Kofola Bundle

How Does Kofola Thrive in a Competitive Market?

Kofola ČeskoSlovensko a.s. isn't just a beverage company; it's a Central and Eastern European success story, achieving record-breaking financial results in 2024. With a 30% increase in turnover, surpassing CZK 11 billion, Kofola has solidified its position in a dynamic market. But how does this iconic brand, known for its flagship cola, achieve such impressive Kofola SWOT Analysis?

This deep dive into the Kofola company will explore its operational model, from Kofola production to its distribution network. We'll examine the Kofola history, its unique ingredients, and how it has adapted to challenges like rising costs and even floods. Understanding the Kofola manufacturing process and its market strategies is key to appreciating its ongoing success and future potential, especially when comparing Kofola vs Coca-Cola or Kofola vs Pepsi.

What Are the Key Operations Driving Kofola’s Success?

The Kofola company, Kofola ČeskoSlovensko, operates through a multifaceted approach to beverage production and distribution. This involves a diverse portfolio of non-alcoholic beverages, including its flagship drink, Kofola, and various bottled waters, syrups, energy drinks, and juices. The company also distributes international brands and produces licensed beverages, showcasing its broad market reach across Central and Eastern Europe.

Kofola production is strategically managed across 11 production sites, emphasizing honest production practices, health-conscious formulations, and sustainable sourcing. This includes reducing sugar content, eliminating preservatives, and sourcing local ingredients. The company's commitment to sustainability extends to initiatives like aiming for carbon neutrality by 2030 and investing in water conservation.

The Kofola company's value proposition centers on its diverse product range, catering to evolving consumer preferences for healthier and natural options. The company's ability to integrate acquisitions and introduce new products demonstrates its agility in expanding its offerings and market reach. The acquisition of Pivovary CZ Group in 2024, further diversified its product range into beer, leveraging its existing business, distribution, and marketing expertise.

Kofola's portfolio includes its namesake drink, bottled waters (Radenska, Rajec), syrups (Jupí), energy drinks (Semtex), and juices (Curiosa). It also distributes international brands like Evian and Badoit. In selected markets, it produces RC Cola, Orangina, and Pepsi under license.

The company operates 11 production sites across Europe, focusing on honest production methods. This includes efforts to reduce sugar, remove preservatives, and utilize sustainable sourcing practices. The company also grows its own herbs and sources local ingredients.

Kofola's robust supply chain and strategic distribution networks enable it to deliver products effectively. Its market presence is concentrated in Central and Eastern Europe. The company has expanded its reach through acquisitions and partnerships.

Kofola is committed to sustainability, aiming for carbon neutrality by 2030. It invests in water conservation measures and promotes sustainable sourcing. These initiatives reflect a commitment to environmental responsibility.

Kofola's core operations encompass a wide range of activities, from beverage production to distribution and marketing. The company's focus on innovation and sustainability sets it apart. Its ability to adapt to market changes is a key strength.

- Diverse product portfolio catering to various consumer preferences.

- Strategic acquisitions and brand diversification, including beer production.

- Emphasis on sustainable practices, including carbon neutrality goals.

- Effective distribution networks and partnerships for broad market reach.

The Kofola company's structure and ownership are critical to understanding its operations. For more details on the ownership structure, you can refer to the article on Owners & Shareholders of Kofola.

