Kofola Bundle

Can Kofola Sustain Its Impressive Growth?

Kofola ČeskoSlovensko a.s. has surged in the beverage market, boasting a 30% turnover increase in 2024 and a strategic entry into the beer market. This remarkable performance begs the question: How does Kofola stack up against its rivals in the competitive landscape? To understand Kofola's future, we must delve into its market position.

This Kofola SWOT Analysis provides a comprehensive overview of the company's strengths and weaknesses, alongside opportunities and threats within the Kofola industry. Understanding the Kofola competitive landscape requires a deep dive into the beverage market, examining Kofola's key competitors, and assessing its market share analysis. This analysis will help to evaluate Kofola's financial performance review and its ability to navigate challenges and opportunities in the Czech Republic drinks sector and beyond.

Where Does Kofola’ Stand in the Current Market?

Kofola ČeskoSlovensko holds a strong market position in the Central and Eastern European beverage industry, particularly in its traditional CzechoSlovak market. Its core operations focus on producing and distributing a diverse range of beverages, including carbonated drinks, bottled waters, syrups, energy drinks, and fresh juices. The company's value proposition centers on offering a wide variety of products that cater to different consumer preferences and occasions, supported by strong brand recognition and effective distribution networks.

The company's success is reflected in its financial performance. In 2024, Kofola reported record sales, with a 30.1% year-on-year increase, reaching CZK 11.31 billion. The operating profit (EBITDA) surged by 49.6% to a record CZK 1.87 billion. This strong financial performance highlights Kofola's ability to adapt to market changes and maintain its competitive edge.

Kofola's product portfolio is extensive, including well-known brands such as Kofola, Vinea, Radenska, Studenac, Rajec, Ondrášovka, Korunní, Jupí, Jupík, Semtex, and UGO. It also distributes brands like Evian and Dilmah and produces Royal Crown Cola, Orangina, and Pepsi under license in select markets. This diverse range allows Kofola to target a broad consumer base and compete effectively across various beverage categories. For deeper insights into the consumer base, you can explore the Target Market of Kofola.

Kofola's market share is particularly strong in the Czech Republic and Slovakia. The company's net sales in 2023 were primarily driven by the Czech Republic (56.4%) and Slovakia (24.2%). This strong regional focus allows Kofola to leverage its brand recognition and distribution networks in its core markets.

Recent acquisitions, such as Pivovary CZ Group in March 2024, have expanded Kofola's portfolio to include beer brands like Zubr, Holba, and Litovel. The acquisition of a 49% stake in Mixa Vending S.R.O. in January 2024 further expanded its presence in the vending machine segment. These moves indicate a strategic effort to diversify and grow.

Kofola's financial performance has been robust, with significant increases in sales and EBITDA in 2024. The company's shares on the Prague Stock Exchange increased by 49% over the six months leading up to February 2025, reflecting strong investor confidence. As of December 31, 2024, Kofola ČeskoSlovensko reported a trailing 12-month revenue of $477 million.

Despite facing challenges such as the Slovak sugar tax and the implementation of the Czech PET bottle and can deposit system, Kofola's management plans substantial investments in business development for 2025. These investments aim to improve efficiency and trading opportunities, indicating a proactive approach to address market challenges and drive future growth.

Kofola's competitive advantages include its strong brand recognition, diverse product portfolio, and effective distribution network. The company's focus on its core markets and strategic acquisitions further enhance its position in the beverage market. Kofola's ability to adapt to market changes and invest in business development positions it well for future growth.

- Strong brand recognition in key markets.

- Diverse product portfolio catering to various consumer preferences.

- Effective distribution network across Central and Eastern Europe.

- Strategic acquisitions to expand market presence.

