Kofola Bundle

Who Really Owns Kofola?

Dive into the fascinating world of Kofola, the iconic Central and Eastern European beverage company, and uncover its ownership secrets. From its humble beginnings in Czechoslovakia to its current market position, Kofola's story is one of strategic evolution and significant ownership changes. Understanding Kofola SWOT Analysis is crucial for grasping its competitive landscape.

This exploration of the Kofola company will reveal the intricacies of its ownership structure, from its founders to its current major shareholders. Learn about the Kofola brand's journey and the key players who have shaped its destiny. We will also delve into the Kofola history, examining the events that have influenced its market share and overall financial information, providing valuable insights for investors and business strategists alike, including details on who is the current owner of Kofola.

Who Founded Kofola?

The story of Kofola, a well-known beverage, began in post-war Czechoslovakia. The origins of the Kofola company trace back to 1959 when the Czechoslovak Research Institute of Medicinal Plants in Prague developed the Kofo syrup. This syrup was the foundation for the Kofola soft drink.

Zdeněk Blažek played a crucial role in developing the initial syrup, which contained fourteen herbal and fruit ingredients, along with caffeine. The Kofola drink was introduced in 1960 and rapidly gained popularity in communist Czechoslovakia. The Kofola brand has a rich history.

After the Velvet Revolution in 1989, Kofola faced challenges and underwent ownership changes. The brand was revitalized in 1998 when Santa acquired the KOFO recipe, later becoming Kofola a.s. and then Kofola ČeskoSlovensko a.s.

Kofola's roots are in 1959 Czechoslovakia, with the development of the Kofo syrup.

Zdeněk Blažek was instrumental in creating the original syrup formula.

The brand faced changes after 1989, with a revival in 1998.

The Samaras family, led by Kostas Samaras, discovered the potential of the Kofola brand.

The Samaras family became the sole owner of the Kofola brand in 2000.

Their control was key to the company's growth.

The Samaras family's acquisition of the Kofola brand in 2000 marked a turning point, setting the stage for its expansion. The company has grown to include a diverse portfolio of products and brands. For detailed information on the company's financial performance and market position, you can explore resources like the company's annual reports or financial news outlets. Further insights into the company's journey can be found in various articles and reports available online.

- The Samaras family's influence was crucial to Kofola's revival.

- The company's early agreements were centered around the Samaras family's vision.

- Kofola's expansion has included acquisitions and new product launches.

- The company has grown significantly since the Samaras family took control.

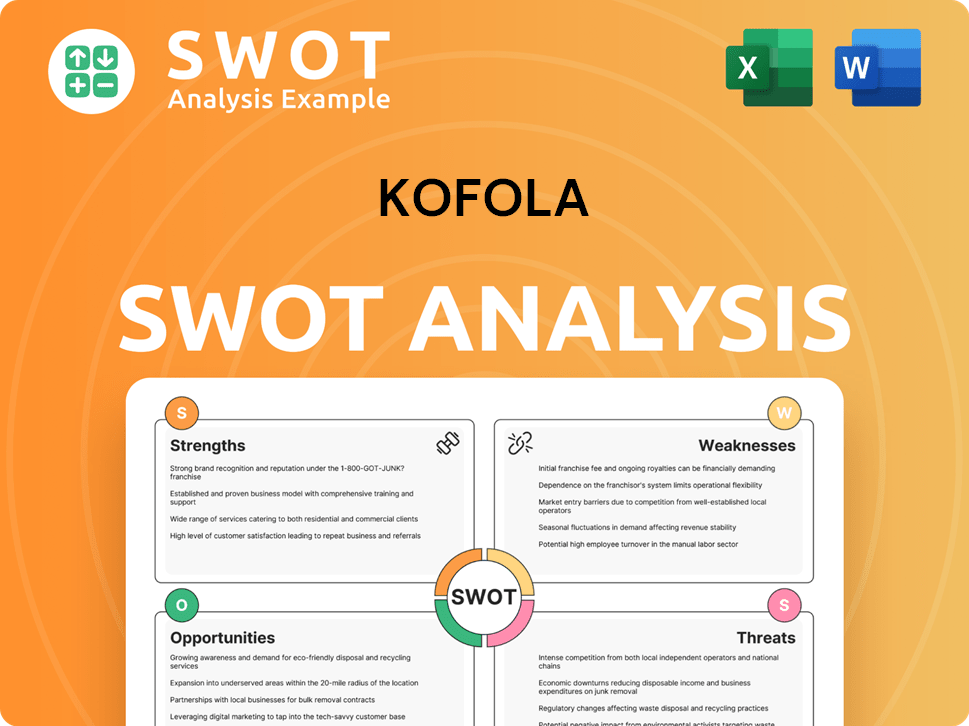

Kofola SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Kofola’s Ownership Changed Over Time?