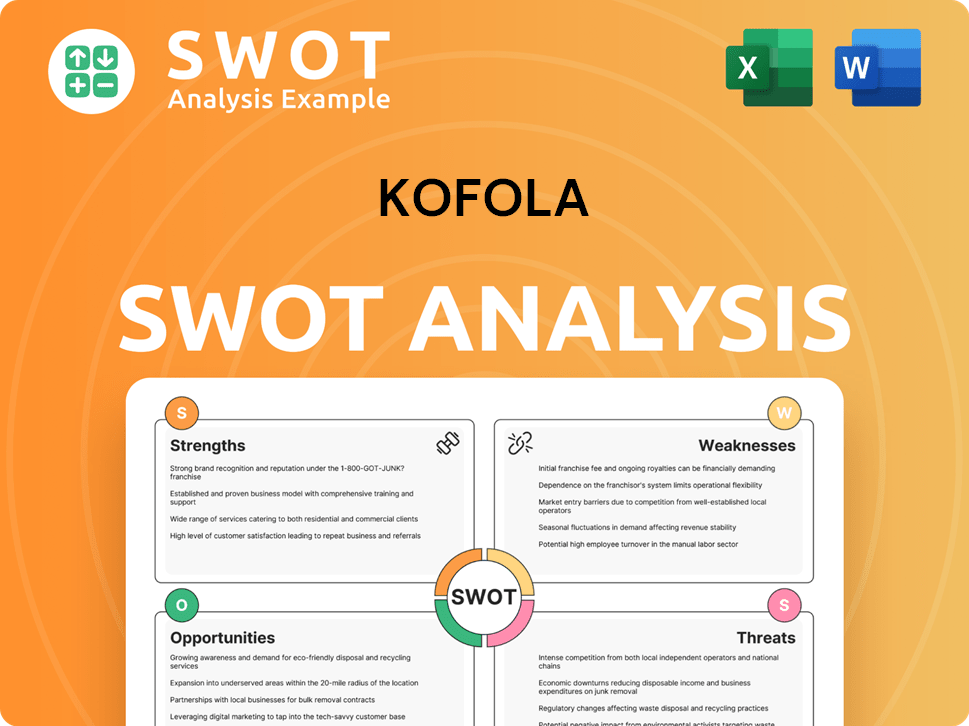

Kofola SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Kofola Make Money?

The Kofola company generates revenue through a diverse range of beverage sales and related services. Their financial success is driven by a strong brand presence and strategic market expansion. This approach allows them to capture a significant share of the beverage market.

The company's revenue streams are primarily centered around the sale of various beverages, including soft drinks, bottled water, and non-carbonated drinks. They also generate income from syrups, fresh drinks, salads, and other related products. This diversified product portfolio helps to cater to a wide consumer base and mitigate risks associated with relying on a single product category.

Geographically, the Czech Republic and Slovakia are the largest contributors to Kofola's net sales. The company also has a strong presence in Slovenia, Croatia, Poland, and other regions. This broad distribution network supports the company's revenue generation by ensuring its products are available to a wide audience.

Soft drinks accounted for 39.1% of revenue, bottled waters for 32.6%, non-carbonated beverages for 8.1%, syrups for 6.3%, and fresh drinks and salads for 5.5%, with other products contributing 8.4%.

The Czech Republic contributed 56.4% of net sales, followed by Slovakia (24.2%), Slovenia (11.1%), Croatia (4.9%), Poland (1.3%), and other regions (2.1%).

In 2024, the Kofola Group experienced a significant 30% increase in turnover, surpassing CZK 11 billion.

The beverage division in the Czech Republic and Slovakia saw a 6% increase in sales in the final quarter of 2024 compared to the previous year.

For 2025, Kofola's management anticipates approximately 3% revenue growth.

The proposed dividend of CZK 21 per share before tax for 2024, with an advanced dividend of CZK 7.50 per share already paid.

The company employs several monetization strategies to drive revenue growth. These include leveraging strong brand recognition, expanding into new segments, and strategic acquisitions. For a deeper understanding of how Kofola competes in the market, you can explore the Competitors Landscape of Kofola.

- Acquisitions: Entering new markets through acquisitions, such as the food and beverage vending machine segment with MIXA VENDING.

- Product Diversification: Expanding the product portfolio to include a wider range of beverages and related products.

- Distribution Network: Strengthening distribution channels to ensure product availability across various regions.

- Efficiency Improvements: Focusing on improvements in production facilities, logistics routes, and trading opportunities.

