Kendrion Bundle

How Does the Kendrion Company Thrive in Today's Market?

Kendrion, a Netherlands-based powerhouse, is at the forefront of innovation, specializing in electromagnetic systems and industrial components. With a rich history dating back to 1859, the Kendrion SWOT Analysis reveals the company's strategic positioning in a world increasingly reliant on advanced technology. But how does Kendrion operations translate into real-world impact and financial success?

From electric vehicles to renewable energy, Kendrion's actuators are vital, driving automation and cleaner energy solutions globally. Recent financial reports highlight Kendrion's resilience and growth, showcasing its ability to navigate market challenges. This analysis will explore the core of the Kendrion company, its strategic advantages, and the potential for continued expansion in key sectors.

What Are the Key Operations Driving Kendrion’s Success?

The Kendrion company specializes in the design, manufacture, and delivery of intelligent actuators, electromagnetic, and mechatronic systems. These components are crucial for the global shift towards electrification and sustainable energy. Kendrion's operations are primarily structured around two core business groups: Industrial Brakes (IB) and Industrial Actuators and Controls (IAC).

Kendrion's products serve diverse customer segments across industries such as automation, commercial vehicles, medical equipment, and wind power. The company's focus on innovation and quality, supported by significant R&D spending, allows it to offer customized solutions. Kendrion's global presence, with subsidiaries worldwide, supports its supply chain and distribution networks.

The company's value proposition lies in its ability to provide high-quality, reliable solutions that meet the evolving needs of various industries. Kendrion's modular product design and agile working methods enable rapid development and customization of products, offering customers time and cost savings. The company's deep engineering knowledge and cross-technology capabilities further enhance its ability to deliver innovative solutions.

Kendrion operates through two main business groups: Industrial Brakes (IB) and Industrial Actuators and Controls (IAC). The IB division focuses on electromagnetic brakes, while the IAC segment specializes in electromagnetic actuators, control technology, and fluid technology. These groups cater to different market segments, including automation, medical, and energy efficiency.

Kendrion's products find applications in various sectors. This includes automation (collaborative and medical robots), commercial vehicles, medical equipment, wind power, intralogistics, energy distribution, and industrial heating processes. Kendrion Kuhnke Automation, part of IAC, focuses on solenoid, fluid, and control technology for sectors like medical technology and aviation.

The company emphasizes advanced manufacturing and technology development to produce high-quality solutions. Kendrion uses a modular product design approach and agile working methods. This allows for the rapid creation of complex products and customized systems. The company's global footprint supports its supply chain and distribution networks.

Kendrion's competitive advantages include high-quality products, significant R&D spending (around 6-7% of annual revenues), and a strong global presence. Its deep engineering knowledge and cross-technology capabilities enable the delivery of innovative solutions. This positions Kendrion as a key player in the electromagnetic systems market.

Kendrion's focus on innovation and quality ensures reliable performance across various applications. The company's modular design approach allows for rapid customization and cost savings for customers. Kendrion's global presence enables efficient supply chain management and worldwide service capabilities.

- High-quality electromagnetic systems and industrial components.

- Customized solutions through modular product design.

- Global presence with subsidiaries worldwide.

- Significant investment in research and development.

Kendrion SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Kendrion Make Money?

The primary revenue streams for the Kendrion company stem from the design, production, and sale of electromagnetic and mechatronic systems and components. These products are primarily targeted at industrial business groups. Following the sale of its Automotive business in Europe and the US in Q1 2025, Kendrion operations are now solely focused on the industrial sector.

For the full year 2024, the company's revenue from continuing operations was EUR 301.5 million, reflecting a 2% decrease compared to 2023. However, Q4 2024 saw an 8% increase in revenue to EUR 76.0 million. Continuing this positive trend, Q1 2025 reported a 4% increase in revenue, reaching EUR 78.1 million.

The company's monetization strategies primarily involve direct product sales to OEM customers globally. Focusing on niche markets with innovative and technologically advanced products, Kendrion leverages its modular product design to offer customized solutions, enabling premium pricing. The strategic shift towards the industrial sector, following the divestment of a significant portion of its Automotive business, aims for sustained growth within this segment. For more details, check out the Target Market of Kendrion.