The evolution of Kofola's ownership has been marked by significant strategic moves and shifts in shareholder structure. A pivotal moment was the company's listing on the Prague Stock Exchange on December 2, 2015, which allowed employees to become shareholders. As of June 13, 2025, the market capitalization of Kofola ČeskoSlovensko a.s. was approximately CZK 10,677.84 million, reflecting its growth and market presence.

Key events include the acquisition of a 42.46% stake in Kofola-Hoop by Enterprise Investors in 2008 and the purchase of the Slovenian mineral water factory Radenska in 2014. More recently, in 2023-2024, Kofola expanded its portfolio by acquiring a 51% stake in Pivovary CZ Group, which produces the Holba, Zubr, and Litovel beer brands. These strategic acquisitions have played a crucial role in shaping the company's ownership structure.

| Shareholder | Stake as of December 31, 2024 | Notes |

|---|---|---|

| Lykos alfa a.s. | 67.22% | Majority owned by Jannis Samaras and family |

| René Musila & Tomáš Jendřejek | 4.60% | Through stakes in Lykos alfa |

| Free Float | 27.23% (as of May 21, 2025) | Approximately 6.1 million shares at the Prague Stock Exchange |

| Key Management (excluding Lykos alfa owners) | 0.95% (as of May 21, 2025) | Approximately 0.2 million shares |

| Radenska d.o.o. | 0.94% | Considering selling its entire stake of 1,025,239 shares |

As of December 31, 2024, Lykos alfa a.s. held the majority of shares at 67.22%, primarily controlled by Jannis Samaras and his family. The free float accounts for approximately 27.23% as of May 21, 2025, with key management personnel holding a smaller percentage. These ownership details provide insight into the control and investment dynamics of the

The ownership of

- Lykos alfa a.s. holds the majority stake.

- The Samaras family is the primary owner of Lykos alfa a.s.

- A significant portion of shares is available as free float.

- Key management also holds a small percentage of shares.

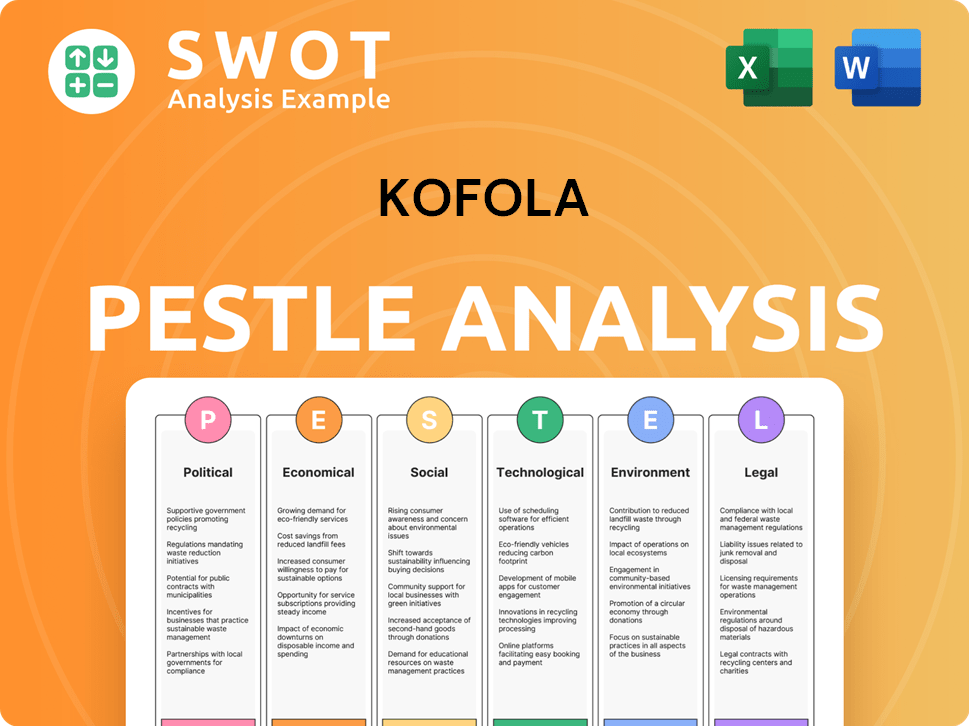

Kofola PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Kofola’s Board?

The Board of Directors of the Kofola ČeskoSlovensko a.s. is pivotal in charting the company's strategic course, working in tandem with the Supervisory Board. Jannis Samaras, as Chairman of the Board, underscores the continued influence of the founding family in the leadership of the company. The Board of Directors is responsible for making decisions on all company matters, unless these are reserved for the general meeting or the supervisory board.