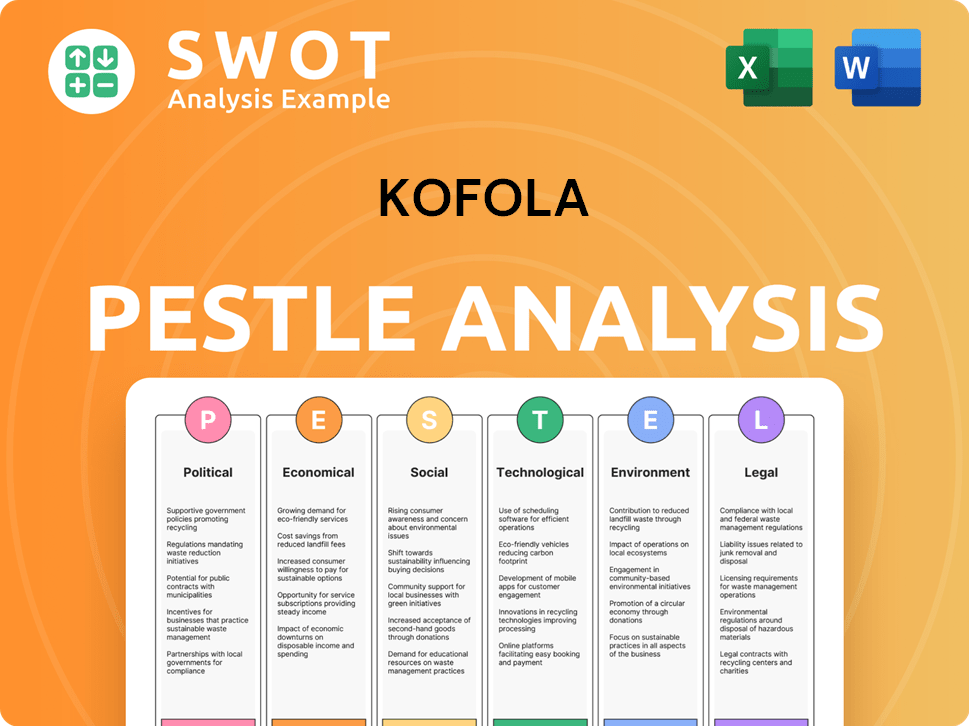

Kofola PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Kofola’s Business Model?

The Growth Strategy of Kofola has been marked by significant milestones, strategic acquisitions, and a focus on expanding its product portfolio and market reach. Key moves in 2024 included the acquisition of Pivovary CZ Group, integrating beer brands like Zubr, Holba, and Litovel, and the acquisition of MIXA VENDING, entering the food and beverage vending machine segment. These strategic steps demonstrate the company's commitment to diversification and growth.

Operational challenges, such as the severe floods in September 2024 that disrupted production for its UGO Salaterie brand, were met with resilience. Despite a five-week halt in production, the company quickly restored operations and still achieved a record year, with a reported 30% increase in turnover for 2024. The company also addressed rising raw material costs by increasing sales and maintaining cost discipline.

Kofola's competitive edge stems from its strong brand recognition, particularly with its flagship soft drink, and a commitment to healthier beverage options. Its diversified portfolio across various beverage categories, including carbonated drinks, waters, juices, syrups, and beer, provides a robust multi-pillar strategy. With 11 production plants across Central and Eastern Europe and the launch of new products like Curiosa fruit drinks and Dilmah Ice Tea in early 2025, the company continues to adapt to evolving consumer preferences.

The acquisition of Pivovary CZ Group in 2024 marked a significant entry into the beer segment. The purchase of MIXA VENDING also expanded its presence in the vending machine market. The company's vertical integration, including apple orchards and co-ownership in coffee plantations, enhanced control over raw materials.

Kofola's strategy involves diversification through acquisitions and product innovation. Entering the beer and vending machine markets demonstrates a commitment to expanding its market presence. Launching new products like Curiosa and Dilmah Ice Tea shows its focus on evolving consumer preferences.

Strong brand recognition and consumer loyalty, particularly for the Kofola soft drink, are key advantages. The focus on healthier beverage alternatives and a diversified product portfolio help mitigate risks. A robust production and distribution network across Central and Eastern Europe supports economies of scale.