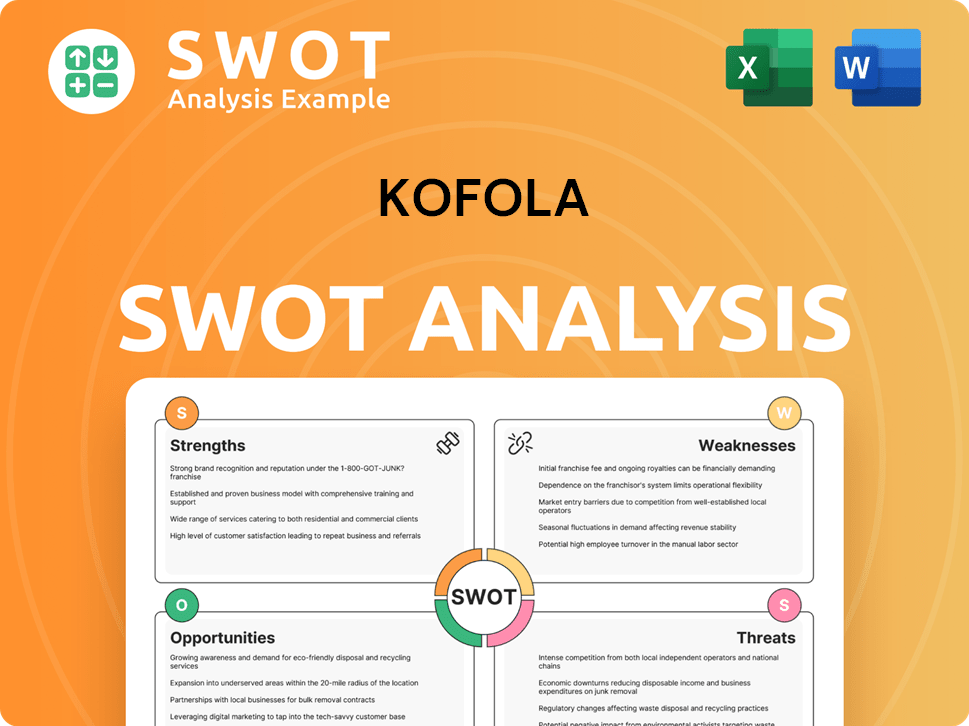

Kofola SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Kofola?

The Kofola competitive landscape is shaped by its presence in the beverage market, where it encounters both global and local players. This dynamic environment requires Kofola to navigate various product segments and geographical regions effectively. Analyzing the Kofola market analysis reveals a complex interplay of established brands and emerging trends.

Kofola ČeskoSlovensko faces competition across its product lines. In the soft drink category, it competes with major brands like Coca-Cola and Pepsi, particularly in the Czech Republic and Slovakia. Beyond soft drinks, the company's portfolio includes bottled waters, juices, syrups, and energy drinks, increasing its exposure to a wider range of competitors.

Following its acquisition of Pivovary CZ Group in March 2024, Kofola now competes in the beer segment, adding another layer to its Kofola competitors. This move reflects the company's strategy to broaden its market presence and diversify its offerings.

The primary competitors in the soft drink category are Coca-Cola and Pepsi. These global giants have a significant market share, particularly in the cola segment. Kofola competes directly with these brands, especially in its core markets of the Czech Republic and Slovakia.

In the broader non-alcoholic beverage market, Kofola competes with a range of companies. These include Mattoni 1873, a major player in mineral and spring waters, and other leading beverage companies in the Czech Republic. The Kofola industry also includes producers of juices, syrups, and energy drinks.

Following the acquisition of Pivovary CZ Group in March 2024, Kofola competes with major breweries in the Czech Republic. This includes brands such as Pilsner Urquell, Staropramen, Velkopopovický Kozel, and Bernard Family Brewery. This expansion diversifies Kofola's portfolio.

Indirect competition comes from local and regional beverage producers. These companies cater to specific consumer preferences and niche markets. Private label brands in retail also contribute to the competitive landscape, influencing market dynamics.

Mergers and acquisitions, such as Kofola's moves into beer and vending machines, demonstrate a dynamic market. This environment encourages companies to expand their portfolios and distribution channels. New entrants focused on health-oriented drinks or innovative distribution models can disrupt the traditional beverage market.

Kofola's strategic moves, like the acquisition of Pivovary CZ Group, are aimed at expanding its market presence. These moves are part of a broader strategy to diversify revenue streams and strengthen its position in the competitive landscape. The company's focus on innovation and expansion is evident.

Understanding the competitive environment requires a close look at the key players and market trends. Factors such as consumer preferences, distribution networks, and marketing strategies play a crucial role. For a deeper dive into the company's performance, consider reading more about the Kofola financial performance review.