The Supervisory Board, which oversees the Board of Directors, consists of five members elected by the General Meeting. As of May 27, 2025, the Supervisory Board members include René Sommer (Chairman), Moshe Cohen-Nehemia, Ladislav Sekerka, Tomáš Jendřejek, and Alexandros Samaras. Tomáš Jendřejek, one of Kofola's founders, holds a minority share through Lykos alfa a.s. The Supervisory Board elects and recalls the members of the Board of Directors.

| Board Role | Name | Details |

|---|---|---|

| Chairman of the Board of Directors | Jannis Samaras | Represents the founding family's continued leadership. |

| Chairman of the Supervisory Board | René Sommer | Oversees the Board of Directors. |

| Supervisory Board Member | Tomáš Jendřejek | Founder and minority shareholder. |

Kofola ČeskoSlovensko operates with a one-share-one-vote structure for its ordinary shares. The majority of voting rights are controlled by the shareholders of Lykos alfa a.s., primarily owned by Jannis Samaras and his family, ensuring a stable ownership structure focused on long-term development. The company's annual general meeting for 2025 is scheduled for June 25, 2025. For more details, you can check out the Brief History of Kofola.

The Samaras family, through Lykos alfa a.s., maintains significant control over Kofola. The Board of Directors, led by Jannis Samaras, steers the company's strategic direction. The one-share-one-vote structure ensures that voting power aligns with share ownership.

- Jannis Samaras, Chairman of the Board, represents the founding family.

- Supervisory Board oversees the Board of Directors.

- Lykos alfa a.s. holds the majority of voting rights.

- Annual General Meeting scheduled for June 25, 2025.

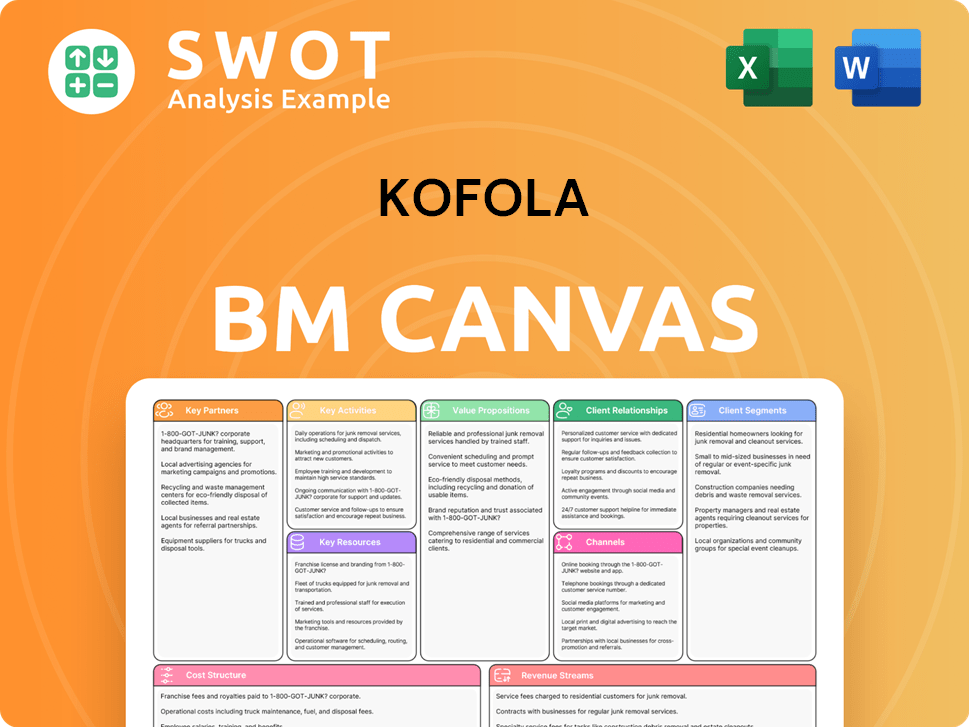

Kofola Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Kofola’s Ownership Landscape?

Over the past few years, the Kofola company has significantly expanded its operations through strategic acquisitions and investments. In March 2024, it entered the Czech beer market by acquiring a 51% stake in Pivovary CZ Group, which includes the Zubr, Holba, and Litovel brands. This move was supported by investment groups, with RSJ holding 29% and Úsovsko a.s. holding 20%. Furthermore, in January 2024, Kofola acquired a 49% stake in Mixa Vending s.r.o., marking its entry into the vending machine segment. By March 2025, the company further solidified its presence in this area by acquiring ASO Vending, which operates over 8,000 vending machines in Slovakia, generating €18 million in turnover during 2024.