In Q1 2025, Industrial Brakes (IB) revenue increased by 7% to EUR 30.1 million. Industrial Actuators and Controls (IAC) revenue declined by 8% to EUR 29.6 million. The retained Mobility segment saw a significant 26% growth, reaching EUR 18.4 million, driven by project ramp-ups in China.

Germany historically represents the main market (38.4% of net sales), followed by other European countries (30.9%), Asia (23.4%), and the Americas (6.5%).

The company aims to strongly expand in China, targeting an annual growth of at least 20% and aiming for €100 million in revenue from China by 2025.

The strategy focuses on direct product sales to OEMs, emphasizing customized solutions and premium pricing. Long-term relationships with key industrial and automotive segments are crucial.

The company's focus on innovative and technologically demanding products for niche markets, combined with its modular product design, allows for customized solutions that can command premium pricing.

The divestment of a significant portion of its Automotive business in 2024, representing around 40% of the group's revenue, signifies a strategic shift to focus entirely on the industrial sector, aiming for sustained and profitable growth within this segment.

Kendrion PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Kendrion’s Business Model?

The story of the Kendrion company is marked by strategic acquisitions and operational adjustments. These moves have reshaped its focus and enhanced its position in the industrial sector. The company has consistently adapted to market changes, including navigating challenges like the COVID-19 pandemic and supply chain issues, while also concentrating on long-term growth.

Key to Kendrion's evolution has been its acquisitions. These strategic moves have broadened its technological capabilities and market reach. The most recent transformation involved the divestiture of a significant portion of its automotive business, signaling a shift towards a pure-play industrial model.

The company's competitive edge is built on high-quality products, substantial R&D investment, and a global presence. Kendrion's focus on innovation and its ability to adapt to changing market demands have been crucial to its success. This has enabled it to serve a worldwide customer base and stay at the forefront of technological advancements.

A pivotal moment was the acquisition of INTORQ in January 2020, boosting its industrial brakes segment and expanding its footprint in China. Kuhnke AG, acquired in May 2013, added to its electromagnetic and mechatronic systems offerings. The acquisition of Magneta GmbH & Co. KG further strengthened its industrial propulsion technology unit.

The company has responded to market downturns by implementing cost control measures. The divestiture of approximately 80% of its Automotive revenue to Solero Technologies, LLC for €65 million in 2024, transformed Kendrion into a pure-play industrial company. This strategic shift allows for greater investment in the industrial sector.

Kendrion's competitive advantages include high-quality products, substantial R&D investments (around 6-7% of annual revenues), and a strong global presence. Its modular R&D approach allows for quick customization. The company's focus on electrification and clean energy aligns with major market trends.

While specific recent financial data isn't available, the company's strategic moves, such as the divestiture of the automotive segment, aim to improve long-term profitability. The company's focus on cost control and cash generation reflects its commitment to financial stability. For a deeper dive into the competitive landscape, consider reading about the Competitors Landscape of Kendrion.

Kendrion's strengths lie in its technological expertise in electromagnetic systems and its ability to deliver industrial components. The company's focus on innovation and customization allows it to meet the specific needs of its customers. Its global presence and deep engineering knowledge enable it to serve a wide range of industries, including industrial automation.

- Strong R&D investment (around 6-7% of annual revenues)

- Strategic acquisitions to expand product offerings

- Focus on electrification and clean energy markets

- Global presence with a growing footprint in Asia

Kendrion Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Kendrion Positioning Itself for Continued Success?

The Kendrion company holds a strong position in specialized business-to-business markets, focusing on intelligent actuators and electromagnetic systems within the industrial sector. Following the divestment of most of its automotive business in 2024, Kendrion is now a pure-play industrial company. Its market share is primarily concentrated in industrial brakes and industrial actuators and controls, with Germany as its primary market, though it is expanding in regions like Europe, Asia, and the Americas, especially in China.

The company's success is underscored by partnerships with 'world market leaders' in various industrial segments, indicating strong customer loyalty. However, Kendrion operations face several risks, including market disruptions, sourcing issues, and the inability to pass on cost increases. The company also faces risks related to attracting and retaining qualified personnel and fluctuations in order volume. For instance, the Industrial Actuators and Controls (IAC) segment experienced an 8% revenue decline in Q1 2025 due to ongoing weakness in machine-building markets.