- Market Share: While specific 2024-2025 market share data for direct competitors is not readily available, Coca-Cola and Pepsi remain dominant in the cola segment.

- Product Portfolio: Kofola's product portfolio includes soft drinks, bottled waters, juices, syrups, and beer, positioning it against a diverse range of competitors.

- Geographic Focus: The Czech Republic and Slovakia are key markets where Kofola has historically held a strong position.

- Strategic Acquisitions: The acquisition of Pivovary CZ Group expanded Kofola's presence in the beer segment.

- Emerging Trends: The rise of health-oriented drinks and innovative distribution models influences the competitive dynamics.

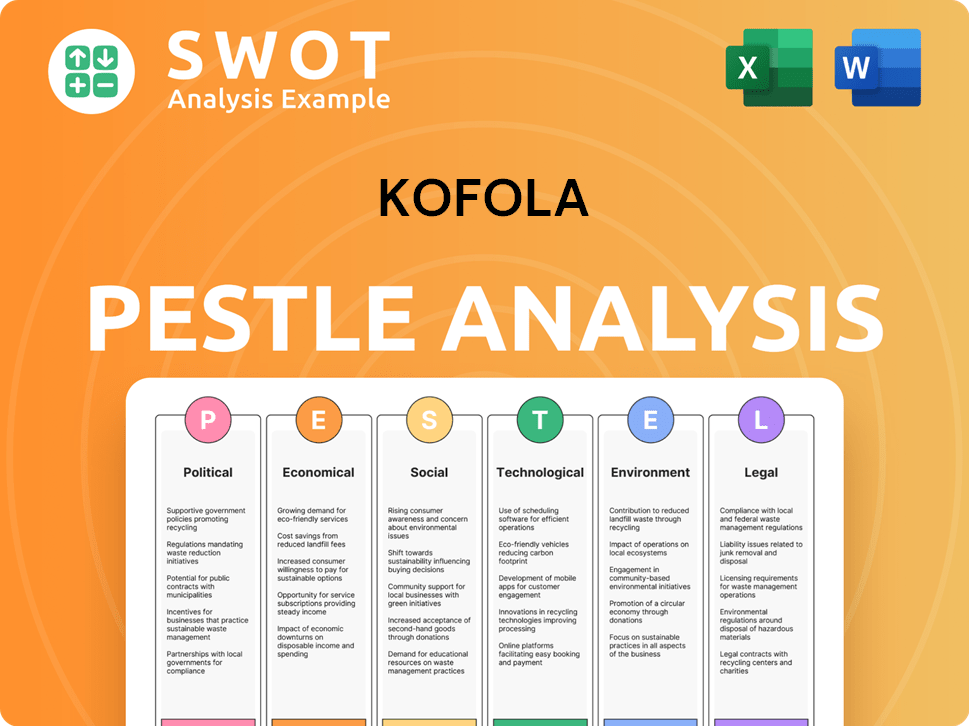

Kofola PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Kofola a Competitive Edge Over Its Rivals?

The competitive landscape for Kofola ČeskoSlovensko is shaped by its strong brand and strategic moves within the beverage market. The company's focus on product innovation and sustainable practices further enhances its position. A deep understanding of the Kofola competitive landscape is crucial for investors and industry analysts.

Key milestones include strategic acquisitions and expansions, such as the purchase of Pivovary CZ Group in March 2024, which have broadened its portfolio. These moves, combined with a focus on operational efficiencies, highlight Kofola's commitment to growth. For detailed insights, explore the Growth Strategy of Kofola.

Kofola's competitive edge is rooted in its unique brand identity and customer loyalty, particularly in the Czech and Slovak markets. Its distinct herbal taste and health-conscious approach, with lower sugar content, set it apart from competitors. This differentiation is key in the Czech Republic drinks market.

Kofola benefits from strong brand equity and deep-rooted customer loyalty, especially for its flagship drink. It is perceived as a unique beverage with nostalgic associations in Czech and Slovak cultures. This emotional connection drives high consumer preference.

