment of predictable fashion staples and trend-right pieces. This approach allows J.Jill to cater to its target audience effectively.

J.Jill delivers value by offering comfortable and fashionable apparel, focusing on fit and quality. The company differentiates itself through a loyal customer base and a high-touch customer experience. Understanding the Target Market of J.Jill is crucial to its success.

J.Jill is enhancing its operational efficiency through a new Order Management System (OMS). The company's strong brand identity and customer-centric approach are key differentiators. The focus on disciplined inventory management contributes to strong gross margins.

- Multi-channel distribution strategy with retail, e-commerce, and catalog sales.

- Implementation of a new Order Management System (OMS) for enhanced efficiency.

- Emphasis on disciplined inventory management to support strong gross margins.

- Focus on a loyal customer base and high-touch customer experience.

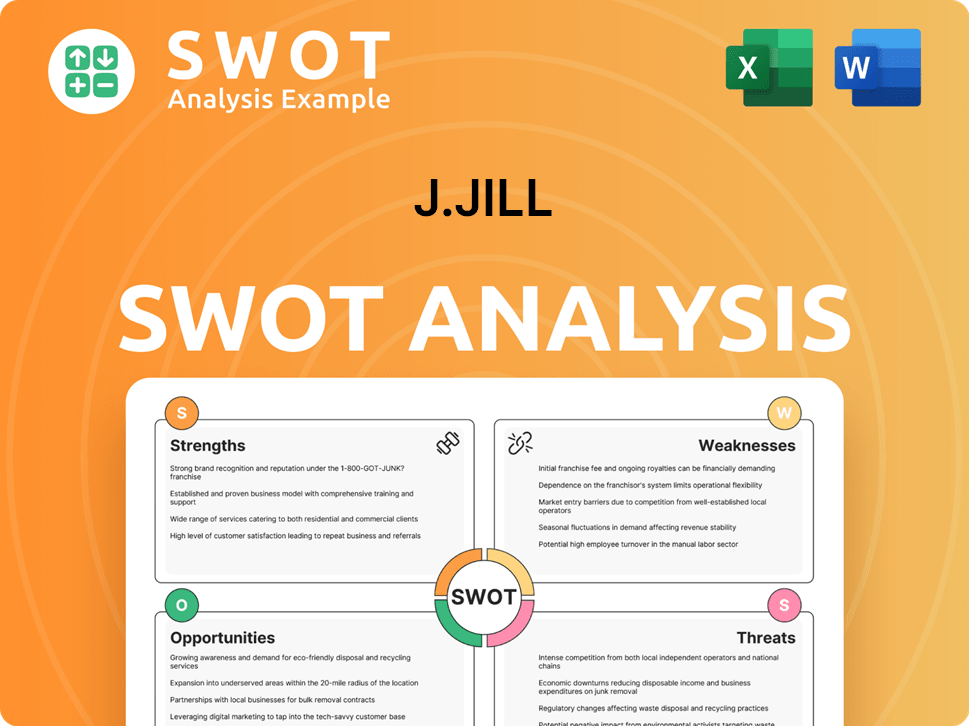

J.Jill SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does J.Jill Make Money?

The J.Jill company generates revenue primarily through the sale of women's apparel, accessories, and footwear. This is achieved through a multi-channel approach, including retail stores, catalogs, and an e-commerce website. The company's focus on driving full-price sales and effective markdown management is key to its profitability.

In fiscal year 2024, which ended February 1, 2025, J.Jill reported net sales of $610.9 million. Direct-to-consumer net sales, encompassing both e-commerce and catalog sales, accounted for 47.5% of total net sales in fiscal year 2024, demonstrating the importance of its online presence. Comparable sales, including both store and direct-to-consumer, increased by 1.5% for the full fiscal year 2024.

The J.Jill business model emphasizes a seamless customer experience across all sales channels, leveraging its omnichannel capabilities. This strategy is designed to enhance customer engagement and drive sales across its various platforms. The company's focus on maintaining strong gross margins is evident in its financial performance.

The primary monetization strategy for J.Jill revolves around driving full-price sales and managing markdowns effectively. This approach contributes to strong gross margins and overall profitability. The company's direct-to-consumer channel, including online and catalog sales, plays a significant role in revenue generation.

