Kendrion Bundle

How Does Kendrion Navigate the Complex Industrial Arena?

In the dynamic world of industrial technology, understanding the Kendrion SWOT Analysis is crucial. Kendrion N.V., a century-old innovator, has carved a significant niche in electromagnetic and mechatronic systems. This analysis delves into the company's competitive positioning, exploring its evolution and strategic moves.

This exploration of the Kendrion competitive landscape provides a comprehensive Kendrion company overview, examining its market share and the strategies employed to maintain its position. We'll conduct a thorough Kendrion market analysis, identifying key Kendrion competitors and assessing their impact. Furthermore, this deep dive offers insights into the Kendrion industry analysis, highlighting its strengths and weaknesses, and its competitive advantages and disadvantages.

Where Does Kendrion’ Stand in the Current Market?

The company, Kendrion N.V., maintains a robust market position within its specialized segments of electromagnetic and mechatronic systems. A thorough Kendrion market analysis reveals its leadership in industrial brakes and controls, especially in niche applications requiring high precision and reliability. The company's core operations revolve around the design, manufacture, and sale of industrial brakes, clutches, solenoids, and control systems.

Kendrion's value proposition centers on providing premium, high-performance solutions, focusing on customized solutions and advanced mechatronic integration. This strategic shift allows the company to differentiate itself from competitors, focusing on value rather than solely on price. The company serves a diverse clientele across automation, commercial vehicles, and medical equipment, providing critical components that enhance the functionality and safety of various systems.

Geographically, Kendrion has a significant presence in Europe, North America, and Asia, with Germany being a particularly strong market for its industrial solutions. The company's financial health, as indicated by its 2023 full-year results, shows a revenue of EUR 518.2 million, an increase of 2.1% compared to 2022, and an adjusted EBITA of EUR 40.5 million, reflecting a margin of 7.8%. This financial performance suggests a stable position relative to industry averages, supporting continued investment in research and development.

The Kendrion competitive landscape includes various players, with the company holding a strong position in specialized markets. While specific market share data for 2024-2025 isn't available, Kendrion is recognized for its expertise in industrial brakes and controls. Understanding Kendrion's market position requires a deep dive into its key rivals and strategic advantages.

Kendrion's primary product lines include industrial brakes, clutches, solenoids, and control systems. These products are essential in automation, commercial vehicles, and medical equipment. The company's focus on high-performance solutions and customized offerings allows it to serve diverse applications effectively.

Kendrion has a significant presence in Europe, North America, and Asia. Germany is a particularly strong market for its industrial solutions. The company's strategic focus on premium, high-performance solutions differentiates it within these key geographic markets.

Kendrion's financial performance in 2023 showed a revenue of EUR 518.2 million and an adjusted EBITA of EUR 40.5 million. This financial stability supports ongoing investments in research and development. The company's strategic shift towards premium solutions enhances its competitive edge.

Kendrion's strengths lie in its specialized expertise and focus on high-performance solutions. The company's ability to provide customized offerings and advanced mechatronic integration gives it a competitive edge. A recent analysis of the Marketing Strategy of Kendrion highlights the company's focus on innovation and customer-centric approaches.

- Strong market position in industrial brakes and controls.

- Focus on premium, high-performance solutions.

- Geographic diversification with a strong presence in key markets.

- Stable financial performance supporting R&D investments.

Kendrion SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Kendrion?

The Growth Strategy of Kendrion involves navigating a complex competitive landscape. This analysis of the Kendrion competitive landscape considers both direct and indirect rivals across its key market segments. Understanding these competitors is crucial for assessing Kendrion's market position and future growth prospects.

Kendrion's market share and overall performance are influenced by its ability to differentiate itself from these competitors. The company's success depends on its ability to innovate, offer competitive pricing, and maintain strong customer relationships in a dynamic environment. A thorough Kendrion market analysis necessitates a close examination of the strategies and strengths of its main rivals.

The Kendrion industry analysis reveals a competitive environment shaped by technological advancements, market consolidation, and evolving customer demands. This competitive pressure requires Kendrion to continuously evaluate and adapt its strategies to maintain and enhance its market position. The following sections provide a detailed look at Kendrion's key competitors.

In the industrial brakes segment, Kendrion faces competition from established players. These competitors offer a range of products and services that challenge Kendrion's market share. Understanding their strengths and strategies is crucial for Kendrion's competitive positioning.

Warner Electric is a significant competitor, providing a broad portfolio of clutches and brakes. Their extensive product range and global distribution network give them a competitive edge. They compete directly with Kendrion in various industrial applications.

Lenze offers integrated automation solutions, including brakes, often bundled with drive technology. This comprehensive approach poses a competitive threat to Kendrion. Lenze's integrated solutions appeal to customers seeking complete automation systems.