The distinctive herbal taste of Kofola, containing 14 herbs and fruits, contributes to its appeal. It contains approximately 30% less sugar than major competitors and no phosphoric acid, appealing to health-conscious consumers. This is a key aspect of Kofola's product portfolio.

Kofola's strategic acquisitions, like the Pivovary CZ Group in March 2024, demonstrate its ability to expand its portfolio and distribution. This expansion leverages existing business, distribution, and marketing expertise, contributing to its market position.

The company emphasizes sustainability and product innovation, investing in hot-fill technology and reducing sugar content. Investments in improving production facility efficiency and logistics routes for 2025 further bolster its competitive standing.

Kofola's competitive advantages include strong brand recognition and a unique product offering. It has a significant presence in the HoReCa segment, particularly with draught Kofola. The company's agile governance and transparent reporting support rapid decision-making.

- Strong brand equity and customer loyalty.

- Unique product with a distinctive herbal taste.

- Extensive distribution networks, especially in HoReCa.

- Strategic acquisitions and agile governance.

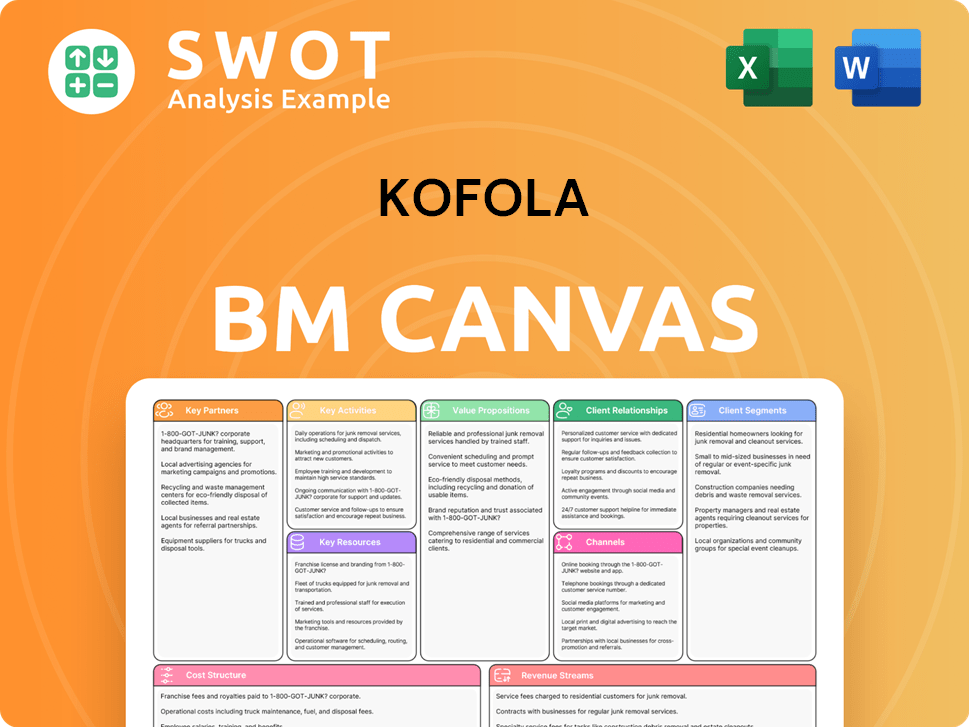

Kofola Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Kofola’s Competitive Landscape?

The Kofola competitive landscape is significantly influenced by shifts in consumer preferences, technological advancements, and regulatory pressures within the beverage market. The company faces both immediate challenges and long-term opportunities as it navigates these complex dynamics. This analysis provides insights into the current position of Kofola, the risks it faces, and its future outlook, focusing on key industry trends and strategic responses.

Kofola's strategic focus includes adapting to the demand for healthier options and managing the impact of regulatory changes, such as the sugar tax in Slovakia. The company's ability to innovate and diversify its product portfolio, as seen with its Fresh & Herbs segment, is crucial for maintaining a competitive edge. Understanding these aspects is essential for a thorough Kofola market analysis and evaluation of its long-term growth potential.

The Kofola industry is currently defined by a move towards healthier products and reduced sugar content. Technological advancements are reshaping distribution, and increasing regulatory scrutiny is impacting operations. The Fresh & Herbs segment continues to grow, reflecting a successful alignment with consumer preferences.