Kendrion is a leader in niche industrial markets, specializing in intelligent actuators and electromagnetic systems. Key areas include industrial brakes and actuators, with a strong presence in Germany and strategic expansion in other regions like China. Customer loyalty is evident through partnerships with leading companies in various industrial sectors.

The company faces risks from market disruptions, sourcing issues, and the inability to pass on cost increases to customers. Changes in laws, unsuccessful strategy implementation, and global socio-economic conditions also pose threats. Additionally, fluctuations in order volume and challenges in attracting and retaining qualified personnel are potential risks.

Kendrion has a positive long-term outlook driven by electrification and clean energy trends. The company aims for a normalized EBITDA of at least 15% from 2025 onwards and is implementing a cost reduction program expected to save EUR 9 million annually. Strategic initiatives include organic growth and leveraging expertise in valves, actuators, and brakes.

The company is focusing on organic growth, using its expertise in valves, actuators, and brakes for solutions in sectors like intralogistics, medical robots, and wind power. Kendrion is also pursuing new business in the AGV market and medical operation robots. Innovation focuses on products contributing to the energy transition, such as the Power Pinch Valve.

Kendrion is aiming for an average organic growth of 5% between 2019 and 2025. The company is targeting a Return on Investment (ROI) of at least 25% in 2025. The cost reduction program, fully implemented by January 1, 2025, is expected to generate net annual savings of EUR 9 million.

- Focus on organic growth.

- Leveraging expertise in valves, actuators, and brakes.

- New business development in AGV and medical operation robots.

- Innovation in products contributing to the energy transition.

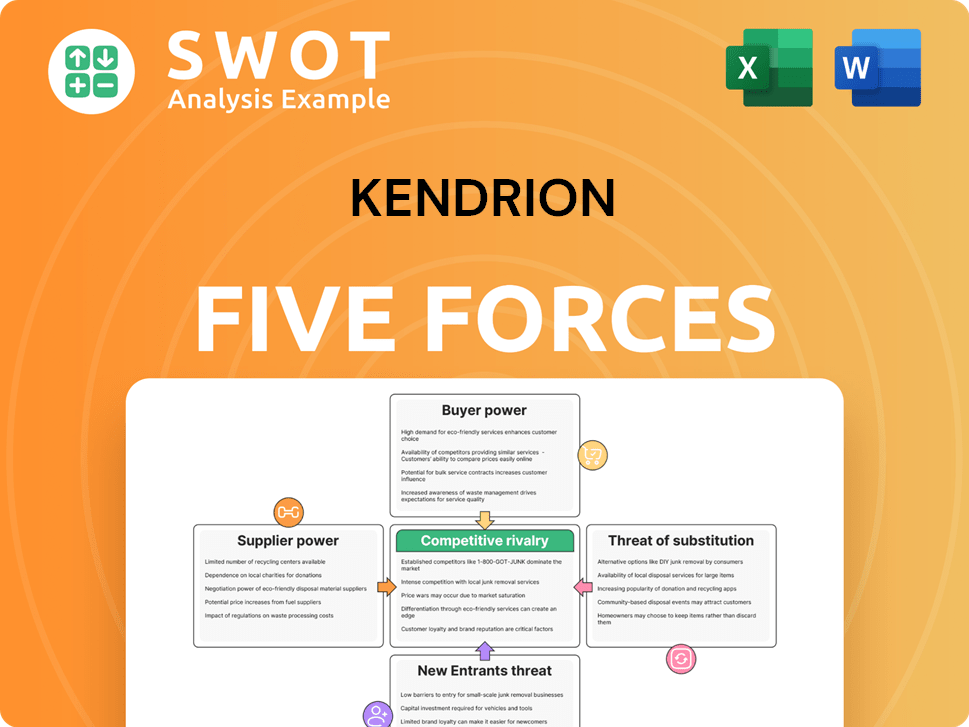

Kendrion Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Kendrion Company?

- What is Competitive Landscape of Kendrion Company?

- What is Growth Strategy and Future Prospects of Kendrion Company?

- What is Sales and Marketing Strategy of Kendrion Company?

- What is Brief History of Kendrion Company?

- Who Owns Kendrion Company?

- What is Customer Demographics and Target Market of Kendrion Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.