Kofola's production capabilities are spread across 11 plants, ensuring efficient manufacturing and distribution. The company's vertical integration, including raw material sourcing, enhances control over the production process. The company's manufacturing process is designed to efficiently produce a wide range of beverages.

Kofola demonstrated strong financial performance in 2024, despite operational challenges. The company's resilience and strategic moves have positioned it well in the market. Kofola's market share in the non-alcoholic beverage market remains competitive.

- The company's revenue increased by 30% in 2024.

- Kofola's diversified portfolio helps to mitigate risks.

- The company continues to innovate with new product launches.

- Kofola's distribution network covers a wide geographic area.

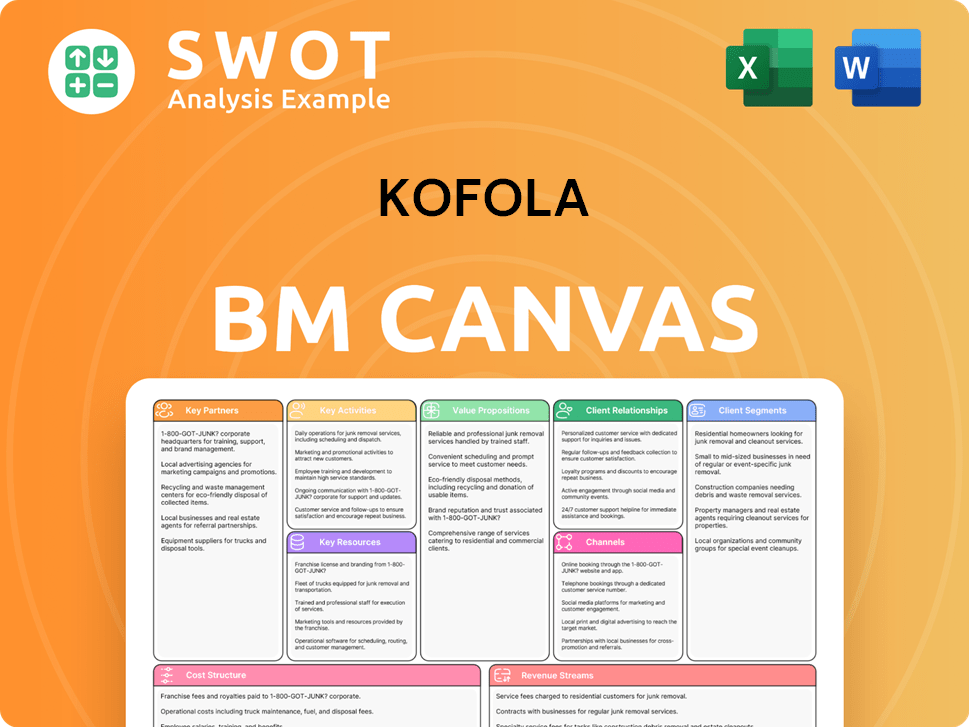

Kofola Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Kofola Positioning Itself for Continued Success?

The Kofola company holds a strong position in the non-alcoholic beverage market within Central and Eastern Europe, particularly in the Czech Republic and Slovakia. The company's diverse product range and strong brand recognition contribute to its market presence. In 2024, the company saw a 6% increase in sales in its Czech and Slovak beverage division during the final quarter, indicating continued strength in its core markets. The Kofola company continues to adapt to market dynamics and consumer preferences.

However, the Kofola company faces several challenges. These include the introduction of a sugar tax in Slovakia in 2025, operational hurdles from the Czech PET bottle deposit system, and rising raw material costs. Broader economic uncertainties and changing consumer preferences also pose risks. Despite these challenges, the Kofola company is committed to innovation and sustainable practices to maintain its market position and drive future growth.

The Kofola company is a leading player in the non-alcoholic beverage market in Central and Eastern Europe. Its portfolio includes soft drinks, bottled waters, juices, syrups, and fresh products. Strong brands like Kofola, Vinea, and Rajec contribute to its market strength. The company's focus on organic growth and strategic acquisitions supports its industry standing.