- Retail Stores: Sales from physical stores contribute to overall revenue, with comparable sales showing growth.

- Direct-to-Consumer: E-commerce and catalog sales are a significant revenue stream, accounting for a substantial portion of total net sales.

- Gross Margin Management: The company focuses on maintaining strong gross margins through full-price sales and effective markdown strategies. In fiscal year 2024, the gross margin was 70.4%.

- Omnichannel Experience: Leveraging omnichannel capabilities to provide a seamless customer experience across all sales channels.

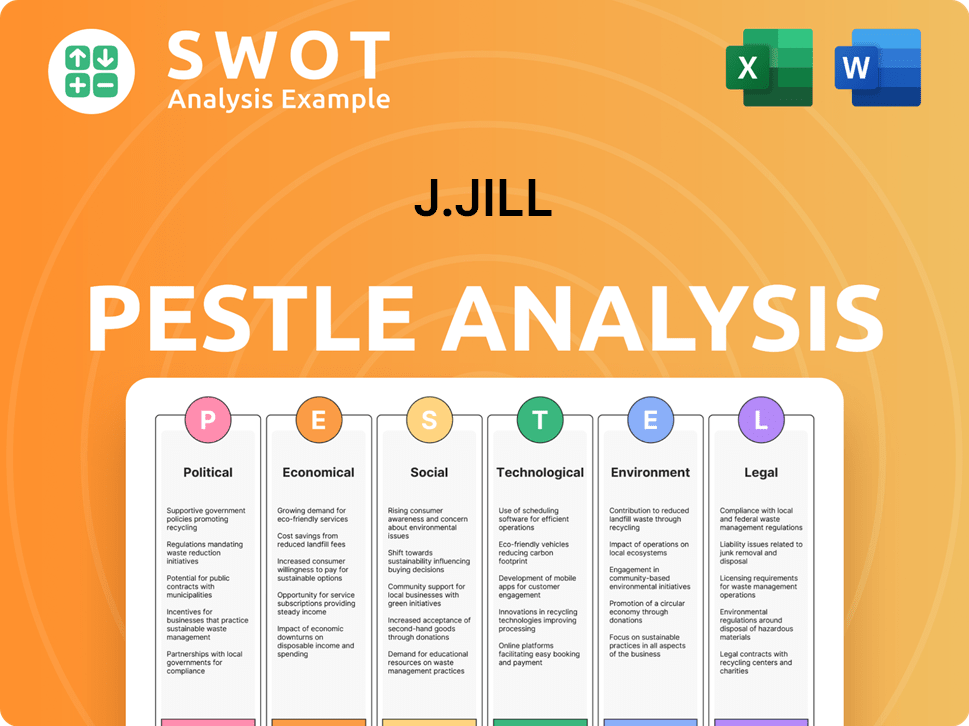

J.Jill PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped J.Jill’s Business Model?

The J.Jill company has navigated significant strategic shifts and achieved notable milestones, shaping its operational and financial trajectory. A key moment in its history was the Initial Public Offering (IPO) in 2017. More recently, the J.Jill business model has centered on a disciplined operational approach, focusing on strong cash generation and strategic investments to foster growth. This focus has been instrumental in the company's ability to adapt and evolve within the competitive landscape of the apparel industry.

In fiscal year 2024, J.Jill expanded its retail footprint by opening nine new stores. This expansion brought the total store count to 252 by February 1, 2025. The company plans to open between 5 and 10 net new stores in fiscal year 2025, demonstrating a continued commitment to retail presence. Simultaneously, J.Jill is investing in its Order Management System (OMS) rollout, designed to enhance operational efficiency and enable ship-from-store capabilities, expected to launch in the second half of fiscal year 2025.

Operationally, J.Jill has prioritized disciplined inventory management, which has resulted in improved gross margins. The gross margin reached 70.4% in fiscal year 2024, reflecting effective cost control and pricing strategies. Despite facing challenges such as a dynamic macroeconomic environment, the impact of adverse weather in early Q1 fiscal year 2025, and continued customer price sensitivity, J.Jill has maintained its financial discipline. The company has also strengthened its balance sheet, including reducing its term loan by approximately $88 million in 2024, and initiated a quarterly dividend program.