Stromag focuses on high-power brakes and clutches for heavy-duty applications. They compete directly with Kendrion in sectors such as wind energy and marine. Stromag's specialization in heavy-duty components makes them a strong competitor in niche markets.

In the industrial controls segment, Kendrion competes with companies specializing in solenoids, actuators, and control valves. These competitors often have strong brand recognition and offer specialized products. Understanding their market strategies is critical.

Bürkert is known for its high-quality fluid control systems, often incorporating solenoid technology. They compete on precision and reliability, offering specialized solutions. Bürkert's focus on quality makes them a strong competitor.

Parker Hannifin offers a vast array of motion and control technologies, including electromagnetic components. Their broad product portfolio and global reach give them a significant competitive advantage. Parker Hannifin's diversification makes them a formidable competitor.

ASCO, an Emerson company, is a leading manufacturer of solenoid valves. They challenge Kendrion with their extensive product range and strong brand recognition. ASCO's established presence in the market makes them a key competitor.

Emerging players in niche mechatronic solutions pose a dynamic competitive challenge. These smaller firms focus on specific technological advancements. Their agility and innovation can disrupt the market.

The Kendrion competitive landscape is also influenced by market trends and technological advancements. These factors create both challenges and opportunities for Kendrion. Understanding these dynamics is crucial for strategic planning.

- Technological Advancements: The rapid pace of innovation in mechatronics requires continuous investment in R&D.

- Market Consolidation: Mergers and acquisitions among competitors can reshape the competitive landscape.

- Customer Demands: Increasing demand for energy-efficient and miniaturized components drives innovation.

- Geopolitical Factors: Global economic conditions and trade policies impact the market.

- Supply Chain Disruptions: Events such as the COVID-19 pandemic and other global events can affect the supply of components.

Kendrion PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Kendrion a Competitive Edge Over Its Rivals?

The competitive landscape for Kendrion is shaped by its specialized focus on electromagnetic and mechatronic systems. The company's strengths lie in its deep engineering expertise and ability to provide customized solutions, particularly for high-value applications. Understanding the Owners & Shareholders of Kendrion can provide insights into the company's strategic direction and financial health, which are crucial for assessing its competitive position.

Kendrion's competitive advantages are rooted in its long-standing presence in the industry, allowing for the development of proprietary technologies and strong customer relationships. These factors contribute to high barriers to entry, making it difficult for new competitors to replicate Kendrion's specialized offerings. The company's market analysis reveals a strategic emphasis on niche markets where precision and reliability are paramount.

The company's ability to innovate and adapt to technological advancements is critical for maintaining its competitive edge. While specific financial data for 2025 isn't available yet, the company's performance in previous years, along with its strategic investments, suggests a commitment to sustained growth and market leadership. Kendrion's strategic moves, including acquisitions and partnerships, further strengthen its position in the market.

Kendrion has a long history in electromagnetic and mechatronic systems. The company has consistently invested in research and development to stay ahead of technological advancements. These investments have allowed Kendrion to offer superior product features and performance.

Kendrion focuses on niche, high-value applications to foster strong customer loyalty. The company collaborates closely with clients to develop tailored solutions, creating sticky relationships. This approach is particularly evident in sectors like medical equipment and specialized automation.

Kendrion's core competitive advantages stem from its deep engineering expertise and specialized product portfolio. The company's focus on innovation contributes to its ability to offer superior product features and performance. These advantages are relatively sustainable due to the specialized nature of its products.

While specific market share figures for 2025 are not yet available, Kendrion's performance in previous years indicates a strong position in its target markets. The company's focus on specialized applications and customized solutions allows it to maintain a competitive edge. The company's financial performance compared to competitors is a key indicator of its market share.

Kendrion's strengths include its deep engineering expertise, specialized product portfolio, and strong customer relationships. However, it faces potential threats from rapid technological advancements and imitation by well-resourced competitors. Analyzing Kendrion's competitive advantages and disadvantages is crucial for assessing its market position.

- Strengths: Deep engineering expertise, specialized product portfolio, strong customer relationships, and focus on niche markets.

- Weaknesses: Vulnerability to rapid technological advancements and potential imitation by competitors.

- Opportunities: Growth in medical devices and specialized automation sectors.

- Threats: Intense competition and economic downturns.

Kendrion Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Kendrion’s Competitive Landscape?

The Revenue Streams & Business Model of Kendrion is significantly influenced by the evolving industry trends, future challenges, and emerging opportunities within its competitive landscape. The company's success hinges on its ability to adapt to technological advancements, regulatory changes, and the dynamic needs of its target markets. Understanding these elements is crucial for evaluating Kendrion's strategic positioning and potential for growth.