Key risks include the impact of a sugar tax in Slovakia and the implementation of a bottle deposit system in the Czech Republic. Rising raw material costs, potential economic slowdowns, and changing consumer preferences also pose challenges. The Kofola company must navigate these risks to maintain profitability and market share. The Brief History of Kofola provides more insights.

Management plans substantial investments in business development for 2025. The company forecasts approximately a 3% revenue growth for 2025, with a consolidated EBITDA guidance of EUR 75.6 – 79.6 million. Strategic initiatives include integrating recent acquisitions and expanding the Fresh & Herbs segment. Sustainability, including carbon neutrality by 2030, is a key focus.

The Kofola company plans to improve production efficiency, logistics, and trading opportunities. They are focused on organic growth, strategic acquisitions, and adapting to market changes. The goal is to sustain and expand profitability. The company's forward-looking strategy emphasizes adapting to market changes and consumer trends.

The Kofola company aims to maintain its total debt at around 2.1 times EBITDA. Planned CAPEX expenses will be 60% of full-year EBITDA. Strategic initiatives include integrating recent acquisitions like Ondrášovka and Korunní. The focus is on organic growth, strategic acquisitions, and adapting to market changes.

- Revenue growth forecast of approximately 3% for 2025.

- Consolidated EBITDA guidance of EUR 75.6 – 79.6 million.

- Emphasis on sustainability and carbon neutrality by 2030.

- Focus on organic growth and strategic acquisitions.

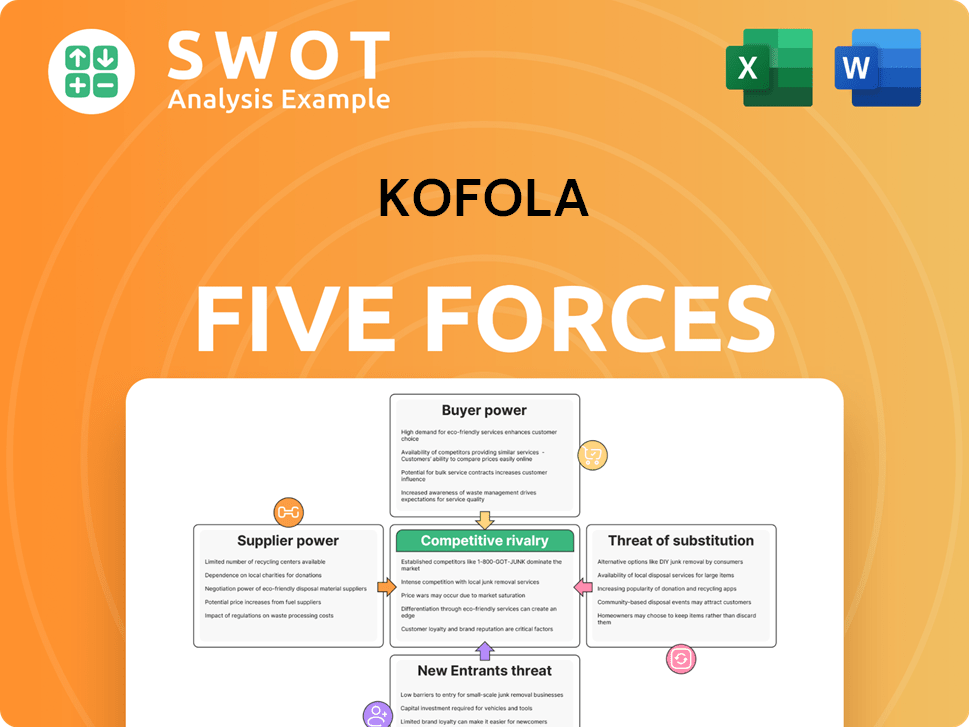

Kofola Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Kofola Company?

- What is Competitive Landscape of Kofola Company?

- What is Growth Strategy and Future Prospects of Kofola Company?

- What is Sales and Marketing Strategy of Kofola Company?

- What is Brief History of Kofola Company?

- Who Owns Kofola Company?

- What is Customer Demographics and Target Market of Kofola Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.