The IPO in 2017 was a critical event for J.Jill. The company has focused on disciplined operations and cash generation. Expansion plans include opening new stores and investing in technology.

Emphasis on disciplined inventory management. Focus on a multi-channel distribution model. Strengthening the balance sheet by reducing debt and initiating a dividend program.

J.Jill has a strong brand identity and a loyal customer base. Its size-inclusive product assortment is a key differentiator. The multi-channel distribution model enhances its reach.

Continued investment in technology. Focus on enhancing the customer experience. Leadership transition with Mary Ellen Coyne as CEO effective May 1, 2025.

J.Jill's competitive advantages include its strong brand identity, described as a 'well-kept secret', and its focus on a relevant, size-inclusive product assortment. The company's multi-channel distribution model, encompassing retail stores, e-commerce, and catalogs, allows for a diversified reach.

- The company is investing in technology to improve customer experience.

- New leadership, with Mary Ellen Coyne as CEO effective May 1, 2025.

- Focus on disciplined inventory management.

- Expansion of retail stores.

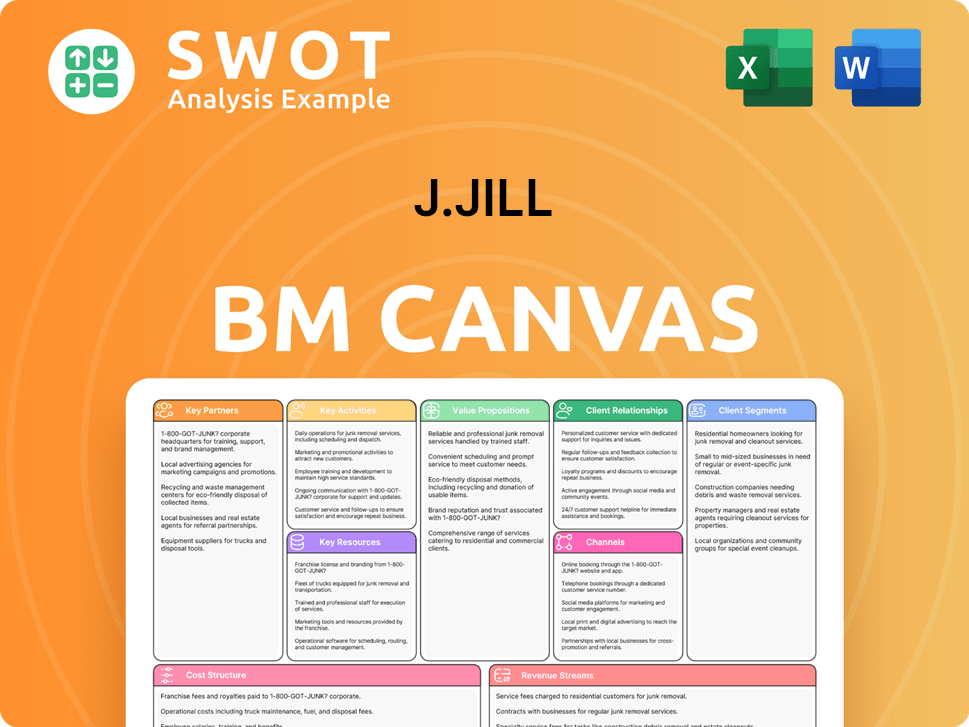

J.Jill Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is J.Jill Positioning Itself for Continued Success?

The J.Jill company occupies a specific niche in the women's apparel market, targeting affluent women aged 45 and over with a focus on relaxed, comfortable, and stylish clothing. The J.Jill business model includes both physical J.Jill stores and a strong online presence, providing an omnichannel shopping experience. As of the end of fiscal year 2024, the company operated 252 stores.

Several factors pose risks to J.Jill, including fluctuations in consumer spending, customer price sensitivity, and competition from other retailers. Supply chain issues and rising costs also present challenges. The company reported a slow start to Q1 fiscal year 2025 due to adverse weather and the initial phase of its Order Management System (OMS) implementation. The company is focused on sustaining and expanding its ability to make money through several strategic initiatives.