Kofola faces challenges from rising raw material costs, especially for oranges and apples, influenced by ecological disasters. Regulatory changes, such as the Czech PET bottle deposit system, require strategic adjustments. Competition is also increasing from new market entrants and evolving business models.

The company plans significant investments in business development for 2025 to enhance production and logistics. Strategic partnerships and product innovations, such as Targa Florio and Radenska Functional, are key. Expansion into the beer market through acquisitions offers new growth avenues.

Kofola is responding to the demand for healthier products by launching new health-oriented drinks and reducing sugar content. The company's Fresh & Herbs segment continues to grow, indicating a successful alignment with this trend. The company is focused on resilience, operational efficiency, and diversified market presence.

Kofola demonstrated resilience in 2024, with its PET division achieving an 18% increase in turnover. Despite facing cost pressures from raw materials and sugar prices, the company is strategically positioned to leverage growth opportunities, including expansion within the Czech Republic drinks market and in export markets. For more insights into the company's strategies, consider reading about the Marketing Strategy of Kofola.

Kofola is implementing several strategic initiatives to navigate the evolving beverage market and capitalize on growth opportunities. These initiatives focus on operational efficiency, diversification, and market expansion.

- Investments in business development for 2025 to improve production and logistics.

- Strategic partnerships and product innovations, such as Targa Florio and Radenska Functional.

- Entry into the beer market through the acquisition of Pivovary CZ Group.

- Expansion of distribution for newly acquired beer brands in retail and gastronomy.

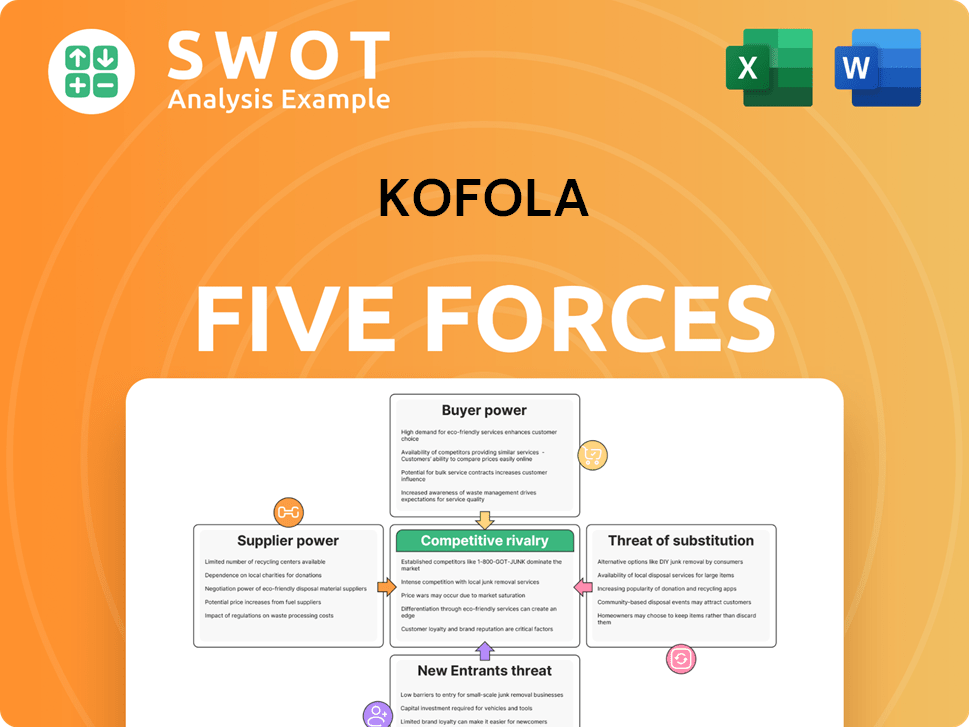

Kofola Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Kofola Company?

- What is Growth Strategy and Future Prospects of Kofola Company?

- How Does Kofola Company Work?

- What is Sales and Marketing Strategy of Kofola Company?

- What is Brief History of Kofola Company?

- Who Owns Kofola Company?

- What is Customer Demographics and Target Market of Kofola Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.