In the realm of Kendrion competitive landscape, the company faces a multifaceted environment shaped by innovation, market dynamics, and strategic partnerships. This analysis covers key aspects, including industry trends, potential challenges, and growth opportunities, providing a comprehensive overview of Kendrion's position and future prospects. It is essential to consider these factors for a complete Kendrion market analysis.

Technological advancements, especially in automation and electrification, are reshaping the industry. The rising demand for more efficient and precise motion control solutions in industrial automation drives the need for advanced electromagnetic components. The shift towards electric vehicles and sustainable energy opens new avenues for Kendrion's expertise in electromagnetic braking and control systems.

Kendrion faces potential disruptions from new market entrants specializing in AI-driven control systems. There is also a threat from declining demand in traditional industrial sectors if the company does not adapt to emerging technologies. Increased regulation on material sourcing and aggressive new competitors with disruptive business models pose further challenges.

Significant growth opportunities exist in emerging markets that are investing in industrial automation and infrastructure. Product innovations, like smart electromagnetic systems with integrated sensors, offer avenues for growth. Strategic partnerships with technology companies or system integrators could expand Kendrion's market reach and enhance its solution offerings.

Kendrion is likely to continue investing in R&D, exploring strategic acquisitions, and focusing on high-growth applications within its core divisions. The company aims to evolve its competitive position to capitalize on these trends. These actions are crucial for sustaining a strong Kendrion market share and addressing the challenges.

The Kendrion competitive landscape involves several key players and dynamics, including the company's main competitors and the strategies they employ. The industry is experiencing an upswing in demand for specialized electromagnetic solutions, driven by the expansion of electric vehicles, renewable energy systems, and advanced industrial automation. The company's ability to innovate and adapt to these changes will be critical. The company’s revenue for 2024 was approximately €430.6 million, showing a slight increase compared to the previous year.

- Market Dynamics: The market is influenced by the growing adoption of electric vehicles, with the electromagnetic components market expected to reach $10.3 billion by 2025.

- Strategic Focus: Kendrion’s strategy includes a focus on R&D, strategic acquisitions, and expanding in high-growth sectors.

- Competitive Positioning: Kendrion competitors include global players and niche specialists, each with specific strengths and weaknesses.

- Financial Performance: Kendrion's financial results, including revenue and profit margins, are essential to assess its competitive standing.

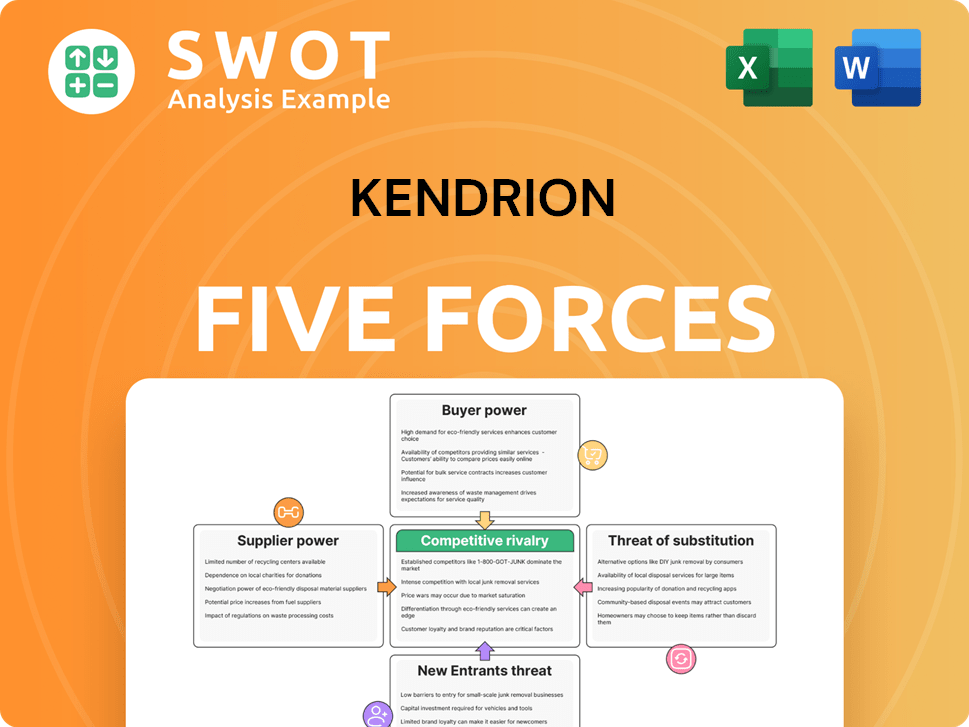

Kendrion Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Kendrion Company?

- What is Growth Strategy and Future Prospects of Kendrion Company?

- How Does Kendrion Company Work?

- What is Sales and Marketing Strategy of Kendrion Company?

- What is Brief History of Kendrion Company?

- Who Owns Kendrion Company?

- What is Customer Demographics and Target Market of Kendrion Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.