J.Jill differentiates itself through its focus on fit, quality, and customer loyalty. The company's omnichannel approach, combining J.Jill online sales with physical J.Jill stores, helps it reach a broad customer base. The company's target demographic is affluent women aged 45 and over, which influences its J.Jill clothing designs and marketing strategies.

Key risks include consumer spending fluctuations, price sensitivity, and competition. Supply chain disruptions and rising costs also present challenges. The company's recent performance has been impacted by adverse weather and the implementation of its OMS. For more insights, you can check out the Marketing Strategy of J.Jill.

J.Jill plans to increase net sales by 1% to 3% and comparable sales to be flat to up 2% in fiscal year 2025. Adjusted EBITDA is projected to be between $101.0 million and $106.0 million. The company aims to open 5 to 10 net new stores in fiscal year 2025.

Investments are focused on completing the OMS rollout and enabling ship-from-store capabilities. Total capital expenditures are expected to be approximately $25.0 million in fiscal year 2025. J.Jill aims to generate about $40.0 million in free cash flow for fiscal year 2025.

J.Jill anticipates growth in net sales and comparable sales for fiscal year 2025. The company is also focused on improving profitability and cash flow generation. These initiatives are designed to strengthen J.Jill's market position and drive long-term value.

- Net sales increase of 1% to 3% in fiscal year 2025.

- Comparable sales expected to be flat to up 2%.

- Adjusted EBITDA projected between $101.0 million and $106.0 million.

- Free cash flow target of approximately $40.0 million for fiscal year 2025.

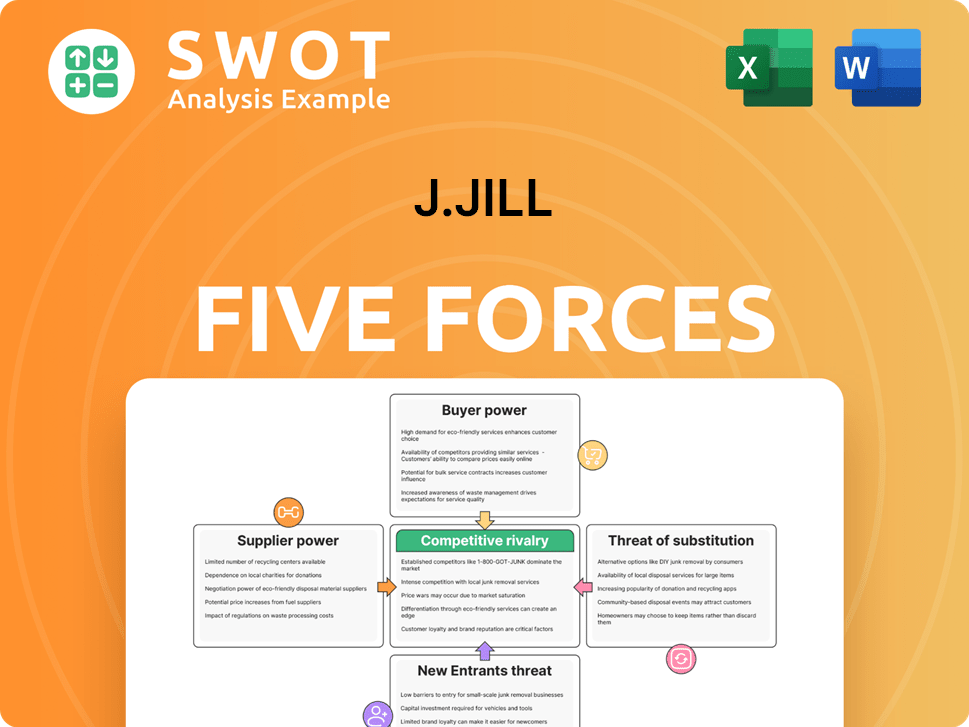

J.Jill Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of J.Jill Company?

- What is Competitive Landscape of J.Jill Company?

- What is Growth Strategy and Future Prospects of J.Jill Company?

- What is Sales and Marketing Strategy of J.Jill Company?

- What is Brief History of J.Jill Company?

- Who Owns J.Jill Company?

- What is Customer Demographics and Target Market of J.Jill Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.