These acquisitions and investments highlight the dynamic nature of the Kofola ownership landscape. Early 2024 saw investments in coffee plantations in Colombia and apple orchards in the Czech Republic, demonstrating a long-term strategy to secure raw materials. Additionally, the restructuring of AETOS a.s. through Lykos alfa a.s. aimed to ensure the management of family assets, although it didn't change the majority voting rights in Kofola ČeskoSlovensko a.s. The company has also been involved in share buyback programs and faced potential share sales from Radenska d.o.o., indicating ongoing adjustments in its ownership structure.

| Key Development | Date | Details |

|---|---|---|

| Acquisition of Pivovary CZ Group | March 2024 | Acquired a 51% stake, entering the Czech beer market. |

| Acquisition of Mixa Vending s.r.o. | January 2024 | Acquired a 49% stake, entering the vending machine segment. |

| Acquisition of ASO Vending | March 2025 | Expanded vending machine business in Slovakia. |

The Kofola brand continues to evolve, adapting to market demands and securing its supply chain. Understanding the Target Market of Kofola is crucial for appreciating how these strategic moves support its long-term goals. These developments reflect a proactive approach to growth and stability within the competitive beverage industry, shaping the future of Kofola drinks and its overall market position.

In March 2024, Kofola acquired a 51% stake in Pivovary CZ Group. This strategic move allowed Kofola to enter the beer market in the Czech Republic. The acquisition included the Zubr, Holba, and Litovel brands.

Kofola expanded its vending machine business through acquisitions. In January 2024, it acquired a 49% stake in Mixa Vending s.r.o. Further expansion happened in March 2025 with the acquisition of ASO Vending.

Early 2024 saw investments in coffee plantations in Colombia. The company also acquired apple orchards in the Czech Republic. These investments aim to secure raw materials.

AETOS a.s. initiated a restructuring to ensure succession. A new company, Lykos alfa a.s., was created. This restructuring did not change the majority voting rights.

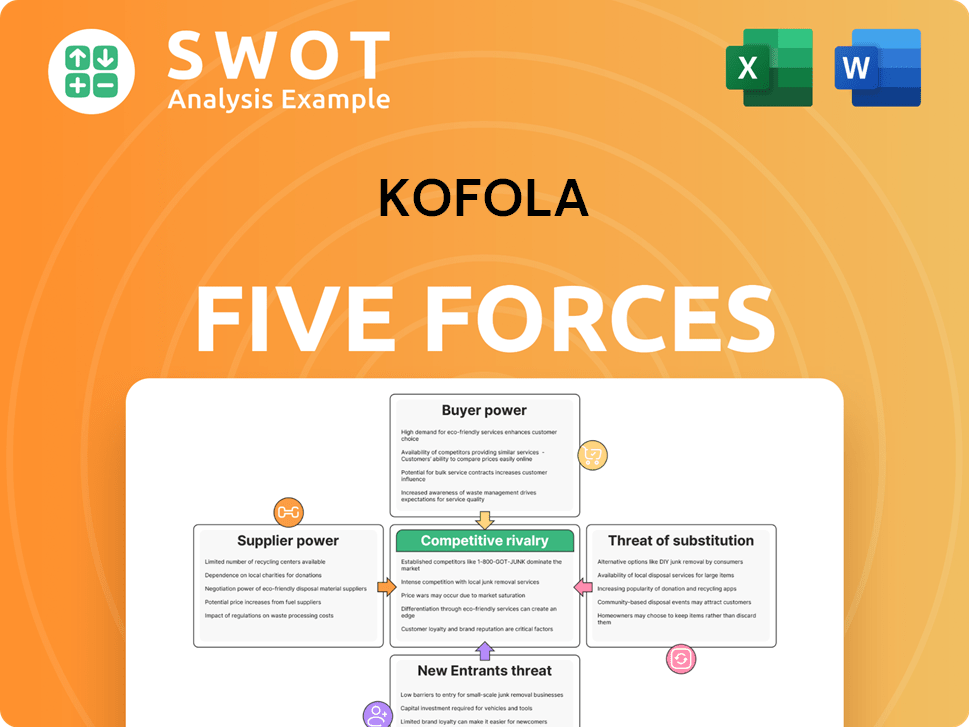

Kofola Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Kofola Company?

- What is Competitive Landscape of Kofola Company?

- What is Growth Strategy and Future Prospects of Kofola Company?

- How Does Kofola Company Work?

- What is Sales and Marketing Strategy of Kofola Company?

- What is Brief History of Kofola Company?

- What is Customer Demographics and Target Market of Kofola Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.